Key Insights

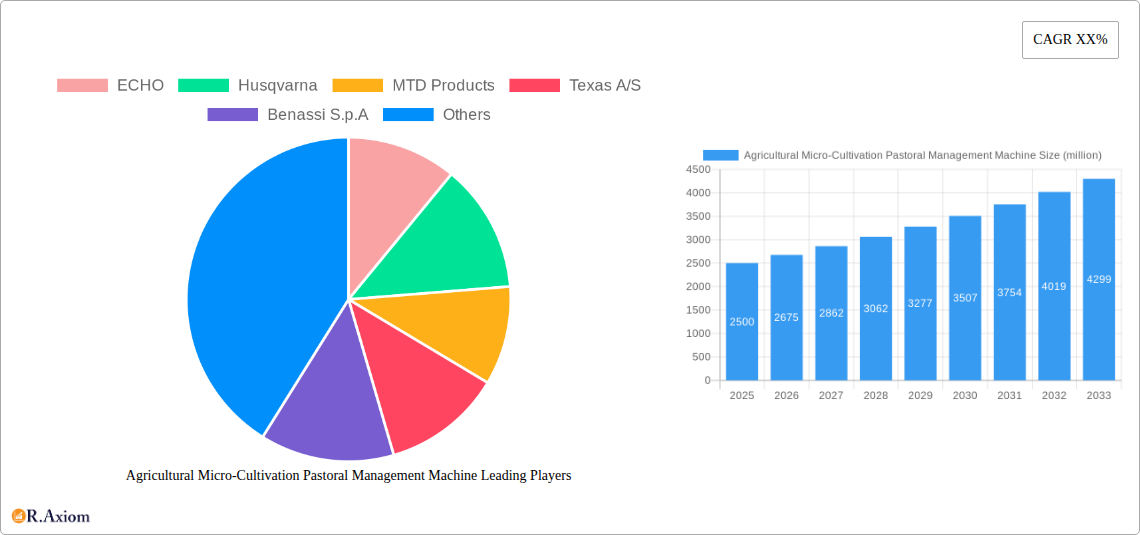

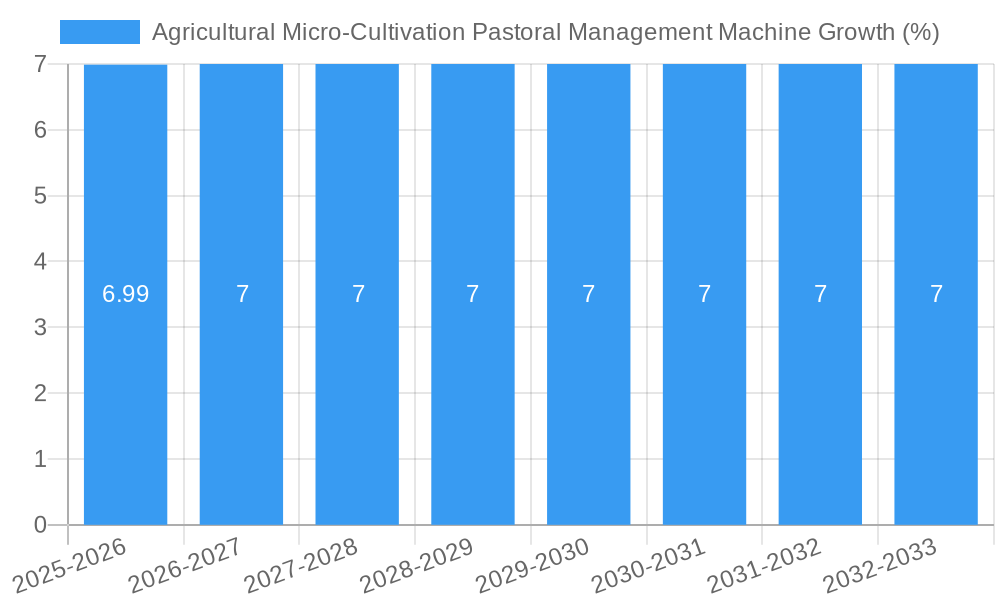

The global market for Agricultural Micro-Cultivation Pastoral Management Machines is poised for significant expansion, driven by an increasing demand for efficient and sustainable agricultural practices. Valued at an estimated $2,500 million in 2025, the market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 7%, reaching an estimated $4,500 million by 2033. This growth is fueled by several key factors, including the escalating need to improve crop yields and livestock productivity on smaller landholdings, a trend particularly prevalent in emerging economies and specialized farming operations. The growing adoption of precision agriculture techniques and the demand for reduced labor costs further bolster market growth. Furthermore, the rising popularity of organic farming and the emphasis on soil health are creating new avenues for micro-cultivation technologies. Manufacturers are increasingly focusing on developing innovative, user-friendly, and fuel-efficient machines to cater to the diverse needs of small-scale farmers and pastoral managers.

The market is segmented by application into Farm and Garden, with the Farm segment expected to dominate due to larger-scale cultivation needs. Within the "Types" segment, both Gasoline Engine and Diesel Engine machines will see continued demand, though advancements in electric and battery-powered alternatives are anticipated to gain traction, particularly in regions with stringent emission regulations and a focus on sustainability. Key players like ECHO, Husqvarna, MTD Products, Deere and Company, and Honda Siel Power are actively investing in research and development, introducing machines with enhanced features such as adjustable tilling depths, variable speed controls, and ergonomic designs. Challenges such as the high initial cost of some advanced machines and the need for specialized maintenance may temper growth in certain segments, but the overall outlook remains robust. Emerging economies, especially in the Asia Pacific region, are expected to be significant growth drivers due to their large agricultural base and increasing adoption of modern farming technologies.

The Agricultural Micro-Cultivation Pastoral Management Machine market exhibits a dynamic concentration landscape, with key players like Deere and Company, ECHO, and Husqvarna holding significant market shares, estimated to be in the millions of units sold annually. Innovation is a primary driver, fueled by advancements in precision agriculture, automation, and sustainable farming practices. Regulatory frameworks, particularly those related to emissions standards and agricultural subsidies, play a crucial role in shaping market entry and product development. The threat of product substitutes, such as manual tools and larger, more centralized agricultural machinery, is present but diminishing as micro-cultivation machines offer targeted efficiency. End-user trends are leaning towards smaller-scale, highly efficient farming operations, community gardens, and urban agriculture, demanding specialized and user-friendly equipment. Mergers and Acquisitions (M&A) activities, though not pervasive, are strategically undertaken to acquire niche technologies or expand market reach. Deal values in significant M&A events in related agricultural machinery sectors have ranged into the hundreds of millions, indicating the potential for consolidation and growth. The market is characterized by a blend of established manufacturers and emerging innovators, all vying to address the evolving needs of modern cultivation.

Agricultural Micro-Cultivation Pastoral Management Machine Industry Trends & Insights

The global Agricultural Micro-Cultivation Pastoral Management Machine market is poised for substantial expansion, driven by a confluence of robust growth drivers, disruptive technological advancements, evolving consumer preferences, and intense competitive dynamics. The Compound Annual Growth Rate (CAGR) is projected to be in the xx% range, indicating a healthy upward trajectory. Market penetration for these specialized machines is steadily increasing across both developed and developing agricultural economies, driven by the need for enhanced productivity and efficiency in smaller-scale farming operations and horticultural applications.

Market Growth Drivers: A primary catalyst is the global shift towards precision agriculture, where micro-cultivation machines enable highly targeted interventions, reducing resource wastage and optimizing yields. The increasing adoption of sustainable farming practices, including organic farming and controlled environment agriculture, further bolsters demand. Furthermore, the growing urban population and the rise of urban farming initiatives necessitate compact and efficient machinery for rooftop gardens, vertical farms, and community plots. Government initiatives promoting modern agricultural techniques and providing subsidies for farm mechanization also contribute significantly to market expansion.

Technological Disruptions: Technological innovation is a defining feature of this sector. The integration of AI and IoT for automated operations, real-time data collection, and predictive maintenance is revolutionizing the functionality of these machines. Advancements in battery technology are leading to the development of more powerful and longer-lasting electric-powered micro-cultivation machines, aligning with the growing demand for eco-friendly solutions. Sophisticated sensor technologies are enabling precise application of fertilizers, pesticides, and water, thereby minimizing environmental impact. Developments in lightweight and durable materials are enhancing machine maneuverability and longevity.

Consumer Preferences: End-users are increasingly seeking versatile, user-friendly, and cost-effective solutions. The demand for machines that can perform multiple tasks, such as tilling, weeding, and soil preparation, is high. There is also a growing preference for ergonomically designed machines that reduce operator fatigue and improve safety. The aesthetic appeal and compact nature of micro-cultivation machines are also becoming important considerations, especially for domestic and hobbyist users.

Competitive Dynamics: The market is characterized by a mix of global agricultural machinery giants and specialized manufacturers. Companies like Deere and Company, ECHO, and Husqvarna are leveraging their established brand reputations and extensive distribution networks. On the other hand, companies like Mantis Garden Tools and VST Tillers Tractors are focusing on niche segments and innovative product offerings. The competitive landscape is dynamic, with continuous product launches and technological upgrades aimed at capturing market share. Strategic partnerships and collaborations are also emerging as key strategies for market players to enhance their product portfolios and expand their geographical reach.

Dominant Markets & Segments in Agricultural Micro-Cultivation Pastoral Management Machine

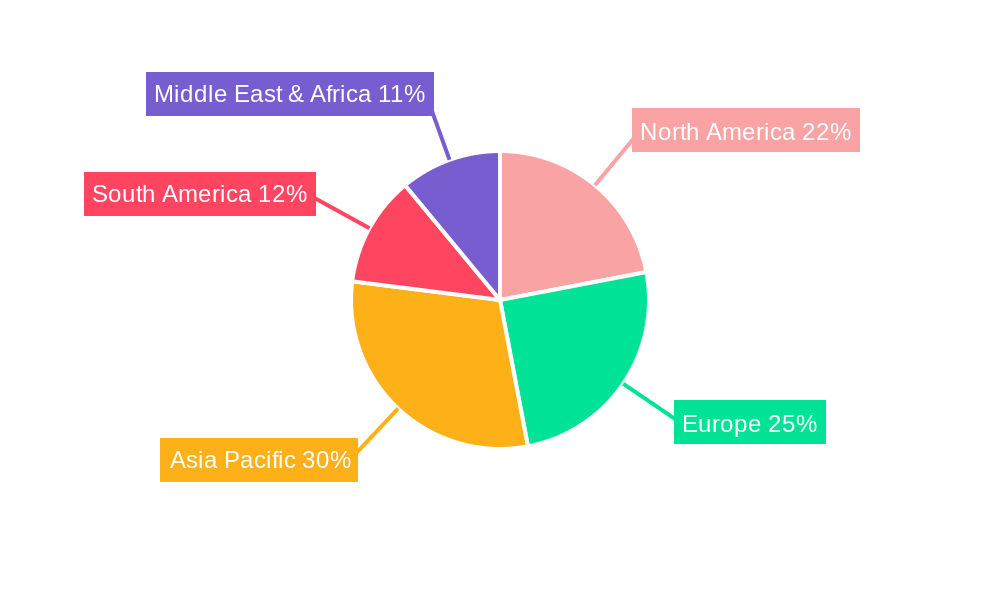

The Agricultural Micro-Cultivation Pastoral Management Machine market's dominance is intricately linked to regional economic strengths, agricultural policies, and infrastructure development. The Farm application segment currently holds the lion's share, driven by the need for efficient micro-management in increasingly diverse farming landscapes. Countries with strong agricultural sectors, such as the United States, European Union member states, and rapidly developing Asian economies like India and China, represent the most dominant markets.

Dominance Analysis:

- Region: North America and Europe currently lead in market dominance due to early adoption of advanced agricultural technologies, higher disposable incomes, and supportive government policies for farm mechanization. However, the Asia-Pacific region is experiencing the fastest growth, fueled by a large agrarian population, increasing mechanization efforts, and government support for smallholder farmers. The Middle East and Africa are emerging markets with significant untapped potential.

- Country: Within these regions, countries like the United States, Germany, France, India, and China are major contributors to the market value. The US market is characterized by large-scale commercial farms increasingly adopting micro-cultivation for specific tasks, while European countries focus on precision farming and organic cultivation. India and China represent massive potential due to their vast agricultural bases and a growing impetus towards modern farming techniques for increased food security.

- Application: Farm: The farm segment's dominance is attributed to its critical role in optimizing crop yields, reducing labor costs, and enhancing the overall efficiency of agricultural operations. Micro-cultivation machines are invaluable for tasks like inter-row cultivation, targeted fertilization, pest control, and soil preparation in various crop types, from large-scale commercial farms to smaller family holdings. The increasing adoption of precision agriculture techniques further solidifies the farm segment's leading position.

- Application: Garden: While smaller than the farm segment, the garden application is witnessing significant growth. This is driven by the rise of home gardening, community gardens, and urban agriculture initiatives. Consumers are increasingly looking for user-friendly and compact machines to maintain their gardens efficiently. The demand for aesthetically pleasing and easy-to-store garden tools also contributes to the growth of this segment.

- Types: Gasoline Engine: Gasoline engine-powered micro-cultivation machines continue to dominate due to their established reliability, power output, and cost-effectiveness. They are favored for their ability to handle demanding tasks in various soil conditions and terrains. Their widespread availability and established service infrastructure also contribute to their dominance.

- Types: Diesel Engine: Diesel engine variants are prominent in larger micro-cultivation machines and for applications requiring sustained power and torque. They are preferred for their fuel efficiency and durability in heavy-duty farm operations. While generally more expensive upfront, their long-term operational cost can be attractive for commercial users.

Key Drivers of Dominance:

- Economic Policies: Government subsidies, tax incentives for farm mechanization, and agricultural reforms promoting efficiency are significant drivers.

- Infrastructure: Well-developed rural infrastructure, including transportation networks and access to electricity, supports the adoption and use of these machines.

- Technological Adoption Rates: Regions with higher technological literacy and a willingness to adopt new farming practices tend to exhibit greater market dominance.

- Farm Size and Structure: The prevalence of small to medium-sized farms often necessitates the use of micro-cultivation machines over larger, less adaptable equipment.

- Labor Costs: Rising labor costs in many regions make mechanization, including the use of micro-cultivation machines, an economically viable solution.

Agricultural Micro-Cultivation Pastoral Management Machine Product Developments

Product development in the Agricultural Micro-Cultivation Pastoral Management Machine sector is characterized by a strong focus on enhanced efficiency, user-friendliness, and sustainability. Innovations include the integration of advanced ergonomic designs for operator comfort and reduced fatigue, as well as the adoption of lighter yet more durable materials for improved maneuverability and longevity. Many new models feature modular designs, allowing for quick swapping of attachments to perform multiple tasks, such as tilling, weeding, furrowing, and aerating. The growing trend towards electrification is also evident, with manufacturers introducing battery-powered models offering quieter operation, zero emissions, and reduced maintenance. Smart features, such as GPS guidance and basic sensor integration for soil analysis, are also starting to appear, hinting at future advancements in precision capabilities for these compact machines. These developments are aimed at broadening market appeal and offering competitive advantages in a diverse and evolving industry.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Agricultural Micro-Cultivation Pastoral Management Machine market, encompassing a detailed segmentation based on key parameters to offer granular insights. The study covers the forecast period from 2025 to 2033, with a base year of 2025 and historical data from 2019 to 2024. The segmentation delves into specific applications and machine types, enabling stakeholders to understand market dynamics at a granular level.

Application: Farm: This segment analyzes the market for micro-cultivation pastoral management machines used in commercial and large-scale agricultural operations. It includes projections for market size, growth rates, and the competitive landscape driven by factors such as farm size, crop types, and the adoption of precision agriculture. Key drivers include the need for enhanced productivity, reduced labor costs, and efficient resource management.

Application: Garden: This segment focuses on the market for machines utilized in home gardening, community gardens, and urban agriculture. It examines growth projections, market penetration, and the competitive strategies employed by manufacturers targeting this consumer segment. Demand here is influenced by factors like urbanization, increasing interest in home-grown produce, and the desire for user-friendly tools.

Types: Gasoline Engine: This segment provides an in-depth analysis of the market share, growth trends, and key players associated with gasoline-powered micro-cultivation pastoral management machines. It explores the advantages of gasoline engines, such as their power and established infrastructure, and their projected market performance in comparison to other engine types.

Types: Diesel Engine: This segment examines the market for diesel-powered micro-cultivation pastoral management machines. It details their specific applications, performance advantages in heavy-duty tasks, and their projected market evolution. Factors influencing this segment include fuel efficiency, durability, and suitability for larger micro-cultivation units.

Key Drivers of Agricultural Micro-Cultivation Pastoral Management Machine Growth

The growth of the Agricultural Micro-Cultivation Pastoral Management Machine market is propelled by a combination of technological, economic, and regulatory factors.

- Technological Advancements: The integration of smart technologies, automation, and advanced power sources (like efficient battery systems) significantly enhances machine performance, user-friendliness, and sustainability. This drives adoption by offering superior efficiency and reduced operational costs.

- Growing Demand for Precision Agriculture: Micro-cultivation machines are central to precision farming, enabling targeted applications of water, fertilizers, and pesticides, leading to optimized yields and reduced environmental impact. This aligns with global trends in sustainable agriculture.

- Rise of Urban Farming and Smallholder Agriculture: The increasing need for efficient food production in urban environments and the empowerment of smallholder farmers in developing regions create a substantial market for compact, versatile, and affordable machinery.

- Government Support and Mechanization Initiatives: Favorable government policies, subsidies for agricultural machinery, and programs promoting farm mechanization in various countries are crucial growth catalysts.

Challenges in the Agricultural Micro-Cultivation Pastoral Management Machine Sector

Despite its growth potential, the Agricultural Micro-Cultivation Pastoral Management Machine sector faces several challenges that can impede its expansion.

- High Initial Investment Costs: While micro-cultivation machines are generally more affordable than larger agricultural equipment, the initial purchase price can still be a barrier for small-scale farmers and hobbyists in price-sensitive markets.

- Limited Awareness and Technical Expertise: In some regions, there is a lack of awareness regarding the benefits and proper usage of micro-cultivation machines, coupled with a shortage of trained technicians for maintenance and repair.

- Supply Chain Disruptions and Component Availability: Geopolitical factors, trade policies, and global supply chain volatility can impact the availability and cost of essential components, leading to production delays and increased prices.

- Competition from Manual Labor and Larger Machinery: In certain contexts, manual labor remains a cost-effective alternative, and in other scenarios, larger, more established machinery might be perceived as a more comprehensive solution, posing competitive pressure.

Emerging Opportunities in Agricultural Micro-Cultivation Pastoral Management Machine

The Agricultural Micro-Cultivation Pastoral Management Machine market is ripe with emerging opportunities for innovation and expansion.

- Development of Smart and IoT-Enabled Machines: Integrating AI, sensors, and connectivity will lead to autonomous operations, predictive maintenance, and enhanced data analytics, offering unparalleled efficiency and insights for users.

- Expansion into Emerging Markets: Untapped potential exists in developing economies in Africa, Asia, and Latin America, where increasing agricultural mechanization and food security initiatives can drive significant demand.

- Growth in Indoor and Vertical Farming: The burgeoning indoor and vertical farming sectors require highly specialized and compact machinery for tasks like soil preparation, nutrient delivery, and pest control within controlled environments.

- Subscription and Rental Models: Offering subscription-based access or rental services for micro-cultivation machines can lower the barrier to entry for new users and provide a recurring revenue stream for manufacturers and service providers.

Leading Players in the Agricultural Micro-Cultivation Pastoral Management Machine Market

- ECHO

- Husqvarna

- MTD Products

- Texas A/S

- Benassi S.p.A

- Mantis Garden Tools

- Deere and Company

- VST Tillers Tractors

- KMW

- Caterpillar

- Honda Siel Power

- WEIMA AGRICULTURAL MACHINERY CO.,LTD.

Key Developments in Agricultural Micro-Cultivation Pastoral Management Machine Industry

- 2023: Introduction of advanced battery technologies enabling longer runtimes and faster charging for electric-powered micro-cultivation machines.

- 2023: Increased integration of smart sensors for soil moisture and nutrient analysis in mid-range models.

- 2022: Launch of highly modular micro-cultivation machines with easily interchangeable attachments for diverse agricultural tasks.

- 2022: Expansion of product lines by major manufacturers to include more ergonomic and user-friendly designs targeting home gardeners.

- 2021: Strategic partnerships formed between agricultural machinery companies and technology firms to develop AI-driven operational features.

- 2020: Growing emphasis on lightweight, durable composite materials for enhanced machine maneuverability and longevity.

- 2019: Significant investment in research and development for emission-free and sustainable micro-cultivation solutions.

Strategic Outlook for Agricultural Micro-Cultivation Pastoral Management Machine Market

- 2023: Introduction of advanced battery technologies enabling longer runtimes and faster charging for electric-powered micro-cultivation machines.

- 2023: Increased integration of smart sensors for soil moisture and nutrient analysis in mid-range models.

- 2022: Launch of highly modular micro-cultivation machines with easily interchangeable attachments for diverse agricultural tasks.

- 2022: Expansion of product lines by major manufacturers to include more ergonomic and user-friendly designs targeting home gardeners.

- 2021: Strategic partnerships formed between agricultural machinery companies and technology firms to develop AI-driven operational features.

- 2020: Growing emphasis on lightweight, durable composite materials for enhanced machine maneuverability and longevity.

- 2019: Significant investment in research and development for emission-free and sustainable micro-cultivation solutions.

Strategic Outlook for Agricultural Micro-Cultivation Pastoral Management Machine Market

The strategic outlook for the Agricultural Micro-Cultivation Pastoral Management Machine market is exceptionally positive, driven by ongoing trends in precision agriculture, sustainable farming practices, and the growing demand for efficient solutions in both commercial and domestic settings. The continuous innovation in automation, electrification, and smart technologies will further enhance the appeal and functionality of these machines, making them indispensable tools for modern cultivation. Manufacturers that focus on developing versatile, user-friendly, and eco-friendly products, while also exploring emerging markets and alternative business models, are poised for significant growth and market leadership. The increasing global focus on food security and sustainable food production will continue to fuel the demand for these highly efficient and adaptable agricultural implements.

Agricultural Micro-Cultivation Pastoral Management Machine Segmentation

-

1. Application

- 1.1. Farm

- 1.2. Garden

-

2. Types

- 2.1. Gasoline Engine

- 2.2. Diesel Engine

Agricultural Micro-Cultivation Pastoral Management Machine Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Agricultural Micro-Cultivation Pastoral Management Machine REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Agricultural Micro-Cultivation Pastoral Management Machine Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Farm

- 5.1.2. Garden

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Gasoline Engine

- 5.2.2. Diesel Engine

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Agricultural Micro-Cultivation Pastoral Management Machine Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Farm

- 6.1.2. Garden

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Gasoline Engine

- 6.2.2. Diesel Engine

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Agricultural Micro-Cultivation Pastoral Management Machine Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Farm

- 7.1.2. Garden

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Gasoline Engine

- 7.2.2. Diesel Engine

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Agricultural Micro-Cultivation Pastoral Management Machine Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Farm

- 8.1.2. Garden

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Gasoline Engine

- 8.2.2. Diesel Engine

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Agricultural Micro-Cultivation Pastoral Management Machine Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Farm

- 9.1.2. Garden

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Gasoline Engine

- 9.2.2. Diesel Engine

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Agricultural Micro-Cultivation Pastoral Management Machine Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Farm

- 10.1.2. Garden

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Gasoline Engine

- 10.2.2. Diesel Engine

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 ECHO

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Husqvarna

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 MTD Products

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Texas A/S

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Benassi S.p.A

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mantis Garden Tools

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Deere and Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 VST Tillers Tractors

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 KMW

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Caterpillar

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Honda Siel Power

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 WEIMA AGRICULTURAL MACHINERY CO.

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 LTD.

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 ECHO

List of Figures

- Figure 1: Global Agricultural Micro-Cultivation Pastoral Management Machine Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Agricultural Micro-Cultivation Pastoral Management Machine Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million), by Application 2024 & 2032

- Figure 4: North America Agricultural Micro-Cultivation Pastoral Management Machine Volume (K), by Application 2024 & 2032

- Figure 5: North America Agricultural Micro-Cultivation Pastoral Management Machine Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Agricultural Micro-Cultivation Pastoral Management Machine Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million), by Types 2024 & 2032

- Figure 8: North America Agricultural Micro-Cultivation Pastoral Management Machine Volume (K), by Types 2024 & 2032

- Figure 9: North America Agricultural Micro-Cultivation Pastoral Management Machine Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Agricultural Micro-Cultivation Pastoral Management Machine Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million), by Country 2024 & 2032

- Figure 12: North America Agricultural Micro-Cultivation Pastoral Management Machine Volume (K), by Country 2024 & 2032

- Figure 13: North America Agricultural Micro-Cultivation Pastoral Management Machine Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Agricultural Micro-Cultivation Pastoral Management Machine Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million), by Application 2024 & 2032

- Figure 16: South America Agricultural Micro-Cultivation Pastoral Management Machine Volume (K), by Application 2024 & 2032

- Figure 17: South America Agricultural Micro-Cultivation Pastoral Management Machine Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Agricultural Micro-Cultivation Pastoral Management Machine Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million), by Types 2024 & 2032

- Figure 20: South America Agricultural Micro-Cultivation Pastoral Management Machine Volume (K), by Types 2024 & 2032

- Figure 21: South America Agricultural Micro-Cultivation Pastoral Management Machine Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Agricultural Micro-Cultivation Pastoral Management Machine Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million), by Country 2024 & 2032

- Figure 24: South America Agricultural Micro-Cultivation Pastoral Management Machine Volume (K), by Country 2024 & 2032

- Figure 25: South America Agricultural Micro-Cultivation Pastoral Management Machine Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Agricultural Micro-Cultivation Pastoral Management Machine Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Agricultural Micro-Cultivation Pastoral Management Machine Volume (K), by Application 2024 & 2032

- Figure 29: Europe Agricultural Micro-Cultivation Pastoral Management Machine Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Agricultural Micro-Cultivation Pastoral Management Machine Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Agricultural Micro-Cultivation Pastoral Management Machine Volume (K), by Types 2024 & 2032

- Figure 33: Europe Agricultural Micro-Cultivation Pastoral Management Machine Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Agricultural Micro-Cultivation Pastoral Management Machine Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Agricultural Micro-Cultivation Pastoral Management Machine Volume (K), by Country 2024 & 2032

- Figure 37: Europe Agricultural Micro-Cultivation Pastoral Management Machine Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Agricultural Micro-Cultivation Pastoral Management Machine Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Agricultural Micro-Cultivation Pastoral Management Machine Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Agricultural Micro-Cultivation Pastoral Management Machine Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Agricultural Micro-Cultivation Pastoral Management Machine Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Agricultural Micro-Cultivation Pastoral Management Machine Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Agricultural Micro-Cultivation Pastoral Management Machine Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Agricultural Micro-Cultivation Pastoral Management Machine Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Agricultural Micro-Cultivation Pastoral Management Machine Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Agricultural Micro-Cultivation Pastoral Management Machine Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Agricultural Micro-Cultivation Pastoral Management Machine Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Agricultural Micro-Cultivation Pastoral Management Machine Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Agricultural Micro-Cultivation Pastoral Management Machine Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Agricultural Micro-Cultivation Pastoral Management Machine Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Agricultural Micro-Cultivation Pastoral Management Machine Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Agricultural Micro-Cultivation Pastoral Management Machine Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Agricultural Micro-Cultivation Pastoral Management Machine Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Agricultural Micro-Cultivation Pastoral Management Machine Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Agricultural Micro-Cultivation Pastoral Management Machine Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Agricultural Micro-Cultivation Pastoral Management Machine Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Agricultural Micro-Cultivation Pastoral Management Machine Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Agricultural Micro-Cultivation Pastoral Management Machine Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Agricultural Micro-Cultivation Pastoral Management Machine Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Agricultural Micro-Cultivation Pastoral Management Machine Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Agricultural Micro-Cultivation Pastoral Management Machine Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Agricultural Micro-Cultivation Pastoral Management Machine Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Agricultural Micro-Cultivation Pastoral Management Machine Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Agricultural Micro-Cultivation Pastoral Management Machine Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Agricultural Micro-Cultivation Pastoral Management Machine Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Agricultural Micro-Cultivation Pastoral Management Machine Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Agricultural Micro-Cultivation Pastoral Management Machine Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Agricultural Micro-Cultivation Pastoral Management Machine Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Agricultural Micro-Cultivation Pastoral Management Machine Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Agricultural Micro-Cultivation Pastoral Management Machine Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Agricultural Micro-Cultivation Pastoral Management Machine Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Agricultural Micro-Cultivation Pastoral Management Machine Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Agricultural Micro-Cultivation Pastoral Management Machine Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Agricultural Micro-Cultivation Pastoral Management Machine Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Agricultural Micro-Cultivation Pastoral Management Machine Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Agricultural Micro-Cultivation Pastoral Management Machine Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Agricultural Micro-Cultivation Pastoral Management Machine Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Agricultural Micro-Cultivation Pastoral Management Machine Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Agricultural Micro-Cultivation Pastoral Management Machine Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Agricultural Micro-Cultivation Pastoral Management Machine Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Agricultural Micro-Cultivation Pastoral Management Machine Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Agricultural Micro-Cultivation Pastoral Management Machine Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Agricultural Micro-Cultivation Pastoral Management Machine Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Agricultural Micro-Cultivation Pastoral Management Machine Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Agricultural Micro-Cultivation Pastoral Management Machine Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Agricultural Micro-Cultivation Pastoral Management Machine Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Agricultural Micro-Cultivation Pastoral Management Machine Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Agricultural Micro-Cultivation Pastoral Management Machine Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Agricultural Micro-Cultivation Pastoral Management Machine Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Agricultural Micro-Cultivation Pastoral Management Machine Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Agricultural Micro-Cultivation Pastoral Management Machine Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Agricultural Micro-Cultivation Pastoral Management Machine Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Agricultural Micro-Cultivation Pastoral Management Machine Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Agricultural Micro-Cultivation Pastoral Management Machine Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Agricultural Micro-Cultivation Pastoral Management Machine Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Agricultural Micro-Cultivation Pastoral Management Machine Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Agricultural Micro-Cultivation Pastoral Management Machine Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Agricultural Micro-Cultivation Pastoral Management Machine Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Agricultural Micro-Cultivation Pastoral Management Machine Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Agricultural Micro-Cultivation Pastoral Management Machine Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Agricultural Micro-Cultivation Pastoral Management Machine Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Agricultural Micro-Cultivation Pastoral Management Machine Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Agricultural Micro-Cultivation Pastoral Management Machine Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Agricultural Micro-Cultivation Pastoral Management Machine Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Agricultural Micro-Cultivation Pastoral Management Machine Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Agricultural Micro-Cultivation Pastoral Management Machine Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Agricultural Micro-Cultivation Pastoral Management Machine Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Agricultural Micro-Cultivation Pastoral Management Machine Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Agricultural Micro-Cultivation Pastoral Management Machine Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Agricultural Micro-Cultivation Pastoral Management Machine Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Agricultural Micro-Cultivation Pastoral Management Machine Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Agricultural Micro-Cultivation Pastoral Management Machine Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Agricultural Micro-Cultivation Pastoral Management Machine Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Agricultural Micro-Cultivation Pastoral Management Machine Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Agricultural Micro-Cultivation Pastoral Management Machine Volume K Forecast, by Country 2019 & 2032

- Table 81: China Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Agricultural Micro-Cultivation Pastoral Management Machine Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Agricultural Micro-Cultivation Pastoral Management Machine Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Agricultural Micro-Cultivation Pastoral Management Machine Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Agricultural Micro-Cultivation Pastoral Management Machine Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Agricultural Micro-Cultivation Pastoral Management Machine Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Agricultural Micro-Cultivation Pastoral Management Machine Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Agricultural Micro-Cultivation Pastoral Management Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Agricultural Micro-Cultivation Pastoral Management Machine Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Agricultural Micro-Cultivation Pastoral Management Machine?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Agricultural Micro-Cultivation Pastoral Management Machine?

Key companies in the market include ECHO, Husqvarna, MTD Products, Texas A/S, Benassi S.p.A, Mantis Garden Tools, Deere and Company, VST Tillers Tractors, KMW, Caterpillar, Honda Siel Power, WEIMA AGRICULTURAL MACHINERY CO., LTD..

3. What are the main segments of the Agricultural Micro-Cultivation Pastoral Management Machine?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Agricultural Micro-Cultivation Pastoral Management Machine," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Agricultural Micro-Cultivation Pastoral Management Machine report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Agricultural Micro-Cultivation Pastoral Management Machine?

To stay informed about further developments, trends, and reports in the Agricultural Micro-Cultivation Pastoral Management Machine, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence