Key Insights

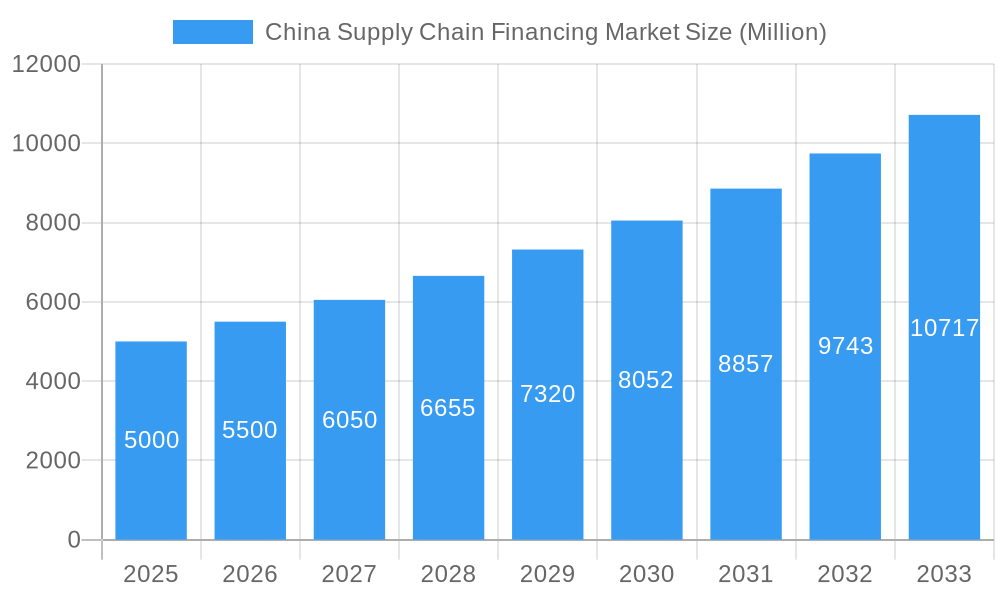

China's supply chain financing market is poised for significant expansion, propelled by a burgeoning e-commerce ecosystem, amplified manufacturing output, and strategic government initiatives focused on optimizing supply chain operations. The market is projected to witness a Compound Annual Growth Rate (CAGR) of 9.2%. Driven by the increasing demand for efficient financing solutions from Small and Medium-sized Enterprises (SMEs), which are integral to China's manufacturing and export sectors, the market size is estimated at 9.3 billion in the base year 2025. Leading financial institutions, including Deutsche Bank, DBS Bank, Bank of China, and Ping An Bank, are actively shaping this landscape by offering diversified financing products catering to varied business requirements. The market is further segmented by financing types, such as invoice and purchase order financing, and by key industries including manufacturing, retail, and technology. The sustained growth of e-commerce and the pervasive digitalization of supply chains are anticipated to accelerate this market's trajectory.

China Supply Chain Financing Market Market Size (In Billion)

While the market presents a promising outlook, potential challenges such as credit risk assessment within the SME segment, evolving regulatory frameworks, and intense competition among financial service providers warrant consideration. Nevertheless, supportive government policies aimed at enhancing supply chain resilience and championing digital transformation are expected to counterbalance these hurdles, fostering continued market growth. The progressive integration of fintech solutions and blockchain technology is also poised to elevate operational efficiency and transparency across supply chains, thereby catalyzing further market expansion. The development of advanced risk management methodologies will be paramount to the sector's enduring success.

China Supply Chain Financing Market Company Market Share

China Supply Chain Financing Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the China Supply Chain Financing market, offering valuable insights into market dynamics, growth drivers, challenges, and future opportunities. The study period covers 2019-2033, with 2025 as the base and estimated year. The report uses Million as the unit for all monetary values.

China Supply Chain Financing Market Concentration & Innovation

This section analyzes the competitive landscape of the China supply chain financing market, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. The market is characterized by a mix of large international banks and domestic players. While precise market share figures for each player require further analysis and data collection, the presence of major international players like Deutsche Bank AG, DBS Bank Ltd, HSBC Bank, and Citibank alongside domestic giants such as Bank of China, Industrial and Commercial Bank of China, and Ping An Bank suggests a moderately concentrated market. Smaller players and fintech firms are also actively participating, driving innovation.

- Market Concentration: Moderate, with a mix of large international and domestic banks. Further research is needed to determine precise market share data for individual players.

- Innovation Drivers: Technological advancements (blockchain, AI), increasing demand for efficient financing solutions, and government initiatives promoting supply chain modernization.

- Regulatory Framework: The regulatory landscape influences market dynamics, with recent mergers and acquisitions requiring approvals from bodies like the China Banking and Insurance Regulatory Commission and the State Administration for Market Regulation. Ongoing regulatory changes may impact market growth.

- Product Substitutes: Alternative financing options, such as factoring and invoice discounting, exist, but these often lack the scale and efficiency offered by supply chain finance solutions.

- End-User Trends: Increasing demand for efficient and transparent financing from SMEs and larger corporations, driven by the need for improved cash flow management and reduced financing costs.

- M&A Activities: Significant M&A activity, such as the Zhongyuan Bank acquisition in May 2022, indicates consolidation and expansion within the market. The estimated value of such transactions is currently unavailable (xx Million).

China Supply Chain Financing Market Industry Trends & Insights

The China supply chain financing market is experiencing robust growth, driven by several key factors. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated at xx%, reflecting the increasing demand for efficient financial solutions within the evolving supply chain ecosystem. Market penetration is currently estimated at xx% and is projected to increase significantly during the forecast period. Technological advancements, notably in areas such as blockchain and artificial intelligence, are revolutionizing supply chain finance. These technologies enhance transparency, streamline processes, and reduce risks associated with traditional financing methods. A growing preference for digital solutions among businesses further fuels market growth.

The competitive dynamics are intense, with both domestic and international players vying for market share. The market is witnessing a significant shift toward digitalization and innovation, with companies constantly looking to improve efficiency and customer experience. Consumer preferences for greater transparency and reduced costs are influencing the evolution of products and services offered.

Dominant Markets & Segments in China Supply Chain Financing Market

While detailed regional and segmental breakdown requires further investigation, the following points illustrate potential areas of dominance:

Key Drivers:

- Economic Policies: Government initiatives promoting economic growth and supply chain development are crucial drivers of market expansion. The "Made in China 2025" initiative, for example, indirectly stimulates demand for supply chain finance.

- Infrastructure Development: Investments in infrastructure, particularly in logistics and transportation, are facilitating efficient supply chain operations and supporting market growth.

Dominance Analysis: The coastal regions of China, particularly those with established manufacturing hubs, are likely to be dominant markets due to higher business activity and demand for financing solutions. However, this needs further confirmation with more market data. Specific industry segments showing higher demand are currently unavailable (xx).

China Supply Chain Financing Market Product Developments

Recent product innovations include the introduction of hybrid financing solutions, as exemplified by DBS Bank's launch in October 2023. These solutions combine traditional financing with sustainability-linked incentives, catering to the increasing demand for environmentally responsible practices. Further advancements in technology, including AI-powered risk assessment and blockchain-based transaction tracking, are enhancing the efficiency and transparency of supply chain finance products. This market fit reflects the evolving needs of businesses seeking optimized financial solutions that align with broader sustainability goals.

Report Scope & Segmentation Analysis

The report segments the China supply chain financing market across several dimensions. Data is unavailable for precise estimations; however, the following provides a potential segmentation:

By Financing Type: Invoice financing, purchase order financing, supply chain receivables financing, etc. Growth projections vary across these segments, with digitally enabled solutions expected to show faster growth.

By Industry: Manufacturing, retail, technology, agriculture, etc. Competitive dynamics differ significantly across industry sectors.

By Company Size: SMEs, large enterprises. The needs and financial capacity of these groups lead to different product offerings and market strategies.

Further analysis will provide quantitative data on market sizes and segment-specific growth projections.

Key Drivers of China Supply Chain Financing Market Growth

Several key factors fuel the growth of the China supply chain financing market:

- Technological Advancements: Blockchain and AI are streamlining processes, reducing costs, and improving transparency.

- Economic Growth: Continued economic growth in China drives increased demand for efficient supply chain solutions.

- Government Support: Favorable government policies promoting supply chain development and modernization are instrumental in driving market expansion.

Challenges in the China Supply Chain Financing Market Sector

The China supply chain financing market faces several challenges:

- Regulatory Hurdles: Navigating complex regulatory environments can pose significant challenges for market participants.

- Supply Chain Disruptions: Global supply chain volatility increases uncertainty and risk for financing providers. Quantifiable impact requires extensive data analysis (xx%).

- Competitive Pressure: Intense competition from established players and new entrants puts pressure on profit margins.

Emerging Opportunities in China Supply Chain Financing Market

Several opportunities exist for growth in this sector:

- Expansion into Underserved Markets: Reaching out to smaller businesses and regions with limited access to financing.

- Technological Innovation: Implementing innovative technologies, such as AI-powered risk management, to enhance efficiency and reduce costs.

- Focus on Sustainability: Developing sustainable financing solutions catering to the growing demand for environmentally responsible practices.

Leading Players in the China Supply Chain Financing Market Market

Key Developments in China Supply Chain Financing Market Industry

October 2023: DBS launched its first hybrid financing solution for SMEs, focusing on sustainability. This signals a growing trend towards incorporating ESG (environmental, social, and governance) factors into supply chain financing.

May 2022: Zhongyuan Bank's acquisition of several smaller banks significantly consolidated the market. This move potentially improves efficiency and expands reach, impacting market competition.

December 2022: Citi's withdrawal from the Chinese consumer banking market had a limited direct impact on the supply chain finance sector but illustrates changing strategic priorities among international banks.

Strategic Outlook for China Supply Chain Financing Market Market

The China supply chain financing market holds significant future potential. The ongoing digital transformation, coupled with supportive government policies and increasing demand for efficient financing solutions, will drive continued growth. Focusing on innovation, particularly in areas like blockchain and AI, and catering to the needs of SMEs, will be crucial for success. The market’s long-term prospects remain positive, offering substantial opportunities for both domestic and international players.

China Supply Chain Financing Market Segmentation

-

1. Offering

- 1.1. Export and Import Bills

- 1.2. Letter of Credit

- 1.3. Performance Bonds

- 1.4. Shipping, Guarantees

- 1.5. Other Offerings

-

2. Provider

- 2.1. Banks

- 2.2. Trade Finance House

- 2.3. Other Providers

-

3. Application

- 3.1. Domestic

- 3.2. International

-

4. End-User

- 4.1. Large Enterprises

- 4.2. Small and Medium-sized Enterprises

China Supply Chain Financing Market Segmentation By Geography

- 1. China

China Supply Chain Financing Market Regional Market Share

Geographic Coverage of China Supply Chain Financing Market

China Supply Chain Financing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Incorporation of New Novel Technologies

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Supply Chain Financing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Export and Import Bills

- 5.1.2. Letter of Credit

- 5.1.3. Performance Bonds

- 5.1.4. Shipping, Guarantees

- 5.1.5. Other Offerings

- 5.2. Market Analysis, Insights and Forecast - by Provider

- 5.2.1. Banks

- 5.2.2. Trade Finance House

- 5.2.3. Other Providers

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Domestic

- 5.3.2. International

- 5.4. Market Analysis, Insights and Forecast - by End-User

- 5.4.1. Large Enterprises

- 5.4.2. Small and Medium-sized Enterprises

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Deutsche Bank AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DBS Bank Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bank of China

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ping An Bank

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Standard Bank

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Flexport

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Industrial and Commercial Bank of China

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 HSBC Bank

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Citibank*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Deutsche Bank AG

List of Figures

- Figure 1: China Supply Chain Financing Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Supply Chain Financing Market Share (%) by Company 2025

List of Tables

- Table 1: China Supply Chain Financing Market Revenue billion Forecast, by Offering 2020 & 2033

- Table 2: China Supply Chain Financing Market Revenue billion Forecast, by Provider 2020 & 2033

- Table 3: China Supply Chain Financing Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: China Supply Chain Financing Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 5: China Supply Chain Financing Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: China Supply Chain Financing Market Revenue billion Forecast, by Offering 2020 & 2033

- Table 7: China Supply Chain Financing Market Revenue billion Forecast, by Provider 2020 & 2033

- Table 8: China Supply Chain Financing Market Revenue billion Forecast, by Application 2020 & 2033

- Table 9: China Supply Chain Financing Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 10: China Supply Chain Financing Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Supply Chain Financing Market?

The projected CAGR is approximately 9.2%.

2. Which companies are prominent players in the China Supply Chain Financing Market?

Key companies in the market include Deutsche Bank AG, DBS Bank Ltd, Bank of China, Ping An Bank, Standard Bank, Flexport, Industrial and Commercial Bank of China, HSBC Bank, Citibank*List Not Exhaustive.

3. What are the main segments of the China Supply Chain Financing Market?

The market segments include Offering, Provider, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.3 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Incorporation of New Novel Technologies.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2023: DBS launched its first hybrid financing solution to help small and medium enterprises (SMEs) access a wider pool of capital to finance their sustainability journeys.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Supply Chain Financing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Supply Chain Financing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Supply Chain Financing Market?

To stay informed about further developments, trends, and reports in the China Supply Chain Financing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence