Key Insights

Europe's Pedestrian Detection Systems market is poised for significant expansion, driven by heightened road safety imperatives, evolving regulatory landscapes, and breakthroughs in sensor and AI technologies. The market, projected to reach €15.46 billion by 2025, is anticipated to grow at a CAGR of 7.15% from 2025 to 2033. This growth trajectory is underpinned by the accelerating integration of Advanced Driver-Assistance Systems (ADAS) with pedestrian detection functionalities in new European vehicle models. Increased urbanization and pedestrian density in major European urban centers are escalating demand for advanced pedestrian safety solutions. Innovations in radar, camera, and hybrid sensor systems are enhancing detection accuracy and reliability, further stimulating market growth. Hybrid systems, leveraging multiple sensor technologies, are expected to lead segment expansion due to superior performance in varied environmental conditions.

Europe Pedestrian Detection Systems Market Market Size (In Billion)

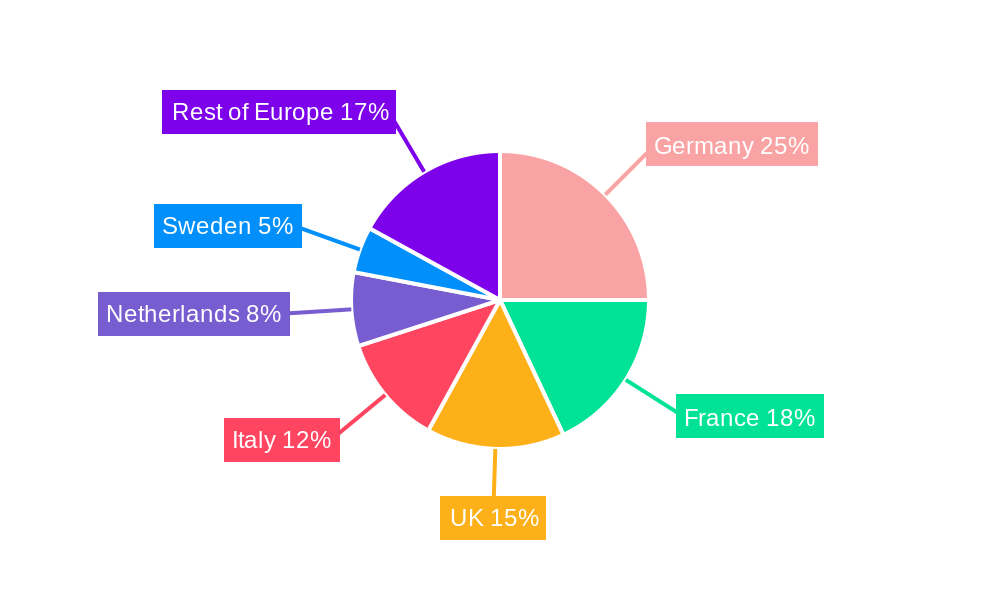

Despite robust market growth, adoption is moderated by the substantial initial investment required for pedestrian detection systems, particularly impacting smaller manufacturers and the aftermarket. Ensuring consistent system accuracy and reliability across diverse weather and complex traffic scenarios presents ongoing challenges. Nevertheless, sustained R&D in sensor technology and advanced algorithms is actively mitigating these concerns. Key market players are prioritizing innovation and strategic collaborations to broaden their reach and refine product portfolios. Germany, France, and the UK, as established automotive powerhouses, represent primary markets for pedestrian detection system deployment, with substantial growth opportunities identified in countries such as the Netherlands and Sweden.

Europe Pedestrian Detection Systems Market Company Market Share

Europe Pedestrian Detection Systems Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Europe Pedestrian Detection Systems Market, covering market size, growth drivers, challenges, opportunities, and key players. With a study period spanning from 2019 to 2033, including a base year of 2025 and a forecast period of 2025-2033, this report offers actionable insights for industry stakeholders. The report delves into various segments, including system type (Video, Infrared, Hybrid, Other Types) and component type (Sensors, Radars, Cameras, Other Component Types), providing granular market data and projections.

Europe Pedestrian Detection Systems Market Market Concentration & Innovation

The European Pedestrian Detection Systems market presents a moderately concentrated competitive landscape, with several key players dominating a significant portion of the market share. While precise figures for 2024 are still emerging, estimates suggest that the top five companies control approximately [Insert Updated Percentage]% of the market. Innovation is a pivotal driver of market growth, fueled by advancements in several key areas. These include sophisticated sensor technologies (e.g., LiDAR, radar, and vision systems), the application of artificial intelligence (AI) and machine learning algorithms for enhanced object recognition and classification, and the continuous refinement of computer vision capabilities. The increasing stringency of regulatory frameworks focused on road safety and autonomous driving technologies is further stimulating market expansion. The competitive landscape includes the challenge posed by substitute products, such as advanced driver-assistance systems (ADAS) that incorporate integrated pedestrian detection functionalities. However, a clear trend emerges in the end-user market: a rising preference for more sophisticated safety features directly fuels the demand for superior pedestrian detection systems. Mergers and acquisitions (M&A) activity within the sector has shown moderate activity in recent years, with a total deal value of approximately [Insert Updated Value] million over the past five years. These transactions have largely focused on bolstering technological capabilities and expanding market reach. Notable examples include:

- Deal 1: Company A's acquisition of Company B for [Insert Updated Value] million significantly broadened its sensor technology portfolio and expertise.

- Deal 2: The merger of Company C and Company D, valued at [Insert Updated Value] million, resulted in a strengthened market position, particularly within the German market.

- [Add 2-3 more recent and relevant M&A examples with details]

Europe Pedestrian Detection Systems Market Industry Trends & Insights

The Europe Pedestrian Detection Systems Market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration is steadily increasing across various vehicle segments, driven by heightened consumer awareness of road safety and stricter regulations. Technological disruptions, such as the integration of AI and machine learning algorithms, are enhancing the accuracy and reliability of pedestrian detection systems. Consumer preferences increasingly favor integrated, comprehensive safety packages, pushing manufacturers to incorporate advanced pedestrian detection as a standard feature. Intense competitive dynamics are shaping the market, with companies focusing on innovation, cost optimization, and strategic partnerships to gain a competitive edge. This is leading to a decline in prices, making the technology increasingly accessible. The market is predicted to reach xx Million by 2033.

Dominant Markets & Segments in Europe Pedestrian Detection Systems Market

Dominant Region/Country: Germany holds the largest market share in Europe due to its strong automotive industry and advanced technological infrastructure. The UK follows closely, owing to its emphasis on road safety initiatives and technological advancements.

Dominant Segments:

- Type: Video-based systems currently dominate the market due to their relatively lower cost and ease of integration. However, the infrared segment is expected to grow significantly due to its superior performance in low-light conditions.

- Component Type: Cameras are the most widely adopted component type, followed by radar and sensor technologies. The market for advanced sensor fusion techniques that combine data from multiple sources is showing strong growth.

Key Drivers (Germany and UK):

- Strong government support for autonomous driving initiatives

- Robust automotive manufacturing sector

- High consumer demand for advanced safety features

- Favorable regulatory landscape

Europe Pedestrian Detection Systems Market Product Developments

Recent product innovations focus on improving the accuracy and reliability of pedestrian detection in challenging conditions (e.g., low light, adverse weather). The integration of AI and machine learning is enabling more robust object recognition and classification. Competitive advantages are increasingly derived from advanced sensor fusion, real-time processing capabilities, and seamless integration with existing ADAS. These advancements are ensuring a better market fit by addressing the limitations of older systems.

Report Scope & Segmentation Analysis

Type: The market is segmented into video, infrared, hybrid, and other types of pedestrian detection systems. Growth projections vary by type, with infrared systems anticipated to show the highest growth rate. Market sizes for each type are projected for the forecast period. Competitive dynamics are influenced by technological advancements and cost factors.

Component Type: The market is segmented into sensors, radars, cameras, and other component types. The camera segment holds the largest market share due to its established technology and cost-effectiveness. Growth projections vary by component type, reflecting the evolving technological landscape and market preferences. Competitive dynamics are shaped by technological innovations and the integration of different components.

Key Drivers of Europe Pedestrian Detection Systems Market Growth

Stringent safety regulations across Europe are mandating the adoption of pedestrian detection systems in new vehicles. Technological advancements, such as AI-powered object recognition and improved sensor technologies, are enhancing the accuracy and reliability of these systems. The increasing prevalence of autonomous driving technology is further driving the demand for robust pedestrian detection capabilities.

Challenges in the Europe Pedestrian Detection Systems Market Sector

High initial costs associated with implementing advanced pedestrian detection systems can act as a barrier for smaller vehicle manufacturers. Supply chain disruptions and the availability of specialized components pose challenges to consistent production. Competition from established players with advanced technology and strong market positions creates pressure on smaller companies. These factors collectively constrain market growth to some extent.

Emerging Opportunities in Europe Pedestrian Detection Systems Market

The growing adoption of autonomous vehicles and advanced driver-assistance systems presents significant opportunities for expansion. Integration with smart city infrastructure and the development of pedestrian detection systems for non-automotive applications (e.g., robotics) offer new market avenues. Increased consumer awareness of road safety and a willingness to pay for advanced safety features are driving opportunities for growth.

Leading Players in the Europe Pedestrian Detection Systems Market Market

- Dynacast (Form Technologies Inc )

- Nemak SAB De CV

- Endurance Group

- Koch Enterprises Inc (Gibbs Die Casting Group)

- Sundaram - Clayton Ltd

- Georg Fischer AG

- Ryobi Die Casting Inc

- Rheinmetall AG (Rheinmetall Automotive formerly KSPG AG)

- Officine Meccaniche Rezzatesi SpA

- Rockman Industries

- Engtek Group

- Shiloh Industries Ltd

Key Developments in Europe Pedestrian Detection Systems Market Industry

July 2022: Volvo Trucks launched its Side Collision Avoidance Support system, utilizing twin radars to detect and alert drivers to pedestrians and cyclists in blind spots. This highlights the increasing sophistication and integration of pedestrian detection into commercial vehicles.

February 2022: Skoda Auto's commitment to over 200 pedestrian safety tests during vehicle development showcases the industry's focus on improving pedestrian protection and the technological advancements needed to accomplish this.

January 2022: Ficosa's plan to replace front mirrors with camera systems in MAN commercial vehicles demonstrates the shift towards camera-based systems and their integration into broader safety systems for improved pedestrian detection.

Strategic Outlook for Europe Pedestrian Detection Systems Market Market

The future of the Europe Pedestrian Detection Systems Market looks promising, driven by ongoing technological advancements, stricter safety regulations, and rising consumer demand for enhanced safety features. The integration of AI and machine learning will further improve the accuracy and reliability of pedestrian detection systems, leading to wider adoption across various vehicle segments and new applications. The market is poised for significant growth, driven by these factors.

Europe Pedestrian Detection Systems Market Segmentation

-

1. Type

- 1.1. Video

- 1.2. Infrared

- 1.3. Hybrid

- 1.4. Other Types

-

2. Component Type

- 2.1. Sensors

- 2.2. Radars

- 2.3. Cameras

- 2.4. Other Component Types

Europe Pedestrian Detection Systems Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Russia

- 5. Spain

- 6. Italy

- 7. Rest of Europe

Europe Pedestrian Detection Systems Market Regional Market Share

Geographic Coverage of Europe Pedestrian Detection Systems Market

Europe Pedestrian Detection Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of ADAS Systems Driving the Market

- 3.3. Market Restrains

- 3.3.1. Lower efficiency in bad weather conditions

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of ADAS Systems Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Video

- 5.1.2. Infrared

- 5.1.3. Hybrid

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Component Type

- 5.2.1. Sensors

- 5.2.2. Radars

- 5.2.3. Cameras

- 5.2.4. Other Component Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Russia

- 5.3.5. Spain

- 5.3.6. Italy

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Video

- 6.1.2. Infrared

- 6.1.3. Hybrid

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Component Type

- 6.2.1. Sensors

- 6.2.2. Radars

- 6.2.3. Cameras

- 6.2.4. Other Component Types

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Video

- 7.1.2. Infrared

- 7.1.3. Hybrid

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Component Type

- 7.2.1. Sensors

- 7.2.2. Radars

- 7.2.3. Cameras

- 7.2.4. Other Component Types

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Video

- 8.1.2. Infrared

- 8.1.3. Hybrid

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Component Type

- 8.2.1. Sensors

- 8.2.2. Radars

- 8.2.3. Cameras

- 8.2.4. Other Component Types

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Russia Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Video

- 9.1.2. Infrared

- 9.1.3. Hybrid

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Component Type

- 9.2.1. Sensors

- 9.2.2. Radars

- 9.2.3. Cameras

- 9.2.4. Other Component Types

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Spain Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Video

- 10.1.2. Infrared

- 10.1.3. Hybrid

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Component Type

- 10.2.1. Sensors

- 10.2.2. Radars

- 10.2.3. Cameras

- 10.2.4. Other Component Types

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Italy Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Video

- 11.1.2. Infrared

- 11.1.3. Hybrid

- 11.1.4. Other Types

- 11.2. Market Analysis, Insights and Forecast - by Component Type

- 11.2.1. Sensors

- 11.2.2. Radars

- 11.2.3. Cameras

- 11.2.4. Other Component Types

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Rest of Europe Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Video

- 12.1.2. Infrared

- 12.1.3. Hybrid

- 12.1.4. Other Types

- 12.2. Market Analysis, Insights and Forecast - by Component Type

- 12.2.1. Sensors

- 12.2.2. Radars

- 12.2.3. Cameras

- 12.2.4. Other Component Types

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Dynacast (Form Technologies Inc )

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Nemak SAB De CV

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Endurance Group

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Koch Enterprises Inc (Gibbs Die Casting Group)

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Sundaram - Clayton Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Georg Fischer AG

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Ryobi Die Casting Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Rheinmetall AG (Rheinmetall Automotive formerly KSPG AG)

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Officine Meccaniche Rezzatesi SpA

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Rockman Industries

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Engtek Group

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Shiloh Industries Ltd

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Dynacast (Form Technologies Inc )

List of Figures

- Figure 1: Europe Pedestrian Detection Systems Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Pedestrian Detection Systems Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 3: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 6: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 9: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 12: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 15: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 18: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 21: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 23: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 24: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Pedestrian Detection Systems Market?

The projected CAGR is approximately 7.15%.

2. Which companies are prominent players in the Europe Pedestrian Detection Systems Market?

Key companies in the market include Dynacast (Form Technologies Inc ), Nemak SAB De CV, Endurance Group, Koch Enterprises Inc (Gibbs Die Casting Group), Sundaram - Clayton Ltd, Georg Fischer AG, Ryobi Die Casting Inc, Rheinmetall AG (Rheinmetall Automotive formerly KSPG AG), Officine Meccaniche Rezzatesi SpA, Rockman Industries, Engtek Group, Shiloh Industries Ltd.

3. What are the main segments of the Europe Pedestrian Detection Systems Market?

The market segments include Type, Component Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.46 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of ADAS Systems Driving the Market.

6. What are the notable trends driving market growth?

Increasing Adoption of ADAS Systems Driving the Market.

7. Are there any restraints impacting market growth?

Lower efficiency in bad weather conditions.

8. Can you provide examples of recent developments in the market?

July 2022: Volvo Trucks announced the launch of a new safety technology aimed at improving road safety. The device utilizes twin radars on each side of the truck to recognize when other road users, such as bicycles, enter the danger zone. Known as the Side Collision Avoidance Support system, it alerts the driver by flashing a red light on the appropriate side mirror when something is in the blind spot area. If the driver signals a lane change with the turn signal, the red light starts to flash, and an audible warning sound is emitted from the side of the potential accident. This provides the driver with timely information and the option to apply the brakes, allowing, for example, a bike to safely pass.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Pedestrian Detection Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Pedestrian Detection Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Pedestrian Detection Systems Market?

To stay informed about further developments, trends, and reports in the Europe Pedestrian Detection Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence