Key Insights

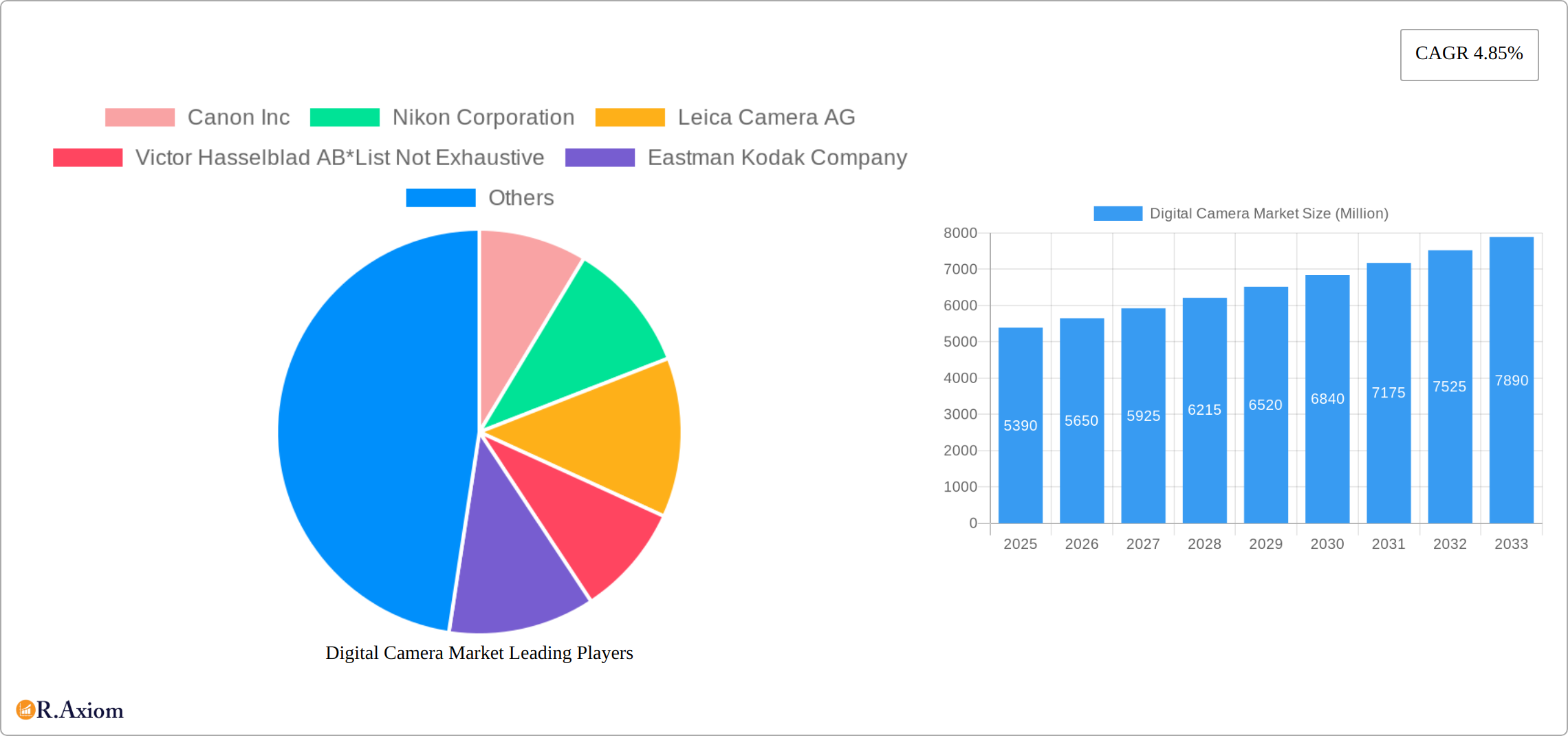

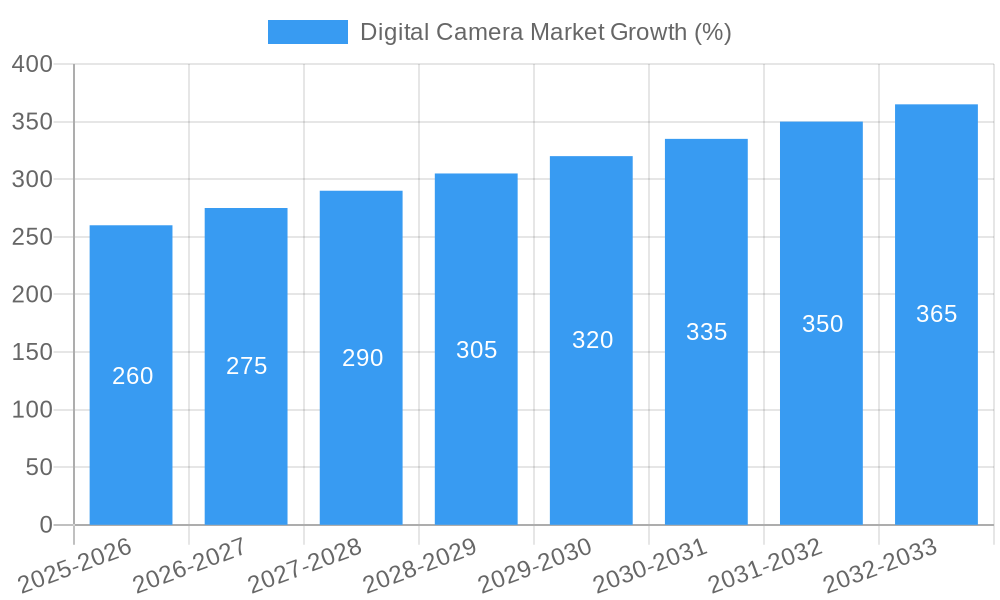

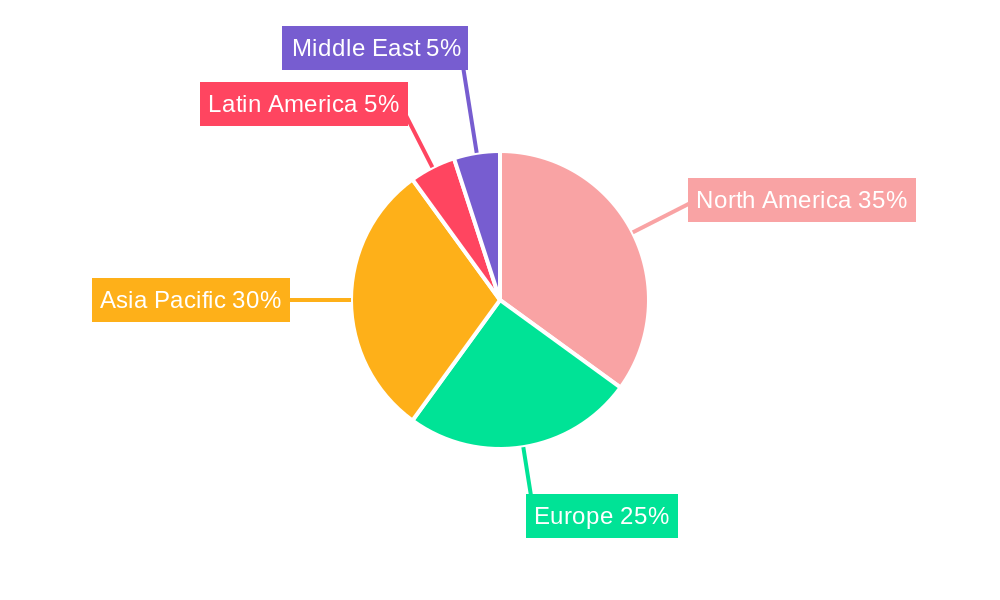

The global digital camera market, valued at $5.39 billion in 2025, is projected to experience steady growth, driven by several key factors. The increasing popularity of photography as a hobby and the professionalization of social media content creation fuel demand for high-quality imaging devices. Advancements in sensor technology, leading to improved image quality and low-light performance, are also significant drivers. Furthermore, the rising adoption of mirrorless cameras, known for their compact size and superior autofocus capabilities, is reshaping market dynamics. While the market faces some restraints, including the competition from smartphone cameras with increasingly sophisticated imaging features and the overall economic climate, the consistent innovation in camera technology and the enduring appeal of professional-grade photography are expected to mitigate these challenges. The market segmentation reveals a diverse landscape, with interchangeable lens cameras maintaining a premium position, while compact digital cameras cater to a broader consumer base. Professional photographers represent a significant segment, but the growing prosumers' market (enthusiasts with professional aspirations) demonstrates strong growth potential. Geographic distribution likely sees a concentration in North America and Asia-Pacific regions given the higher disposable incomes and established camera markets in these regions, while Europe and other regions contribute to the overall growth. The projected Compound Annual Growth Rate (CAGR) of 4.85% over the forecast period (2025-2033) indicates a robust, albeit moderate, expansion trajectory.

The market's future hinges on technological innovations, such as advancements in artificial intelligence (AI) for image processing and the integration of advanced video capabilities in digital cameras. Strategic partnerships between camera manufacturers and software developers will also play a crucial role in enhancing user experience and expanding market reach. Manufacturers are likely focusing on niche segments, like high-end professional cameras catering to specific needs, to maintain profitability. The ongoing evolution of the market will be shaped by consumer preferences, economic fluctuations, and technological breakthroughs, creating exciting opportunities for innovation and market expansion within the digital imaging sector.

Digital Camera Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global digital camera market, covering the period 2019-2033. It offers actionable insights into market dynamics, competitive landscapes, and future growth projections, empowering stakeholders to make informed strategic decisions. The report leverages extensive primary and secondary research, incorporating data from key industry players such as Canon Inc, Nikon Corporation, Leica Camera AG, Victor Hasselblad AB, Eastman Kodak Company, OM Digital Solutions Corporation, Sigma Corporation, Panasonic Corporation, Sony Corporation, and Fujifilm Holdings Corporation. The analysis encompasses various segments including lens type (built-in, interchangeable), camera type (compact digital camera, DSLR, mirrorless), and end-user (professional photographers, prosumers, hobbyists).

Digital Camera Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities within the digital camera industry. The global digital camera market exhibits a moderately concentrated structure, with a few major players holding significant market share. However, the presence of numerous niche players and continuous innovation fuels competition. The market share of the top five players is estimated at xx% in 2025, while the remaining xx% is divided among numerous smaller players.

- Innovation Drivers: Advancements in sensor technology, image processing, and lens design are key drivers of innovation. The development of mirrorless cameras with superior autofocus and image quality is significantly impacting market dynamics.

- Regulatory Frameworks: Government regulations related to import/export and intellectual property rights influence market operations. Compliance with these regulations varies across regions.

- Product Substitutes: Smartphones with advanced camera capabilities pose a significant threat to the digital camera market, particularly in the compact camera segment. However, professional photographers and enthusiasts often prefer the superior quality and flexibility of dedicated digital cameras.

- End-user Trends: Growing demand for high-quality images and videos, particularly among professional photographers and prosumers, supports market growth.

- M&A Activities: The digital camera industry has witnessed several mergers and acquisitions (M&A) in recent years. While specific deal values are not publicly disclosed in all instances, the total M&A value is estimated at $xx Million in the last five years. These activities often aim to expand product portfolios, enhance technological capabilities, and increase market reach.

Digital Camera Market Industry Trends & Insights

The global digital camera market is projected to experience a CAGR of xx% during the forecast period (2025-2033). This growth is driven by several factors, including the increasing demand for high-quality images and videos in various applications, such as professional photography, videography, and amateur photography. Technological advancements, such as the development of improved image sensors and lens technologies, are also contributing to market growth.

- Market Growth Drivers: The increasing adoption of digital cameras in various industries such as journalism, filmmaking, and event photography is a significant growth driver. The rising disposable income of consumers in developing countries also contributes to the growth of the digital camera market. The market penetration of digital cameras in developed countries is relatively high, with xx% of households owning at least one digital camera in 2025. However, continued growth is anticipated in emerging economies.

- Technological Disruptions: The emergence of mirrorless cameras and improvements in smartphone camera technology represent significant technological disruptions. However, dedicated digital cameras still maintain an edge in image quality, especially at the professional level.

- Consumer Preferences: Consumers are increasingly demanding higher resolution, better image quality, and advanced features such as 4K video recording and improved autofocus systems. This preference fuels innovation and drives the market forward.

- Competitive Dynamics: Intense competition among major players leads to continuous innovation and price reductions, benefiting consumers.

Dominant Markets & Segments in Digital Camera Market

The North American region dominates the global digital camera market, driven by high consumer spending power and advanced technological adoption. Asia-Pacific is expected to experience significant growth during the forecast period, fueled by increasing disposable income and the growing popularity of photography as a hobby. Within market segments, mirrorless cameras are experiencing the most significant growth due to their advanced features and compact designs.

- Leading Region: North America

- Key Drivers: High disposable income, advanced technological infrastructure, strong demand for high-quality images.

- Leading Country: United States

- Key Drivers: Large consumer base, robust economy, strong demand for professional photography equipment.

- Leading Segment (By Lens Type): Interchangeable Lenses

- Key Drivers: Superior image quality, flexibility, wider range of creative options.

- Leading Segment (By Camera Type): Mirrorless Cameras

- Key Drivers: Advanced autofocus, superior image quality, compact design.

- Leading Segment (By End-user): Prosumers

- Key Drivers: High demand for advanced features, willingness to invest in better equipment, increasing adoption of mirrorless cameras.

Digital Camera Market Product Developments

Recent product innovations focus on improving image quality, autofocus speed, and video recording capabilities. The introduction of mirrorless cameras with improved sensor technology and in-body image stabilization systems has significantly impacted the market. Manufacturers are increasingly emphasizing features like high-resolution sensors, superior low-light performance, and advanced video recording capabilities to appeal to professional and pro-consumer segments. New software and firmware updates frequently enhance performance and functionality.

Report Scope & Segmentation Analysis

This report segments the digital camera market by lens type (built-in, interchangeable), camera type (compact digital camera, DSLR, mirrorless), and end-user (professional photographers, prosumers, hobbyists). Each segment's market size, growth projections, and competitive dynamics are analyzed.

- By Lens Type: The interchangeable lens segment is projected to experience faster growth due to its flexibility and superior image quality.

- By Camera Type: The mirrorless camera segment is expected to dominate, driven by technological advancements and compact designs.

- By End-user: The prosumers segment displays significant growth potential due to rising disposable income and increased interest in photography.

Key Drivers of Digital Camera Market Growth

Technological advancements are significantly propelling the growth of the digital camera market. These include the development of higher-resolution image sensors boasting superior low-light performance and dynamic range, improved lens technology offering sharper images and faster autofocus, and the integration of advanced image processing capabilities. The resulting demand for high-quality images and videos fuels market expansion across diverse applications, including professional photography, filmmaking, journalism, wildlife photography, and social media content creation. Beyond professional use, the rising disposable incomes in developing economies are creating a burgeoning consumer base eager for high-quality imaging solutions. Furthermore, government initiatives promoting digital media and technology adoption, particularly in education and tourism, are indirectly fostering market growth.

Challenges in the Digital Camera Market Sector

The pervasive adoption of smartphones equipped with increasingly sophisticated camera systems presents a formidable challenge to the dedicated digital camera market. The convenience and seamless integration of smartphone cameras into daily life have led to a decline in the demand for standalone devices. This is exacerbated by fluctuations in raw material prices, especially those of essential components like semiconductors and rare earth elements, and global supply chain disruptions, which impact manufacturing costs and product availability. The intense competition among established manufacturers and the emergence of new players result in aggressive price wars and pressure on profit margins. These factors collectively contribute to a projected reduction in overall digital camera sales, impacting market growth and profitability.

Emerging Opportunities in Digital Camera Market

Despite the challenges, significant opportunities remain within the digital camera market. The burgeoning demand for high-quality images and videos in rapidly developing economies, particularly in Asia-Pacific and Latin America, presents a substantial growth avenue. Technological innovations like the integration of artificial intelligence (AI) for features such as automated scene recognition, advanced object tracking, and computational photography are creating new market segments and attracting tech-savvy consumers. The rising popularity of video content creation, including live streaming and vlogging, further fuels the demand for digital cameras optimized for video recording, with capabilities like high frame rates, exceptional image stabilization, and advanced audio recording options.

Leading Players in the Digital Camera Market Market

- Canon Inc

- Nikon Corporation

- Leica Camera AG

- Victor Hasselblad AB

- Eastman Kodak Company

- OM Digital Solutions Corporation

- Sigma Corporation

- Panasonic Corporation

- Sony Corporation

- Fujifilm Holdings Corporation

Key Developments in Digital Camera Market Industry

- September 2022: FUJIFILM North America Corporation launched the FUJINON XF56mmF1.2 R WR lens, a high-aperture prime lens enhancing its mirrorless camera system and catering to professional photographers and videographers.

- September 2022: Canon U.S.A., Inc. expanded its cinema and broadcast offerings with new 8K lenses and equipment, signaling a commitment to high-resolution video production and meeting the demands of the growing professional filmmaking market.

- October 2022: Fujifilm partnered with Adobe to develop "FUJIFILM X-H2S" firmware with Camera to Cloud (C2C) connectivity, improving workflow efficiency and streamlining the process of transferring images and videos for professional use.

- [Add more recent developments here with dates and brief descriptions]

Strategic Outlook for Digital Camera Market Market

The digital camera market is poised for continued growth, driven by technological advancements, the increasing demand for high-quality images and videos, and the expansion of the market into emerging economies. Focusing on innovation, particularly in video capabilities and AI-powered features, will be crucial for manufacturers to maintain a competitive edge. Strategic partnerships and collaborations will also play a key role in driving future growth.

Digital Camera Market Segmentation

-

1. Lens Type

- 1.1. Built-in

- 1.2. Interchangeable

-

2. Camera Type

- 2.1. Compact Digital Camera

- 2.2. DSLR

- 2.3. Mirrorless

-

3. End User

- 3.1. Pro Photographers

- 3.2. Prosumers

- 3.3. Hobbyists

Digital Camera Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Digital Camera Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.85% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Anticipated Increase in Sales of Mirror-less Lens; Demand for Specialized Products from Niche Customer Base

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness to Challenge the Market Growth

- 3.4. Market Trends

- 3.4.1. Increase in Sales of Mirror-less Lens is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Digital Camera Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Lens Type

- 5.1.1. Built-in

- 5.1.2. Interchangeable

- 5.2. Market Analysis, Insights and Forecast - by Camera Type

- 5.2.1. Compact Digital Camera

- 5.2.2. DSLR

- 5.2.3. Mirrorless

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Pro Photographers

- 5.3.2. Prosumers

- 5.3.3. Hobbyists

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Australia and New Zealand

- 5.4.5. Latin America

- 5.4.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Lens Type

- 6. North America Digital Camera Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Lens Type

- 6.1.1. Built-in

- 6.1.2. Interchangeable

- 6.2. Market Analysis, Insights and Forecast - by Camera Type

- 6.2.1. Compact Digital Camera

- 6.2.2. DSLR

- 6.2.3. Mirrorless

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Pro Photographers

- 6.3.2. Prosumers

- 6.3.3. Hobbyists

- 6.1. Market Analysis, Insights and Forecast - by Lens Type

- 7. Europe Digital Camera Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Lens Type

- 7.1.1. Built-in

- 7.1.2. Interchangeable

- 7.2. Market Analysis, Insights and Forecast - by Camera Type

- 7.2.1. Compact Digital Camera

- 7.2.2. DSLR

- 7.2.3. Mirrorless

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Pro Photographers

- 7.3.2. Prosumers

- 7.3.3. Hobbyists

- 7.1. Market Analysis, Insights and Forecast - by Lens Type

- 8. Asia Digital Camera Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Lens Type

- 8.1.1. Built-in

- 8.1.2. Interchangeable

- 8.2. Market Analysis, Insights and Forecast - by Camera Type

- 8.2.1. Compact Digital Camera

- 8.2.2. DSLR

- 8.2.3. Mirrorless

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Pro Photographers

- 8.3.2. Prosumers

- 8.3.3. Hobbyists

- 8.1. Market Analysis, Insights and Forecast - by Lens Type

- 9. Australia and New Zealand Digital Camera Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Lens Type

- 9.1.1. Built-in

- 9.1.2. Interchangeable

- 9.2. Market Analysis, Insights and Forecast - by Camera Type

- 9.2.1. Compact Digital Camera

- 9.2.2. DSLR

- 9.2.3. Mirrorless

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Pro Photographers

- 9.3.2. Prosumers

- 9.3.3. Hobbyists

- 9.1. Market Analysis, Insights and Forecast - by Lens Type

- 10. Latin America Digital Camera Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Lens Type

- 10.1.1. Built-in

- 10.1.2. Interchangeable

- 10.2. Market Analysis, Insights and Forecast - by Camera Type

- 10.2.1. Compact Digital Camera

- 10.2.2. DSLR

- 10.2.3. Mirrorless

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Pro Photographers

- 10.3.2. Prosumers

- 10.3.3. Hobbyists

- 10.1. Market Analysis, Insights and Forecast - by Lens Type

- 11. Middle East and Africa Digital Camera Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Lens Type

- 11.1.1. Built-in

- 11.1.2. Interchangeable

- 11.2. Market Analysis, Insights and Forecast - by Camera Type

- 11.2.1. Compact Digital Camera

- 11.2.2. DSLR

- 11.2.3. Mirrorless

- 11.3. Market Analysis, Insights and Forecast - by End User

- 11.3.1. Pro Photographers

- 11.3.2. Prosumers

- 11.3.3. Hobbyists

- 11.1. Market Analysis, Insights and Forecast - by Lens Type

- 12. North America Digital Camera Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Europe Digital Camera Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Asia Pacific Digital Camera Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Latin America Digital Camera Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Middle East Digital Camera Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Canon Inc

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Nikon Corporation

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Leica Camera AG

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Victor Hasselblad AB*List Not Exhaustive

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Eastman Kodak Company

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 OM Digital Solutions Corporation

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Sigma Corporation

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Panasonic Corporation

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Sony Corporation

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Fujifilm Holdings Corporation

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.1 Canon Inc

List of Figures

- Figure 1: Global Digital Camera Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Digital Camera Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Digital Camera Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Digital Camera Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Digital Camera Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Digital Camera Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Digital Camera Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Digital Camera Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Digital Camera Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East Digital Camera Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East Digital Camera Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Digital Camera Market Revenue (Million), by Lens Type 2024 & 2032

- Figure 13: North America Digital Camera Market Revenue Share (%), by Lens Type 2024 & 2032

- Figure 14: North America Digital Camera Market Revenue (Million), by Camera Type 2024 & 2032

- Figure 15: North America Digital Camera Market Revenue Share (%), by Camera Type 2024 & 2032

- Figure 16: North America Digital Camera Market Revenue (Million), by End User 2024 & 2032

- Figure 17: North America Digital Camera Market Revenue Share (%), by End User 2024 & 2032

- Figure 18: North America Digital Camera Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Digital Camera Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Digital Camera Market Revenue (Million), by Lens Type 2024 & 2032

- Figure 21: Europe Digital Camera Market Revenue Share (%), by Lens Type 2024 & 2032

- Figure 22: Europe Digital Camera Market Revenue (Million), by Camera Type 2024 & 2032

- Figure 23: Europe Digital Camera Market Revenue Share (%), by Camera Type 2024 & 2032

- Figure 24: Europe Digital Camera Market Revenue (Million), by End User 2024 & 2032

- Figure 25: Europe Digital Camera Market Revenue Share (%), by End User 2024 & 2032

- Figure 26: Europe Digital Camera Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Digital Camera Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Digital Camera Market Revenue (Million), by Lens Type 2024 & 2032

- Figure 29: Asia Digital Camera Market Revenue Share (%), by Lens Type 2024 & 2032

- Figure 30: Asia Digital Camera Market Revenue (Million), by Camera Type 2024 & 2032

- Figure 31: Asia Digital Camera Market Revenue Share (%), by Camera Type 2024 & 2032

- Figure 32: Asia Digital Camera Market Revenue (Million), by End User 2024 & 2032

- Figure 33: Asia Digital Camera Market Revenue Share (%), by End User 2024 & 2032

- Figure 34: Asia Digital Camera Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Digital Camera Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Australia and New Zealand Digital Camera Market Revenue (Million), by Lens Type 2024 & 2032

- Figure 37: Australia and New Zealand Digital Camera Market Revenue Share (%), by Lens Type 2024 & 2032

- Figure 38: Australia and New Zealand Digital Camera Market Revenue (Million), by Camera Type 2024 & 2032

- Figure 39: Australia and New Zealand Digital Camera Market Revenue Share (%), by Camera Type 2024 & 2032

- Figure 40: Australia and New Zealand Digital Camera Market Revenue (Million), by End User 2024 & 2032

- Figure 41: Australia and New Zealand Digital Camera Market Revenue Share (%), by End User 2024 & 2032

- Figure 42: Australia and New Zealand Digital Camera Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Australia and New Zealand Digital Camera Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: Latin America Digital Camera Market Revenue (Million), by Lens Type 2024 & 2032

- Figure 45: Latin America Digital Camera Market Revenue Share (%), by Lens Type 2024 & 2032

- Figure 46: Latin America Digital Camera Market Revenue (Million), by Camera Type 2024 & 2032

- Figure 47: Latin America Digital Camera Market Revenue Share (%), by Camera Type 2024 & 2032

- Figure 48: Latin America Digital Camera Market Revenue (Million), by End User 2024 & 2032

- Figure 49: Latin America Digital Camera Market Revenue Share (%), by End User 2024 & 2032

- Figure 50: Latin America Digital Camera Market Revenue (Million), by Country 2024 & 2032

- Figure 51: Latin America Digital Camera Market Revenue Share (%), by Country 2024 & 2032

- Figure 52: Middle East and Africa Digital Camera Market Revenue (Million), by Lens Type 2024 & 2032

- Figure 53: Middle East and Africa Digital Camera Market Revenue Share (%), by Lens Type 2024 & 2032

- Figure 54: Middle East and Africa Digital Camera Market Revenue (Million), by Camera Type 2024 & 2032

- Figure 55: Middle East and Africa Digital Camera Market Revenue Share (%), by Camera Type 2024 & 2032

- Figure 56: Middle East and Africa Digital Camera Market Revenue (Million), by End User 2024 & 2032

- Figure 57: Middle East and Africa Digital Camera Market Revenue Share (%), by End User 2024 & 2032

- Figure 58: Middle East and Africa Digital Camera Market Revenue (Million), by Country 2024 & 2032

- Figure 59: Middle East and Africa Digital Camera Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Digital Camera Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Digital Camera Market Revenue Million Forecast, by Lens Type 2019 & 2032

- Table 3: Global Digital Camera Market Revenue Million Forecast, by Camera Type 2019 & 2032

- Table 4: Global Digital Camera Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Global Digital Camera Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Digital Camera Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Digital Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Digital Camera Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Digital Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Digital Camera Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Digital Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Digital Camera Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Digital Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Digital Camera Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Digital Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Digital Camera Market Revenue Million Forecast, by Lens Type 2019 & 2032

- Table 17: Global Digital Camera Market Revenue Million Forecast, by Camera Type 2019 & 2032

- Table 18: Global Digital Camera Market Revenue Million Forecast, by End User 2019 & 2032

- Table 19: Global Digital Camera Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Digital Camera Market Revenue Million Forecast, by Lens Type 2019 & 2032

- Table 21: Global Digital Camera Market Revenue Million Forecast, by Camera Type 2019 & 2032

- Table 22: Global Digital Camera Market Revenue Million Forecast, by End User 2019 & 2032

- Table 23: Global Digital Camera Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Digital Camera Market Revenue Million Forecast, by Lens Type 2019 & 2032

- Table 25: Global Digital Camera Market Revenue Million Forecast, by Camera Type 2019 & 2032

- Table 26: Global Digital Camera Market Revenue Million Forecast, by End User 2019 & 2032

- Table 27: Global Digital Camera Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Global Digital Camera Market Revenue Million Forecast, by Lens Type 2019 & 2032

- Table 29: Global Digital Camera Market Revenue Million Forecast, by Camera Type 2019 & 2032

- Table 30: Global Digital Camera Market Revenue Million Forecast, by End User 2019 & 2032

- Table 31: Global Digital Camera Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Digital Camera Market Revenue Million Forecast, by Lens Type 2019 & 2032

- Table 33: Global Digital Camera Market Revenue Million Forecast, by Camera Type 2019 & 2032

- Table 34: Global Digital Camera Market Revenue Million Forecast, by End User 2019 & 2032

- Table 35: Global Digital Camera Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Global Digital Camera Market Revenue Million Forecast, by Lens Type 2019 & 2032

- Table 37: Global Digital Camera Market Revenue Million Forecast, by Camera Type 2019 & 2032

- Table 38: Global Digital Camera Market Revenue Million Forecast, by End User 2019 & 2032

- Table 39: Global Digital Camera Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Camera Market?

The projected CAGR is approximately 4.85%.

2. Which companies are prominent players in the Digital Camera Market?

Key companies in the market include Canon Inc, Nikon Corporation, Leica Camera AG, Victor Hasselblad AB*List Not Exhaustive, Eastman Kodak Company, OM Digital Solutions Corporation, Sigma Corporation, Panasonic Corporation, Sony Corporation, Fujifilm Holdings Corporation.

3. What are the main segments of the Digital Camera Market?

The market segments include Lens Type, Camera Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.39 Million as of 2022.

5. What are some drivers contributing to market growth?

Anticipated Increase in Sales of Mirror-less Lens; Demand for Specialized Products from Niche Customer Base.

6. What are the notable trends driving market growth?

Increase in Sales of Mirror-less Lens is Driving the Market.

7. Are there any restraints impacting market growth?

Lack of Awareness to Challenge the Market Growth.

8. Can you provide examples of recent developments in the market?

October 2022 - Fujifilm announced a partnership with Adobe to produce a new mirrorless digital camera firmware, "FUJIFILM X-H2S" (X-H2S), in spring 2023, which would deliver the world's first native Camera to Cloud (C2C) connectivity for mirrorless digital cameras, driven by Frame.io. At the same time, the firmware for the "FT-XH" file transmitters will also be launched.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Digital Camera Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Digital Camera Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Digital Camera Market?

To stay informed about further developments, trends, and reports in the Digital Camera Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence