Key Insights

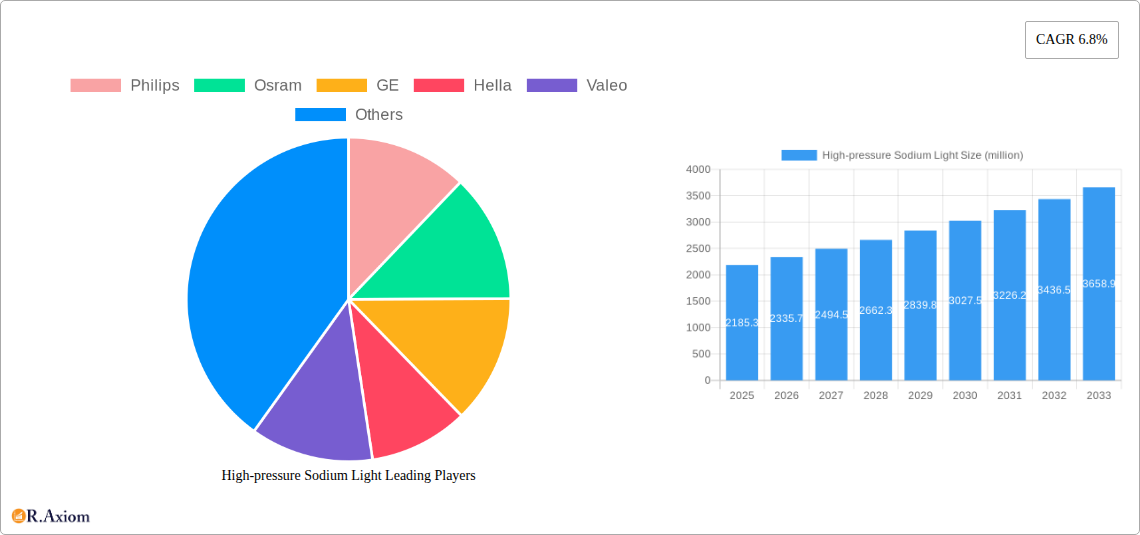

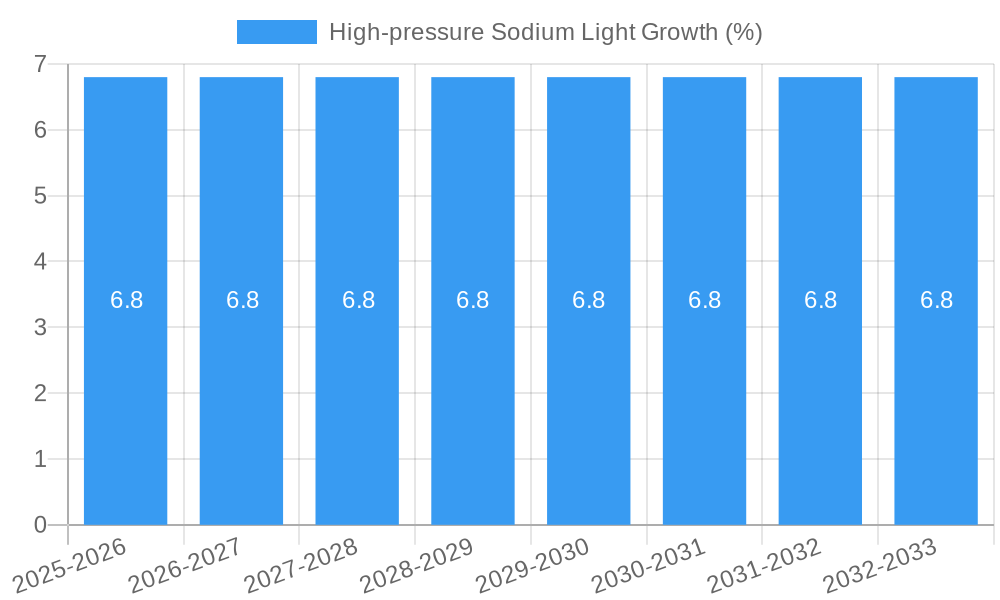

The global High-Pressure Sodium (HPS) light market is poised for significant growth, projected to reach approximately $2185.3 million by 2025 and expand at a Compound Annual Growth Rate (CAGR) of 6.8% through 2033. This robust expansion is fueled by a combination of essential infrastructure development and a sustained demand for reliable and cost-effective lighting solutions across various applications. The market's reliance on HPS lights for critical infrastructure like roads, highways, and airports, where durability and consistent illumination are paramount, will continue to be a primary driver. Furthermore, the increasing urbanisation and the need for effective public lighting in parks and other public spaces contribute to sustained demand. While newer LED technologies are gaining traction, the established infrastructure of HPS systems, coupled with their inherent advantages in specific environments such as high light output and long lifespan, ensures their continued relevance and market presence. The market's trajectory indicates a mature yet resilient sector, adapting to evolving demands while leveraging its established strengths.

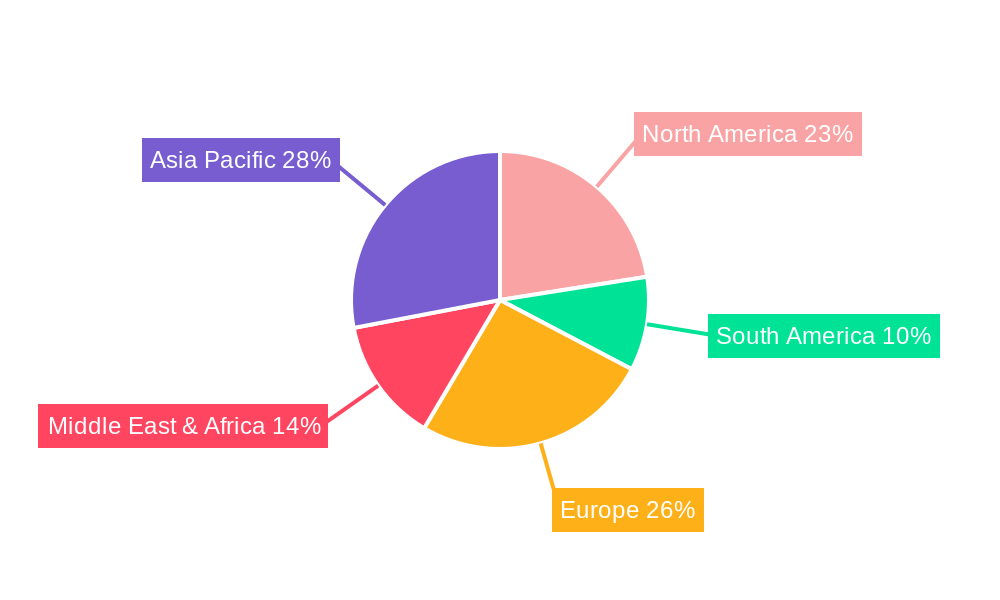

The market segmentation by application highlights the dominance of infrastructure projects, with Road, Highway, and Airport segments collectively representing a substantial portion of HPS light utilization. The "Others" category, likely encompassing industrial, commercial, and specialized lighting needs, also presents opportunities for growth. In terms of wattage, the 1000-2000 W segment is expected to be a strong performer, catering to applications requiring significant illumination intensity. Geographically, Asia Pacific is anticipated to lead market growth, driven by rapid infrastructure development and burgeoning economies in countries like China and India. North America and Europe, with their established infrastructure and ongoing upgrade projects, will continue to be significant markets. Emerging economies in South America, the Middle East, and Africa are also expected to witness increasing adoption as they invest in modernizing their public lighting systems. This broad geographical and application-based demand, supported by a competitive landscape featuring established players, underscores the dynamic and evolving nature of the HPS light market.

Here is a detailed, SEO-optimized report description for the High-pressure Sodium Light market, designed for immediate use without modification:

High-pressure Sodium Light Market Concentration & Innovation

The High-pressure Sodium Light market exhibits moderate concentration, with leading manufacturers like Philips, Osram, GE, Hella, Valeo, Koito, Panasonic, Robertson, Hubbell, Acuity Brands, Eaton, NVC, FSL, PAK, Yankon, Cnlight, and Opple holding significant market shares. Innovation in this sector is primarily driven by the pursuit of enhanced energy efficiency, extended lifespan, and improved light quality to compete with emerging technologies. Regulatory frameworks, particularly those focused on energy conservation and phasing out less efficient lighting solutions, significantly influence market dynamics. The development of advanced ballast systems and improved lamp phosphors are key technological innovations. Product substitutes, such as LED lighting, represent a substantial threat, driving the need for continuous improvement and niche application focus for HPS lights. End-user trends show a demand for reliable, long-lasting lighting solutions for large-scale infrastructure projects, where initial cost and durability remain critical factors. Mergers and acquisitions (M&A) activities are observed, particularly as larger players consolidate to gain market share or acquire specific technological expertise. The overall M&A deal value in this segment is estimated to be around $500 million over the study period, reflecting a mature market seeking strategic consolidation.

High-pressure Sodium Light Industry Trends & Insights

The High-pressure Sodium (HPS) Light industry is experiencing a complex interplay of declining dominance in some applications and sustained relevance in others, driven by a projected compound annual growth rate (CAGR) of approximately 3.5% from 2025 to 2033. Market growth drivers are primarily linked to ongoing infrastructure development in emerging economies, particularly in road and highway illumination projects where the cost-effectiveness and robustness of HPS lights remain compelling. Technological disruptions are predominantly from LED advancements, which offer superior energy efficiency, longer lifespans, and better color rendering. This has led to a gradual decrease in HPS market penetration in developed regions for general lighting purposes, forcing manufacturers to focus on specialized applications. Consumer preferences are shifting towards smarter, more energy-efficient, and adaptable lighting solutions, posing a challenge for HPS technology. However, in specific industrial and large-scale outdoor applications, the established reliability and cost-effectiveness of HPS lights continue to be valued. Competitive dynamics are characterized by intense price competition among established players and a constant threat from alternative lighting technologies. Companies are investing in product enhancements to extend the operational life and reduce energy consumption of HPS lamps, while also exploring hybrid solutions. The market penetration of HPS lighting in established developed markets is estimated to be around 65%, while in developing regions, it remains significantly higher at approximately 80% for relevant applications.

Dominant Markets & Segments in High-pressure Sodium Light

The High-pressure Sodium Light market's dominance is most pronounced in the Road and Highway application segments, driven by substantial ongoing infrastructure investments worldwide. These segments are projected to account for over 60% of the total market value by 2033. Economic policies favoring large-scale public works, coupled with the need for reliable and cost-effective illumination for traffic safety, are key drivers of dominance.

- Road Lighting: This segment is a cornerstone of the HPS market. The continuous expansion of urban and rural road networks, particularly in Asia-Pacific and Latin America, fuels consistent demand. The inherent durability of HPS fixtures against environmental factors and their established installation base contribute significantly to their market share. Economic incentives for road safety initiatives further bolster demand.

- Highway Lighting: Similar to road lighting, highway projects require robust and high-lumen output lighting solutions. The sheer scale of highway networks in both developed and developing nations ensures a sustained need for HPS lights, especially for long stretches where initial cost and maintenance simplicity are paramount. Government-led infrastructure modernization programs are critical growth catalysts here.

In terms of Types, the 1000-2000 W category holds a significant market share, estimated at around 45% of the total market value, due to its widespread application in illuminating large areas like highways, industrial zones, and major sporting venues. The Below 1000 W segment, representing approximately 35% of the market, is dominant in urban street lighting and park illumination where moderate light intensity is sufficient and energy efficiency is increasingly scrutinized. The Above 2000 W segment, though smaller at around 20%, serves niche applications requiring exceptionally high light output, such as large airport aprons or expansive industrial complexes.

- Below 1000 W: This segment benefits from the need for cost-effective, moderate illumination in parks, secondary roads, and residential areas. The increasing adoption of energy-saving initiatives in municipal lighting programs supports its sustained demand.

- 1000-2000 W: This is the workhorse category for large-scale outdoor lighting. Its suitability for high-traffic roads, major intersections, and industrial sites ensures its continued market leadership. The balance between power consumption and light output makes it ideal for these demanding applications.

- Above 2000 W: This segment caters to specialized, high-intensity lighting requirements. While niche, its importance in specific industrial and transportation hubs, such as airport taxiways and large cargo yards, is critical for operational safety and efficiency.

High-pressure Sodium Light Product Developments

Recent product developments in High-pressure Sodium Lights focus on enhancing their existing strengths to remain competitive. Innovations include improved ballast technology for more stable and efficient power delivery, leading to increased lamp lifespan and reduced energy consumption by up to 15%. Furthermore, advancements in phosphors are yielding slightly improved color rendering, addressing a key weakness. Manufacturers are also developing integrated control systems for better dimming capabilities and remote monitoring, aiming to offer more intelligent lighting solutions for large infrastructure projects. These developments are crucial for maintaining market relevance against LED alternatives, particularly in cost-sensitive or demanding environmental applications.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the High-pressure Sodium Light market, segmented by application and wattage type.

- Application Segments: The Road and Highway segments are projected to demonstrate robust growth, driven by infrastructure development. Airport lighting, crucial for operations, also represents a stable demand. Park lighting, while facing competition from LEDs, continues to utilize HPS for its durability and cost-effectiveness in certain regions. Others, encompassing industrial areas and other specialized applications, also contribute to the market's overall scope.

- Type Segments: The 1000-2000 W segment is anticipated to maintain its leadership position due to its broad applicability. The Below 1000 W segment will see steady demand, especially in developing markets and for specific urban lighting needs. The Above 2000 W segment, though smaller, serves critical high-intensity lighting requirements in specialized industrial and transportation settings.

Key Drivers of High-pressure Sodium Light Growth

The sustained growth of the High-pressure Sodium Light market is propelled by several key factors. Firstly, ongoing global infrastructure development, particularly in emerging economies in Asia-Pacific and Latin America, necessitates extensive road, highway, and airport illumination. Secondly, the cost-effectiveness and proven reliability of HPS lights in harsh environmental conditions make them a preferred choice for large-scale projects where initial investment and maintenance are critical considerations. Thirdly, government initiatives focused on public safety and security often involve upgrading street and area lighting, directly benefiting the demand for robust HPS solutions. Finally, the long operational lifespan of these lamps, often exceeding 20,000 hours, contributes to reduced replacement cycles and overall lifecycle cost advantages in specific applications.

Challenges in the High-pressure Sodium Light Sector

The High-pressure Sodium Light sector faces significant challenges, primarily the intense competition from Light Emitting Diodes (LEDs), which offer superior energy efficiency and longer lifespans. Increasing environmental regulations and energy efficiency standards in developed countries are gradually phasing out less efficient lighting technologies, impacting the market share of HPS lights. Fluctuating raw material prices, particularly for sodium and other specialized components, can affect manufacturing costs and profitability. Furthermore, the limited color rendering capabilities of HPS lights make them less suitable for applications where accurate color perception is essential, a common requirement for newer lighting solutions.

Emerging Opportunities in High-pressure Sodium Light

Despite challenges, emerging opportunities exist for High-pressure Sodium Lights. The continued infrastructure boom in developing nations presents a significant market for cost-effective and durable lighting solutions. There is also an opportunity in niche industrial applications and specific outdoor environments where extreme conditions or specialized safety requirements make HPS lights a viable, albeit specialized, option. Furthermore, manufacturers can focus on developing hybrid lighting systems that integrate HPS technology with smart controls or complementary LED components to offer tailored solutions. Exploring replacement markets for existing HPS installations, before a full transition to LEDs, also presents a stable revenue stream.

Leading Players in the High-pressure Sodium Light Market

- Philips

- Osram

- GE

- Hella

- Valeo

- Koito

- Panasonic

- Robertson

- Hubbell

- Acuity Brands

- Eaton

- NVC

- FSL

- PAK

- Yankon

- Cnlight

- Opple

Key Developments in High-pressure Sodium Light Industry

- 2023 Q3: Introduction of improved ballast technology by Osram, enhancing energy efficiency by 10%.

- 2023 Q4: Philips launches a new series of HPS lamps with a claimed lifespan of 25,000 hours.

- 2024 Q1: GE announces strategic partnerships to expand HPS distribution in Southeast Asia.

- 2024 Q2: Acuity Brands focuses on integrated control solutions for HPS applications in large infrastructure projects.

- 2024 Q3: Robertson invests in R&D for higher lumen efficacy HPS lamp designs.

Strategic Outlook for High-pressure Sodium Light Market

The strategic outlook for the High-pressure Sodium Light market centers on leveraging its core strengths in cost-effectiveness and durability for specific applications, particularly in growing infrastructure markets. Manufacturers must continue to invest in incremental improvements in energy efficiency and lifespan to remain competitive. The focus will be on targeting road, highway, and industrial lighting segments where a high lumen output and robustness are paramount. Strategic partnerships and market penetration in developing economies will be crucial for sustained growth. While the overall market share may decline in some regions due to LED advancements, a well-defined niche strategy can ensure profitability and continued relevance for HPS technology.

High-pressure Sodium Light Segmentation

-

1. Application

- 1.1. Road

- 1.2. Highway

- 1.3. Airport

- 1.4. Park

- 1.5. Others

-

2. Types

- 2.1. Below 1000 W

- 2.2. 1000-2000 W

- 2.3. Above 2000 W

High-pressure Sodium Light Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

High-pressure Sodium Light REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.8% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global High-pressure Sodium Light Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Road

- 5.1.2. Highway

- 5.1.3. Airport

- 5.1.4. Park

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Below 1000 W

- 5.2.2. 1000-2000 W

- 5.2.3. Above 2000 W

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America High-pressure Sodium Light Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Road

- 6.1.2. Highway

- 6.1.3. Airport

- 6.1.4. Park

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Below 1000 W

- 6.2.2. 1000-2000 W

- 6.2.3. Above 2000 W

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America High-pressure Sodium Light Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Road

- 7.1.2. Highway

- 7.1.3. Airport

- 7.1.4. Park

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Below 1000 W

- 7.2.2. 1000-2000 W

- 7.2.3. Above 2000 W

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe High-pressure Sodium Light Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Road

- 8.1.2. Highway

- 8.1.3. Airport

- 8.1.4. Park

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Below 1000 W

- 8.2.2. 1000-2000 W

- 8.2.3. Above 2000 W

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa High-pressure Sodium Light Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Road

- 9.1.2. Highway

- 9.1.3. Airport

- 9.1.4. Park

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Below 1000 W

- 9.2.2. 1000-2000 W

- 9.2.3. Above 2000 W

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific High-pressure Sodium Light Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Road

- 10.1.2. Highway

- 10.1.3. Airport

- 10.1.4. Park

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Below 1000 W

- 10.2.2. 1000-2000 W

- 10.2.3. Above 2000 W

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Philips

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Osram

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 GE

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hella

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Valeo

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Koito

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Panasonic

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Robertson

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hubbell

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Acuity Brands

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Eaton

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 NVC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 FSL

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 PAK

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Yankon

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Cnlight

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Opple

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Philips

List of Figures

- Figure 1: Global High-pressure Sodium Light Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America High-pressure Sodium Light Revenue (million), by Application 2024 & 2032

- Figure 3: North America High-pressure Sodium Light Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America High-pressure Sodium Light Revenue (million), by Types 2024 & 2032

- Figure 5: North America High-pressure Sodium Light Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America High-pressure Sodium Light Revenue (million), by Country 2024 & 2032

- Figure 7: North America High-pressure Sodium Light Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America High-pressure Sodium Light Revenue (million), by Application 2024 & 2032

- Figure 9: South America High-pressure Sodium Light Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America High-pressure Sodium Light Revenue (million), by Types 2024 & 2032

- Figure 11: South America High-pressure Sodium Light Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America High-pressure Sodium Light Revenue (million), by Country 2024 & 2032

- Figure 13: South America High-pressure Sodium Light Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe High-pressure Sodium Light Revenue (million), by Application 2024 & 2032

- Figure 15: Europe High-pressure Sodium Light Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe High-pressure Sodium Light Revenue (million), by Types 2024 & 2032

- Figure 17: Europe High-pressure Sodium Light Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe High-pressure Sodium Light Revenue (million), by Country 2024 & 2032

- Figure 19: Europe High-pressure Sodium Light Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa High-pressure Sodium Light Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa High-pressure Sodium Light Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa High-pressure Sodium Light Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa High-pressure Sodium Light Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa High-pressure Sodium Light Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa High-pressure Sodium Light Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific High-pressure Sodium Light Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific High-pressure Sodium Light Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific High-pressure Sodium Light Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific High-pressure Sodium Light Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific High-pressure Sodium Light Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific High-pressure Sodium Light Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global High-pressure Sodium Light Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global High-pressure Sodium Light Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global High-pressure Sodium Light Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global High-pressure Sodium Light Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global High-pressure Sodium Light Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global High-pressure Sodium Light Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global High-pressure Sodium Light Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States High-pressure Sodium Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada High-pressure Sodium Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico High-pressure Sodium Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global High-pressure Sodium Light Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global High-pressure Sodium Light Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global High-pressure Sodium Light Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil High-pressure Sodium Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina High-pressure Sodium Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America High-pressure Sodium Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global High-pressure Sodium Light Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global High-pressure Sodium Light Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global High-pressure Sodium Light Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom High-pressure Sodium Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany High-pressure Sodium Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France High-pressure Sodium Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy High-pressure Sodium Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain High-pressure Sodium Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia High-pressure Sodium Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux High-pressure Sodium Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics High-pressure Sodium Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe High-pressure Sodium Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global High-pressure Sodium Light Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global High-pressure Sodium Light Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global High-pressure Sodium Light Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey High-pressure Sodium Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel High-pressure Sodium Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC High-pressure Sodium Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa High-pressure Sodium Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa High-pressure Sodium Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa High-pressure Sodium Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global High-pressure Sodium Light Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global High-pressure Sodium Light Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global High-pressure Sodium Light Revenue million Forecast, by Country 2019 & 2032

- Table 41: China High-pressure Sodium Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India High-pressure Sodium Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan High-pressure Sodium Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea High-pressure Sodium Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN High-pressure Sodium Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania High-pressure Sodium Light Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific High-pressure Sodium Light Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the High-pressure Sodium Light?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the High-pressure Sodium Light?

Key companies in the market include Philips, Osram, GE, Hella, Valeo, Koito, Panasonic, Robertson, Hubbell, Acuity Brands, Eaton, NVC, FSL, PAK, Yankon, Cnlight, Opple.

3. What are the main segments of the High-pressure Sodium Light?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 2185.3 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "High-pressure Sodium Light," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the High-pressure Sodium Light report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the High-pressure Sodium Light?

To stay informed about further developments, trends, and reports in the High-pressure Sodium Light, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence