Key Insights

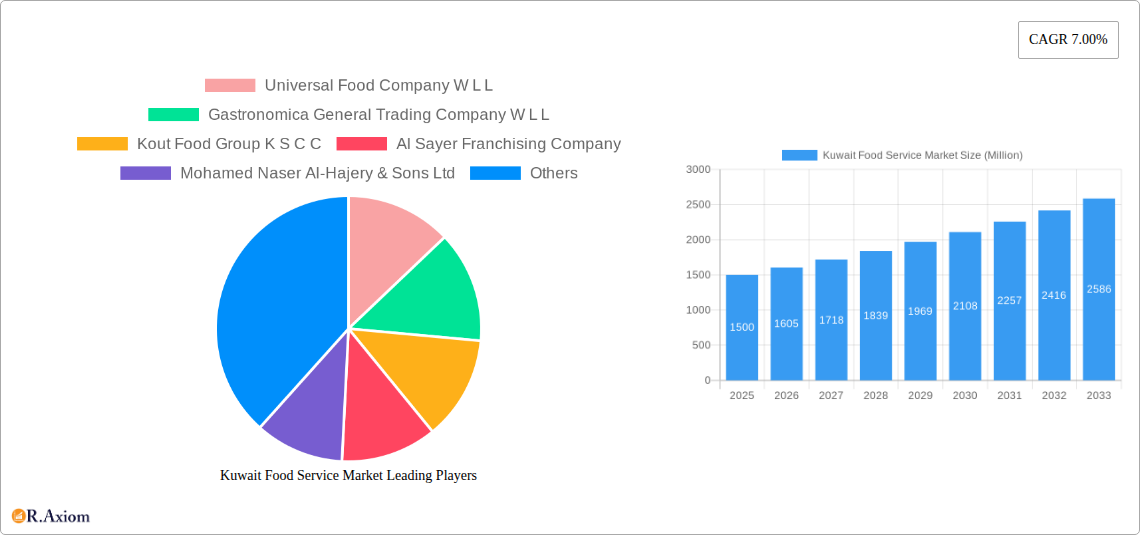

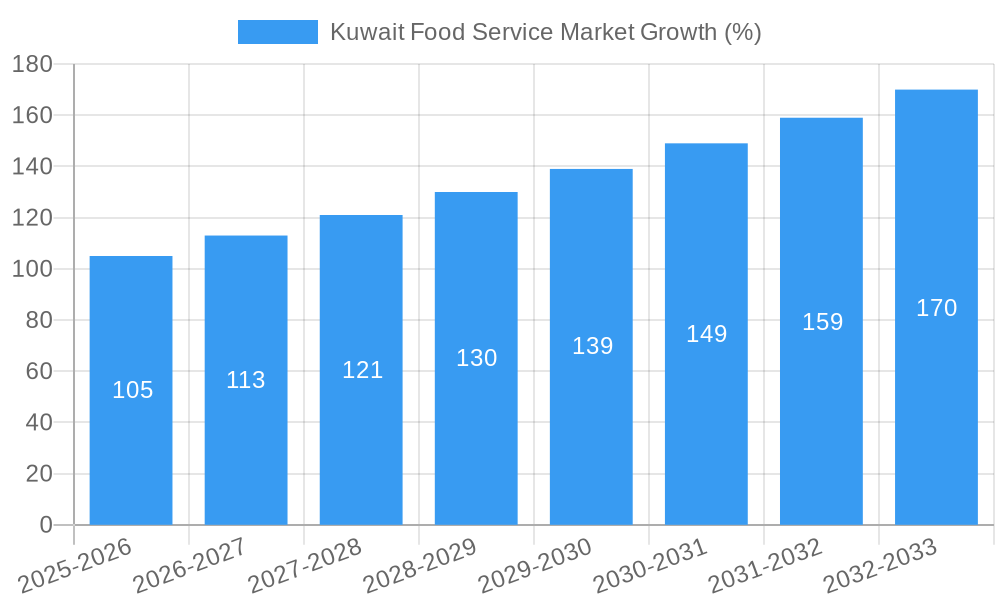

The Kuwait food service market, exhibiting a robust Compound Annual Growth Rate (CAGR) of 7.00% from 2019 to 2024, is projected to continue its expansion through 2033. This growth is fueled by several key factors. A burgeoning population, rising disposable incomes, and a significant influx of tourists contribute to increased demand for diverse food and beverage offerings. The market's segmentation reveals a dynamic landscape, with chained outlets holding a substantial share, driven by brand recognition and standardized quality. However, independent outlets continue to thrive, catering to local preferences and offering unique dining experiences. The location segmentation shows significant demand across various sectors, including leisure, lodging, retail, standalone establishments, and the crucial travel and foodservice segments (cafes, bars, and quick-service restaurants - QSRs). The presence of established international and local players like Americana Restaurants International PLC, Alshaya Co., and LuLu Group International reflects the market's maturity and competitiveness. However, challenges remain, including potential fluctuations in consumer spending due to economic factors and increased competition. Furthermore, maintaining food safety standards and adapting to evolving consumer preferences – such as health-conscious choices and delivery services – will be critical for sustained success.

The forecast period (2025-2033) is expected to see a consolidation of market players as larger chains expand their reach while smaller, independent operators focus on niche offerings and personalized services. Technological advancements, including online ordering and delivery platforms, will play a significant role in shaping the market's future. The market's diverse culinary landscape, catering to both local and international palates, ensures its continued resilience and potential for future growth. Government initiatives promoting tourism and infrastructure development will further contribute to the sector's expansion. This suggests a promising outlook for investors and businesses seeking to participate in this dynamic and growing market, emphasizing the importance of strategic planning and adaptation to changing consumer demands.

Kuwait Food Service Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Kuwait food service market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. The report covers the period from 2019 to 2033, with a focus on 2025 as the base and estimated year, and a forecast period extending to 2033. The historical period analyzed spans 2019-2024. The market is segmented by outlet type (chained and independent), location (leisure, lodging, retail, standalone, travel), and food service type (cafes & bars, other QSR cuisines). Key players such as Americana Restaurants International PLC, Kout Food Group K S C C, and Alghanim Industries are profiled, providing a 360-degree view of the market landscape.

Kuwait Food Service Market Market Concentration & Innovation

This section analyzes the competitive landscape of the Kuwait food service market, examining market concentration, innovation drivers, and regulatory influences. We delve into the impact of mergers and acquisitions (M&A) activities, evaluating deal values and their effect on market share. The analysis also explores consumer trends, product substitutions, and the overall regulatory framework shaping the market. Key metrics such as market share for leading players and M&A deal values (in Millions) are provided. We estimate that the top 5 players hold approximately xx% of the market share in 2025. M&A activity in the last five years has involved deals totaling approximately xx Million, primarily focused on expansion and diversification.

- Market Concentration: High concentration with a few dominant players.

- Innovation Drivers: Technological advancements, evolving consumer preferences, and government initiatives promoting food safety and hygiene.

- Regulatory Framework: Stringent food safety regulations and licensing requirements influence market dynamics.

- Product Substitutes: The increasing popularity of home-cooked meals and meal delivery services presents competitive pressure.

- End-User Trends: Growing demand for healthy and convenient food options is driving innovation.

- M&A Activities: Consolidation is a key trend, with larger players acquiring smaller chains to increase their market footprint.

Kuwait Food Service Market Industry Trends & Insights

This section explores the key trends shaping the Kuwait food service market. We examine market growth drivers, the impact of technological disruptions (such as online ordering and delivery platforms), evolving consumer preferences (e.g., demand for healthy and diverse cuisines), and the competitive dynamics among various players. We project a Compound Annual Growth Rate (CAGR) of xx% for the forecast period (2025-2033), with market penetration expected to reach xx% by 2033. Factors such as increasing disposable incomes, a young and growing population, and the influx of tourists contribute to market growth. The growing adoption of online food delivery platforms is significantly influencing consumer behavior and market dynamics.

Dominant Markets & Segments in Kuwait Food Service Market

This section identifies the leading segments within the Kuwait food service market. We analyze the dominance of specific segments based on outlet type, location, and food service type, providing a comprehensive overview of the market landscape. Detailed analysis considers economic policies, infrastructure development, and consumer spending patterns.

- Outlet Type: Chained outlets are expected to dominate due to brand recognition and established supply chains. Independent outlets, however, offer a diverse culinary experience.

- Location: The retail segment is likely to be the largest, followed by leisure and lodging. Standalone outlets are also prevalent.

- Food Service Type: Cafes & Bars and Other QSR Cuisines (Quick Service Restaurants) are anticipated to exhibit strong growth, reflecting the changing consumer preferences. The diverse culinary preferences of the Kuwaiti population drive demand for a broad range of cuisines.

Kuwait Food Service Market Product Developments

The Kuwait food service market is witnessing significant product innovation, driven by technological advancements and changing consumer preferences. The rise of cloud kitchens, personalized meal options, and the integration of technology for online ordering and delivery are key trends shaping product development. Companies are focusing on creating unique culinary experiences and adapting to the demands of a discerning consumer base.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation of the Kuwait food service market based on outlet type (chained and independent), location (leisure, lodging, retail, standalone, travel), and food service type (cafes & bars, other QSR cuisines). Each segment's growth projections, market sizes, and competitive dynamics are analyzed in detail. For instance, the chained outlet segment is projected to grow at a CAGR of xx% during the forecast period, driven by expansion plans and brand loyalty.

Key Drivers of Kuwait Food Service Market Growth

Several factors contribute to the growth of the Kuwait food service market. These include the rising disposable incomes of the Kuwaiti population, a growing young population with diverse culinary preferences, and the continuous development of the tourism sector. Furthermore, the expanding retail infrastructure and the government’s focus on developing the hospitality industry further boost market growth. Technological advancements such as online ordering and delivery platforms also play a vital role.

Challenges in the Kuwait Food Service Market Sector

The Kuwait food service market faces challenges, including intense competition, fluctuating food prices, and the high cost of labor. Stringent food safety regulations and the reliance on imported ingredients also present challenges. These factors affect profitability and market expansion. The impact of these challenges is reflected in the fluctuating profit margins of some key players.

Emerging Opportunities in Kuwait Food Service Market

The Kuwait food service market presents various opportunities, such as the increasing popularity of healthy and organic food options, the growing demand for customized dining experiences, and the expanding usage of food delivery apps. These trends indicate a strong potential for growth, particularly for businesses that can cater to these evolving consumer demands.

Leading Players in the Kuwait Food Service Market Market

- Universal Food Company W L L

- Gastronomica General Trading Company W L L

- Kout Food Group K S C C

- Al Sayer Franchising Company

- Mohamed Naser Al-Hajery & Sons Ltd

- Americana Restaurants International PLC

- M H Alshaya Co WLL

- LuLu Group International

- Al Maousherji Catering Company

- Alghanim Industries & Yusuf A Alghanim & Sons W L L

- The Sultan Center

- AlAmar Foods Company

Key Developments in Kuwait Food Service Market Industry

- August 2022: Americana Restaurants International PLC secured a franchise agreement with Peet's Coffee to enter the GCC market, signifying a move towards premium coffee offerings.

- June 2022: Americana Restaurants partnered with Miso Robotics to integrate robotic automation in its operations, enhancing efficiency and potentially reducing labor costs.

- April 2022: The Sultan Center announced a five-year expansion plan, indicating significant investment in infrastructure and market reach.

Strategic Outlook for Kuwait Food Service Market Market

The Kuwait food service market exhibits robust growth potential, driven by increasing disposable incomes, a young and expanding population, and the country's thriving tourism sector. Businesses that can adapt to changing consumer preferences and adopt innovative technologies, such as online ordering and delivery platforms, are poised to capture significant market share in the years to come. The continued development of the retail and hospitality sectors will further fuel market expansion.

Kuwait Food Service Market Segmentation

-

1. Foodservice Type

-

1.1. Cafes & Bars

-

1.1.1. By Cuisine

- 1.1.1.1. Juice/Smoothie/Desserts Bars

- 1.1.1.2. Specialist Coffee & Tea Shops

-

1.1.1. By Cuisine

- 1.2. Cloud Kitchen

-

1.3. Full Service Restaurants

- 1.3.1. Asian

- 1.3.2. European

- 1.3.3. Latin American

- 1.3.4. Middle Eastern

- 1.3.5. North American

- 1.3.6. Other FSR Cuisines

-

1.4. Quick Service Restaurants

- 1.4.1. Bakeries

- 1.4.2. Burger

- 1.4.3. Ice Cream

- 1.4.4. Meat-based Cuisines

- 1.4.5. Pizza

- 1.4.6. Other QSR Cuisines

-

1.1. Cafes & Bars

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

Kuwait Food Service Market Segmentation By Geography

- 1. Kuwait

Kuwait Food Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use

- 3.3. Market Restrains

- 3.3.1. Increasing Shift Toward Plant-Based Protein

- 3.4. Market Trends

- 3.4.1. An increase in the number of online meal delivery application users and a rise in the number of outlets favour the market growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Kuwait Food Service Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 5.1.1. Cafes & Bars

- 5.1.1.1. By Cuisine

- 5.1.1.1.1. Juice/Smoothie/Desserts Bars

- 5.1.1.1.2. Specialist Coffee & Tea Shops

- 5.1.1.1. By Cuisine

- 5.1.2. Cloud Kitchen

- 5.1.3. Full Service Restaurants

- 5.1.3.1. Asian

- 5.1.3.2. European

- 5.1.3.3. Latin American

- 5.1.3.4. Middle Eastern

- 5.1.3.5. North American

- 5.1.3.6. Other FSR Cuisines

- 5.1.4. Quick Service Restaurants

- 5.1.4.1. Bakeries

- 5.1.4.2. Burger

- 5.1.4.3. Ice Cream

- 5.1.4.4. Meat-based Cuisines

- 5.1.4.5. Pizza

- 5.1.4.6. Other QSR Cuisines

- 5.1.1. Cafes & Bars

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Kuwait

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

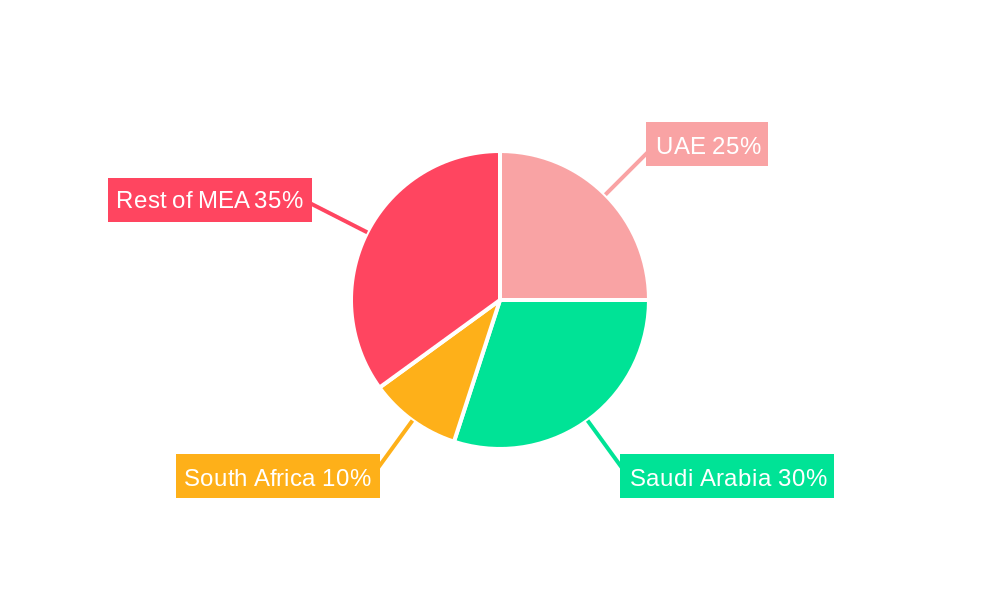

- 6. UAE Kuwait Food Service Market Analysis, Insights and Forecast, 2019-2031

- 7. South Africa Kuwait Food Service Market Analysis, Insights and Forecast, 2019-2031

- 8. Saudi Arabia Kuwait Food Service Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of MEA Kuwait Food Service Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Universal Food Company W L L

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Gastronomica General Trading Company W L L

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Kout Food Group K S C C

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Al Sayer Franchising Company

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Mohamed Naser Al-Hajery & Sons Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Americana Restaurants International PLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 M H Alshaya Co WLL

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 LuLu Group International

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Al Maousherji Catering Company

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Alghanim Industries & Yusuf A Alghanim & Sons W L L

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 The Sultan Center

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 AlAmar Foods Company

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Universal Food Company W L L

List of Figures

- Figure 1: Kuwait Food Service Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Kuwait Food Service Market Share (%) by Company 2024

List of Tables

- Table 1: Kuwait Food Service Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Kuwait Food Service Market Volume Thousand Tons Forecast, by Region 2019 & 2032

- Table 3: Kuwait Food Service Market Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 4: Kuwait Food Service Market Volume Thousand Tons Forecast, by Foodservice Type 2019 & 2032

- Table 5: Kuwait Food Service Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 6: Kuwait Food Service Market Volume Thousand Tons Forecast, by Outlet 2019 & 2032

- Table 7: Kuwait Food Service Market Revenue Million Forecast, by Location 2019 & 2032

- Table 8: Kuwait Food Service Market Volume Thousand Tons Forecast, by Location 2019 & 2032

- Table 9: Kuwait Food Service Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Kuwait Food Service Market Volume Thousand Tons Forecast, by Region 2019 & 2032

- Table 11: Kuwait Food Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Kuwait Food Service Market Volume Thousand Tons Forecast, by Country 2019 & 2032

- Table 13: UAE Kuwait Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: UAE Kuwait Food Service Market Volume (Thousand Tons) Forecast, by Application 2019 & 2032

- Table 15: South Africa Kuwait Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South Africa Kuwait Food Service Market Volume (Thousand Tons) Forecast, by Application 2019 & 2032

- Table 17: Saudi Arabia Kuwait Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Saudi Arabia Kuwait Food Service Market Volume (Thousand Tons) Forecast, by Application 2019 & 2032

- Table 19: Rest of MEA Kuwait Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of MEA Kuwait Food Service Market Volume (Thousand Tons) Forecast, by Application 2019 & 2032

- Table 21: Kuwait Food Service Market Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 22: Kuwait Food Service Market Volume Thousand Tons Forecast, by Foodservice Type 2019 & 2032

- Table 23: Kuwait Food Service Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 24: Kuwait Food Service Market Volume Thousand Tons Forecast, by Outlet 2019 & 2032

- Table 25: Kuwait Food Service Market Revenue Million Forecast, by Location 2019 & 2032

- Table 26: Kuwait Food Service Market Volume Thousand Tons Forecast, by Location 2019 & 2032

- Table 27: Kuwait Food Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Kuwait Food Service Market Volume Thousand Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Kuwait Food Service Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the Kuwait Food Service Market?

Key companies in the market include Universal Food Company W L L, Gastronomica General Trading Company W L L, Kout Food Group K S C C, Al Sayer Franchising Company, Mohamed Naser Al-Hajery & Sons Ltd, Americana Restaurants International PLC, M H Alshaya Co WLL, LuLu Group International, Al Maousherji Catering Company, Alghanim Industries & Yusuf A Alghanim & Sons W L L, The Sultan Center, AlAmar Foods Company.

3. What are the main segments of the Kuwait Food Service Market?

The market segments include Foodservice Type, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use.

6. What are the notable trends driving market growth?

An increase in the number of online meal delivery application users and a rise in the number of outlets favour the market growth.

7. Are there any restraints impacting market growth?

Increasing Shift Toward Plant-Based Protein.

8. Can you provide examples of recent developments in the market?

August 2022: Americana Restaurants International PLC declared that it made a franchise agreement with a United States-based craft coffee company, Peet's Coffee, to enter the GCC market.June 2022: Americana Restaurants, the master franchisee in the MENA region for KFC, Pizza Hut, Hardee's, Krispy Kreme and more, announced that it had entered a partnership with Miso Robotics, a US-based company that has been transforming the restaurant industry through robotics and intelligent automation.April 2022: The Sulthan Center announced its five-year expansion plan spanning multiple countries and store categories. It had 25 properties in Kuwait, Jordan, Oman, and Bahrain, in over 20,000 sq. m. of space.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Thousand Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Kuwait Food Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Kuwait Food Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Kuwait Food Service Market?

To stay informed about further developments, trends, and reports in the Kuwait Food Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence