Key Insights

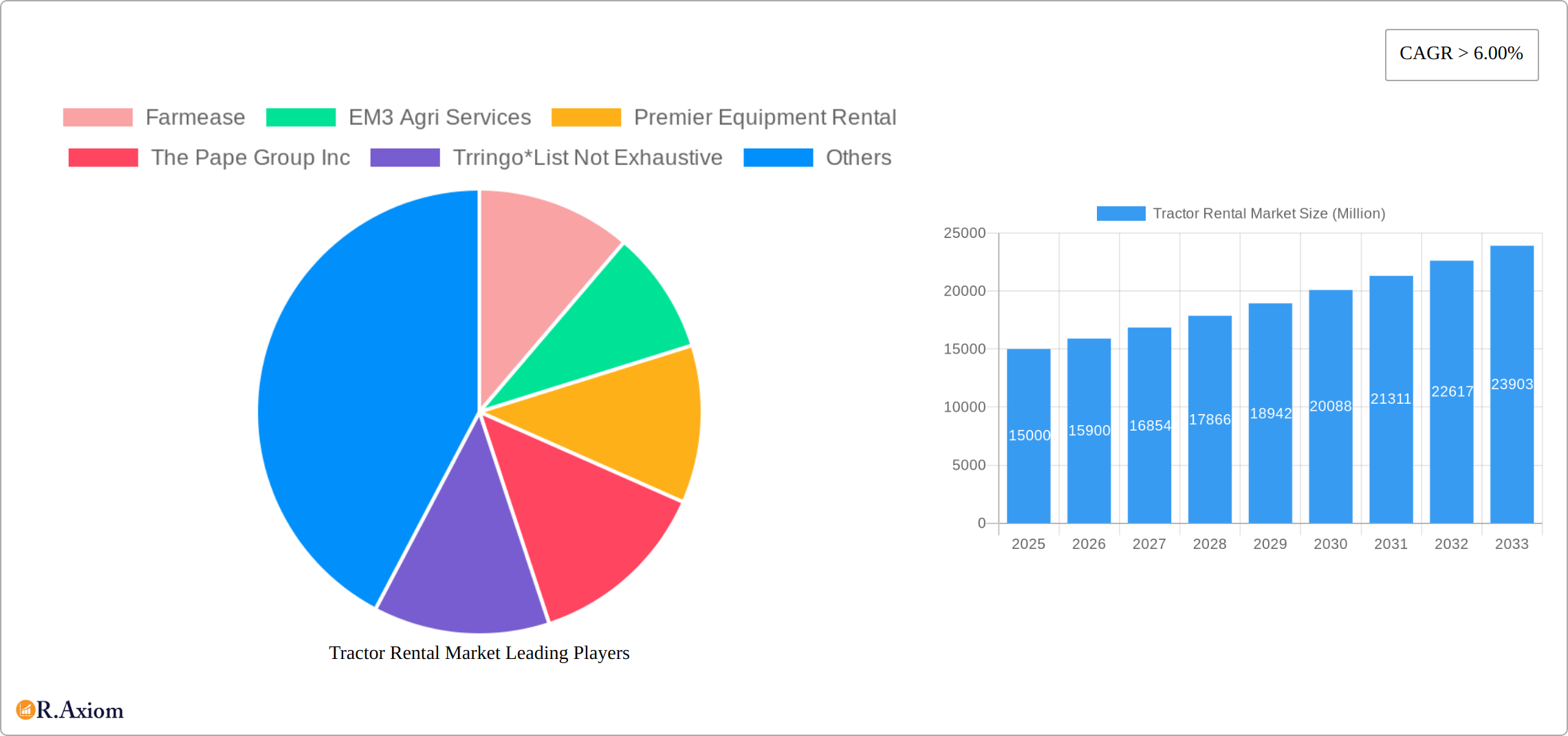

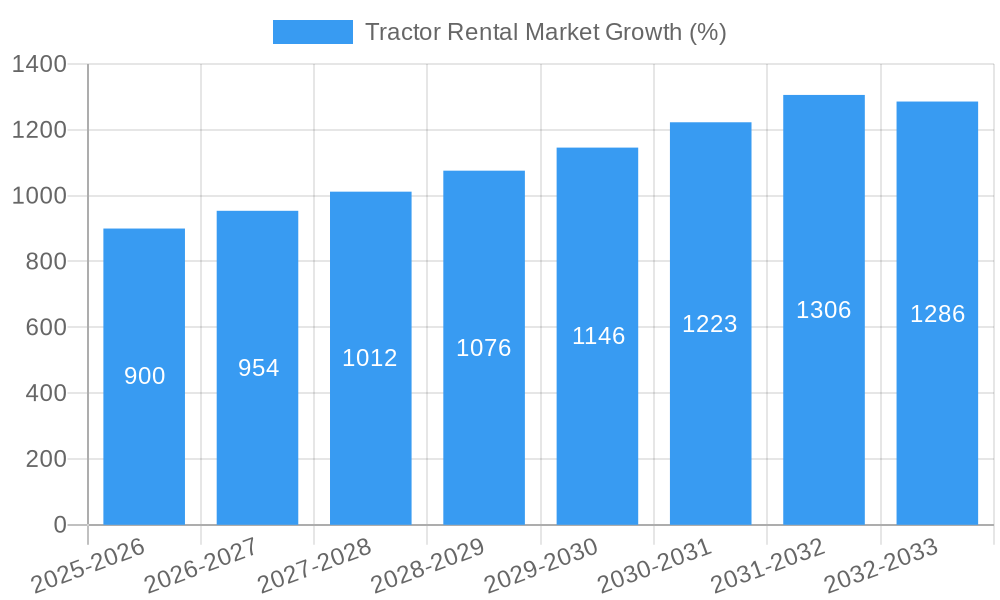

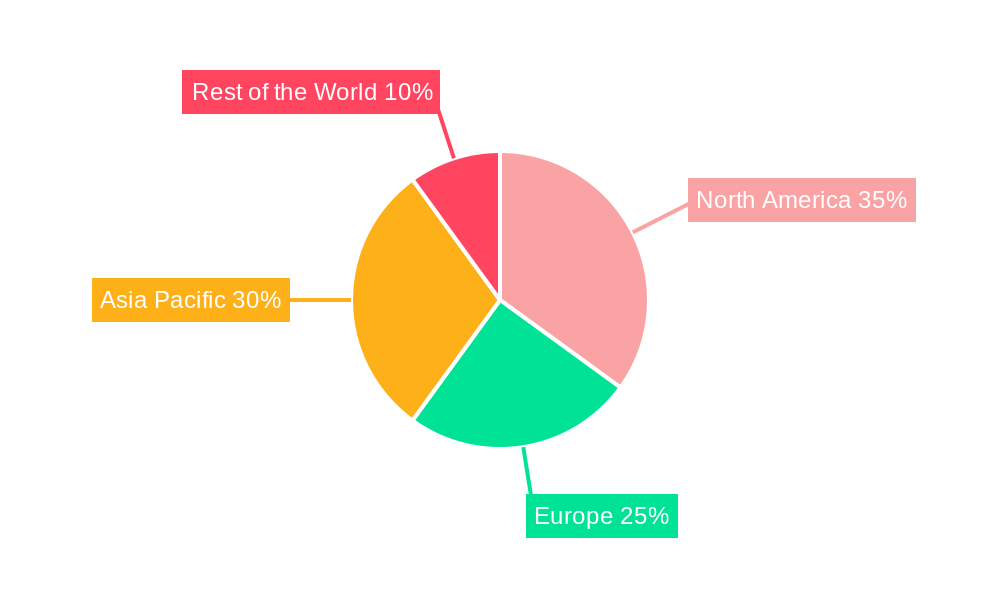

The global tractor rental market is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 6% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing demand for efficient and cost-effective agricultural practices is pushing farmers and agricultural businesses towards renting tractors instead of outright purchase. This is particularly true for smaller farms and those facing seasonal fluctuations in workload. Secondly, technological advancements in tractor technology, including GPS-guided systems and precision farming tools, are boosting rental demand as farmers seek access to cutting-edge equipment without significant capital investment. Finally, the growth of contract farming and agricultural service providers further fuels market expansion, as these entities rely heavily on tractor rentals to meet their operational needs. The market is segmented by tractor type (utility, row crop, industrial, earthmoving), power source (internal combustion engine, electric), and power type (less than 100 hp, 100-200 hp, more than 200 hp), reflecting the diversity of agricultural and industrial applications. Geographic variations exist, with North America and Asia Pacific expected to dominate the market due to robust agricultural sectors and increasing adoption of mechanized farming. However, growth in other regions, including Europe and parts of South America, is anticipated as agricultural modernization efforts gain momentum. Competitive forces within the market are shaping pricing and service offerings, with both large multinational corporations and smaller regional rental businesses competing for market share. The continued focus on sustainable agriculture and environmentally friendly equipment will likely influence future market growth and shape the trajectory of technological advancements in the tractor rental sector.

The competitive landscape is diverse, featuring both large established players like John Deere and smaller specialized rental companies. This fragmentation presents opportunities for businesses focusing on niche markets or offering specialized services, such as maintenance and repair packages alongside rentals. The market's trajectory is inextricably linked to broader macroeconomic trends affecting agriculture, including commodity prices, government policies supporting agricultural modernization, and technological innovations that increase efficiency and output. The continuing integration of technology within tractors and rental platforms suggests a future characterized by enhanced data analytics, remote monitoring, and improved customer service, ultimately driving market expansion and increased penetration across diverse agricultural and industrial applications. Therefore, strategic investment in technology and adaptation to the evolving needs of the customer base are pivotal for companies seeking success in this dynamic market segment.

This in-depth report provides a comprehensive analysis of the global Tractor Rental Market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with a focus on the forecast period from 2025 to 2033, and a base year of 2025. The study meticulously examines market segmentation, key players, growth drivers, challenges, and emerging opportunities. Expect detailed data, including market size estimations in Millions, CAGR projections, and competitive landscapes.

Tractor Rental Market Concentration & Innovation

This section analyzes the level of concentration within the tractor rental market, identifying key players and their market share. Innovation drivers, including technological advancements and evolving farming practices, are explored. The report also examines the regulatory landscape, the impact of substitute products (e.g., alternative tillage methods), and end-user trends influencing market dynamics. Furthermore, mergers and acquisitions (M&A) activities, including their deal values and impact on market consolidation, are thoroughly investigated.

- Market Concentration: The market exhibits a moderately concentrated structure, with a few major players holding significant market share. The top five players account for approximately xx% of the total market revenue in 2025. Smaller, regional players also contribute significantly to the market, particularly in emerging economies.

- Innovation Drivers: Technological advancements, such as precision farming technologies integrated into rental tractors, are driving innovation. The increasing adoption of GPS-guided systems, automated steering, and variable-rate technology enhances efficiency and productivity, boosting market demand.

- Regulatory Frameworks: Government regulations pertaining to emissions standards, safety, and equipment maintenance significantly influence the market. Subsidies and incentives for adopting modern farming techniques also play a role.

- Product Substitutes: The market faces competition from alternative methods of land cultivation, but the overall demand for tractors for various applications remains substantial. The penetration of substitute technologies is estimated at xx% in 2025.

- End-User Trends: A growing demand from large-scale commercial farms and increasing adoption of tractor rentals by small and marginal farmers drive market expansion. Shifting farming practices toward mechanization are also vital drivers.

- M&A Activities: The tractor rental sector has seen considerable M&A activity in recent years, with deal values exceeding $xx Million in the last five years. These activities largely focus on consolidation and expansion into new geographic markets.

Tractor Rental Market Industry Trends & Insights

This section delves into the prevailing market trends influencing the tractor rental sector's growth trajectory. It covers factors such as market growth drivers (e.g., rising agricultural output, increasing land under cultivation), technological disruptions (e.g., automation, digitalization), evolving consumer preferences (e.g., demand for technologically advanced equipment), and competitive dynamics (e.g., pricing strategies, service offerings). Specific metrics like CAGR and market penetration rates are included to provide a quantitative understanding of the market's evolution.

The global Tractor Rental Market is projected to witness significant growth, with a CAGR of xx% during the forecast period (2025-2033). This growth is attributed to several factors, including the increasing demand for efficient and cost-effective farming solutions, the rising adoption of precision agriculture techniques, and the expansion of the agricultural sector in developing economies. Technological advancements, such as the integration of IoT and AI in tractors, are further driving market expansion. The market penetration rate for tractor rental services is expected to reach xx% by 2033, indicating substantial market uptake. Competitive dynamics are shaped by factors such as pricing, equipment quality, and service offerings. The market is witnessing the emergence of innovative business models, such as subscription-based rental services and on-demand tractor availability platforms.

Dominant Markets & Segments in Tractor Rental Market

This section analyzes the leading regions, countries, and market segments within the Tractor Rental Market, examining their dominance based on economic policies, infrastructure development, agricultural practices, and technological advancements. The analysis encompasses detailed segmentation by tractor type (Utility Tractors, Row Crop Tractors, Industrial Tractors, Earth Moving Tractors), power source (Internal Combustion Engine (ICE), Electric), and power type (Less than 100 hp, 100-200 hp, More than 200 hp). We delve into the key factors influencing market share and growth potential within each segment.

By Tractor Type:

- Utility Tractors: This segment maintains the largest market share due to its versatility and adaptability across diverse farming operations. Its broad application and cost-effectiveness contribute to its continued dominance.

- Row Crop Tractors: This segment demonstrates robust growth, fueled by increasing demand for efficient and precise row crop cultivation techniques, particularly in large-scale agricultural operations.

- Industrial Tractors: This segment experiences steady, consistent growth, driven by applications beyond agriculture, including construction, landscaping, and material handling.

- Earth Moving Tractors: This segment shows moderate growth, primarily stimulated by ongoing infrastructure development projects and the need for heavy-duty earthmoving capabilities.

By Power Source:

- Internal Combustion Engine (ICE): While currently dominating the market, the ICE segment faces increasing pressure from stricter emission regulations. However, ongoing advancements in fuel efficiency and engine technology continue to support its market presence.

- Electric: This segment is poised for significant growth, driven by environmental concerns, government incentives for sustainable technologies, and continuous advancements in battery technology and charging infrastructure. The cost-effectiveness and reduced operational costs of electric tractors are major contributing factors to its projected growth.

By Power Type:

- 100-200 hp: This power range remains the most dominant, reflecting the widespread suitability of these tractors for a variety of agricultural and industrial applications, striking a balance between power and operational cost-efficiency.

- Less than 100 hp: This segment caters to smaller-scale operations and specialized tasks, maintaining a steady market share.

- More than 200 hp: This segment is experiencing growth driven by the needs of large-scale farming and specialized applications requiring high power output.

Key Geographic Drivers:

- North America: Maintains a significant market share due to its advanced agricultural practices, high mechanization levels, and established rental infrastructure.

- Asia-Pacific: Projected to experience the fastest growth due to expanding agricultural activities, increasing demand for mechanized farming, and a growing need for efficient land utilization.

- Europe: Shows steady growth driven by technological advancements, sustainable farming initiatives, and the adoption of precision agriculture techniques.

Key Market Drivers:

- Government Policies: Supportive government policies promoting agricultural mechanization, subsidies, and favorable lending schemes are crucial drivers of market expansion.

- Infrastructure Development: Improved rural infrastructure (roads, electricity, communication networks) enhances tractor accessibility and operational efficiency, positively impacting market growth.

- Technological Advancements: Precision agriculture technologies, GPS-guided systems, and automation features are driving efficiency improvements and increasing the demand for technologically advanced rental tractors.

The competitive landscape is marked by both large multinational corporations and smaller, regional rental providers. The market is characterized by varying business models, ranging from simple equipment rental to comprehensive service packages that encompass maintenance, operator training, and precision farming solutions.

Tractor Rental Market Product Developments

This section summarizes recent product innovations, highlighting technological trends and market fit. The focus is on advancements enhancing efficiency, precision, and ease of use, influencing market competitiveness. The rise of digitally connected tractors with remote monitoring capabilities and the incorporation of advanced precision farming technologies are highlighted. These features directly translate to improved operational efficiency and cost savings for end-users, driving market demand.

Report Scope & Segmentation Analysis

This report provides a detailed analysis of the Tractor Rental Market, segmented by tractor type (Utility Tractors, Row Crop Tractors, Industrial Tractors, Earth Moving Tractors), power source (IC Engine, Electric), and power type (Less than 100 hp, 100-200 hp, More than 200 hp). Each segment’s market size, growth projections, and competitive dynamics are analyzed. The report covers the historical period (2019-2024), base year (2025), estimated year (2025), and forecast period (2025-2033).

Key Drivers of Tractor Rental Market Growth

Several factors propel the growth of the Tractor Rental Market. Technological advancements, such as precision farming tools and GPS-guided systems, enhance efficiency and productivity, increasing market demand. Favorable economic policies supporting agricultural mechanization and infrastructure development further contribute to growth. Government initiatives promoting sustainable farming practices also play a significant role.

Challenges in the Tractor Rental Market Sector

The Tractor Rental Market faces challenges such as stringent emission norms impacting operating costs, disruptions in the supply chain affecting equipment availability, and intense competition amongst rental providers. These factors can lead to fluctuations in pricing and affect overall profitability. The impact of these challenges on the market is estimated to be xx% reduction in overall growth in 2026.

Emerging Opportunities in Tractor Rental Market

Emerging opportunities lie in expanding into untapped markets, particularly in developing economies. The adoption of innovative business models, such as subscription-based services and online rental platforms, presents significant growth potential. The integration of advanced technologies, such as AI and IoT, offers opportunities for improved operational efficiency and customer experience.

Leading Players in the Tractor Rental Market Market

- Farmease

- EM3 Agri Services

- Premier Equipment Rental

- The Pape Group Inc

- Trringo

- Kwipped Inc

- Flaman Group of Companies

- Titan Machinery

- Pacific Tractor & Implement

- John Deere

- JFarm Services

Key Developments in Tractor Rental Market Industry

- June 2022: Launch of an app-based farm equipment rental system in Bihar, India, facilitating access to tractors for small and marginal farmers. This initiative is expected to significantly boost market demand in the region.

Strategic Outlook for Tractor Rental Market Market

The Tractor Rental Market is poised for sustained growth, driven by technological advancements, favorable economic conditions, and increasing demand for efficient farming solutions. Expansion into new markets, particularly in developing economies, presents significant opportunities. The adoption of innovative business models and the integration of advanced technologies will further enhance market growth and profitability.

Tractor Rental Market Segmentation

-

1. Tractor Type

- 1.1. Utility Tractors

- 1.2. Row Crop Tractors

- 1.3. Industrial Tractors

- 1.4. Earth Moving Tractors

-

2. Power Source

- 2.1. IC Engine

- 2.2. Electric

-

3. Power Type

- 3.1. Less than 100 hp

- 3.2. 100-200 hp

- 3.3. More than 200 hp

Tractor Rental Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Tractor Rental Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing demand from automobile industry4.; Increased focus on precision products

- 3.3. Market Restrains

- 3.3.1. 4.; The cost of production and transportation4.; Regulations and quality standards

- 3.4. Market Trends

- 3.4.1. Increase in Online Rental Services is driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Tractor Rental Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Tractor Type

- 5.1.1. Utility Tractors

- 5.1.2. Row Crop Tractors

- 5.1.3. Industrial Tractors

- 5.1.4. Earth Moving Tractors

- 5.2. Market Analysis, Insights and Forecast - by Power Source

- 5.2.1. IC Engine

- 5.2.2. Electric

- 5.3. Market Analysis, Insights and Forecast - by Power Type

- 5.3.1. Less than 100 hp

- 5.3.2. 100-200 hp

- 5.3.3. More than 200 hp

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Tractor Type

- 6. North America Tractor Rental Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Tractor Type

- 6.1.1. Utility Tractors

- 6.1.2. Row Crop Tractors

- 6.1.3. Industrial Tractors

- 6.1.4. Earth Moving Tractors

- 6.2. Market Analysis, Insights and Forecast - by Power Source

- 6.2.1. IC Engine

- 6.2.2. Electric

- 6.3. Market Analysis, Insights and Forecast - by Power Type

- 6.3.1. Less than 100 hp

- 6.3.2. 100-200 hp

- 6.3.3. More than 200 hp

- 6.1. Market Analysis, Insights and Forecast - by Tractor Type

- 7. Europe Tractor Rental Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Tractor Type

- 7.1.1. Utility Tractors

- 7.1.2. Row Crop Tractors

- 7.1.3. Industrial Tractors

- 7.1.4. Earth Moving Tractors

- 7.2. Market Analysis, Insights and Forecast - by Power Source

- 7.2.1. IC Engine

- 7.2.2. Electric

- 7.3. Market Analysis, Insights and Forecast - by Power Type

- 7.3.1. Less than 100 hp

- 7.3.2. 100-200 hp

- 7.3.3. More than 200 hp

- 7.1. Market Analysis, Insights and Forecast - by Tractor Type

- 8. Asia Pacific Tractor Rental Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Tractor Type

- 8.1.1. Utility Tractors

- 8.1.2. Row Crop Tractors

- 8.1.3. Industrial Tractors

- 8.1.4. Earth Moving Tractors

- 8.2. Market Analysis, Insights and Forecast - by Power Source

- 8.2.1. IC Engine

- 8.2.2. Electric

- 8.3. Market Analysis, Insights and Forecast - by Power Type

- 8.3.1. Less than 100 hp

- 8.3.2. 100-200 hp

- 8.3.3. More than 200 hp

- 8.1. Market Analysis, Insights and Forecast - by Tractor Type

- 9. Rest of the World Tractor Rental Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Tractor Type

- 9.1.1. Utility Tractors

- 9.1.2. Row Crop Tractors

- 9.1.3. Industrial Tractors

- 9.1.4. Earth Moving Tractors

- 9.2. Market Analysis, Insights and Forecast - by Power Source

- 9.2.1. IC Engine

- 9.2.2. Electric

- 9.3. Market Analysis, Insights and Forecast - by Power Type

- 9.3.1. Less than 100 hp

- 9.3.2. 100-200 hp

- 9.3.3. More than 200 hp

- 9.1. Market Analysis, Insights and Forecast - by Tractor Type

- 10. North America Tractor Rental Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Rest of North America

- 11. Europe Tractor Rental Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Rest of Europe

- 12. Asia Pacific Tractor Rental Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 India

- 12.1.2 China

- 12.1.3 Japan

- 12.1.4 South Korea

- 12.1.5 Rest of Asia Pacific

- 13. Rest of the World Tractor Rental Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 South America

- 13.1.2 Middle East and Africa

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Farmease

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 EM3 Agri Services

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Premier Equipment Rental

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 The Pape Group Inc

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Trringo*List Not Exhaustive

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Kwipped Inc

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Flaman Group of Companies

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Titan Machinery

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Pacific Tractor & Implement

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 John Deere

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 JFarm Services

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.1 Farmease

List of Figures

- Figure 1: Global Tractor Rental Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Tractor Rental Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Tractor Rental Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Tractor Rental Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Tractor Rental Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Tractor Rental Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Tractor Rental Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Tractor Rental Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Tractor Rental Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Tractor Rental Market Revenue (Million), by Tractor Type 2024 & 2032

- Figure 11: North America Tractor Rental Market Revenue Share (%), by Tractor Type 2024 & 2032

- Figure 12: North America Tractor Rental Market Revenue (Million), by Power Source 2024 & 2032

- Figure 13: North America Tractor Rental Market Revenue Share (%), by Power Source 2024 & 2032

- Figure 14: North America Tractor Rental Market Revenue (Million), by Power Type 2024 & 2032

- Figure 15: North America Tractor Rental Market Revenue Share (%), by Power Type 2024 & 2032

- Figure 16: North America Tractor Rental Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Tractor Rental Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Tractor Rental Market Revenue (Million), by Tractor Type 2024 & 2032

- Figure 19: Europe Tractor Rental Market Revenue Share (%), by Tractor Type 2024 & 2032

- Figure 20: Europe Tractor Rental Market Revenue (Million), by Power Source 2024 & 2032

- Figure 21: Europe Tractor Rental Market Revenue Share (%), by Power Source 2024 & 2032

- Figure 22: Europe Tractor Rental Market Revenue (Million), by Power Type 2024 & 2032

- Figure 23: Europe Tractor Rental Market Revenue Share (%), by Power Type 2024 & 2032

- Figure 24: Europe Tractor Rental Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Tractor Rental Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Tractor Rental Market Revenue (Million), by Tractor Type 2024 & 2032

- Figure 27: Asia Pacific Tractor Rental Market Revenue Share (%), by Tractor Type 2024 & 2032

- Figure 28: Asia Pacific Tractor Rental Market Revenue (Million), by Power Source 2024 & 2032

- Figure 29: Asia Pacific Tractor Rental Market Revenue Share (%), by Power Source 2024 & 2032

- Figure 30: Asia Pacific Tractor Rental Market Revenue (Million), by Power Type 2024 & 2032

- Figure 31: Asia Pacific Tractor Rental Market Revenue Share (%), by Power Type 2024 & 2032

- Figure 32: Asia Pacific Tractor Rental Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Tractor Rental Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of the World Tractor Rental Market Revenue (Million), by Tractor Type 2024 & 2032

- Figure 35: Rest of the World Tractor Rental Market Revenue Share (%), by Tractor Type 2024 & 2032

- Figure 36: Rest of the World Tractor Rental Market Revenue (Million), by Power Source 2024 & 2032

- Figure 37: Rest of the World Tractor Rental Market Revenue Share (%), by Power Source 2024 & 2032

- Figure 38: Rest of the World Tractor Rental Market Revenue (Million), by Power Type 2024 & 2032

- Figure 39: Rest of the World Tractor Rental Market Revenue Share (%), by Power Type 2024 & 2032

- Figure 40: Rest of the World Tractor Rental Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of the World Tractor Rental Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Tractor Rental Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Tractor Rental Market Revenue Million Forecast, by Tractor Type 2019 & 2032

- Table 3: Global Tractor Rental Market Revenue Million Forecast, by Power Source 2019 & 2032

- Table 4: Global Tractor Rental Market Revenue Million Forecast, by Power Type 2019 & 2032

- Table 5: Global Tractor Rental Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Tractor Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Tractor Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Europe Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Tractor Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: India Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: China Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: South Korea Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Asia Pacific Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Tractor Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: South America Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Middle East and Africa Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Tractor Rental Market Revenue Million Forecast, by Tractor Type 2019 & 2032

- Table 25: Global Tractor Rental Market Revenue Million Forecast, by Power Source 2019 & 2032

- Table 26: Global Tractor Rental Market Revenue Million Forecast, by Power Type 2019 & 2032

- Table 27: Global Tractor Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: United States Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Canada Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of North America Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Tractor Rental Market Revenue Million Forecast, by Tractor Type 2019 & 2032

- Table 32: Global Tractor Rental Market Revenue Million Forecast, by Power Source 2019 & 2032

- Table 33: Global Tractor Rental Market Revenue Million Forecast, by Power Type 2019 & 2032

- Table 34: Global Tractor Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 35: Germany Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: United Kingdom Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: France Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Europe Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Tractor Rental Market Revenue Million Forecast, by Tractor Type 2019 & 2032

- Table 40: Global Tractor Rental Market Revenue Million Forecast, by Power Source 2019 & 2032

- Table 41: Global Tractor Rental Market Revenue Million Forecast, by Power Type 2019 & 2032

- Table 42: Global Tractor Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 43: India Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: China Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Japan Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: South Korea Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Global Tractor Rental Market Revenue Million Forecast, by Tractor Type 2019 & 2032

- Table 49: Global Tractor Rental Market Revenue Million Forecast, by Power Source 2019 & 2032

- Table 50: Global Tractor Rental Market Revenue Million Forecast, by Power Type 2019 & 2032

- Table 51: Global Tractor Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: South America Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Middle East and Africa Tractor Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tractor Rental Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Tractor Rental Market?

Key companies in the market include Farmease, EM3 Agri Services, Premier Equipment Rental, The Pape Group Inc, Trringo*List Not Exhaustive, Kwipped Inc, Flaman Group of Companies, Titan Machinery, Pacific Tractor & Implement, John Deere, JFarm Services.

3. What are the main segments of the Tractor Rental Market?

The market segments include Tractor Type, Power Source, Power Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing demand from automobile industry4.; Increased focus on precision products.

6. What are the notable trends driving market growth?

Increase in Online Rental Services is driving the Market.

7. Are there any restraints impacting market growth?

4.; The cost of production and transportation4.; Regulations and quality standards.

8. Can you provide examples of recent developments in the market?

In June 2022, The Bihar cooperative department will launch an app-based system for renting farm equipment such as harvesters and tractors to small and marginal farmers in approximately 3,000 primary agricultural credit societies. Farmers who do not have farm equipment for tilling the land or other cultivation needs would be able to book it through the app, and the machines would be delivered to their door based on availability. According to sources, the rental would be on an hourly basis.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tractor Rental Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tractor Rental Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tractor Rental Market?

To stay informed about further developments, trends, and reports in the Tractor Rental Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence