Key Insights

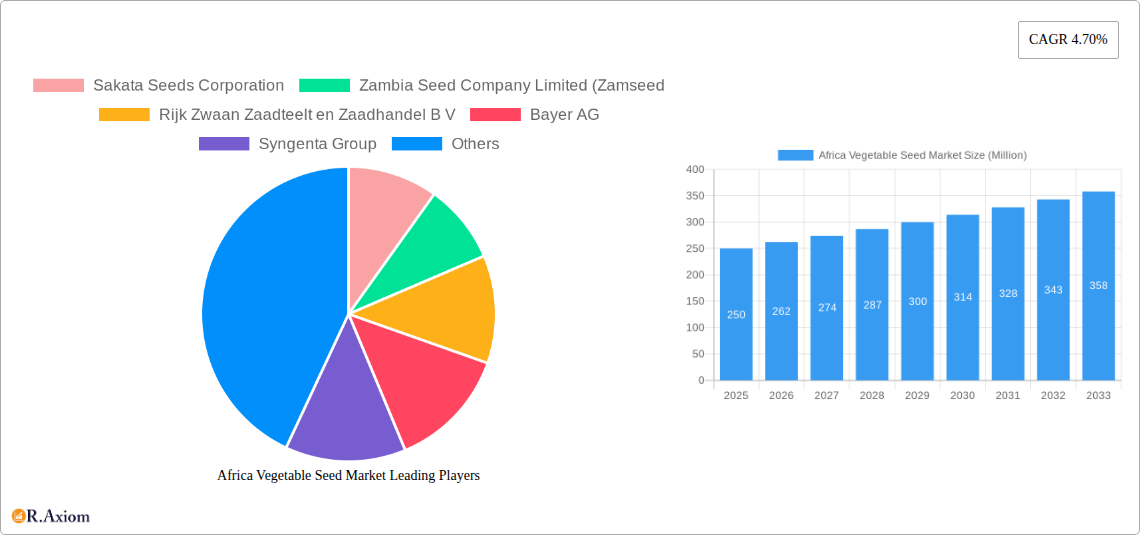

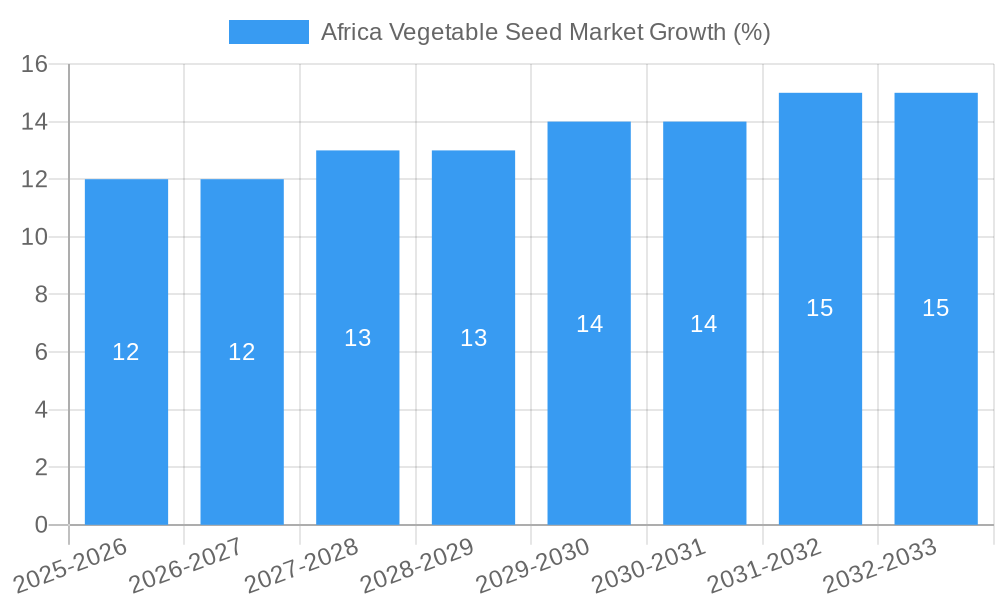

The African vegetable seed market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 4.70% from 2025 to 2033. This expansion is fueled by several key factors. Increasing consumer demand for fresh produce, coupled with rising disposable incomes in several African nations, particularly in South Africa, Nigeria, and Kenya, are significantly boosting the market. Furthermore, the growing adoption of advanced agricultural techniques, such as protected cultivation and the use of hybrid seeds, is enhancing crop yields and quality, thereby stimulating seed demand. Government initiatives promoting agricultural development and food security across the continent are also playing a vital role. The market is segmented by crop family (Brassicas, Solanaceae, Cucurbits, Roots & Bulbs), cultivation mechanism (open field, protected cultivation), and breeding technology (hybrids, open-pollinated varieties), reflecting the diverse agricultural practices across the region. South Africa, with its relatively advanced agricultural infrastructure, maintains a significant market share. However, substantial growth potential exists in other regions, especially those experiencing rapid population growth and urbanization. Companies such as Sakata Seeds, Rijk Zwaan, Syngenta, and Bayer are major players, competing based on seed quality, technological innovation, and distribution networks.

However, challenges remain. Limited access to irrigation and advanced farming technologies in many areas hinders widespread adoption of improved seeds. Climate change, characterized by erratic rainfall patterns and increased pest incidence, poses a considerable threat to crop yields and market stability. Furthermore, infrastructural limitations impacting seed distribution and storage, as well as limited farmer access to credit and agricultural extension services, are key constraints to growth. Overcoming these obstacles through public-private partnerships, investment in agricultural infrastructure, and the development of climate-resilient seed varieties will be essential for unlocking the full potential of the African vegetable seed market. The focus on enhancing farmer education and promoting sustainable agricultural practices is also crucial for long-term market sustainability and growth.

This comprehensive report provides an in-depth analysis of the Africa vegetable seed market, covering the period from 2019 to 2033. It offers crucial insights into market dynamics, competitive landscape, and future growth opportunities for industry stakeholders, investors, and researchers. The report utilizes a robust methodology, incorporating historical data (2019-2024), base year estimations (2025), and forecast projections (2025-2033) to present a clear and actionable picture of this dynamic market.

Africa Vegetable Seed Market Market Concentration & Innovation

The Africa vegetable seed market exhibits a moderately concentrated landscape, dominated by a few multinational corporations alongside several regional players. Key players such as Sakata Seeds Corporation, Rijk Zwaan Zaadteelt en Zaadhandel B V, Bayer AG, Syngenta Group, BASF SE, Groupe Limagrain, Takii and Co Ltd, Enza Zaden, and Bejo Zaden BV hold significant market shares, often exceeding xx% individually. However, smaller, localized seed companies continue to play a role, particularly in serving specific regional needs and varieties.

Market concentration is influenced by factors like economies of scale in research and development (R&D), access to distribution networks, and brand recognition. Innovation plays a crucial role, driving market expansion. This includes the development of:

- High-yielding varieties: Resistant to diseases, pests, and adverse climatic conditions.

- Improved seed quality: Enhanced germination rates and uniform crop establishment.

- Biotechnology applications: Genetically modified (GM) seeds (where applicable and legally permissible) are improving yields and stress tolerance.

- Precision breeding techniques: Marker-assisted selection and genomic selection are accelerating the development of superior varieties.

Regulatory frameworks vary across African nations, impacting market access and seed distribution. The prevalence of informal seed markets also presents a challenge. The increasing demand for quality seed, however, is driving formalization and standardization efforts. The existence of substitute options, such as farmer-saved seeds, is a significant factor influencing market penetration. End-user trends, including preferences for specific vegetable types and cultivation practices (open field vs. protected cultivation), are shaping market demand. Mergers and acquisitions (M&A) activity, such as the recent Enza Zaden acquisition, indicate strategic moves by major players to expand their market presence and product portfolios. While precise M&A deal values are not publicly available for all transactions, they typically range from xx Million to xx Million USD, depending on the target company’s size and portfolio.

Africa Vegetable Seed Market Industry Trends & Insights

The Africa vegetable seed market is witnessing robust growth, driven by rising consumer demand for fresh produce, increasing urbanization, and a growing awareness of nutrition. The market is projected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration is gradually increasing, particularly in regions with improved agricultural infrastructure and access to credit.

Technological disruptions are changing the landscape. This includes:

- Precision agriculture technologies: GPS-guided planting, variable rate fertilization, and remote sensing are optimizing resource use and increasing yields.

- Data analytics: Improved data collection and analysis are enabling better decision-making in seed selection, planting, and crop management.

- E-commerce platforms: Facilitating direct seed sales to farmers and improving accessibility.

Consumer preferences are shifting toward high-quality, nutritious, and convenient vegetables. This trend fuels the demand for high-yielding, disease-resistant seed varieties that meet consumer expectations. The competitive dynamics are shaped by several factors including:

- Global seed companies' expansion: Into new markets and segments.

- Regional players' consolidation: To gain market share and competitiveness.

- Government initiatives: Promoting seed quality and improving agricultural infrastructure.

Dominant Markets & Segments in Africa Vegetable Seed Market

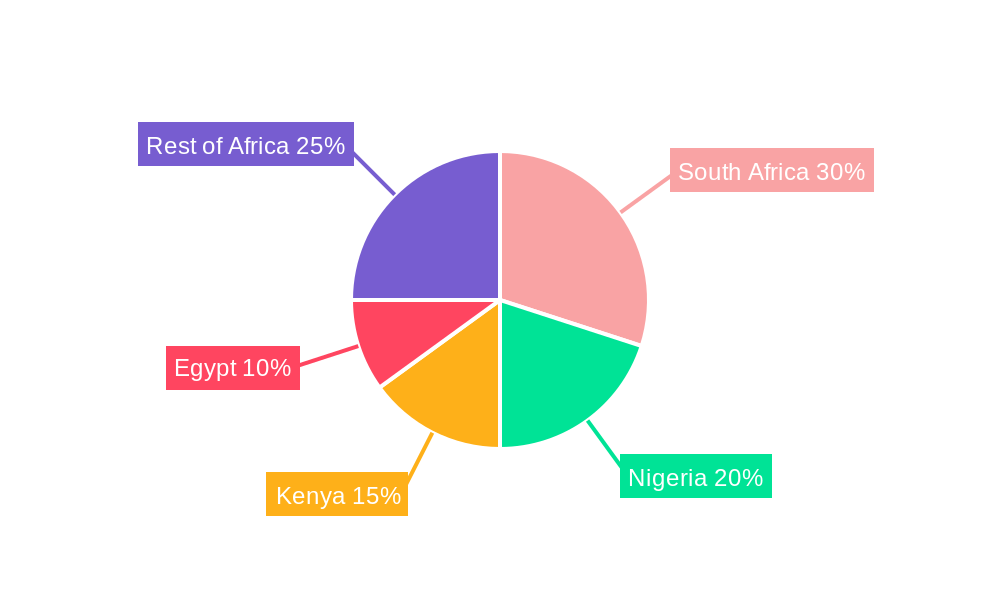

South Africa holds the largest market share within the African vegetable seed market, followed by Egypt, Nigeria, and Kenya. The dominance of these countries is attributable to several factors:

- Developed agricultural infrastructure: Including irrigation systems and storage facilities.

- Higher agricultural productivity: Resulting in greater demand for quality seeds.

- Stronger economies: Enabling increased investment in agriculture and improved farmer incomes.

- Government support: For agricultural development and seed production.

Key drivers for dominance:

- Economic policies: Supportive policies promoting agricultural growth and investment.

- Infrastructure: Availability of irrigation systems, storage, and transportation networks.

- Farmer education and training: Access to information and skills for effective seed utilization.

Within segments, the Hybrid breeding technology dominates due to higher yields and improved consistency compared to open-pollinated varieties. The open field cultivation mechanism holds a significant market share due to widespread adoption across various regions. Among crop families, Brassicas and Solanaceae constitute significant portions of the market, driven by strong demand for vegetables like cabbage, tomatoes, and peppers. Cucurbits and root & bulb crops also hold significant market shares.

Africa Vegetable Seed Market Product Developments

The market is characterized by continuous product innovation, focused on developing disease-resistant, high-yielding, and climate-resilient varieties. Technological advancements in seed breeding, such as marker-assisted selection and genomic selection, are accelerating the pace of innovation. New seed varieties are adapted to specific local growing conditions and consumer preferences. This ensures improved crop establishment, enhanced yields, and better nutritional content.

Report Scope & Segmentation Analysis

This report segments the Africa vegetable seed market based on several key parameters:

Country: Egypt, Ethiopia, Ghana, Kenya, Nigeria, South Africa, Tanzania, and Rest of Africa. Crop Family: Brassicas, Solanaceae, Cucurbits, and Other Roots & Bulbs. Breeding Technology: Hybrids, Open Pollinated Varieties & Hybrid Derivatives. Cultivation Mechanism: Open Field, Protected Cultivation. Segments: Other Solanaceae: Unclassified Vegetables, Other Brassicas: Cucurbits, Other Cucurbits: Roots & Bulbs, Other Roots & Bulbs: Solanaceae.

Each segment's growth projections, market size, and competitive dynamics are thoroughly analyzed, providing actionable insights into market opportunities and potential threats. The forecast period for 2025-2033 offers valuable insights for strategic decision making.

Key Drivers of Africa Vegetable Seed Market Growth

The Africa vegetable seed market is experiencing significant growth, driven by various factors:

- Rising consumer demand: For fresh produce fueled by urbanization and changing dietary habits.

- Government support: Promoting agricultural development through subsidies, research funding, and infrastructure development.

- Technological advancements: Improving seed quality, yield, and resistance to pests and diseases.

- Expanding distribution networks: Increasing accessibility of quality seeds to farmers in diverse regions.

Challenges in the Africa Vegetable Seed Market Sector

Several challenges hinder the growth of the Africa vegetable seed market:

- Climate change: Impacts crop yields and increases vulnerability to pests and diseases.

- Limited access to credit: Restricting farmers' investments in quality seeds.

- Poor infrastructure: Hampers seed distribution and post-harvest management.

- Counterfeit seeds: Undermining market confidence and reducing yields.

- High seed costs in some regions constrain farmer adoption.

Emerging Opportunities in Africa Vegetable Seed Market

Several opportunities exist for growth in the Africa vegetable seed market:

- Expanding into underserved markets: Targeting regions with lower seed penetration.

- Developing climate-resilient seed varieties: Addressing the challenges posed by climate change.

- Investing in seed production capacity: Meeting the growing demand for quality seeds.

- Leveraging technology: Employing precision agriculture techniques to optimize seed utilization and crop management.

Leading Players in the Africa Vegetable Seed Market Market

- Sakata Seeds Corporation

- Zambia Seed Company Limited (Zamseed)

- Rijk Zwaan Zaadteelt en Zaadhandel B V

- Bayer AG

- Syngenta Group

- BASF SE

- Groupe Limagrain

- Takii and Co Ltd

- Enza Zaden

- Bejo Zaden BV

Key Developments in Africa Vegetable Seed Market Industry

- July 2023: Takii Seeds introduced a new winter carrot variety, Fuyu Chiaki, known for its cold resistance and adaptability.

- July 2023: Enza Zaden acquired Carosem's carrot breeding program, expanding its product portfolio.

- July 2023: Enza Zaden launched new lettuce varieties with high resistance to three Bremia lactucae races (Bl: 38EU, Bl: 39EU, and Bl: 40EU).

Strategic Outlook for Africa Vegetable Seed Market Market

The Africa vegetable seed market is poised for significant expansion driven by rising demand, technological innovation, and supportive government policies. Strategic investments in research and development, improved distribution networks, and capacity building initiatives will be crucial for realizing this market's full potential. Focus on developing climate-resilient seed varieties, addressing infrastructure challenges, and promoting sustainable agricultural practices will be essential for long-term growth and ensuring food security.

Africa Vegetable Seed Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Africa Vegetable Seed Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Vegetable Seed Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Vegetable Seed Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. South Africa Africa Vegetable Seed Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Africa Vegetable Seed Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Africa Vegetable Seed Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Africa Vegetable Seed Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Africa Vegetable Seed Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Africa Vegetable Seed Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Sakata Seeds Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Zambia Seed Company Limited (Zamseed

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Rijk Zwaan Zaadteelt en Zaadhandel B V

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Bayer AG

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Syngenta Group

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 BASF SE

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Groupe Limagrain

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Takii and Co Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Enza Zaden

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Bejo Zaden BV

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Sakata Seeds Corporation

List of Figures

- Figure 1: Africa Vegetable Seed Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Vegetable Seed Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Vegetable Seed Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Vegetable Seed Market Volume Kiloton Forecast, by Region 2019 & 2032

- Table 3: Africa Vegetable Seed Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: Africa Vegetable Seed Market Volume Kiloton Forecast, by Production Analysis 2019 & 2032

- Table 5: Africa Vegetable Seed Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: Africa Vegetable Seed Market Volume Kiloton Forecast, by Consumption Analysis 2019 & 2032

- Table 7: Africa Vegetable Seed Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: Africa Vegetable Seed Market Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: Africa Vegetable Seed Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: Africa Vegetable Seed Market Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: Africa Vegetable Seed Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: Africa Vegetable Seed Market Volume Kiloton Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: Africa Vegetable Seed Market Revenue Million Forecast, by Region 2019 & 2032

- Table 14: Africa Vegetable Seed Market Volume Kiloton Forecast, by Region 2019 & 2032

- Table 15: Africa Vegetable Seed Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Africa Vegetable Seed Market Volume Kiloton Forecast, by Country 2019 & 2032

- Table 17: South Africa Africa Vegetable Seed Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Africa Africa Vegetable Seed Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 19: Sudan Africa Vegetable Seed Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Sudan Africa Vegetable Seed Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 21: Uganda Africa Vegetable Seed Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Uganda Africa Vegetable Seed Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 23: Tanzania Africa Vegetable Seed Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Tanzania Africa Vegetable Seed Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 25: Kenya Africa Vegetable Seed Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Kenya Africa Vegetable Seed Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 27: Rest of Africa Africa Vegetable Seed Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Africa Africa Vegetable Seed Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 29: Africa Vegetable Seed Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 30: Africa Vegetable Seed Market Volume Kiloton Forecast, by Production Analysis 2019 & 2032

- Table 31: Africa Vegetable Seed Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 32: Africa Vegetable Seed Market Volume Kiloton Forecast, by Consumption Analysis 2019 & 2032

- Table 33: Africa Vegetable Seed Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 34: Africa Vegetable Seed Market Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 35: Africa Vegetable Seed Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 36: Africa Vegetable Seed Market Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 37: Africa Vegetable Seed Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 38: Africa Vegetable Seed Market Volume Kiloton Forecast, by Price Trend Analysis 2019 & 2032

- Table 39: Africa Vegetable Seed Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Africa Vegetable Seed Market Volume Kiloton Forecast, by Country 2019 & 2032

- Table 41: Nigeria Africa Vegetable Seed Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Nigeria Africa Vegetable Seed Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 43: South Africa Africa Vegetable Seed Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Africa Africa Vegetable Seed Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 45: Egypt Africa Vegetable Seed Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Egypt Africa Vegetable Seed Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 47: Kenya Africa Vegetable Seed Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Kenya Africa Vegetable Seed Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 49: Ethiopia Africa Vegetable Seed Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Ethiopia Africa Vegetable Seed Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 51: Morocco Africa Vegetable Seed Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Morocco Africa Vegetable Seed Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 53: Ghana Africa Vegetable Seed Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Ghana Africa Vegetable Seed Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 55: Algeria Africa Vegetable Seed Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Algeria Africa Vegetable Seed Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 57: Tanzania Africa Vegetable Seed Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Tanzania Africa Vegetable Seed Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 59: Ivory Coast Africa Vegetable Seed Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Ivory Coast Africa Vegetable Seed Market Volume (Kiloton) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Vegetable Seed Market?

The projected CAGR is approximately 4.70%.

2. Which companies are prominent players in the Africa Vegetable Seed Market?

Key companies in the market include Sakata Seeds Corporation, Zambia Seed Company Limited (Zamseed, Rijk Zwaan Zaadteelt en Zaadhandel B V, Bayer AG, Syngenta Group, BASF SE, Groupe Limagrain, Takii and Co Ltd, Enza Zaden, Bejo Zaden BV.

3. What are the main segments of the Africa Vegetable Seed Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

July 2023: Takii Seeds introduced a new variety of winter carrots called Fuyu Chiaki. These carrots are well-adapted to winter conditions and exhibit good cold resistance. Additionally, they can thrive in a wide range of soils, making them a versatile choice for farmers.July 2023: Enza Zaden acquired the carrot breeding program from the German company Carosem. This strategic acquisition aims to expand Enza Zaden's product portfolio by incorporating carrot seeds with several commercial varieties and inventories.July 2023: Enza Zaden introduced new lettuce varieties that exhibit high resistance to three new Bermian races, namely, Bl: 38EU, Bl: 39EU, and Bl: 40EU. The new lettuce varieties not only offer high resistance to these races but also have the capability to grow in various soil types while still achieving high yields.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Vegetable Seed Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Vegetable Seed Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Vegetable Seed Market?

To stay informed about further developments, trends, and reports in the Africa Vegetable Seed Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence