Key Insights

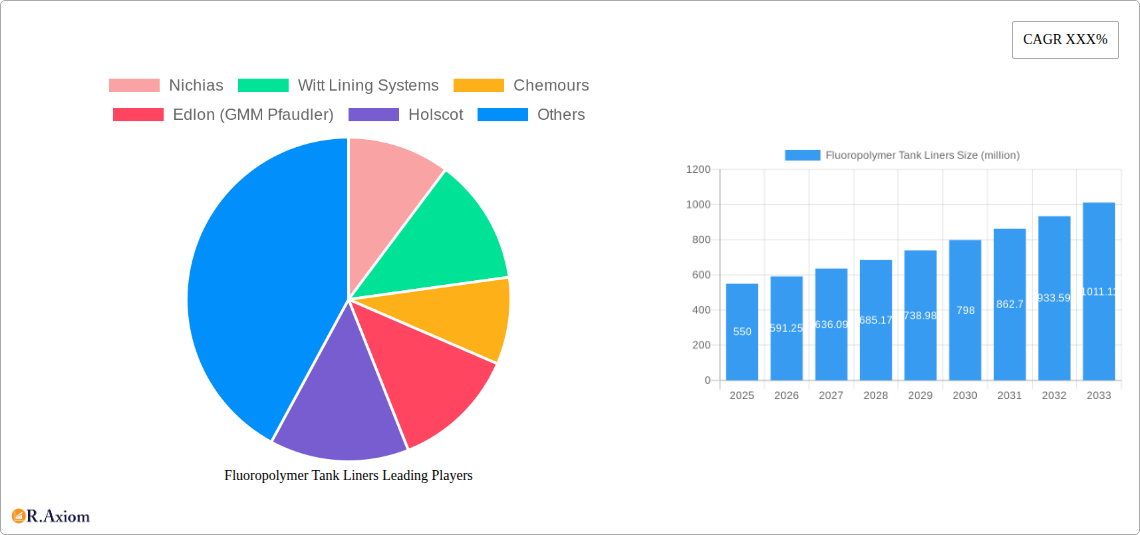

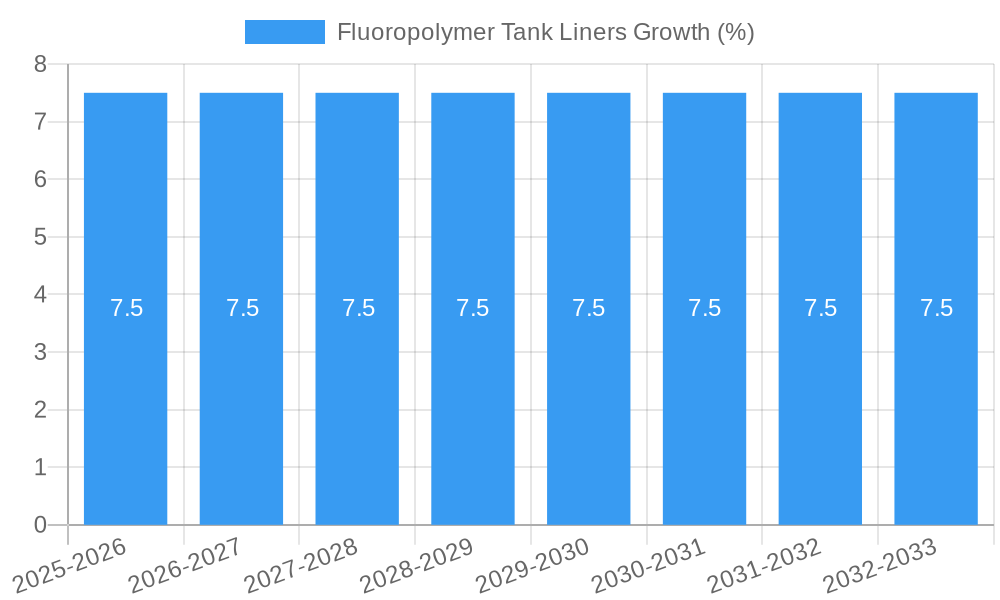

The global Fluoropolymer Tank Liners market is experiencing robust growth, projected to reach an estimated market size of approximately $550 million by 2025. This expansion is driven by the increasing demand for chemical inertness, superior corrosion resistance, and high-temperature performance offered by fluoropolymers, essential for protecting storage tanks in aggressive environments. Key industries like Chemical Industry and Oil Refining are the primary consumers, leveraging these liners to ensure product purity, extend equipment lifespan, and comply with stringent safety and environmental regulations. The market's Compound Annual Growth Rate (CAGR) is estimated to be around 7.5% from 2025 to 2033, indicating sustained momentum. This upward trajectory is further fueled by advancements in polymer technology, leading to the development of more durable and versatile liner materials, and a growing emphasis on operational safety and environmental protection across various industrial sectors.

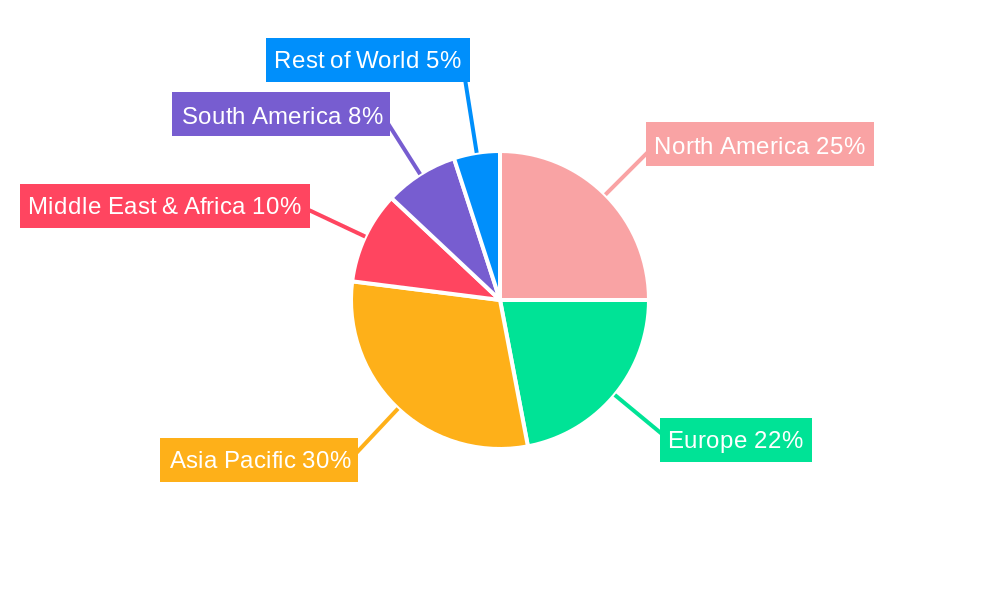

The market is segmented by type, with PTFE (Polytetrafluoroethylene) and PFA (Perfluoroalkoxy Alkane) dominating due to their exceptional chemical resistance and broad operating temperature ranges. Other types like ETFE, FEP, ECTFE, and PVDF also hold significant shares, catering to specific application needs. Geographically, the Asia Pacific region is emerging as a key growth hub, driven by rapid industrialization and increasing investments in infrastructure within countries like China and India. North America and Europe remain mature yet substantial markets, characterized by a strong presence of established players and a continuous demand for high-performance solutions. Restraints such as the high initial cost of fluoropolymer materials and the complex installation processes are being gradually overcome through technological innovations and increasing awareness of the long-term cost-effectiveness and operational benefits. Major companies like Nichias, Chemours, and Edlon (GMM Pfaudler) are at the forefront, investing in research and development to expand their product portfolios and market reach.

Fluoropolymer Tank Liners Market Concentration & Innovation

The global fluoropolymer tank liners market exhibits a moderate to high concentration, with a few key players dominating a significant portion of the market share. Leading companies like Nichias, Witt Lining Systems, Chemours, and Edlon (GMM Pfaudler) have established strong brand recognition and extensive distribution networks, contributing to their market dominance. Innovation remains a critical driver, fueled by the demand for enhanced chemical resistance, thermal stability, and longevity in demanding industrial applications. Research and development efforts are focused on improving liner performance, reducing installation complexities, and developing cost-effective solutions. Regulatory frameworks, particularly those concerning environmental safety and chemical handling in sectors like the Chemical Industry and Oil Refining, are continuously evolving, influencing product specifications and material choices. The threat of product substitutes, while present from other corrosion-resistant materials, is mitigated by the superior performance characteristics of fluoropolymers in highly aggressive environments. End-user trends point towards increased adoption of fluoropolymer liners in specialized applications requiring extreme purity and resistance to corrosive media. Mergers and acquisitions (M&A) activities within the sector, with reported deal values reaching into the hundreds of million, are indicative of strategic consolidation aimed at expanding market reach, acquiring innovative technologies, and achieving economies of scale. For instance, key M&A activities contribute an estimated fifty million to market consolidation.

Fluoropolymer Tank Liners Industry Trends & Insights

The fluoropolymer tank liners industry is poised for significant growth, driven by escalating demand for robust containment solutions across a spectrum of industrial sectors. The projected Compound Annual Growth Rate (CAGR) for this market is estimated at 6.5% over the forecast period of 2025–2033. This robust expansion is underpinned by several critical trends. Firstly, the Chemical Industry, a cornerstone of demand, continues to invest heavily in infrastructure that requires reliable and chemically inert materials for storing and transporting aggressive chemicals. The increasing complexity and corrosive nature of newly developed chemical compounds necessitate advanced lining solutions that fluoropolymers readily provide. Secondly, the Oil Refining sector, facing stringent environmental regulations and the need to handle increasingly sour crude oil, is a substantial market for fluoropolymer liners, offering protection against corrosion and extending the lifespan of valuable assets. The market penetration for advanced fluoropolymer liners in critical applications within these industries is estimated to reach 70% by 2033.

Technological disruptions are also playing a pivotal role. Innovations in polymer synthesis and manufacturing processes are leading to the development of liners with enhanced mechanical strength, improved adhesion properties, and even greater resistance to extreme temperatures and pressures. Advancements in application techniques, such as improved welding and fabrication methods, are making fluoropolymer liners more accessible and cost-effective for a wider range of tank sizes and configurations. Consumer preferences are increasingly shifting towards solutions that offer long-term cost savings through reduced maintenance, fewer product contaminations, and minimized downtime. The focus on sustainability and the circular economy is also influencing product development, with a growing emphasis on recyclable fluoropolymer materials and energy-efficient manufacturing processes. Competitive dynamics are characterized by intense innovation, strategic partnerships, and a drive to offer customized solutions that meet the unique challenges of diverse end-users. The global market size is expected to reach approximately 3.5 billion by the end of the forecast period.

Dominant Markets & Segments in Fluoropolymer Tank Liners

The Chemical Industry stands as the undisputed leader in the fluoropolymer tank liners market, accounting for an estimated 55% of the total market revenue. This dominance is propelled by several compelling factors. The inherent nature of chemical processing involves the handling of highly corrosive acids, alkalis, solvents, and other aggressive substances, necessitating materials that offer unparalleled chemical inertness and resistance. Fluoropolymers, with their exceptional non-reactive properties, are the material of choice for ensuring the integrity and safety of storage tanks, reactors, and piping systems within this sector. For instance, the PTFE type of fluoropolymer holds a significant market share within the chemical industry due to its broad chemical resistance and high-temperature capabilities.

The Oil Refining sector represents the second-largest segment, contributing approximately 25% to the market share. The increasing complexity of crude oil, coupled with stricter environmental regulations aimed at preventing leaks and spills, drives the demand for high-performance liners. Fluoropolymer liners are crucial in protecting tanks and equipment from corrosion caused by sulfur compounds, acids, and other contaminants found in crude oil and refined products. This segment's growth is further spurred by the need for extended equipment lifespan and reduced maintenance costs in harsh operational environments.

Geographically, North America and Europe currently dominate the fluoropolymer tank liners market, holding a combined market share of over 60%. This leadership is attributed to the presence of a well-established and advanced chemical and petrochemical industry, coupled with stringent regulatory frameworks that mandate the use of high-performance materials for safety and environmental protection. Significant investments in infrastructure upgrades and expansion projects within these regions further bolster demand.

In terms of material types, PTFE continues to be the most prevalent fluoropolymer, accounting for roughly 40% of the market. Its widespread use is due to its excellent chemical resistance, thermal stability, and dielectric properties, making it suitable for a vast array of applications. PFA and ETFE are also gaining traction, particularly in applications requiring higher mechanical strength and improved processability. The forecast period anticipates a growth rate of 7% for ETFE liners.

Fluoropolymer Tank Liners Product Developments

Product developments in the fluoropolymer tank liners market are centered on enhancing material performance and expanding application suitability. Innovations include the formulation of new fluoropolymer blends offering superior abrasion resistance and reduced permeation for highly aggressive chemicals. Advancements in liner fabrication techniques, such as multi-layer extrusion and specialized welding methods, enable the creation of seamless, highly reliable liners that minimize leak risks. These developments provide a significant competitive advantage by offering increased service life, reduced downtime, and improved safety profiles for end-users across various industries.

Fluoropolymer Tank Liners Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the fluoropolymer tank liners market, segmented by application and type.

Application Segmentation:

- Chemical Industry: This segment is expected to witness robust growth, driven by the increasing production of specialty chemicals and the need for secure containment of corrosive substances. Market size for this segment is projected to reach 1.9 billion by 2033.

- Oil Refining: This segment is characterized by its critical need for corrosion resistance and longevity, especially with the processing of sour crude. Expected growth for this segment is approximately 6% CAGR.

- Others: This includes diverse applications such as semiconductor manufacturing, pharmaceuticals, and food processing, where high purity and chemical inertness are paramount. This segment is projected to grow at a CAGR of 5.5%.

Type Segmentation:

- PTFE: Expected to maintain its leading position due to its proven performance and broad applicability.

- PFA: Witnessing increased adoption for its higher temperature resistance and improved melt processability.

- ETFE: Gaining traction for its excellent impact strength and chemical resistance.

- FEP: Suitable for applications requiring good chemical resistance and flexibility.

- ECTFE: Known for its excellent chemical resistance and barrier properties.

- PVDF: Utilized in applications demanding good mechanical strength and UV resistance.

Key Drivers of Fluoropolymer Tank Liners Growth

The growth of the fluoropolymer tank liners market is propelled by several key drivers. Firstly, the ever-increasing stringency of environmental regulations across the Chemical Industry and Oil Refining sectors mandates the use of highly resistant containment solutions to prevent leaks and contamination, thereby boosting demand for fluoropolymer liners. Secondly, technological advancements in polymer science are leading to the development of liners with enhanced chemical inertness, thermal stability, and mechanical strength, expanding their applicability into more demanding environments. Thirdly, the growing global industrialization and expansion of manufacturing facilities worldwide, particularly in emerging economies, are creating a substantial need for reliable and durable tank lining systems. The projected market size for fluoropolymer liners is expected to reach 3.5 billion by 2033.

Challenges in the Fluoropolymer Tank Liners Sector

Despite the promising growth trajectory, the fluoropolymer tank liners sector faces several challenges. The high cost of raw materials, primarily fluoropolymers, contributes to the overall expense of tank liners, potentially limiting adoption in price-sensitive applications. Furthermore, the complexity of installation for some types of liners requires specialized expertise and equipment, which can increase project timelines and costs. Stringent regulatory compliance related to manufacturing processes and material handling can also pose challenges for producers. Lastly, the availability of alternative corrosion-resistant materials, although often with performance limitations, presents a degree of competitive pressure.

Emerging Opportunities in Fluoropolymer Tank Liners

Emerging opportunities in the fluoropolymer tank liners market are diverse and promising. The increasing demand for high-purity linings in the pharmaceutical and semiconductor industries presents a significant growth avenue, as these sectors require absolute inertness to prevent product contamination. The development of bio-based or recycled fluoropolymer materials aligns with growing sustainability trends and could attract environmentally conscious customers. Furthermore, advancements in smart lining technologies, incorporating sensors for leak detection and performance monitoring, offer opportunities for value-added services and integrated solutions. Expansion into new geographic markets with developing industrial bases also represents a substantial opportunity.

Leading Players in the Fluoropolymer Tank Liners Market

- Nichias

- Witt Lining Systems

- Chemours

- Edlon (GMM Pfaudler)

- Holscot

- Electro Chemical

- Plastichem

- Rastekindo Cipta Global

- Sun Fluoro System

- Allied Suprem

- Fluoron

- Praxair Surface Technologies

- Sigma Roto Lining

- Alfa Chemistry

- AGC Chemicals

Key Developments in Fluoropolymer Tank Liners Industry

- 2023: Nichias launched a new generation of high-performance PTFE liners with enhanced chemical resistance for the chemical processing industry.

- 2022: Witt Lining Systems acquired a specialized fabrication company, expanding its manufacturing capabilities and product portfolio.

- 2022: Chemours announced significant investments in expanding its ETFE production capacity to meet growing global demand.

- 2021: Edlon (GMM Pfaudler) introduced an innovative FEP liner solution for ultra-high purity applications in the semiconductor sector.

- 2020: Holscot developed a proprietary PFA lining technology offering improved thermal stability for extreme temperature applications.

Strategic Outlook for Fluoropolymer Tank Liners Market

The strategic outlook for the fluoropolymer tank liners market is exceptionally positive, driven by continuous innovation and the relentless demand for superior material performance in critical industrial applications. Growth catalysts include the increasing complexity of chemical processes, stringent environmental protection mandates, and the growing need for asset longevity in sectors like oil and gas. Investments in research and development focused on advanced material properties, sustainable production methods, and integrated digital solutions will be crucial for market leaders. The market is expected to see continued consolidation through strategic partnerships and acquisitions, leading to enhanced competitive advantages and expanded global reach, solidifying its position as an indispensable component in safeguarding industrial infrastructure against corrosion and chemical attack. The projected market size is 3.5 billion by 2033.

Fluoropolymer Tank Liners Segmentation

-

1. Application

- 1.1. Chemical Industry

- 1.2. Oil Refining

- 1.3. Others

-

2. Type

- 2.1. PTFE

- 2.2. PFA

- 2.3. ETFE

- 2.4. FEP

- 2.5. ECTFE

- 2.6. PVDF

Fluoropolymer Tank Liners Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Fluoropolymer Tank Liners REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fluoropolymer Tank Liners Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Chemical Industry

- 5.1.2. Oil Refining

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. PTFE

- 5.2.2. PFA

- 5.2.3. ETFE

- 5.2.4. FEP

- 5.2.5. ECTFE

- 5.2.6. PVDF

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Fluoropolymer Tank Liners Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Chemical Industry

- 6.1.2. Oil Refining

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. PTFE

- 6.2.2. PFA

- 6.2.3. ETFE

- 6.2.4. FEP

- 6.2.5. ECTFE

- 6.2.6. PVDF

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Fluoropolymer Tank Liners Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Chemical Industry

- 7.1.2. Oil Refining

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. PTFE

- 7.2.2. PFA

- 7.2.3. ETFE

- 7.2.4. FEP

- 7.2.5. ECTFE

- 7.2.6. PVDF

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Fluoropolymer Tank Liners Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Chemical Industry

- 8.1.2. Oil Refining

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. PTFE

- 8.2.2. PFA

- 8.2.3. ETFE

- 8.2.4. FEP

- 8.2.5. ECTFE

- 8.2.6. PVDF

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Fluoropolymer Tank Liners Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Chemical Industry

- 9.1.2. Oil Refining

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. PTFE

- 9.2.2. PFA

- 9.2.3. ETFE

- 9.2.4. FEP

- 9.2.5. ECTFE

- 9.2.6. PVDF

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Fluoropolymer Tank Liners Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Chemical Industry

- 10.1.2. Oil Refining

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. PTFE

- 10.2.2. PFA

- 10.2.3. ETFE

- 10.2.4. FEP

- 10.2.5. ECTFE

- 10.2.6. PVDF

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Nichias

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Witt Lining Systems

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Chemours

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Edlon (GMM Pfaudler)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Holscot

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Electro Chemical

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Plastichem

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Rastekindo Cipta Global

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sun Fluoro System

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Allied Suprem

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Fluoron

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Praxair Surface Technologies

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Sigma Roto Lining

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Alfa Chemistry

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 AGC Chemicals

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Nichias

List of Figures

- Figure 1: Global Fluoropolymer Tank Liners Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Fluoropolymer Tank Liners Revenue (million), by Application 2024 & 2032

- Figure 3: North America Fluoropolymer Tank Liners Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Fluoropolymer Tank Liners Revenue (million), by Type 2024 & 2032

- Figure 5: North America Fluoropolymer Tank Liners Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Fluoropolymer Tank Liners Revenue (million), by Country 2024 & 2032

- Figure 7: North America Fluoropolymer Tank Liners Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Fluoropolymer Tank Liners Revenue (million), by Application 2024 & 2032

- Figure 9: South America Fluoropolymer Tank Liners Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Fluoropolymer Tank Liners Revenue (million), by Type 2024 & 2032

- Figure 11: South America Fluoropolymer Tank Liners Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Fluoropolymer Tank Liners Revenue (million), by Country 2024 & 2032

- Figure 13: South America Fluoropolymer Tank Liners Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Fluoropolymer Tank Liners Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Fluoropolymer Tank Liners Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Fluoropolymer Tank Liners Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Fluoropolymer Tank Liners Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Fluoropolymer Tank Liners Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Fluoropolymer Tank Liners Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Fluoropolymer Tank Liners Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Fluoropolymer Tank Liners Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Fluoropolymer Tank Liners Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Fluoropolymer Tank Liners Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Fluoropolymer Tank Liners Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Fluoropolymer Tank Liners Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Fluoropolymer Tank Liners Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Fluoropolymer Tank Liners Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Fluoropolymer Tank Liners Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Fluoropolymer Tank Liners Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Fluoropolymer Tank Liners Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Fluoropolymer Tank Liners Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Fluoropolymer Tank Liners Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Fluoropolymer Tank Liners Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Fluoropolymer Tank Liners Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Fluoropolymer Tank Liners Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Fluoropolymer Tank Liners Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Fluoropolymer Tank Liners Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Fluoropolymer Tank Liners Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Fluoropolymer Tank Liners Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Fluoropolymer Tank Liners Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Fluoropolymer Tank Liners Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Fluoropolymer Tank Liners Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Fluoropolymer Tank Liners Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Fluoropolymer Tank Liners Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Fluoropolymer Tank Liners Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Fluoropolymer Tank Liners Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Fluoropolymer Tank Liners Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Fluoropolymer Tank Liners Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Fluoropolymer Tank Liners Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Fluoropolymer Tank Liners Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Fluoropolymer Tank Liners Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Fluoropolymer Tank Liners Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Fluoropolymer Tank Liners Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Fluoropolymer Tank Liners Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Fluoropolymer Tank Liners Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Fluoropolymer Tank Liners Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Fluoropolymer Tank Liners Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Fluoropolymer Tank Liners Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Fluoropolymer Tank Liners Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Fluoropolymer Tank Liners Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Fluoropolymer Tank Liners Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Fluoropolymer Tank Liners Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Fluoropolymer Tank Liners Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Fluoropolymer Tank Liners Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Fluoropolymer Tank Liners Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Fluoropolymer Tank Liners Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Fluoropolymer Tank Liners Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Fluoropolymer Tank Liners Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Fluoropolymer Tank Liners Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Fluoropolymer Tank Liners Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Fluoropolymer Tank Liners Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Fluoropolymer Tank Liners Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Fluoropolymer Tank Liners Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Fluoropolymer Tank Liners Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Fluoropolymer Tank Liners Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Fluoropolymer Tank Liners Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Fluoropolymer Tank Liners Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Fluoropolymer Tank Liners Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fluoropolymer Tank Liners?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Fluoropolymer Tank Liners?

Key companies in the market include Nichias, Witt Lining Systems, Chemours, Edlon (GMM Pfaudler), Holscot, Electro Chemical, Plastichem, Rastekindo Cipta Global, Sun Fluoro System, Allied Suprem, Fluoron, Praxair Surface Technologies, Sigma Roto Lining, Alfa Chemistry, AGC Chemicals.

3. What are the main segments of the Fluoropolymer Tank Liners?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fluoropolymer Tank Liners," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fluoropolymer Tank Liners report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fluoropolymer Tank Liners?

To stay informed about further developments, trends, and reports in the Fluoropolymer Tank Liners, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence