Key Insights

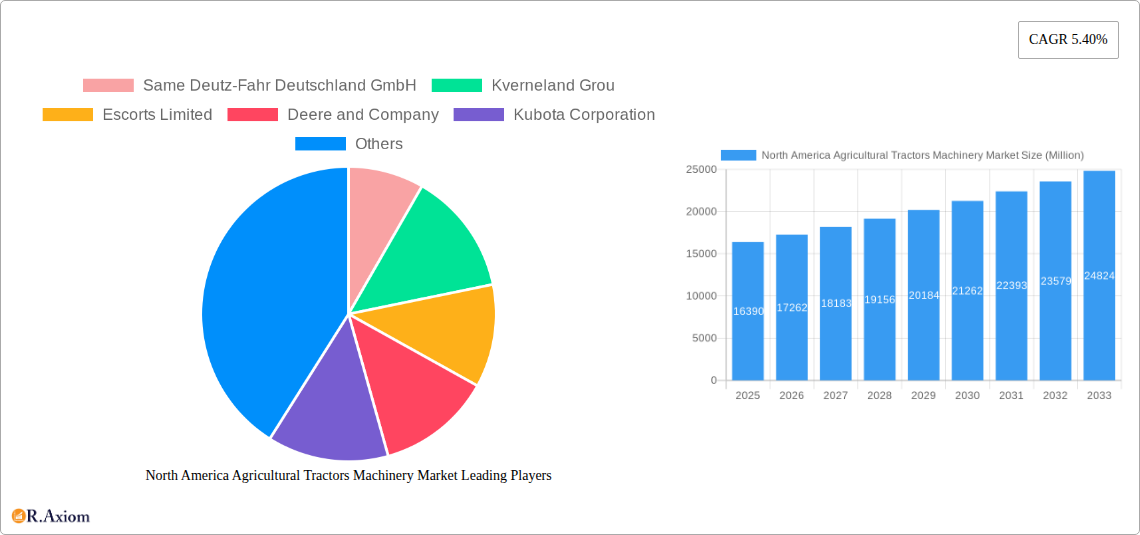

The North America agricultural tractors machinery market, valued at $16.39 billion in 2025, is projected to experience robust growth, driven by several key factors. Increased demand for efficient and technologically advanced farming equipment, fueled by a growing global population and the need for higher crop yields, is a primary driver. Precision farming technologies, such as GPS-guided tractors and automated systems, are gaining traction, improving operational efficiency and reducing labor costs. Furthermore, government initiatives promoting sustainable agricultural practices and investments in agricultural infrastructure are contributing to market expansion. The market is segmented by horsepower (Below 40 HP, 40-100 HP, Above 100 HP) and drive type (4WD), with the higher horsepower segments likely experiencing faster growth due to the increasing scale of modern farms. Key players like Deere & Company, Kubota Corporation, and Mahindra & Mahindra Ltd. are competing through product innovation, strategic partnerships, and geographic expansion. The North American market, comprising the United States, Canada, and Mexico, represents a significant share of the global market, benefiting from a relatively advanced agricultural sector and strong government support for technological upgrades in farming.

North America Agricultural Tractors Machinery Market Market Size (In Billion)

However, market growth faces certain challenges. High initial investment costs for advanced machinery can be a barrier for smaller farms, potentially limiting market penetration. Fluctuations in commodity prices and weather patterns also influence demand for agricultural equipment. Furthermore, competition from established players and the emergence of new entrants is intensifying, impacting profitability and market share. Despite these restraints, the long-term outlook for the North American agricultural tractors machinery market remains positive, driven by the continuous technological advancements and the rising demand for efficient and sustainable agricultural practices. The forecast period (2025-2033) promises significant growth opportunities for established players and innovative entrants alike, especially those catering to precision farming technologies and specialized tractor models.

North America Agricultural Tractors Machinery Market Company Market Share

North America Agricultural Tractors Machinery Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America Agricultural Tractors Machinery Market, covering the period from 2019 to 2033. It offers invaluable insights for industry stakeholders, investors, and market researchers seeking to understand the current market dynamics and future growth prospects. The report incorporates extensive data analysis, industry trends, and expert opinions to deliver actionable intelligence. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

North America Agricultural Tractors Machinery Market Concentration & Innovation

This section analyzes the competitive landscape of the North American agricultural tractor market, focusing on market concentration, innovation, regulations, and industry activities. The market is characterized by a moderately consolidated structure with key players such as Deere & Company, AGCO Corp, and CNH Industrial NV holding significant market share. Precise market share figures for 2024 are currently unavailable, but estimates place Deere & Company at approximately xx% and AGCO Corp at approximately xx%. The remaining market share is distributed among other significant players and smaller companies.

- Innovation Drivers: Technological advancements, such as precision farming technologies (GPS guidance, auto-steer), automation, and the increasing adoption of electric and autonomous tractors, are driving significant innovation in the market. The integration of IoT (Internet of Things) and data analytics further enhances operational efficiency and yields.

- Regulatory Framework: Government regulations concerning emissions, safety, and fuel efficiency significantly impact tractor design and manufacturing. Compliance costs and technological adaptations form a substantial part of the market's operational expenses.

- Product Substitutes: While direct substitutes for tractors are limited, alternative farming practices and labor-intensive methods remain relevant, especially for small-scale operations. However, the overall trend favors tractor adoption due to efficiency gains.

- End-User Trends: The growing demand for high-efficiency, technologically advanced tractors from large-scale commercial farms and the increasing adoption of tractors in smaller farms drive market growth. This is further fueled by rising labor costs and the need for increased productivity.

- M&A Activities: The sector has witnessed several mergers and acquisitions in recent years, with deal values ranging from xx Million to xx Million. These activities indicate consolidation and a drive for technological integration within the market.

North America Agricultural Tractors Machinery Market Industry Trends & Insights

The North American agricultural tractors machinery market is experiencing robust growth driven by several factors. The increasing adoption of precision farming techniques is boosting demand for technologically advanced tractors. Favorable government policies supporting agricultural modernization and increased investments in agricultural infrastructure are contributing to market expansion. Furthermore, rising food demand due to population growth necessitates increased agricultural output, fueling the need for efficient farm machinery. The market has witnessed a significant increase in the use of data analytics and precision farming technologies, leading to improved efficiency and crop yields. This has fueled a positive feedback loop, further increasing the demand for advanced agricultural equipment. The average growth rate (CAGR) from 2019-2024 was approximately xx%, indicating a healthy growth trajectory. The market penetration of advanced technologies like GPS guidance systems and auto-steer capabilities is steadily increasing, with estimates suggesting penetration levels exceeding xx% in 2024. The competitive landscape is characterized by intense rivalry among major players, leading to technological innovation and pricing pressures.

Dominant Markets & Segments in North America Agricultural Tractors Machinery Market

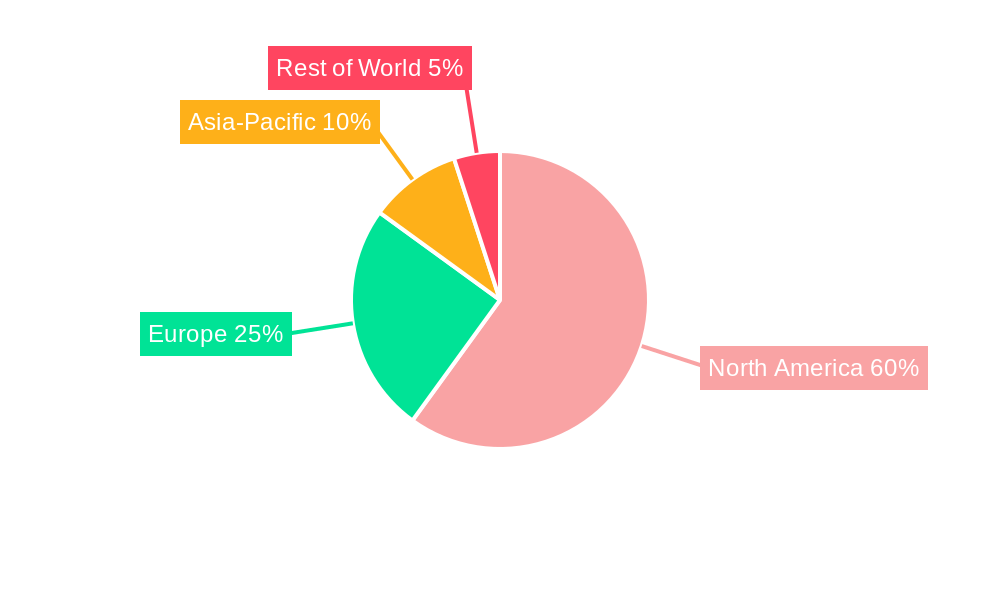

The United States dominates the North American agricultural tractors machinery market, owing to its extensive agricultural land, large-scale farming operations, and significant investments in agricultural technology. Canada also contributes substantially but on a smaller scale.

- Segment Dominance:

- Above 100 HP: This segment commands the largest market share due to the prevalence of large-scale farms in North America requiring high-power tractors.

- 4WD Farm Tractors: The demand for 4WD tractors is significant, particularly in regions with challenging terrains and wet conditions.

- Key Drivers (US):

- Economic Policies: Government subsidies and support for agricultural modernization significantly drive market growth.

- Infrastructure: Well-developed agricultural infrastructure, including efficient transportation networks, facilitates the widespread adoption of agricultural machinery.

- Technological Advancements: The continuous advancement of farming technologies like precision agriculture and automation increases the adoption of advanced tractors.

The dominance of the US market is likely to continue due to its large agricultural sector, favorable policies, and technological advancements.

North America Agricultural Tractors Machinery Market Product Developments

Recent product developments in the North American agricultural tractors market are focused on enhancing efficiency, precision, and sustainability. Manufacturers are incorporating advanced technologies like GPS-guided systems, auto-steer capabilities, and telematics for improved operational management. Electric and autonomous tractors are also emerging as significant technological developments, offering solutions for reducing environmental impact and enhancing labor efficiency. These developments cater to the growing demands for sustainability and precise control in modern agriculture, offering competitive advantages in terms of efficiency and reduced operating costs. This results in increased yield and reduced environmental impact, appealing to both large-scale and smaller farms.

Report Scope & Segmentation Analysis

This report segments the North American agricultural tractors market based on tractor horsepower: Below 40 HP, 40-100 HP, Above 100 HP, and 4WD Farm Tractors.

- Below 40 HP: This segment caters to small-scale farmers and specialized applications, with growth projections moderately slower than other segments.

- 40-100 HP: This segment witnesses significant demand from medium-sized farms and represents a substantial market share. Growth is expected to be relatively stable.

- Above 100 HP: This high-power segment is dominated by large-scale farms and exhibits strong growth prospects due to the increasing demand for high-efficiency machinery.

- 4WD Farm Tractors: Growth is driven by the need for tractors capable of handling challenging terrains and wet conditions. This segment has a sizable market share.

Each segment's competitive dynamics are analyzed in detail within the report.

Key Drivers of North America Agricultural Tractors Machinery Market Growth

Several factors drive growth in the North American agricultural tractors market: increased demand for food and agricultural products, the rising adoption of precision farming technologies, government support for agricultural modernization, and the growing need for efficient farming practices. Favorable government policies, including subsidies and investment incentives, further stimulate market expansion. The increasing adoption of high-tech tractors coupled with improved yield and productivity serves as another key driver.

Challenges in the North America Agricultural Tractors Machinery Market Sector

The North American agricultural tractors market faces challenges such as high initial investment costs for advanced tractors, potential supply chain disruptions impacting the availability of components, and the intense competition among established players. Fluctuations in raw material prices also affect the cost of production and impact profitability. Meeting stringent environmental regulations adds to the operational complexity and cost for manufacturers.

Emerging Opportunities in North America Agricultural Tractors Machinery Market

The market offers opportunities in the development and adoption of electric and autonomous tractors, the integration of advanced data analytics and precision farming technologies, and the expansion into niche markets such as vineyards and orchards. The rising interest in sustainable agriculture and the growing demand for higher yields provide significant opportunities for innovation and market expansion.

Leading Players in the North America Agricultural Tractors Machinery Market Market

Key Developments in North America Agricultural Tractors Machinery Industry

- March 2021: CNH Industrial NV partnered with Monarch Tractor to advance electric and autonomous tractor technologies, highlighting the shift towards sustainable and efficient farming.

- November 2022: John Deere launched the 5EN and 5ML Series specialty tractors, demonstrating continuous innovation in meeting the needs of diverse farming operations.

- January 2023: John Deere's partnership with Microsoft aims to enhance dealer efficiency and customer service through technology integration, showcasing the importance of digital transformation within the industry.

Strategic Outlook for North America Agricultural Tractors Machinery Market Market

The North American agricultural tractors market is poised for sustained growth, driven by technological advancements, favorable government policies, and the increasing demand for efficient and sustainable farming practices. The adoption of electric and autonomous tractors, coupled with precision farming technologies, will significantly shape the market's future. Companies focusing on innovation, sustainability, and customer-centric solutions are well-positioned to capitalize on the market's growth potential.

North America Agricultural Tractors Machinery Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North America Agricultural Tractors Machinery Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Agricultural Tractors Machinery Market Regional Market Share

Geographic Coverage of North America Agricultural Tractors Machinery Market

North America Agricultural Tractors Machinery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shortage of Skilled Labor; Government Support to Enhance Farm Mechanization

- 3.3. Market Restrains

- 3.3.1. Heavy Initial Procurement Cost and High Expenditure on Maintenance

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of Farm Mechanization and Shortage of Labor

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Agricultural Tractors Machinery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Same Deutz-Fahr Deutschland GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kverneland Grou

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Escorts Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Deere and Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kubota Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tractors and Farm Equipment Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AGCO Corp

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CNH Industrial NV

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mahindra & Mahindra Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Claas KGaA mbH

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Same Deutz-Fahr Deutschland GmbH

List of Figures

- Figure 1: North America Agricultural Tractors Machinery Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Agricultural Tractors Machinery Market Share (%) by Company 2025

List of Tables

- Table 1: North America Agricultural Tractors Machinery Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: North America Agricultural Tractors Machinery Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: North America Agricultural Tractors Machinery Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: North America Agricultural Tractors Machinery Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: North America Agricultural Tractors Machinery Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: North America Agricultural Tractors Machinery Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: North America Agricultural Tractors Machinery Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: North America Agricultural Tractors Machinery Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: North America Agricultural Tractors Machinery Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: North America Agricultural Tractors Machinery Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: North America Agricultural Tractors Machinery Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: North America Agricultural Tractors Machinery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States North America Agricultural Tractors Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada North America Agricultural Tractors Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico North America Agricultural Tractors Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Agricultural Tractors Machinery Market?

The projected CAGR is approximately 5.40%.

2. Which companies are prominent players in the North America Agricultural Tractors Machinery Market?

Key companies in the market include Same Deutz-Fahr Deutschland GmbH, Kverneland Grou, Escorts Limited, Deere and Company, Kubota Corporation, Tractors and Farm Equipment Ltd, AGCO Corp, CNH Industrial NV, Mahindra & Mahindra Ltd, Claas KGaA mbH.

3. What are the main segments of the North America Agricultural Tractors Machinery Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.39 Million as of 2022.

5. What are some drivers contributing to market growth?

Shortage of Skilled Labor; Government Support to Enhance Farm Mechanization.

6. What are the notable trends driving market growth?

Increasing Adoption of Farm Mechanization and Shortage of Labor.

7. Are there any restraints impacting market growth?

Heavy Initial Procurement Cost and High Expenditure on Maintenance.

8. Can you provide examples of recent developments in the market?

January 2023: John Deere partnered with Microsoft to bring new value and efficiencies to John Deere Dealers. The system will provide a common technology platform for many aspects of a tractor dealer's business, enabling new opportunities for growth, innovation, and customer insights for dealers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Agricultural Tractors Machinery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Agricultural Tractors Machinery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Agricultural Tractors Machinery Market?

To stay informed about further developments, trends, and reports in the North America Agricultural Tractors Machinery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence