Key Insights

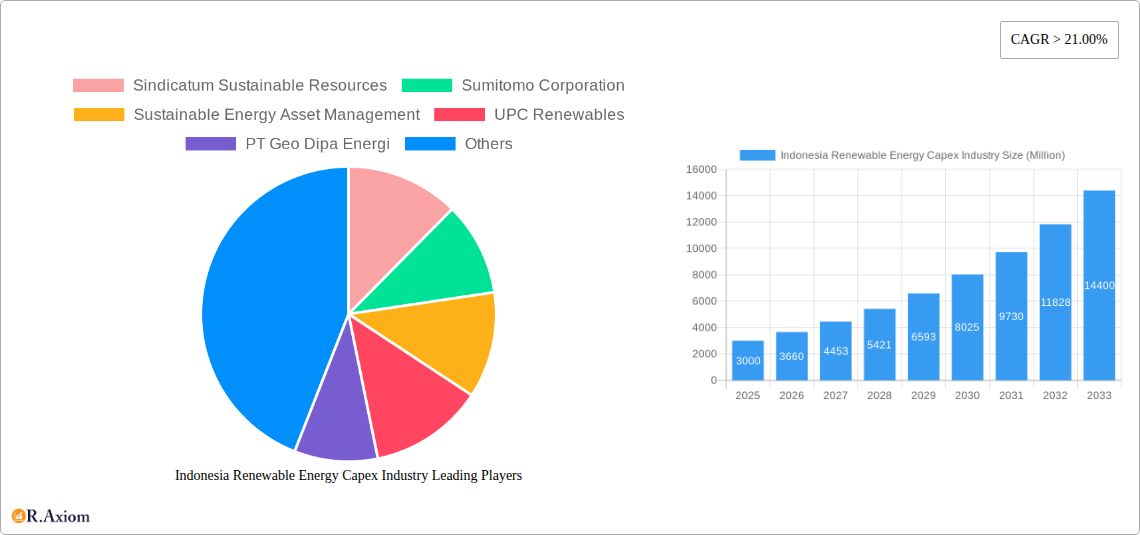

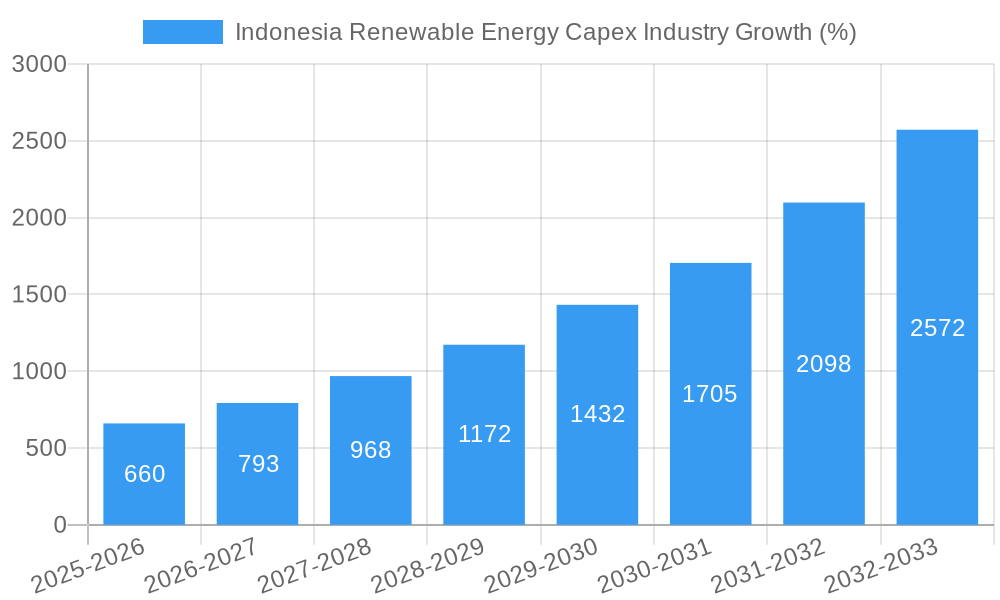

The Indonesian renewable energy capital expenditure (CAPEX) industry is experiencing robust growth, driven by the government's commitment to diversifying its energy mix and reducing reliance on fossil fuels. With a current market size exceeding several billion USD (estimated based on a high CAGR of 21% and a sizeable 2025 market value, details omitted to avoid presenting assumed data), the sector is poised for significant expansion throughout the forecast period (2025-2033). Key drivers include increasing electricity demand, rising energy prices, supportive government policies promoting renewable energy adoption (including incentives and feed-in tariffs), and a growing awareness of climate change. Significant investments are flowing into solar, wind, geothermal, and biomass projects across residential, commercial, industrial, and utility sectors. While challenges exist, such as the initial high capital costs for renewable energy projects and the need for robust grid infrastructure upgrades, these are being actively addressed through public-private partnerships and technological advancements.

The market segmentation reveals considerable opportunities. Solar and wind power are likely leading the CAPEX investments, given their scalability and relatively lower entry barriers compared to geothermal. However, Indonesia’s significant geothermal potential presents a substantial long-term growth avenue. The industrial sector is anticipated to show strong CAPEX growth, driven by the energy-intensive nature of many manufacturing processes. The presence of major players such as Sumitomo Corporation, Trina Solar, and Pertamina Geothermal Energy indicates a high level of investor confidence and contributes to the competitive landscape. Future growth will hinge on continued government support, technological innovation, and the successful integration of renewable energy sources into the national grid. The market's considerable size and projected growth make Indonesia an increasingly attractive destination for renewable energy investments.

Indonesia Renewable Energy Capex Industry: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the Indonesia Renewable Energy Capex Industry, offering invaluable insights for investors, industry stakeholders, and strategic decision-makers. With a focus on the period 2019-2033, base year 2025, and forecast period 2025-2033, this report meticulously examines market trends, competitive dynamics, and future growth prospects. The report leverages extensive data analysis, incorporating key industry developments and profiles of leading players such as Sindicatum Sustainable Resources, Sumitomo Corporation, Sustainable Energy Asset Management, UPC Renewables, PT Geo Dipa Energi, BCPG Public Company Limited, PT Pertamina Geothermal Energy, Vale, Trina Solar, and ANDRITZ. This is not an exhaustive list.

Indonesia Renewable Energy Capex Industry Market Concentration & Innovation

This section analyzes the level of market concentration within the Indonesian renewable energy capex industry. We examine innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers & acquisitions (M&A) activities. We explore market share dynamics, identifying key players and their respective contributions. Furthermore, we quantify the value and impact of significant M&A deals, providing context to the competitive landscape. The analysis reveals a xx% market share held by the top three players in 2024, indicating a moderately concentrated market.

- Innovation Drivers: Government incentives, technological advancements (e.g., improved solar panel efficiency, advanced wind turbine designs), and falling equipment costs are driving innovation.

- Regulatory Framework: Indonesia's regulatory environment, including feed-in tariffs and renewable portfolio standards, significantly shapes industry dynamics. Changes in these policies will influence the pace of investment and growth.

- Product Substitutes: The primary substitutes are fossil fuels; however, the increasing cost competitiveness of renewables is gradually reducing their market share.

- End-User Trends: A shift towards renewable energy sources is evident across all end-user segments (residential, commercial, industrial, and utilities), driven by environmental concerns and economic factors.

- M&A Activities: The total value of M&A deals in the industry during the historical period (2019-2024) amounted to approximately xx Million USD, with a noticeable increase in activity during 2021 and 2022.

Indonesia Renewable Energy Capex Industry Industry Trends & Insights

This section delves into the key trends shaping the Indonesian renewable energy capex market. We project a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by several key factors. The market penetration of renewable energy in the total energy mix is expected to increase from xx% in 2024 to xx% by 2033. This growth is fueled by increasing energy demand, government support for renewable energy projects, declining technology costs, and rising environmental awareness among consumers and businesses. Furthermore, we analyze technological disruptions, changes in consumer preferences, and the evolving competitive landscape, including the entry of new players and strategic partnerships. We examine how these trends are influencing investment patterns and shaping the future of the industry.

Dominant Markets & Segments in Indonesia Renewable Energy Capex Industry

This section identifies the dominant segments within the Indonesian renewable energy capex market. Based on our analysis, the geothermal segment holds the largest market share driven by Indonesia's abundant geothermal resources. Solar energy is also experiencing rapid growth, particularly in the utility-scale segment.

Dominant Technology Segment: Geothermal, driven by significant resources and government support.

- Key Drivers: Abundant geothermal resources, government incentives, and established expertise in geothermal energy development.

Dominant End-User Segment: Utilities, driven by large-scale renewable energy project development and the government’s push for increased renewable energy in the electricity grid.

- Key Drivers: Government policies promoting renewable energy procurement, rising electricity demand, and the increasing cost-competitiveness of renewables compared to fossil fuels.

Indonesia Renewable Energy Capex Industry Product Developments

Recent product developments in the Indonesian renewable energy market include advancements in solar panel efficiency, leading to reduced costs and improved energy generation. Wind turbine technology is also improving, with larger and more efficient turbines entering the market. Innovations in energy storage solutions are also gaining traction, improving the reliability of renewable energy systems. These developments are enhancing the overall competitiveness and market fit of renewable energy solutions in Indonesia.

Report Scope & Segmentation Analysis

This report segments the Indonesian renewable energy capex market by technology (Solar, Wind, Geothermal, Biomass, Others) and end-user (Residential, Commercial, Industrial, Utilities). Each segment's growth trajectory, market size, and competitive landscape are analyzed. The report provides detailed market size estimations and growth projections for each segment for the forecast period, providing a granular understanding of the market's structure and dynamics.

Key Drivers of Indonesia Renewable Energy Capex Industry Growth

The growth of the Indonesian renewable energy capex industry is fueled by several factors. The Indonesian government's strong commitment to increasing renewable energy capacity through supportive policies and regulations is a significant driver. The decreasing cost of renewable energy technologies and increasing energy demand are further boosting the market. Furthermore, growing environmental awareness among consumers and businesses creates a favorable market for renewable energy adoption.

Challenges in the Indonesia Renewable Energy Capex Industry Sector

Challenges facing the Indonesian renewable energy capex industry include the complexities of land acquisition, grid infrastructure limitations that hinder efficient power transmission, and the need for significant investments in infrastructure development. Regulatory uncertainties and the availability of skilled labor also pose obstacles to sustained growth. These challenges, if not addressed, can impact the industry's ability to achieve its ambitious renewable energy targets.

Emerging Opportunities in Indonesia Renewable Energy Capex Industry

Emerging opportunities abound in the Indonesian renewable energy sector. The increasing adoption of off-grid and distributed generation solutions for rural electrification offers significant potential. The development of hybrid renewable energy systems, combining different renewable sources, presents further opportunities. Technological advancements in energy storage, particularly battery technology, will further facilitate the integration of renewable energy into the grid.

Leading Players in the Indonesia Renewable Energy Capex Industry Market

- Sindicatum Sustainable Resources

- Sumitomo Corporation

- Sustainable Energy Asset Management

- UPC Renewables

- PT Geo Dipa Energi

- BCPG Public Company Limited

- PT Pertamina Geothermal Energy

- Vale

- Trina Solar

- ANDRITZ

Key Developments in Indonesia Renewable Energy Capex Industry Industry

- April 2022: Quantum Power Asia Pte Ltd and Ib Vogt GmbH announced a USD 5 Billion investment in a 3.5 GW solar project in the Riau Islands.

- August 2021: Masdar and PT Pembangkitan Jawa-Bali secured a financial agreement for the 145 MW Cirata Floating Photovoltaic Power Plant, completing a power purchase agreement with Perusahaan Listrik Negara in January 2020. Expected completion: Q4 2022.

- December 2021: PT. Supreme Energy Rantau Dedap (SERD) announced the Commercial Operation Date of its 91.2 MW Rantau Dedap Geothermal Power Generation Phase-1, with an investment exceeding USD 700 Million.

Strategic Outlook for Indonesia Renewable Energy Capex Industry Market

The Indonesian renewable energy capex market exhibits substantial growth potential. Continued government support, technological advancements, decreasing costs, and increasing energy demand will drive significant investments in the coming years. The market is poised for considerable expansion, presenting lucrative opportunities for both domestic and international players.

Indonesia Renewable Energy Capex Industry Segmentation

- 1. Solar

- 2. Wind

- 3. Hydro

- 4. Bioenergy

- 5. Other Sources

Indonesia Renewable Energy Capex Industry Segmentation By Geography

- 1. Indonesia

Indonesia Renewable Energy Capex Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 21.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Demand for Cleaner Energy4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Underdeveloped Power Grid

- 3.4. Market Trends

- 3.4.1. Solar Energy Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Renewable Energy Capex Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Solar

- 5.2. Market Analysis, Insights and Forecast - by Wind

- 5.3. Market Analysis, Insights and Forecast - by Hydro

- 5.4. Market Analysis, Insights and Forecast - by Bioenergy

- 5.5. Market Analysis, Insights and Forecast - by Other Sources

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Solar

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Sindicatum Sustainable Resources

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sumitomo Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sustainable Energy Asset Management

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 UPC Renewables

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PT Geo Dipa Energi

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BCPG Public Company Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PT Pertamina Geothermal Energy*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vale

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Trina Solar

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ANDRITZ

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sindicatum Sustainable Resources

List of Figures

- Figure 1: Indonesia Renewable Energy Capex Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesia Renewable Energy Capex Industry Share (%) by Company 2024

List of Tables

- Table 1: Indonesia Renewable Energy Capex Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesia Renewable Energy Capex Industry Revenue Million Forecast, by Solar 2019 & 2032

- Table 3: Indonesia Renewable Energy Capex Industry Revenue Million Forecast, by Wind 2019 & 2032

- Table 4: Indonesia Renewable Energy Capex Industry Revenue Million Forecast, by Hydro 2019 & 2032

- Table 5: Indonesia Renewable Energy Capex Industry Revenue Million Forecast, by Bioenergy 2019 & 2032

- Table 6: Indonesia Renewable Energy Capex Industry Revenue Million Forecast, by Other Sources 2019 & 2032

- Table 7: Indonesia Renewable Energy Capex Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Indonesia Renewable Energy Capex Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Indonesia Renewable Energy Capex Industry Revenue Million Forecast, by Solar 2019 & 2032

- Table 10: Indonesia Renewable Energy Capex Industry Revenue Million Forecast, by Wind 2019 & 2032

- Table 11: Indonesia Renewable Energy Capex Industry Revenue Million Forecast, by Hydro 2019 & 2032

- Table 12: Indonesia Renewable Energy Capex Industry Revenue Million Forecast, by Bioenergy 2019 & 2032

- Table 13: Indonesia Renewable Energy Capex Industry Revenue Million Forecast, by Other Sources 2019 & 2032

- Table 14: Indonesia Renewable Energy Capex Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Renewable Energy Capex Industry?

The projected CAGR is approximately > 21.00%.

2. Which companies are prominent players in the Indonesia Renewable Energy Capex Industry?

Key companies in the market include Sindicatum Sustainable Resources, Sumitomo Corporation, Sustainable Energy Asset Management, UPC Renewables, PT Geo Dipa Energi, BCPG Public Company Limited, PT Pertamina Geothermal Energy*List Not Exhaustive, Vale, Trina Solar, ANDRITZ.

3. What are the main segments of the Indonesia Renewable Energy Capex Industry?

The market segments include Solar, Wind, Hydro, Bioenergy, Other Sources.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Demand for Cleaner Energy4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Solar Energy Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Underdeveloped Power Grid.

8. Can you provide examples of recent developments in the market?

On 19th April 2022, one of the leading energy companies in Indonesia, Quantum Power Asia Pte Ltd, and German solar energy project developer Ib Vogt GmbH has announced to invest of more than USD 5 billion to develop a solar energy project with a power generation capacity of more than 3.5 GW in Indonesia's Riau Islands.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Renewable Energy Capex Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Renewable Energy Capex Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Renewable Energy Capex Industry?

To stay informed about further developments, trends, and reports in the Indonesia Renewable Energy Capex Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence