Key Insights

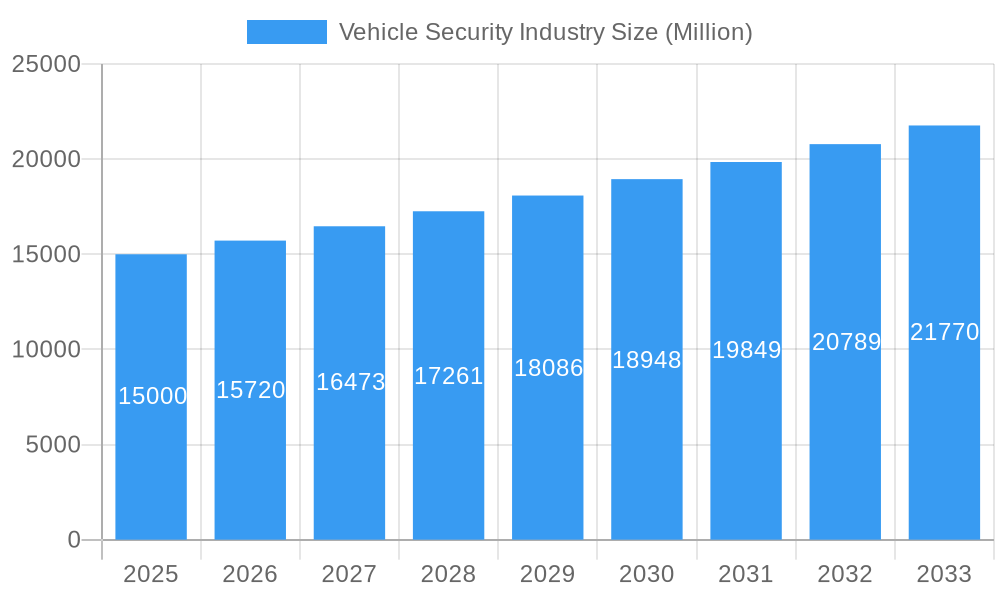

The global vehicle security system market is poised for significant expansion, driven by escalating vehicle theft incidents, heightened consumer demand for sophisticated security measures, and the pervasive integration of smart technologies. This market, estimated at $3.37 billion in 2025, is projected to achieve a Compound Annual Growth Rate (CAGR) of 11% from 2025 to 2033. Key growth drivers include the rising adoption of Advanced Driver-Assistance Systems (ADAS) and connected car technologies, which create fertile ground for advanced security solutions. Moreover, stringent regulatory mandates for enhanced vehicle safety across various regions are propelling market growth. Popular segments like alarm systems, keyless entry, and immobilizers are principal contributors to this upward trajectory. However, substantial initial investment costs and the potential for technological vulnerabilities may present challenges to market expansion.

Vehicle Security Industry Market Size (In Billion)

Intensified competition among established industry leaders such as Alps Alpine, Tokai Rika, Continental AG, and Bosch, alongside burgeoning technology firms, is fostering innovation and driving price competitiveness.

Vehicle Security Industry Company Market Share

Regional market dynamics reveal North America and Europe as current leaders, attributed to high vehicle ownership and mature automotive sectors. Conversely, the Asia-Pacific region is anticipated to witness substantial growth, fueled by robust economic development and increasing vehicle sales in emerging economies like China and India. Market segmentation by type, including alarms, keyless entry, immobilizers, central locking, and others, reflects diverse consumer preferences and technological advancements. The continuous evolution of security technologies, such as biometric authentication and cloud-based solutions, will further sculpt the market landscape. The growing synergy between vehicle security systems, telematics, and insurance services presents novel revenue opportunities for market participants.

This report delivers a comprehensive analysis of the Vehicle Security Industry, forecasting a market valuation of $3.37 billion by 2033. The analysis covers the period 2019-2033, with 2025 serving as the base year and 2025-2033 as the forecast period. It offers actionable intelligence for stakeholders, including manufacturers, suppliers, investors, and policymakers, based on extensive primary and secondary research.

Vehicle Security Industry Market Concentration & Innovation

The vehicle security industry presents a moderately concentrated market structure, dominated by key players like Continental AG, Robert Bosch GmbH, HELLA GmbH & Co KGaA, and ZF Friedrichshafen AG, who collectively hold a significant market share. However, a vibrant ecosystem of smaller, innovative companies prevents any single entity from achieving complete dominance. This dynamic landscape is further shaped by consistent mergers and acquisitions (M&A) activity, with recent years witnessing deal values exceeding hundreds of millions of dollars. These strategic acquisitions primarily focus on expanding technological capabilities, geographical reach, and bolstering intellectual property portfolios.

- Market Share Dynamics: While precise figures fluctuate, Continental AG and Robert Bosch GmbH consistently rank among the leading players, commanding substantial market share in 2023. The competitive landscape, however, is fluid, with smaller companies specializing in niche technologies and geographical markets vying for position.

- Innovation Catalysts: Several factors fuel innovation within the sector. Advancements in automotive electronics, growing cybersecurity concerns, the proliferation of vehicle connectivity, and the increasing prevalence of autonomous driving technologies are all major driving forces. These trends necessitate the development of more sophisticated and resilient security solutions.

- Regulatory Compliance: Stringent global safety and cybersecurity regulations are paramount, driving the adoption of advanced vehicle security systems. Meeting these standards is not merely a compliance issue but a crucial element in gaining market acceptance and building consumer trust.

- Technological Disruption: While traditional vehicle security solutions remain dominant, the emergence of alternative authentication methods, such as biometric systems and advanced cryptographic techniques, presents both challenges and opportunities. These technologies are gradually integrating into existing systems, enhancing security and creating new market segments.

- Evolving Consumer Preferences: Growing consumer demand for enhanced vehicle security, particularly against theft and increasingly sophisticated cyberattacks, is a primary driver of market growth. This demand pushes manufacturers to constantly improve their offerings and innovate new security features.

- M&A Activity: The past five years have witnessed robust M&A activity within the vehicle security industry, with an average of numerous deals annually. These transactions are primarily driven by the need for technology integration, geographical expansion, and access to specialized talent and intellectual property. The average deal value has demonstrated a significant upward trend.

Vehicle Security Industry Industry Trends & Insights

The global vehicle security market is experiencing substantial growth, driven by technological advancements, increasing vehicle connectivity, and rising consumer awareness of security risks. The market is projected to register a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological disruptions, such as the integration of digital keys and advanced driver-assistance systems (ADAS), are reshaping the competitive landscape. Consumer preferences are shifting towards seamless and secure access solutions, boosting demand for keyless entry and remote locking systems. The industry’s competitive dynamics are characterized by intense rivalry among established players and emerging startups, leading to continuous product innovation and pricing pressures. Market penetration of advanced vehicle security features varies considerably across vehicle segments and geographic regions, with higher penetration rates observed in premium vehicles and developed markets.

Dominant Markets & Segments in Vehicle Security Industry

The North American market continues to hold a prominent position in the global vehicle security industry, followed closely by Europe and the rapidly expanding Asia-Pacific region. This leadership stems from high vehicle ownership rates, strong consumer demand for advanced security features, a well-developed automotive industry infrastructure, and supportive government regulations. Within the product segments, Keyless Entry systems maintain the largest market share, fueled by consumer preference for convenience and ease of access. However, the market is diversifying, with increasing demand for integrated security packages.

North American Market Leadership:

- High vehicle ownership rates and a large installed base of vehicles.

- Strong consumer demand for advanced security features and a willingness to pay a premium.

- A mature and well-established automotive industry infrastructure with extensive supply chains.

- Supportive government regulations promoting vehicle safety and security standards.

Keyless Entry System Prevalence:

- Enhanced convenience and user-friendliness compared to traditional key-based systems.

- High adoption rates in premium and luxury vehicles, driving technological advancements and security enhancements.

- Continuous improvements in wireless communication and secure access protocols, ensuring robust security alongside convenience.

Alarm Systems: While experiencing slower growth compared to Keyless Entry, alarm systems remain a critical component of a comprehensive vehicle security solution, providing a crucial layer of deterrence.

Immobilizer Systems: Essential for preventing vehicle theft, immobilizer systems are often mandated by governments and are a non-negotiable element of vehicle security.

Central Locking Systems: A standard feature across most vehicles, central locking systems are constantly being improved with enhanced security measures and integration with other security features.

Emerging Technologies: This rapidly evolving segment includes cutting-edge technologies such as digital keys, biometric authentication, and advanced driver-assistance systems (ADAS) integration, offering significant growth potential and innovative security solutions.

Vehicle Security Industry Product Developments

Recent product innovations prioritize enhanced cybersecurity, seamless integration of digital keys, and improved user experience. The adoption of standards like CCC Digital Key 3.0 compliant system-on-chip solutions exemplifies this trend, simplifying the implementation of smartphone-based keyless access while maintaining high security standards. These advancements provide manufacturers with a competitive edge, offering secure and convenient access features that resonate with evolving consumer expectations and address the increasing complexity of vehicle security threats.

Furthermore, we see a move towards integrated security systems, combining various technologies to provide a holistic approach to vehicle protection. This includes features like in-vehicle monitoring, remote diagnostics, and advanced threat detection capabilities.

Report Scope & Segmentation Analysis

This report segments the vehicle security market by Type: Alarm, Keyless Entry, Immobilizer, Central Locking, and Other Types. Each segment is analyzed based on its growth projections, market size, and competitive dynamics. For instance, the Keyless Entry segment is expected to witness significant growth due to the rising popularity of smartphone-based digital keys. The Alarm Systems segment, although mature, continues to be an essential security feature. Immobilizer systems remain a key security component in vehicle anti-theft strategies, while Central Locking Systems maintain consistent market demand. The “Other Types” segment encompasses innovative technologies like biometric access and advanced cybersecurity systems, offering high growth potential.

Key Drivers of Vehicle Security Industry Growth

The vehicle security market is propelled by several key factors, including:

- Technological Advancements: The continuous development of sophisticated security systems, including digital keys, biometric authentication, and advanced encryption techniques.

- Rising Cybersecurity Concerns: Increasing cyberattacks targeting vehicle systems are pushing for enhanced security measures.

- Stringent Government Regulations: Governments worldwide are implementing stricter safety and security standards, mandating advanced security features in vehicles.

- Growing Vehicle Connectivity: The increasing integration of vehicles with the internet requires advanced security protocols to protect against cyber threats.

Challenges in the Vehicle Security Industry Sector

The vehicle security industry faces several challenges:

- High Research & Development Costs: Developing sophisticated and secure systems necessitates significant investments in research and development.

- Supply Chain Disruptions: Global supply chain issues can impact the availability of components and affect production timelines.

- Intense Competition: The industry is highly competitive, with numerous established and emerging players vying for market share.

- Cybersecurity Threats: The constant evolution of cyberattacks poses a major challenge to system security and requires continuous updates and improvements.

Emerging Opportunities in Vehicle Security Industry

The vehicle security market presents several compelling opportunities for growth and innovation:

- Expansion into Emerging Markets: Developing economies, characterized by rising vehicle ownership rates and increasing disposable incomes, present significant untapped potential for vehicle security solutions. Tailoring solutions to the specific needs and security challenges of these markets is crucial for success.

- Seamless Integration with Autonomous Driving Technologies: The increasing adoption of autonomous driving necessitates robust security systems to protect against unauthorized access, cyberattacks, and data breaches. This presents a huge opportunity for the development of advanced security measures specifically designed for autonomous vehicles.

- Innovation through Emerging Technologies: Emerging technologies like blockchain, AI, and machine learning offer exciting new avenues for enhanced vehicle security. Blockchain can enhance data security and transparency, while AI can improve threat detection and response capabilities.

- Proactive Cybersecurity Measures: The escalating prominence of cybersecurity threats underscores the need for proactive security measures. This creates opportunities for developing and implementing advanced security systems that can effectively counter a wide range of cyberattacks.

- Data-Driven Security: Analyzing vehicle data to identify patterns and vulnerabilities can lead to more effective preventative measures. This requires developing advanced analytics and security monitoring systems.

Leading Players in the Vehicle Security Industry Market

- Alps Alpine Co Ltd

- TOKAIRIKE CO LTD

- Mitsubishi Electric Corporation

- HELLA GmbH & Co KGaA

- Continental AG

- Viper Security Systems (Directed Electronics)

- Robert Bosch GmbH

- Valeo SA

- Clifford (Directed Inc)

- BorgWarner Inc

- ZF Friedrichshafen AG

- Magna International

- Aptiv PLC

- Delphi Technologies

Key Developments in Vehicle Security Industry Industry

- June 2022: STMicroelectronics launched a CCC Digital Key release 3.0 compliant system-on-chip solution, accelerating the adoption of digital car keys. This significantly impacts market dynamics by driving the shift towards smartphone-based access.

- May 2022: Alps Alpine Co., Ltd. and Giesecke+Devrient GmbH jointly developed a CCC-compliant wireless digital key system, furthering the integration of digital key technologies. This enhances competitiveness by offering a secure and compliant solution.

- July 2021: ZF launched the ZF ProAI supercomputer at IAA 2021, featuring advanced security mechanisms against cyber threats. This development strengthens market leadership by providing cutting-edge cybersecurity solutions for software-defined vehicles.

- March 2021: Hella opened a new development center in Craiova, Romania, signaling an expansion in software and electronics capabilities. This strengthens their position in the market by improving their R&D capabilities and production capacity.

Strategic Outlook for Vehicle Security Industry Market

The vehicle security market is poised for robust growth driven by increasing vehicle production, rising consumer demand for advanced security features, and ongoing technological advancements. The market’s future potential is significant, particularly in emerging markets and with the expanding integration of vehicle security with other automotive technologies, such as autonomous driving. Continued innovation in cybersecurity measures, digital key technologies, and biometric authentication systems will be crucial in shaping the market's future trajectory.

Vehicle Security Industry Segmentation

-

1. Type

- 1.1. Alarm

- 1.2. Keyless Entry

- 1.3. Immobilizer

- 1.4. Central Locking

- 1.5. Other Types

Vehicle Security Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Vehicle Security Industry Regional Market Share

Geographic Coverage of Vehicle Security Industry

Vehicle Security Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Popularity of Sports Bike to Foster the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. High Cost of Premium Helmets Deter Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Number of Advanced Technologies to Boost the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Vehicle Security Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Alarm

- 5.1.2. Keyless Entry

- 5.1.3. Immobilizer

- 5.1.4. Central Locking

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Vehicle Security Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Alarm

- 6.1.2. Keyless Entry

- 6.1.3. Immobilizer

- 6.1.4. Central Locking

- 6.1.5. Other Types

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Vehicle Security Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Alarm

- 7.1.2. Keyless Entry

- 7.1.3. Immobilizer

- 7.1.4. Central Locking

- 7.1.5. Other Types

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Vehicle Security Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Alarm

- 8.1.2. Keyless Entry

- 8.1.3. Immobilizer

- 8.1.4. Central Locking

- 8.1.5. Other Types

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Vehicle Security Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Alarm

- 9.1.2. Keyless Entry

- 9.1.3. Immobilizer

- 9.1.4. Central Locking

- 9.1.5. Other Types

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Alps Alpine Co Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 TOKAI RIKA CO LTD

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Mitsubishi Electric Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 HELLA GmbH & Co KGaA

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Continental AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Viper Security Systems (Directed Electronics

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Robert Bosch GmbH

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Valeo SA

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Clifford (Directed Inc )

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Brogwarner Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 ZF Friedrichshafen AG

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Alps Alpine Co Ltd

List of Figures

- Figure 1: Global Vehicle Security Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Vehicle Security Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Vehicle Security Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Vehicle Security Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Vehicle Security Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Vehicle Security Industry Revenue (billion), by Type 2025 & 2033

- Figure 7: Europe Vehicle Security Industry Revenue Share (%), by Type 2025 & 2033

- Figure 8: Europe Vehicle Security Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Vehicle Security Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Vehicle Security Industry Revenue (billion), by Type 2025 & 2033

- Figure 11: Asia Pacific Vehicle Security Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Asia Pacific Vehicle Security Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Vehicle Security Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Vehicle Security Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: Rest of the World Vehicle Security Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Rest of the World Vehicle Security Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Rest of the World Vehicle Security Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Vehicle Security Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Vehicle Security Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Vehicle Security Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 4: Global Vehicle Security Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Rest of North America Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global Vehicle Security Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 9: Global Vehicle Security Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Germany Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: United Kingdom Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: France Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Italy Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Spain Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Vehicle Security Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global Vehicle Security Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 18: China Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Japan Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: India Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: South Korea Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Global Vehicle Security Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 24: Global Vehicle Security Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 25: South America Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Middle East and Africa Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vehicle Security Industry?

The projected CAGR is approximately 11%.

2. Which companies are prominent players in the Vehicle Security Industry?

Key companies in the market include Alps Alpine Co Ltd, TOKAI RIKA CO LTD, Mitsubishi Electric Corporation, HELLA GmbH & Co KGaA, Continental AG, Viper Security Systems (Directed Electronics, Robert Bosch GmbH, Valeo SA, Clifford (Directed Inc ), Brogwarner Inc, ZF Friedrichshafen AG.

3. What are the main segments of the Vehicle Security Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.37 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Popularity of Sports Bike to Foster the Growth of the Market.

6. What are the notable trends driving market growth?

Increasing Number of Advanced Technologies to Boost the Market Growth.

7. Are there any restraints impacting market growth?

High Cost of Premium Helmets Deter Market Growth.

8. Can you provide examples of recent developments in the market?

June 2022: STMicroelectronics introduced a new system-on-chip solution for secure car access that is Car Connectivity Consortium (CCC) Digital Key release 3.0 compliant to accelerate the introduction of digital car keys, giving users keyless access to vehicles via their mobile devices.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vehicle Security Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vehicle Security Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vehicle Security Industry?

To stay informed about further developments, trends, and reports in the Vehicle Security Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence