Key Insights

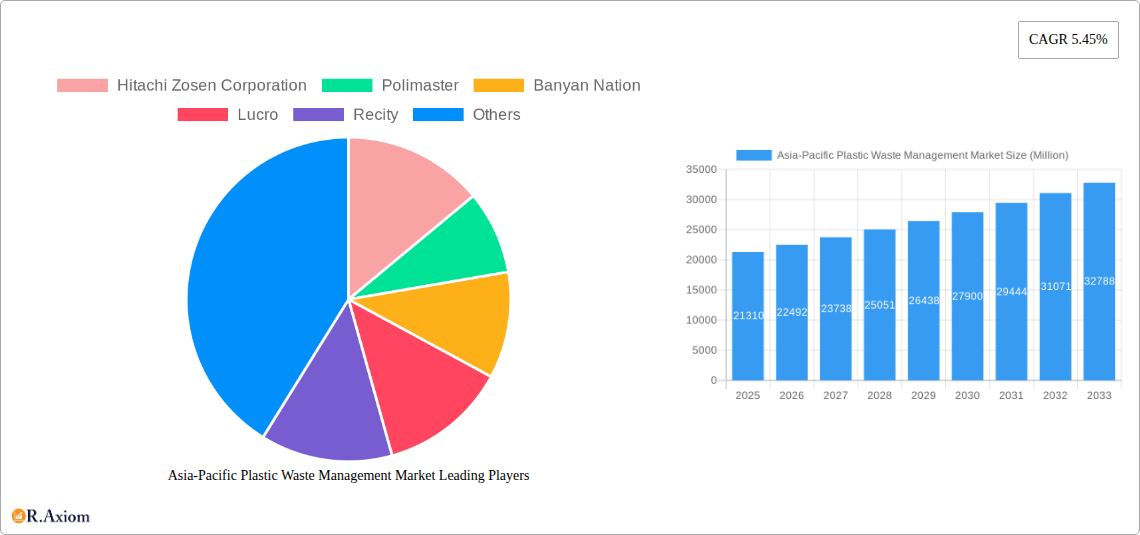

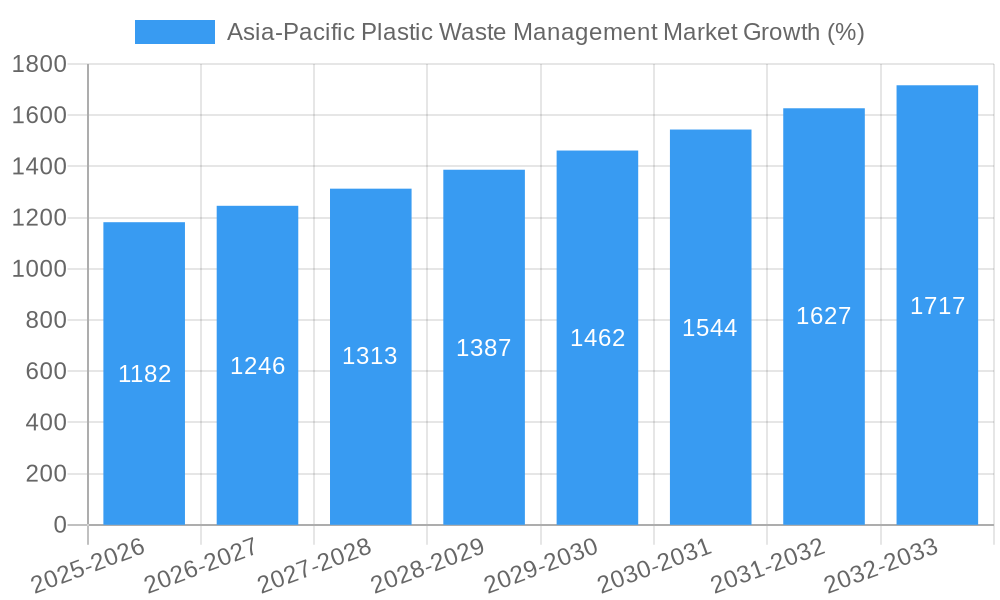

The Asia-Pacific plastic waste management market, valued at $21.31 billion in 2025, is projected to experience robust growth, driven by escalating environmental concerns, stringent government regulations, and increasing consumer awareness regarding plastic pollution. A Compound Annual Growth Rate (CAGR) of 5.45% from 2025 to 2033 indicates a significant market expansion. Key drivers include the rising adoption of advanced waste management technologies, such as plastic-to-fuel conversion and chemical recycling, coupled with a growing emphasis on circular economy principles. The increasing generation of plastic waste, particularly in rapidly developing economies within the region, further fuels market growth. However, challenges remain, including the high cost of implementing and maintaining waste management infrastructure, especially in less developed areas, along with the need for consistent and effective waste segregation practices. The market segmentation, while not explicitly detailed, likely comprises diverse categories such as waste collection, processing, recycling, and disposal services, each experiencing varied growth rates based on technological advancements and policy changes. Leading companies, including Hitachi Zosen Corporation, Polimaster, and Waste Management Inc., are actively investing in innovative solutions and expanding their operations across the region to capitalize on these opportunities. The market's future hinges on successful partnerships between public and private sectors, fostering sustainable solutions and advancing the overall efficiency of plastic waste management practices.

The substantial growth trajectory highlights the significant investment potential within the Asia-Pacific plastic waste management market. The market's maturity varies across different countries, with some exhibiting more advanced waste management systems than others. This uneven distribution of infrastructure creates opportunities for investment in upgrading existing facilities and developing new ones, particularly in regions with limited capacity. The consistent implementation and enforcement of stricter environmental regulations are crucial for driving long-term sustainable growth. Moreover, initiatives that promote public awareness and encourage individual responsibility in proper waste disposal practices will prove instrumental in ensuring the successful implementation and long-term efficacy of the market's waste management solutions. Furthermore, continued innovation in plastic recycling technologies, along with the development of biodegradable and compostable alternatives, will contribute significantly to shaping the future landscape of the Asia-Pacific plastic waste management market.

Asia-Pacific Plastic Waste Management Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Asia-Pacific plastic waste management market, covering market size, growth drivers, challenges, opportunities, and key players. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report utilizes data from the historical period (2019-2024) to project the forecast period (2025-2033), offering actionable insights for industry stakeholders.

Asia-Pacific Plastic Waste Management Market Market Concentration & Innovation

The Asia-Pacific plastic waste management market exhibits a moderately concentrated landscape, with a few large multinational corporations and a growing number of regional players vying for market share. Market concentration is influenced by factors such as technological capabilities, geographical reach, and access to capital. While precise market share figures for individual companies are proprietary data, analysis suggests that companies like SUEZ and Waste Management Inc. hold significant shares, though the exact percentages are subject to constant flux due to mergers and acquisitions (M&A) activity. The average M&A deal value in the region over the past five years has been approximately xx Million, with a noticeable increase in activity in 2022-2024 driven by the increasing need for advanced waste management solutions.

Innovation Drivers:

- Stringent Government Regulations: Governments across the Asia-Pacific region are increasingly implementing stricter regulations on plastic waste disposal, driving innovation in recycling technologies and waste-to-energy solutions.

- Technological Advancements: Advances in plastic recycling technologies, such as chemical recycling and advanced sorting systems, are creating new opportunities for market expansion.

- Growing Environmental Awareness: Rising public awareness about the environmental impact of plastic pollution is pushing demand for sustainable waste management solutions.

Regulatory Frameworks & Substitutes: The regulatory environment varies significantly across countries, impacting market dynamics. The emergence of biodegradable plastics and alternative packaging materials presents a potential challenge as substitutes, although their widespread adoption remains limited.

End-User Trends & M&A Activity: The focus is shifting towards sustainable practices across various end-user segments, from municipalities to industries. M&A activities are being driven by the need for scaling operations, technological integrations and securing a larger market share.

Asia-Pacific Plastic Waste Management Market Industry Trends & Insights

The Asia-Pacific plastic waste management market is experiencing robust growth, driven by several factors. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is estimated to be xx%, exceeding the global average. Market penetration is expected to reach xx% by 2033, reflecting the increasing adoption of advanced waste management solutions.

Market Growth Drivers:

- Rapid urbanization and economic development leading to increased waste generation.

- Growing government initiatives promoting circular economy principles and sustainable waste management.

- Increasing demand for efficient and environmentally friendly waste disposal solutions.

- Technological advancements in recycling technologies and waste-to-energy solutions.

Technological Disruptions: The integration of artificial intelligence (AI), automation, and data analytics is revolutionizing waste management processes, leading to improved efficiency and resource recovery. The adoption of blockchain technology for waste traceability and transparency is also gaining traction.

Consumer Preferences & Competitive Dynamics: Consumers are increasingly demanding environmentally conscious products and services, pushing companies to adopt sustainable practices. Competitive dynamics are marked by intense competition among established players and the emergence of innovative startups.

Dominant Markets & Segments in Asia-Pacific Plastic Waste Management Market

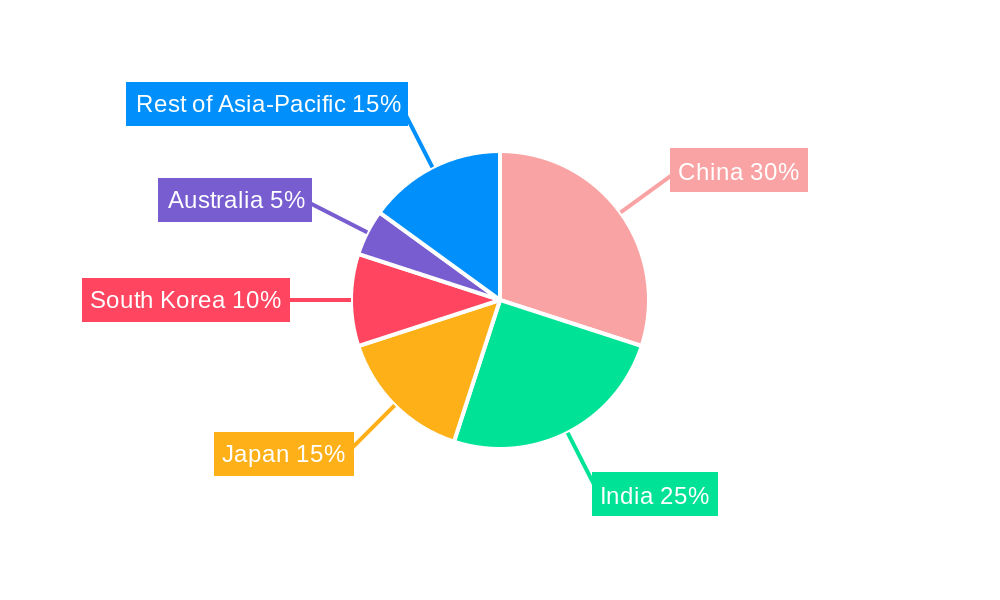

China and India are currently the dominant markets in the Asia-Pacific region, driven by their large populations and significant waste generation. Other countries like Japan, South Korea, and Australia are showing strong growth due to stringent regulations and advanced infrastructure.

Key Drivers of Market Dominance:

- China: Massive investments in waste management infrastructure, supportive government policies, and a growing focus on circular economy principles.

- India: Rapid urbanization, rising environmental awareness, and increasing government efforts to improve waste management practices.

- Japan and South Korea: Well-established recycling infrastructure, advanced technologies, and strong emphasis on waste reduction.

Market Segmentation: The market is segmented based on waste type (plastic bottles, films, packaging etc.), technology (mechanical recycling, chemical recycling, incineration), and service type (collection, transportation, processing, disposal). The mechanical recycling segment currently dominates, but chemical recycling is gaining momentum due to technological advancements and its ability to handle difficult-to-recycle plastics.

Asia-Pacific Plastic Waste Management Market Product Developments

Recent product innovations include advanced sorting technologies, chemical recycling processes, and waste-to-energy plants. These advancements offer enhanced efficiency and resource recovery, addressing the challenges of plastic waste management. The market fit for these innovations is high, given the growing demand for sustainable solutions and stricter environmental regulations. Companies are focusing on developing solutions that are cost-effective, scalable, and environmentally friendly.

Report Scope & Segmentation Analysis

This report offers comprehensive segmentation analysis across various parameters, including:

- By Waste Type: Plastic bottles, films, packaging, and others. The packaging segment is expected to witness the fastest growth, fuelled by rising consumption and packaging waste generation.

- By Technology: Mechanical recycling, chemical recycling, biological recycling, incineration, and others. Chemical recycling is poised for significant growth due to technological advancements.

- By Service Type: Collection, transportation, processing, and disposal. The processing segment is witnessing significant innovation.

- By End-User: Municipalities, industries, and households. The municipal segment currently holds the largest share, with significant growth potential in the industrial sector.

Each segment’s analysis includes market size, growth projections, and competitive dynamics.

Key Drivers of Asia-Pacific Plastic Waste Management Market Growth

The Asia-Pacific plastic waste management market’s growth is propelled by several key drivers:

- Stringent Government Regulations: Governments across the region are implementing stricter regulations to curb plastic pollution, incentivizing investment in waste management infrastructure.

- Technological Advancements: Innovations in recycling technologies and waste-to-energy solutions are enhancing efficiency and resource recovery.

- Growing Environmental Awareness: Rising public awareness about the environmental impact of plastic waste is driving demand for sustainable solutions.

- Economic Development: Rapid urbanization and economic growth are leading to increased waste generation, creating a need for effective waste management systems.

Challenges in the Asia-Pacific Plastic Waste Management Market Sector

The Asia-Pacific plastic waste management market faces several challenges:

- Lack of Infrastructure: Many regions in the Asia-Pacific lack adequate waste management infrastructure, hindering efficient waste collection and processing. This results in significant leakage of plastic waste into the environment.

- High Cost of Implementation: Implementing advanced waste management technologies can be expensive, posing a significant barrier for many countries.

- Limited Public Awareness: Lack of public awareness about responsible waste disposal practices remains a significant challenge.

- Technological Limitations: Recycling certain types of plastics, especially complex multi-layered plastics, remains technologically challenging.

Emerging Opportunities in Asia-Pacific Plastic Waste Management Market

Several emerging opportunities exist within the Asia-Pacific plastic waste management market:

- Chemical Recycling: Chemical recycling offers a viable solution for recycling difficult-to-recycle plastics, representing a significant market opportunity.

- Waste-to-Energy: Converting plastic waste into energy offers an environmentally friendly and cost-effective disposal option.

- Bioplastics: The growing use of biodegradable and compostable plastics presents opportunities for sustainable waste management solutions.

- Blockchain Technology: Implementing blockchain technology to improve waste traceability and transparency can create new market opportunities.

Leading Players in the Asia-Pacific Plastic Waste Management Market Market

- Hitachi Zosen Corporation

- Polimaster

- Banyan Nation

- Lucro

- Recity

- SUEZ

- Waste Management Inc

- Cleanaway Waste Management Limited

- Plastic Bank

- Agilyx

- GreenTech Environmental Co Ltd

Key Developments in Asia-Pacific Plastic Waste Management Market Industry

April 2024: Launch of "Mapping Plastic Litter in Mekong Countries and Proposing Innovative Waste Management Solutions" initiative to combat plastic pollution in Bangkok (Thailand), Vientiane (Lao PDR), Battambang (Cambodia), and Can Tho (Vietnam). This significantly impacts the market by focusing attention and resources on crucial areas.

March 2023: World Bank's USD 250 Million loan approval to combat plastic pollution in Shaanxi Province, China. This development directly boosts investment and infrastructure development in the Chinese market, influencing broader national strategies.

Strategic Outlook for Asia-Pacific Plastic Waste Management Market Market

The Asia-Pacific plastic waste management market is poised for significant growth driven by stringent regulations, technological advancements, and increasing environmental awareness. Opportunities exist in developing advanced recycling technologies, improving waste collection infrastructure, and promoting public awareness campaigns. Companies that can effectively adapt to evolving regulations, innovate in waste management technologies, and address the specific needs of diverse markets in the region are well-positioned to capture significant market share. The market's future hinges on collaboration between governments, businesses, and communities to achieve sustainable waste management practices.

Asia-Pacific Plastic Waste Management Market Segmentation

-

1. Polymer

- 1.1. Polypropylene (PP)

- 1.2. Polyethylene (PE)

- 1.3. Polyvinyl Chloride (PVC)

- 1.4. Terephthalate (PET)

- 1.5. Other Polymers

-

2. Source

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

- 2.4. Other Sources (Construction, Healthcare, etc.)

-

3. Treatment

- 3.1. Recycling

- 3.2. Chemical Treatment

- 3.3. Landfill

- 3.4. Other Treatments

Asia-Pacific Plastic Waste Management Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Plastic Waste Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.45% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Plastic Consumption; Stricter Regulations and Policies Aimed at Reducing Plastic Waste

- 3.3. Market Restrains

- 3.3.1. Increasing Plastic Consumption; Stricter Regulations and Policies Aimed at Reducing Plastic Waste

- 3.4. Market Trends

- 3.4.1. Rapid Urbanization Exacerbates Escalating Plastic Predicament in Asia-Pacific

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Plastic Waste Management Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Polymer

- 5.1.1. Polypropylene (PP)

- 5.1.2. Polyethylene (PE)

- 5.1.3. Polyvinyl Chloride (PVC)

- 5.1.4. Terephthalate (PET)

- 5.1.5. Other Polymers

- 5.2. Market Analysis, Insights and Forecast - by Source

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.2.4. Other Sources (Construction, Healthcare, etc.)

- 5.3. Market Analysis, Insights and Forecast - by Treatment

- 5.3.1. Recycling

- 5.3.2. Chemical Treatment

- 5.3.3. Landfill

- 5.3.4. Other Treatments

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Polymer

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Hitachi Zosen Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Polimaster

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Banyan Nation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lucro

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Recity

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SUEZ

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Waste Management Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cleanaway Waste Management Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Plastic Bank

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Agilyx

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 GreenTech Environmental Co Ltd*List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Hitachi Zosen Corporation

List of Figures

- Figure 1: Asia-Pacific Plastic Waste Management Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Plastic Waste Management Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Polymer 2019 & 2032

- Table 4: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Polymer 2019 & 2032

- Table 5: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Source 2019 & 2032

- Table 6: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Source 2019 & 2032

- Table 7: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Treatment 2019 & 2032

- Table 8: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Treatment 2019 & 2032

- Table 9: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Polymer 2019 & 2032

- Table 12: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Polymer 2019 & 2032

- Table 13: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Source 2019 & 2032

- Table 14: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Source 2019 & 2032

- Table 15: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Treatment 2019 & 2032

- Table 16: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Treatment 2019 & 2032

- Table 17: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Country 2019 & 2032

- Table 19: China Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: China Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 21: Japan Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Japan Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 23: South Korea Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 25: India Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: India Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 27: Australia Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Australia Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 29: New Zealand Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: New Zealand Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 31: Indonesia Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Indonesia Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 33: Malaysia Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Malaysia Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 35: Singapore Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Singapore Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 37: Thailand Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Thailand Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 39: Vietnam Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Vietnam Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 41: Philippines Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Philippines Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Plastic Waste Management Market?

The projected CAGR is approximately 5.45%.

2. Which companies are prominent players in the Asia-Pacific Plastic Waste Management Market?

Key companies in the market include Hitachi Zosen Corporation, Polimaster, Banyan Nation, Lucro, Recity, SUEZ, Waste Management Inc, Cleanaway Waste Management Limited, Plastic Bank, Agilyx, GreenTech Environmental Co Ltd*List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Plastic Waste Management Market?

The market segments include Polymer, Source, Treatment.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.31 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Plastic Consumption; Stricter Regulations and Policies Aimed at Reducing Plastic Waste.

6. What are the notable trends driving market growth?

Rapid Urbanization Exacerbates Escalating Plastic Predicament in Asia-Pacific.

7. Are there any restraints impacting market growth?

Increasing Plastic Consumption; Stricter Regulations and Policies Aimed at Reducing Plastic Waste.

8. Can you provide examples of recent developments in the market?

April 2024: A new initiative, "Mapping Plastic Litter in Mekong Countries and Proposing Innovative Waste Management Solutions," was introduced to combat Southeast Asia's escalating plastic pollution crisis. The project's primary goal is to chart and diminish the volume of plastic waste entering the waterways of the Mekong countries, focusing on four pilot cities: Bangkok (Thailand), Vientiane (Lao PDR), Battambang (Cambodia), and Can Tho (Vietnam).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Plastic Waste Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Plastic Waste Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Plastic Waste Management Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Plastic Waste Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence