Key Insights

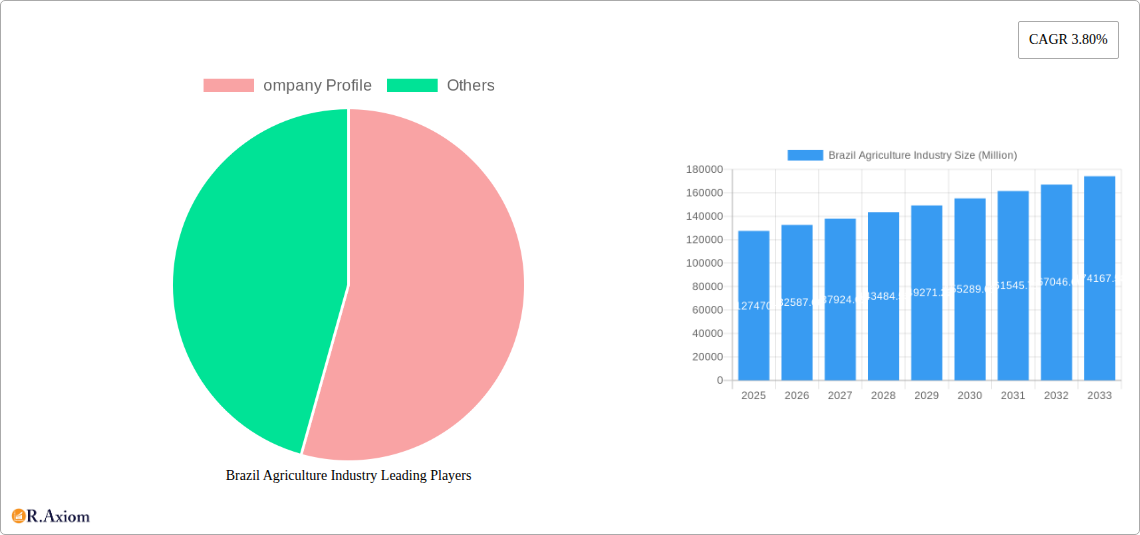

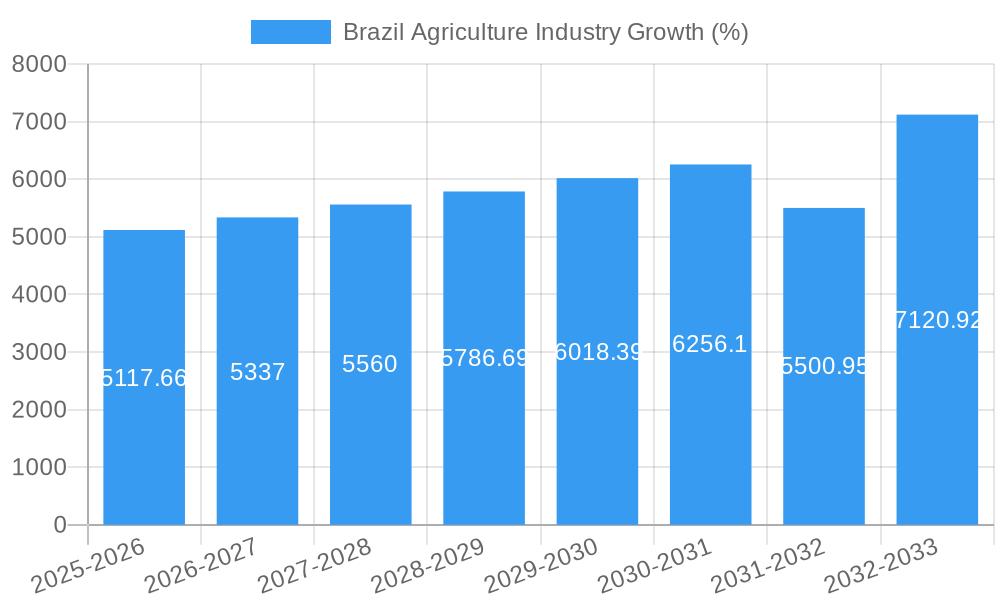

The Brazilian agriculture industry, valued at $127.47 billion in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 3.80% from 2025 to 2033. This growth is fueled by several key factors. Firstly, increasing global demand for food and agricultural products, particularly from emerging economies, presents significant export opportunities for Brazil. Secondly, advancements in agricultural technology, such as precision farming techniques and improved crop varieties, are enhancing productivity and yields. Finally, government initiatives aimed at supporting the agricultural sector, including investments in infrastructure and research and development, contribute to a favorable business environment. However, challenges remain. Climate change poses a significant risk, with increasing frequency and intensity of droughts and extreme weather events impacting crop production. Furthermore, land-use conflicts and sustainability concerns require careful management to ensure long-term industry viability. The industry is segmented into vegetables, food crops/cereals, and fruits, each contributing significantly to the overall market value and characterized by unique production, consumption, import, and export dynamics. Brazil's geographic diversity and favorable climatic conditions allow for the cultivation of a vast array of agricultural products, positioning it as a major global player in the agricultural market.

The segmentation of the Brazilian agricultural market reveals nuanced growth patterns. While precise market sizes for each segment (vegetables, food crops/cereals, and fruits) are not provided, analyzing the overall market size and CAGR allows for informed estimation. Assuming a relatively even distribution across segments, each could be reasonably valued around $42.49 billion in 2025. Further detailed analysis would require disaggregated data on production, consumption, import, and export for each segment to determine segment-specific CAGRs and identify which segments are experiencing the most rapid growth, possibly driven by factors like specific global demand shifts or technological advancements affecting particular crops. Understanding these nuances is crucial for targeted investment and strategic decision-making within the Brazilian agricultural industry.

Brazil Agriculture Industry: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the Brazilian agriculture industry, covering the period 2019-2033, with a focus on market size, segmentation, key players, and future growth prospects. It's an indispensable resource for industry stakeholders, investors, and researchers seeking actionable insights into this dynamic market. The report utilizes 2025 as the base year and offers detailed forecasts until 2033.

Keywords: Brazil agriculture, agriculture market Brazil, Brazilian farming, food crops Brazil, vegetable market Brazil, fruit market Brazil, Brazilian agriculture industry analysis, agricultural exports Brazil, agricultural imports Brazil, Brazil agribusiness, Brazilian food production, market size Brazil agriculture, Brazil agricultural technology, CAGR Brazil agriculture.

Brazil Agriculture Industry Market Concentration & Innovation

This section analyzes the market concentration within the Brazilian agriculture sector, identifying dominant players and assessing their market share. We examine the drivers of innovation, including technological advancements, regulatory changes, and consumer demand. Furthermore, the report details the impact of mergers and acquisitions (M&A) activity, providing insights into deal values and their influence on market structure. The regulatory framework governing the industry, including environmental regulations and trade policies, will be critically evaluated. Substitutes for agricultural products and their potential impact on market dynamics are also discussed. Lastly, we analyze evolving end-user trends and their implications for the industry.

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2025, with a predicted increase to xx% by 2033.

- M&A Activity: Total M&A deal value in the period 2019-2024 reached approximately USD xx Million, with an anticipated increase to USD xx Million during 2025-2033. Key drivers include consolidation and expansion into new segments.

- Innovation Drivers: Focus is on technological adoption such as precision agriculture, biotechnology, and sustainable farming practices.

- Regulatory Framework: Analysis includes the impact of environmental regulations and trade agreements on market participants.

Brazil Agriculture Industry Industry Trends & Insights

This section delves into the key trends shaping the Brazilian agriculture industry. We explore market growth drivers, such as increasing domestic and global demand, and the impact of technological disruptions, including the adoption of precision agriculture techniques and automation. Consumer preferences for sustainably produced food are examined, along with their influence on production methods and product offerings. The competitive landscape is analyzed, assessing the strategic moves of key players and their impact on market share. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected at xx%, driven by increased productivity, technological improvements, and expanding export markets. Market penetration of key technologies is also examined, focusing on adoption rates and implications.

Dominant Markets & Segments in Brazil Agriculture Industry

This section identifies the leading segments within the Brazilian agriculture industry: vegetables, food crops/cereals, and fruits. We provide a detailed analysis of each segment, including market size, domestic production and consumption, import and export volumes and values. The analysis identifies the dominant regions within Brazil for each segment.

Vegetables:

- Market Size (USD Million): 2025: USD xx Million; 2033: USD xx Million

- Domestic Production Overview: [Detailed overview including key producing regions and production volumes]

- Domestic Consumption Overview: [Detailed overview including per capita consumption and trends]

- Import Value & Volume: 2025: USD xx Million, xx tons; 2033: USD xx Million, xx tons

- Export Value & Volume: 2025: USD xx Million, xx tons; 2033: USD xx Million, xx tons

- Key Drivers: Government support for vegetable production, increasing demand from domestic and export markets, access to advanced agricultural technologies.

Food Crops/Cereals:

- Market Size (USD Million): 2025: USD xx Million; 2033: USD xx Million

- Domestic Production Overview: [Detailed overview including key producing regions and production volumes]

- Domestic Consumption Overview: [Detailed overview including per capita consumption and trends]

- Import Value & Volume: 2025: USD xx Million, xx tons; 2033: USD xx Million, xx tons

- Export Value & Volume: 2025: USD xx Million, xx tons; 2033: USD xx Million, xx tons

- Key Drivers: Strong domestic demand, favorable climatic conditions, government incentives for cereal production.

Fruits:

- Market Size (USD Million): 2025: USD xx Million; 2033: USD xx Million

- Domestic Production Overview: [Detailed overview including key producing regions and production volumes]

- Domestic Consumption Overview: [Detailed overview including per capita consumption and trends]

- Import Value & Volume: 2025: USD xx Million, xx tons; 2033: USD xx Million, xx tons

- Export Value & Volume: 2025: USD xx Million, xx tons; 2033: USD xx Million, xx tons

- Key Drivers: Growing global demand for tropical fruits, advancements in post-harvest technologies, improving logistics infrastructure.

Dominance Analysis: [Paragraph analyzing the leading regions, segments, and factors contributing to their dominance within each category].

Brazil Agriculture Industry Product Developments

Recent product developments in the Brazilian agriculture industry include the introduction of new high-yield crop varieties, improved pest and disease management strategies, and the wider adoption of precision agriculture technologies, leading to increased efficiency and reduced environmental impact. These innovations are improving product quality, enhancing profitability, and enhancing the competitiveness of Brazilian agricultural products in both domestic and international markets.

Report Scope & Segmentation Analysis

This report segments the Brazilian agriculture industry based on the types of agricultural products: vegetables, food crops/cereals, and fruits. Each segment is further analyzed based on production regions, consumption patterns, import/export dynamics, and key market drivers. Growth projections for each segment are provided for the forecast period (2025-2033). The competitive dynamics within each segment are also assessed, considering the market share of key players and their strategic initiatives.

Key Drivers of Brazil Agriculture Industry Growth

Several factors are driving the growth of the Brazilian agriculture industry. These include favorable climatic conditions, the vast arable land area, government support for agricultural development through subsidies and infrastructure improvements, and increasing domestic and global demand for agricultural products. The adoption of advanced technologies like precision agriculture and biotechnology is boosting productivity and efficiency. Furthermore, increasing investments in logistics and infrastructure are enhancing the competitiveness of Brazilian agricultural exports.

Challenges in the Brazil Agriculture Industry Sector

The Brazilian agriculture industry faces several challenges, including dependence on weather patterns, potential for environmental concerns (deforestation, water usage), limited access to credit for smallholder farmers, and infrastructure gaps in some regions, impacting transportation costs and market access. These factors pose constraints on production efficiency and profitability. Competition from other agricultural exporting countries also presents a challenge.

Emerging Opportunities in Brazil Agriculture Industry

Emerging opportunities include the increasing demand for organic and sustainably produced agricultural products, the potential for expansion into high-value crops, the growth of the biofuel industry, and further advancements in agricultural technologies such as AI-driven precision farming. The development of value-added agricultural products and expansion into niche markets also present significant opportunities for growth.

Leading Players in the Brazil Agriculture Industry Market

- [Company Name 1] Company Website

- [Company Name 2] Company Website

- [Company Name 3]

- [Company Name 4]

- [Company Name 5]

Key Developments in Brazil Agriculture Industry Industry

- 2023-Q3: Introduction of a new drought-resistant soybean variety by [Company Name].

- 2022-Q4: Merger between two major agricultural cooperatives.

- 2021-Q2: Government initiative to improve rural infrastructure launched.

- 2020-Q1: Significant investment in precision agriculture technologies by [Company Name].

Strategic Outlook for Brazil Agriculture Industry Market

The Brazilian agriculture industry is poised for continued growth over the forecast period, driven by favorable long-term trends, increasing investments in technology and infrastructure, and the growing global demand for food and agricultural products. Focus on sustainability and innovation, coupled with proactive government support, will further enhance the sector’s competitiveness and drive substantial market expansion over the next decade.

Brazil Agriculture Industry Segmentation

-

1. Food Crops / Cereals

- 1.1. Market Size (USD Million)

- 1.2. Domestic Production Overview

- 1.3. Domestic Consumption Overview

- 1.4. Import Value & Volume

- 1.5. Export Value & Volume

-

2. Fruits

- 2.1. Market Size (USD Million)

- 2.2. Domestic Production Overview

- 2.3. Domestic Consumption Overview

- 2.4. Import Value & Volume

- 2.5. Export Value & Volume

-

3. Vegetables

- 3.1. Market Size (USD Million)

- 3.2. Domestic Production Overview

- 3.3. Domestic Consumption Overview

- 3.4. Import Value & Volume

- 3.5. Export Value & Volume

-

4. Food Crops / Cereals

- 4.1. Market Size (USD Million)

- 4.2. Domestic Production Overview

- 4.3. Domestic Consumption Overview

- 4.4. Import Value & Volume

- 4.5. Export Value & Volume

-

5. Fruits

- 5.1. Market Size (USD Million)

- 5.2. Domestic Production Overview

- 5.3. Domestic Consumption Overview

- 5.4. Import Value & Volume

- 5.5. Export Value & Volume

-

6. Vegetables

- 6.1. Market Size (USD Million)

- 6.2. Domestic Production Overview

- 6.3. Domestic Consumption Overview

- 6.4. Import Value & Volume

- 6.5. Export Value & Volume

Brazil Agriculture Industry Segmentation By Geography

- 1. Brazil

Brazil Agriculture Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Berry Consumption for Health Benefits; Increasing Adoption of High-Technology Farm Practices; Growing Usage of Berries in the Food and Beverage Industries

- 3.3. Market Restrains

- 3.3.1. High Production Cost Involved in Berry Production; Increasing Disease and Pest Infestations

- 3.4. Market Trends

- 3.4.1. Higher Adoption of GM Crops and High Yielding Variety Seeds

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Agriculture Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Food Crops / Cereals

- 5.1.1. Market Size (USD Million)

- 5.1.2. Domestic Production Overview

- 5.1.3. Domestic Consumption Overview

- 5.1.4. Import Value & Volume

- 5.1.5. Export Value & Volume

- 5.2. Market Analysis, Insights and Forecast - by Fruits

- 5.2.1. Market Size (USD Million)

- 5.2.2. Domestic Production Overview

- 5.2.3. Domestic Consumption Overview

- 5.2.4. Import Value & Volume

- 5.2.5. Export Value & Volume

- 5.3. Market Analysis, Insights and Forecast - by Vegetables

- 5.3.1. Market Size (USD Million)

- 5.3.2. Domestic Production Overview

- 5.3.3. Domestic Consumption Overview

- 5.3.4. Import Value & Volume

- 5.3.5. Export Value & Volume

- 5.4. Market Analysis, Insights and Forecast - by Food Crops / Cereals

- 5.4.1. Market Size (USD Million)

- 5.4.2. Domestic Production Overview

- 5.4.3. Domestic Consumption Overview

- 5.4.4. Import Value & Volume

- 5.4.5. Export Value & Volume

- 5.5. Market Analysis, Insights and Forecast - by Fruits

- 5.5.1. Market Size (USD Million)

- 5.5.2. Domestic Production Overview

- 5.5.3. Domestic Consumption Overview

- 5.5.4. Import Value & Volume

- 5.5.5. Export Value & Volume

- 5.6. Market Analysis, Insights and Forecast - by Vegetables

- 5.6.1. Market Size (USD Million)

- 5.6.2. Domestic Production Overview

- 5.6.3. Domestic Consumption Overview

- 5.6.4. Import Value & Volume

- 5.6.5. Export Value & Volume

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Food Crops / Cereals

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1. ompany Profile

List of Figures

- Figure 1: Brazil Agriculture Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Agriculture Industry Share (%) by Company 2024

List of Tables

- Table 1: Brazil Agriculture Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Agriculture Industry Revenue Million Forecast, by Food Crops / Cereals 2019 & 2032

- Table 3: Brazil Agriculture Industry Revenue Million Forecast, by Fruits 2019 & 2032

- Table 4: Brazil Agriculture Industry Revenue Million Forecast, by Vegetables 2019 & 2032

- Table 5: Brazil Agriculture Industry Revenue Million Forecast, by Food Crops / Cereals 2019 & 2032

- Table 6: Brazil Agriculture Industry Revenue Million Forecast, by Fruits 2019 & 2032

- Table 7: Brazil Agriculture Industry Revenue Million Forecast, by Vegetables 2019 & 2032

- Table 8: Brazil Agriculture Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 9: Brazil Agriculture Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Brazil Agriculture Industry Revenue Million Forecast, by Food Crops / Cereals 2019 & 2032

- Table 11: Brazil Agriculture Industry Revenue Million Forecast, by Fruits 2019 & 2032

- Table 12: Brazil Agriculture Industry Revenue Million Forecast, by Vegetables 2019 & 2032

- Table 13: Brazil Agriculture Industry Revenue Million Forecast, by Food Crops / Cereals 2019 & 2032

- Table 14: Brazil Agriculture Industry Revenue Million Forecast, by Fruits 2019 & 2032

- Table 15: Brazil Agriculture Industry Revenue Million Forecast, by Vegetables 2019 & 2032

- Table 16: Brazil Agriculture Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Agriculture Industry?

The projected CAGR is approximately 3.80%.

2. Which companies are prominent players in the Brazil Agriculture Industry?

Key companies in the market include ompany Profile.

3. What are the main segments of the Brazil Agriculture Industry?

The market segments include Food Crops / Cereals, Fruits, Vegetables, Food Crops / Cereals, Fruits, Vegetables.

4. Can you provide details about the market size?

The market size is estimated to be USD 127.47 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Berry Consumption for Health Benefits; Increasing Adoption of High-Technology Farm Practices; Growing Usage of Berries in the Food and Beverage Industries.

6. What are the notable trends driving market growth?

Higher Adoption of GM Crops and High Yielding Variety Seeds.

7. Are there any restraints impacting market growth?

High Production Cost Involved in Berry Production; Increasing Disease and Pest Infestations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Agriculture Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Agriculture Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Agriculture Industry?

To stay informed about further developments, trends, and reports in the Brazil Agriculture Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence