Key Insights

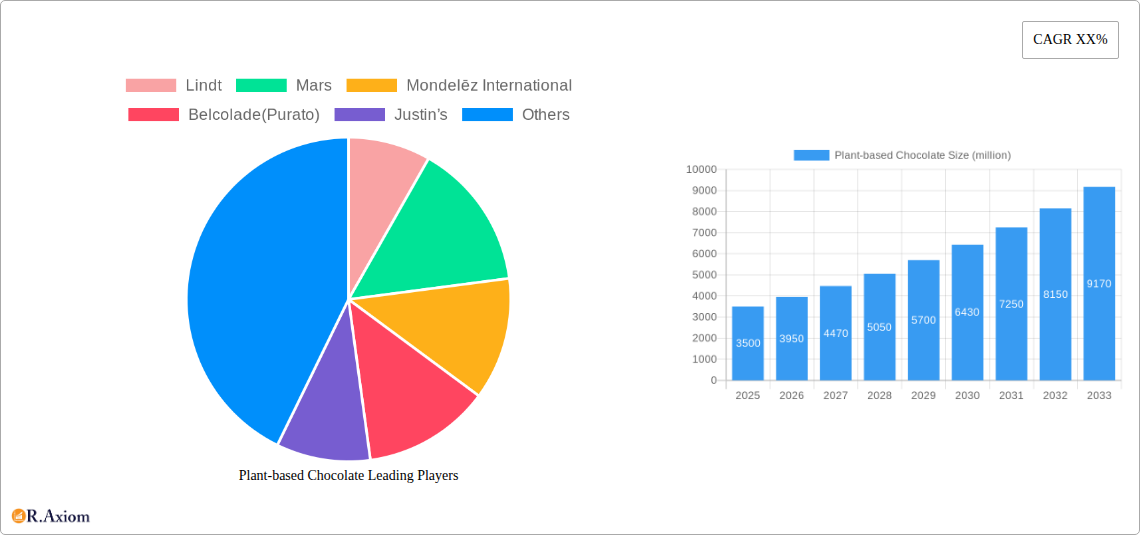

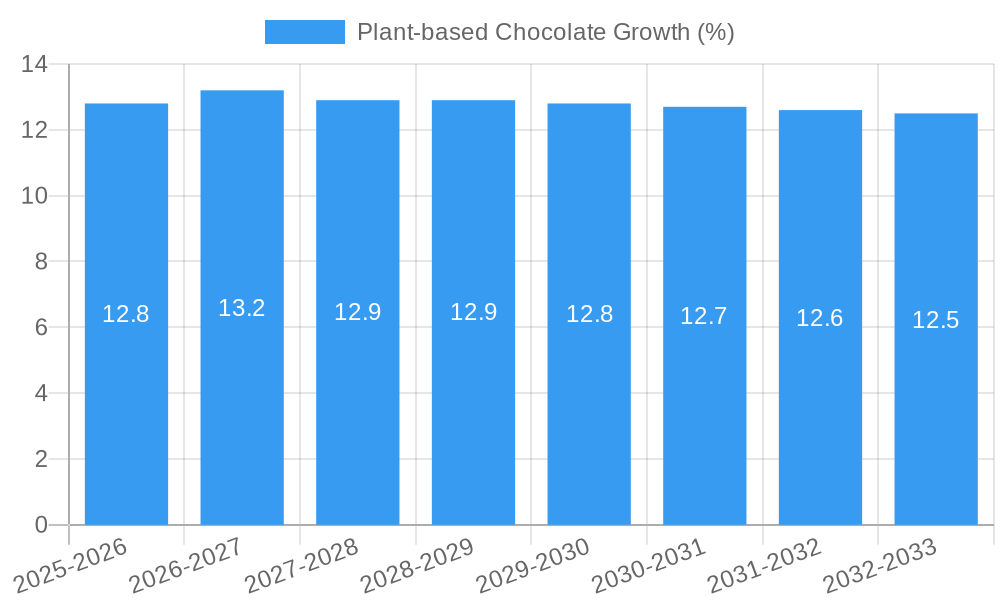

The global plant-based chocolate market is experiencing robust expansion, projected to reach an estimated $3,500 million by 2025 with a projected Compound Annual Growth Rate (CAGR) of 12.5% through 2033. This significant growth is fueled by a confluence of evolving consumer preferences and increasing ethical considerations. Key drivers include the rising awareness of health benefits associated with plant-based diets, such as improved cardiovascular health and reduced inflammation, alongside a growing demand for vegan and dairy-free alternatives. Ethical concerns surrounding animal welfare and environmental sustainability further propel consumers towards plant-based chocolate. This surge in demand is leading to a diversification of product offerings, with a notable increase in the availability of both original and flavored plant-based chocolates across various retail channels.

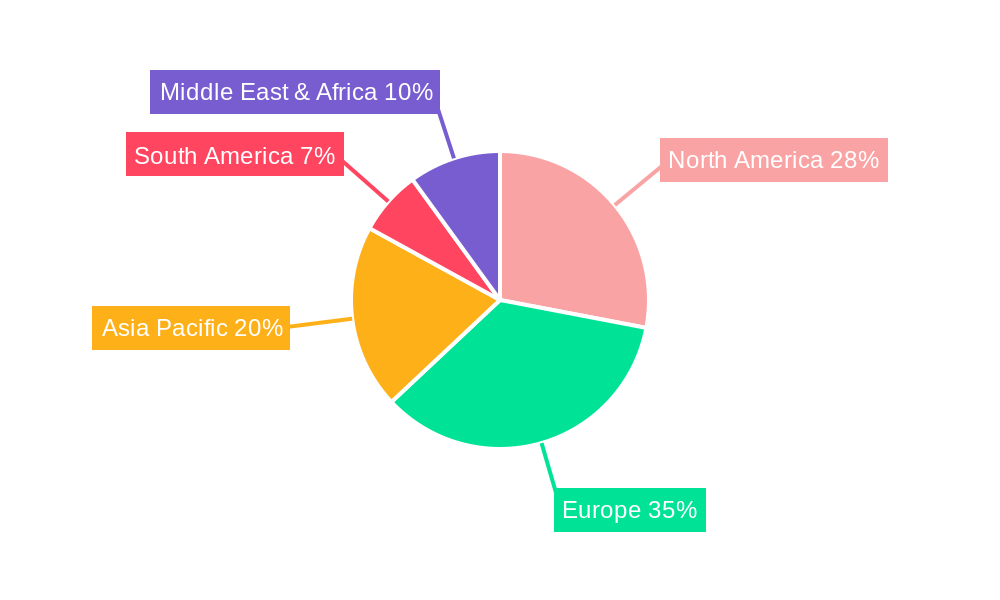

The market is segmented into Online Retail and Offline Retail, with online platforms playing an increasingly vital role in accessibility and consumer reach. In terms of product types, Original Chocolate and Flavored Chocolate are the primary categories, with innovation in flavors and ingredient combinations driving consumer interest. While the market demonstrates strong growth potential, certain restraints exist. These include the higher cost of raw materials compared to conventional chocolate and consumer perception regarding taste and texture, though these are rapidly being addressed by manufacturers through advanced processing techniques and premium ingredient sourcing. Key players like Lindt, Mars, Mondelēz International, and emerging vegan brands such as LOVE RAW and Hu Kitchen are actively investing in product development and market expansion, indicating a highly competitive yet promising landscape. The Asia Pacific region, particularly China and India, is anticipated to be a significant growth engine due to a burgeoning middle class adopting healthier lifestyles and increasing interest in sustainable products.

Here's the SEO-optimized, detailed report description for Plant-based Chocolate, incorporating high-traffic keywords and adhering to all your specifications:

Plant-based Chocolate Market Concentration & Innovation

The global plant-based chocolate market is characterized by a dynamic interplay of established confectionery giants and agile vegan brands, creating a moderately concentrated landscape with significant room for innovation. Leading companies such as Lindt, Mars, and Mondelēz International are increasingly investing in their plant-based portfolios, while niche players like LOVE RAW, Fabalous Organic, and Hu Kitchen are carving out substantial market share through dedicated vegan offerings. Innovation is a key differentiator, driven by advancements in alternative milk bases (oat, almond, coconut), ingredient sourcing, and flavor profiles. Regulatory frameworks, particularly those surrounding labeling and health claims, are evolving, influencing product development and market entry strategies. The threat of product substitutes, while present from other plant-based snacks, remains relatively low for premium chocolate experiences. End-user trends strongly favor healthier, ethically sourced, and sustainable options, pushing manufacturers towards cleaner ingredient lists and transparent supply chains. Mergers and acquisitions (M&A) activities are a significant indicator of market consolidation and strategic expansion. For instance, M&A deal values in the plant-based food sector, often including chocolate, have reached billions, signaling investor confidence and the pursuit of synergistic growth. Market share within the plant-based chocolate segment is increasingly being influenced by the successful integration of vegan lines by mainstream brands and the continued ascent of dedicated vegan brands, collectively shaping the competitive arena.

Plant-based Chocolate Industry Trends & Insights

The plant-based chocolate industry is experiencing unprecedented growth, driven by a confluence of powerful market growth drivers that are reshaping consumer choices and manufacturer strategies. The most significant catalyst is the escalating consumer demand for ethical, sustainable, and healthier confectionery alternatives. This trend is fueled by growing awareness of the environmental impact of dairy farming, increasing concerns about lactose intolerance and dairy allergies, and a broader societal shift towards plant-centric diets for perceived health benefits. Technological disruptions are playing a pivotal role in enhancing the sensory experience of plant-based chocolate. Innovations in the processing of alternative milk sources, such as oat and almond, are yielding smoother textures and richer flavors that closely mimic traditional dairy chocolate, thereby reducing the taste gap that once deterred consumers. Furthermore, advancements in cocoa bean sourcing and processing technologies are leading to more complex and nuanced flavor profiles, appealing to discerning chocolate aficionados. Consumer preferences are rapidly evolving beyond simple dairy-free options, with a strong emphasis on premiumization, artisanal craftsmanship, and unique flavor combinations. Transparency in ingredient sourcing, ethical labor practices, and eco-friendly packaging are becoming non-negotiable for a significant segment of the market. The competitive dynamics are intensifying, with a dual-pronged approach to market penetration. Established confectionery giants are leveraging their vast distribution networks and brand recognition to launch and expand their plant-based lines, while innovative startups are focusing on niche markets, unique product formulations, and direct-to-consumer channels to build brand loyalty. The compound annual growth rate (CAGR) for the plant-based chocolate market is projected to remain robust, with estimates often exceeding 15%, indicating substantial market penetration and a sustained upward trajectory. This growth is further propelled by increasing accessibility through both online retail and traditional offline channels, making plant-based chocolate a mainstream choice for a growing demographic.

Dominant Markets & Segments in Plant-based Chocolate

The plant-based chocolate market exhibits distinct regional dominance and segment preferences, largely dictated by consumer awareness, dietary trends, and market infrastructure. North America, particularly the United States, has emerged as a leading region for plant-based chocolate consumption. This dominance is underpinned by strong consumer advocacy for veganism and flexitarianism, a well-established health and wellness culture, and a robust retail ecosystem that readily embraces new product categories. Government initiatives promoting sustainable food systems and a growing number of vegan-friendly establishments further bolster this leadership. Within North America, the United States accounts for a substantial share, driven by proactive marketing campaigns by both established and emerging brands, and a high disposable income that supports premium product purchases.

When examining the Application segments, Offline Retail currently holds a dominant position, reflecting the traditional purchasing habits of consumers for confectionery products. This includes supermarkets, hypermarkets, specialty food stores, and convenience stores. The widespread availability of plant-based chocolate alongside conventional options makes it easily accessible to a broader consumer base. However, Online Retail is exhibiting a significantly faster growth rate. This segment's expansion is fueled by the convenience of e-commerce, the ability of online platforms to cater to niche dietary needs, and the direct-to-consumer (DTC) models employed by many plant-based brands. Online channels allow for more targeted marketing and a wider product selection, appealing to consumers actively seeking out vegan alternatives.

In terms of Types, Original Chocolate (dark, milk-style, white-style made with plant-based ingredients) currently commands a larger market share. This is primarily due to its broad appeal and its status as a foundational product in the chocolate category. Consumers are increasingly seeking direct plant-based alternatives to classic chocolate formats. However, Flavored Chocolate is experiencing rapid growth and is poised to capture a significant portion of the market in the coming years. This segment's dynamism is driven by consumer desire for novel taste experiences, with popular flavors including mint, fruit infusions, caramel, and spices. The ability to innovate with a wider array of plant-based flavorings allows brands to differentiate themselves and appeal to adventurous palates.

Key drivers for this dominance include robust economic policies supporting the growth of the alternative food sector, advanced logistics and supply chain infrastructure in leading regions that ensure product availability and freshness, and increasing consumer education campaigns highlighting the benefits of plant-based diets. Economic policies such as tax incentives for sustainable food production and supportive import/export regulations further contribute to market expansion.

Plant-based Chocolate Product Developments

Plant-based chocolate product developments are characterized by a relentless pursuit of sensory parity with dairy-based chocolates and an expansion of flavor profiles. Innovations focus on achieving superior creaminess and mouthfeel through advanced processing of alternative milk bases like oat, almond, and coconut, coupled with novel emulsifying agents. Companies are also investing in ethically sourced, single-origin cocoa beans to enhance flavor complexity and appeal to premium segments. Competitive advantages are being forged through unique ingredient combinations, such as the incorporation of superfoods and adaptogens, and the development of allergen-free formulations, catering to a wider range of dietary needs and preferences.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the global plant-based chocolate market. Segmentation is detailed across key areas to provide granular insights. The Application segment is bifurcated into Online Retail, encompassing direct-to-consumer websites, e-commerce platforms, and online grocery services, and Offline Retail, covering traditional brick-and-mortar stores such as supermarkets, hypermarkets, and specialty health food stores. For the Types segment, analysis is provided for Original Chocolate, which includes traditional dark, milk-style, and white chocolate formulations made entirely from plant-based ingredients, and Flavored Chocolate, encompassing all original chocolate types infused with various plant-based flavorings like fruits, spices, nuts, and herbs. Growth projections and competitive dynamics are assessed for each of these segments.

Key Drivers of Plant-based Chocolate Growth

The plant-based chocolate market is propelled by a confluence of powerful drivers. Technological advancements in creating superior textures and flavors from alternative milk bases are crucial, reducing the perceived compromise for consumers. Economic factors, including rising disposable incomes in key emerging markets and increased investment in the plant-based sector, are fueling market expansion. Regulatory shifts that favor sustainable agriculture and transparent labeling also contribute positively. Furthermore, the growing consumer awareness of health benefits associated with plant-based diets and the ethical concerns surrounding animal welfare and environmental impact are significant motivators for increased adoption.

Challenges in the Plant-based Chocolate Sector

Despite its robust growth, the plant-based chocolate sector faces several challenges. Regulatory hurdles related to labeling standards and the definition of "chocolate" can create confusion. Supply chain complexities, particularly in securing consistent, high-quality plant-based ingredients at scale and ensuring ethical sourcing, pose logistical challenges. Competitive pressures from both established confectionery players launching vegan lines and a growing number of independent vegan brands can impact market share and profitability. High production costs compared to conventional chocolate also remain a restraint.

Emerging Opportunities in Plant-based Chocolate

Emerging opportunities in the plant-based chocolate sector are abundant and diverse. The development of new and innovative plant-based milk alternatives, such as those derived from legumes or seeds, offers avenues for unique flavor profiles and textures. Expanding into emerging markets with growing awareness of health and sustainability presents significant untapped potential. The increasing consumer demand for functional ingredients, such as probiotics or adaptogens incorporated into chocolate, opens new product development frontiers. Furthermore, the growth of personalized nutrition and customizability in food products presents opportunities for niche offerings within the plant-based chocolate space.

Leading Players in the Plant-based Chocolate Market

- Lindt

- Mars

- Mondelēz International

- Belcolade (Purato)

- Justin’s

- Nomo (Kinnerton)

- LOVE RAW

- Fabalous Organic

- Alter Eco

- Chocolove

- Eating Evolved

- Endangered Species

- Equal Exchange

- Goodio

- Hu Kitchen

- Taza Chocolate

- Theo Chocolate

Key Developments in Plant-based Chocolate Industry

- 2023: Mars launches a comprehensive range of vegan chocolate bars under its popular brand names, significantly expanding accessibility.

- 2023: Lindt enhances its HELLO range with new plant-based flavor innovations, responding to strong consumer demand.

- 2022: Mondelēz International acquires a significant stake in a leading plant-based chocolate brand, signaling strategic expansion.

- 2022: Nomo (Kinnerton) expands its distribution network into key international markets, increasing global reach.

- 2021: LOVE RAW experiences substantial growth, becoming a go-to brand for premium vegan chocolate.

- 2021: Belcolade (Purato) introduces innovative, single-origin plant-based chocolate couvertures for professional use.

- 2020: Hu Kitchen focuses on ingredient transparency and minimal processing, resonating with health-conscious consumers.

- 2019: Fabalous Organic gains traction for its commitment to organic and sustainable sourcing practices.

Strategic Outlook for Plant-based Chocolate Market

The strategic outlook for the plant-based chocolate market remains exceptionally positive, driven by sustained consumer interest in health, ethics, and sustainability. Future growth will be catalyzed by ongoing innovation in ingredient technology, leading to more sophisticated textures and flavors that challenge the dominance of dairy. Expanded distribution channels, particularly the burgeoning online retail sector, will further enhance accessibility. Companies that prioritize transparent sourcing, ethical production, and unique flavor profiles are well-positioned to capture significant market share. The increasing investment from established players and the agility of specialized vegan brands will foster a dynamic and competitive landscape, ultimately benefiting consumers with a wider array of delicious and conscious chocolate choices.

Plant-based Chocolate Segmentation

-

1. Application

- 1.1. Online Retail

- 1.2. Offline Retail

-

2. Types

- 2.1. Original Chocolate

- 2.2. Flavored Chocolate

Plant-based Chocolate Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Plant-based Chocolate REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Plant-based Chocolate Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online Retail

- 5.1.2. Offline Retail

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Original Chocolate

- 5.2.2. Flavored Chocolate

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Plant-based Chocolate Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online Retail

- 6.1.2. Offline Retail

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Original Chocolate

- 6.2.2. Flavored Chocolate

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Plant-based Chocolate Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online Retail

- 7.1.2. Offline Retail

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Original Chocolate

- 7.2.2. Flavored Chocolate

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Plant-based Chocolate Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online Retail

- 8.1.2. Offline Retail

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Original Chocolate

- 8.2.2. Flavored Chocolate

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Plant-based Chocolate Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online Retail

- 9.1.2. Offline Retail

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Original Chocolate

- 9.2.2. Flavored Chocolate

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Plant-based Chocolate Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online Retail

- 10.1.2. Offline Retail

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Original Chocolate

- 10.2.2. Flavored Chocolate

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Lindt

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Mars

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mondelēz International

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Belcolade(Purato)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Justin’s

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nomo(Kinnerton)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 LOVE RAW

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Fabalous Organic

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Alter Eco

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Chocolove

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Eating Evolved

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Endangered Species

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Equal Exchange

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Goodio

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Hu Kitchen

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Taza Chocolate

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Theo Chocolate

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Lindt

List of Figures

- Figure 1: Global Plant-based Chocolate Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Plant-based Chocolate Revenue (million), by Application 2024 & 2032

- Figure 3: North America Plant-based Chocolate Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Plant-based Chocolate Revenue (million), by Types 2024 & 2032

- Figure 5: North America Plant-based Chocolate Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Plant-based Chocolate Revenue (million), by Country 2024 & 2032

- Figure 7: North America Plant-based Chocolate Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Plant-based Chocolate Revenue (million), by Application 2024 & 2032

- Figure 9: South America Plant-based Chocolate Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Plant-based Chocolate Revenue (million), by Types 2024 & 2032

- Figure 11: South America Plant-based Chocolate Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Plant-based Chocolate Revenue (million), by Country 2024 & 2032

- Figure 13: South America Plant-based Chocolate Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Plant-based Chocolate Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Plant-based Chocolate Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Plant-based Chocolate Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Plant-based Chocolate Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Plant-based Chocolate Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Plant-based Chocolate Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Plant-based Chocolate Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Plant-based Chocolate Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Plant-based Chocolate Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Plant-based Chocolate Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Plant-based Chocolate Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Plant-based Chocolate Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Plant-based Chocolate Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Plant-based Chocolate Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Plant-based Chocolate Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Plant-based Chocolate Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Plant-based Chocolate Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Plant-based Chocolate Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Plant-based Chocolate Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Plant-based Chocolate Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Plant-based Chocolate Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Plant-based Chocolate Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Plant-based Chocolate Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Plant-based Chocolate Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Plant-based Chocolate Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Plant-based Chocolate Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Plant-based Chocolate Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Plant-based Chocolate Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Plant-based Chocolate Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Plant-based Chocolate Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Plant-based Chocolate Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Plant-based Chocolate Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Plant-based Chocolate Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Plant-based Chocolate Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Plant-based Chocolate Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Plant-based Chocolate Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Plant-based Chocolate Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Plant-based Chocolate Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Plant-based Chocolate Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Plant-based Chocolate Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Plant-based Chocolate Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Plant-based Chocolate Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Plant-based Chocolate Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Plant-based Chocolate Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Plant-based Chocolate Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Plant-based Chocolate Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Plant-based Chocolate Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Plant-based Chocolate Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Plant-based Chocolate Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Plant-based Chocolate Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Plant-based Chocolate Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Plant-based Chocolate Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Plant-based Chocolate Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Plant-based Chocolate Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Plant-based Chocolate Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Plant-based Chocolate Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Plant-based Chocolate Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Plant-based Chocolate Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Plant-based Chocolate Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Plant-based Chocolate Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Plant-based Chocolate Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Plant-based Chocolate Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Plant-based Chocolate Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Plant-based Chocolate Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Plant-based Chocolate Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Plant-based Chocolate?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Plant-based Chocolate?

Key companies in the market include Lindt, Mars, Mondelēz International, Belcolade(Purato), Justin’s, Nomo(Kinnerton), LOVE RAW, Fabalous Organic, Alter Eco, Chocolove, Eating Evolved, Endangered Species, Equal Exchange, Goodio, Hu Kitchen, Taza Chocolate, Theo Chocolate.

3. What are the main segments of the Plant-based Chocolate?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Plant-based Chocolate," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Plant-based Chocolate report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Plant-based Chocolate?

To stay informed about further developments, trends, and reports in the Plant-based Chocolate, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence