Key Insights

The GCC (Gulf Cooperation Council) green cement market is demonstrating substantial growth, propelled by stringent environmental regulations mandating reduced carbon emissions in construction. Growing awareness of traditional cement's environmental impact is driving demand for sustainable alternatives. Government initiatives promoting green infrastructure and building projects are significantly accelerating market expansion. Extensive infrastructure development, notably in Saudi Arabia and the UAE, requires substantial cement volumes, presenting a considerable opportunity for green cement manufacturers. Despite potentially higher initial costs, the long-term economic advantages of reduced carbon footprints and enhanced durability are fostering adoption. Innovations in green cement production, including the utilization of supplementary cementitious materials (SCMs) like fly ash and slag, are further contributing to market growth. Key challenges include raw material availability and cost, alongside the necessity for increased market education.

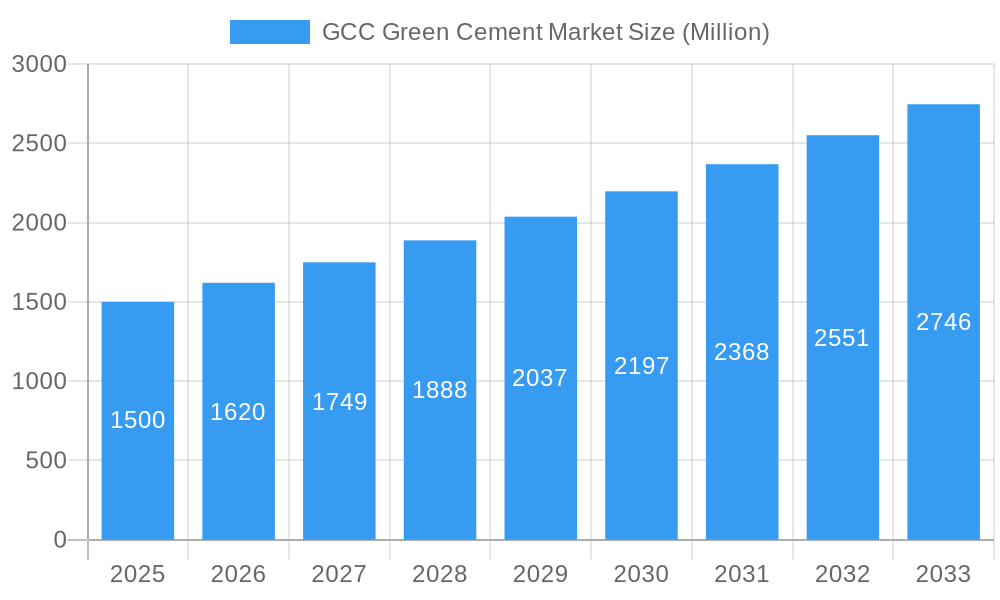

GCC Green Cement Market Market Size (In Million)

The market is segmented by cement type (e.g., Portland limestone cement, geopolymer cement), application (residential, commercial, infrastructure), and geographical presence across GCC nations. Leading companies such as CEMEX, Holcim, and UltraTech Cement are investing heavily in R&D to enhance green cement technologies and broaden market reach. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of 8.9%, indicating a robust outlook from 2025 to 2033. Growth is expected to be particularly pronounced in countries with ambitious national development plans and a strong focus on sustainable urban development. While challenges concerning raw material sourcing and initial capital investment persist, the GCC green cement market's long-term prospects are exceptionally positive, driven by the increasing emphasis on environmental sustainability and vigorous regional construction activity.

GCC Green Cement Market Company Market Share

This comprehensive report analyzes the GCC Green Cement Market from 2019 to 2033, offering critical insights into market dynamics, competitive landscapes, and future growth trajectories. Utilizing extensive primary and secondary research, including data from key industry players, publications, and governmental sources, this report empowers stakeholders to make informed strategic decisions. The base year for this analysis is 2025, with market size estimations for 2025 and projections extending to 2033, encompassing the historical period of 2019-2024. The projected market size for 2025 is 1.15 million.

GCC Green Cement Market Concentration & Innovation

This section analyzes the GCC green cement market's competitive landscape, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities. The market is moderately concentrated, with several major players holding significant shares. However, the emergence of innovative startups and technological advancements is fostering a dynamic competitive environment.

- Market Share: The top 5 players collectively hold approximately xx% of the market share in 2025, with UltraTech Cement Ltd. and HOLCIM anticipated to be among the leaders. Precise market share figures require further research.

- Innovation Drivers: Stringent environmental regulations, increasing awareness of carbon footprint reduction, and advancements in green cement technology are key drivers for innovation. The push for sustainable construction is a major force.

- Regulatory Frameworks: Government initiatives promoting sustainable construction and stricter emission standards are driving market growth. Specific policies vary by country but overall aim to incentivize green cement adoption.

- Product Substitutes: Traditional Portland cement remains a significant substitute, but its environmental impact is pushing many towards greener alternatives. The competitiveness of substitutes depends greatly on price differentials and regulatory frameworks.

- End-User Trends: The construction sector’s growing demand for eco-friendly materials and building practices is fueling market expansion. Government infrastructure projects are also significant drivers.

- M&A Activities: The past five years have seen xx M&A deals in the GCC green cement market, with an estimated total value of xx Million. These transactions have primarily focused on technological acquisitions and expansion into new markets. Examples are not available at this time.

GCC Green Cement Market Industry Trends & Insights

This section delves into the key trends and insights shaping the GCC green cement market. The market is experiencing significant growth driven by several factors, including:

The GCC green cement market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is attributed to several factors: increasing government support for sustainable construction, rising environmental concerns, and technological advancements in green cement production. Market penetration of green cement is expected to reach xx% by 2033. The increasing awareness amongst consumers of the environmental impact of traditional cement is a driving factor. Competitive dynamics are shaped by technological innovation, pricing strategies, and brand reputation. Technological disruptions include advancements in low-carbon clinker production and the development of alternative binder materials. The shift in consumer preferences towards sustainable construction significantly impacts market dynamics.

Dominant Markets & Segments in GCC Green Cement Market

This section identifies the leading regions, countries, and segments within the GCC green cement market. While detailed data necessitates further analysis, it is anticipated that Saudi Arabia and the UAE will likely represent the most significant national markets due to large-scale infrastructure projects and a strong push for sustainability.

- Key Drivers in Dominant Markets:

- Saudi Arabia: Vision 2030's focus on sustainable development and massive infrastructure investments.

- UAE: Strong emphasis on green building initiatives and a commitment to carbon neutrality targets.

- Other GCC countries: Government regulations and policies promoting sustainable construction practices.

The detailed dominance analysis would require access to specific sales figures and market share data for each country and segment.

GCC Green Cement Market Product Developments

Recent product innovations focus on reducing carbon emissions during cement production through the use of alternative materials, such as industrial byproducts and waste materials. These innovations aim to improve the environmental performance of green cement while maintaining strength and durability, enhancing market competitiveness. The development of new applications for green cement in various construction projects and infrastructure projects also contributes to market growth.

Report Scope & Segmentation Analysis

This report segments the GCC green cement market by type (e.g., Portland cement, blended cement), application (e.g., residential, commercial, infrastructure), and country. Growth projections, market sizes, and competitive dynamics are analyzed for each segment. More detailed information on individual segments is available in the full report.

Key Drivers of GCC Green Cement Market Growth

Several factors drive the growth of the GCC green cement market. These include:

- Stringent environmental regulations: Governments are increasingly implementing strict regulations to reduce carbon emissions, pushing the adoption of green cement.

- Rising environmental awareness: Consumers and businesses are becoming more aware of the environmental impact of traditional cement, leading to a preference for sustainable alternatives.

- Technological advancements: Innovations in green cement production are reducing costs and improving the performance of green cement products.

Challenges in the GCC Green Cement Market Sector

Despite significant growth potential, several challenges hinder the GCC green cement market's expansion. These include:

- High initial investment costs: Setting up green cement production facilities requires substantial upfront investment.

- Limited availability of raw materials: Finding suitable alternative materials for cement production can be challenging.

- Competition from traditional cement: Traditional cement remains significantly cheaper than green cement.

Emerging Opportunities in GCC Green Cement Market

The GCC green cement market presents various emerging opportunities. These include:

- Growing demand from infrastructure projects: Large-scale infrastructure projects across the GCC region create substantial demand for green cement.

- Development of innovative technologies: Advancements in green cement production technologies are continually reducing costs and improving performance.

- Expansion into new applications: Green cement is finding applications beyond traditional construction, such as in precast concrete elements and 3D-printed construction.

Leading Players in the GCC Green Cement Market Market

- CEMEX S A B de C V

- DUCON INDUSTRIES

- Green Cement Factory

- JSW Cement

- Raysut Cement Company

- HOLCIM

- Hoffmann Green Cement Technologies

- Heidelberg Materials

- Sharjah Cement & Industrial Development Co

- UltraTech Cement Ltd

- Kiran Global Chem Limited

- List Not Exhaustive

Key Developments in GCC Green Cement Market Industry

- June 2023: Hoffmann Green Cement Technologies partnered with Shurfah Holding to produce green cement in Saudi Arabia, with plans to build four new production units starting in 2024.

- December 2023: Hoffmann Green Cement Technologies extended its partnership with the Centre Scientifique et Technique du Bâtiment (CSTB) for three more years.

Strategic Outlook for GCC Green Cement Market Market

The GCC green cement market holds significant long-term growth potential. Continued government support for sustainable construction, increasing consumer awareness of environmental issues, and ongoing technological advancements will drive market expansion. The strategic focus should be on innovation, cost reduction, and building strong partnerships to capture the market's significant growth opportunities.

GCC Green Cement Market Segmentation

-

1. Product Type

- 1.1. Fly Ash-based

- 1.2. Slag-based

- 1.3. Limestone-based

- 1.4. Silica fume-based

- 1.5. Other Pr

-

2. Construction Sector

- 2.1. Residential

- 2.2. Non-residential

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. United Arab Emirates

- 3.3. Qatar

- 3.4. Rest of GCC

GCC Green Cement Market Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. Qatar

- 4. Rest of GCC

GCC Green Cement Market Regional Market Share

Geographic Coverage of GCC Green Cement Market

GCC Green Cement Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Construction Activities in GCC Countries; Favorable Government Policies for Green Building Construction; Abundance of Availability of Raw Materials

- 3.3. Market Restrains

- 3.3.1. Growing Construction Activities in GCC Countries; Favorable Government Policies for Green Building Construction; Abundance of Availability of Raw Materials

- 3.4. Market Trends

- 3.4.1. Residential Construction to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Green Cement Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Fly Ash-based

- 5.1.2. Slag-based

- 5.1.3. Limestone-based

- 5.1.4. Silica fume-based

- 5.1.5. Other Pr

- 5.2. Market Analysis, Insights and Forecast - by Construction Sector

- 5.2.1. Residential

- 5.2.2. Non-residential

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. United Arab Emirates

- 5.3.3. Qatar

- 5.3.4. Rest of GCC

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. Qatar

- 5.4.4. Rest of GCC

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Saudi Arabia GCC Green Cement Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Fly Ash-based

- 6.1.2. Slag-based

- 6.1.3. Limestone-based

- 6.1.4. Silica fume-based

- 6.1.5. Other Pr

- 6.2. Market Analysis, Insights and Forecast - by Construction Sector

- 6.2.1. Residential

- 6.2.2. Non-residential

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. United Arab Emirates

- 6.3.3. Qatar

- 6.3.4. Rest of GCC

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Arab Emirates GCC Green Cement Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Fly Ash-based

- 7.1.2. Slag-based

- 7.1.3. Limestone-based

- 7.1.4. Silica fume-based

- 7.1.5. Other Pr

- 7.2. Market Analysis, Insights and Forecast - by Construction Sector

- 7.2.1. Residential

- 7.2.2. Non-residential

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. United Arab Emirates

- 7.3.3. Qatar

- 7.3.4. Rest of GCC

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Qatar GCC Green Cement Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Fly Ash-based

- 8.1.2. Slag-based

- 8.1.3. Limestone-based

- 8.1.4. Silica fume-based

- 8.1.5. Other Pr

- 8.2. Market Analysis, Insights and Forecast - by Construction Sector

- 8.2.1. Residential

- 8.2.2. Non-residential

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. United Arab Emirates

- 8.3.3. Qatar

- 8.3.4. Rest of GCC

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of GCC GCC Green Cement Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Fly Ash-based

- 9.1.2. Slag-based

- 9.1.3. Limestone-based

- 9.1.4. Silica fume-based

- 9.1.5. Other Pr

- 9.2. Market Analysis, Insights and Forecast - by Construction Sector

- 9.2.1. Residential

- 9.2.2. Non-residential

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Saudi Arabia

- 9.3.2. United Arab Emirates

- 9.3.3. Qatar

- 9.3.4. Rest of GCC

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 CEMEX S A B de C V

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 DUCON INDUSTRIES

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Green Cement Factory

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 JSW Cement

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Raysut Cement Company

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 HOLCIM

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Hoffmann Green Cement Technologies

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Heidelberg Materials

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Sharjah Cement & Industrial Development Co

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 UltraTech Cement Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Kiran Global Chem Limited*List Not Exhaustive

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 CEMEX S A B de C V

List of Figures

- Figure 1: Global GCC Green Cement Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Saudi Arabia GCC Green Cement Market Revenue (million), by Product Type 2025 & 2033

- Figure 3: Saudi Arabia GCC Green Cement Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Saudi Arabia GCC Green Cement Market Revenue (million), by Construction Sector 2025 & 2033

- Figure 5: Saudi Arabia GCC Green Cement Market Revenue Share (%), by Construction Sector 2025 & 2033

- Figure 6: Saudi Arabia GCC Green Cement Market Revenue (million), by Geography 2025 & 2033

- Figure 7: Saudi Arabia GCC Green Cement Market Revenue Share (%), by Geography 2025 & 2033

- Figure 8: Saudi Arabia GCC Green Cement Market Revenue (million), by Country 2025 & 2033

- Figure 9: Saudi Arabia GCC Green Cement Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: United Arab Emirates GCC Green Cement Market Revenue (million), by Product Type 2025 & 2033

- Figure 11: United Arab Emirates GCC Green Cement Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: United Arab Emirates GCC Green Cement Market Revenue (million), by Construction Sector 2025 & 2033

- Figure 13: United Arab Emirates GCC Green Cement Market Revenue Share (%), by Construction Sector 2025 & 2033

- Figure 14: United Arab Emirates GCC Green Cement Market Revenue (million), by Geography 2025 & 2033

- Figure 15: United Arab Emirates GCC Green Cement Market Revenue Share (%), by Geography 2025 & 2033

- Figure 16: United Arab Emirates GCC Green Cement Market Revenue (million), by Country 2025 & 2033

- Figure 17: United Arab Emirates GCC Green Cement Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Qatar GCC Green Cement Market Revenue (million), by Product Type 2025 & 2033

- Figure 19: Qatar GCC Green Cement Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Qatar GCC Green Cement Market Revenue (million), by Construction Sector 2025 & 2033

- Figure 21: Qatar GCC Green Cement Market Revenue Share (%), by Construction Sector 2025 & 2033

- Figure 22: Qatar GCC Green Cement Market Revenue (million), by Geography 2025 & 2033

- Figure 23: Qatar GCC Green Cement Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Qatar GCC Green Cement Market Revenue (million), by Country 2025 & 2033

- Figure 25: Qatar GCC Green Cement Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of GCC GCC Green Cement Market Revenue (million), by Product Type 2025 & 2033

- Figure 27: Rest of GCC GCC Green Cement Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Rest of GCC GCC Green Cement Market Revenue (million), by Construction Sector 2025 & 2033

- Figure 29: Rest of GCC GCC Green Cement Market Revenue Share (%), by Construction Sector 2025 & 2033

- Figure 30: Rest of GCC GCC Green Cement Market Revenue (million), by Geography 2025 & 2033

- Figure 31: Rest of GCC GCC Green Cement Market Revenue Share (%), by Geography 2025 & 2033

- Figure 32: Rest of GCC GCC Green Cement Market Revenue (million), by Country 2025 & 2033

- Figure 33: Rest of GCC GCC Green Cement Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GCC Green Cement Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Global GCC Green Cement Market Revenue million Forecast, by Construction Sector 2020 & 2033

- Table 3: Global GCC Green Cement Market Revenue million Forecast, by Geography 2020 & 2033

- Table 4: Global GCC Green Cement Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global GCC Green Cement Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 6: Global GCC Green Cement Market Revenue million Forecast, by Construction Sector 2020 & 2033

- Table 7: Global GCC Green Cement Market Revenue million Forecast, by Geography 2020 & 2033

- Table 8: Global GCC Green Cement Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: Global GCC Green Cement Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 10: Global GCC Green Cement Market Revenue million Forecast, by Construction Sector 2020 & 2033

- Table 11: Global GCC Green Cement Market Revenue million Forecast, by Geography 2020 & 2033

- Table 12: Global GCC Green Cement Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: Global GCC Green Cement Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 14: Global GCC Green Cement Market Revenue million Forecast, by Construction Sector 2020 & 2033

- Table 15: Global GCC Green Cement Market Revenue million Forecast, by Geography 2020 & 2033

- Table 16: Global GCC Green Cement Market Revenue million Forecast, by Country 2020 & 2033

- Table 17: Global GCC Green Cement Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 18: Global GCC Green Cement Market Revenue million Forecast, by Construction Sector 2020 & 2033

- Table 19: Global GCC Green Cement Market Revenue million Forecast, by Geography 2020 & 2033

- Table 20: Global GCC Green Cement Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Green Cement Market?

The projected CAGR is approximately 8.9%.

2. Which companies are prominent players in the GCC Green Cement Market?

Key companies in the market include CEMEX S A B de C V, DUCON INDUSTRIES, Green Cement Factory, JSW Cement, Raysut Cement Company, HOLCIM, Hoffmann Green Cement Technologies, Heidelberg Materials, Sharjah Cement & Industrial Development Co, UltraTech Cement Ltd, Kiran Global Chem Limited*List Not Exhaustive.

3. What are the main segments of the GCC Green Cement Market?

The market segments include Product Type, Construction Sector, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.15 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Construction Activities in GCC Countries; Favorable Government Policies for Green Building Construction; Abundance of Availability of Raw Materials.

6. What are the notable trends driving market growth?

Residential Construction to Dominate the Market.

7. Are there any restraints impacting market growth?

Growing Construction Activities in GCC Countries; Favorable Government Policies for Green Building Construction; Abundance of Availability of Raw Materials.

8. Can you provide examples of recent developments in the market?

December 2023: Hoffmann Green Cement Technologies announced that the partnership contract signed in 2021 with the Centre Scientifique et Technique du Bâtiment (CSTB) has been extended for a further three years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Green Cement Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Green Cement Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Green Cement Market?

To stay informed about further developments, trends, and reports in the GCC Green Cement Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence