Key Insights

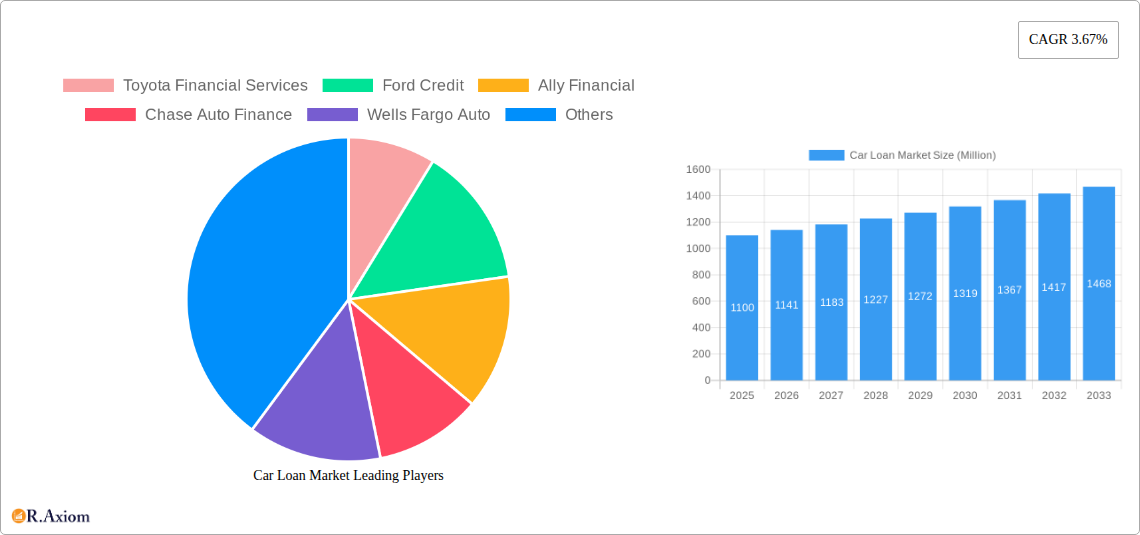

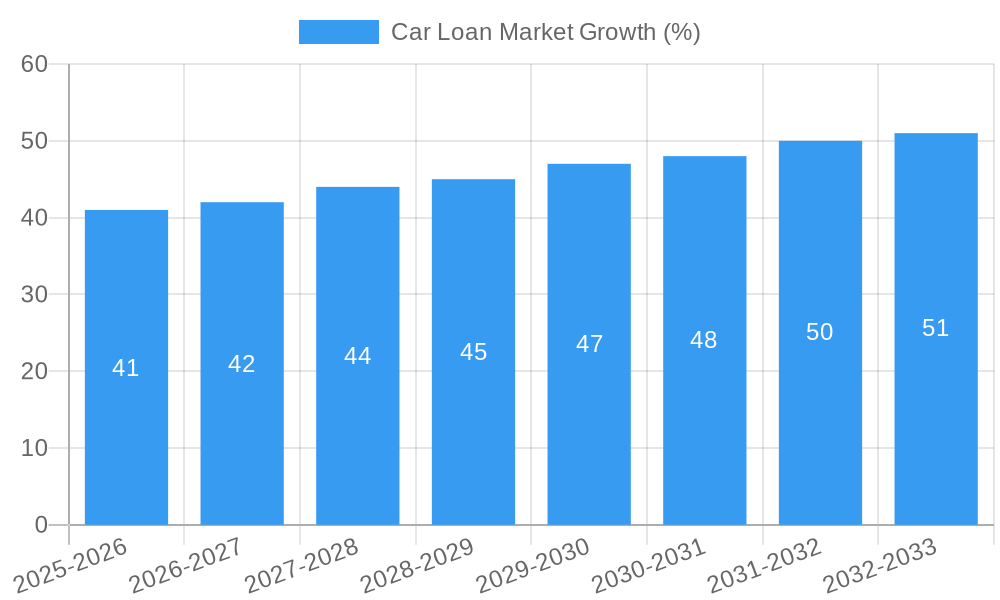

The global car loan market, valued at $1.10 trillion in 2025, is projected to experience steady growth, driven by several key factors. Rising vehicle sales, particularly in emerging economies with expanding middle classes, fuel demand for financing options. Favorable interest rates and readily available credit further stimulate borrowing for automotive purchases. Increased consumer preference for new vehicles, coupled with innovative financing products like longer loan terms and balloon payments, are also contributing to market expansion. The competitive landscape, featuring major players like Toyota Financial Services, Ford Credit, and Ally Financial, alongside traditional banks and emerging fintech lenders, is driving innovation in lending practices and customer experience. However, economic downturns and fluctuations in interest rates pose potential risks to market growth. Furthermore, stringent regulatory requirements and increasing concerns about consumer debt levels could act as restraints in certain regions. The market is segmented by loan type (new car loans, used car loans, refinancing), vehicle type (passenger cars, commercial vehicles), and region, each presenting unique growth opportunities. This segmentation allows lenders to tailor their products to specific customer needs and risk profiles. The forecast period (2025-2033) suggests a continued, albeit moderated, growth trajectory, with the market responding to macroeconomic conditions and evolving consumer behavior.

The 3.67% CAGR indicates a consistent expansion of the car loan market throughout the forecast period. While the provided data lacks regional breakdowns and specific segment details, a plausible scenario involves a more significant growth rate in developing economies, driven by increasing vehicle affordability and rising personal incomes. Conversely, mature markets may exhibit a slightly lower growth rate due to market saturation and higher levels of existing vehicle ownership. The competitive landscape will likely see increased consolidation and innovation, with players leveraging technology and data analytics to optimize risk assessment and personalize their offerings. This trend toward personalized services and digital platforms will enhance customer engagement and drive further market expansion. The potential impact of future economic uncertainty and evolving regulatory landscapes will remain key factors influencing market growth throughout the forecast period.

This in-depth report provides a comprehensive analysis of the global car loan market from 2019 to 2033, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. The report covers market sizing, segmentation, competitive landscape, growth drivers, challenges, and future opportunities. With a focus on key players like Toyota Financial Services, Ford Credit, Ally Financial, and others, this report unveils the intricate dynamics of this significant financial sector. The study period spans 2019-2033, with 2025 serving as both the base and estimated year.

Car Loan Market Concentration & Innovation

The car loan market exhibits a moderately concentrated landscape, with a few major players holding significant market share. Toyota Financial Services, Ford Credit, and Ally Financial, for instance, collectively account for an estimated xx% of the market in 2025. However, the market also accommodates numerous regional and niche players, contributing to a dynamic competitive environment.

Market Concentration Metrics (2025 Estimates):

- Top 3 Players Market Share: xx%

- Top 5 Players Market Share: xx%

- Herfindahl-Hirschman Index (HHI): xx

Innovation Drivers:

- Technological advancements in lending platforms and risk assessment models are driving efficiency and expansion.

- The increasing adoption of digital lending channels and mobile applications enhances accessibility and convenience.

- Development of innovative financing products, such as lease-to-own options and bundled financing packages.

Regulatory Frameworks and M&A Activities:

Stringent regulatory frameworks governing lending practices influence market dynamics, shaping responsible lending and consumer protection. The market has witnessed notable M&A activities in recent years, with deal values totaling an estimated $xx Million in 2024. These activities often aim to expand market reach, enhance product offerings, and improve operational efficiencies. Examples include the acquisition of Volkswagen's Russian assets by Art-Finance LLC in May 2023.

Car Loan Market Industry Trends & Insights

The global car loan market is experiencing robust growth, driven by several key factors. Rising vehicle sales, particularly in developing economies, fuel demand for financing options. Favorable economic conditions, characterized by low interest rates and increased consumer spending, further stimulate market expansion. Technological disruptions, such as the rise of fintech lending platforms and digital lending channels, are revolutionizing the industry, enhancing efficiency and accessibility. Consumer preferences are shifting towards online applications and personalized financing solutions, demanding streamlined processes and tailor-made offerings.

Key Market Trends:

- CAGR (2025-2033): xx%

- Market Penetration: xx% (2025)

- Shift towards digital lending platforms: xx% increase in online loan applications from 2019 to 2024.

The competitive landscape is marked by both intense competition among established players and the emergence of innovative fintech companies. These new entrants are challenging the traditional lending models with disruptive technologies and customer-centric approaches. The industry is witnessing a convergence of traditional financial institutions and tech companies, leading to collaborative partnerships and strategic alliances.

Dominant Markets & Segments in Car Loan Market

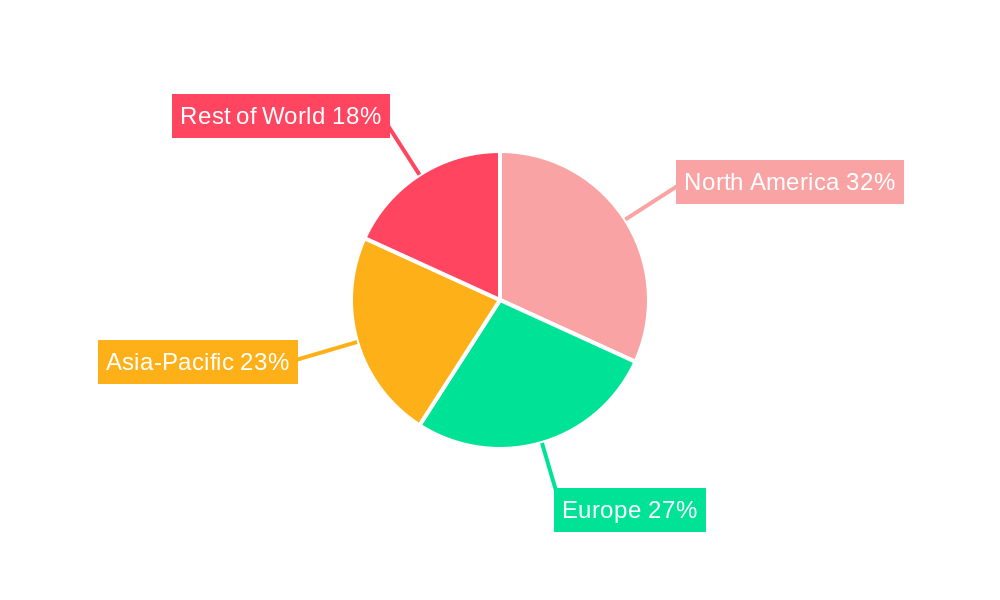

The North American car loan market currently holds the dominant position globally, followed by the European and Asian markets. This dominance is primarily attributed to high vehicle ownership rates, robust economic growth, and well-established financial infrastructure.

Key Drivers of Dominance in North America:

- Strong economic growth: Creates a favorable environment for consumer spending and vehicle purchases.

- Developed financial infrastructure: Facilitates easy access to credit and diverse financing options.

- High vehicle ownership rates: Drives consistent demand for car loans.

Other significant regional markets include:

- Europe: Growing adoption of electric vehicles and government incentives for green transportation are boosting demand.

- Asia: Rapid economic expansion and rising middle-class incomes fuel growth, particularly in emerging economies.

The market is further segmented by loan type (new car loans vs. used car loans), loan term, interest rates and credit scores. The new car loan segment holds a larger market share compared to used car loans, primarily due to higher loan amounts and longer repayment periods.

Car Loan Market Product Developments

Recent product innovations center on digital lending platforms that offer streamlined applications, faster processing times, and personalized loan offers based on credit scores and risk assessment models. These platforms utilize advanced algorithms and data analytics to optimize risk management and improve customer experience. The integration of AI and machine learning is enhancing credit scoring accuracy and reducing the risk of loan defaults. The emphasis is on creating a seamless and convenient borrowing experience, catering to evolving consumer expectations.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the car loan market, segmented by:

- Geography: North America, Europe, Asia-Pacific, Rest of the World.

- Vehicle Type: New vehicles, Used vehicles.

- Loan Type: Secured, Unsecured.

- Consumer Segment: Individual, Commercial.

Each segment's growth projections, market sizes, and competitive dynamics are analyzed in detail, providing a granular understanding of market trends.

Key Drivers of Car Loan Market Growth

Several factors contribute to the growth of the car loan market. Firstly, economic growth, particularly in emerging economies, drives increased disposable income and vehicle demand. Secondly, favorable government policies and incentives aimed at promoting vehicle purchases, such as subsidized interest rates or tax breaks, play a crucial role. Finally, technological advancements, like the development of innovative lending platforms and digital channels, improve accessibility and efficiency, fostering market expansion.

Challenges in the Car Loan Market Sector

The car loan market faces challenges like fluctuating interest rates impacting borrowing costs and consumer affordability. Stricter regulatory compliance requirements can increase operational expenses for lenders. Furthermore, intense competition among established players and the emergence of new fintech competitors create pressure on profit margins. Economic downturns or recessions can significantly affect demand for car loans, leading to increased loan defaults.

Emerging Opportunities in Car Loan Market

The rise of electric vehicles (EVs) presents a significant opportunity, with specialized financing options for EV purchases gaining traction. The adoption of blockchain technology promises to enhance security and transparency in lending processes. The expanding use of big data and AI-powered analytics enables more accurate credit risk assessment and personalized loan offerings. Expansion into underserved markets or developing economies presents considerable potential for growth.

Leading Players in the Car Loan Market Market

- Toyota Financial Services

- Ford Credit

- Ally Financial

- Chase Auto Finance

- Wells Fargo Auto

- Bank of America

- Capital One Auto Finance

- Santander Consumer

- BMW Financial Services

- Honda Financial Services

- List Not Exhaustive

Key Developments in Car Loan Market Industry

- May 2023: Art-Finance LLC acquired Volkswagen's Russian assets, significantly altering the Russian automotive market's financial landscape.

- April 2022: Faurecia and Mercedes-Benz partnered to integrate Faurecia's app platform, impacting in-car technology and potentially influencing financing options tied to connected car features.

Strategic Outlook for Car Loan Market Market

The car loan market is poised for continued growth, driven by factors like the increasing adoption of digital technologies, the expanding EV market, and economic growth in emerging economies. Strategic partnerships and innovations in lending technologies will further shape the market. Companies that prioritize customer experience and adapt to the evolving regulatory landscape will be best positioned for success in this dynamic sector.

Car Loan Market Segmentation

-

1. Product Type

- 1.1. Passenger Vehicle

- 1.2. Commercial Vehicle

-

2. Ownership

- 2.1. New Vehicles

- 2.2. Used Vehicles

-

3. Provider Type

- 3.1. Banks

- 3.2. Non-Banking Financial Services

- 3.3. Original Equipment Manufacturers

- 3.4. Other Provider Types (Fintech Companies)

-

4. Tenure

- 4.1. Less Than Three Years

- 4.2. 3-5 Years

- 4.3. More Than 5 Years

Car Loan Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. South Korea

- 3.3. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Chile

- 4.3. Rest of Latin America

- 5. Middle East and Africa

- 6. UAE

- 7. Saudi Arabia

- 8. Rest of Middle East and Africa

Car Loan Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.67% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Demand for Luxury Cars Fueling the Market Growth

- 3.3. Market Restrains

- 3.3.1. Rise in Demand for Luxury Cars Fueling the Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Sales of Passenger Cars in Asia

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Car Loan Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Passenger Vehicle

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Ownership

- 5.2.1. New Vehicles

- 5.2.2. Used Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Provider Type

- 5.3.1. Banks

- 5.3.2. Non-Banking Financial Services

- 5.3.3. Original Equipment Manufacturers

- 5.3.4. Other Provider Types (Fintech Companies)

- 5.4. Market Analysis, Insights and Forecast - by Tenure

- 5.4.1. Less Than Three Years

- 5.4.2. 3-5 Years

- 5.4.3. More Than 5 Years

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Latin America

- 5.5.5. Middle East and Africa

- 5.5.6. UAE

- 5.5.7. Saudi Arabia

- 5.5.8. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Car Loan Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Passenger Vehicle

- 6.1.2. Commercial Vehicle

- 6.2. Market Analysis, Insights and Forecast - by Ownership

- 6.2.1. New Vehicles

- 6.2.2. Used Vehicles

- 6.3. Market Analysis, Insights and Forecast - by Provider Type

- 6.3.1. Banks

- 6.3.2. Non-Banking Financial Services

- 6.3.3. Original Equipment Manufacturers

- 6.3.4. Other Provider Types (Fintech Companies)

- 6.4. Market Analysis, Insights and Forecast - by Tenure

- 6.4.1. Less Than Three Years

- 6.4.2. 3-5 Years

- 6.4.3. More Than 5 Years

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Car Loan Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Passenger Vehicle

- 7.1.2. Commercial Vehicle

- 7.2. Market Analysis, Insights and Forecast - by Ownership

- 7.2.1. New Vehicles

- 7.2.2. Used Vehicles

- 7.3. Market Analysis, Insights and Forecast - by Provider Type

- 7.3.1. Banks

- 7.3.2. Non-Banking Financial Services

- 7.3.3. Original Equipment Manufacturers

- 7.3.4. Other Provider Types (Fintech Companies)

- 7.4. Market Analysis, Insights and Forecast - by Tenure

- 7.4.1. Less Than Three Years

- 7.4.2. 3-5 Years

- 7.4.3. More Than 5 Years

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Car Loan Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Passenger Vehicle

- 8.1.2. Commercial Vehicle

- 8.2. Market Analysis, Insights and Forecast - by Ownership

- 8.2.1. New Vehicles

- 8.2.2. Used Vehicles

- 8.3. Market Analysis, Insights and Forecast - by Provider Type

- 8.3.1. Banks

- 8.3.2. Non-Banking Financial Services

- 8.3.3. Original Equipment Manufacturers

- 8.3.4. Other Provider Types (Fintech Companies)

- 8.4. Market Analysis, Insights and Forecast - by Tenure

- 8.4.1. Less Than Three Years

- 8.4.2. 3-5 Years

- 8.4.3. More Than 5 Years

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Latin America Car Loan Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Passenger Vehicle

- 9.1.2. Commercial Vehicle

- 9.2. Market Analysis, Insights and Forecast - by Ownership

- 9.2.1. New Vehicles

- 9.2.2. Used Vehicles

- 9.3. Market Analysis, Insights and Forecast - by Provider Type

- 9.3.1. Banks

- 9.3.2. Non-Banking Financial Services

- 9.3.3. Original Equipment Manufacturers

- 9.3.4. Other Provider Types (Fintech Companies)

- 9.4. Market Analysis, Insights and Forecast - by Tenure

- 9.4.1. Less Than Three Years

- 9.4.2. 3-5 Years

- 9.4.3. More Than 5 Years

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Car Loan Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Passenger Vehicle

- 10.1.2. Commercial Vehicle

- 10.2. Market Analysis, Insights and Forecast - by Ownership

- 10.2.1. New Vehicles

- 10.2.2. Used Vehicles

- 10.3. Market Analysis, Insights and Forecast - by Provider Type

- 10.3.1. Banks

- 10.3.2. Non-Banking Financial Services

- 10.3.3. Original Equipment Manufacturers

- 10.3.4. Other Provider Types (Fintech Companies)

- 10.4. Market Analysis, Insights and Forecast - by Tenure

- 10.4.1. Less Than Three Years

- 10.4.2. 3-5 Years

- 10.4.3. More Than 5 Years

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. UAE Car Loan Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Passenger Vehicle

- 11.1.2. Commercial Vehicle

- 11.2. Market Analysis, Insights and Forecast - by Ownership

- 11.2.1. New Vehicles

- 11.2.2. Used Vehicles

- 11.3. Market Analysis, Insights and Forecast - by Provider Type

- 11.3.1. Banks

- 11.3.2. Non-Banking Financial Services

- 11.3.3. Original Equipment Manufacturers

- 11.3.4. Other Provider Types (Fintech Companies)

- 11.4. Market Analysis, Insights and Forecast - by Tenure

- 11.4.1. Less Than Three Years

- 11.4.2. 3-5 Years

- 11.4.3. More Than 5 Years

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Saudi Arabia Car Loan Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Passenger Vehicle

- 12.1.2. Commercial Vehicle

- 12.2. Market Analysis, Insights and Forecast - by Ownership

- 12.2.1. New Vehicles

- 12.2.2. Used Vehicles

- 12.3. Market Analysis, Insights and Forecast - by Provider Type

- 12.3.1. Banks

- 12.3.2. Non-Banking Financial Services

- 12.3.3. Original Equipment Manufacturers

- 12.3.4. Other Provider Types (Fintech Companies)

- 12.4. Market Analysis, Insights and Forecast - by Tenure

- 12.4.1. Less Than Three Years

- 12.4.2. 3-5 Years

- 12.4.3. More Than 5 Years

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Rest of Middle East and Africa Car Loan Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - by Product Type

- 13.1.1. Passenger Vehicle

- 13.1.2. Commercial Vehicle

- 13.2. Market Analysis, Insights and Forecast - by Ownership

- 13.2.1. New Vehicles

- 13.2.2. Used Vehicles

- 13.3. Market Analysis, Insights and Forecast - by Provider Type

- 13.3.1. Banks

- 13.3.2. Non-Banking Financial Services

- 13.3.3. Original Equipment Manufacturers

- 13.3.4. Other Provider Types (Fintech Companies)

- 13.4. Market Analysis, Insights and Forecast - by Tenure

- 13.4.1. Less Than Three Years

- 13.4.2. 3-5 Years

- 13.4.3. More Than 5 Years

- 13.1. Market Analysis, Insights and Forecast - by Product Type

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Toyota Financial Services

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Ford Credit

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Ally Financial

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Chase Auto Finance

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Wells Fargo Auto

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Bank of America

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Capital One Auto Finance

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Santander Consumer

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 BMW Financial Services

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Honda Financial Services**List Not Exhaustive

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Toyota Financial Services

List of Figures

- Figure 1: Global Car Loan Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Car Loan Market Volume Breakdown (Trillion, %) by Region 2024 & 2032

- Figure 3: North America Car Loan Market Revenue (Million), by Product Type 2024 & 2032

- Figure 4: North America Car Loan Market Volume (Trillion), by Product Type 2024 & 2032

- Figure 5: North America Car Loan Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 6: North America Car Loan Market Volume Share (%), by Product Type 2024 & 2032

- Figure 7: North America Car Loan Market Revenue (Million), by Ownership 2024 & 2032

- Figure 8: North America Car Loan Market Volume (Trillion), by Ownership 2024 & 2032

- Figure 9: North America Car Loan Market Revenue Share (%), by Ownership 2024 & 2032

- Figure 10: North America Car Loan Market Volume Share (%), by Ownership 2024 & 2032

- Figure 11: North America Car Loan Market Revenue (Million), by Provider Type 2024 & 2032

- Figure 12: North America Car Loan Market Volume (Trillion), by Provider Type 2024 & 2032

- Figure 13: North America Car Loan Market Revenue Share (%), by Provider Type 2024 & 2032

- Figure 14: North America Car Loan Market Volume Share (%), by Provider Type 2024 & 2032

- Figure 15: North America Car Loan Market Revenue (Million), by Tenure 2024 & 2032

- Figure 16: North America Car Loan Market Volume (Trillion), by Tenure 2024 & 2032

- Figure 17: North America Car Loan Market Revenue Share (%), by Tenure 2024 & 2032

- Figure 18: North America Car Loan Market Volume Share (%), by Tenure 2024 & 2032

- Figure 19: North America Car Loan Market Revenue (Million), by Country 2024 & 2032

- Figure 20: North America Car Loan Market Volume (Trillion), by Country 2024 & 2032

- Figure 21: North America Car Loan Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: North America Car Loan Market Volume Share (%), by Country 2024 & 2032

- Figure 23: Europe Car Loan Market Revenue (Million), by Product Type 2024 & 2032

- Figure 24: Europe Car Loan Market Volume (Trillion), by Product Type 2024 & 2032

- Figure 25: Europe Car Loan Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 26: Europe Car Loan Market Volume Share (%), by Product Type 2024 & 2032

- Figure 27: Europe Car Loan Market Revenue (Million), by Ownership 2024 & 2032

- Figure 28: Europe Car Loan Market Volume (Trillion), by Ownership 2024 & 2032

- Figure 29: Europe Car Loan Market Revenue Share (%), by Ownership 2024 & 2032

- Figure 30: Europe Car Loan Market Volume Share (%), by Ownership 2024 & 2032

- Figure 31: Europe Car Loan Market Revenue (Million), by Provider Type 2024 & 2032

- Figure 32: Europe Car Loan Market Volume (Trillion), by Provider Type 2024 & 2032

- Figure 33: Europe Car Loan Market Revenue Share (%), by Provider Type 2024 & 2032

- Figure 34: Europe Car Loan Market Volume Share (%), by Provider Type 2024 & 2032

- Figure 35: Europe Car Loan Market Revenue (Million), by Tenure 2024 & 2032

- Figure 36: Europe Car Loan Market Volume (Trillion), by Tenure 2024 & 2032

- Figure 37: Europe Car Loan Market Revenue Share (%), by Tenure 2024 & 2032

- Figure 38: Europe Car Loan Market Volume Share (%), by Tenure 2024 & 2032

- Figure 39: Europe Car Loan Market Revenue (Million), by Country 2024 & 2032

- Figure 40: Europe Car Loan Market Volume (Trillion), by Country 2024 & 2032

- Figure 41: Europe Car Loan Market Revenue Share (%), by Country 2024 & 2032

- Figure 42: Europe Car Loan Market Volume Share (%), by Country 2024 & 2032

- Figure 43: Asia Pacific Car Loan Market Revenue (Million), by Product Type 2024 & 2032

- Figure 44: Asia Pacific Car Loan Market Volume (Trillion), by Product Type 2024 & 2032

- Figure 45: Asia Pacific Car Loan Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 46: Asia Pacific Car Loan Market Volume Share (%), by Product Type 2024 & 2032

- Figure 47: Asia Pacific Car Loan Market Revenue (Million), by Ownership 2024 & 2032

- Figure 48: Asia Pacific Car Loan Market Volume (Trillion), by Ownership 2024 & 2032

- Figure 49: Asia Pacific Car Loan Market Revenue Share (%), by Ownership 2024 & 2032

- Figure 50: Asia Pacific Car Loan Market Volume Share (%), by Ownership 2024 & 2032

- Figure 51: Asia Pacific Car Loan Market Revenue (Million), by Provider Type 2024 & 2032

- Figure 52: Asia Pacific Car Loan Market Volume (Trillion), by Provider Type 2024 & 2032

- Figure 53: Asia Pacific Car Loan Market Revenue Share (%), by Provider Type 2024 & 2032

- Figure 54: Asia Pacific Car Loan Market Volume Share (%), by Provider Type 2024 & 2032

- Figure 55: Asia Pacific Car Loan Market Revenue (Million), by Tenure 2024 & 2032

- Figure 56: Asia Pacific Car Loan Market Volume (Trillion), by Tenure 2024 & 2032

- Figure 57: Asia Pacific Car Loan Market Revenue Share (%), by Tenure 2024 & 2032

- Figure 58: Asia Pacific Car Loan Market Volume Share (%), by Tenure 2024 & 2032

- Figure 59: Asia Pacific Car Loan Market Revenue (Million), by Country 2024 & 2032

- Figure 60: Asia Pacific Car Loan Market Volume (Trillion), by Country 2024 & 2032

- Figure 61: Asia Pacific Car Loan Market Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Car Loan Market Volume Share (%), by Country 2024 & 2032

- Figure 63: Latin America Car Loan Market Revenue (Million), by Product Type 2024 & 2032

- Figure 64: Latin America Car Loan Market Volume (Trillion), by Product Type 2024 & 2032

- Figure 65: Latin America Car Loan Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 66: Latin America Car Loan Market Volume Share (%), by Product Type 2024 & 2032

- Figure 67: Latin America Car Loan Market Revenue (Million), by Ownership 2024 & 2032

- Figure 68: Latin America Car Loan Market Volume (Trillion), by Ownership 2024 & 2032

- Figure 69: Latin America Car Loan Market Revenue Share (%), by Ownership 2024 & 2032

- Figure 70: Latin America Car Loan Market Volume Share (%), by Ownership 2024 & 2032

- Figure 71: Latin America Car Loan Market Revenue (Million), by Provider Type 2024 & 2032

- Figure 72: Latin America Car Loan Market Volume (Trillion), by Provider Type 2024 & 2032

- Figure 73: Latin America Car Loan Market Revenue Share (%), by Provider Type 2024 & 2032

- Figure 74: Latin America Car Loan Market Volume Share (%), by Provider Type 2024 & 2032

- Figure 75: Latin America Car Loan Market Revenue (Million), by Tenure 2024 & 2032

- Figure 76: Latin America Car Loan Market Volume (Trillion), by Tenure 2024 & 2032

- Figure 77: Latin America Car Loan Market Revenue Share (%), by Tenure 2024 & 2032

- Figure 78: Latin America Car Loan Market Volume Share (%), by Tenure 2024 & 2032

- Figure 79: Latin America Car Loan Market Revenue (Million), by Country 2024 & 2032

- Figure 80: Latin America Car Loan Market Volume (Trillion), by Country 2024 & 2032

- Figure 81: Latin America Car Loan Market Revenue Share (%), by Country 2024 & 2032

- Figure 82: Latin America Car Loan Market Volume Share (%), by Country 2024 & 2032

- Figure 83: Middle East and Africa Car Loan Market Revenue (Million), by Product Type 2024 & 2032

- Figure 84: Middle East and Africa Car Loan Market Volume (Trillion), by Product Type 2024 & 2032

- Figure 85: Middle East and Africa Car Loan Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 86: Middle East and Africa Car Loan Market Volume Share (%), by Product Type 2024 & 2032

- Figure 87: Middle East and Africa Car Loan Market Revenue (Million), by Ownership 2024 & 2032

- Figure 88: Middle East and Africa Car Loan Market Volume (Trillion), by Ownership 2024 & 2032

- Figure 89: Middle East and Africa Car Loan Market Revenue Share (%), by Ownership 2024 & 2032

- Figure 90: Middle East and Africa Car Loan Market Volume Share (%), by Ownership 2024 & 2032

- Figure 91: Middle East and Africa Car Loan Market Revenue (Million), by Provider Type 2024 & 2032

- Figure 92: Middle East and Africa Car Loan Market Volume (Trillion), by Provider Type 2024 & 2032

- Figure 93: Middle East and Africa Car Loan Market Revenue Share (%), by Provider Type 2024 & 2032

- Figure 94: Middle East and Africa Car Loan Market Volume Share (%), by Provider Type 2024 & 2032

- Figure 95: Middle East and Africa Car Loan Market Revenue (Million), by Tenure 2024 & 2032

- Figure 96: Middle East and Africa Car Loan Market Volume (Trillion), by Tenure 2024 & 2032

- Figure 97: Middle East and Africa Car Loan Market Revenue Share (%), by Tenure 2024 & 2032

- Figure 98: Middle East and Africa Car Loan Market Volume Share (%), by Tenure 2024 & 2032

- Figure 99: Middle East and Africa Car Loan Market Revenue (Million), by Country 2024 & 2032

- Figure 100: Middle East and Africa Car Loan Market Volume (Trillion), by Country 2024 & 2032

- Figure 101: Middle East and Africa Car Loan Market Revenue Share (%), by Country 2024 & 2032

- Figure 102: Middle East and Africa Car Loan Market Volume Share (%), by Country 2024 & 2032

- Figure 103: UAE Car Loan Market Revenue (Million), by Product Type 2024 & 2032

- Figure 104: UAE Car Loan Market Volume (Trillion), by Product Type 2024 & 2032

- Figure 105: UAE Car Loan Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 106: UAE Car Loan Market Volume Share (%), by Product Type 2024 & 2032

- Figure 107: UAE Car Loan Market Revenue (Million), by Ownership 2024 & 2032

- Figure 108: UAE Car Loan Market Volume (Trillion), by Ownership 2024 & 2032

- Figure 109: UAE Car Loan Market Revenue Share (%), by Ownership 2024 & 2032

- Figure 110: UAE Car Loan Market Volume Share (%), by Ownership 2024 & 2032

- Figure 111: UAE Car Loan Market Revenue (Million), by Provider Type 2024 & 2032

- Figure 112: UAE Car Loan Market Volume (Trillion), by Provider Type 2024 & 2032

- Figure 113: UAE Car Loan Market Revenue Share (%), by Provider Type 2024 & 2032

- Figure 114: UAE Car Loan Market Volume Share (%), by Provider Type 2024 & 2032

- Figure 115: UAE Car Loan Market Revenue (Million), by Tenure 2024 & 2032

- Figure 116: UAE Car Loan Market Volume (Trillion), by Tenure 2024 & 2032

- Figure 117: UAE Car Loan Market Revenue Share (%), by Tenure 2024 & 2032

- Figure 118: UAE Car Loan Market Volume Share (%), by Tenure 2024 & 2032

- Figure 119: UAE Car Loan Market Revenue (Million), by Country 2024 & 2032

- Figure 120: UAE Car Loan Market Volume (Trillion), by Country 2024 & 2032

- Figure 121: UAE Car Loan Market Revenue Share (%), by Country 2024 & 2032

- Figure 122: UAE Car Loan Market Volume Share (%), by Country 2024 & 2032

- Figure 123: Saudi Arabia Car Loan Market Revenue (Million), by Product Type 2024 & 2032

- Figure 124: Saudi Arabia Car Loan Market Volume (Trillion), by Product Type 2024 & 2032

- Figure 125: Saudi Arabia Car Loan Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 126: Saudi Arabia Car Loan Market Volume Share (%), by Product Type 2024 & 2032

- Figure 127: Saudi Arabia Car Loan Market Revenue (Million), by Ownership 2024 & 2032

- Figure 128: Saudi Arabia Car Loan Market Volume (Trillion), by Ownership 2024 & 2032

- Figure 129: Saudi Arabia Car Loan Market Revenue Share (%), by Ownership 2024 & 2032

- Figure 130: Saudi Arabia Car Loan Market Volume Share (%), by Ownership 2024 & 2032

- Figure 131: Saudi Arabia Car Loan Market Revenue (Million), by Provider Type 2024 & 2032

- Figure 132: Saudi Arabia Car Loan Market Volume (Trillion), by Provider Type 2024 & 2032

- Figure 133: Saudi Arabia Car Loan Market Revenue Share (%), by Provider Type 2024 & 2032

- Figure 134: Saudi Arabia Car Loan Market Volume Share (%), by Provider Type 2024 & 2032

- Figure 135: Saudi Arabia Car Loan Market Revenue (Million), by Tenure 2024 & 2032

- Figure 136: Saudi Arabia Car Loan Market Volume (Trillion), by Tenure 2024 & 2032

- Figure 137: Saudi Arabia Car Loan Market Revenue Share (%), by Tenure 2024 & 2032

- Figure 138: Saudi Arabia Car Loan Market Volume Share (%), by Tenure 2024 & 2032

- Figure 139: Saudi Arabia Car Loan Market Revenue (Million), by Country 2024 & 2032

- Figure 140: Saudi Arabia Car Loan Market Volume (Trillion), by Country 2024 & 2032

- Figure 141: Saudi Arabia Car Loan Market Revenue Share (%), by Country 2024 & 2032

- Figure 142: Saudi Arabia Car Loan Market Volume Share (%), by Country 2024 & 2032

- Figure 143: Rest of Middle East and Africa Car Loan Market Revenue (Million), by Product Type 2024 & 2032

- Figure 144: Rest of Middle East and Africa Car Loan Market Volume (Trillion), by Product Type 2024 & 2032

- Figure 145: Rest of Middle East and Africa Car Loan Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 146: Rest of Middle East and Africa Car Loan Market Volume Share (%), by Product Type 2024 & 2032

- Figure 147: Rest of Middle East and Africa Car Loan Market Revenue (Million), by Ownership 2024 & 2032

- Figure 148: Rest of Middle East and Africa Car Loan Market Volume (Trillion), by Ownership 2024 & 2032

- Figure 149: Rest of Middle East and Africa Car Loan Market Revenue Share (%), by Ownership 2024 & 2032

- Figure 150: Rest of Middle East and Africa Car Loan Market Volume Share (%), by Ownership 2024 & 2032

- Figure 151: Rest of Middle East and Africa Car Loan Market Revenue (Million), by Provider Type 2024 & 2032

- Figure 152: Rest of Middle East and Africa Car Loan Market Volume (Trillion), by Provider Type 2024 & 2032

- Figure 153: Rest of Middle East and Africa Car Loan Market Revenue Share (%), by Provider Type 2024 & 2032

- Figure 154: Rest of Middle East and Africa Car Loan Market Volume Share (%), by Provider Type 2024 & 2032

- Figure 155: Rest of Middle East and Africa Car Loan Market Revenue (Million), by Tenure 2024 & 2032

- Figure 156: Rest of Middle East and Africa Car Loan Market Volume (Trillion), by Tenure 2024 & 2032

- Figure 157: Rest of Middle East and Africa Car Loan Market Revenue Share (%), by Tenure 2024 & 2032

- Figure 158: Rest of Middle East and Africa Car Loan Market Volume Share (%), by Tenure 2024 & 2032

- Figure 159: Rest of Middle East and Africa Car Loan Market Revenue (Million), by Country 2024 & 2032

- Figure 160: Rest of Middle East and Africa Car Loan Market Volume (Trillion), by Country 2024 & 2032

- Figure 161: Rest of Middle East and Africa Car Loan Market Revenue Share (%), by Country 2024 & 2032

- Figure 162: Rest of Middle East and Africa Car Loan Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Car Loan Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Car Loan Market Volume Trillion Forecast, by Region 2019 & 2032

- Table 3: Global Car Loan Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Global Car Loan Market Volume Trillion Forecast, by Product Type 2019 & 2032

- Table 5: Global Car Loan Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 6: Global Car Loan Market Volume Trillion Forecast, by Ownership 2019 & 2032

- Table 7: Global Car Loan Market Revenue Million Forecast, by Provider Type 2019 & 2032

- Table 8: Global Car Loan Market Volume Trillion Forecast, by Provider Type 2019 & 2032

- Table 9: Global Car Loan Market Revenue Million Forecast, by Tenure 2019 & 2032

- Table 10: Global Car Loan Market Volume Trillion Forecast, by Tenure 2019 & 2032

- Table 11: Global Car Loan Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: Global Car Loan Market Volume Trillion Forecast, by Region 2019 & 2032

- Table 13: Global Car Loan Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: Global Car Loan Market Volume Trillion Forecast, by Product Type 2019 & 2032

- Table 15: Global Car Loan Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 16: Global Car Loan Market Volume Trillion Forecast, by Ownership 2019 & 2032

- Table 17: Global Car Loan Market Revenue Million Forecast, by Provider Type 2019 & 2032

- Table 18: Global Car Loan Market Volume Trillion Forecast, by Provider Type 2019 & 2032

- Table 19: Global Car Loan Market Revenue Million Forecast, by Tenure 2019 & 2032

- Table 20: Global Car Loan Market Volume Trillion Forecast, by Tenure 2019 & 2032

- Table 21: Global Car Loan Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Car Loan Market Volume Trillion Forecast, by Country 2019 & 2032

- Table 23: United States Car Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: United States Car Loan Market Volume (Trillion) Forecast, by Application 2019 & 2032

- Table 25: Canada Car Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Canada Car Loan Market Volume (Trillion) Forecast, by Application 2019 & 2032

- Table 27: Rest of North America Car Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of North America Car Loan Market Volume (Trillion) Forecast, by Application 2019 & 2032

- Table 29: Global Car Loan Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 30: Global Car Loan Market Volume Trillion Forecast, by Product Type 2019 & 2032

- Table 31: Global Car Loan Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 32: Global Car Loan Market Volume Trillion Forecast, by Ownership 2019 & 2032

- Table 33: Global Car Loan Market Revenue Million Forecast, by Provider Type 2019 & 2032

- Table 34: Global Car Loan Market Volume Trillion Forecast, by Provider Type 2019 & 2032

- Table 35: Global Car Loan Market Revenue Million Forecast, by Tenure 2019 & 2032

- Table 36: Global Car Loan Market Volume Trillion Forecast, by Tenure 2019 & 2032

- Table 37: Global Car Loan Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Global Car Loan Market Volume Trillion Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Car Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Car Loan Market Volume (Trillion) Forecast, by Application 2019 & 2032

- Table 41: Germany Car Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Germany Car Loan Market Volume (Trillion) Forecast, by Application 2019 & 2032

- Table 43: Rest of Europe Car Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Rest of Europe Car Loan Market Volume (Trillion) Forecast, by Application 2019 & 2032

- Table 45: Global Car Loan Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 46: Global Car Loan Market Volume Trillion Forecast, by Product Type 2019 & 2032

- Table 47: Global Car Loan Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 48: Global Car Loan Market Volume Trillion Forecast, by Ownership 2019 & 2032

- Table 49: Global Car Loan Market Revenue Million Forecast, by Provider Type 2019 & 2032

- Table 50: Global Car Loan Market Volume Trillion Forecast, by Provider Type 2019 & 2032

- Table 51: Global Car Loan Market Revenue Million Forecast, by Tenure 2019 & 2032

- Table 52: Global Car Loan Market Volume Trillion Forecast, by Tenure 2019 & 2032

- Table 53: Global Car Loan Market Revenue Million Forecast, by Country 2019 & 2032

- Table 54: Global Car Loan Market Volume Trillion Forecast, by Country 2019 & 2032

- Table 55: China Car Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: China Car Loan Market Volume (Trillion) Forecast, by Application 2019 & 2032

- Table 57: South Korea Car Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: South Korea Car Loan Market Volume (Trillion) Forecast, by Application 2019 & 2032

- Table 59: Rest of Asia Pacific Car Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of Asia Pacific Car Loan Market Volume (Trillion) Forecast, by Application 2019 & 2032

- Table 61: Global Car Loan Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 62: Global Car Loan Market Volume Trillion Forecast, by Product Type 2019 & 2032

- Table 63: Global Car Loan Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 64: Global Car Loan Market Volume Trillion Forecast, by Ownership 2019 & 2032

- Table 65: Global Car Loan Market Revenue Million Forecast, by Provider Type 2019 & 2032

- Table 66: Global Car Loan Market Volume Trillion Forecast, by Provider Type 2019 & 2032

- Table 67: Global Car Loan Market Revenue Million Forecast, by Tenure 2019 & 2032

- Table 68: Global Car Loan Market Volume Trillion Forecast, by Tenure 2019 & 2032

- Table 69: Global Car Loan Market Revenue Million Forecast, by Country 2019 & 2032

- Table 70: Global Car Loan Market Volume Trillion Forecast, by Country 2019 & 2032

- Table 71: Brazil Car Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Brazil Car Loan Market Volume (Trillion) Forecast, by Application 2019 & 2032

- Table 73: Chile Car Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: Chile Car Loan Market Volume (Trillion) Forecast, by Application 2019 & 2032

- Table 75: Rest of Latin America Car Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: Rest of Latin America Car Loan Market Volume (Trillion) Forecast, by Application 2019 & 2032

- Table 77: Global Car Loan Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 78: Global Car Loan Market Volume Trillion Forecast, by Product Type 2019 & 2032

- Table 79: Global Car Loan Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 80: Global Car Loan Market Volume Trillion Forecast, by Ownership 2019 & 2032

- Table 81: Global Car Loan Market Revenue Million Forecast, by Provider Type 2019 & 2032

- Table 82: Global Car Loan Market Volume Trillion Forecast, by Provider Type 2019 & 2032

- Table 83: Global Car Loan Market Revenue Million Forecast, by Tenure 2019 & 2032

- Table 84: Global Car Loan Market Volume Trillion Forecast, by Tenure 2019 & 2032

- Table 85: Global Car Loan Market Revenue Million Forecast, by Country 2019 & 2032

- Table 86: Global Car Loan Market Volume Trillion Forecast, by Country 2019 & 2032

- Table 87: Global Car Loan Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 88: Global Car Loan Market Volume Trillion Forecast, by Product Type 2019 & 2032

- Table 89: Global Car Loan Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 90: Global Car Loan Market Volume Trillion Forecast, by Ownership 2019 & 2032

- Table 91: Global Car Loan Market Revenue Million Forecast, by Provider Type 2019 & 2032

- Table 92: Global Car Loan Market Volume Trillion Forecast, by Provider Type 2019 & 2032

- Table 93: Global Car Loan Market Revenue Million Forecast, by Tenure 2019 & 2032

- Table 94: Global Car Loan Market Volume Trillion Forecast, by Tenure 2019 & 2032

- Table 95: Global Car Loan Market Revenue Million Forecast, by Country 2019 & 2032

- Table 96: Global Car Loan Market Volume Trillion Forecast, by Country 2019 & 2032

- Table 97: Global Car Loan Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 98: Global Car Loan Market Volume Trillion Forecast, by Product Type 2019 & 2032

- Table 99: Global Car Loan Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 100: Global Car Loan Market Volume Trillion Forecast, by Ownership 2019 & 2032

- Table 101: Global Car Loan Market Revenue Million Forecast, by Provider Type 2019 & 2032

- Table 102: Global Car Loan Market Volume Trillion Forecast, by Provider Type 2019 & 2032

- Table 103: Global Car Loan Market Revenue Million Forecast, by Tenure 2019 & 2032

- Table 104: Global Car Loan Market Volume Trillion Forecast, by Tenure 2019 & 2032

- Table 105: Global Car Loan Market Revenue Million Forecast, by Country 2019 & 2032

- Table 106: Global Car Loan Market Volume Trillion Forecast, by Country 2019 & 2032

- Table 107: Global Car Loan Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 108: Global Car Loan Market Volume Trillion Forecast, by Product Type 2019 & 2032

- Table 109: Global Car Loan Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 110: Global Car Loan Market Volume Trillion Forecast, by Ownership 2019 & 2032

- Table 111: Global Car Loan Market Revenue Million Forecast, by Provider Type 2019 & 2032

- Table 112: Global Car Loan Market Volume Trillion Forecast, by Provider Type 2019 & 2032

- Table 113: Global Car Loan Market Revenue Million Forecast, by Tenure 2019 & 2032

- Table 114: Global Car Loan Market Volume Trillion Forecast, by Tenure 2019 & 2032

- Table 115: Global Car Loan Market Revenue Million Forecast, by Country 2019 & 2032

- Table 116: Global Car Loan Market Volume Trillion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Car Loan Market?

The projected CAGR is approximately 3.67%.

2. Which companies are prominent players in the Car Loan Market?

Key companies in the market include Toyota Financial Services, Ford Credit, Ally Financial, Chase Auto Finance, Wells Fargo Auto, Bank of America, Capital One Auto Finance, Santander Consumer, BMW Financial Services, Honda Financial Services**List Not Exhaustive.

3. What are the main segments of the Car Loan Market?

The market segments include Product Type, Ownership, Provider Type, Tenure.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.10 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Demand for Luxury Cars Fueling the Market Growth.

6. What are the notable trends driving market growth?

Increasing Sales of Passenger Cars in Asia.

7. Are there any restraints impacting market growth?

Rise in Demand for Luxury Cars Fueling the Market Growth.

8. Can you provide examples of recent developments in the market?

May 2023: A subsidiary of Russian auto dealer Avilon, Art-Finance LLC, completed the acquisition of German automaker Volkswagen's Russian assets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Car Loan Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Car Loan Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Car Loan Market?

To stay informed about further developments, trends, and reports in the Car Loan Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence