Key Insights

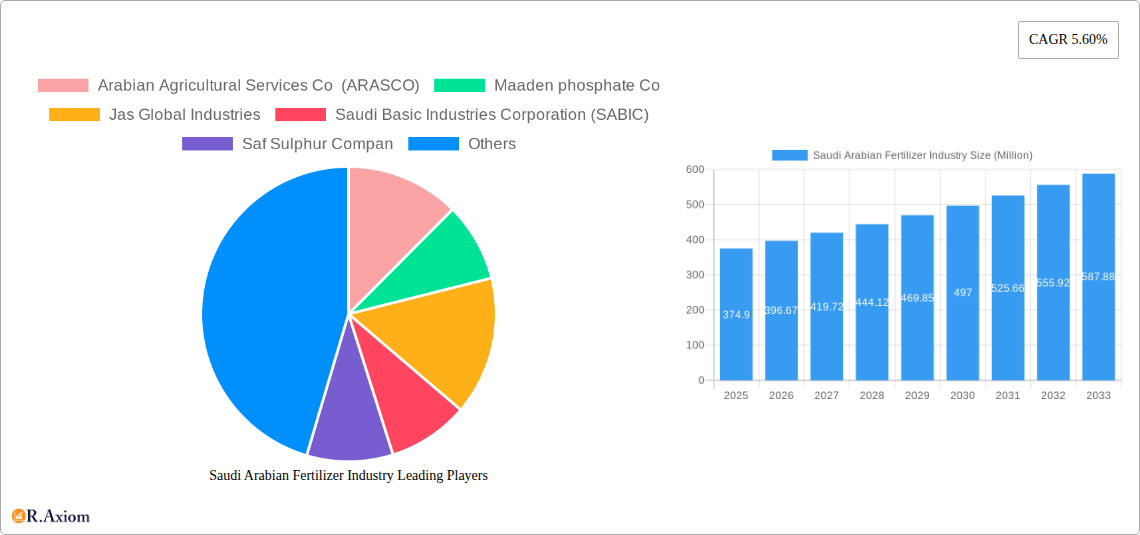

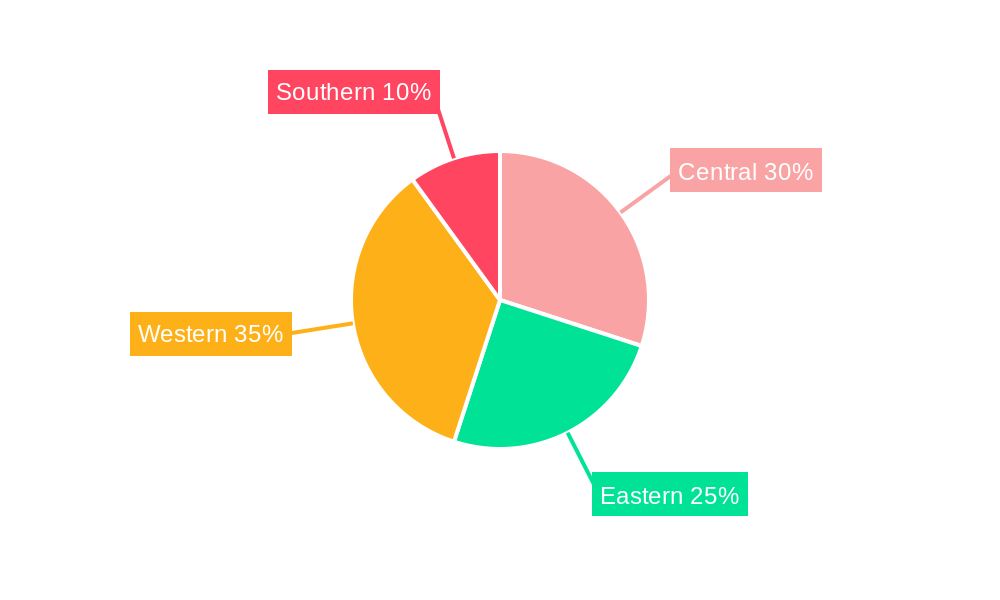

The Saudi Arabian fertilizer market, valued at $374.90 million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 5.60% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the Kingdom's significant agricultural sector, encompassing grains, pulses, oilseeds, fruits, vegetables, and commercial crops, necessitates a consistent supply of fertilizers to enhance yields and meet domestic food security demands. The increasing adoption of modern farming techniques and government initiatives promoting agricultural modernization further contribute to market growth. Secondly, the rising population and urbanization in Saudi Arabia are creating a higher demand for food, indirectly boosting fertilizer consumption. However, the market also faces challenges, including fluctuating global commodity prices, potential water scarcity impacting irrigation and fertilizer application, and the need for sustainable fertilizer practices to mitigate environmental impact. The market is segmented by fertilizer type (nitrogenous, phosphatic, potassic, micronutrient) and application (grains & cereals, pulses & oilseeds, fruits & vegetables, commercial crops, turf & ornamental crops), offering diverse investment opportunities. Leading players like Arabian Agricultural Services Co (ARASCO), Maaden Phosphate Co, and Saudi Basic Industries Corporation (SABIC) are strategically positioned to capitalize on this growth, focusing on innovation and sustainable solutions. Regional variations in market demand exist, with central, eastern, western, and southern regions showing different growth trajectories based on agricultural activity and infrastructure. Analysis of historical data (2019-2024) reveals a steady upward trend, indicating a positive outlook for the long-term prospects of the Saudi Arabian fertilizer market.

Saudi Arabian Fertilizer Industry Market Size (In Million)

The competitive landscape is characterized by a mix of both domestic and international players. While established companies leverage their existing infrastructure and market knowledge, new entrants are focusing on niche segments and specialized fertilizer products. Future growth will depend on factors such as government policies supporting agriculture, investments in research and development for efficient fertilizer technologies, and a proactive approach towards sustainable agricultural practices. The market’s expansion is also influenced by global events impacting commodity prices and trade relations. Successful players will need to demonstrate adaptability, efficiency, and a commitment to environmental sustainability to thrive in this dynamic market.

Saudi Arabian Fertilizer Industry Company Market Share

Saudi Arabian Fertilizer Industry: Market Analysis & Forecast Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Saudi Arabian fertilizer industry, covering market size, segmentation, key players, growth drivers, challenges, and future outlook. The report utilizes data from the historical period (2019-2024), base year (2025), and estimated year (2025) to project the forecast period (2025-2033). This crucial resource is designed for industry stakeholders, investors, and strategic decision-makers seeking actionable insights into this dynamic market.

Saudi Arabian Fertilizer Industry Market Concentration & Innovation

The Saudi Arabian fertilizer industry exhibits a moderately concentrated market structure, with a few major players holding significant market share. Arabian Agricultural Services Co (ARASCO), Maaden Phosphate Co, and Saudi Basic Industries Corporation (SABIC) are prominent examples. Market share data for 2024 indicates ARASCO holds approximately xx%, Maaden Phosphate Co holds xx%, and SABIC holds xx% of the total market, with the remaining share distributed among other players such as Jas Global Industries, Saf Sulphur Company, Al-Jubail Fertilizer Company (AlBayroni), Al-Tayseer Chemical Industry, Takamul National Agriculture, and Saudi United Fertilizer Company (AlAsmida). Innovation is driven by the increasing demand for high-efficiency fertilizers, sustainable agricultural practices, and government initiatives promoting food security. Regulatory frameworks, including environmental regulations and import/export policies, significantly impact industry operations. The emergence of biofertilizers presents a potential substitute, albeit with limited current market penetration. End-user trends are shifting towards precision agriculture and optimized fertilizer application techniques. M&A activity has been relatively moderate in recent years, with a total deal value of approximately xx Million in the period 2019-2024, primarily focused on consolidating production capacity and expanding market reach.

Saudi Arabian Fertilizer Industry Industry Trends & Insights

The Saudi Arabian fertilizer market is projected to experience robust growth throughout the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) of approximately xx%. Several factors contribute to this growth. Government initiatives to boost agricultural production and enhance food security are playing a significant role. Technological advancements in fertilizer production, such as improved efficiency and reduced environmental impact, are also driving market expansion. The increasing adoption of advanced farming techniques and precision agriculture is contributing to higher fertilizer consumption. Consumer preferences are increasingly focused on sustainable and environmentally friendly fertilizer products. Competitive dynamics are shaped by price competition, product differentiation, and the ongoing pursuit of innovation. Market penetration of specialized fertilizers, such as micronutrients and secondary macronutrients, is steadily increasing as awareness of their benefits grows. This signifies a crucial market shift towards tailored nutrient solutions for specific crops and soil conditions. The overall demand is fueled by the expansion of cultivated land and the intensification of agricultural practices to meet rising food demand.

Dominant Markets & Segments in Saudi Arabian Fertilizer Industry

Leading Segment: Nitrogenous fertilizers dominate the Saudi Arabian fertilizer market, driven by the high demand from the grains and cereals sector. The increasing acreage under cultivation contributes to a substantial demand. Phosphatic fertilizers constitute a notable segment, with growth fueled by the rising importance of soil health and balanced fertilization. Potassic fertilizers, while less prominent, are witnessing gradual growth in demand for optimal crop yield. Micronutrient fertilizers are growing in importance.

Key Drivers:

- Government Support: Substantial government investment in agricultural development and initiatives promoting food security are driving the fertilizer market.

- Infrastructure Development: Improved irrigation systems and advancements in agricultural infrastructure directly support fertilizer application and uptake.

- Economic Growth: A growing economy boosts disposable income, leading to increased demand for agricultural products, indirectly driving fertilizer demand.

The dominance of nitrogenous fertilizers is closely linked to the extensive cultivation of grains and cereals, which are major contributors to Saudi Arabia's agricultural output. While other segments, such as phosphatic and potassic fertilizers, are experiencing growth, nitrogenous fertilizers remain the cornerstone of the industry. The dominance of the Grains and Cereals segment is significantly driven by government policies and the overall food security objective. The segment's substantial contribution to the national agricultural output solidifies its prominent role in the fertilizer industry.

Saudi Arabian Fertilizer Industry Product Developments

Recent product innovations focus on enhancing fertilizer efficiency, reducing environmental impact, and improving crop yields. The development of slow-release fertilizers and controlled-release technologies aims to optimize nutrient uptake and reduce nutrient runoff. There is a growing interest in biofertilizers and other sustainable alternatives to traditional chemical fertilizers. These advancements are improving market fit by catering to the rising demand for environmentally friendly and cost-effective solutions. This aligns with global trends towards sustainable agriculture. The development of specialized blends caters to specific crop needs and soil conditions.

Report Scope & Segmentation Analysis

This report segments the Saudi Arabian fertilizer market based on fertilizer type (Nitrogenous Fertilizers, Phosphatic Fertilizers, Potassic Fertilizers, Other Phosphatic Fertilizers, Sulfate of Potash (SOP), Secondary Macronutrient Fertilizers, Micronutrient Fertilizers) and application (Grains and Cereals, Pulses and Oilseeds, Fruits and Vegetables, Commercial Crops, Turf and Ornamental Crops). Each segment is analyzed in terms of market size, growth rate, and competitive landscape. Growth projections for each segment vary based on factors such as crop production patterns, government policies, and technological advancements. Competitive dynamics differ across segments, reflecting the level of competition and market concentration.

Key Drivers of Saudi Arabian Fertilizer Industry Growth

The Saudi Arabian fertilizer industry's growth is fueled by several key factors. Government initiatives promoting food security and agricultural diversification are a primary driver. Increased investments in irrigation and agricultural infrastructure directly support fertilizer consumption. Rising consumer demand for fresh produce and a growing population contribute to the need for enhanced agricultural productivity. Technological advancements, particularly in precision farming and efficient fertilizer application methods, play a significant role. Furthermore, favorable government policies and subsidies create a supportive environment for industry growth.

Challenges in the Saudi Arabian Fertilizer Industry Sector

The Saudi Arabian fertilizer industry faces challenges such as water scarcity, which impacts agricultural productivity and fertilizer use efficiency. Fluctuations in global energy prices affect production costs. Stringent environmental regulations, while beneficial in the long term, can impose short-term challenges on manufacturers. Competition from international fertilizer producers can put pressure on local companies. These factors can collectively impact profitability and market share. Furthermore, logistics and supply chain constraints can cause delays and increases in costs.

Emerging Opportunities in Saudi Arabian Fertilizer Industry

Emerging opportunities exist in the development and adoption of sustainable and eco-friendly fertilizers. There's significant potential in the expanding market for specialized fertilizers tailored to specific crop needs and soil conditions. Advances in precision agriculture and data-driven farming techniques offer opportunities for optimizing fertilizer use and improving efficiency. Exploring new markets and export opportunities can drive further growth. Furthermore, investing in research and development to create innovative and high-efficiency products can secure a competitive advantage.

Leading Players in the Saudi Arabian Fertilizer Industry Market

- Arabian Agricultural Services Co (ARASCO)

- Maaden Phosphate Co

- Jas Global Industries

- Saudi Basic Industries Corporation (SABIC)

- Saf Sulphur Company

- Al-Jubail Fertilizer Company (AlBayroni)

- Al-Tayseer Chemical Industry

- Takamul National Agriculture

- Saudi United Fertilizer Company (AlAsmida)

Key Developments in Saudi Arabian Fertilizer Industry Industry

- 2022 Q4: ARASCO announces a new investment in expanding its production capacity for nitrogenous fertilizers.

- 2023 Q1: Maaden Phosphate Co unveils a new line of micronutrient fertilizers.

- 2023 Q3: SABIC invests in research and development for sustainable fertilizer technologies. (Note: Specific details may be limited depending on public information availability. These are examples of the type of data included).

Strategic Outlook for Saudi Arabian Fertilizer Industry Market

The Saudi Arabian fertilizer industry is poised for continued growth, driven by government support, technological advancements, and increasing agricultural demand. Focusing on sustainable and innovative fertilizer solutions will be crucial for long-term success. Companies should prioritize efficient production, strategic partnerships, and expansion into new markets. Adapting to environmental regulations and embracing precision agriculture techniques will be essential for maintaining a competitive edge. The industry's future rests on leveraging technological advancements and sustainable practices to meet growing agricultural demands effectively and responsibly.

Saudi Arabian Fertilizer Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Saudi Arabian Fertilizer Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabian Fertilizer Industry Regional Market Share

Geographic Coverage of Saudi Arabian Fertilizer Industry

Saudi Arabian Fertilizer Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Skilled Labor Shortage; Favorable Government Policies

- 3.3. Market Restrains

- 3.3.1. Fragmentation of Land Holdings; Increasing Interest of Farmers Toward Custom Hiring Center

- 3.4. Market Trends

- 3.4.1. Increasing Export Potential for Fertilizers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabian Fertilizer Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Arabian Agricultural Services Co (ARASCO)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Maaden phosphate Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Jas Global Industries

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Saudi Basic Industries Corporation (SABIC)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Saf Sulphur Compan

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Al-Jubail Fertilizer Company (AlBayroni)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Al-Tayseer Chemical Industry

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Takamul National Agriculture

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Saudi United Fertilizer Company (AlAsmida)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Arabian Agricultural Services Co (ARASCO)

List of Figures

- Figure 1: Saudi Arabian Fertilizer Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabian Fertilizer Industry Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabian Fertilizer Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Saudi Arabian Fertilizer Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Saudi Arabian Fertilizer Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Saudi Arabian Fertilizer Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Saudi Arabian Fertilizer Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Saudi Arabian Fertilizer Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Saudi Arabian Fertilizer Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Saudi Arabian Fertilizer Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Saudi Arabian Fertilizer Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Saudi Arabian Fertilizer Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Saudi Arabian Fertilizer Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Saudi Arabian Fertilizer Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabian Fertilizer Industry?

The projected CAGR is approximately 5.60%.

2. Which companies are prominent players in the Saudi Arabian Fertilizer Industry?

Key companies in the market include Arabian Agricultural Services Co (ARASCO), Maaden phosphate Co, Jas Global Industries, Saudi Basic Industries Corporation (SABIC), Saf Sulphur Compan, Al-Jubail Fertilizer Company (AlBayroni), Al-Tayseer Chemical Industry, Takamul National Agriculture, Saudi United Fertilizer Company (AlAsmida).

3. What are the main segments of the Saudi Arabian Fertilizer Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 374.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Skilled Labor Shortage; Favorable Government Policies.

6. What are the notable trends driving market growth?

Increasing Export Potential for Fertilizers.

7. Are there any restraints impacting market growth?

Fragmentation of Land Holdings; Increasing Interest of Farmers Toward Custom Hiring Center.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabian Fertilizer Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabian Fertilizer Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabian Fertilizer Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabian Fertilizer Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence