Key Insights

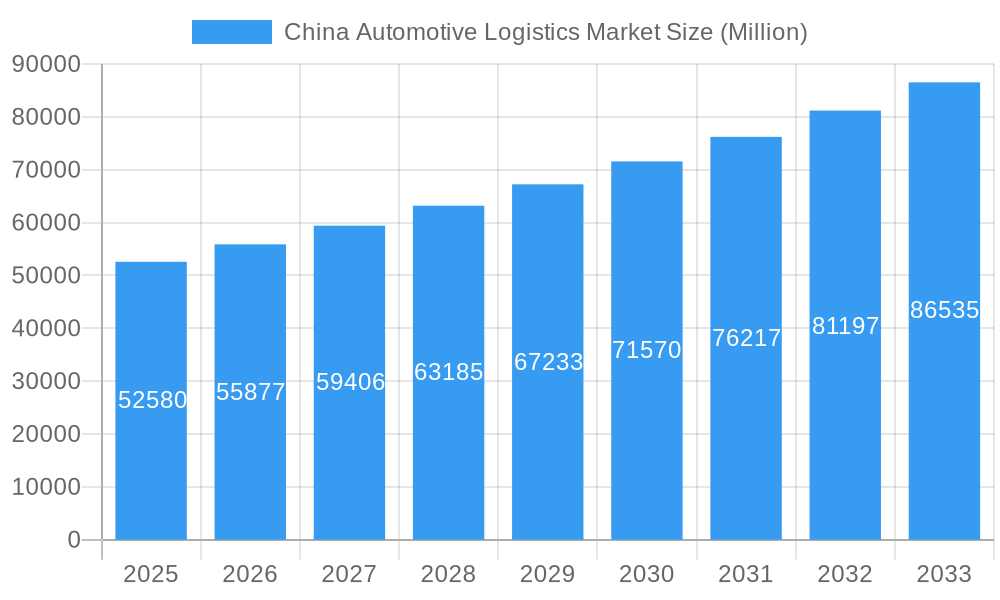

The China automotive logistics market, valued at $52.58 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.96% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning Chinese automotive industry, driven by increasing domestic consumption and robust export demand, necessitates efficient logistics solutions for finished vehicles and auto components. Furthermore, advancements in technology, such as the adoption of sophisticated transportation management systems (TMS) and warehouse automation, are streamlining operations and reducing costs. The growing preference for just-in-time inventory management strategies within the automotive supply chain also contributes to market growth. While infrastructure limitations in certain regions and potential fluctuations in fuel prices pose challenges, the overall market outlook remains positive, driven by government initiatives promoting efficient logistics and the ongoing expansion of the electric vehicle (EV) sector, which presents unique logistics requirements.

China Automotive Logistics Market Market Size (In Billion)

The market is segmented by service type (transportation, warehousing, distribution, and inventory management, and other services) and by vehicle type (finished vehicles and auto components). Transportation currently dominates, but the warehousing and inventory management segments are anticipated to experience significant growth due to the increasing complexity of automotive supply chains. Major players like Apex Group, DHL, Nippon Express, UPS, GEODIS, Yusen Logistics, China Ocean Shipping, SAIC Anji Logistics, BLG Logistics, Sinotrans, and HYCX Group are actively competing for market share, leveraging their established networks and technological capabilities. The continued expansion of China's automotive production and sales, coupled with ongoing investments in logistics infrastructure, will further propel market growth throughout the forecast period. The focus on sustainable and efficient logistics solutions will likely shape future market trends, with companies increasingly adopting green technologies and optimizing their operations to reduce environmental impact.

China Automotive Logistics Market Company Market Share

China Automotive Logistics Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the China Automotive Logistics Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this report meticulously examines market trends, segmentation, key players, and future growth prospects. The market is projected to reach xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. This report leverages extensive primary and secondary research, ensuring accuracy and reliability.

China Automotive Logistics Market Market Concentration & Innovation

The China automotive logistics market exhibits a moderately concentrated landscape, with a handful of dominant players holding significant market share. Apex Group, DHL, Nippon Express, UPS, GEODIS, Yusen Logistics Co Ltd, China Ocean Shipping (Group) Company, SAIC Anji Logistics, BLG Logistics, Sinotrans Co Ltd, and HYCX Group are among the key players, competing based on service offerings, geographical reach, and technological capabilities. Market share data for these companies is xx, reflecting a competitive but not fully saturated market.

Innovation is a crucial driver, with companies investing in technological advancements such as automated warehousing systems, route optimization software, and real-time tracking capabilities. Government regulations, including those focused on environmental sustainability and supply chain efficiency, significantly influence innovation and market development. The presence of product substitutes, particularly in transportation modes, introduces competitive pressure. End-user trends, such as the growing demand for electric vehicles and the increasing complexity of global supply chains, are shaping the market's evolution. Mergers and acquisitions (M&A) activity has been moderate, with deal values totaling approximately xx Million in the past five years. These deals primarily focus on expanding geographical reach and enhancing service portfolios.

China Automotive Logistics Market Industry Trends & Insights

The China automotive logistics market is experiencing robust growth, driven by the nation's burgeoning automotive industry and expanding export activities. The increasing production and sales of electric vehicles (EVs) and new energy vehicles (NEVs) are fueling demand for specialized logistics solutions. Technological disruptions, including the adoption of blockchain technology for enhanced supply chain transparency and the use of Artificial Intelligence (AI) for predictive analytics, are transforming industry operations. Consumer preferences, particularly the growing expectation for faster and more reliable delivery, are pushing logistics providers to optimize their services. Competitive dynamics are intensifying as companies invest in infrastructure, technology, and strategic partnerships to gain a competitive edge. Market penetration for advanced logistics solutions like automated guided vehicles (AGVs) in warehousing is estimated at xx%, with significant growth projected over the forecast period. The market displays a steady CAGR of xx% illustrating the positive trajectory.

Dominant Markets & Segments in China Automotive Logistics Market

By Type: The finished vehicle segment dominates the market, driven by the substantial volume of vehicles produced and traded within China and internationally. This segment benefits significantly from robust manufacturing infrastructure, while the auto component segment is experiencing relatively faster growth due to the increasing sophistication of vehicle components and rising production.

By Service: Transportation services represent the largest segment, accounting for xx Million of the total market. The growth in this segment is being propelled by increasing demand for efficient and reliable transportation of both finished vehicles and auto components. Warehousing, distribution, and inventory management services also contribute significantly, particularly with the growth of e-commerce and omnichannel distribution strategies.

The leading regions within China are the coastal provinces and major manufacturing hubs, benefiting from well-established infrastructure and proximity to key automotive manufacturing plants and export ports. Key drivers include favorable government policies promoting automotive industry growth, significant investments in transportation infrastructure, and the expanding domestic market.

China Automotive Logistics Market Product Developments

The China automotive logistics market is experiencing significant product innovation, driven by the need for greater efficiency, sustainability, and transparency. Key developments include the widespread adoption of electric and alternative fuel vehicles for transportation, significantly reducing the environmental impact of logistics operations and aligning with global sustainability goals. This shift is complemented by the implementation of advanced tracking and management systems, leveraging technologies like IoT and AI to enhance supply chain visibility and accountability. Real-time data analysis enables proactive risk management and optimized route planning, resulting in faster delivery times and reduced operational costs. Furthermore, the integration of automated warehousing and handling systems is streamlining processes and minimizing human error. This focus on technological advancements and sustainable practices is reshaping the competitive landscape and driving continuous improvement within the market. Future developments will likely center on autonomous vehicles, drone delivery for smaller parts, and further integration of blockchain technology for enhanced security and traceability.

Report Scope & Segmentation Analysis

By Type: This report segments the market into Finished Vehicle logistics and Auto Component logistics. A detailed analysis of each segment's market size, growth rate (CAGR), and competitive dynamics is provided. The Finished Vehicle logistics segment is expected to experience robust growth, driven by increasing domestic sales and exports, while the Auto Component logistics segment will benefit from the expansion of the automotive manufacturing sector and the rising demand for replacement parts. Specific CAGR projections for each segment are included in the full report.

By Service: The report comprehensively analyzes the market based on service offerings, including Transportation, Warehousing, Distribution and Inventory Management, and Value-Added Services (e.g., customs brokerage, last-mile delivery). Each service segment's contribution to overall market growth, competitive intensity, and future prospects are discussed. The growth of e-commerce and the increasing focus on just-in-time inventory management are key factors driving demand across all service segments.

Key Drivers of China Automotive Logistics Market Growth

The remarkable growth of the China automotive logistics market is fueled by a confluence of factors. The rapid expansion of China's domestic automotive industry, coupled with a surge in automotive exports, creates substantial demand for efficient logistics solutions. Significant investments in logistics infrastructure, including improved road networks, rail connections, and port facilities, are further enhancing capacity and connectivity. Government policies promoting the development of the logistics sector and incentivizing technological advancements are also playing a crucial role. The increasing adoption of new energy vehicles (NEVs) is a major driver, demanding specialized logistics solutions to accommodate their unique characteristics and charging requirements. Finally, the ongoing implementation of sophisticated supply chain management (SCM) practices, including improved forecasting, inventory optimization, and risk mitigation strategies, contributes significantly to market expansion.

Challenges in the China Automotive Logistics Market Sector

Despite its significant growth, the China automotive logistics market faces several challenges. The complex regulatory environment, including customs procedures and transportation regulations, can add complexity and increase operational costs. Infrastructure limitations in certain regions, particularly in less developed areas, can hinder efficient transportation and delivery. Intense competition among logistics providers necessitates continuous innovation and cost optimization to maintain profitability. Fluctuations in fuel prices, a significant expense for transportation, represent a recurring challenge. Moreover, geopolitical uncertainties and potential supply chain disruptions due to natural disasters or global events pose significant risks to the smooth operation of the automotive logistics network. Managing these challenges effectively is crucial for sustained market success.

Emerging Opportunities in China Automotive Logistics Market

Despite the challenges, the China automotive logistics market presents numerous exciting opportunities. The increasing adoption of cutting-edge technologies, including artificial intelligence (AI) for route optimization and predictive maintenance, and blockchain technology for enhanced transparency and security, is transforming the sector. The growth of e-commerce for automotive parts and accessories creates new avenues for specialized logistics services. Expanding into less-served rural markets and developing tailored logistics solutions for the rapidly growing NEV segment offer substantial potential for market expansion. Furthermore, the integration of sustainable practices throughout the supply chain, including the use of renewable energy sources and eco-friendly packaging, will present additional opportunities for innovative and environmentally responsible logistics providers.

Leading Players in the China Automotive Logistics Market Market

- Apex Group

- DHL (DHL)

- Nippon Express (Nippon Express)

- UPS (UPS)

- GEODIS (GEODIS)

- Yusen Logistics Co Ltd (Yusen Logistics)

- China Ocean Shipping (Group) Company

- SAIC Anji Logistics

- BLG Logistics

- Sinotrans Co Ltd

- HYCX Group

Key Developments in China Automotive Logistics Market Industry

May 2023: SAIC Anji Logistics ordered four methanol-ready car carriers, showcasing commitment to sustainable practices and reducing GHG emissions. This signals a shift towards environmentally friendly operations within the industry.

July 2023: COSCO Shipping launched a full-chain logistics service for new energy vehicles, responding to the rising demand for efficient export solutions in this growing segment. This demonstrates an agile response to market needs and potential for future growth in this niche sector.

Strategic Outlook for China Automotive Logistics Market Market

The China automotive logistics market is poised for continued growth, driven by sustained expansion in the automotive industry, increased exports, and ongoing technological innovation. Opportunities abound for companies that can adapt to evolving market demands, embrace sustainable practices, and leverage technological advancements to optimize their operations. The strategic focus on efficiency, sustainability, and technological integration will be critical for future success in this dynamic market.

China Automotive Logistics Market Segmentation

-

1. Type

- 1.1. Finished Vehicle

- 1.2. Auto Component

-

2. Service

- 2.1. Transportation

- 2.2. Warehous

- 2.3. Other Services

China Automotive Logistics Market Segmentation By Geography

- 1. China

China Automotive Logistics Market Regional Market Share

Geographic Coverage of China Automotive Logistics Market

China Automotive Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing New Energy Vehicles Sales

- 3.3. Market Restrains

- 3.3.1. Trade War between China and the United States

- 3.4. Market Trends

- 3.4.1. Chinese Investment in NEVs (New Energy Vehicles) Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Automotive Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Finished Vehicle

- 5.1.2. Auto Component

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Transportation

- 5.2.2. Warehous

- 5.2.3. Other Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Apex Group**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nippon Express

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 UPS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 GEODIS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Yusen Logistics Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 China Ocean Shipping (Group) Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SAIC Anji Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BLG Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sinotrans Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 HYCX Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Apex Group**List Not Exhaustive

List of Figures

- Figure 1: China Automotive Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Automotive Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: China Automotive Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: China Automotive Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 3: China Automotive Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: China Automotive Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: China Automotive Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 6: China Automotive Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Automotive Logistics Market?

The projected CAGR is approximately 5.96%.

2. Which companies are prominent players in the China Automotive Logistics Market?

Key companies in the market include Apex Group**List Not Exhaustive, DHL, Nippon Express, UPS, GEODIS, Yusen Logistics Co Ltd, China Ocean Shipping (Group) Company, SAIC Anji Logistics, BLG Logistics, Sinotrans Co Ltd, HYCX Group.

3. What are the main segments of the China Automotive Logistics Market?

The market segments include Type, Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 52.58 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing New Energy Vehicles Sales.

6. What are the notable trends driving market growth?

Chinese Investment in NEVs (New Energy Vehicles) Driving the Market Growth.

7. Are there any restraints impacting market growth?

Trade War between China and the United States.

8. Can you provide examples of recent developments in the market?

May 2023: SAIC Anji (a wholly-owned subsidiary of China’s SAIC Motor specializing in the automotive logistics business) placed an order for four methanol-ready car carriers to reduce greenhouse gas (GHG) emissions. As informed, the 9,000 CEU vessels will be built by China Merchants Jinling Shipyard (CMJL Nanjing). They will measure 228 meters in length with a molded depth of 15.4 meters and a width of 37.8 meters. The car carriers will also be scrubber-fitted to reduce greenhouse gas (GHG) emissions additionally.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Automotive Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Automotive Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Automotive Logistics Market?

To stay informed about further developments, trends, and reports in the China Automotive Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence