Key Insights

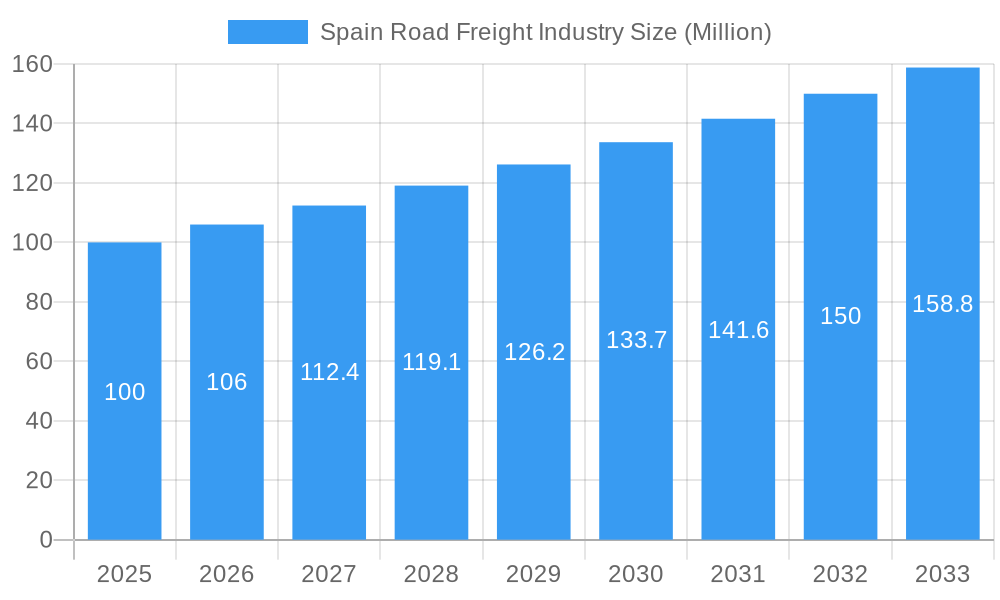

The Spain road freight market, valued at €62.92 billion in 2024, is poised for significant expansion, projected to grow at a CAGR of 3.2% from 2024 to 2033. Key growth drivers include Spain's expanding e-commerce landscape, necessitating efficient last-mile delivery, and ongoing infrastructure development enhancing logistical capabilities. Increased emphasis on supply chain resilience and domestic transport diversification further bolsters demand. Robust performance in the construction, manufacturing, and agricultural sectors also fuels freight volume.

Spain Road Freight Industry Market Size (In Billion)

Challenges confronting the industry include rising operational costs due to fuel price volatility and driver scarcity. Evolving environmental regulations necessitate investment in sustainable trucking technologies. Competition from alternative transport modes requires continuous service enhancement and cost optimization. To navigate these challenges and capitalize on opportunities, companies should prioritize technology adoption for fleet management and optimization, invest in driver recruitment and retention, and explore sustainable solutions. Specialization in high-demand segments, such as temperature-controlled logistics for agriculture, offers a competitive edge. Strategic alliances are also crucial for addressing infrastructure and labor constraints.

Spain Road Freight Industry Company Market Share

This report offers a detailed analysis of the Spain road freight market, encompassing size, segmentation, key participants, and future outlook. The study covers the period from 2019 to 2033, with 2024 as the base year and forecasts extending to 2033. This research is indispensable for stakeholders, investors, and decision-makers seeking to understand and leverage opportunities within this evolving market.

Spain Road Freight Industry Market Concentration & Innovation

The Spanish road freight industry exhibits a moderately concentrated market structure, with a few major players holding significant market share. A P Moller - Maersk, DB Schenker, XPO Inc, and DHL Group are among the leading global companies operating in the country, alongside prominent domestic players like Trans Sese SL, Primafrio, and Marcotran Transportes Internacionales S L. Market share data for 2024 suggests that the top five players control approximately xx% of the total market, with the remaining share distributed amongst numerous smaller operators and niche players. This concentration, however, is challenged by the emergence of smaller, specialized firms focusing on niche segments like temperature-controlled transportation or sustainable logistics solutions.

Innovation within the sector is driven by several factors:

- Technological advancements: The increasing adoption of telematics, route optimization software, and digital freight platforms is enhancing efficiency and transparency within the supply chain.

- Sustainability initiatives: Stringent environmental regulations and growing consumer demand for environmentally friendly transportation solutions are pushing companies to adopt cleaner fuels and electric vehicles. As evidenced by recent investments in electric fleets by DB Schenker and XPO's LESS initiative using HVO fuel, this trend is rapidly gaining traction.

- Regulatory changes: Government initiatives aimed at improving infrastructure and streamlining logistics processes are creating opportunities for innovation and growth.

- Mergers and acquisitions (M&A): Consolidation activities in the sector, including both domestic and international mergers, result in increased market share for larger players and improved operational efficiency. The total value of M&A deals in the Spanish road freight industry in 2024 reached approximately €xx Million.

The presence of substitute modes of transportation, such as rail and maritime, also impacts market dynamics. Nevertheless, the flexibility and widespread reach of road transport continue to maintain its dominance, especially for short-haul and last-mile deliveries. End-user trends, including a preference for just-in-time delivery systems and e-commerce growth, further fuel the demand for efficient and reliable road freight services.

Spain Road Freight Industry Industry Trends & Insights

The Spanish road freight industry is experiencing steady growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors:

- Economic growth: Continued economic expansion in Spain is driving up demand for transportation services across various sectors.

- E-commerce boom: The rapid expansion of online retail has significantly increased the volume of parcels and smaller shipments needing efficient last-mile delivery.

- Infrastructure development: Government investments in road infrastructure are improving connectivity and supporting efficient transportation.

- Technological advancements: The adoption of advanced technologies is optimizing logistics operations, reducing costs, and enhancing efficiency. This includes using telematics, AI-powered route optimization, and automated warehousing.

- Supply Chain resilience: Post-pandemic efforts towards improving supply chain reliability and diversification are bolstering demand. This translates to a greater preference for flexible and responsive road freight solutions.

Market penetration of technology is significant, with over xx% of major players integrating telematics and digital freight management systems. The industry, however, still faces challenges in adapting to technological disruption, particularly regarding cybersecurity and data integration. Competitive dynamics are characterized by intense competition among major players and the emergence of niche players focusing on sustainable and specialized services. Consumer preferences are shifting toward faster, more reliable, and environmentally friendly delivery options, forcing companies to innovate and adapt their offerings.

Dominant Markets & Segments in Spain Road Freight Industry

The Spanish road freight market shows significant variations across segments.

- Leading Region: The most dominant region is likely to remain the xx region in Spain, driven by factors such as high population density, industrial concentration, and proximity to major ports.

- Containerization: Containerized freight dominates due to its efficiency for larger volumes. Non-containerized freight retains significance for smaller shipments and specialized goods.

- Distance: Long-haul transport holds a larger market share due to inter-regional and international trade, while short-haul dominates due to last-mile delivery and urban logistics demands.

- Goods Configuration: Solid goods represent the largest share, with fluid goods commanding a significant portion particularly within the chemical and food sectors.

- Temperature Control: The temperature-controlled segment is experiencing significant growth driven by the food and pharmaceutical industries. Non-temperature controlled still holds a larger market share due to the diversity of goods transported.

- End User Industry: The Wholesale and Retail Trade sector, followed by Manufacturing, are the major end-users due to high volumes of goods movement.

- Destination: Domestic transport continues to dominate, while international transport is growing steadily due to increased cross-border trade.

- Truckload Specification: FTL transport remains dominant due to cost efficiency for large shipments. LTL offers flexibility for smaller loads but faces complexities in route optimization and cost-effectiveness.

Key drivers for dominance vary by segment: for instance, the growth of e-commerce fuels the short-haul and LTL sectors, whereas manufacturing expansion impacts the long-haul FTL segment. Economic policies supporting infrastructure development and trade liberalization continue to strongly influence the overall market dominance and growth patterns across all segments.

Spain Road Freight Industry Product Developments

Product innovation in the Spanish road freight industry is heavily focused on enhancing efficiency, sustainability, and technological integration. This includes the implementation of advanced telematics systems for real-time tracking and route optimization, the adoption of electric and alternative fuel vehicles, and the development of sophisticated logistics platforms integrating various supply chain actors. Such innovations cater to the growing demand for improved visibility, reduced environmental impact, and efficient cost management within the sector, directly contributing to a competitive advantage in the market.

Report Scope & Segmentation Analysis

This report encompasses a detailed analysis of the Spanish road freight industry across numerous segments:

- Containerization: Containerized and non-containerized freight, analyzing volume, revenue, and growth projections for each.

- Distance: Long-haul and short-haul transportation, focusing on market size, growth rates, and key players.

- Goods Configuration: Fluid goods and solid goods, highlighting the specific challenges and opportunities within each.

- Temperature Control: Temperature-controlled and non-temperature-controlled transportation, emphasizing market trends and technological advancements.

- End User Industry: Agriculture, Fishing, and Forestry; Construction; Manufacturing; Oil and Gas; Mining and Quarrying; Wholesale and Retail Trade; and Others – analyzing sector-specific demand and growth.

- Destination: Domestic and international transportation, evaluating the impact of cross-border trade and regulatory factors.

- Truckload Specification: FTL and LTL transportation, with a focus on market share, pricing dynamics, and competitive pressures.

Each segment's market size, growth projections, and competitive dynamics are analyzed, providing a granular understanding of the market landscape.

Key Drivers of Spain Road Freight Industry Growth

The growth of the Spanish road freight industry is driven by several key factors:

- Technological advancements: Implementation of telematics, route optimization software, and autonomous driving technologies are increasing efficiency and reducing costs.

- Economic growth: Continued economic expansion in Spain is increasing demand across various sectors.

- E-commerce boom: The surge in online retail is boosting demand for last-mile delivery services.

- Favorable government policies: Regulations aimed at streamlining logistics and improving infrastructure support industry growth.

These factors converge to create a positive environment for growth and innovation.

Challenges in the Spain Road Freight Industry Sector

The Spanish road freight industry faces several significant challenges:

- Driver shortages: A critical shortage of qualified drivers is impacting operational efficiency and increasing costs.

- Fuel price volatility: Fluctuations in fuel prices impact transportation costs and profitability.

- Stringent environmental regulations: Meeting increasingly strict emission standards requires significant investments in new technologies.

- Infrastructure limitations: Congestion in urban areas and limited capacity on certain routes create bottlenecks and delays.

These factors collectively create significant headwinds for industry growth.

Emerging Opportunities in Spain Road Freight Industry

Several promising opportunities exist within the Spanish road freight sector:

- Sustainable logistics: Growing demand for eco-friendly transportation solutions presents opportunities for companies offering electric vehicles and alternative fuels.

- Technological innovation: Adopting AI, automation, and big data analytics can enhance efficiency and create new service offerings.

- Last-mile delivery optimization: Addressing the challenges of urban logistics and improving last-mile delivery efficiency is a crucial area for innovation.

- Cross-border e-commerce: The growth of online retail across borders creates opportunities for international transport companies.

These trends represent significant growth potential for companies that can adapt and innovate.

Leading Players in the Spain Road Freight Industry Market

- A P Moller - Maersk

- DB Schenker

- XPO Inc

- Trans Sese SL

- DHL Group

- DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- Dachser

- Marcotran Transportes Internacionales S L

- International Distributions Services

- La Poste Group

- Primafrio

Key Developments in Spain Road Freight Industry Industry

- September 2023: DB Schenker's testing of Volta Zero electric trucks in Norway signifies a significant step towards sustainable urban deliveries, potentially impacting the Spanish market through future adoption.

- July 2023: DACHSER's expansion of emission-free deliveries to twelve more European cities, including Barcelona, demonstrates a commitment to sustainable practices, influencing competitive dynamics within the Spanish market.

- July 2023: XPO's LESS initiative in Spain, using HVO fuel, showcases a proactive approach to decarbonization, offering a competitive advantage and shaping future fuel choices within the industry.

These developments highlight the growing importance of sustainability and technological innovation within the Spanish road freight industry.

Strategic Outlook for Spain Road Freight Industry Market

The future of the Spanish road freight industry appears positive, driven by continued economic growth, e-commerce expansion, and advancements in technology. Opportunities exist for companies that can adapt to the growing demand for sustainable solutions, leverage technological innovations to improve efficiency and transparency, and address the challenges of driver shortages and urban logistics. The market is likely to witness increased consolidation, with larger players acquiring smaller firms to expand their market share and service capabilities. Companies that can effectively integrate sustainability initiatives, technological advancements, and efficient operational strategies will be best positioned for success in the years ahead.

Spain Road Freight Industry Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Destination

- 2.1. Domestic

- 2.2. International

-

3. Truckload Specification

- 3.1. Full-Truck-Load (FTL)

- 3.2. Less than-Truck-Load (LTL)

-

4. Containerization

- 4.1. Containerized

- 4.2. Non-Containerized

-

5. Distance

- 5.1. Long Haul

- 5.2. Short Haul

-

6. Goods Configuration

- 6.1. Fluid Goods

- 6.2. Solid Goods

-

7. Temperature Control

- 7.1. Non-Temperature Controlled

Spain Road Freight Industry Segmentation By Geography

- 1. Spain

Spain Road Freight Industry Regional Market Share

Geographic Coverage of Spain Road Freight Industry

Spain Road Freight Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Road Freight Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 5.3.1. Full-Truck-Load (FTL)

- 5.3.2. Less than-Truck-Load (LTL)

- 5.4. Market Analysis, Insights and Forecast - by Containerization

- 5.4.1. Containerized

- 5.4.2. Non-Containerized

- 5.5. Market Analysis, Insights and Forecast - by Distance

- 5.5.1. Long Haul

- 5.5.2. Short Haul

- 5.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 5.6.1. Fluid Goods

- 5.6.2. Solid Goods

- 5.7. Market Analysis, Insights and Forecast - by Temperature Control

- 5.7.1. Non-Temperature Controlled

- 5.8. Market Analysis, Insights and Forecast - by Region

- 5.8.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 A P Moller - Maersk

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DB Schenker

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 XPO Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Trans Sese SL

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DHL Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Dachser

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Marcotran Transportes Internacionales S L

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 International Distributions Services

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 La Poste Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Primafrio

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 A P Moller - Maersk

List of Figures

- Figure 1: Spain Road Freight Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Spain Road Freight Industry Share (%) by Company 2025

List of Tables

- Table 1: Spain Road Freight Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 2: Spain Road Freight Industry Revenue billion Forecast, by Destination 2020 & 2033

- Table 3: Spain Road Freight Industry Revenue billion Forecast, by Truckload Specification 2020 & 2033

- Table 4: Spain Road Freight Industry Revenue billion Forecast, by Containerization 2020 & 2033

- Table 5: Spain Road Freight Industry Revenue billion Forecast, by Distance 2020 & 2033

- Table 6: Spain Road Freight Industry Revenue billion Forecast, by Goods Configuration 2020 & 2033

- Table 7: Spain Road Freight Industry Revenue billion Forecast, by Temperature Control 2020 & 2033

- Table 8: Spain Road Freight Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 9: Spain Road Freight Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 10: Spain Road Freight Industry Revenue billion Forecast, by Destination 2020 & 2033

- Table 11: Spain Road Freight Industry Revenue billion Forecast, by Truckload Specification 2020 & 2033

- Table 12: Spain Road Freight Industry Revenue billion Forecast, by Containerization 2020 & 2033

- Table 13: Spain Road Freight Industry Revenue billion Forecast, by Distance 2020 & 2033

- Table 14: Spain Road Freight Industry Revenue billion Forecast, by Goods Configuration 2020 & 2033

- Table 15: Spain Road Freight Industry Revenue billion Forecast, by Temperature Control 2020 & 2033

- Table 16: Spain Road Freight Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Road Freight Industry?

The projected CAGR is approximately 3.2%.

2. Which companies are prominent players in the Spain Road Freight Industry?

Key companies in the market include A P Moller - Maersk, DB Schenker, XPO Inc, Trans Sese SL, DHL Group, DSV A/S (De Sammensluttede Vognmænd af Air and Sea), Dachser, Marcotran Transportes Internacionales S L, International Distributions Services, La Poste Group, Primafrio.

3. What are the main segments of the Spain Road Freight Industry?

The market segments include End User Industry, Destination, Truckload Specification, Containerization, Distance, Goods Configuration, Temperature Control.

4. Can you provide details about the market size?

The market size is estimated to be USD 62.92 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

September 2023: DB Schenker in Norway conducted a test with the electrically powered and highly innovative Volta Zero from Volta Trucks. In 2021, DB Schenker and Volta Trucks announced a partnership. The subsequent pre-order of nearly 1,500 zer-tailpipe emission Volta Zero vehicles was the largest order of medium-duty electric trucks in Europe to date. DB Schenker plans to deploy the all-electric, 16-ton Volta Zero in its European terminals to deliver goods from distribution hubs to urban areas and city centers.July 2023: DACHSER is significantly expanding its emission-free delivery of non-chilled groupage shipments to defined downtown areas. By the end of 2025, the company plans to launch DACHSER Emission-Free Delivery in twelve more European cities Amsterdam, Barcelona, Dublin, Hamburg, Cologne, London, Malaga, Rotterdam, Stockholm, Toulouse, Warsaw, and Vienna.July 2023: XPO has launched LESS, its Low Emissions Sustainable Solution, in Spain in partnership with Repsol. LESS is a decarbonisation initiative developed by XPO to offer its road transport customers a faster transition to the use of a renewable fuel, also known as HVO (Hydrotreated Vegetable Oil), a fuel capable of reducing CO2 emissions by up to 90% compared to conventional fuels and without the need to modify the current vehicle fleet. To strengthen the LESS® solution in Spain, XPO has signed a partnership agreement for this sustainable project with Repsol, which will provide more than 1 million liters of renewable fuel by 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Road Freight Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Road Freight Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Road Freight Industry?

To stay informed about further developments, trends, and reports in the Spain Road Freight Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence