Key Insights

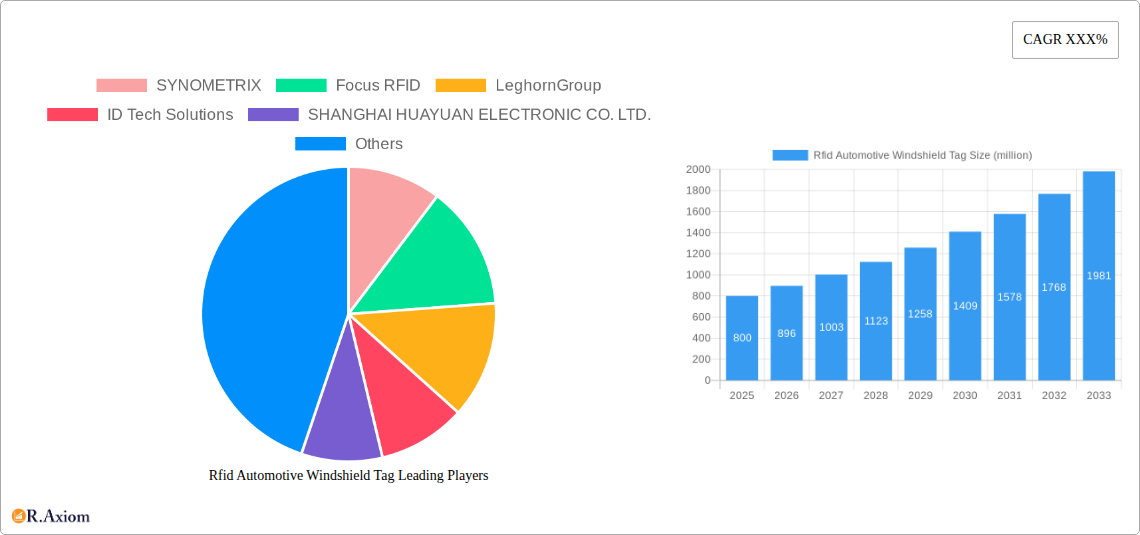

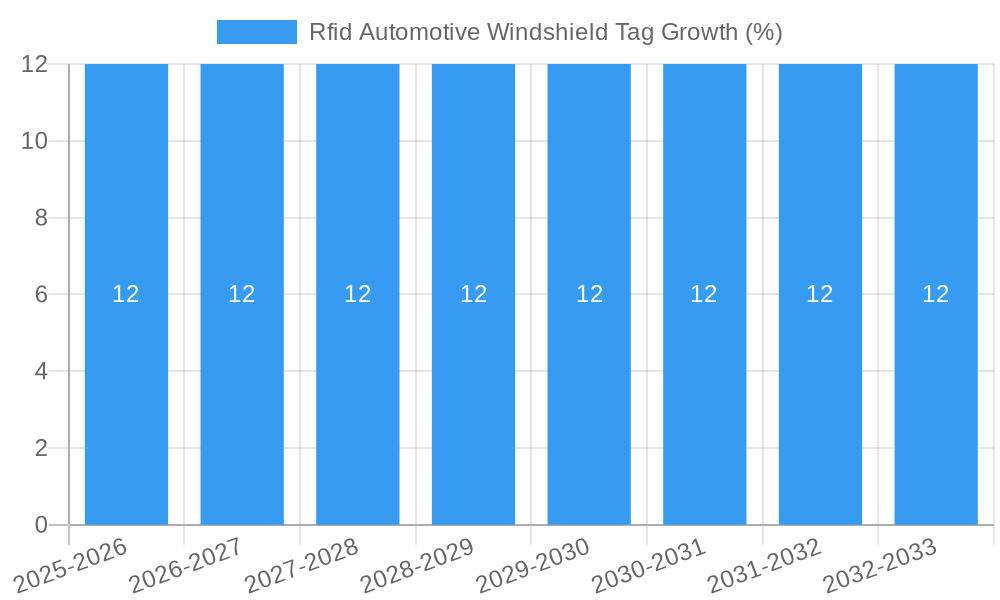

The RFID automotive windshield tag market is poised for significant expansion, driven by escalating demand for enhanced vehicle identification, toll collection efficiency, and access control systems. Anticipated to reach approximately $800 million by 2025, the market is projected to grow at a robust Compound Annual Growth Rate (CAGR) of around 12-15% through 2033. This growth is underpinned by the increasing adoption of Electronic Toll Collection (ETC) systems, the need for secure vehicle authentication in parking and fleet management, and the integration of RFID technology into modern vehicle ecosystems. The passenger car segment, with its sheer volume, is expected to dominate market share, while the commercial vehicle segment will see substantial growth due to logistics optimization and fleet tracking requirements. Key technological advancements, such as miniaturization, enhanced durability, and improved read ranges, are also contributing to the market's upward trajectory.

The market's expansion is further fueled by government initiatives promoting contactless payment solutions and smart city development, which directly benefit RFID windshield tag adoption. However, challenges such as initial implementation costs, data security concerns, and the need for standardized protocols across different regions could temper growth to some extent. Despite these hurdles, the overwhelming benefits of streamlined operations, reduced congestion, and improved security are compelling industries to invest in these solutions. Emerging trends include the development of more intelligent tags with embedded sensors for additional data collection and the increasing integration of RFID with other IoT devices for a more connected automotive experience. Asia Pacific, led by China and India, is expected to emerge as a dominant region due to rapid vehicle sales and significant infrastructure development, followed closely by North America and Europe, which already have established ETC networks.

Rfid Automotive Windshield Tag Market Concentration & Innovation

The RFID automotive windshield tag market is characterized by a moderate level of concentration, with several key players vying for market share. Major companies such as SYNOMETRIX, Focus RFID, LeghornGroup, ID Tech Solutions, SHANGHAI HUAYUAN ELECTRONIC CO. LTD., Dipole RFID, Kathrein Solutions, Perfect ID, Indian Barcode Corporation, DO RFID TAG company, Arizon RFID Technology, Best Barcode System Pvt Ltd, GSRFID, Lex, Xinchuangyi, Innov, and Chuangxinjia are actively contributing to market dynamics. Innovation is a significant driver, fueled by advancements in RFID technology, including enhanced read range, increased data storage capacity, and improved tamper-proof features. Regulatory frameworks, particularly those related to vehicle identification, toll collection, and aftermarket tracking, play a crucial role in shaping product development and adoption. Product substitutes, such as QR codes and other visual identification methods, pose a challenge, but RFID's inherent advantages in automation and bulk reading offer a competitive edge. End-user trends are shifting towards greater adoption of smart city initiatives, enhanced vehicle security, and streamlined fleet management solutions, all of which benefit RFID windshield tag integration. Merger and acquisition (M&A) activities, with an estimated total deal value of over fifty million dollars in the historical period, are observed as companies seek to expand their product portfolios, geographical reach, and technological capabilities.

Rfid Automotive Windshield Tag Industry Trends & Insights

The RFID automotive windshield tag industry is experiencing robust growth, driven by an increasing demand for automated vehicle identification and tracking solutions across diverse applications. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 15.75% during the forecast period of 2025–2033. This growth is underpinned by several key trends. Firstly, the burgeoning automotive sector, encompassing both passenger cars and commercial vehicles, is a primary market driver. As vehicle production scales, so does the need for efficient identification and management systems. Secondly, advancements in RFID technology are continuously enhancing performance and reducing costs. Innovations in UHF RFID tags, for instance, offer extended read ranges and improved durability, making them more suitable for demanding automotive environments. Thirdly, the escalating adoption of intelligent transportation systems (ITS) and smart city initiatives globally necessitates sophisticated vehicle identification capabilities for traffic management, toll collection, and access control. Market penetration is deepening as governments and private enterprises recognize the benefits of these technologies in improving efficiency and security. Furthermore, the increasing emphasis on supply chain visibility and logistics management for commercial fleets is also propelling the adoption of RFID windshield tags for real-time tracking and monitoring of goods and vehicles. Consumer preferences are subtly evolving towards greater convenience and security, with a growing appreciation for seamless toll payment and vehicle access experiences facilitated by RFID technology. The competitive landscape is dynamic, with established players and emerging startups continuously innovating to capture market share. Key industry developments include the integration of RFID tags with other vehicle electronics, the development of more secure and tamper-evident tag designs, and the expansion of cloud-based RFID management platforms.

Dominant Markets & Segments in Rfid Automotive Windshield Tag

The global RFID automotive windshield tag market is segmented across various applications and product types, with distinct regions and segments exhibiting varying levels of dominance.

Application Dominance:

Passenger Car: This segment holds a significant market share due to the sheer volume of passenger vehicles produced and operated globally. Key drivers include:

- Enhanced User Convenience: Facilitating seamless toll payments (e.g., ETC - Electronic Toll Collection), parking management, and access control to restricted areas.

- Aftermarket Security & Tracking: Enabling vehicle owners to track their vehicles for security purposes or for fleet management of personal vehicles.

- Regulatory Mandates: Some regions are increasingly implementing mandatory identification systems for passenger vehicles.

- Technological Integration: The growing integration of smart features in passenger cars, where RFID windshield tags can serve as an identification key.

Commercial Vehicle: This segment is a rapidly growing contributor, driven by the critical need for efficient fleet management and supply chain optimization. Key drivers include:

- Logistics & Supply Chain Efficiency: Real-time tracking of goods, route optimization, and inventory management.

- Fleet Management & Monitoring: Monitoring vehicle location, driver behavior, and maintenance schedules.

- Regulatory Compliance: Meeting tracking and reporting requirements for commercial transport.

- Reduced Operational Costs: Automation of entry/exit points in distribution centers and ports.

Type Dominance:

- PET (Polyethylene Terephthalate): This type of tag is a leading choice due to its excellent durability, resistance to environmental factors (UV, moisture), and cost-effectiveness. Its flexibility also makes it ideal for windshield application.

- PVC (Polyvinyl Chloride): PVC tags offer good durability and a balance of cost and performance, making them a popular choice for a wide range of automotive applications.

- Paper: While less common for permanent windshield applications due to lower durability, paper-based RFID tags are utilized in specific, short-term applications or as part of layered security solutions.

- Others: This category encompasses specialized materials designed for extreme environmental conditions or advanced security features, catering to niche market demands.

Passenger Car: This segment holds a significant market share due to the sheer volume of passenger vehicles produced and operated globally. Key drivers include:

- Enhanced User Convenience: Facilitating seamless toll payments (e.g., ETC - Electronic Toll Collection), parking management, and access control to restricted areas.

- Aftermarket Security & Tracking: Enabling vehicle owners to track their vehicles for security purposes or for fleet management of personal vehicles.

- Regulatory Mandates: Some regions are increasingly implementing mandatory identification systems for passenger vehicles.

- Technological Integration: The growing integration of smart features in passenger cars, where RFID windshield tags can serve as an identification key.

Commercial Vehicle: This segment is a rapidly growing contributor, driven by the critical need for efficient fleet management and supply chain optimization. Key drivers include:

- Logistics & Supply Chain Efficiency: Real-time tracking of goods, route optimization, and inventory management.

- Fleet Management & Monitoring: Monitoring vehicle location, driver behavior, and maintenance schedules.

- Regulatory Compliance: Meeting tracking and reporting requirements for commercial transport.

- Reduced Operational Costs: Automation of entry/exit points in distribution centers and ports.

- PET (Polyethylene Terephthalate): This type of tag is a leading choice due to its excellent durability, resistance to environmental factors (UV, moisture), and cost-effectiveness. Its flexibility also makes it ideal for windshield application.

- PVC (Polyvinyl Chloride): PVC tags offer good durability and a balance of cost and performance, making them a popular choice for a wide range of automotive applications.

- Paper: While less common for permanent windshield applications due to lower durability, paper-based RFID tags are utilized in specific, short-term applications or as part of layered security solutions.

- Others: This category encompasses specialized materials designed for extreme environmental conditions or advanced security features, catering to niche market demands.

The dominant regions for RFID automotive windshield tag adoption are North America and Europe, driven by well-established intelligent transportation systems, strong automotive manufacturing bases, and proactive government initiatives. Asia-Pacific is emerging as a significant growth region, fueled by rapid automotive market expansion and increasing investments in smart infrastructure.

Rfid Automotive Windshield Tag Product Developments

Recent product developments in the RFID automotive windshield tag market are focused on enhancing performance, security, and integration capabilities. Innovations include the development of ultra-thin and flexible tags that conform seamlessly to windshield contours, minimizing driver obstruction. Enhanced read range capabilities are being achieved through advancements in antenna design and chip technology, enabling faster and more reliable identification from greater distances. Furthermore, there's a growing emphasis on tamper-evident features and secure data encryption to prevent unauthorized access and ensure the integrity of vehicle identification. The integration of these tags with vehicle-specific data platforms and cloud-based management systems is also a key trend, offering end-users comprehensive tracking, management, and analytical insights. These developments aim to address the evolving needs of the automotive industry for efficient, secure, and intelligent vehicle identification solutions.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the RFID automotive windshield tag market, covering a study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033. The market is segmented by application and product type.

- Application: Passenger Car: This segment is expected to witness steady growth, driven by increasing convenience features and aftermarket applications. Market projections indicate a significant market size in the base year, with continued expansion expected throughout the forecast period. Competitive dynamics are influenced by established automotive component suppliers and specialized RFID solution providers.

- Application: Commercial Vehicle: This segment is anticipated to experience robust growth, fueled by the demand for efficient fleet management and supply chain optimization. Projections show a substantial market size and an accelerated growth trajectory due to the critical role of RFID in logistics.

- Type: Paper: The paper segment is expected to maintain a niche market presence, primarily for short-term or specialized applications, with modest growth projections.

- Type: PET: This segment is projected to hold a dominant position due to its durability and cost-effectiveness, exhibiting strong growth throughout the forecast period.

- Type: PVC: PVC tags are expected to demonstrate consistent growth, offering a balanced solution for various automotive needs.

- Type: Others: This segment, encompassing advanced and specialized materials, is projected to grow at a moderate pace, catering to specific high-performance or security-focused applications.

Key Drivers of Rfid Automotive Windshield Tag Growth

The growth of the RFID automotive windshield tag market is propelled by several interconnected factors. Technological advancements, particularly in UHF RFID technology, are enhancing read range, data accuracy, and tag durability, making them more suitable for automotive applications. The increasing adoption of intelligent transportation systems (ITS) globally, including electronic toll collection (ETC) and smart parking solutions, directly fuels demand for automated vehicle identification. The robust growth of the global automotive industry, characterized by high production volumes of both passenger and commercial vehicles, provides a substantial installed base for RFID tags. Furthermore, growing concerns for vehicle security and the need for efficient fleet management solutions in the commercial vehicle sector are significant catalysts. Government initiatives promoting smart city development and digital transformation in transportation further accelerate market penetration.

Challenges in the Rfid Automotive Windshield Tag Sector

Despite its promising growth, the RFID automotive windshield tag sector faces several challenges. The initial cost of implementing RFID systems, including tags, readers, and integration software, can be a barrier to widespread adoption, particularly for smaller businesses or in price-sensitive markets. Regulatory hurdles and standardization issues across different regions can create complexities in product development and deployment. Competition from alternative identification technologies, such as QR codes and Bluetooth-based systems, requires continuous innovation to maintain a competitive edge. Supply chain disruptions, as witnessed in recent global events, can impact the availability and cost of raw materials for tag manufacturing. Furthermore, ensuring the long-term durability and reliability of RFID tags in harsh automotive environments, subjected to extreme temperatures, UV exposure, and mechanical stress, remains a technical challenge.

Emerging Opportunities in Rfid Automotive Windshield Tag

The RFID automotive windshield tag market is ripe with emerging opportunities. The expansion of autonomous driving technology presents a new avenue, as RFID can play a role in vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication for enhanced safety and navigation. The growing demand for connected car services and the Internet of Vehicles (IoV) creates a need for unique and secure vehicle identifiers, where RFID windshield tags can be integrated. The burgeoning electric vehicle (EV) market offers opportunities for specialized RFID tags that can manage battery charging data or vehicle identification for charging stations. Furthermore, the increasing focus on predictive maintenance and vehicle health monitoring can be facilitated by RFID tags that store diagnostic information. The development of more sophisticated and secure anti-counterfeiting solutions for automotive parts, leveraging RFID technology, also presents a significant growth area.

Leading Players in the Rfid Automotive Windshield Tag Market

- SYNOMETRIX

- Focus RFID

- LeghornGroup

- ID Tech Solutions

- SHANGHAI HUAYUAN ELECTRONIC CO. LTD.

- Dipole RFID

- Kathrein Solutions

- Perfect ID

- Indian Barcode Corporation

- DO RFID TAG company

- Arizon RFID Technology

- Best Barcode System Pvt Ltd

- GSRFID

- Lex

- Xinchuangyi

- Innov

- Chuangxinjia

Key Developments in Rfid Automotive Windshield Tag Industry

- 2023/08: Launch of ultra-thin, highly durable PET RFID windshield tags with enhanced read range for improved toll collection systems.

- 2023/05: Introduction of tamper-evident RFID tags with integrated security features for aftermarket vehicle tracking and anti-theft solutions.

- 2022/11: Strategic partnership formed between a leading RFID chip manufacturer and an automotive component supplier to accelerate the integration of RFID into new vehicle platforms.

- 2022/07: Development of a cloud-based platform for managing and monitoring RFID windshield tags across large commercial vehicle fleets, offering real-time analytics.

- 2021/09: Successful implementation of a nationwide electronic toll collection system utilizing advanced UHF RFID windshield tags in a major emerging market.

Strategic Outlook for Rfid Automotive Windshield Tag Market

The strategic outlook for the RFID automotive windshield tag market remains exceptionally positive, driven by sustained innovation and increasing adoption across various automotive segments. The growing emphasis on smart cities and intelligent transportation infrastructure will continue to be a primary growth catalyst, demanding efficient and reliable vehicle identification solutions. The continuous evolution of RFID technology, promising enhanced performance, reduced costs, and greater security, will further solidify its position. Strategic collaborations between RFID manufacturers, automotive OEMs, and system integrators will be crucial for unlocking new applications and expanding market reach. The increasing adoption of connected car technologies and the burgeoning demand for data-driven insights in fleet management will present significant opportunities for market expansion. Companies focusing on developing specialized, high-performance, and secure RFID solutions tailored to the evolving needs of the automotive industry are poised for substantial success.

Rfid Automotive Windshield Tag Segmentation

-

1. Application

- 1.1. Passenger Car

- 1.2. Commercial Vehicle

-

2. Type

- 2.1. Paper

- 2.2. PET

- 2.3. PVC

- 2.4. Others

Rfid Automotive Windshield Tag Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Rfid Automotive Windshield Tag REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Rfid Automotive Windshield Tag Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Passenger Car

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Paper

- 5.2.2. PET

- 5.2.3. PVC

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Rfid Automotive Windshield Tag Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Passenger Car

- 6.1.2. Commercial Vehicle

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Paper

- 6.2.2. PET

- 6.2.3. PVC

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Rfid Automotive Windshield Tag Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Passenger Car

- 7.1.2. Commercial Vehicle

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Paper

- 7.2.2. PET

- 7.2.3. PVC

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Rfid Automotive Windshield Tag Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Passenger Car

- 8.1.2. Commercial Vehicle

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Paper

- 8.2.2. PET

- 8.2.3. PVC

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Rfid Automotive Windshield Tag Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Passenger Car

- 9.1.2. Commercial Vehicle

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Paper

- 9.2.2. PET

- 9.2.3. PVC

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Rfid Automotive Windshield Tag Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Passenger Car

- 10.1.2. Commercial Vehicle

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Paper

- 10.2.2. PET

- 10.2.3. PVC

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 SYNOMETRIX

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Focus RFID

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 LeghornGroup

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ID Tech Solutions

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SHANGHAI HUAYUAN ELECTRONIC CO. LTD.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dipole RFID

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kathrein Solutions

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Perfect ID

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Indian Barcode Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 DO RFID TAG company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Arizon RFID Technology

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Best Barcode System Pvt Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 GSRFID

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Lex

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Xinchuangyi

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Innov

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Chuangxinjia

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 SYNOMETRIX

List of Figures

- Figure 1: Global Rfid Automotive Windshield Tag Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Rfid Automotive Windshield Tag Revenue (million), by Application 2024 & 2032

- Figure 3: North America Rfid Automotive Windshield Tag Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Rfid Automotive Windshield Tag Revenue (million), by Type 2024 & 2032

- Figure 5: North America Rfid Automotive Windshield Tag Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Rfid Automotive Windshield Tag Revenue (million), by Country 2024 & 2032

- Figure 7: North America Rfid Automotive Windshield Tag Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Rfid Automotive Windshield Tag Revenue (million), by Application 2024 & 2032

- Figure 9: South America Rfid Automotive Windshield Tag Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Rfid Automotive Windshield Tag Revenue (million), by Type 2024 & 2032

- Figure 11: South America Rfid Automotive Windshield Tag Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Rfid Automotive Windshield Tag Revenue (million), by Country 2024 & 2032

- Figure 13: South America Rfid Automotive Windshield Tag Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Rfid Automotive Windshield Tag Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Rfid Automotive Windshield Tag Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Rfid Automotive Windshield Tag Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Rfid Automotive Windshield Tag Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Rfid Automotive Windshield Tag Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Rfid Automotive Windshield Tag Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Rfid Automotive Windshield Tag Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Rfid Automotive Windshield Tag Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Rfid Automotive Windshield Tag Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Rfid Automotive Windshield Tag Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Rfid Automotive Windshield Tag Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Rfid Automotive Windshield Tag Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Rfid Automotive Windshield Tag Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Rfid Automotive Windshield Tag Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Rfid Automotive Windshield Tag Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Rfid Automotive Windshield Tag Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Rfid Automotive Windshield Tag Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Rfid Automotive Windshield Tag Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Rfid Automotive Windshield Tag Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Rfid Automotive Windshield Tag Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Rfid Automotive Windshield Tag Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Rfid Automotive Windshield Tag Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Rfid Automotive Windshield Tag Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Rfid Automotive Windshield Tag Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Rfid Automotive Windshield Tag Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Rfid Automotive Windshield Tag Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Rfid Automotive Windshield Tag Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Rfid Automotive Windshield Tag Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Rfid Automotive Windshield Tag Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Rfid Automotive Windshield Tag Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Rfid Automotive Windshield Tag Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Rfid Automotive Windshield Tag Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Rfid Automotive Windshield Tag Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Rfid Automotive Windshield Tag Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Rfid Automotive Windshield Tag Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Rfid Automotive Windshield Tag Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Rfid Automotive Windshield Tag Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Rfid Automotive Windshield Tag Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Rfid Automotive Windshield Tag Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Rfid Automotive Windshield Tag Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Rfid Automotive Windshield Tag Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Rfid Automotive Windshield Tag Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Rfid Automotive Windshield Tag Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Rfid Automotive Windshield Tag Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Rfid Automotive Windshield Tag Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Rfid Automotive Windshield Tag Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Rfid Automotive Windshield Tag Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Rfid Automotive Windshield Tag Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Rfid Automotive Windshield Tag Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Rfid Automotive Windshield Tag Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Rfid Automotive Windshield Tag Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Rfid Automotive Windshield Tag Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Rfid Automotive Windshield Tag Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Rfid Automotive Windshield Tag Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Rfid Automotive Windshield Tag Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Rfid Automotive Windshield Tag Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Rfid Automotive Windshield Tag Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Rfid Automotive Windshield Tag Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Rfid Automotive Windshield Tag Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Rfid Automotive Windshield Tag Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Rfid Automotive Windshield Tag Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Rfid Automotive Windshield Tag Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Rfid Automotive Windshield Tag Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Rfid Automotive Windshield Tag Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Rfid Automotive Windshield Tag Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Rfid Automotive Windshield Tag?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Rfid Automotive Windshield Tag?

Key companies in the market include SYNOMETRIX, Focus RFID, LeghornGroup, ID Tech Solutions, SHANGHAI HUAYUAN ELECTRONIC CO. LTD., Dipole RFID, Kathrein Solutions, Perfect ID, Indian Barcode Corporation, DO RFID TAG company, Arizon RFID Technology, Best Barcode System Pvt Ltd, GSRFID, Lex, Xinchuangyi, Innov, Chuangxinjia.

3. What are the main segments of the Rfid Automotive Windshield Tag?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Rfid Automotive Windshield Tag," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Rfid Automotive Windshield Tag report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Rfid Automotive Windshield Tag?

To stay informed about further developments, trends, and reports in the Rfid Automotive Windshield Tag, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence