Key Insights

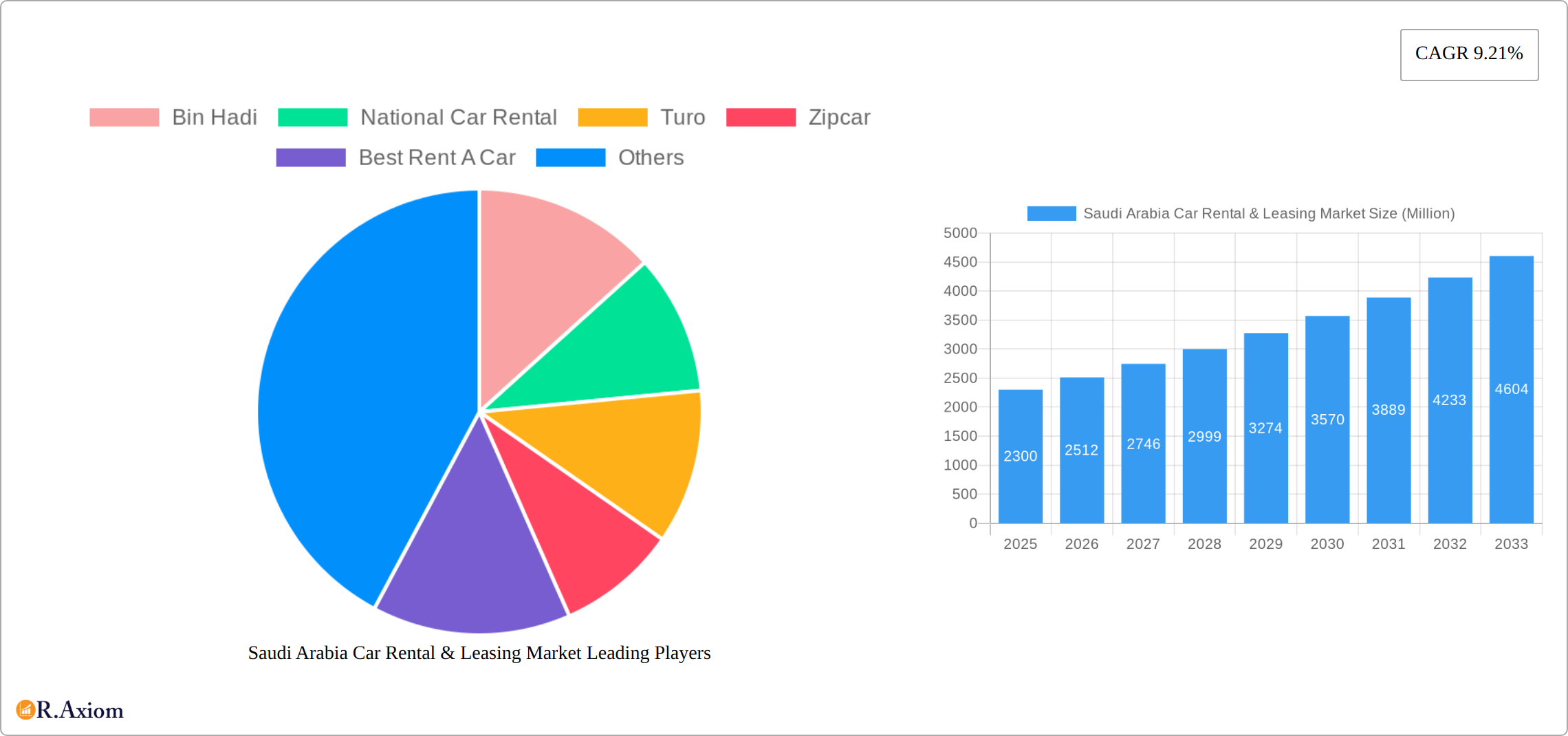

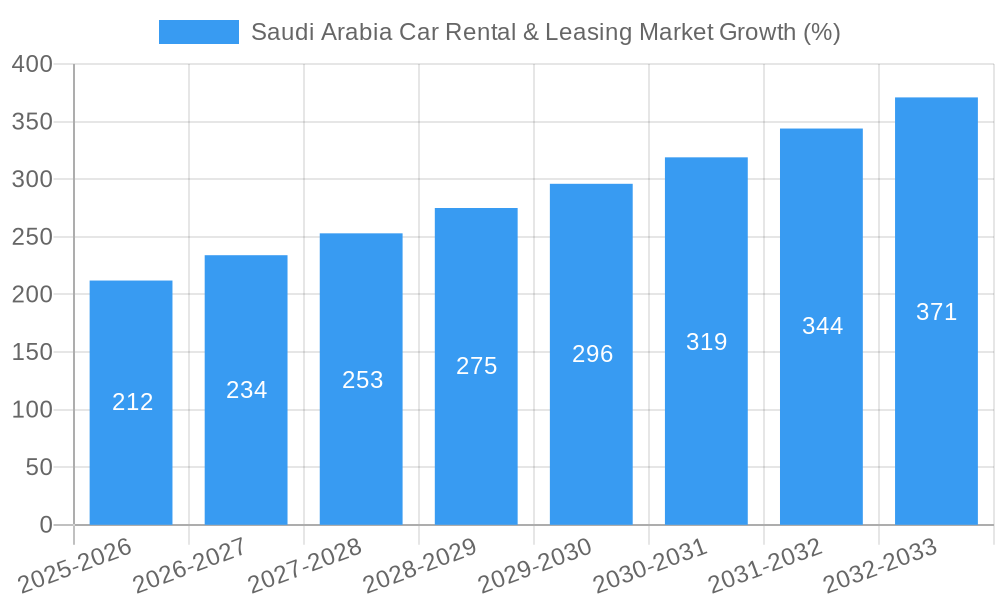

The Saudi Arabian car rental and leasing market is experiencing robust growth, projected to reach a market size of $2.3 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 9.21% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, a burgeoning tourism sector and increasing inbound travel are significantly boosting demand for rental vehicles. Secondly, the rise of ride-hailing services and the growing preference for short-term rentals are contributing to market dynamism. Thirdly, the government's initiatives promoting infrastructure development and facilitating ease of doing business are creating a positive environment for the industry's expansion. Finally, the increasing disposable incomes and a young, rapidly growing population are fueling higher vehicle ownership and rental demand. Segmentation reveals that long-term leasing is expected to have a larger market share compared to short-term rentals, driven by corporate demand and cost effectiveness. Within vehicle types, the premium/luxury segment is showing a notable growth trajectory, reflecting rising affluence and demand for high-end vehicles. Online booking is gaining traction, signifying a shift towards digitalization in the sector. Competition is fierce, with both international players like Hertz and Avis Budget Group, and local operators like Bin Hadi and National Car Rental vying for market dominance. Regional variations exist, with urban centers such as Riyadh and Jeddah exhibiting higher demand compared to rural areas. While the market is currently dominated by offline bookings, online platforms are steadily gaining popularity, indicating a digital transformation within the industry. The market faces some challenges, including fluctuating fuel prices and potential regulatory changes; however, the overall outlook remains positive, with continued growth expected throughout the forecast period.

The competitive landscape comprises a mix of global and regional players, reflecting both the internationalization of the car rental sector and the presence of strong domestic businesses. Strategies employed by companies include fleet expansion to cater to increased demand, investment in technology to improve online booking and management systems, and diversification of services such as offering chauffeur-driven vehicles and specialized rental options. The geographic spread of the market also impacts business strategies, with companies focusing on areas with high tourist traffic and developing localized marketing approaches. The future growth will likely be shaped by further technological advancements, sustainable mobility initiatives, and evolving consumer preferences. The government's ongoing investments in infrastructure and tourism will remain critical in shaping the long-term trajectory of the Saudi Arabian car rental and leasing market.

Saudi Arabia Car Rental & Leasing Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Saudi Arabia car rental and leasing market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's current state, future trajectory, and key growth drivers.

Saudi Arabia Car Rental & Leasing Market Concentration & Innovation

This section analyzes the competitive landscape of the Saudi Arabia car rental and leasing market, examining market concentration, innovation drivers, regulatory influences, and market dynamics. The analysis covers the period from 2019 to 2024, providing insights into past trends and their implications for the future.

The Saudi Arabian car rental and leasing market exhibits a moderately concentrated structure, with a few major players holding significant market share. While precise market share figures for individual companies are proprietary and unavailable for public disclosure, estimations suggest that the top 5 players hold approximately xx% of the overall market. The market is characterized by both established international players and local companies. This mix fosters a dynamic competitive environment.

Innovation Drivers:

- Technological advancements: The integration of online booking platforms, mobile apps, and digital payment systems has significantly enhanced customer experience and operational efficiency.

- Fleet diversification: The market is witnessing increasing diversity in vehicle types, catering to a wider range of customer preferences. This includes the rise of electric and hybrid vehicles.

- Subscription models: Subscription-based car rental and leasing services are gaining traction, offering flexible and cost-effective options for consumers.

Regulatory Framework: The regulatory environment plays a crucial role, influencing market access, operational standards, and competition. Recent government initiatives aimed at promoting economic diversification and improving infrastructure have indirectly stimulated the market.

Product Substitutes: Ride-hailing services (e.g., Uber, Careem) represent a significant substitute for short-term car rentals. Private car ownership remains a primary alternative for long-term use.

End-User Trends: Growing urbanization, rising disposable incomes, and increased tourism are key factors driving demand for car rental and leasing services.

M&A Activities: While specific deal values are confidential, the market has seen a moderate level of mergers and acquisitions activity in recent years, primarily focused on consolidating market share and expanding service offerings. These deals often involve local players acquiring smaller firms or international companies establishing a stronger presence.

Saudi Arabia Car Rental & Leasing Market Industry Trends & Insights

This section delves into the key trends shaping the Saudi Arabia car rental and leasing market, including market growth, technological disruptions, and competitive dynamics. The analysis provides a comprehensive overview of the market's evolution from 2019 to 2024 and projects its future trajectory until 2033.

The Saudi Arabia car rental and leasing market has experienced substantial growth in recent years, driven by factors such as rising disposable incomes, increased tourism, and government initiatives aimed at modernizing the transportation sector. The market's Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) is estimated to be xx%, and it is projected to reach xx% during the forecast period (2025-2033). Market penetration is relatively high in urban areas, but significant potential exists for expansion in rural regions.

Technological disruptions have profoundly impacted the market, with the rise of online booking platforms, mobile apps, and digital payment systems. These technologies have streamlined the rental process, improved customer experience, and enhanced operational efficiency for rental companies. The increasing adoption of telematics and connected car technologies is also shaping the future of the industry.

Consumer preferences are evolving towards greater convenience, flexibility, and value-added services. This trend is reflected in the growing popularity of subscription-based rental models and the demand for a wider variety of vehicle types. The rise of eco-friendly vehicles (electric and hybrid) is also influencing consumer choices.

Competitive dynamics are characterized by a mix of established international players and local companies. Competition is primarily based on pricing, service quality, fleet diversity, and technological capabilities. The market is also witnessing increased competition from ride-hailing services.

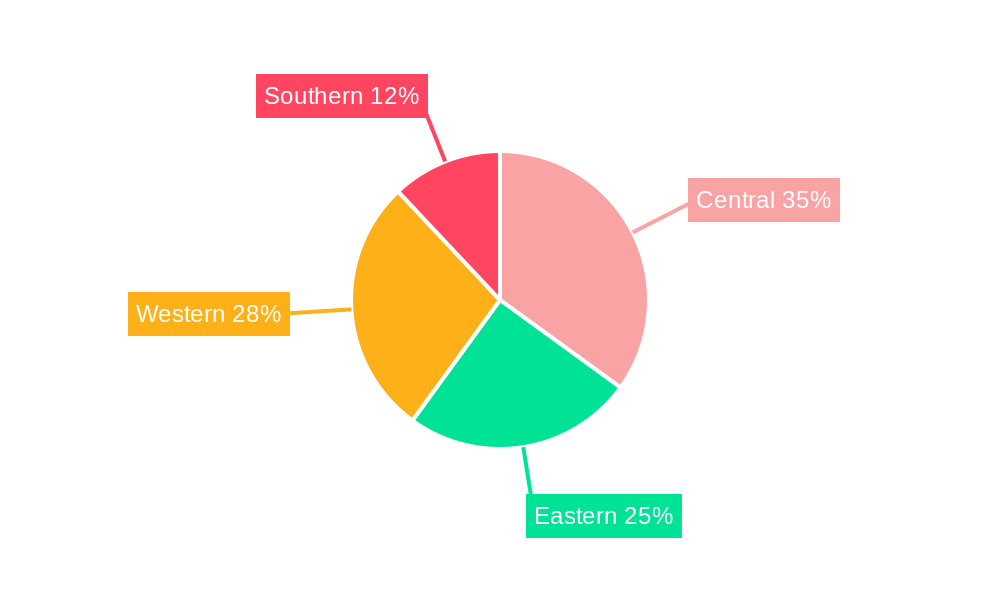

Dominant Markets & Segments in Saudi Arabia Car Rental & Leasing Market

This section analyzes the dominant segments within the Saudi Arabia car rental and leasing market, based on duration, vehicle type, body type, and booking type. The analysis identifies the leading regions, segments, and key drivers of growth within each category.

Dominant Segments:

- Duration: Short-term leasing currently dominates the market, driven by the high volume of tourist traffic and business travelers. Long-term leasing is a growing segment, reflecting the increasing demand for flexible vehicle solutions.

- Vehicle Type: Economy/Budget vehicles represent the largest share of the market, due to price sensitivity. However, the premium/luxury segment is showing strong growth due to increased disposable incomes and a shift in consumer preferences.

- Body Type: Sedans and SUVs are the most popular vehicle body types, catering to diverse needs. The demand for SUVs is particularly high.

- Booking Type: While offline bookings remain significant, online bookings are rapidly growing in popularity, driven by increased internet penetration and the convenience of online platforms.

Key Drivers of Segment Dominance:

- Economic Policies: Government initiatives supporting tourism and infrastructure development are boosting demand across all segments.

- Infrastructure: Improved road networks and transportation infrastructure are crucial in facilitating the growth of the car rental and leasing market.

- Tourism: The increasing number of tourists visiting Saudi Arabia fuels demand for short-term rental services.

- Business Travel: A thriving business environment and increased corporate travel contribute significantly to short and long-term leasing demand.

- Technological advancements: Online booking systems and mobile applications are making it more convenient to rent cars, thus expanding the market's reach.

Saudi Arabia Car Rental & Leasing Market Product Developments

The Saudi Arabian car rental and leasing market is experiencing a dynamic period of product innovation, fueled by technological advancements and evolving consumer preferences. This includes the integration of cutting-edge telematics, sophisticated connected car technologies, and seamless digital services, all designed to elevate the customer experience and optimize operational efficiency. Furthermore, a notable trend is the expansion of fleets to incorporate electric and hybrid vehicles, directly addressing the surge in demand for environmentally conscious transportation options. These product enhancements not only improve service quality but also provide a significant competitive edge for companies catering to the increasingly diverse needs and expectations of the Saudi Arabian consumer base. Specific examples include subscription-based rental models offering greater flexibility and personalized packages tailored to individual customer profiles.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation of the Saudi Arabia car rental and leasing market, analyzing various key dimensions. These include rental duration (short-term and long-term), vehicle type (categorized as economy/budget, mid-size, and premium/luxury), body type (ranging from hatchbacks and sedans to multi-utility vehicles (MUVs) and SUVs), and booking method (online and offline). The report delivers in-depth analysis of growth projections, precise market sizing, and a detailed examination of the competitive landscape within each segment. While all segments exhibit positive growth projections, short-term rentals are expected to retain a substantial market share, driven by robust tourism and business travel. The luxury segment, however, is projected to demonstrate the most significant growth rate. Online booking is anticipated to experience rapid expansion, fueled by the increasing preference for convenience and widespread technology adoption. Specific data points, such as projected compound annual growth rates (CAGRs) for each segment, are included within the full report.

Key Drivers of Saudi Arabia Car Rental & Leasing Market Growth

The growth trajectory of the Saudi Arabia car rental and leasing market is propelled by several key factors. Robust economic growth, fueled by ambitious diversification initiatives (Vision 2030) and a significant influx of tourism, is a primary driver of increased demand. Simultaneously, technological advancements, particularly the proliferation of user-friendly online booking platforms and mobile applications, are enhancing convenience and operational efficiency. Government-led initiatives focused on infrastructure development and regulatory streamlining are further stimulating market expansion. Improvements to the national road network and substantial investments in the tourism sector provide additional support for sustained market growth. The increasing adoption of ride-sharing services is also indirectly impacting demand, showcasing a wider shift towards mobility solutions.

Challenges in the Saudi Arabia Car Rental & Leasing Market Sector

Despite its considerable growth potential, the Saudi Arabia car rental and leasing market faces several challenges. High vehicle acquisition costs and insurance premiums can significantly impact profitability. Maintaining a diverse and meticulously maintained fleet demands substantial investment. Intense competition from both established players and emerging ride-hailing services, coupled with the prevalence of private car ownership, creates ongoing competitive pressures. Furthermore, stringent regulatory requirements and the dynamic nature of the regulatory landscape add complexity to operational management. These factors contribute to a multifaceted operating environment that necessitates agile strategies for effective risk mitigation and the sustained achievement of profitability. Addressing these challenges will require innovative approaches to fleet management, cost optimization, and regulatory compliance.

Emerging Opportunities in Saudi Arabia Car Rental & Leasing Market

The Saudi Arabia car rental and leasing market presents a wealth of emerging opportunities. The burgeoning tourism sector is creating a substantial demand for short-term rentals, particularly in key tourist destinations. The government's strong commitment to sustainable transportation is further fueling the demand for electric and hybrid vehicles. Moreover, the ongoing development of smart city initiatives is creating exciting opportunities for innovative solutions and strategic collaborations within the sector. These dynamic trends represent significant avenues for market expansion and growth, demanding proactive adaptation and the development of innovative solutions to capitalize on these opportunities. This includes exploring partnerships with technology providers and leveraging data analytics to improve efficiency and customer satisfaction.

Leading Players in the Saudi Arabia Car Rental & Leasing Market Market

- Bin Hadi

- National Car Rental

- Turo

- Zipcar

- Best Rent A Car

- Hanco Automotive

- Budget Rent-A-Car

- Auto Rent

- Theeb Rent A Car

- Ejaro

- Key Car Rental

- Strong Rent a Car

- Yelo Corporation (Al Wefaq)

- Hertz Corporation

- Sixt SE

- Samara Land Transportation Services

- Autoworld (Al-Jazira Equipment Company Limited)

- Esar International Group

- Europcar Mobility Group

- Avis Budget Group Inc

Key Developments in Saudi Arabia Car Rental & Leasing Market Industry

- October 2022: Lumi, Seera’s car rental and leasing unit, opened its first car showroom in Riyadh, indicating market expansion beyond rentals.

- April 2023: ALTAWKILAT Premium partnered with PEAX to supply luxury vehicles, signifying growth in the premium segment.

- June 2023: Lumi Rental Company secured a large leasing agreement with Saudi Post, demonstrating the potential of large-scale fleet contracts.

- November 2023: Budget Saudi secured a long-term leasing deal with SABIC, highlighting significant contract wins in the long-term leasing sector.

Strategic Outlook for Saudi Arabia Car Rental & Leasing Market Market

The Saudi Arabia car rental and leasing market holds substantial growth potential, fueled by sustained economic expansion, increased tourism, and government initiatives. The ongoing shift towards digitalization presents opportunities for innovative business models and service enhancements. The rising demand for sustainable transportation will further drive innovation and market diversification. Companies that adapt to these trends, investing in technology and expanding service offerings, are poised to benefit from this dynamic and expanding market.

Saudi Arabia Car Rental & Leasing Market Segmentation

-

1. Duration

- 1.1. Short-term Leasing

- 1.2. Long-term Leasing

-

2. Vehicle Type

- 2.1. Economy/Budget

- 2.2. Premium/Luxury

-

3. Body Type

- 3.1. Hatchback

- 3.2. Sedan

- 3.3. Multi Utility Vehicle and Sports Utility Vehicle

-

4. Booking Type

- 4.1. Online

- 4.2. Offline

Saudi Arabia Car Rental & Leasing Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Car Rental & Leasing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.21% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in the Logistics and E-commerce Industries and Establishment of New Corporate Offices Driving the Market

- 3.3. Market Restrains

- 3.3.1. Impact of Inflation on Costs and Consumer Spending is a Key Challenge

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Sports Utility Vehicles to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Car Rental & Leasing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Duration

- 5.1.1. Short-term Leasing

- 5.1.2. Long-term Leasing

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Economy/Budget

- 5.2.2. Premium/Luxury

- 5.3. Market Analysis, Insights and Forecast - by Body Type

- 5.3.1. Hatchback

- 5.3.2. Sedan

- 5.3.3. Multi Utility Vehicle and Sports Utility Vehicle

- 5.4. Market Analysis, Insights and Forecast - by Booking Type

- 5.4.1. Online

- 5.4.2. Offline

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Duration

- 6. Central Saudi Arabia Car Rental & Leasing Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Car Rental & Leasing Market Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Car Rental & Leasing Market Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Car Rental & Leasing Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Bin Hadi

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 National Car Rental

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Turo

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Zipcar

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Best Rent A Car

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Hanco Automotive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Budget Rent-A-Car

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Auto Rent

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Theeb Rent A Car

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Ejaro

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Key Car Rental

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Strong Rent a Car

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Yelo Corporation (Al Wefaq)

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Hertz Corporation

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Sixt SE

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 Samara Land Transportation Services

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 Autoworld (Al-Jazira Equipment Company Limited

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.18 Esar International Group

- 10.2.18.1. Overview

- 10.2.18.2. Products

- 10.2.18.3. SWOT Analysis

- 10.2.18.4. Recent Developments

- 10.2.18.5. Financials (Based on Availability)

- 10.2.19 Europcar Mobility Group

- 10.2.19.1. Overview

- 10.2.19.2. Products

- 10.2.19.3. SWOT Analysis

- 10.2.19.4. Recent Developments

- 10.2.19.5. Financials (Based on Availability)

- 10.2.20 Avis Budget Group Inc

- 10.2.20.1. Overview

- 10.2.20.2. Products

- 10.2.20.3. SWOT Analysis

- 10.2.20.4. Recent Developments

- 10.2.20.5. Financials (Based on Availability)

- 10.2.1 Bin Hadi

List of Figures

- Figure 1: Saudi Arabia Car Rental & Leasing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Car Rental & Leasing Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Duration 2019 & 2032

- Table 3: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 4: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Body Type 2019 & 2032

- Table 5: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 6: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Central Saudi Arabia Car Rental & Leasing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Eastern Saudi Arabia Car Rental & Leasing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Western Saudi Arabia Car Rental & Leasing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Southern Saudi Arabia Car Rental & Leasing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Duration 2019 & 2032

- Table 13: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 14: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Body Type 2019 & 2032

- Table 15: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 16: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Car Rental & Leasing Market?

The projected CAGR is approximately 9.21%.

2. Which companies are prominent players in the Saudi Arabia Car Rental & Leasing Market?

Key companies in the market include Bin Hadi, National Car Rental, Turo, Zipcar, Best Rent A Car, Hanco Automotive, Budget Rent-A-Car, Auto Rent, Theeb Rent A Car, Ejaro, Key Car Rental, Strong Rent a Car, Yelo Corporation (Al Wefaq), Hertz Corporation, Sixt SE, Samara Land Transportation Services, Autoworld (Al-Jazira Equipment Company Limited, Esar International Group, Europcar Mobility Group, Avis Budget Group Inc.

3. What are the main segments of the Saudi Arabia Car Rental & Leasing Market?

The market segments include Duration, Vehicle Type, Body Type, Booking Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in the Logistics and E-commerce Industries and Establishment of New Corporate Offices Driving the Market.

6. What are the notable trends driving market growth?

Increasing Demand for Sports Utility Vehicles to Drive the Market.

7. Are there any restraints impacting market growth?

Impact of Inflation on Costs and Consumer Spending is a Key Challenge.

8. Can you provide examples of recent developments in the market?

November 2023: The United International Transportation Company, Budget Saudi, secured a long-term deal with Saudi Basic Industries Corp. (SABIC) for leasing the transport firm’s 263 vehicles. The contract, valued at SAR 39.8 million (USD 10.6 million), is for four years. The leasing deal will be automatically renewed for 12 months at the end of the initial term.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Car Rental & Leasing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Car Rental & Leasing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Car Rental & Leasing Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Car Rental & Leasing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence