Key Insights

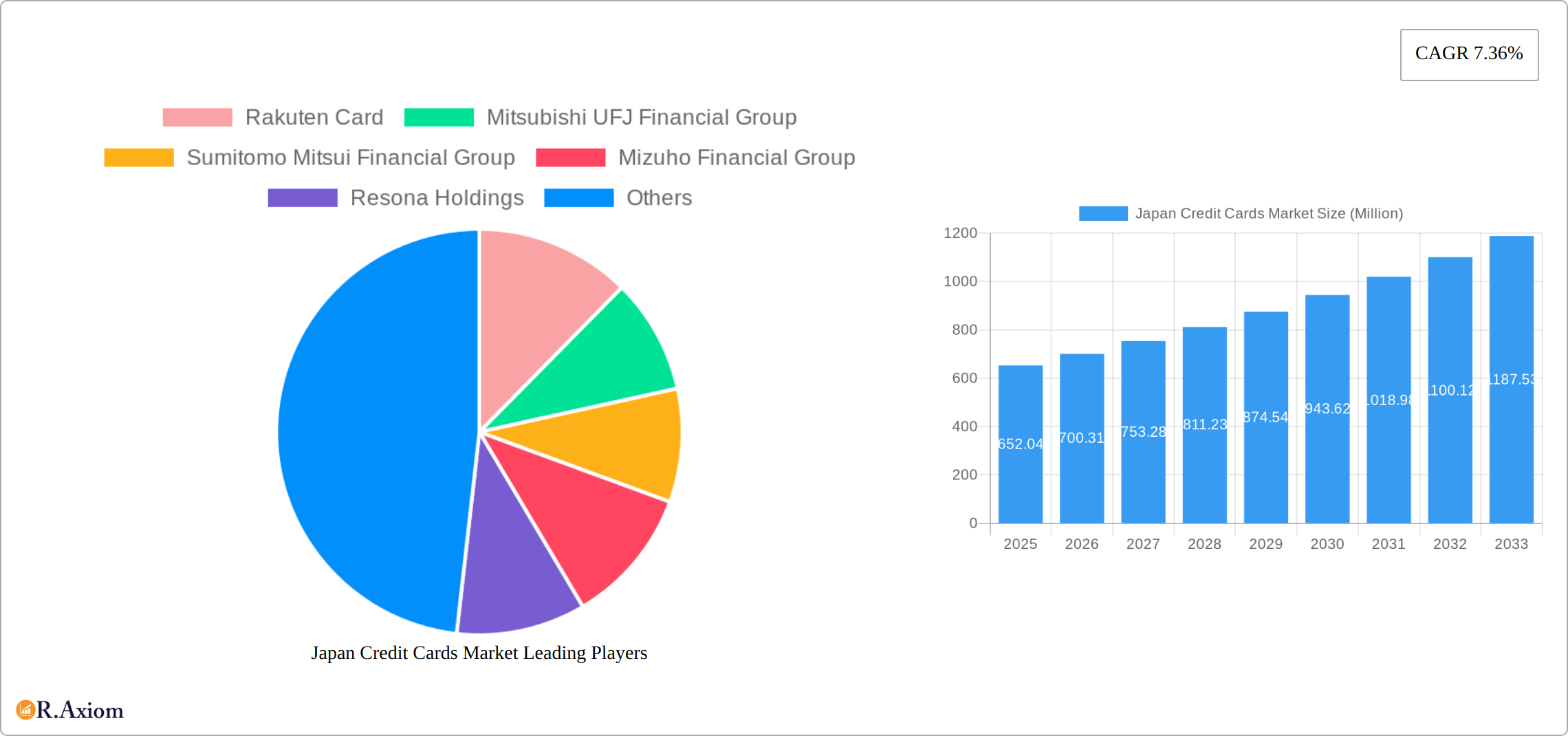

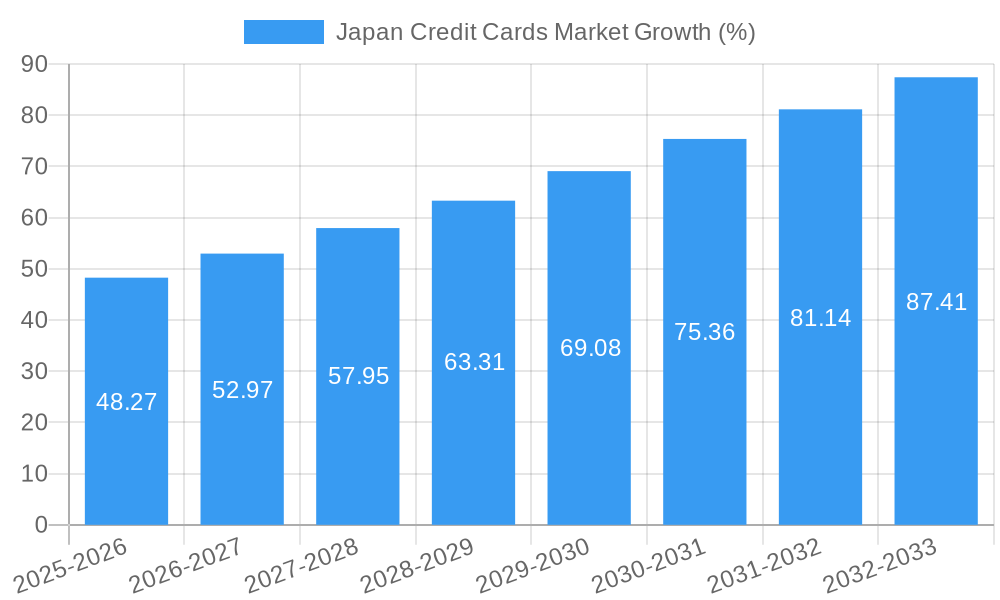

The Japan credit card market, valued at $652.04 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 7.36% from 2025 to 2033. This expansion is driven by several key factors. Increasing digitalization and e-commerce adoption are significantly boosting cashless transactions, fueling demand for credit cards. Government initiatives promoting financial inclusion and the rising middle class with increased disposable income further contribute to market growth. Furthermore, innovative features like contactless payments, rewards programs, and enhanced security measures are attracting a wider consumer base. The competitive landscape is dominated by major players such as Rakuten Card, Mitsubishi UFJ Financial Group, and Sumitomo Mitsui Financial Group, among others, each vying for market share through strategic partnerships, product diversification, and aggressive marketing campaigns. However, challenges such as concerns over debt accumulation and stringent regulatory frameworks could potentially temper growth. The market is segmented by card type (e.g., debit, credit, prepaid), issuing bank, and geographic region, offering opportunities for niche players to target specific demographics and needs.

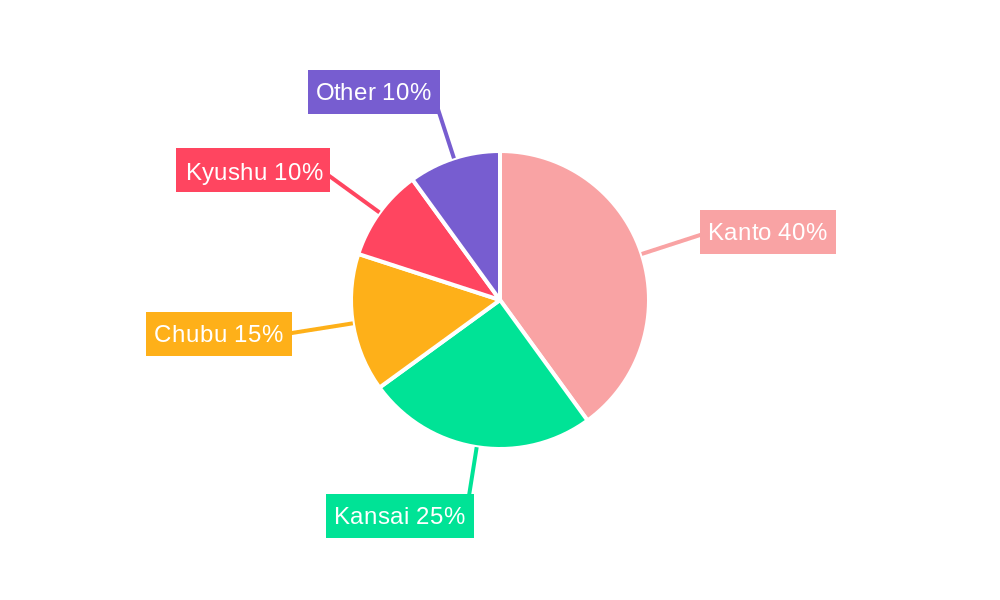

The forecast period (2025-2033) suggests continuous expansion, with the market likely exceeding $1 billion by 2033. This projection considers sustained economic growth in Japan, increasing consumer confidence, and the ongoing shift towards digital payments. While data on specific regional market share is unavailable, it's reasonable to assume a concentration of market activity in major urban centers like Tokyo, Osaka, and Nagoya, reflecting higher population density and economic activity. Continuous monitoring of consumer spending patterns, regulatory changes, and technological advancements will be crucial in accurately assessing future market performance and potential shifts in market leadership.

Japan Credit Cards Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Japan Credit Cards Market, covering the period 2019-2033. It offers invaluable insights into market dynamics, competitive landscape, and future growth prospects, making it an essential resource for industry stakeholders, investors, and strategic decision-makers. The report leverages robust data and analysis, employing a comprehensive research methodology to accurately forecast market trends.

Japan Credit Cards Market Concentration & Innovation

This section analyzes the competitive intensity of the Japanese credit card market, identifying key players and assessing their market share. The report examines the innovative forces driving market growth, including technological advancements, evolving consumer preferences, and regulatory influences. Furthermore, it explores the impact of mergers and acquisitions (M&A) activities on market consolidation and competitive dynamics.

- Market Concentration: The Japanese credit card market exhibits a moderately concentrated structure, with a few dominant players controlling a significant portion of the market share. Rakuten Card, Mitsubishi UFJ Financial Group, Sumitomo Mitsui Financial Group, and Mizuho Financial Group are among the key players, holding a combined market share estimated at xx%. The precise market share of each player will be detailed in the full report.

- Innovation Drivers: Key drivers of innovation include the adoption of contactless payment technologies, the integration of mobile payment platforms, and the introduction of loyalty and rewards programs tailored to Japanese consumer preferences. The emergence of fintech companies is also influencing market innovation.

- Regulatory Framework: The regulatory environment in Japan impacts credit card operations, including data privacy, consumer protection, and anti-money laundering regulations. The report assesses the impact of these regulations on market participants and innovation.

- Product Substitutes: The rise of digital wallets and mobile payment platforms presents a growing challenge to traditional credit cards. The report analyzes the competitive dynamics between credit cards and these emerging substitutes.

- End-User Trends: The report examines evolving consumer behavior, payment preferences, and spending habits within the Japanese market. Factors influencing trends include demographics, digital literacy, and lifestyle changes.

- M&A Activities: The report analyzes past and ongoing M&A activities in the market, including deals values and their impact on market structure. For instance, the recent acquisition of Greenhill by Mizuho Financial Group signals a potential shift in market dynamics. The total value of M&A deals in the credit card sector during the study period (2019-2024) is estimated at xx Million.

Japan Credit Cards Market Industry Trends & Insights

This section delves into the overarching trends shaping the Japan Credit Cards Market. It explores factors driving market growth, technological disruptions, shifting consumer preferences, and the competitive dynamics influencing market evolution. Specific data points such as Compound Annual Growth Rate (CAGR) and market penetration rates will be analyzed to illustrate these trends. The forecast period (2025-2033) projects a xx% CAGR, driven by various factors including increasing digital adoption and government initiatives. Market penetration for credit card usage in Japan is estimated at xx% in 2025, with further growth anticipated in the forecast period.

Dominant Markets & Segments in Japan Credit Cards Market

This section delves into the leading regions, segments, and consumer demographics within Japan's dynamic credit card market. It offers a granular analysis of market leadership, identifying key factors driving this dominance and exploring the nuances of regional and segmental variations.

Key Drivers of Dominance:

- Economic Factors: A detailed examination of economic indicators—including GDP growth, disposable income levels, consumer spending habits, and prevalent economic sentiment—reveals their influence on market dominance across different regions and segments. This analysis will highlight correlations between economic performance and credit card usage patterns.

- Infrastructure: The availability and accessibility of robust digital infrastructure, including internet penetration, mobile device usage, and the prevalence of contactless payment terminals, significantly impacts market penetration and dominance. This section will analyze the interplay between technological infrastructure and credit card adoption rates.

- Government Policies: Government regulations, including those concerning data privacy, financial security, and the promotion of digital payments, play a crucial role in shaping market dynamics. The analysis will include an evaluation of the impact of specific policies on market growth and the competitive landscape.

- Consumer Behavior & Preferences: This section explores the evolving preferences of Japanese consumers, including their adoption of digital payment methods, loyalty programs, and preferred credit card features. Understanding these trends is essential for identifying dominant segments and forecasting future market trends.

Dominance Analysis: A comprehensive analysis of market leadership across geographical regions and specific credit card segments (e.g., rewards cards, cashback cards, co-branded cards, premium cards, travel cards) will be presented. The leading regions and segments will be identified, accompanied by a thorough assessment of the underlying factors contributing to their dominance. This includes a comparative analysis of market share across major players.

Japan Credit Cards Market Product Developments

This section examines the recent innovations in credit card products, highlighting technological advancements and their impact on market competitiveness. The trend towards contactless payments and mobile-integrated features, coupled with personalized rewards programs, is creating new opportunities for market expansion. Specific examples of new product features and their market appeal will be presented in the full report.

Report Scope & Segmentation Analysis

The report segments the Japan Credit Cards Market based on several criteria, including card type (e.g., debit, credit, prepaid), payment network (e.g., Visa, Mastercard, JCB), income group, and geographic location. Growth projections, market sizes, and competitive landscapes will be detailed for each segment. For example, the premium credit card segment is expected to exhibit higher growth rates compared to the standard credit card segment due to increased affluence among certain demographics.

Key Drivers of Japan Credit Cards Market Growth

Several factors contribute to the growth of the Japan Credit Cards Market. These include the increasing adoption of digital payment methods, the expanding e-commerce sector, government initiatives promoting financial inclusion, and the evolving preferences of Japanese consumers towards convenient and cashless transactions. The increasing penetration of smartphones and improved internet infrastructure are also key contributors.

Challenges in the Japan Credit Cards Market Sector

Despite significant growth potential, the Japanese credit card market faces challenges such as intense competition among existing players, stringent regulations governing financial services, concerns about data security and privacy, and the need for continuous innovation to stay ahead of changing consumer expectations. The report will quantify the impact of these challenges on market growth.

Emerging Opportunities in Japan Credit Cards Market

The Japan Credit Cards Market presents several emerging opportunities. The expansion of the digital economy, the growing use of fintech solutions, and the increasing adoption of contactless payments offer considerable potential for market expansion. Furthermore, tapping into the increasing spending capacity of specific demographics and catering to their unique needs presents further opportunities.

Leading Players in the Japan Credit Cards Market

- Rakuten Card

- Mitsubishi UFJ Financial Group

- Sumitomo Mitsui Financial Group

- Mizuho Financial Group

- Resona Holdings

- Japan Post Bank

- Aozora Bank

- Norinchukin Bank

- Shizuoka Bank

- JCB (Japan Credit Bureau)

- List Not Exhaustive

Key Developments in Japan Credit Cards Market Industry

- May 2023: Sumitomo Mitsui Banking Corporation invested USD 10 Million in Closed Loop Partners' Circular Plastics Fund, demonstrating a commitment to environmental sustainability and potentially influencing the perception of the company among environmentally conscious consumers.

- May 2023: Mizuho Financial Group's acquisition of Greenhill & Co. for approximately USD 550 Million significantly expands Mizuho's investment banking capabilities, potentially impacting its competitiveness in the credit card market through enhanced financial services offerings.

Strategic Outlook for Japan Credit Cards Market

The Japan Credit Cards Market is poised for continued growth, driven by technological advancements, evolving consumer preferences, and increasing digitalization. The market's long-term potential hinges on companies' ability to innovate, adapt to changing regulations, and provide secure, convenient, and rewarding payment experiences for Japanese consumers. This report will provide crucial insights that inform effective strategic planning and decision-making for navigating the opportunities and challenges ahead.

Japan Credit Cards Market Segmentation

-

1. Card Type

- 1.1. General Purpose Credit Cards

- 1.2. Specialty & Other Credit Cards

-

2. Application

- 2.1. Food & Groceries

- 2.2. Health & Pharmacy

- 2.3. Restaurants & Bars

- 2.4. Consumer Electronics

- 2.5. Media & Entertainment

- 2.6. Travel & Tourism

- 2.7. Other Applications

-

3. Provider

- 3.1. Visa

- 3.2. MasterCard

- 3.3. Other Providers

Japan Credit Cards Market Segmentation By Geography

- 1. Japan

Japan Credit Cards Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.36% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Usage of Credit Card give the bonus and reward points

- 3.3. Market Restrains

- 3.3.1. Usage of Credit Card give the bonus and reward points

- 3.4. Market Trends

- 3.4.1. Increasing in Number of Credit Card issued

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Credit Cards Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Card Type

- 5.1.1. General Purpose Credit Cards

- 5.1.2. Specialty & Other Credit Cards

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food & Groceries

- 5.2.2. Health & Pharmacy

- 5.2.3. Restaurants & Bars

- 5.2.4. Consumer Electronics

- 5.2.5. Media & Entertainment

- 5.2.6. Travel & Tourism

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Provider

- 5.3.1. Visa

- 5.3.2. MasterCard

- 5.3.3. Other Providers

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Card Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Rakuten Card

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mitsubishi UFJ Financial Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sumitomo Mitsui Financial Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mizuho Financial Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Resona Holdings

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Japan Post Bank

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Aozora Bank

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Norinchukin Bank

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shizuoka Bank

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 JCB (Japan Credit Bureau)**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Rakuten Card

List of Figures

- Figure 1: Japan Credit Cards Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan Credit Cards Market Share (%) by Company 2024

List of Tables

- Table 1: Japan Credit Cards Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan Credit Cards Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Japan Credit Cards Market Revenue Million Forecast, by Card Type 2019 & 2032

- Table 4: Japan Credit Cards Market Volume Billion Forecast, by Card Type 2019 & 2032

- Table 5: Japan Credit Cards Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Japan Credit Cards Market Volume Billion Forecast, by Application 2019 & 2032

- Table 7: Japan Credit Cards Market Revenue Million Forecast, by Provider 2019 & 2032

- Table 8: Japan Credit Cards Market Volume Billion Forecast, by Provider 2019 & 2032

- Table 9: Japan Credit Cards Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Japan Credit Cards Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Japan Credit Cards Market Revenue Million Forecast, by Card Type 2019 & 2032

- Table 12: Japan Credit Cards Market Volume Billion Forecast, by Card Type 2019 & 2032

- Table 13: Japan Credit Cards Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Japan Credit Cards Market Volume Billion Forecast, by Application 2019 & 2032

- Table 15: Japan Credit Cards Market Revenue Million Forecast, by Provider 2019 & 2032

- Table 16: Japan Credit Cards Market Volume Billion Forecast, by Provider 2019 & 2032

- Table 17: Japan Credit Cards Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Japan Credit Cards Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Credit Cards Market?

The projected CAGR is approximately 7.36%.

2. Which companies are prominent players in the Japan Credit Cards Market?

Key companies in the market include Rakuten Card, Mitsubishi UFJ Financial Group, Sumitomo Mitsui Financial Group, Mizuho Financial Group, Resona Holdings, Japan Post Bank, Aozora Bank, Norinchukin Bank, Shizuoka Bank, JCB (Japan Credit Bureau)**List Not Exhaustive.

3. What are the main segments of the Japan Credit Cards Market?

The market segments include Card Type, Application, Provider.

4. Can you provide details about the market size?

The market size is estimated to be USD 652.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Usage of Credit Card give the bonus and reward points.

6. What are the notable trends driving market growth?

Increasing in Number of Credit Card issued.

7. Are there any restraints impacting market growth?

Usage of Credit Card give the bonus and reward points.

8. Can you provide examples of recent developments in the market?

May 2023: Sumitomo Mitsui Banking Corporation announced a USD 10 million investment in U.S.-based Closed Loop Partners' Circular Plastics Fund. The Closed Loop Circular Plastics Fund is managed and operated by Closed Loop Partners, an investment firm dedicated to advancing the circular economy. The fund provides catalytic debt and equity financing into solutions and infrastructure that advance the recovery and recycling of plastics, helping keep more materials in circulation while reducing greenhouse gas emissions and leading a shift to the circular economy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Credit Cards Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Credit Cards Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Credit Cards Market?

To stay informed about further developments, trends, and reports in the Japan Credit Cards Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence