Key Insights

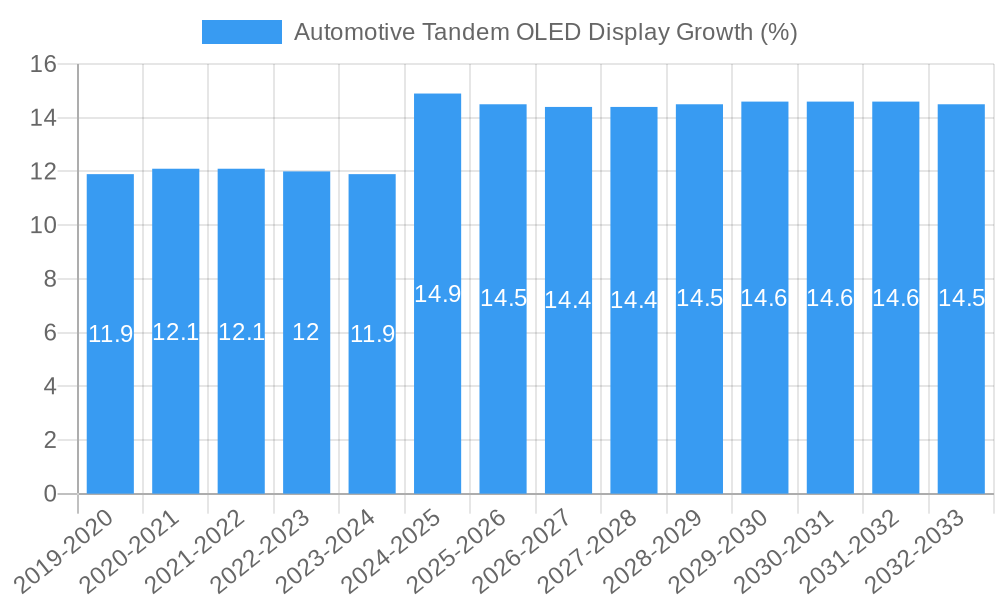

The global Automotive Tandem OLED Display market is poised for significant expansion, projected to reach a substantial market size of $214 million. This impressive growth is fueled by a remarkable Compound Annual Growth Rate (CAGR) of 13.3% during the forecast period of 2025-2033. This upward trajectory is primarily driven by the escalating demand for advanced in-car infotainment systems and increasingly sophisticated dashboard displays. The superior contrast ratios, vibrant colors, and flexible form factors offered by tandem OLED technology are making it the preferred choice for automotive manufacturers seeking to differentiate their vehicles and enhance the passenger experience. The passenger vehicle segment is expected to dominate, owing to the higher production volumes and the increasing integration of premium features.

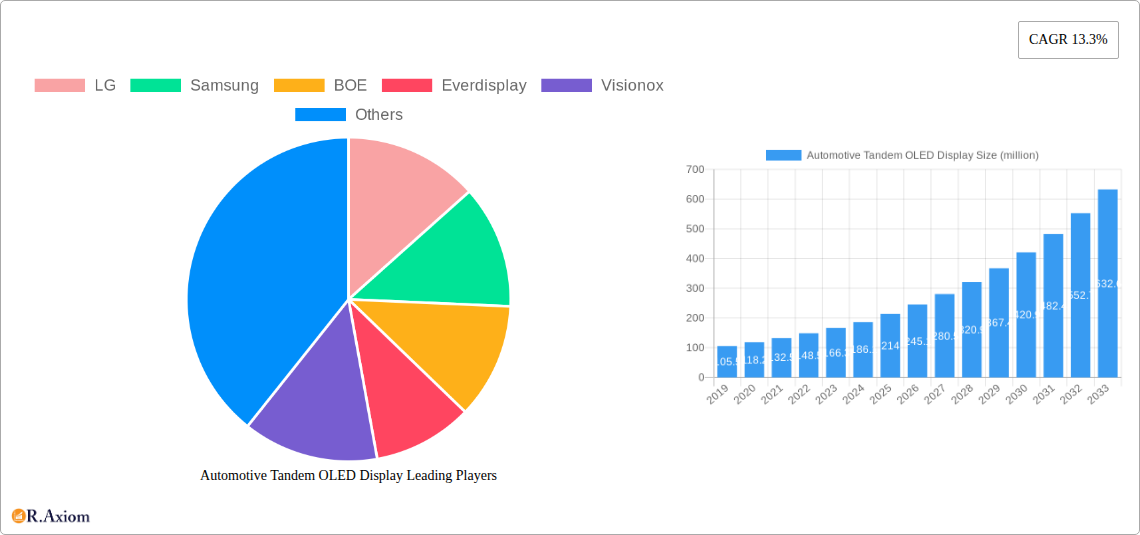

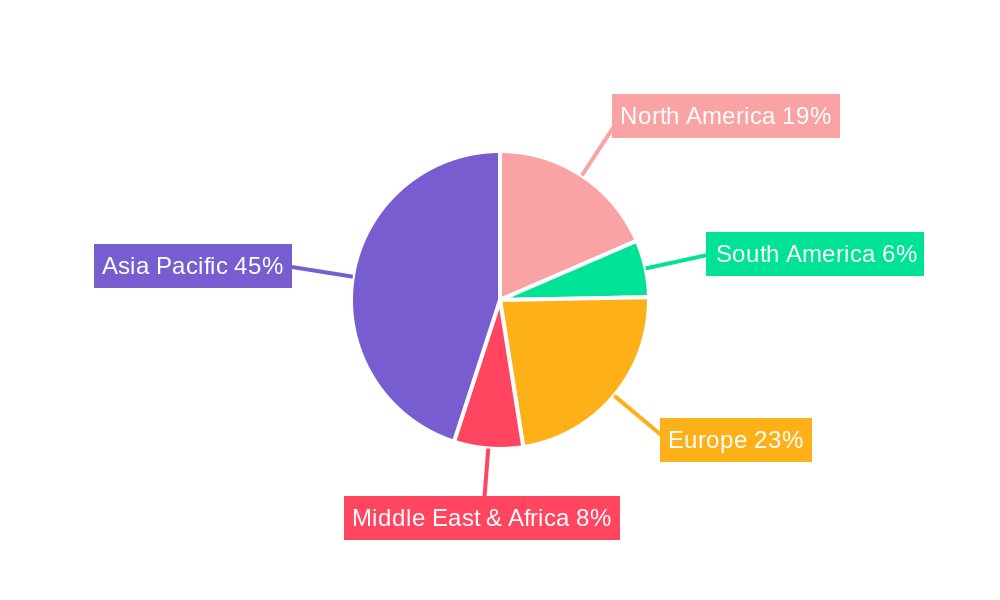

Key trends shaping the market include the growing adoption of larger, more immersive displays within vehicle cabins, supporting functionalities like augmented reality navigation and advanced driver-assistance systems (ADAS) visualization. The evolution towards three-stack tandem OLED technology promises even greater brightness and longevity, further solidifying its appeal. While market growth is robust, potential restraints such as the initial high cost of implementation and the need for robust thermal management solutions for these advanced displays need to be addressed. Major players like LG, Samsung, BOE, Everdisplay, and Visionox are actively investing in research and development to overcome these challenges and capitalize on the burgeoning opportunities, particularly in the Asia Pacific region, which is anticipated to be a leading market due to the strong presence of automotive manufacturing hubs and increasing consumer demand for technologically advanced vehicles.

Here is the detailed report description for Automotive Tandem OLED Displays, optimized for SEO and designed for immediate use:

Automotive Tandem OLED Display Market Concentration & Innovation

The Automotive Tandem OLED Display market exhibits a moderate to high concentration, with key players such as LG, Samsung, BOE, Everdisplay, and Visionox holding significant market shares. Innovation remains a primary driver, fueled by advancements in display technology aimed at enhancing durability, brightness, and energy efficiency for in-vehicle applications. Regulatory frameworks, particularly concerning automotive safety and environmental standards, are increasingly influencing product development and material choices. While product substitutes like advanced LCD technologies exist, the superior contrast ratios, viewing angles, and design flexibility of Tandem OLEDs position them favorably for premium and future automotive segments. End-user trends point towards an increasing demand for immersive digital cockpits, augmented reality head-up displays (AR-HUDs), and sophisticated infotainment systems, all areas where Tandem OLEDs excel. Mergers and acquisitions (M&A) activities are anticipated to increase as companies seek to consolidate expertise, secure supply chains, and gain a competitive edge. Expected M&A deal values are projected to reach several hundred million dollars annually, reflecting strategic investments in this rapidly evolving sector.

Automotive Tandem OLED Display Industry Trends & Insights

The global Automotive Tandem OLED Display market is on an upward trajectory, driven by a confluence of technological advancements, evolving consumer expectations, and the relentless pursuit of enhanced in-cabin experiences. The Compound Annual Growth Rate (CAGR) is projected to exceed xx% over the forecast period. This robust growth is intrinsically linked to the increasing integration of sophisticated digital interfaces within vehicles, ranging from expansive dashboard displays to personalized passenger screens. Technological disruptions are a hallmark of this sector, with continuous improvements in Tandem OLED technology enhancing factors like pixel density, color accuracy, and lifespan. The development of two-stack and three-stack tandem OLED panels offers significant advantages in terms of brightness, power efficiency, and longevity, making them ideal for the demanding automotive environment. Consumer preferences are shifting towards seamless, intuitive, and visually engaging in-car technology. Drivers and passengers alike expect high-definition displays that can deliver rich multimedia content, real-time navigation with augmented reality overlays, and advanced driver-assistance systems (ADAS) information with exceptional clarity. This burgeoning demand for premium in-cabin aesthetics and functionality directly translates into higher market penetration for Automotive Tandem OLED Displays. Competitive dynamics are intense, with leading manufacturers like LG, Samsung, BOE, Everdisplay, and Visionox investing heavily in R&D to maintain their technological lead and secure lucrative supply agreements with major automotive OEMs. The industry is witnessing a push towards larger, more flexible, and even transparent OLED displays, pushing the boundaries of automotive interior design. Furthermore, the growing adoption of electric vehicles (EVs) is also a significant catalyst, as EVs often incorporate more advanced digital cockpits to showcase energy efficiency data and offer a more futuristic user experience, thus accelerating the adoption of Tandem OLED displays. The estimated market penetration for Tandem OLED displays in new vehicles is expected to reach xx% by the end of the forecast period.

Dominant Markets & Segments in Automotive Tandem OLED Display

The Automotive Tandem OLED Display market's dominance is largely dictated by the Passenger Vehicle segment, which is expected to account for the largest market share throughout the forecast period. This segment's dominance is fueled by several key drivers.

- Consumer Demand for Premium Features: Passenger vehicle buyers are increasingly associating advanced in-car technology, including high-resolution displays, with vehicle luxury and innovation. This demand is particularly strong in developed economies.

- Technological Advancements in Cockpit Design: The trend towards integrated digital cockpits, large central infotainment screens, and sophisticated driver displays in passenger cars directly benefits Tandem OLED technology due to its superior visual performance and design flexibility.

- Luxury and Performance Vehicle Adoption: High-end and performance vehicles are early adopters of cutting-edge display technologies, driving initial market penetration and setting benchmarks for the broader passenger vehicle segment.

- Increased Screen Real Estate: The growing trend of multi-screen setups and larger displays within passenger cabins, encompassing instrument clusters, central consoles, and even passenger entertainment systems, significantly boosts the demand for the advanced capabilities offered by Tandem OLEDs.

Within the Types of Tandem OLEDs, the Two-Stack Tandem OLED technology is currently the dominant force.

- Cost-Effectiveness and Maturity: Two-stack tandem OLEDs represent a more mature and cost-effective manufacturing process compared to their three-stack counterparts, making them the preferred choice for current large-scale automotive production.

- Performance Balance: They offer a compelling balance of brightness, efficiency, and longevity, meeting the essential requirements for most automotive display applications without the added manufacturing complexity and cost of three-stack designs.

- Wide Applicability: Their performance characteristics make them suitable for a broad range of applications within both passenger and commercial vehicles, from instrument clusters to infotainment systems.

Geographically, Asia Pacific is anticipated to be the leading region, driven by its robust automotive manufacturing base and growing demand for advanced vehicle features. Within this region, China stands out as a dominant country, propelled by its massive domestic automotive market and the presence of leading display manufacturers like BOE and Visionox. Key drivers for this regional dominance include:

- Strong Automotive Manufacturing Ecosystem: The region hosts a significant number of global automotive manufacturers and suppliers, fostering rapid adoption of new technologies.

- Government Support for Advanced Technologies: Supportive government policies and investments in R&D for display technologies and electric vehicles further accelerate market growth.

- Rapidly Growing Middle Class: An expanding middle class in countries like China and India translates to higher disposable incomes and increased demand for vehicles equipped with advanced features.

- Technological Innovation Hubs: The concentration of leading display panel manufacturers in Asia Pacific fuels continuous innovation and competitive pricing.

The Commercial Vehicle segment, while currently smaller, is expected to witness substantial growth, driven by the increasing demand for sophisticated fleet management systems, driver information displays, and enhanced safety features in trucks and buses.

Automotive Tandem OLED Display Product Developments

Product developments in the Automotive Tandem OLED Display sector are characterized by a relentless pursuit of enhanced visual quality, durability, and integration capabilities. Innovations are focused on increasing brightness levels for superior sunlight readability and AR-HUD applications, reducing power consumption for better EV range, and improving the lifespan and resistance to extreme temperatures and vibrations, crucial for automotive environments. The development of three-stack tandem OLEDs offers a significant leap in performance, promising even greater brightness and efficiency. Furthermore, manufacturers are exploring flexible and transparent OLED designs, enabling novel dashboard layouts and immersive user experiences previously unattainable. These advancements are crucial for achieving competitive advantages by offering automotive OEMs displays that are not only visually stunning but also highly reliable and energy-efficient, directly aligning with the evolving demands for next-generation connected and autonomous vehicles.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global Automotive Tandem OLED Display market, segmented by Application and Type. The Application segment encompasses Passenger Vehicles and Commercial Vehicles. The Type segment is further categorized into Two-Stack Tandem OLED, Three-Stack Tandem OLED, and Others.

The Passenger Vehicle segment is projected to dominate the market, driven by the increasing demand for advanced infotainment systems, digital cockpits, and premium in-cabin experiences. Market sizes are estimated to reach several billion dollars by 2033, with a strong CAGR. Competitive dynamics within this segment are intense, with a focus on feature-rich displays.

The Commercial Vehicle segment, while smaller, is expected to exhibit robust growth, fueled by the need for advanced driver information systems, navigation, and safety features. Market sizes are projected to grow significantly, with an increasing CAGR. Competitive dynamics here are influenced by total cost of ownership and operational efficiency.

The Two-Stack Tandem OLED segment is anticipated to hold the largest market share, benefiting from its maturity, cost-effectiveness, and widespread adoption. Market sizes are substantial, with steady growth projected. Competitive dynamics revolve around established supply chains and manufacturing efficiencies.

The Three-Stack Tandem OLED segment is expected to witness the fastest growth, driven by its superior performance characteristics for high-end applications. Market sizes are growing rapidly, with a high CAGR. Competitive dynamics are focused on technological innovation and capturing premium market share.

The Others segment will encompass emerging or niche Tandem OLED technologies and applications, expected to represent a smaller but potentially growing portion of the market.

Key Drivers of Automotive Tandem OLED Display Growth

The growth of the Automotive Tandem OLED Display market is propelled by several interconnected factors. Technological advancements in display manufacturing, particularly the development of more efficient and durable tandem OLED structures, are fundamental. The increasing sophistication of in-vehicle electronics, including the widespread adoption of digital cockpits and AR-HUDs, directly fuels demand. Furthermore, the escalating consumer expectation for premium and immersive in-car experiences, driven by the consumer electronics industry, plays a significant role. Regulatory mandates for enhanced vehicle safety and information dissemination also contribute to the adoption of advanced display solutions.

Challenges in the Automotive Tandem OLED Display Sector

Despite robust growth, the Automotive Tandem OLED Display sector faces several challenges. The high manufacturing costs associated with OLED technology, especially for complex tandem structures, can be a barrier to widespread adoption, particularly in lower-cost vehicle segments. Durability and lifespan concerns in extreme automotive environments (temperature fluctuations, vibrations) require continuous innovation and rigorous testing. Supply chain complexities and dependence on a few key suppliers can lead to potential disruptions and price volatility. Regulatory hurdles related to automotive safety certifications for new display technologies also present a challenge.

Emerging Opportunities in Automotive Tandem OLED Display

Emerging opportunities in the Automotive Tandem OLED Display market are vast and exciting. The expanding Electric Vehicle (EV) market presents a significant opportunity, as EVs often feature more advanced digital interfaces. The growth of autonomous driving will necessitate sophisticated displays for real-time information processing and passenger interaction. The development of flexible and rollable OLED displays opens new avenues for innovative interior design and user experiences. Furthermore, the increasing adoption of in-car entertainment systems and personalized passenger displays creates new market segments. The potential for transparent OLED displays in applications like windshields for AR-HUDs is a major frontier.

Leading Players in the Automotive Tandem OLED Display Market

LG Samsung BOE Everdisplay Visionox

Key Developments in Automotive Tandem OLED Display Industry

- 2023/Q4: LG Display unveils next-generation Tandem OLED technology with enhanced brightness and durability for automotive applications.

- 2023/Q3: Samsung Display announces advancements in its automotive OLED roadmap, focusing on flexible and larger display solutions.

- 2023/Q2: BOE showcases its expanded portfolio of automotive OLED displays, emphasizing cost-effectiveness for mass-market adoption.

- 2023/Q1: Visionox highlights its focus on high-performance Tandem OLEDs for demanding commercial vehicle applications.

- 2022/Q4: Everdisplay reports significant progress in scaling up production of its automotive-grade Tandem OLED panels.

Strategic Outlook for Automotive Tandem OLED Display Market

The strategic outlook for the Automotive Tandem OLED Display market is overwhelmingly positive, driven by the synergistic growth of automotive technological innovation and consumer demand for premium in-cabin experiences. Continued investment in R&D for two-stack and three-stack tandem OLEDs will be critical to improve performance and reduce costs. Strategic partnerships between display manufacturers and automotive OEMs will accelerate the integration of these advanced displays into new vehicle models. The trend towards electrification and autonomy will further solidify the position of Tandem OLEDs as the preferred display technology for future vehicles, unlocking significant market potential and driving innovation in areas such as augmented reality integration and sophisticated user interfaces.

Automotive Tandem OLED Display Segmentation

-

1. Application

- 1.1. Passenger Vehicle

- 1.2. Commercial Vehicle

-

2. Types

- 2.1. Two-Stack Tandem OLED

- 2.2. Three-Stack Tandem OLED

- 2.3. Others

Automotive Tandem OLED Display Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Automotive Tandem OLED Display REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.3% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Tandem OLED Display Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Passenger Vehicle

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Two-Stack Tandem OLED

- 5.2.2. Three-Stack Tandem OLED

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Automotive Tandem OLED Display Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Passenger Vehicle

- 6.1.2. Commercial Vehicle

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Two-Stack Tandem OLED

- 6.2.2. Three-Stack Tandem OLED

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Automotive Tandem OLED Display Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Passenger Vehicle

- 7.1.2. Commercial Vehicle

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Two-Stack Tandem OLED

- 7.2.2. Three-Stack Tandem OLED

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Automotive Tandem OLED Display Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Passenger Vehicle

- 8.1.2. Commercial Vehicle

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Two-Stack Tandem OLED

- 8.2.2. Three-Stack Tandem OLED

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Automotive Tandem OLED Display Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Passenger Vehicle

- 9.1.2. Commercial Vehicle

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Two-Stack Tandem OLED

- 9.2.2. Three-Stack Tandem OLED

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Automotive Tandem OLED Display Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Passenger Vehicle

- 10.1.2. Commercial Vehicle

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Two-Stack Tandem OLED

- 10.2.2. Three-Stack Tandem OLED

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 LG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Samsung

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BOE

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Everdisplay

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Visionox

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 LG

List of Figures

- Figure 1: Global Automotive Tandem OLED Display Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Automotive Tandem OLED Display Revenue (million), by Application 2024 & 2032

- Figure 3: North America Automotive Tandem OLED Display Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Automotive Tandem OLED Display Revenue (million), by Types 2024 & 2032

- Figure 5: North America Automotive Tandem OLED Display Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Automotive Tandem OLED Display Revenue (million), by Country 2024 & 2032

- Figure 7: North America Automotive Tandem OLED Display Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Automotive Tandem OLED Display Revenue (million), by Application 2024 & 2032

- Figure 9: South America Automotive Tandem OLED Display Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Automotive Tandem OLED Display Revenue (million), by Types 2024 & 2032

- Figure 11: South America Automotive Tandem OLED Display Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Automotive Tandem OLED Display Revenue (million), by Country 2024 & 2032

- Figure 13: South America Automotive Tandem OLED Display Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Automotive Tandem OLED Display Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Automotive Tandem OLED Display Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Automotive Tandem OLED Display Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Automotive Tandem OLED Display Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Automotive Tandem OLED Display Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Automotive Tandem OLED Display Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Automotive Tandem OLED Display Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Automotive Tandem OLED Display Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Automotive Tandem OLED Display Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Automotive Tandem OLED Display Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Automotive Tandem OLED Display Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Automotive Tandem OLED Display Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Automotive Tandem OLED Display Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Automotive Tandem OLED Display Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Automotive Tandem OLED Display Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Automotive Tandem OLED Display Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Automotive Tandem OLED Display Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Automotive Tandem OLED Display Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Automotive Tandem OLED Display Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Automotive Tandem OLED Display Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Automotive Tandem OLED Display Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Automotive Tandem OLED Display Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Automotive Tandem OLED Display Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Automotive Tandem OLED Display Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Automotive Tandem OLED Display Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Automotive Tandem OLED Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Automotive Tandem OLED Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Automotive Tandem OLED Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Automotive Tandem OLED Display Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Automotive Tandem OLED Display Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Automotive Tandem OLED Display Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Automotive Tandem OLED Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Automotive Tandem OLED Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Automotive Tandem OLED Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Automotive Tandem OLED Display Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Automotive Tandem OLED Display Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Automotive Tandem OLED Display Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Automotive Tandem OLED Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Automotive Tandem OLED Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Automotive Tandem OLED Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Automotive Tandem OLED Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Automotive Tandem OLED Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Automotive Tandem OLED Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Automotive Tandem OLED Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Automotive Tandem OLED Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Automotive Tandem OLED Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Automotive Tandem OLED Display Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Automotive Tandem OLED Display Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Automotive Tandem OLED Display Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Automotive Tandem OLED Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Automotive Tandem OLED Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Automotive Tandem OLED Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Automotive Tandem OLED Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Automotive Tandem OLED Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Automotive Tandem OLED Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Automotive Tandem OLED Display Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Automotive Tandem OLED Display Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Automotive Tandem OLED Display Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Automotive Tandem OLED Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Automotive Tandem OLED Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Automotive Tandem OLED Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Automotive Tandem OLED Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Automotive Tandem OLED Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Automotive Tandem OLED Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Automotive Tandem OLED Display Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Tandem OLED Display?

The projected CAGR is approximately 13.3%.

2. Which companies are prominent players in the Automotive Tandem OLED Display?

Key companies in the market include LG, Samsung, BOE, Everdisplay, Visionox.

3. What are the main segments of the Automotive Tandem OLED Display?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 214 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Tandem OLED Display," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Tandem OLED Display report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Tandem OLED Display?

To stay informed about further developments, trends, and reports in the Automotive Tandem OLED Display, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence