Key Insights

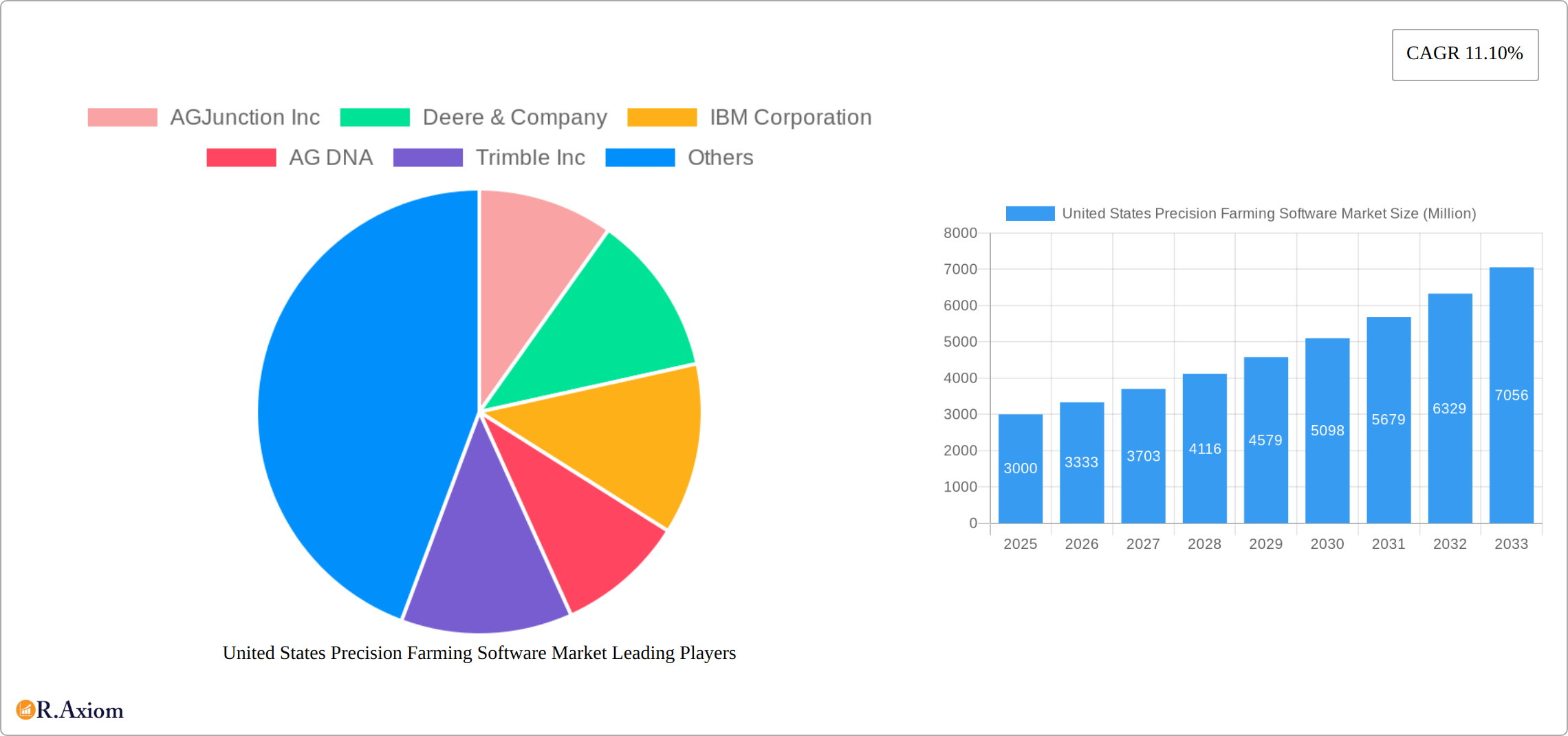

The United States precision farming software market is experiencing robust growth, fueled by the increasing adoption of technology in agriculture to enhance efficiency and productivity. The market's Compound Annual Growth Rate (CAGR) of 11.10% from 2019 to 2024 suggests a significant upward trajectory, and this momentum is expected to continue through 2033. Key drivers include the need for improved crop yields in the face of climate change and growing global food demand. Farmers are increasingly utilizing software solutions for tasks like crop management (optimizing planting, fertilization, and irrigation), financial management (tracking costs and profitability), farm inventory management (monitoring supplies and equipment), personnel management (streamlining workforce operations), and weather tracking and forecasting (making informed decisions based on weather patterns). The preference for cloud-based solutions over locally installed software is also a significant trend, driven by accessibility, scalability, and data management capabilities. While high initial investment costs and the need for reliable internet connectivity can pose challenges, the long-term benefits in terms of increased efficiency and profitability are compelling farmers to adopt these technologies. The market segmentation reveals strong demand across various application areas, with crop management and financial management currently leading the way. The presence of major players like Deere & Company, IBM, and Trimble indicates a mature market with established industry leaders and competitive innovation. The US market, given its strong agricultural sector and technological advancements, represents a significant portion of the global precision farming software market. Future growth will likely be driven by further integration of AI and machine learning into precision farming software, leading to more sophisticated data analysis and decision-making tools for farmers.

The market size for the US precision farming software market in 2025 is estimated at $3 billion based on the provided CAGR and reasonable estimations of previous years' market values. Considering the market dynamics and projected growth, the market is poised to exceed $5 billion by 2033. Competition among major players is fierce, emphasizing the need for continuous innovation and the development of user-friendly and effective solutions. Successful companies will likely focus on providing comprehensive platforms integrating various aspects of farm management, offering superior customer support, and adapting their solutions to meet the specific needs of different farming operations and scales. Furthermore, collaborations between software providers and agricultural equipment manufacturers are likely to strengthen and further drive market growth.

United States Precision Farming Software Market: A Comprehensive Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the United States precision farming software market, offering valuable insights for stakeholders, investors, and industry professionals. The study covers the period 2019-2033, with 2025 serving as the base and estimated year. The report forecasts market trends up to 2033, leveraging historical data from 2019-2024. Key market segments, including application and software type, are thoroughly examined, along with a detailed competitive landscape featuring leading players like AGJunction Inc, Deere & Company, IBM Corporation, AG DNA, Trimble Inc, Bayer CropScience A, TopCon Corporation, Granular Inc, AGCO Corporation, and AG Leader Technology Inc. The report uses Million USD as the currency for all market value estimations.

United States Precision Farming Software Market Concentration & Innovation

The United States precision farming software market exhibits a moderately concentrated landscape, with a few dominant players holding significant market share. While precise market share figures require further analysis, Deere & Company and Trimble Inc. are projected to hold substantial positions due to their established presence and comprehensive product portfolios. However, the market is witnessing increasing competition from smaller, specialized firms focusing on niche applications or innovative technologies. This competition is driving innovation and fostering the development of more sophisticated and integrated solutions.

Several factors fuel market innovation:

- Technological advancements: The integration of AI, machine learning, and IoT is transforming data collection, analysis, and decision-making in precision farming.

- Growing demand for data-driven insights: Farmers are increasingly recognizing the value of data-driven decision-making to optimize yields, reduce costs, and improve sustainability.

- Government support and regulatory frameworks: Government initiatives promoting sustainable agriculture and technological adoption are driving innovation and market growth. However, data privacy and security regulations present ongoing challenges.

Mergers and acquisitions (M&A) are prevalent, with deal values exceeding xx Million in the past five years. These activities reflect strategic efforts to consolidate market share, expand product portfolios, and acquire innovative technologies. Future M&A activity is anticipated to further reshape the competitive landscape. The presence of substitute technologies, such as traditional farming practices, although limited, necessitates continuous innovation to maintain a competitive edge. End-user trends favour solutions offering seamless integration with existing farm management systems and user-friendly interfaces.

United States Precision Farming Software Market Industry Trends & Insights

The United States precision farming software market is experiencing robust and dynamic growth, fueled by the persistent drive for operational efficiency, enhanced crop yields, and sustainable agricultural practices. The market is projected to witness a significant Compound Annual Growth Rate (CAGR) of approximately 12-15% during the forecast period (2025-2033), indicating a strong upward trajectory. This expansion is primarily driven by the increasing adoption of sophisticated precision farming techniques by a diverse range of farmers, from large-scale operations to smaller, family-owned farms, all seeking to optimize resource allocation and boost overall productivity. Market penetration is currently estimated at around 35-40%, with substantial untapped potential for further expansion, especially as technology becomes more accessible and user-friendly for a wider segment of the agricultural community.

Technological advancements are profoundly reshaping the market landscape. The widespread adoption of cloud-based solutions is enabling enhanced data accessibility, scalability, and collaboration. Furthermore, the integration of Artificial Intelligence (AI) and Machine Learning (ML) is transforming raw data into actionable insights, facilitating predictive analytics, automated decision-making, and highly personalized farming strategies. Consumer preferences are clearly shifting towards comprehensive software solutions that offer seamless data integration from various farm sources, intuitive user interfaces, and robust analytical capabilities. The competitive dynamics are characterized by a blend of established industry giants and agile emerging startups. Established players are strategically leveraging their extensive infrastructure, deep customer relationships, and broad product portfolios to maintain and expand their market share. Concurrently, startups are driving innovation through cutting-edge technologies, novel business models, and a focus on niche market needs, often fostering rapid advancements. The market is also witnessing an increasing trend of strategic collaborations and partnerships between software providers and leading agricultural equipment manufacturers, aimed at delivering truly integrated and end-to-end solutions that simplify the adoption and utilization of precision farming technologies.

Dominant Markets & Segments in United States Precision Farming Software Market

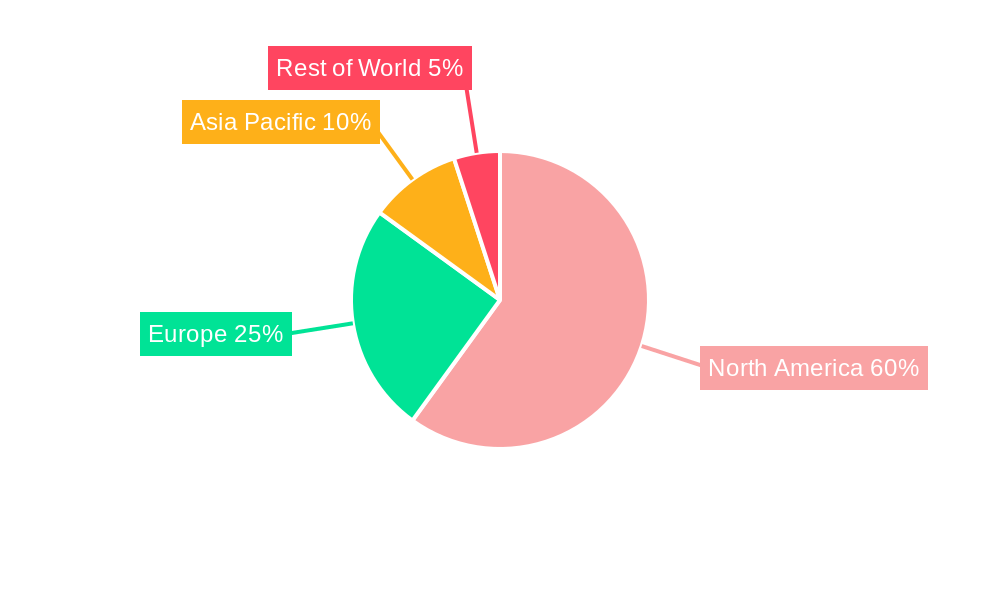

The Midwest region of the United States is expected to dominate the precision farming software market due to its extensive agricultural land and high concentration of large-scale farms. However, growth is anticipated across all regions as adoption increases.

Dominant Application Segments:

- Crop Management: This segment is the largest and fastest-growing, driven by the need to optimize crop yields and reduce input costs. Key drivers include favorable government policies supporting agricultural technology adoption and the increasing availability of high-quality agricultural data.

- Financial Management: This segment is experiencing growth due to the need for better financial control and decision-making.

- Other Application Areas: This segment encompasses various applications including livestock management, irrigation control, and soil health monitoring, and presents significant growth potential as adoption of these technologies expands.

Dominant Software Type:

- Cloud-based: This segment is the dominant software type, driven by its scalability, accessibility, and enhanced data sharing capabilities. Key drivers include the increasing availability of high-speed internet and growing acceptance of cloud solutions among farmers.

United States Precision Farming Software Market Product Developments

Recent product developments in the United States precision farming software market underscore a clear trend towards the creation of highly integrated, intelligent, and comprehensive platforms. These platforms are designed to offer a complete suite of functionalities, encompassing advanced data acquisition from sensors and machinery, sophisticated analysis powered by AI and ML algorithms, and actionable decision support tools that empower farmers with real-time guidance. A key focus is on leveraging AI and ML for predictive analytics, allowing farmers to anticipate potential issues such as pest outbreaks or nutrient deficiencies, and to receive optimized recommendations for irrigation, fertilization, and planting strategies. The competitive advantage in this evolving market is increasingly defined by the platform’s user-friendliness, the accuracy and reliability of its data interpretation, and its ability to seamlessly integrate with existing farm management systems and a wide array of agricultural equipment. The emphasis is on developing solutions that directly address the specific, nuanced needs and challenges faced by diverse farming operations, thereby fostering stronger market fit, higher user adoption rates, and ultimately, improved farm profitability and sustainability.

Report Scope & Segmentation Analysis

This report segments the United States precision farming software market based on application (Crop Management, Financial Management, Farm Inventory Management, Personnel Management, Weather Tracking and Forecasting, Other Application Areas) and type (Local/Web-based, Cloud-based). Each segment's market size, growth projections, and competitive dynamics are analyzed. For instance, the Crop Management segment is expected to hold the largest market share due to its widespread use in optimizing crop yields. The Cloud-based segment is projected to experience significant growth driven by its scalability and data accessibility advantages.

Key Drivers of United States Precision Farming Software Market Growth

Several factors fuel the market’s growth:

- Technological advancements: AI, machine learning, and IoT are enhancing data analysis and decision-making.

- Government support: Policies promoting sustainable agriculture and technology adoption stimulate market growth.

- Increasing awareness: Farmers are increasingly aware of the benefits of data-driven decision-making.

- Rising demand for efficiency: Farmers are seeking solutions to improve productivity and reduce costs.

Challenges in the United States Precision Farming Software Market Sector

Despite the significant growth and innovation, the United States precision farming software market sector continues to grapple with several key challenges:

- High Initial Investment Costs: The acquisition and implementation of advanced precision farming software and compatible hardware can represent a substantial upfront financial commitment, posing a significant barrier to adoption, particularly for smaller farms with limited capital.

- Data Security and Privacy Concerns: The collection and storage of sensitive farm data, including operational details, crop yields, and soil conditions, raise critical concerns regarding data security, potential breaches, and the privacy of proprietary information. Ensuring robust protection against unauthorized access is paramount.

- Lack of Digital Literacy and Training: A segment of the farming population may lack the necessary technological proficiency or access to adequate training to effectively utilize and leverage the full capabilities of precision farming software, hindering its widespread and optimal adoption.

- Interoperability and Standardization Issues: The absence of universal industry standards can lead to significant interoperability challenges. Data exchange between different software platforms, hardware components, and farm management systems from various manufacturers can be complex and inefficient, limiting seamless integration and data flow.

- Connectivity and Infrastructure Gaps: Reliable internet connectivity, especially in remote or rural agricultural areas, remains a critical prerequisite for many cloud-based precision farming solutions. Gaps in infrastructure can impede real-time data transmission and the functionality of the software.

Emerging Opportunities in United States Precision Farming Software Market

The United States precision farming software market is ripe with emerging opportunities that promise to further accelerate its growth and impact:

- Deep Integration with Emerging Agricultural Technologies: The convergence of precision farming software with other cutting-edge technologies, such as robotics for automated tasks, autonomous vehicles for field operations, drones for aerial monitoring, and advanced IoT sensors, presents immense opportunities to create highly efficient and automated farming ecosystems.

- Expansion into Underserved Markets and Niche Segments: Growing adoption of precision farming principles in less developed agricultural regions within the US, as well as the development of specialized solutions tailored to the unique needs of niche agricultural segments (e.g., organic farming, specialty crops, livestock management), offer significant avenues for market penetration and revenue growth.

- Data Analytics and Predictive Insights as a Service: Moving beyond basic data reporting, there is a growing opportunity to offer advanced data analytics and predictive insights as a subscription-based service, providing farmers with ongoing, expert-level guidance without requiring them to manage complex analytical tools themselves.

- Focus on Sustainability and Environmental Monitoring: With increasing emphasis on sustainable agriculture, software solutions that specifically focus on optimizing water usage, minimizing fertilizer runoff, monitoring soil health, and reducing carbon footprints are expected to see strong demand.

- Development of User-Friendly, Scalable Solutions for Small to Medium-Sized Farms: Creating more accessible, affordable, and easy-to-use software packages designed to meet the specific needs and budgets of small to medium-sized farms can unlock a vast segment of the market currently underserved by high-end solutions.

Leading Players in the United States Precision Farming Software Market Market

- AGJunction Inc

- Deere & Company

- IBM Corporation

- AG DNA

- Trimble Inc

- Bayer CropScience (now part of Bayer AG)

- TopCon Corporation

- Granular Inc (a division of Corteva Agriscience)

- AGCO Corporation

- AG Leader Technology Inc

Key Developments in United States Precision Farming Software Market Industry

- 2023-Q4: Deere & Company launched a new cloud-based precision farming platform.

- 2022-Q3: AGJunction Inc. acquired a smaller precision farming software company, expanding its product portfolio.

- 2021-Q2: Trimble Inc. announced a partnership with a major agricultural cooperative to offer integrated precision farming solutions. (Further developments to be added upon data acquisition)

Strategic Outlook for United States Precision Farming Software Market Market

The United States precision farming software market is poised for sustained growth, driven by technological innovation, favorable government policies, and the increasing adoption of data-driven decision-making in agriculture. The market’s future potential lies in the development and adoption of advanced analytical tools, improved data integration across platforms, and the expansion into new agricultural markets. The ability to provide user-friendly, cost-effective, and scalable solutions will be crucial for success in this dynamic market.

United States Precision Farming Software Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

United States Precision Farming Software Market Segmentation By Geography

- 1. United States

United States Precision Farming Software Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Legalization of Cannabis; Growing Focus on Health Benefits of Cannabis

- 3.3. Market Restrains

- 3.3.1. Lack of Data on Dosages and Results; Lack of Access to Financial Assistance

- 3.4. Market Trends

- 3.4.1. Farm Labor Shortage and Rise in Average Farm Size

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Precision Farming Software Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. China United States Precision Farming Software Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Australia United States Precision Farming Software Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. India United States Precision Farming Software Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Japan United States Precision Farming Software Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Thailand United States Precision Farming Software Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Rest of Asia Pacific United States Precision Farming Software Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 AGJunction Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Deere & Company

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 IBM Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 AG DNA

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Trimble Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Bayer CropScience A

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 TopCon Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Granular Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 AGCO Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 AG Leader Technology Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 AGJunction Inc

List of Figures

- Figure 1: United States Precision Farming Software Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Precision Farming Software Market Share (%) by Company 2024

List of Tables

- Table 1: United States Precision Farming Software Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Precision Farming Software Market Volume Kiloton Forecast, by Region 2019 & 2032

- Table 3: United States Precision Farming Software Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: United States Precision Farming Software Market Volume Kiloton Forecast, by Production Analysis 2019 & 2032

- Table 5: United States Precision Farming Software Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: United States Precision Farming Software Market Volume Kiloton Forecast, by Consumption Analysis 2019 & 2032

- Table 7: United States Precision Farming Software Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: United States Precision Farming Software Market Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: United States Precision Farming Software Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: United States Precision Farming Software Market Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: United States Precision Farming Software Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: United States Precision Farming Software Market Volume Kiloton Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: United States Precision Farming Software Market Revenue Million Forecast, by Region 2019 & 2032

- Table 14: United States Precision Farming Software Market Volume Kiloton Forecast, by Region 2019 & 2032

- Table 15: United States Precision Farming Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United States Precision Farming Software Market Volume Kiloton Forecast, by Country 2019 & 2032

- Table 17: United States Precision Farming Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United States Precision Farming Software Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 19: United States Precision Farming Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United States Precision Farming Software Market Volume Kiloton Forecast, by Country 2019 & 2032

- Table 21: United States Precision Farming Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: United States Precision Farming Software Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 23: United States Precision Farming Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: United States Precision Farming Software Market Volume Kiloton Forecast, by Country 2019 & 2032

- Table 25: United States Precision Farming Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: United States Precision Farming Software Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 27: United States Precision Farming Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: United States Precision Farming Software Market Volume Kiloton Forecast, by Country 2019 & 2032

- Table 29: United States Precision Farming Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: United States Precision Farming Software Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 31: United States Precision Farming Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: United States Precision Farming Software Market Volume Kiloton Forecast, by Country 2019 & 2032

- Table 33: United States Precision Farming Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: United States Precision Farming Software Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 35: United States Precision Farming Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: United States Precision Farming Software Market Volume Kiloton Forecast, by Country 2019 & 2032

- Table 37: United States Precision Farming Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: United States Precision Farming Software Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 39: United States Precision Farming Software Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 40: United States Precision Farming Software Market Volume Kiloton Forecast, by Production Analysis 2019 & 2032

- Table 41: United States Precision Farming Software Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 42: United States Precision Farming Software Market Volume Kiloton Forecast, by Consumption Analysis 2019 & 2032

- Table 43: United States Precision Farming Software Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 44: United States Precision Farming Software Market Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 45: United States Precision Farming Software Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 46: United States Precision Farming Software Market Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 47: United States Precision Farming Software Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 48: United States Precision Farming Software Market Volume Kiloton Forecast, by Price Trend Analysis 2019 & 2032

- Table 49: United States Precision Farming Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 50: United States Precision Farming Software Market Volume Kiloton Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Precision Farming Software Market?

The projected CAGR is approximately 11.10%.

2. Which companies are prominent players in the United States Precision Farming Software Market?

Key companies in the market include AGJunction Inc, Deere & Company, IBM Corporation, AG DNA, Trimble Inc, Bayer CropScience A, TopCon Corporation, Granular Inc, AGCO Corporation, AG Leader Technology Inc.

3. What are the main segments of the United States Precision Farming Software Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Legalization of Cannabis; Growing Focus on Health Benefits of Cannabis.

6. What are the notable trends driving market growth?

Farm Labor Shortage and Rise in Average Farm Size.

7. Are there any restraints impacting market growth?

Lack of Data on Dosages and Results; Lack of Access to Financial Assistance.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Precision Farming Software Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Precision Farming Software Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Precision Farming Software Market?

To stay informed about further developments, trends, and reports in the United States Precision Farming Software Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence