Key Insights

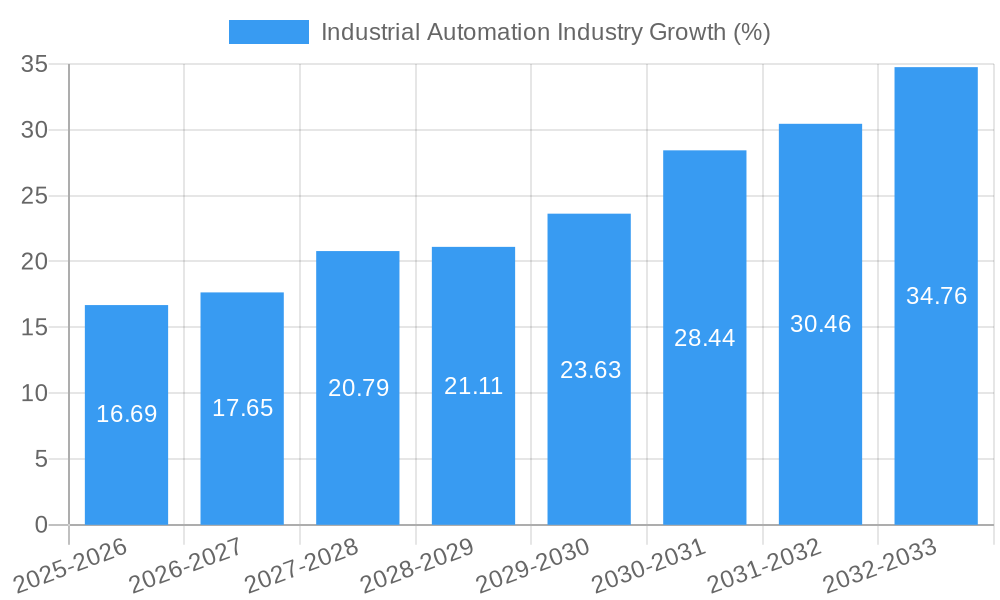

The Industrial Automation market is experiencing robust growth, projected to reach $199.69 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 8.80% from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing demand for enhanced productivity and efficiency across various industries, including automotive, chemical, and oil & gas, is fueling the adoption of advanced automation technologies. The integration of smart sensors, industrial IoT (IIoT), and artificial intelligence (AI) in industrial control systems is further accelerating market growth. Furthermore, the global shift towards Industry 4.0 principles, promoting automation and digitalization in manufacturing processes, is creating substantial opportunities for market players. Government initiatives promoting automation and digital transformation in various sectors also contribute to the market's upward trajectory.

However, several challenges restrain market expansion. High initial investment costs associated with implementing and maintaining automation systems can be a deterrent, particularly for smaller companies. Concerns about cybersecurity risks associated with interconnected systems and the potential for job displacement due to automation also need to be addressed. Despite these restraints, the long-term benefits of increased productivity, improved product quality, and reduced operational costs outweigh these concerns, ensuring continued market growth. The market segmentation reveals significant opportunities across various product types (industrial control systems, field devices) and end-user industries. North America and Europe currently hold significant market share, but Asia-Pacific is poised for substantial growth given its rapidly expanding manufacturing sector and supportive government policies. Major players like Honeywell, Bosch, Siemens, and ABB are driving innovation and competition in this dynamic market.

Industrial Automation Industry: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the Industrial Automation Industry, covering market size, segmentation, growth drivers, challenges, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers actionable insights for industry stakeholders, investors, and strategic decision-makers. The report analyzes the market across various segments, including By Product (Industrial Control Systems, Other Industrial Control Systems: Field Devices) and By End-User Industry (Automotive, Chemical and Petrochemical, Utility, Pharmaceutical, Food and Beverage, Oil and Gas, Other End-user Industries). The total market value is projected to reach xx Million by 2033.

Industrial Automation Industry Market Concentration & Innovation

The industrial automation market is moderately concentrated, dominated by several multinational corporations holding substantial market share. Key players include Honeywell International Inc, Robert Bosch GmbH, Texas Instruments Inc, Mitsubishi Electric Corporation, Siemens AG, General Electric Co, Schneider Electric SE, Omron Corporation, Rockwell Automation Inc, Yokogawa Electric Corporation, ABB Limited, and Emerson Electric Company. While precise 2024 market share data for the top 5 players is proprietary, industry estimates suggest a collective share exceeding 40%. This concentration reflects significant barriers to entry, including high R&D investment requirements and established supply chains.

Innovation is a crucial competitive differentiator, driven by escalating demand for automation across diverse industries. Heavy R&D investment is focused on AI-powered automation, seamless IoT integration, robust cloud-based solutions, and advanced cybersecurity measures. Stringent regulatory frameworks, particularly concerning safety and data privacy (like GDPR and CCPA), heavily influence industry practices and necessitate significant compliance investments. The rise of advanced robotics and machine learning presents both opportunities and challenges for established players, prompting strategic mergers and acquisitions (M&A) to consolidate market share and access new technologies. Over the past five years, the average annual value of M&A deals within the sector has been approximately $50 Billion, reflecting a clear consolidation trend.

- Market Concentration: Top 5 players hold approximately 40%+ market share (2024 - estimated).

- Innovation Drivers: AI, IoT, Cloud computing, Cybersecurity, Edge Computing.

- M&A Activity: Average annual deal value approximately $50 Billion (2019-2024 - estimated).

Industrial Automation Industry Industry Trends & Insights

The Industrial Automation market exhibits robust growth, driven by increasing demand for enhanced productivity, efficiency, and quality across diverse industries. The global market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a market value of xx Million by 2033. This growth is fueled by several key factors: the rising adoption of Industry 4.0 technologies, increasing investments in automation by businesses across sectors, government initiatives promoting automation, and the growing need to optimize manufacturing processes. Technological disruptions, including the rise of AI, machine learning, and advanced robotics, are reshaping the industry, leading to increased automation levels and improved operational efficiency. Consumer preferences for higher quality, customized products, and faster delivery times further drive automation adoption. The competitive dynamics are characterized by intense competition among established players and the emergence of innovative start-ups, fostering innovation and driving prices down. Market penetration of industrial automation solutions varies across different industries, with the automotive and electronics sectors being particularly advanced.

Dominant Markets & Segments in Industrial Automation Industry

The Industrial Automation market exhibits significant regional disparities, with North America and Asia-Pacific leading as dominant regions. Within these regions, the United States, China, Japan, and Germany are key growth drivers and possess substantial market shares. This geographical distribution is influenced by factors such as manufacturing concentration, technological advancements, and government support for industrial automation initiatives.

By Product:

- Industrial Control Systems (ICS): This segment commands the largest market share, driven by the rising demand for advanced control systems across various sectors. Key drivers include enhanced process optimization, improved energy efficiency, remote monitoring capabilities, and the need for improved operational visibility.

- Field Devices (Sensors, Actuators, etc.): This segment experiences robust growth, fueled by technological advancements, miniaturization, and enhanced connectivity. The proliferation of smart sensors and actuators allows for more granular data collection and improved process control.

- Robotics and Automation Systems: This is a rapidly expanding segment, driven by the increased adoption of collaborative robots (cobots) and advanced robotics systems in various industries.

By End-User Industry:

- Automotive: High automation levels persist, with ongoing investments in robotics, advanced control systems, and digital twins to optimize production and enhance quality control. The transition to electric vehicles (EVs) is further driving automation adoption.

- Chemical and Petrochemical: This sector requires substantial automation due to inherent safety concerns and the need for precise process control. Automation contributes to increased efficiency and reduced environmental impact.

- Utilities (Power Generation & Distribution): Automation is crucial for optimizing energy production, transmission, and distribution. Smart grid technologies, renewable energy integration, and improved grid resilience are key drivers.

- Pharmaceutical: Stringent regulatory compliance and the demand for precise process control in pharmaceutical manufacturing necessitates advanced automation solutions to ensure product quality and safety.

- Food and Beverage: Automation enhances food safety and quality control, improves productivity, minimizes waste, and ensures compliance with strict hygiene regulations.

- Oil and Gas: Automation optimizes extraction processes, pipeline management, and refining operations, particularly in challenging environments.

- Metals and Mining: Automation improves safety, efficiency, and productivity in hazardous mining environments.

Industrial Automation Industry Product Developments

Recent product innovations revolve around AI-powered solutions, advanced robotics (including collaborative robots and autonomous mobile robots), and secure, seamless connectivity. These developments enable improved operational efficiency, predictive maintenance capabilities, enhanced safety, and reduced downtime. The integration of cloud-based solutions and robust IoT technologies optimizes data management, facilitates remote monitoring and control, and supports data-driven decision making. New products emphasize intuitive user interfaces, modular designs, and straightforward integration to provide flexible and adaptable automation solutions.

Report Scope & Segmentation Analysis

This report segments the Industrial Automation market by product type (Industrial Control Systems, Other Industrial Control Systems: Field Devices) and end-user industry (Automotive, Chemical and Petrochemical, Utility, Pharmaceutical, Food and Beverage, Oil and Gas, Other End-user Industries). Each segment is analyzed in terms of market size, growth projections, competitive dynamics, and key drivers. Growth projections are provided for each segment throughout the forecast period (2025-2033). Competitive landscapes are mapped, highlighting key players and their strategies within each segment.

Key Drivers of Industrial Automation Industry Growth

Several factors are driving the expansion of the Industrial Automation Industry. Technological advancements in AI, robotics, and IoT are central, creating increasingly sophisticated and efficient automation solutions. Economic pressures, including the need to boost productivity and reduce operational costs, incentivize automation adoption. Government regulations and policies that promote safety, efficiency, and Industry 4.0 adoption, along with investments in infrastructure development, all contribute significantly to market growth.

Challenges in the Industrial Automation Industry Sector

The industry faces challenges including high initial investment costs for automation systems, the need for skilled labor to implement and maintain these systems, and cybersecurity concerns related to connected devices. Supply chain disruptions can also impact the availability of components and the timely delivery of projects. Intense competition among established players and new entrants creates pricing pressures. Regulatory compliance adds complexity and cost. These factors collectively impact market growth and profitability.

Emerging Opportunities in Industrial Automation Industry

Significant opportunities exist in AI-powered automation systems, advanced robotics, and proactive predictive maintenance solutions. Expansion into new sectors, like renewable energy, smart cities, and sustainable manufacturing, holds considerable potential. The increasing demand for customized automation solutions and the expanding adoption of secure, scalable cloud-based platforms further fuel opportunities for growth and innovation. The integration of digital twins for improved asset management and process optimization also represents a significant emerging opportunity.

Leading Players in the Industrial Automation Industry Market

- Honeywell International Inc

- Robert Bosch GmbH

- Texas Instruments Inc

- Mitsubishi Electric Corporation

- Siemens AG

- General Electric Co

- Schneider Electric SE

- Omron Corporation

- Rockwell Automation Inc

- Yokogawa Electric Corporation

- ABB Limited

- Emerson Electric Company

Key Developments in Industrial Automation Industry Industry

- June 2022: Mitsubishi Electric Corporation announced a INR 2.2 Billion investment in a new Indian factory, boosting FA control system production. This expansion reflects the growing demand within the Indian market.

- May 2022: DENSO Corporation and Honeywell collaborated on an electric motor for the Lilium Jet, marking DENSO's entry into aerospace and showcasing strategic alliances within the sector.

- May 2022: Emerson launched its PACSystems RSTi-EP CPE 200 programmable automation controllers, targeting OEMs and emphasizing ease of use and reduced reliance on specialized software engineering.

Strategic Outlook for Industrial Automation Industry Market

The Industrial Automation market is poised for continued strong growth, fueled by ongoing technological advancements, increasing demand for automation across various industries, and supportive government policies. The focus on Industry 4.0, smart manufacturing, and digital transformation will further drive market expansion. Opportunities lie in leveraging AI, IoT, and cloud technologies to create more intelligent, efficient, and adaptable automation solutions. The convergence of various technologies and the emergence of new applications will shape the future landscape of the industry.

Industrial Automation Industry Segmentation

-

1. Product

-

1.1. By Industrial Control Systems

- 1.1.1. Distributed Control System (DCS)

- 1.1.2. Programmable Logic Controller (PLC)

- 1.1.3. Supervisory Control and Data Acquisition (SCADA)

- 1.1.4. Product Lifecycle Management (PLM)

- 1.1.5. Human Machine Interface (HMI)

- 1.1.6. Manufacturing Execution System (MES)

- 1.1.7. Enterprise Resource Planning (ERP)

- 1.1.8. Other Industrial Control Systems

-

1.2. Field Devices

- 1.2.1. Machine Vision Systems

- 1.2.2. Robotics (Industrial)

- 1.2.3. Sensors and Transmitters

- 1.2.4. Motors and Drives

- 1.2.5. Other Field Devices

-

1.1. By Industrial Control Systems

-

2. End-User Industry

- 2.1. Automotive

- 2.2. Chemical and Petrochemical

- 2.3. Utility

- 2.4. Pharmaceutical

- 2.5. Food and Beverage

- 2.6. Oil and Gas

- 2.7. Other End-user Industries

Industrial Automation Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East

Industrial Automation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Emphasis on Energy Efficiency and Cost Reduction; Growing Trend Towards Automation

- 3.3. Market Restrains

- 3.3.1. ; Trade Tensions and Implementation Challenges

- 3.4. Market Trends

- 3.4.1. Automotive is Expected to Register a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Automation Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. By Industrial Control Systems

- 5.1.1.1. Distributed Control System (DCS)

- 5.1.1.2. Programmable Logic Controller (PLC)

- 5.1.1.3. Supervisory Control and Data Acquisition (SCADA)

- 5.1.1.4. Product Lifecycle Management (PLM)

- 5.1.1.5. Human Machine Interface (HMI)

- 5.1.1.6. Manufacturing Execution System (MES)

- 5.1.1.7. Enterprise Resource Planning (ERP)

- 5.1.1.8. Other Industrial Control Systems

- 5.1.2. Field Devices

- 5.1.2.1. Machine Vision Systems

- 5.1.2.2. Robotics (Industrial)

- 5.1.2.3. Sensors and Transmitters

- 5.1.2.4. Motors and Drives

- 5.1.2.5. Other Field Devices

- 5.1.1. By Industrial Control Systems

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Automotive

- 5.2.2. Chemical and Petrochemical

- 5.2.3. Utility

- 5.2.4. Pharmaceutical

- 5.2.5. Food and Beverage

- 5.2.6. Oil and Gas

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Industrial Automation Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. By Industrial Control Systems

- 6.1.1.1. Distributed Control System (DCS)

- 6.1.1.2. Programmable Logic Controller (PLC)

- 6.1.1.3. Supervisory Control and Data Acquisition (SCADA)

- 6.1.1.4. Product Lifecycle Management (PLM)

- 6.1.1.5. Human Machine Interface (HMI)

- 6.1.1.6. Manufacturing Execution System (MES)

- 6.1.1.7. Enterprise Resource Planning (ERP)

- 6.1.1.8. Other Industrial Control Systems

- 6.1.2. Field Devices

- 6.1.2.1. Machine Vision Systems

- 6.1.2.2. Robotics (Industrial)

- 6.1.2.3. Sensors and Transmitters

- 6.1.2.4. Motors and Drives

- 6.1.2.5. Other Field Devices

- 6.1.1. By Industrial Control Systems

- 6.2. Market Analysis, Insights and Forecast - by End-User Industry

- 6.2.1. Automotive

- 6.2.2. Chemical and Petrochemical

- 6.2.3. Utility

- 6.2.4. Pharmaceutical

- 6.2.5. Food and Beverage

- 6.2.6. Oil and Gas

- 6.2.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Industrial Automation Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. By Industrial Control Systems

- 7.1.1.1. Distributed Control System (DCS)

- 7.1.1.2. Programmable Logic Controller (PLC)

- 7.1.1.3. Supervisory Control and Data Acquisition (SCADA)

- 7.1.1.4. Product Lifecycle Management (PLM)

- 7.1.1.5. Human Machine Interface (HMI)

- 7.1.1.6. Manufacturing Execution System (MES)

- 7.1.1.7. Enterprise Resource Planning (ERP)

- 7.1.1.8. Other Industrial Control Systems

- 7.1.2. Field Devices

- 7.1.2.1. Machine Vision Systems

- 7.1.2.2. Robotics (Industrial)

- 7.1.2.3. Sensors and Transmitters

- 7.1.2.4. Motors and Drives

- 7.1.2.5. Other Field Devices

- 7.1.1. By Industrial Control Systems

- 7.2. Market Analysis, Insights and Forecast - by End-User Industry

- 7.2.1. Automotive

- 7.2.2. Chemical and Petrochemical

- 7.2.3. Utility

- 7.2.4. Pharmaceutical

- 7.2.5. Food and Beverage

- 7.2.6. Oil and Gas

- 7.2.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Industrial Automation Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. By Industrial Control Systems

- 8.1.1.1. Distributed Control System (DCS)

- 8.1.1.2. Programmable Logic Controller (PLC)

- 8.1.1.3. Supervisory Control and Data Acquisition (SCADA)

- 8.1.1.4. Product Lifecycle Management (PLM)

- 8.1.1.5. Human Machine Interface (HMI)

- 8.1.1.6. Manufacturing Execution System (MES)

- 8.1.1.7. Enterprise Resource Planning (ERP)

- 8.1.1.8. Other Industrial Control Systems

- 8.1.2. Field Devices

- 8.1.2.1. Machine Vision Systems

- 8.1.2.2. Robotics (Industrial)

- 8.1.2.3. Sensors and Transmitters

- 8.1.2.4. Motors and Drives

- 8.1.2.5. Other Field Devices

- 8.1.1. By Industrial Control Systems

- 8.2. Market Analysis, Insights and Forecast - by End-User Industry

- 8.2.1. Automotive

- 8.2.2. Chemical and Petrochemical

- 8.2.3. Utility

- 8.2.4. Pharmaceutical

- 8.2.5. Food and Beverage

- 8.2.6. Oil and Gas

- 8.2.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Latin America Industrial Automation Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. By Industrial Control Systems

- 9.1.1.1. Distributed Control System (DCS)

- 9.1.1.2. Programmable Logic Controller (PLC)

- 9.1.1.3. Supervisory Control and Data Acquisition (SCADA)

- 9.1.1.4. Product Lifecycle Management (PLM)

- 9.1.1.5. Human Machine Interface (HMI)

- 9.1.1.6. Manufacturing Execution System (MES)

- 9.1.1.7. Enterprise Resource Planning (ERP)

- 9.1.1.8. Other Industrial Control Systems

- 9.1.2. Field Devices

- 9.1.2.1. Machine Vision Systems

- 9.1.2.2. Robotics (Industrial)

- 9.1.2.3. Sensors and Transmitters

- 9.1.2.4. Motors and Drives

- 9.1.2.5. Other Field Devices

- 9.1.1. By Industrial Control Systems

- 9.2. Market Analysis, Insights and Forecast - by End-User Industry

- 9.2.1. Automotive

- 9.2.2. Chemical and Petrochemical

- 9.2.3. Utility

- 9.2.4. Pharmaceutical

- 9.2.5. Food and Beverage

- 9.2.6. Oil and Gas

- 9.2.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Middle East Industrial Automation Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. By Industrial Control Systems

- 10.1.1.1. Distributed Control System (DCS)

- 10.1.1.2. Programmable Logic Controller (PLC)

- 10.1.1.3. Supervisory Control and Data Acquisition (SCADA)

- 10.1.1.4. Product Lifecycle Management (PLM)

- 10.1.1.5. Human Machine Interface (HMI)

- 10.1.1.6. Manufacturing Execution System (MES)

- 10.1.1.7. Enterprise Resource Planning (ERP)

- 10.1.1.8. Other Industrial Control Systems

- 10.1.2. Field Devices

- 10.1.2.1. Machine Vision Systems

- 10.1.2.2. Robotics (Industrial)

- 10.1.2.3. Sensors and Transmitters

- 10.1.2.4. Motors and Drives

- 10.1.2.5. Other Field Devices

- 10.1.1. By Industrial Control Systems

- 10.2. Market Analysis, Insights and Forecast - by End-User Industry

- 10.2.1. Automotive

- 10.2.2. Chemical and Petrochemical

- 10.2.3. Utility

- 10.2.4. Pharmaceutical

- 10.2.5. Food and Beverage

- 10.2.6. Oil and Gas

- 10.2.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. North America Industrial Automation Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Industrial Automation Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United Kingdom

- 12.1.2 Germany

- 12.1.3 France

- 12.1.4 Rest of Europe

- 13. Asia Pacific Industrial Automation Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 India

- 13.1.3 Japan

- 13.1.4 Rest of Asia Pacific

- 14. Latin America Industrial Automation Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East Industrial Automation Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Honeywell International Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Robert Bosch GmbH*List Not Exhaustive

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Texas Instruments Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Mitsubishi Electric Corporation

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Siemens AG

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 General Electric Co

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Schneider Electric SE

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Omron Corporation

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Rockwell Automation Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Yokogawa Electric Corporation

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 ABB Limited

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Emerson Electric Company

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Industrial Automation Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Industrial Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Industrial Automation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Industrial Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Industrial Automation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Industrial Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Industrial Automation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Industrial Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Industrial Automation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East Industrial Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East Industrial Automation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Industrial Automation Industry Revenue (Million), by Product 2024 & 2032

- Figure 13: North America Industrial Automation Industry Revenue Share (%), by Product 2024 & 2032

- Figure 14: North America Industrial Automation Industry Revenue (Million), by End-User Industry 2024 & 2032

- Figure 15: North America Industrial Automation Industry Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 16: North America Industrial Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Industrial Automation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Industrial Automation Industry Revenue (Million), by Product 2024 & 2032

- Figure 19: Europe Industrial Automation Industry Revenue Share (%), by Product 2024 & 2032

- Figure 20: Europe Industrial Automation Industry Revenue (Million), by End-User Industry 2024 & 2032

- Figure 21: Europe Industrial Automation Industry Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 22: Europe Industrial Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Industrial Automation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Industrial Automation Industry Revenue (Million), by Product 2024 & 2032

- Figure 25: Asia Pacific Industrial Automation Industry Revenue Share (%), by Product 2024 & 2032

- Figure 26: Asia Pacific Industrial Automation Industry Revenue (Million), by End-User Industry 2024 & 2032

- Figure 27: Asia Pacific Industrial Automation Industry Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 28: Asia Pacific Industrial Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Industrial Automation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Industrial Automation Industry Revenue (Million), by Product 2024 & 2032

- Figure 31: Latin America Industrial Automation Industry Revenue Share (%), by Product 2024 & 2032

- Figure 32: Latin America Industrial Automation Industry Revenue (Million), by End-User Industry 2024 & 2032

- Figure 33: Latin America Industrial Automation Industry Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 34: Latin America Industrial Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Industrial Automation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East Industrial Automation Industry Revenue (Million), by Product 2024 & 2032

- Figure 37: Middle East Industrial Automation Industry Revenue Share (%), by Product 2024 & 2032

- Figure 38: Middle East Industrial Automation Industry Revenue (Million), by End-User Industry 2024 & 2032

- Figure 39: Middle East Industrial Automation Industry Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 40: Middle East Industrial Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East Industrial Automation Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Industrial Automation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Industrial Automation Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Global Industrial Automation Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 4: Global Industrial Automation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Industrial Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Industrial Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Industrial Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Industrial Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United Kingdom Industrial Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Germany Industrial Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France Industrial Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Industrial Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Industrial Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: China Industrial Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: India Industrial Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Japan Industrial Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Asia Pacific Industrial Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Industrial Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Industrial Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Industrial Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Industrial Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Industrial Automation Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 23: Global Industrial Automation Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 24: Global Industrial Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: United States Industrial Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Canada Industrial Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Industrial Automation Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 28: Global Industrial Automation Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 29: Global Industrial Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: United Kingdom Industrial Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Germany Industrial Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: France Industrial Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Europe Industrial Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Industrial Automation Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 35: Global Industrial Automation Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 36: Global Industrial Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 37: China Industrial Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: India Industrial Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Japan Industrial Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of Asia Pacific Industrial Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Industrial Automation Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 42: Global Industrial Automation Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 43: Global Industrial Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 44: Global Industrial Automation Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 45: Global Industrial Automation Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 46: Global Industrial Automation Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Automation Industry?

The projected CAGR is approximately 8.80%.

2. Which companies are prominent players in the Industrial Automation Industry?

Key companies in the market include Honeywell International Inc, Robert Bosch GmbH*List Not Exhaustive, Texas Instruments Inc, Mitsubishi Electric Corporation, Siemens AG, General Electric Co, Schneider Electric SE, Omron Corporation, Rockwell Automation Inc, Yokogawa Electric Corporation, ABB Limited, Emerson Electric Company.

3. What are the main segments of the Industrial Automation Industry?

The market segments include Product, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 199.69 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Emphasis on Energy Efficiency and Cost Reduction; Growing Trend Towards Automation.

6. What are the notable trends driving market growth?

Automotive is Expected to Register a Significant Growth.

7. Are there any restraints impacting market growth?

; Trade Tensions and Implementation Challenges.

8. Can you provide examples of recent developments in the market?

June 2022 - Mitsubishi Electric Corporation announced that it would invest around INR 2.2 billion in its subsidiary Mitsubishi Electric India Pvt. Ltd. to establish a new factory in India. The company is expected to start factory operations in December 2023, with the factory manufacturing inverters and other factory automation (FA) control system products, expanding the company's capabilities to meet the growing demand in India.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Automation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Automation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Automation Industry?

To stay informed about further developments, trends, and reports in the Industrial Automation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence