Key Insights

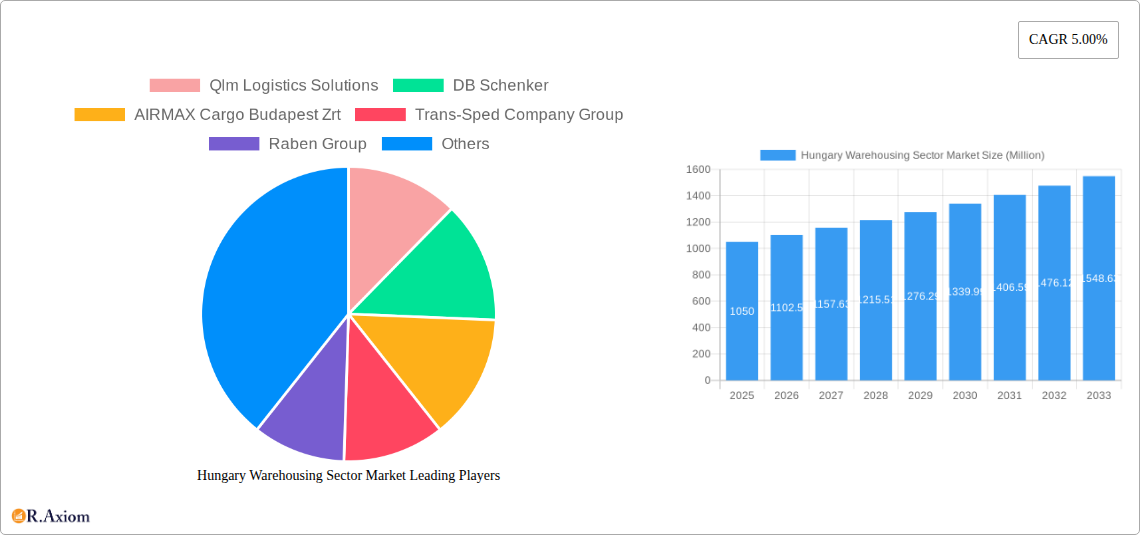

The Hungarian warehousing sector market, valued at €1.05 billion in 2025, is projected to experience robust growth, driven by a flourishing e-commerce sector, increasing cross-border trade within the EU, and the expansion of manufacturing and logistics activities within the country. A Compound Annual Growth Rate (CAGR) of 5% is anticipated from 2025 to 2033, indicating a significant market expansion over the forecast period. This growth is fueled by several key factors. The rise of e-commerce necessitates efficient warehousing and distribution networks, creating substantial demand for both general and specialized warehousing solutions, like refrigerated storage for food and beverage companies. Furthermore, Hungary's strategic geographical location within Central Europe makes it an attractive hub for regional distribution, benefiting from its proximity to major European markets. Growth within the manufacturing, consumer goods, and food and beverage sectors directly translates into increased warehousing needs. While the market faces potential restraints such as labor shortages and the need for infrastructure improvements, ongoing investments in modernization and automation are mitigating these challenges. The segmentation analysis highlights the significant roles of private and public warehouses, with public warehousing likely experiencing faster growth due to the increasing need for flexible and scalable solutions by businesses of various sizes.

Hungary Warehousing Sector Market Market Size (In Billion)

The market's structure shows a diverse range of players, including both large international logistics providers like DB Schenker and CEVA Logistics, and local companies like ADR Logistics Kft and Webshippy Magyarország Kft. This competitive landscape fosters innovation and drives efficiency improvements within the sector. The continued expansion of the EU single market and associated trade liberalization will continue to boost demand, while potential challenges could arise from geopolitical uncertainties and global economic fluctuations. However, the long-term outlook for the Hungarian warehousing sector remains positive, fueled by the structural trends outlined above and underpinned by the country's growing economic strength and strategic importance within the European logistics network. The diverse range of warehousing types (general, refrigerated, farm products) indicates a market that caters to a wide spectrum of industry needs.

Hungary Warehousing Sector Market Company Market Share

Hungary Warehousing Sector Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Hungary warehousing sector market, encompassing market size, segmentation, key players, growth drivers, challenges, and future opportunities. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. This report is essential for investors, industry stakeholders, and strategic decision-makers seeking to understand the dynamics of this evolving market.

Hungary Warehousing Sector Market Concentration & Innovation

The Hungarian warehousing market exhibits a moderately concentrated landscape, with several large players and a number of smaller, regional operators. Market share is largely dependent on warehouse capacity, geographic reach, and specialized services offered. While precise market share data for individual companies is proprietary and unavailable, a few major companies such as DB Schenker and Raben Group likely hold significant market share. Innovation is driven by the increasing adoption of automation technologies, such as automated guided vehicles (AGVs) and warehouse management systems (WMS), to improve efficiency and reduce costs.

- Market Concentration: Moderate, with a few dominant players and many smaller firms.

- Innovation Drivers: Automation (AGVs, WMS), digitalization, sustainable practices.

- Regulatory Framework: The report will analyze relevant Hungarian regulations impacting warehousing operations, including those related to safety, environmental standards, and employment laws.

- Product Substitutes: Limited direct substitutes exist; competition primarily focuses on service differentiation and cost efficiency.

- End-User Trends: Growing demand from e-commerce, manufacturing, and food and beverage sectors is shaping warehousing requirements.

- M&A Activities: Recent acquisitions, like Rhenus's acquisition of ITS Logistics Hungary KFT, indicate consolidation and expansion within the sector. The estimated value of M&A deals in this sector in 2024 was xx Million. This section provides an analysis of M&A activity and its impact on the market structure.

Hungary Warehousing Sector Market Industry Trends & Insights

The Hungarian warehousing market is experiencing robust growth, fueled by several key factors. The expansion of e-commerce is a major driver, demanding increased warehousing space and advanced logistics solutions. The country's strategic location within Central Europe and its access to major transportation routes further contribute to this growth. Technological advancements in automation and digitalization are transforming warehousing operations, optimizing efficiency and reducing costs. However, competition is intense, forcing companies to continuously innovate and adapt to evolving customer demands. The Compound Annual Growth Rate (CAGR) for the market during the historical period (2019-2024) was xx%, and is projected to be xx% during the forecast period (2025-2033). Market penetration of automated systems is increasing steadily, with an estimated xx% penetration in 2025.

Dominant Markets & Segments in Hungary Warehousing Sector Market

The Hungarian warehousing sector is characterized by a strong geographical concentration, primarily within major industrial and logistics hubs situated near Budapest and along key transportation corridors. The manufacturing sector stands out as a significant driver of overall warehousing demand, closely followed by the robust and consistently growing food and beverage, and consumer goods sectors. This dominance is further underpinned by increasing production volumes and the growing complexity of modern supply chains.

- By End-User Industry:

- Manufacturing: This segment continues to be the dominant force, propelled by ongoing industrial growth and the increasing sophistication of supply chain management.

- Consumer Goods: Experiencing robust expansion, this segment's growth is fueled by the burgeoning e-commerce landscape and steadily rising consumer spending power across Hungary.

- Food and Beverages: A critical sector, it generates substantial demand for specialized temperature-controlled warehousing solutions to maintain product integrity and safety.

- Retail: The retail sector is increasingly relying on efficient warehousing infrastructure to support its complex distribution networks and ensure timely product availability.

- Healthcare: This segment presents specific and often stringent warehousing requirements, particularly for pharmaceuticals and sensitive medical supplies.

- Other End-User Industries: Encompasses a diverse array of sectors, each with unique warehousing needs that contribute to the market's overall demand.

- By Type:

- General Warehousing and Storage: Remains the largest and most prevalent segment, offering versatile solutions for a wide range of goods and inventory management needs.

- Refrigerated Warehousing and Storage: Essential for the food and beverage industry, this segment is vital for preserving perishable goods and meeting stringent regulatory standards.

- Farm Product Warehousing and Storage: A specialized niche catering to the unique requirements of storing and preserving agricultural produce.

- By Ownership:

- Private Warehouses: Primarily utilized by large corporations for their internal logistics operations and supply chain management.

- Public Warehouses: Offering flexible and scalable warehousing services, these facilities cater to a broad spectrum of clients, from SMEs to larger enterprises.

- Bonded Warehouses: Specialized sites designed for the storage of goods under customs control, facilitating international trade and import/export operations.

The sustained growth within these dominant segments is significantly influenced by a combination of favorable economic policies, continuous infrastructure development, and Hungary's strategic geographical positioning within Central Europe. Public warehouses, in particular, are witnessing accelerated growth owing to their inherent flexibility and their capacity to serve a diverse client base with varied logistical requirements.

Hungary Warehousing Sector Market Product Developments

Recent product innovations focus on enhancing efficiency and sustainability. This includes the integration of advanced warehouse management systems (WMS), the implementation of automated guided vehicles (AGVs), and the adoption of green logistics practices to reduce environmental impact. The competitive landscape rewards companies offering customized solutions, technological integration, and improved supply chain visibility.

Report Scope & Segmentation Analysis

This comprehensive report meticulously segments the Hungary warehousing market. The analysis is structured across key dimensions, including end-user industry (categorized into Manufacturing, Consumer Goods, Food and Beverages, Retail, Healthcare, and Other sectors), type of warehousing (General, Refrigerated, and Farm Product), and ownership models (Private, Public, and Bonded). For each identified segment, the report provides detailed projections for growth, estimates of market size in millions, and an in-depth analysis of competitive dynamics. For instance, the refrigerated warehousing segment is projected for significant expansion, driven by the burgeoning food and beverage industry. Similarly, the public warehousing segment is expected to demonstrate considerable potential due to the increasing trend of outsourcing logistics functions by businesses seeking greater efficiency and cost-effectiveness.

Key Drivers of Hungary Warehousing Sector Market Growth

Growth is propelled by e-commerce expansion, favorable government policies supporting logistics infrastructure development, foreign direct investment (FDI) in manufacturing, and the increasing adoption of automation technologies improving efficiency. The strategic location of Hungary within Central Europe enhances its appeal as a logistics hub.

Challenges in the Hungary Warehousing Sector Market Sector

Challenges include the rising cost of labor, competition from neighboring countries, infrastructure limitations in certain regions, and the need for continuous investment in technological upgrades to maintain competitiveness. Furthermore, adapting to evolving regulatory requirements and managing supply chain disruptions remain critical challenges. These factors may collectively impact market growth by approximately xx% by 2033, based on projected trends.

Emerging Opportunities in Hungary Warehousing Sector Market

The Hungarian warehousing sector is ripe with emerging opportunities. A key driver is the rapid expansion of e-commerce logistics, necessitating more sophisticated and agile warehousing solutions. The increasing demand for specialized warehousing, particularly in the realm of cold chain logistics for temperature-sensitive products, presents a significant growth avenue. Furthermore, the potential for increased automation and the integration of advanced technologies within warehouse operations offer avenues for enhanced efficiency and productivity. The growing emphasis on sustainable warehousing practices, encompassing energy efficiency and waste reduction, is also shaping future opportunities. Strategic expansion into less saturated regions within Hungary and actively tapping into nascent or high-growth emerging sectors will be crucial for unlocking substantial growth potential.

Leading Players in the Hungary Warehousing Sector Market Market

- Qlm Logistics Solutions

- DB Schenker

- AIRMAX Cargo Budapest Zrt

- Trans-Sped Company Group

- Raben Group

- CEVA Logistics

- ADR Logistics Kft

- Eurasia Logistics Ltd

- Webshippy Magyarország Kft

- Rhenus Logistics

Key Developments in Hungary Warehousing Sector Market Industry

- September 2023: Sennebogen GmbH's inauguration of a new manufacturing facility in Litér, Hungary, signifies an expansion in steel and welded assembly production capacity. This development indirectly bolsters the warehousing sector by increasing the volume of goods requiring storage and logistical support within the manufacturing domain.

- September 2023: Rhenus's strategic acquisition of ITS Logistics Hungary KFT marks a significant step in consolidating its presence within the Central-East European market. This move is anticipated to lead to an increase in Rhenus's warehousing capacity and a stronger competitive position in the region.

Strategic Outlook for Hungary Warehousing Sector Market Market

The future outlook for the Hungarian warehousing sector is exceptionally positive, projecting sustained and robust growth. This expansion will be primarily fueled by the persistent rise of e-commerce, ongoing industrial development across various sectors, and the transformative impact of technological advancements. Companies that proactively embrace and integrate automation, digitalization, and sustainable operational practices are best positioned to not only capitalize on emerging opportunities but also to effectively navigate the evolving challenges of the market. The sector holds substantial future potential, offering ample scope for both strategic expansion and significant innovation.

Hungary Warehousing Sector Market Segmentation

-

1. Type

- 1.1. General Warehousing and Storage

- 1.2. Refrigerated warehousing and storage

- 1.3. Farm Product warehousing and storage

-

2. Ownership

- 2.1. Private Warehouses

- 2.2. Public Warehouses

- 2.3. Bonded Warehouse

-

3. End-User Industry

- 3.1. Manufacturing

- 3.2. Consumer Goods

- 3.3. Food and Beverages

- 3.4. Retail

- 3.5. Helathcare

- 3.6. Other End-User Industries

Hungary Warehousing Sector Market Segmentation By Geography

- 1. Hungary

Hungary Warehousing Sector Market Regional Market Share

Geographic Coverage of Hungary Warehousing Sector Market

Hungary Warehousing Sector Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Popularity of Omnichannel Distribution

- 3.3. Market Restrains

- 3.3.1. High Investment and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. Increase in logistics space construction

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Hungary Warehousing Sector Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. General Warehousing and Storage

- 5.1.2. Refrigerated warehousing and storage

- 5.1.3. Farm Product warehousing and storage

- 5.2. Market Analysis, Insights and Forecast - by Ownership

- 5.2.1. Private Warehouses

- 5.2.2. Public Warehouses

- 5.2.3. Bonded Warehouse

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Manufacturing

- 5.3.2. Consumer Goods

- 5.3.3. Food and Beverages

- 5.3.4. Retail

- 5.3.5. Helathcare

- 5.3.6. Other End-User Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Hungary

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Qlm Logistics Solutions

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DB Schenker

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AIRMAX Cargo Budapest Zrt

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Trans-Sped Company Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Raben Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CEVA Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ADR Logistics Kft **List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Eurasia Logistics Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Webshippy Magyarország Kft

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Rhenus Logistics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Qlm Logistics Solutions

List of Figures

- Figure 1: Hungary Warehousing Sector Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Hungary Warehousing Sector Market Share (%) by Company 2025

List of Tables

- Table 1: Hungary Warehousing Sector Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Hungary Warehousing Sector Market Revenue Million Forecast, by Ownership 2020 & 2033

- Table 3: Hungary Warehousing Sector Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 4: Hungary Warehousing Sector Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Hungary Warehousing Sector Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Hungary Warehousing Sector Market Revenue Million Forecast, by Ownership 2020 & 2033

- Table 7: Hungary Warehousing Sector Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 8: Hungary Warehousing Sector Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hungary Warehousing Sector Market?

The projected CAGR is approximately 5.00%.

2. Which companies are prominent players in the Hungary Warehousing Sector Market?

Key companies in the market include Qlm Logistics Solutions, DB Schenker, AIRMAX Cargo Budapest Zrt, Trans-Sped Company Group, Raben Group, CEVA Logistics, ADR Logistics Kft **List Not Exhaustive, Eurasia Logistics Ltd, Webshippy Magyarország Kft, Rhenus Logistics.

3. What are the main segments of the Hungary Warehousing Sector Market?

The market segments include Type, Ownership, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.05 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Popularity of Omnichannel Distribution.

6. What are the notable trends driving market growth?

Increase in logistics space construction.

7. Are there any restraints impacting market growth?

High Investment and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

September 2023: Germany-based material handling equipment manufacturer Sennebogen GmbH inaugurated its new manufacturing facility, Termelés-Logistic-Centrum GmbH, in Litér, Hungary. Covering an expansive area of 315,000 square feet, the state-of-the-art plant is strategically designed to enhance Sennebogen's capacity for the production of steel and welded assemblies. In addition to the advanced manufacturing capabilities, the facility also includes office space. Situated on a sprawling 32-acre site, the new plant is located approximately a half-hour drive from Sennebogen's initial manufacturing site in Balatonfüred, Hungary.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hungary Warehousing Sector Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hungary Warehousing Sector Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hungary Warehousing Sector Market?

To stay informed about further developments, trends, and reports in the Hungary Warehousing Sector Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence