Key Insights

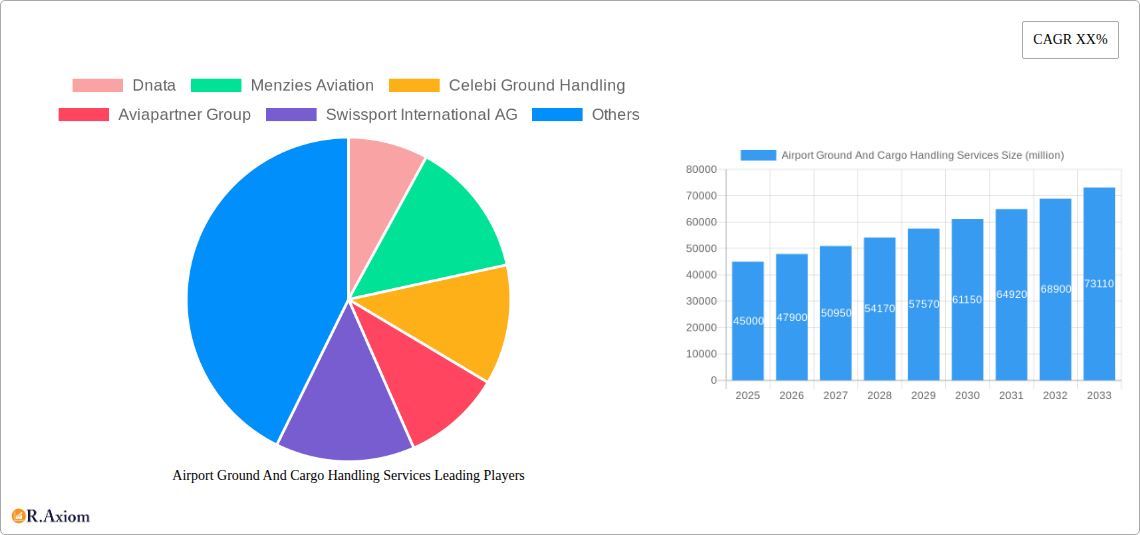

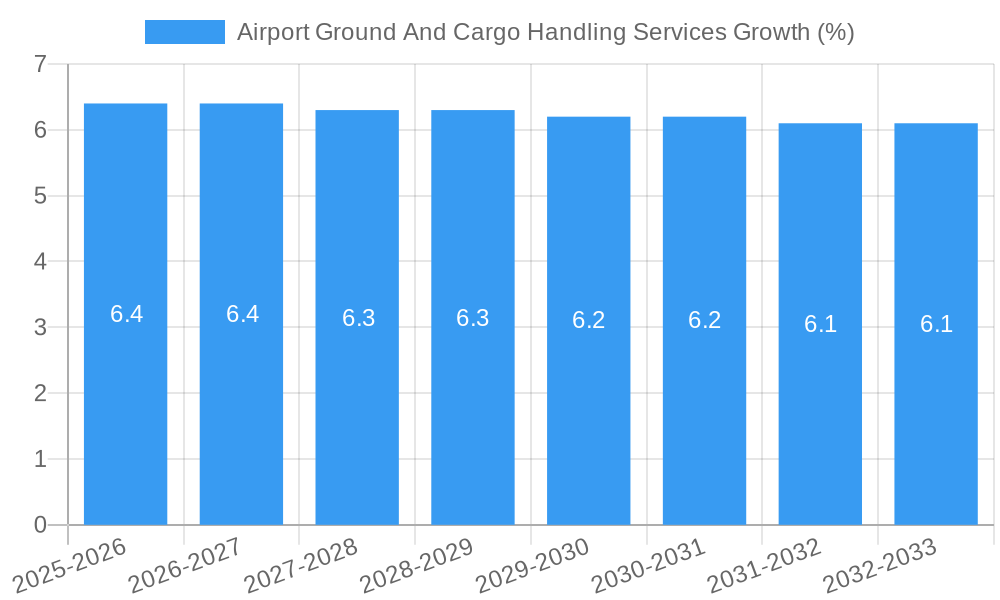

The global Airport Ground and Cargo Handling Services market is projected for substantial growth, estimated at a market size of approximately $45 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of around 6.5% through 2033. This expansion is fueled by a confluence of factors, primarily the robust recovery and anticipated surge in air passenger traffic post-pandemic. The increasing volume of global trade, further amplified by the e-commerce boom, significantly bolsters demand for efficient cargo and mail handling services. Furthermore, the continuous modernization of airport infrastructure worldwide, coupled with airlines' strategic focus on outsourcing non-core operations to specialized ground handling providers for cost optimization and enhanced service quality, are key growth drivers. The market is segmented across various applications, including domestic and international services, and by types such as passenger handling, baggage handling, cargo and mail handling, aircraft handling, and ramp handling, all contributing to the dynamic ecosystem of airport operations.

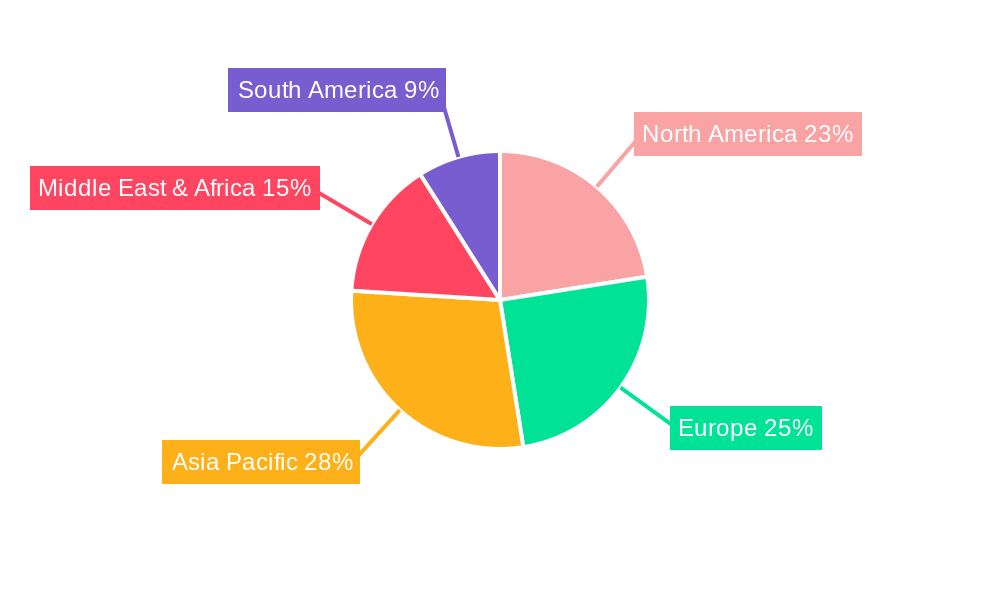

Navigating this evolving landscape presents certain restraints, including the ever-present challenge of maintaining stringent safety and security standards amidst increasing operational complexity, the impact of fluctuating fuel prices on airline profitability which can indirectly affect ground handling budgets, and the persistent labor shortage in certain regions, impacting service delivery capacity. However, the market is actively embracing technological advancements and operational innovations. Automation in baggage handling, the adoption of AI for optimizing flight turnarounds, and the implementation of digital platforms for real-time communication and resource management are emerging trends that are set to redefine efficiency. Leading companies like Dnata, Menzies Aviation, and Swissport International AG are heavily investing in these areas to maintain a competitive edge. Regionally, the Asia Pacific, driven by China and India's burgeoning aviation sectors, along with established markets in North America and Europe, are expected to be key contributors to the market's overall expansion, with emerging economies in the Middle East & Africa also presenting significant opportunities.

This in-depth report provides a panoramic view of the global Airport Ground And Cargo Handling Services market, encompassing its historical performance, current dynamics, and future projections. With a study period from 2019 to 2033, a base year of 2025, and a forecast period from 2025 to 2033, this analysis delves into critical aspects of this vital aviation sector. The report is designed for industry stakeholders, including ground handling companies, cargo handlers, airport operators, airline executives, investors, and government agencies, seeking to understand market concentration, innovation, key trends, dominant segments, product developments, growth drivers, challenges, and emerging opportunities. We leverage high-traffic keywords relevant to airport services, ground operations, cargo logistics, aviation management, and passenger handling to ensure maximum search visibility.

Airport Ground And Cargo Handling Services Market Concentration & Innovation

The global Airport Ground And Cargo Handling Services market exhibits a moderate to high concentration, with a few key players dominating the landscape. Leading companies such as Swissport International AG, Dnata, and Menzies Aviation command significant market share, estimated to be in the hundreds of millions of dollars. This concentration is driven by high capital investment requirements, stringent regulatory approvals, and the need for extensive operational expertise. Innovation is a critical differentiator, with advancements focusing on enhancing efficiency, safety, and sustainability. Key innovation drivers include:

- Automation and Robotics: Implementation of automated baggage handling systems, autonomous ground support equipment (GSE), and robotic solutions for aircraft cleaning and maintenance are transforming operations.

- Digitalization and AI: Leveraging data analytics, artificial intelligence (AI), and machine learning (ML) for predictive maintenance, route optimization, resource allocation, and enhanced passenger experience.

- Sustainability Initiatives: Adoption of electric GSE, development of eco-friendly fuel solutions for ground operations, and optimization of energy consumption within airport facilities.

- Regulatory Frameworks: Evolving international and national aviation regulations, including those pertaining to safety, security, and environmental standards, influence operational practices and innovation investment.

- Product Substitutes: While direct substitutes for essential ground handling services are limited, the rise of self-service technologies at airports (e.g., self-bag drop, biometric check-in) indirectly impacts the scope of traditional passenger handling services.

- End-User Trends: Airlines are increasingly outsourcing ground handling to specialized providers to reduce costs and focus on core competencies. Airports are also seeking partners who can offer a comprehensive suite of services to enhance passenger and cargo flow.

- M&A Activities: Mergers and acquisitions are a significant factor in market concentration. Recent M&A deals in the sector have seen values ranging from tens of millions to hundreds of millions of dollars, consolidating market share and expanding service portfolios. For instance, the acquisition of smaller regional players by larger entities allows for greater geographic reach and economies of scale.

Airport Ground And Cargo Handling Services Industry Trends & Insights

The Airport Ground And Cargo Handling Services industry is experiencing robust growth, driven by a confluence of factors reshaping air travel and logistics. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5-7% over the forecast period. This expansion is fueled by the resurgence of air passenger traffic post-pandemic and the sustained demand for efficient air cargo handling. A significant trend is the increasing complexity of airport operations, necessitating specialized expertise that ground handlers provide. This includes managing a growing fleet of aircraft with diverse operational requirements, from wide-body passenger jets to specialized cargo freighters.

Technological disruptions are at the forefront of this industry's evolution. The integration of advanced technologies such as AI-powered analytics for optimizing turnaround times, IoT sensors for real-time monitoring of GSE, and the deployment of autonomous vehicles for baggage and cargo movement are becoming increasingly prevalent. These innovations not only enhance operational efficiency but also contribute to improved safety and reduced environmental impact. The global cargo handling segment, in particular, is benefiting from the boom in e-commerce and the need for expedited international cargo services.

Consumer preferences are also playing a crucial role. Passengers expect seamless and stress-free experiences at airports, pushing ground handlers to adopt more passenger-centric approaches. This includes faster baggage claim, efficient boarding processes, and improved communication during disruptions. Airlines, in turn, are demanding more integrated and technologically advanced solutions from their handling partners to ensure on-time performance and customer satisfaction. The competitive dynamics within the market are intensifying, with established players continuously seeking to expand their global footprint through strategic partnerships, acquisitions, and service diversification. Emerging players are also focusing on niche markets and innovative service offerings to carve out their space. The market penetration of advanced digital solutions is steadily increasing, as stakeholders recognize their potential to drive significant operational improvements and cost savings. The ramp handling and aircraft handling segments are witnessing increased demand for specialized services that ensure aircraft safety and operational readiness.

Dominant Markets & Segments in Airport Ground And Cargo Handling Services

The Airport Ground And Cargo Handling Services market is characterized by significant regional variations and segment-specific growth trajectories. International applications currently hold a dominant position, driven by global connectivity and the significant volume of cross-border air travel and trade. This dominance is underpinned by several key factors:

- Global Trade Flows: The backbone of international commerce relies heavily on air cargo for time-sensitive and high-value goods, necessitating robust cargo and mail handling services at major international hubs.

- Global Tourism and Business Travel: The resurgence of international tourism and business travel post-pandemic is directly increasing demand for comprehensive passenger handling and baggage handling services at airports worldwide.

- Airline Network Expansion: Major international airlines continuously expand their global networks, requiring consistent and high-quality ground handling support across multiple continents.

- Economic Policies: Favorable trade agreements and economic policies that promote international commerce directly boost the demand for international cargo handling.

- Infrastructure Development: Significant investments in expanding and modernizing international airports, including cargo terminals and passenger facilities, create a conducive environment for growth.

Among the types of services, Passenger Handling and Baggage Handling collectively represent the largest segment due to the sheer volume of passenger movements. However, Cargo and Mail Handling is experiencing exceptional growth, fueled by e-commerce and the demand for expedited logistics. Aircraft Handling and Ramp Handling are essential, high-value services that require specialized equipment and trained personnel, with their demand directly correlating with aircraft movements.

Geographically, regions such as North America and Europe currently lead in terms of market value due to their well-established aviation infrastructure and high passenger and cargo volumes. However, the Asia-Pacific region is poised for the fastest growth, driven by rapid economic development, expanding middle class, and increasing air travel demand. Key drivers for regional dominance include:

- Economic Growth and Disposable Income: Higher disposable incomes in emerging economies translate to increased air travel.

- Airport Infrastructure Investment: Governments and private entities are heavily investing in new airports and upgrading existing ones across Asia-Pacific.

- Rise of Low-Cost Carriers: The proliferation of low-cost carriers in developing regions significantly boosts passenger traffic.

- E-commerce Penetration: The booming e-commerce sector in Asia-Pacific is a major catalyst for cargo handling services.

Airport Ground And Cargo Handling Services Product Developments

Innovations in Airport Ground And Cargo Handling Services are primarily focused on enhancing operational efficiency, safety, and sustainability. Companies are investing in autonomous ground support equipment (GSE), such as self-driving baggage tractors and automated aircraft pushback systems, to reduce labor costs and improve turnaround times. Digitalization is a key trend, with the development of advanced software platforms for real-time data management, predictive maintenance of GSE, and AI-driven route optimization for ground operations. Enhanced baggage handling systems, incorporating advanced scanning and sorting technologies, are reducing mishandling and improving delivery speed. Furthermore, the focus on sustainability has led to the development of electric GSE and the optimization of energy consumption within airport facilities. These product developments offer significant competitive advantages by enabling service providers to offer faster, more reliable, and environmentally friendly solutions.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global Airport Ground And Cargo Handling Services market, segmented across various critical dimensions. The primary segmentation considers the application type: Domestic and International services, with the latter currently dominating due to global travel and trade. Further segmentation is based on the types of services offered: Passenger Handling, Baggage Handling, Cargo And Mail Handling, Aircraft Handling, Ramp Handling, and Others. The Cargo And Mail Handling segment is projected to exhibit the highest growth rate over the forecast period, driven by the e-commerce boom and global trade dynamics. Passenger Handling and Baggage Handling continue to be the largest segments by volume, reflecting consistent air travel demand. Growth projections for each segment are detailed, alongside current market sizes and prevailing competitive dynamics.

Key Drivers of Airport Ground And Cargo Handling Services Growth

The growth of the Airport Ground And Cargo Handling Services sector is propelled by several intertwined factors. A primary driver is the sustained recovery and projected growth in global air passenger traffic, directly increasing demand for comprehensive passenger handling and baggage handling services. The burgeoning e-commerce sector and global supply chain demands are fueling an unprecedented surge in air cargo handling operations. Technological advancements, including automation, AI, and digitalization of ground operations, are enhancing efficiency, safety, and cost-effectiveness, making outsourced handling services more attractive to airlines. Favorable regulatory environments that promote aviation infrastructure development and streamline ground operations also contribute significantly. Furthermore, the increasing trend of airlines and airports outsourcing non-core activities to specialized ground handling providers to optimize resources and focus on core competencies is a substantial growth catalyst.

Challenges in the Airport Ground And Cargo Handling Services Sector

Despite robust growth, the Airport Ground And Cargo Handling Services sector faces several significant challenges. Intense competition among service providers can lead to price wars, impacting profit margins, especially for basic services. High capital investment required for advanced GSE, technology implementation, and facility upgrades presents a substantial barrier to entry and expansion. Strict and evolving regulatory compliance for safety, security, and environmental standards necessitates continuous investment and adaptation. Labor shortages, particularly for skilled ramp agents and specialized technicians, can lead to operational disruptions and increased labor costs. Furthermore, disruptions in the global supply chain can impact the availability and cost of essential equipment and spare parts for GSE. The cyclical nature of the aviation industry, influenced by global economic conditions and geopolitical events, can also lead to unpredictable demand fluctuations.

Emerging Opportunities in Airport Ground And Cargo Handling Services

Emerging opportunities in the Airport Ground And Cargo Handling Services market are abundant, driven by innovation and evolving industry needs. The increasing adoption of electric and sustainable GSE presents a significant opportunity for providers to offer eco-friendly services and align with global sustainability goals. The growing demand for specialized cargo handling, including temperature-sensitive goods and pharmaceuticals, opens avenues for niche service providers. The integration of advanced data analytics and AI offers opportunities to develop predictive maintenance solutions, optimize operational workflows, and provide enhanced customer insights to airlines. As airports become increasingly digitized, there is a growing need for integrated technology solutions that connect ground handling operations with air traffic control and airline systems. The expansion of air cargo through e-commerce and the rise of new express cargo lanes also represent a substantial growth opportunity.

Leading Players in the Airport Ground And Cargo Handling Services Market

- Dnata

- Menzies Aviation

- Celebi Ground Handling

- Aviapartner Group

- Swissport International AG

- Worldwide Flight Services

- Fraport AG

- Airport Associates

- Qatar Aviation Services

- AirPart GmbH

Key Developments in Airport Ground And Cargo Handling Services Industry

- 2023/06: Swissport International AG announces expansion of its cargo handling services at major European hubs, investing millions in new infrastructure and technology.

- 2023/03: Dnata partners with a leading airline to pilot autonomous aircraft refueling systems, aiming for enhanced efficiency and safety.

- 2022/11: Menzies Aviation acquires a regional ground handler in Southeast Asia, significantly expanding its operational footprint and market share in the Asia-Pacific region.

- 2022/09: Celebi Ground Handling introduces a new AI-powered baggage tracking system across its network, reducing lost baggage rates by an estimated xx%.

- 2022/05: Worldwide Flight Services invests millions in upgrading its fleet of electric ground support equipment, committing to carbon neutrality.

- 2021/12: Fraport AG announces a strategic partnership with a technology firm to develop smart airport solutions, focusing on integrated passenger and cargo flow management.

- 2021/07: Airport Associates launches a new digital platform for real-time communication and operational oversight, improving collaboration with airlines and airports.

Strategic Outlook for Airport Ground And Cargo Handling Services Market

- 2023/06: Swissport International AG announces expansion of its cargo handling services at major European hubs, investing millions in new infrastructure and technology.

- 2023/03: Dnata partners with a leading airline to pilot autonomous aircraft refueling systems, aiming for enhanced efficiency and safety.

- 2022/11: Menzies Aviation acquires a regional ground handler in Southeast Asia, significantly expanding its operational footprint and market share in the Asia-Pacific region.

- 2022/09: Celebi Ground Handling introduces a new AI-powered baggage tracking system across its network, reducing lost baggage rates by an estimated xx%.

- 2022/05: Worldwide Flight Services invests millions in upgrading its fleet of electric ground support equipment, committing to carbon neutrality.

- 2021/12: Fraport AG announces a strategic partnership with a technology firm to develop smart airport solutions, focusing on integrated passenger and cargo flow management.

- 2021/07: Airport Associates launches a new digital platform for real-time communication and operational oversight, improving collaboration with airlines and airports.

Strategic Outlook for Airport Ground And Cargo Handling Services Market

The strategic outlook for the Airport Ground And Cargo Handling Services market is overwhelmingly positive, characterized by continuous innovation and expansion. Key growth catalysts include the ongoing digitalization of airport operations, leading to increased demand for integrated technology solutions and data-driven services. The growing emphasis on sustainability presents significant opportunities for providers investing in electric GSE and eco-friendly operational practices. The booming air cargo sector, propelled by e-commerce, will remain a critical growth engine, demanding specialized handling capabilities. Furthermore, strategic partnerships and consolidation through M&A activities will continue to shape the market, creating larger, more integrated service providers capable of offering comprehensive solutions globally. Airlines and airports will increasingly rely on specialized ground handlers to enhance efficiency, passenger experience, and operational resilience.

Airport Ground And Cargo Handling Services Segmentation

-

1. Application

- 1.1. Domestic

- 1.2. International

-

2. Types

- 2.1. Passenger Handling

- 2.2. Baggage Handling

- 2.3. Cargo And Mail Handling

- 2.4. Aircraft Handling

- 2.5. Ramp Handling

- 2.6. Others

Airport Ground And Cargo Handling Services Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Airport Ground And Cargo Handling Services REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Airport Ground And Cargo Handling Services Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Domestic

- 5.1.2. International

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Passenger Handling

- 5.2.2. Baggage Handling

- 5.2.3. Cargo And Mail Handling

- 5.2.4. Aircraft Handling

- 5.2.5. Ramp Handling

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Airport Ground And Cargo Handling Services Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Domestic

- 6.1.2. International

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Passenger Handling

- 6.2.2. Baggage Handling

- 6.2.3. Cargo And Mail Handling

- 6.2.4. Aircraft Handling

- 6.2.5. Ramp Handling

- 6.2.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Airport Ground And Cargo Handling Services Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Domestic

- 7.1.2. International

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Passenger Handling

- 7.2.2. Baggage Handling

- 7.2.3. Cargo And Mail Handling

- 7.2.4. Aircraft Handling

- 7.2.5. Ramp Handling

- 7.2.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Airport Ground And Cargo Handling Services Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Domestic

- 8.1.2. International

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Passenger Handling

- 8.2.2. Baggage Handling

- 8.2.3. Cargo And Mail Handling

- 8.2.4. Aircraft Handling

- 8.2.5. Ramp Handling

- 8.2.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Airport Ground And Cargo Handling Services Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Domestic

- 9.1.2. International

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Passenger Handling

- 9.2.2. Baggage Handling

- 9.2.3. Cargo And Mail Handling

- 9.2.4. Aircraft Handling

- 9.2.5. Ramp Handling

- 9.2.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Airport Ground And Cargo Handling Services Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Domestic

- 10.1.2. International

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Passenger Handling

- 10.2.2. Baggage Handling

- 10.2.3. Cargo And Mail Handling

- 10.2.4. Aircraft Handling

- 10.2.5. Ramp Handling

- 10.2.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Dnata

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Menzies Aviation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Celebi Ground Handling

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Aviapartner Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Swissport International AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Worldwide Flight Services

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fraport AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Airport Associates

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Qatar Aviation Services

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 AirPart GmbH

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Dnata

List of Figures

- Figure 1: Global Airport Ground And Cargo Handling Services Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Airport Ground And Cargo Handling Services Revenue (million), by Application 2024 & 2032

- Figure 3: North America Airport Ground And Cargo Handling Services Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Airport Ground And Cargo Handling Services Revenue (million), by Types 2024 & 2032

- Figure 5: North America Airport Ground And Cargo Handling Services Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Airport Ground And Cargo Handling Services Revenue (million), by Country 2024 & 2032

- Figure 7: North America Airport Ground And Cargo Handling Services Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Airport Ground And Cargo Handling Services Revenue (million), by Application 2024 & 2032

- Figure 9: South America Airport Ground And Cargo Handling Services Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Airport Ground And Cargo Handling Services Revenue (million), by Types 2024 & 2032

- Figure 11: South America Airport Ground And Cargo Handling Services Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Airport Ground And Cargo Handling Services Revenue (million), by Country 2024 & 2032

- Figure 13: South America Airport Ground And Cargo Handling Services Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Airport Ground And Cargo Handling Services Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Airport Ground And Cargo Handling Services Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Airport Ground And Cargo Handling Services Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Airport Ground And Cargo Handling Services Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Airport Ground And Cargo Handling Services Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Airport Ground And Cargo Handling Services Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Airport Ground And Cargo Handling Services Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Airport Ground And Cargo Handling Services Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Airport Ground And Cargo Handling Services Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Airport Ground And Cargo Handling Services Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Airport Ground And Cargo Handling Services Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Airport Ground And Cargo Handling Services Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Airport Ground And Cargo Handling Services Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Airport Ground And Cargo Handling Services Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Airport Ground And Cargo Handling Services Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Airport Ground And Cargo Handling Services Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Airport Ground And Cargo Handling Services Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Airport Ground And Cargo Handling Services Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Airport Ground And Cargo Handling Services Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Airport Ground And Cargo Handling Services Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Airport Ground And Cargo Handling Services Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Airport Ground And Cargo Handling Services Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Airport Ground And Cargo Handling Services Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Airport Ground And Cargo Handling Services Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Airport Ground And Cargo Handling Services Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Airport Ground And Cargo Handling Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Airport Ground And Cargo Handling Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Airport Ground And Cargo Handling Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Airport Ground And Cargo Handling Services Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Airport Ground And Cargo Handling Services Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Airport Ground And Cargo Handling Services Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Airport Ground And Cargo Handling Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Airport Ground And Cargo Handling Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Airport Ground And Cargo Handling Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Airport Ground And Cargo Handling Services Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Airport Ground And Cargo Handling Services Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Airport Ground And Cargo Handling Services Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Airport Ground And Cargo Handling Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Airport Ground And Cargo Handling Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Airport Ground And Cargo Handling Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Airport Ground And Cargo Handling Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Airport Ground And Cargo Handling Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Airport Ground And Cargo Handling Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Airport Ground And Cargo Handling Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Airport Ground And Cargo Handling Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Airport Ground And Cargo Handling Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Airport Ground And Cargo Handling Services Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Airport Ground And Cargo Handling Services Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Airport Ground And Cargo Handling Services Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Airport Ground And Cargo Handling Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Airport Ground And Cargo Handling Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Airport Ground And Cargo Handling Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Airport Ground And Cargo Handling Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Airport Ground And Cargo Handling Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Airport Ground And Cargo Handling Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Airport Ground And Cargo Handling Services Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Airport Ground And Cargo Handling Services Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Airport Ground And Cargo Handling Services Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Airport Ground And Cargo Handling Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Airport Ground And Cargo Handling Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Airport Ground And Cargo Handling Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Airport Ground And Cargo Handling Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Airport Ground And Cargo Handling Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Airport Ground And Cargo Handling Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Airport Ground And Cargo Handling Services Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Airport Ground And Cargo Handling Services?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Airport Ground And Cargo Handling Services?

Key companies in the market include Dnata, Menzies Aviation, Celebi Ground Handling, Aviapartner Group, Swissport International AG, Worldwide Flight Services, Fraport AG, Airport Associates, Qatar Aviation Services, AirPart GmbH.

3. What are the main segments of the Airport Ground And Cargo Handling Services?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Airport Ground And Cargo Handling Services," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Airport Ground And Cargo Handling Services report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Airport Ground And Cargo Handling Services?

To stay informed about further developments, trends, and reports in the Airport Ground And Cargo Handling Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence