Key Insights

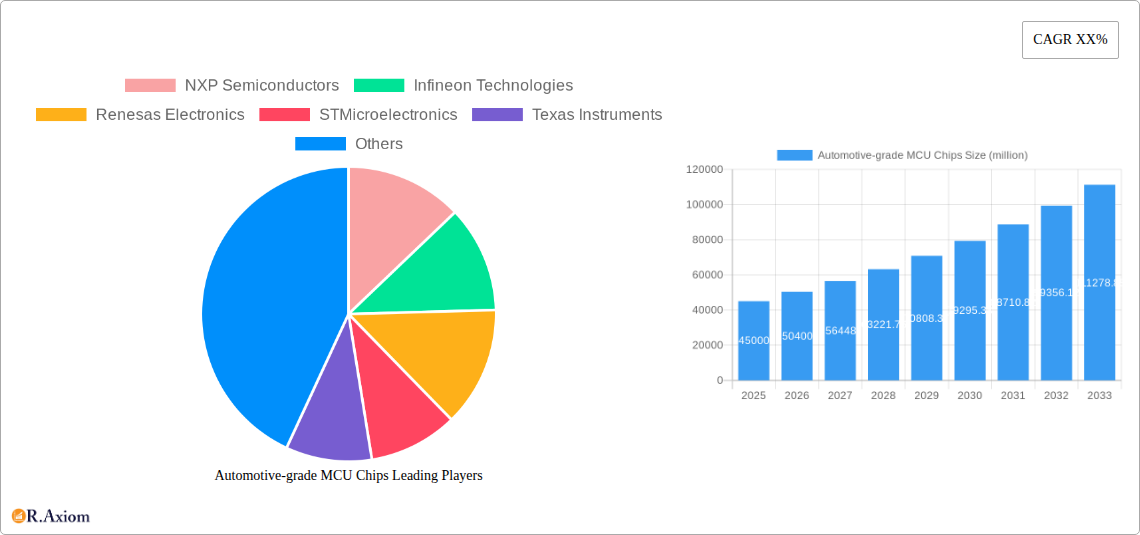

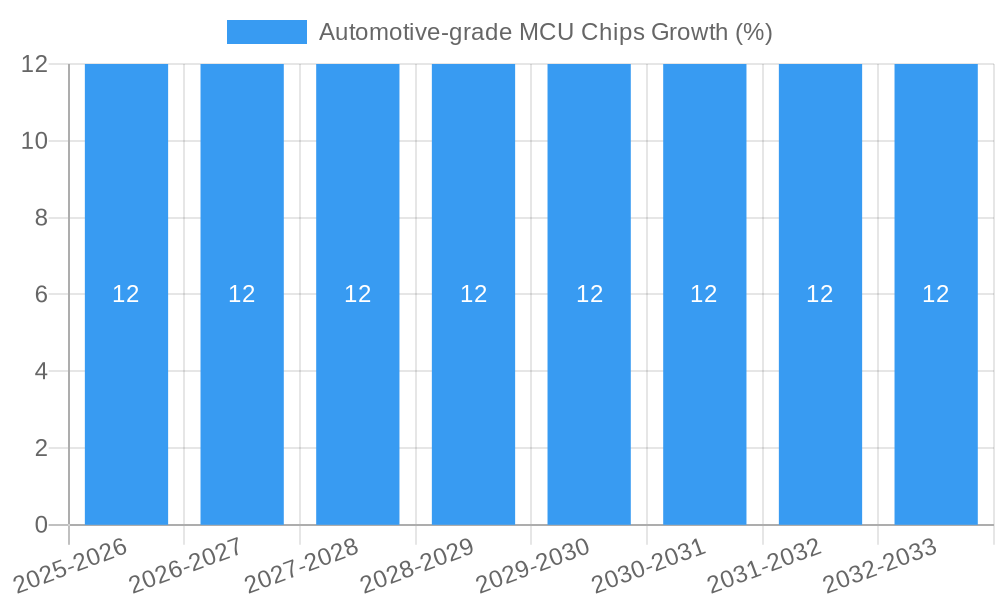

The Automotive-grade MCU Chips market is poised for substantial growth, projected to reach an estimated $45 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 12% anticipated from 2025 to 2033. This expansion is primarily fueled by the escalating demand for sophisticated in-car electronics and advanced driver-assistance systems (ADAS). The increasing complexity of vehicle architectures, driven by the integration of features like intelligent cockpits, advanced infotainment systems, and enhanced powertrain and chassis control, necessitates the adoption of high-performance and reliable microcontrollers. Furthermore, the ongoing transition towards electric and autonomous vehicles is a significant catalyst, as these platforms heavily rely on advanced MCU capabilities for everything from battery management to sophisticated sensor processing and real-time control. The market's value is expected to be in the tens of billions of USD, reflecting the critical role these chips play in modern automotive manufacturing.

While the market exhibits strong growth potential, certain factors could moderate its trajectory. The global semiconductor supply chain disruptions, although gradually easing, can still pose challenges to consistent production and timely delivery of automotive-grade MCUs. Moreover, the stringent regulatory requirements and the need for extensive validation processes for automotive components can increase development timelines and costs. However, these restraints are being addressed through strategic investments in manufacturing capacity and the development of more resilient supply chain models. The market is segmented by application, with ADAS and Intelligent Cockpit Domain expected to witness the highest growth rates due to their direct association with vehicle safety and user experience. In terms of type, 32-bit MCUs are dominating the market owing to their superior processing power and memory capabilities, essential for handling complex automotive functions. Key players like NXP Semiconductors, Infineon Technologies, and Renesas Electronics are at the forefront, driving innovation and catering to the evolving needs of the automotive industry.

Automotive-grade MCU Chips Market Analysis and Forecast: A Comprehensive Report (2019-2033)

This in-depth market research report provides a detailed analysis and forecast for the Automotive-grade MCU Chips market. Covering the historical period from 2019 to 2024, the base year of 2025, and an extensive forecast period extending to 2033, this report offers critical insights into market dynamics, technological advancements, and strategic opportunities for industry stakeholders. The report delves into key applications such as Body Control, Car Infotainment Systems, Intelligent Cockpit Domains, ADAS, Powertrain, and Chassis and Safety Systems, while also examining market segmentation across 8-bit, 16-bit, and 32-bit MCU architectures.

With an estimated market size projected to reach hundreds of millions in the forecast period, this report is an indispensable resource for semiconductor manufacturers, automotive OEMs, Tier-1 suppliers, research institutions, and investors seeking to understand the evolving landscape of automotive microcontrollers. We analyze the competitive environment, regulatory landscape, and emerging trends that are shaping the future of this vital sector.

Automotive-grade MCU Chips Market Concentration & Innovation

The automotive-grade MCU chips market exhibits a moderate to high concentration, with a few dominant players holding significant market share. NXP Semiconductors, Infineon Technologies, Renesas Electronics, STMicroelectronics, and Texas Instruments are key leaders, collectively accounting for over 70% of the global market. This concentration is driven by substantial R&D investments, stringent qualification processes, and long-standing relationships with automotive OEMs. Innovation is a primary driver, fueled by the increasing complexity of vehicle electronics, the demand for advanced driver-assistance systems (ADAS), and the transition to electric and autonomous vehicles. Key innovation areas include enhanced processing power, integrated safety features, low power consumption, and specialized architectures for AI and machine learning applications. Regulatory frameworks, such as ISO 26262 for functional safety, play a crucial role in product development and market entry, ensuring the reliability and safety of automotive MCUs. Product substitutes are limited due to the highly specialized nature and rigorous certification requirements of automotive-grade components. End-user trends, particularly the consumer demand for connected, intelligent, and safe vehicles, are pushing the boundaries of MCU capabilities. Mergers and acquisitions (M&A) activities are strategic maneuvers to consolidate market position, acquire new technologies, and expand product portfolios. Notable M&A deals in recent years have involved acquisitions valued in the hundreds of millions to billions of dollars, aimed at strengthening capabilities in areas like AI, cybersecurity, and high-performance computing for automotive applications.

Automotive-grade MCU Chips Industry Trends & Insights

The automotive-grade MCU chips industry is experiencing robust growth, driven by several transformative trends. The global market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period, reaching a market value of hundreds of millions. A primary growth driver is the exponential rise in the number of MCUs per vehicle, fueled by the increasing integration of advanced features. Modern vehicles can contain anywhere from hundreds to thousands of individual MCUs, performing diverse functions from powertrain management to advanced infotainment and ADAS. The relentless pursuit of enhanced safety and autonomous driving capabilities is a significant catalyst, necessitating high-performance, low-latency MCUs for real-time processing of sensor data and complex algorithms. The evolution of the intelligent cockpit domain, demanding sophisticated graphical interfaces, connectivity, and personalized user experiences, also contributes substantially to market expansion.

Technological disruptions, such as the advent of Automotive Ethernet, the increasing adoption of AI and machine learning for predictive maintenance and autonomous decision-making, and the growing need for robust cybersecurity solutions, are reshaping the MCU landscape. Manufacturers are investing heavily in developing MCUs with integrated security features, advanced processing capabilities (e.g., neural processing units), and higher levels of integration to reduce component count and system costs. Consumer preferences are shifting towards vehicles that offer seamless connectivity, advanced driver assistance, and intuitive user interfaces, directly translating into higher demand for sophisticated automotive MCUs. The electrification of vehicles is another major trend, requiring specialized MCUs for battery management systems, motor control, and charging infrastructure.

Competitive dynamics are intensifying, with established players investing in R&D and market expansion while new entrants, particularly from Asia, are emerging with cost-effective solutions. The industry is also witnessing a trend towards domain controllers and centralized computing architectures, which consolidate the functions of multiple traditional ECUs onto more powerful MCUs, leading to simplified vehicle architectures and reduced wiring harnesses. The market penetration of advanced MCU solutions is steadily increasing as vehicle manufacturers adopt newer platforms to meet evolving regulatory standards and consumer expectations for features and performance. The demand for MCUs capable of handling complex software stacks and over-the-air (OTA) updates is also a key insight into future market trajectory.

Dominant Markets & Segments in Automotive-grade MCU Chips

The 32-bit MCU segment is unequivocally the dominant force in the automotive-grade MCU chips market, commanding an estimated market share exceeding 80% of the total market value. This dominance is primarily attributed to the increasing computational demands of modern automotive applications, particularly ADAS, intelligent cockpits, and advanced powertrain systems, which necessitate the high performance and complex processing capabilities offered by 32-bit architectures. The forecast period anticipates continued robust growth for 32-bit MCUs, with a projected CAGR of XX%.

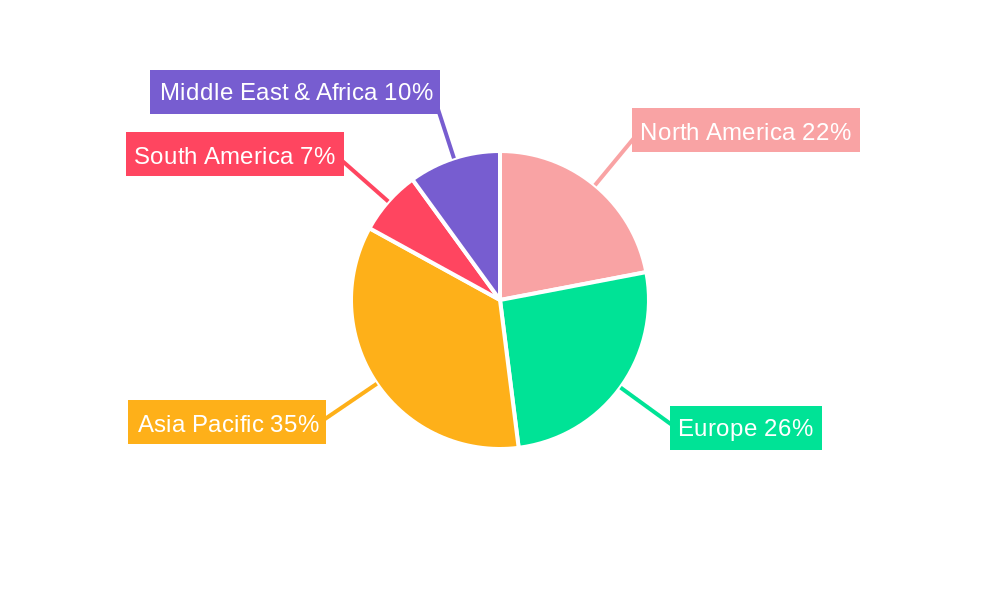

Regionally, Asia Pacific, driven by the burgeoning automotive manufacturing hubs in China, Japan, South Korea, and India, represents the largest and fastest-growing market for automotive-grade MCU chips. The region is projected to account for over 40% of the global market revenue during the forecast period. This dominance is supported by strong government initiatives promoting electric vehicles (EVs) and smart mobility, coupled with a significant increase in vehicle production and a growing adoption of advanced automotive technologies. China, in particular, stands out as a key country, with its vast automotive market and aggressive push towards intelligent connected vehicles (ICVs) and autonomous driving technologies. Economic policies in these regions, such as subsidies for EV production and R&D tax incentives for automotive electronics, are crucial drivers. Infrastructure development, including the expansion of 5G networks for enhanced vehicle connectivity, further bolsters the adoption of advanced MCU-enabled features.

Among the application segments, ADAS (Advanced Driver-Assistance Systems) and the Intelligent Cockpit Domain are emerging as the most significant growth areas, collectively projected to contribute over 50% of the market value by 2033. The increasing prevalence of safety regulations mandating ADAS features and the consumer demand for enhanced in-car experiences are the primary drivers. ADAS applications, including adaptive cruise control, lane-keeping assist, and automated emergency braking, require MCUs with high processing power, real-time capabilities, and integrated safety functions. The intelligent cockpit, encompassing advanced infotainment systems, digital instrument clusters, and head-up displays, necessitates MCUs capable of handling complex graphics, connectivity, and AI-driven features.

Key Drivers for 32-bit Dominance:

- Increasing complexity of vehicle electronics and software.

- Demand for high-performance computing in ADAS and autonomous driving.

- Requirements for advanced graphics and AI processing in intelligent cockpits.

- Superior power efficiency and integration capabilities compared to older architectures.

Key Drivers for Asia Pacific Dominance:

- Largest global automotive production volume.

- Strong government support for EVs and smart mobility.

- Rapid adoption of advanced automotive technologies.

- Growing middle class with increased purchasing power for premium vehicle features.

Key Drivers for ADAS and Intelligent Cockpit Growth:

- Stringent automotive safety regulations.

- Consumer demand for enhanced safety and convenience.

- Technological advancements in sensors, AI, and connectivity.

- Competitive pressure among automakers to offer cutting-edge features.

Automotive-grade MCU Chips Product Developments

Product developments in the automotive-grade MCU chips sector are characterized by a relentless pursuit of higher performance, enhanced safety, and increased integration. Manufacturers are introducing next-generation 32-bit MCUs with multi-core architectures, advanced signal processing capabilities, and integrated hardware accelerators for AI and machine learning. These innovations cater to the growing demand for ADAS, autonomous driving, and sophisticated in-vehicle infotainment systems. Product differentiation is achieved through advanced functional safety features adhering to ISO 26262 standards, enhanced cybersecurity protocols, and optimized power consumption for electrified powertrains. Competitive advantages are being built on the ability to provide comprehensive solutions that include robust software stacks, development tools, and strong technical support, enabling faster time-to-market for automotive OEMs.

Report Scope & Segmentation Analysis

This report provides a comprehensive market analysis and forecast for automotive-grade MCU chips, encompassing detailed segmentation across key dimensions. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033.

Application Segmentation: The market is analyzed across Body Control modules, Car Infotainment Systems, the rapidly evolving Intelligent Cockpit Domain, ADAS (Advanced Driver-Assistance Systems), Powertrain management, and Chassis and Safety Systems. Each application segment is projected to exhibit distinct growth trajectories, with ADAS and Intelligent Cockpit expected to witness the highest CAGRs, reaching an estimated market size of hundreds of millions each by 2033.

Type Segmentation: The report further segments the market by MCU architecture: 8 Bits, 16 Bits, and 32 Bits. The 32-bit segment is the dominant category, projected to continue its strong growth and hold the largest market share throughout the forecast period, driven by increasing computational needs. The 8-bit and 16-bit segments, while mature, will continue to serve specific niche applications.

Key Drivers of Automotive-grade MCU Chips Growth

The automotive-grade MCU chips market is propelled by several interconnected drivers. The escalating complexity of vehicle electronics, driven by features like advanced driver-assistance systems (ADAS) and sophisticated infotainment, necessitates more powerful and integrated MCUs. The global push towards electrification and autonomous driving technologies is a paramount growth catalyst, requiring specialized MCUs for battery management, motor control, and sensor fusion. Stringent government regulations mandating enhanced safety features (e.g., ISO 26262 for functional safety) are compelling automakers to adopt higher-grade, more reliable MCUs. Furthermore, the consumer demand for connected, personalized, and feature-rich in-car experiences is fueling the growth of intelligent cockpits and advanced infotainment systems, directly boosting demand for high-performance MCUs.

Challenges in the Automotive-grade MCU Chips Sector

Despite the robust growth, the automotive-grade MCU chips sector faces significant challenges. The stringent qualification and validation processes required for automotive components lead to long development cycles and high R&D costs, creating barriers to entry for new players. Supply chain disruptions, exacerbated by global chip shortages and geopolitical uncertainties, pose a persistent threat to production and delivery timelines. Intense competition from established semiconductor giants and emerging players, particularly in cost-sensitive markets, puts pressure on profit margins. Evolving cybersecurity threats necessitate continuous innovation in security features, adding complexity and cost to MCU development. Moreover, the increasing demand for specialized, high-performance MCUs can outstrip supply, leading to potential shortages and price volatility.

Emerging Opportunities in Automotive-grade MCU Chips

Emerging opportunities in the automotive-grade MCU chips market are abundant, driven by the rapid evolution of automotive technology. The burgeoning market for autonomous driving systems presents immense potential for high-performance MCUs capable of handling complex AI algorithms and real-time sensor data processing. The continued growth of electric vehicles (EVs) creates demand for specialized MCUs in battery management, charging, and powertrain control. The concept of software-defined vehicles and over-the-air (OTA) updates opens avenues for MCUs with enhanced memory, processing power, and robust update capabilities. The development of vehicle-to-everything (V2X) communication technologies will require MCUs with integrated connectivity and high-speed data processing. Furthermore, the trend towards centralized domain controllers presents an opportunity for highly integrated, powerful MCUs that can consolidate the functionality of multiple traditional ECUs.

Leading Players in the Automotive-grade MCU Chips Market

- NXP Semiconductors

- Infineon Technologies

- Renesas Electronics

- STMicroelectronics

- Texas Instruments

- Bosch Semiconductors

- Onsemi

- Microchip Technology

- AutoChips

- BYD Semiconductor

- C Core Technology

- Chipsea Tech Shenzhen

- Sino Wealth Electronic Ltd.

- GigaDevice

- Unigroup Guoxin

- Ingenic Semiconductor Co

- Nuvoton

- Cypress Semiconductor

- Silicon Labs

- ChipON

- Anhui Saitong Microelectronics Co.,Ltd.

Key Developments in Automotive-grade MCU Chips Industry

- 2023 March: NXP Semiconductors launches new S32G vehicle processing platforms for advanced ADAS and domain control.

- 2023 February: Infineon Technologies announces new AURIX TC4xx MCUs with enhanced cybersecurity and AI capabilities.

- 2022 November: Renesas Electronics expands its R-Car SoC family for intelligent cockpit and ADAS applications.

- 2022 October: STMicroelectronics introduces new STM32H7 microcontrollers for high-performance automotive applications.

- 2022 September: Texas Instruments unveils new Sitara processors for automotive gateway and cockpit applications.

- 2022 July: Bosch Semiconductors announces advancements in automotive radar and MCU integration for ADAS.

- 2022 June: Onsemi introduces new image signal processors and MCUs for automotive camera systems.

- 2022 May: Microchip Technology enhances its SAM V71/E70/S70 automotive MCUs with improved safety and security features.

Strategic Outlook for Automotive-grade MCU Chips Market

The strategic outlook for the automotive-grade MCU chips market remains exceptionally positive, driven by the accelerating transformation of the automotive industry. The convergence of electrification, autonomous driving, and connectivity is creating an unprecedented demand for advanced semiconductor solutions. Key growth catalysts include the increasing adoption of AI and machine learning in vehicles for enhanced safety and user experience, the expansion of V2X communication for smarter traffic management, and the development of software-defined architectures that will rely on powerful and flexible MCUs. Strategic partnerships between MCU manufacturers and automotive OEMs, along with targeted R&D investments in next-generation technologies like AI accelerators and advanced security features, will be critical for success. Companies that can offer integrated solutions, robust supply chains, and demonstrate compliance with evolving safety and regulatory standards will be well-positioned to capitalize on the significant market opportunities ahead.

Automotive-grade MCU Chips Segmentation

-

1. Application

- 1.1. Body Control

- 1.2. Car Infotainment System

- 1.3. Intelligent Cockpit Domain

- 1.4. ADAS

- 1.5. Powertrain

- 1.6. Chassis and Safety Systems

-

2. Types

- 2.1. 8 Bits

- 2.2. 16 Bit

- 2.3. 32 Bit

Automotive-grade MCU Chips Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Automotive-grade MCU Chips REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive-grade MCU Chips Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Body Control

- 5.1.2. Car Infotainment System

- 5.1.3. Intelligent Cockpit Domain

- 5.1.4. ADAS

- 5.1.5. Powertrain

- 5.1.6. Chassis and Safety Systems

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. 8 Bits

- 5.2.2. 16 Bit

- 5.2.3. 32 Bit

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Automotive-grade MCU Chips Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Body Control

- 6.1.2. Car Infotainment System

- 6.1.3. Intelligent Cockpit Domain

- 6.1.4. ADAS

- 6.1.5. Powertrain

- 6.1.6. Chassis and Safety Systems

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. 8 Bits

- 6.2.2. 16 Bit

- 6.2.3. 32 Bit

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Automotive-grade MCU Chips Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Body Control

- 7.1.2. Car Infotainment System

- 7.1.3. Intelligent Cockpit Domain

- 7.1.4. ADAS

- 7.1.5. Powertrain

- 7.1.6. Chassis and Safety Systems

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. 8 Bits

- 7.2.2. 16 Bit

- 7.2.3. 32 Bit

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Automotive-grade MCU Chips Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Body Control

- 8.1.2. Car Infotainment System

- 8.1.3. Intelligent Cockpit Domain

- 8.1.4. ADAS

- 8.1.5. Powertrain

- 8.1.6. Chassis and Safety Systems

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. 8 Bits

- 8.2.2. 16 Bit

- 8.2.3. 32 Bit

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Automotive-grade MCU Chips Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Body Control

- 9.1.2. Car Infotainment System

- 9.1.3. Intelligent Cockpit Domain

- 9.1.4. ADAS

- 9.1.5. Powertrain

- 9.1.6. Chassis and Safety Systems

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. 8 Bits

- 9.2.2. 16 Bit

- 9.2.3. 32 Bit

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Automotive-grade MCU Chips Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Body Control

- 10.1.2. Car Infotainment System

- 10.1.3. Intelligent Cockpit Domain

- 10.1.4. ADAS

- 10.1.5. Powertrain

- 10.1.6. Chassis and Safety Systems

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. 8 Bits

- 10.2.2. 16 Bit

- 10.2.3. 32 Bit

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 NXP Semiconductors

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Infineon Technologies

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Renesas Electronics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 STMicroelectronics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Texas Instruments

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bosch Semiconductors

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Onsemi

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Microchip Technology

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 AutoChips

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BYD Semiconductor

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 C Core Technology

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Chipsea Tech Shenzhen

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Sino Wealth Electronic Ltd.

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 GigaDevice

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Unigroup Guoxin

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Ingenic Semiconductor Co

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Nuvoton

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Cypress Semiconductor

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Silicon Labs

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 ChipON

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Anhui Saitong Microelectronics Co.

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Ltd.

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.1 NXP Semiconductors

List of Figures

- Figure 1: Global Automotive-grade MCU Chips Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Automotive-grade MCU Chips Revenue (million), by Application 2024 & 2032

- Figure 3: North America Automotive-grade MCU Chips Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Automotive-grade MCU Chips Revenue (million), by Types 2024 & 2032

- Figure 5: North America Automotive-grade MCU Chips Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Automotive-grade MCU Chips Revenue (million), by Country 2024 & 2032

- Figure 7: North America Automotive-grade MCU Chips Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Automotive-grade MCU Chips Revenue (million), by Application 2024 & 2032

- Figure 9: South America Automotive-grade MCU Chips Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Automotive-grade MCU Chips Revenue (million), by Types 2024 & 2032

- Figure 11: South America Automotive-grade MCU Chips Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Automotive-grade MCU Chips Revenue (million), by Country 2024 & 2032

- Figure 13: South America Automotive-grade MCU Chips Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Automotive-grade MCU Chips Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Automotive-grade MCU Chips Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Automotive-grade MCU Chips Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Automotive-grade MCU Chips Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Automotive-grade MCU Chips Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Automotive-grade MCU Chips Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Automotive-grade MCU Chips Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Automotive-grade MCU Chips Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Automotive-grade MCU Chips Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Automotive-grade MCU Chips Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Automotive-grade MCU Chips Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Automotive-grade MCU Chips Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Automotive-grade MCU Chips Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Automotive-grade MCU Chips Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Automotive-grade MCU Chips Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Automotive-grade MCU Chips Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Automotive-grade MCU Chips Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Automotive-grade MCU Chips Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Automotive-grade MCU Chips Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Automotive-grade MCU Chips Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Automotive-grade MCU Chips Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Automotive-grade MCU Chips Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Automotive-grade MCU Chips Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Automotive-grade MCU Chips Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Automotive-grade MCU Chips Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Automotive-grade MCU Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Automotive-grade MCU Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Automotive-grade MCU Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Automotive-grade MCU Chips Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Automotive-grade MCU Chips Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Automotive-grade MCU Chips Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Automotive-grade MCU Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Automotive-grade MCU Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Automotive-grade MCU Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Automotive-grade MCU Chips Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Automotive-grade MCU Chips Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Automotive-grade MCU Chips Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Automotive-grade MCU Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Automotive-grade MCU Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Automotive-grade MCU Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Automotive-grade MCU Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Automotive-grade MCU Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Automotive-grade MCU Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Automotive-grade MCU Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Automotive-grade MCU Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Automotive-grade MCU Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Automotive-grade MCU Chips Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Automotive-grade MCU Chips Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Automotive-grade MCU Chips Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Automotive-grade MCU Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Automotive-grade MCU Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Automotive-grade MCU Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Automotive-grade MCU Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Automotive-grade MCU Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Automotive-grade MCU Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Automotive-grade MCU Chips Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Automotive-grade MCU Chips Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Automotive-grade MCU Chips Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Automotive-grade MCU Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Automotive-grade MCU Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Automotive-grade MCU Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Automotive-grade MCU Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Automotive-grade MCU Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Automotive-grade MCU Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Automotive-grade MCU Chips Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive-grade MCU Chips?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Automotive-grade MCU Chips?

Key companies in the market include NXP Semiconductors, Infineon Technologies, Renesas Electronics, STMicroelectronics, Texas Instruments, Bosch Semiconductors, Onsemi, Microchip Technology, AutoChips, BYD Semiconductor, C Core Technology, Chipsea Tech Shenzhen, Sino Wealth Electronic Ltd., GigaDevice, Unigroup Guoxin, Ingenic Semiconductor Co, Nuvoton, Cypress Semiconductor, Silicon Labs, ChipON, Anhui Saitong Microelectronics Co., Ltd..

3. What are the main segments of the Automotive-grade MCU Chips?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive-grade MCU Chips," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive-grade MCU Chips report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive-grade MCU Chips?

To stay informed about further developments, trends, and reports in the Automotive-grade MCU Chips, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence