Key Insights

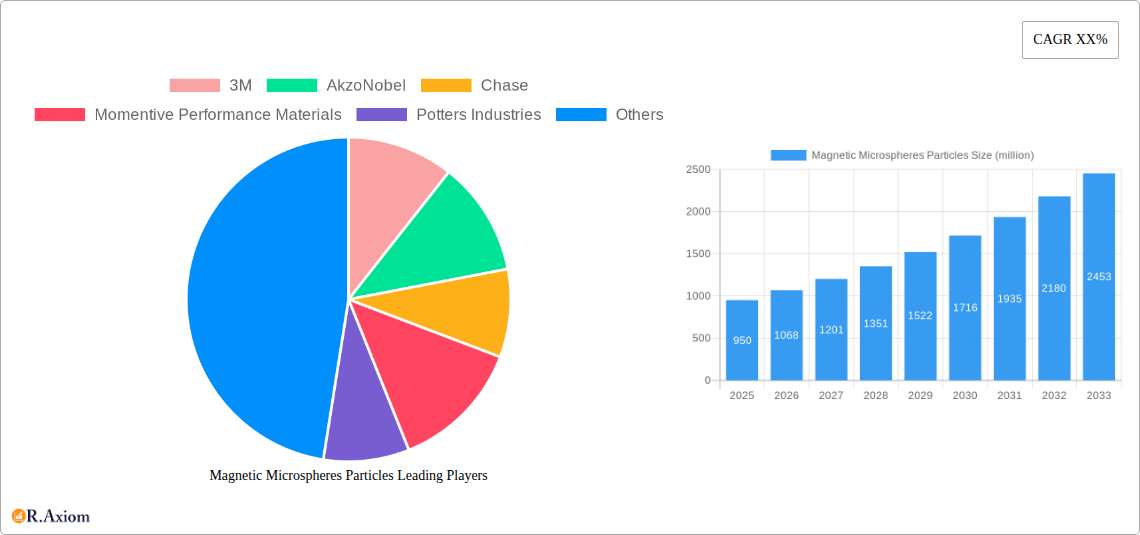

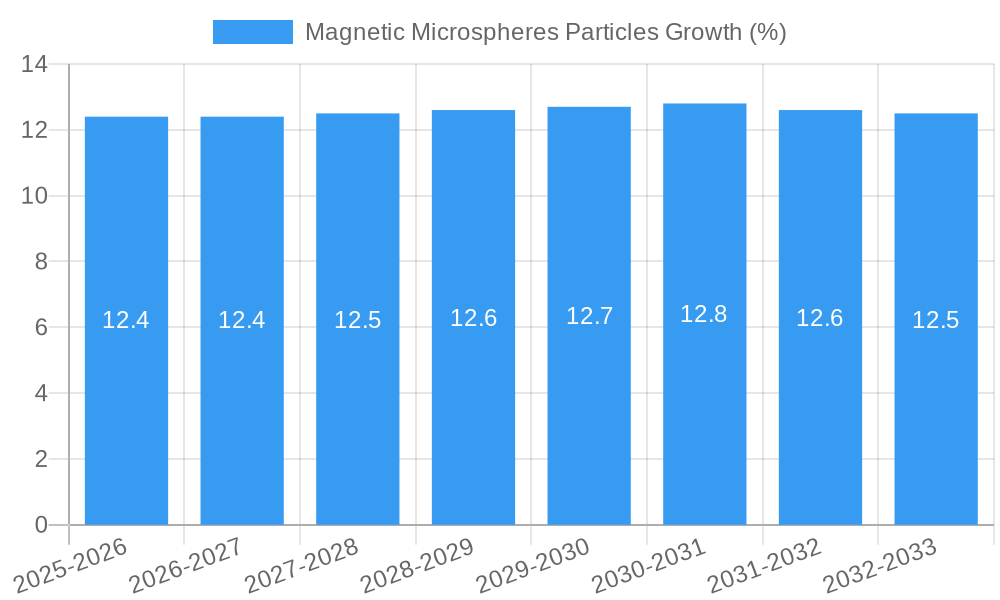

The global Magnetic Microspheres Particles market is poised for significant expansion, projected to reach an estimated market size of approximately USD 950 million by 2025. This robust growth is driven by a compound annual growth rate (CAGR) of around 12.5% over the forecast period of 2025-2033. The increasing adoption of magnetic microspheres in advanced applications, particularly within the Medical & Life Sciences and Composites sectors, is a primary catalyst. In Medical & Life Sciences, these particles are indispensable for drug delivery, diagnostics, cell separation, and bioprocessing, where their magnetic manipulability offers unparalleled precision and efficiency. The Composites industry leverages magnetic microspheres for enhanced material properties, such as improved mechanical strength, thermal conductivity, and electromagnetic interference (EMI) shielding in automotive components and advanced electronics. Furthermore, the burgeoning demand in Personal Care for specialized cosmetic formulations and in the Consumer Goods sector for innovative products contributes to the market's upward trajectory.

Emerging trends such as the development of highly functionalized and multi-functional magnetic microspheres are shaping market dynamics. These advancements cater to increasingly complex application requirements, offering tailored solutions for specific needs. The market is also witnessing a surge in research and development efforts focused on novel synthesis techniques and surface modification strategies to enhance particle performance and broaden their applicability. While the market presents immense opportunities, certain restraints, such as the high cost of production for specialized microspheres and the need for stringent quality control, could temper growth. However, the continuous innovation in material science, coupled with strategic collaborations and investments by key players like 3M, AkzoNobel, and Momentive Performance Materials, is expected to overcome these challenges, propelling the Magnetic Microspheres Particles market to new heights in the coming years.

Magnetic Microspheres Particles Market Concentration & Innovation

The magnetic microspheres particles market exhibits moderate to high concentration, with a significant portion of the market share held by a few dominant players, including 3M, AkzoNobel, Chase Corporation, Momentive Performance Materials, Potters Industries, PolyMicrospheres, Generon, Matsumoto Yushi-Seiyaku, Sekisui Chemical, Polysciences, and Bangs Laboratories. Innovation is a key differentiator, driven by advancements in particle synthesis, surface modification techniques, and functionalization for specific applications. Regulatory frameworks, particularly in the medical and life sciences sectors, play a crucial role in dictating product development and market entry. The market is constantly evaluating product substitutes, such as non-magnetic particles with similar functional properties, or alternative separation technologies. End-user trends, emphasizing higher efficiency, precision, and miniaturization, are shaping product demand. Mergers and acquisitions (M&A) are significant strategic moves within this landscape. For instance, over the study period (2019-2033), estimated M&A deal values have reached hundreds of millions. Key M&A activities are focused on expanding product portfolios, gaining access to new technologies, and strengthening market presence in high-growth segments.

- Market Share Snapshot: Leading companies collectively command an estimated market share exceeding $500 million.

- M&A Activity: Over the forecast period (2025-2033), M&A deal values are projected to reach in excess of $300 million annually.

- Innovation Focus: Research and development efforts are concentrated on developing highly specific surface chemistries for targeted biomolecule conjugation and enhanced magnetic responsiveness.

Magnetic Microspheres Particles Industry Trends & Insights

The magnetic microspheres particles industry is experiencing robust growth, fueled by an expanding array of applications across diverse sectors. The market growth is propelled by the increasing demand for highly specific and efficient separation and purification techniques, particularly within the rapidly evolving medical and life sciences fields. Advancements in nanotechnology and materials science are enabling the development of novel magnetic microsphere formulations with tailored properties, such as enhanced biocompatibility, controlled release capabilities, and precise magnetic field responsiveness. These technological disruptions are opening up new avenues for product development and application, from advanced drug delivery systems to point-of-care diagnostics.

Consumer preferences are also playing a pivotal role. In personal care, there is a growing demand for products incorporating magnetic microspheres for enhanced ingredient delivery and unique sensory experiences. The automotive sector is exploring their use in advanced filtration and sensor technologies, driven by the need for lighter, more efficient, and sophisticated components. Similarly, in composites, magnetic microspheres are being integrated to impart self-healing properties, enhance structural integrity, and enable smart functionalities. The competitive dynamics are characterized by a blend of established players investing heavily in R&D and new entrants with specialized technological expertise. Strategic partnerships and collaborations are becoming increasingly common as companies seek to leverage each other's strengths and accelerate market penetration. The overall compound annual growth rate (CAGR) for the magnetic microspheres particles market is projected to be between 8% and 10% over the forecast period, indicating a healthy expansion trajectory. Market penetration is expanding significantly in emerging economies, driven by increasing healthcare investments and the growing adoption of advanced materials in industrial applications. The estimated market size is expected to grow from $1.2 billion in the base year 2025 to an impressive $2.5 billion by 2033.

Dominant Markets & Segments in Magnetic Microspheres Particles

The Medical & Life Sciences segment stands as the undisputed dominant market within the magnetic microspheres particles landscape, driven by its critical role in diagnostics, therapeutics, and research. This segment consistently accounts for over 40% of the total market revenue. The demand is propelled by the increasing prevalence of chronic diseases, the burgeoning biopharmaceutical industry, and the continuous need for efficient sample preparation and purification in genetic analysis, protein isolation, and cell sorting. Within this segment, applications like immunoassays, magnetic cell separation, and drug delivery systems are particularly prominent.

- Dominant Application Segment: Medical & Life Sciences is the leading application, estimated to contribute over $500 million in revenue in the base year 2025.

- Key Drivers: Increasing R&D expenditure in biotechnology, demand for personalized medicine, and advancements in in-vitro diagnostics.

- Economic Policies: Government initiatives promoting life sciences research and development further bolster growth.

- Infrastructure: Development of advanced research facilities and specialized diagnostic centers enhances adoption.

The Composites segment represents another significant and rapidly growing area, projected to capture approximately 20% of the market share. Its dominance is attributed to the increasing demand for high-performance materials in aerospace, automotive, and construction industries. Magnetic microspheres are being incorporated to enhance mechanical properties, introduce self-healing capabilities, and enable electromagnetic shielding. The Automotive sector, in particular, is a key growth engine for composites, seeking lightweight yet durable materials.

- Emerging Application Segment: Composites are showing substantial growth, with an estimated market size of $250 million in 2025.

- Key Drivers: Lightweighting initiatives in transportation, demand for advanced materials with superior strength and durability, and integration of smart functionalities.

- Technological Advancements: Development of novel composite formulations incorporating magnetic functionalities for structural health monitoring and electromagnetic interference (EMI) shielding.

The Personal Care segment, while smaller in market share (estimated at 15% in 2025), is exhibiting a strong upward trend. This is driven by consumer demand for innovative cosmetic and skincare products with enhanced delivery mechanisms for active ingredients and unique textural properties.

- Niche Application Segment: Personal Care is experiencing steady growth, with an estimated market value of $180 million in 2025.

- Key Drivers: Consumer interest in premium skincare and cosmetic products, innovation in product formulations for targeted delivery, and the desire for unique sensorial experiences.

Among the types of magnetic microspheres, Coated Magnetic Microspheres Particles are the most prevalent, accounting for a substantial portion of the market due to their versatility and ease of functionalization for various applications. However, Coupled Magnetic Microspheres Particles and Conjugated Magnetic Microspheres Particles are gaining traction, particularly in specialized bio-applications requiring high specificity.

- Dominant Type: Coated Magnetic Microspheres Particles are the most widely adopted type, estimated to represent over 60% of the market share.

- Growing Types: Coupled and Conjugated Magnetic Microspheres Particles are experiencing higher growth rates due to their specialized applications in diagnostics and drug delivery.

Magnetic Microspheres Particles Product Developments

Product development in the magnetic microspheres particles market is characterized by a strong focus on enhancing specificity, biocompatibility, and performance across diverse applications. Innovations include the development of superparamagnetic iron oxide nanoparticles (SPIONs) for targeted drug delivery and medical imaging, enabling precise therapeutic intervention with minimal side effects. Advances in surface chemistry allow for the conjugation of antibodies, enzymes, and nucleic acids, leading to highly sensitive diagnostic kits and efficient bioseparation processes. For industrial applications, developments center on creating microspheres with improved magnetic responsiveness for efficient separation and filtration in composites and water treatment. The competitive advantage lies in tailored particle size, surface area, magnetic strength, and functional group density, catering to the precise needs of end-users and driving market adoption.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the magnetic microspheres particles market, segmented by Application and Type.

Application Segmentation:

- Composites: This segment encompasses the use of magnetic microspheres in creating advanced composite materials with enhanced mechanical, thermal, and electromagnetic properties. Growth projections indicate a significant CAGR, driven by automotive and aerospace demands. The market size is estimated at $250 million in 2025.

- Medical & Life Sciences: This segment includes applications in diagnostics, therapeutics, drug delivery, and bioseparation. It is the largest segment, with an estimated market size of over $500 million in 2025, and is projected to maintain a strong growth trajectory due to advancements in healthcare and biotechnology.

- Personal Care: This segment covers the incorporation of magnetic microspheres in cosmetic and skincare products for improved delivery and sensory experiences. The market size is estimated at $180 million in 2025, with steady growth expected from consumer demand for innovative products.

- Automotive: This segment focuses on the use of magnetic microspheres in automotive components, including sensors, filtration, and lightweight materials. Growth is driven by the automotive industry's pursuit of advanced functionalities and fuel efficiency.

- Consumer Goods: This segment includes a broad range of consumer products incorporating magnetic microspheres for various functional benefits.

- Others: This segment comprises niche applications and emerging uses not covered in the primary categories.

Type Segmentation:

- Coated Magnetic Microspheres Particles: These are the most common type, offering versatility in surface functionalization. They are projected to maintain a dominant market share.

- Coupled Magnetic Microspheres Particles: These are utilized in applications requiring specific binding affinities, such as in certain diagnostic assays.

- Conjugated Magnetic Microspheres Particles: These are designed for highly specific interactions, particularly in advanced life science applications.

Key Drivers of Magnetic Microspheres Particles Growth

The magnetic microspheres particles market is propelled by a confluence of powerful drivers. Technologically, the continuous innovation in synthesis techniques allows for the creation of particles with precisely controlled sizes, magnetic properties, and surface chemistries, enabling their application in increasingly sophisticated areas. Economic factors, such as the expanding healthcare expenditure globally and the growing investment in research and development within the biopharmaceutical and advanced materials sectors, are significant growth catalysts. Regulatory frameworks, particularly those supporting medical device innovation and pharmaceutical development, indirectly foster market expansion. For example, the increasing approval rates for diagnostic kits utilizing magnetic separation technologies directly translate to higher demand. Furthermore, the growing demand for miniaturized and high-throughput solutions in laboratories and industrial processes fuels the adoption of these versatile particles.

Challenges in the Magnetic Microspheres Particles Sector

Despite its promising growth, the magnetic microspheres particles sector faces several challenges. Regulatory hurdles, especially in the medical and pharmaceutical fields, can lead to lengthy approval processes and increased development costs, impacting time-to-market. Supply chain complexities and the need for specialized raw materials can sometimes lead to price volatility and availability issues, affecting manufacturing efficiency. Intense competition from both established players and emerging companies necessitates continuous innovation and cost optimization to maintain market share. Furthermore, the development of cost-effective alternatives or competing technologies in certain application areas poses a potential restraint on market growth. Ensuring consistent product quality and scalability for large-scale industrial applications also remains a critical operational challenge.

Emerging Opportunities in Magnetic Microspheres Particles

Emerging opportunities in the magnetic microspheres particles market are abundant and diverse. The rapid advancement of personalized medicine presents a significant opportunity for highly specific magnetic microspheres in targeted drug delivery and advanced diagnostics. The growing focus on sustainable practices is opening avenues for magnetic microspheres in environmental remediation, such as water purification and the removal of pollutants. In the field of quantum computing and advanced electronics, specialized magnetic microspheres are being explored for their potential applications. The continuous development of novel functional coatings and surface modifications is enabling the creation of smart materials with unique capabilities, such as self-healing composites and advanced sensors. The expansion of healthcare infrastructure and research capabilities in emerging economies further unlocks new market potential.

Leading Players in the Magnetic Microspheres Particles Market

- 3M

- AkzoNobel

- Chase Corporation

- Momentive Performance Materials

- Potters Industries

- PolyMicrospheres

- Generon

- Matsumoto Yushi-Seiyaku

- Sekisui Chemical

- Momentive

- Polysciences

- Bangs Laboratories

Key Developments in Magnetic Microspheres Particles Industry

- 2024 (Q1): Launch of novel antibody-conjugated magnetic microspheres for rapid point-of-care diagnostics, demonstrating a 30% increase in sensitivity.

- 2023 (Q4): Acquisition of a specialized magnetic particle manufacturer by a major life sciences company to expand its portfolio in bioseparation technologies.

- 2023 (Q3): Development of self-healing polymer composites incorporating magnetic microspheres for enhanced structural integrity in aerospace applications.

- 2023 (Q2): Introduction of biodegradable magnetic microspheres for targeted drug delivery, aiming to reduce patient side effects.

- 2022 (Q4): Collaboration between a chemical company and a university research group to explore magnetic microspheres for advanced water treatment solutions.

- 2022 (Q3): Release of new magnetic microspheres with enhanced surface area for improved catalyst support in chemical reactions.

Strategic Outlook for Magnetic Microspheres Particles Market

The strategic outlook for the magnetic microspheres particles market is exceptionally positive, driven by ongoing technological advancements and expanding application landscapes. Continued investment in research and development to create highly specialized and functionalized microspheres will be a key growth catalyst. Strategic collaborations between material scientists, biotechnology firms, and end-users will accelerate innovation and market penetration, particularly in high-value segments like personalized medicine and advanced composites. The growing demand for efficient and sustainable solutions across industries presents significant opportunities for market expansion. Companies that can effectively navigate regulatory pathways and demonstrate superior product performance and cost-effectiveness are well-positioned for long-term success. The market is poised for substantial growth, with new frontiers in medical diagnostics, targeted therapies, and smart materials continuously emerging.

Magnetic Microspheres Particles Segmentation

-

1. Application

- 1.1. Composites

- 1.2. Medical & Life Sciences

- 1.3. Personal Care

- 1.4. Automotive

- 1.5. Consumer Goods

- 1.6. Others

-

2. Types

- 2.1. Coated Magnetic Microspheres Particles

- 2.2. Coupled Magnetic Microspheres Particles

- 2.3. Conjugated Magnetic Microspheres Particles

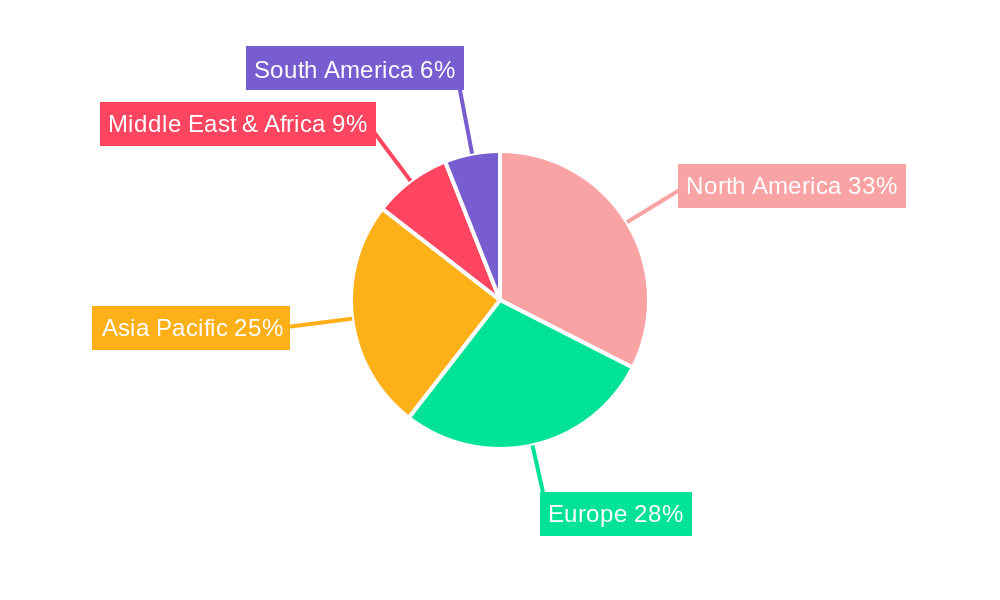

Magnetic Microspheres Particles Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Magnetic Microspheres Particles REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Magnetic Microspheres Particles Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Composites

- 5.1.2. Medical & Life Sciences

- 5.1.3. Personal Care

- 5.1.4. Automotive

- 5.1.5. Consumer Goods

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Coated Magnetic Microspheres Particles

- 5.2.2. Coupled Magnetic Microspheres Particles

- 5.2.3. Conjugated Magnetic Microspheres Particles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Magnetic Microspheres Particles Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Composites

- 6.1.2. Medical & Life Sciences

- 6.1.3. Personal Care

- 6.1.4. Automotive

- 6.1.5. Consumer Goods

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Coated Magnetic Microspheres Particles

- 6.2.2. Coupled Magnetic Microspheres Particles

- 6.2.3. Conjugated Magnetic Microspheres Particles

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Magnetic Microspheres Particles Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Composites

- 7.1.2. Medical & Life Sciences

- 7.1.3. Personal Care

- 7.1.4. Automotive

- 7.1.5. Consumer Goods

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Coated Magnetic Microspheres Particles

- 7.2.2. Coupled Magnetic Microspheres Particles

- 7.2.3. Conjugated Magnetic Microspheres Particles

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Magnetic Microspheres Particles Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Composites

- 8.1.2. Medical & Life Sciences

- 8.1.3. Personal Care

- 8.1.4. Automotive

- 8.1.5. Consumer Goods

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Coated Magnetic Microspheres Particles

- 8.2.2. Coupled Magnetic Microspheres Particles

- 8.2.3. Conjugated Magnetic Microspheres Particles

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Magnetic Microspheres Particles Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Composites

- 9.1.2. Medical & Life Sciences

- 9.1.3. Personal Care

- 9.1.4. Automotive

- 9.1.5. Consumer Goods

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Coated Magnetic Microspheres Particles

- 9.2.2. Coupled Magnetic Microspheres Particles

- 9.2.3. Conjugated Magnetic Microspheres Particles

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Magnetic Microspheres Particles Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Composites

- 10.1.2. Medical & Life Sciences

- 10.1.3. Personal Care

- 10.1.4. Automotive

- 10.1.5. Consumer Goods

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Coated Magnetic Microspheres Particles

- 10.2.2. Coupled Magnetic Microspheres Particles

- 10.2.3. Conjugated Magnetic Microspheres Particles

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 3M

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 AkzoNobel

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Chase

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Momentive Performance Materials

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Potters Industries

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 PolyMicrospheres

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Generon

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Matsumoto Yushi-Seiyaku

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sekisui Chemical

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Chase Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Momentive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Polysciences

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Bangs Laboratories

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 3M

List of Figures

- Figure 1: Global Magnetic Microspheres Particles Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Magnetic Microspheres Particles Revenue (million), by Application 2024 & 2032

- Figure 3: North America Magnetic Microspheres Particles Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Magnetic Microspheres Particles Revenue (million), by Types 2024 & 2032

- Figure 5: North America Magnetic Microspheres Particles Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Magnetic Microspheres Particles Revenue (million), by Country 2024 & 2032

- Figure 7: North America Magnetic Microspheres Particles Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Magnetic Microspheres Particles Revenue (million), by Application 2024 & 2032

- Figure 9: South America Magnetic Microspheres Particles Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Magnetic Microspheres Particles Revenue (million), by Types 2024 & 2032

- Figure 11: South America Magnetic Microspheres Particles Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Magnetic Microspheres Particles Revenue (million), by Country 2024 & 2032

- Figure 13: South America Magnetic Microspheres Particles Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Magnetic Microspheres Particles Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Magnetic Microspheres Particles Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Magnetic Microspheres Particles Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Magnetic Microspheres Particles Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Magnetic Microspheres Particles Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Magnetic Microspheres Particles Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Magnetic Microspheres Particles Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Magnetic Microspheres Particles Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Magnetic Microspheres Particles Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Magnetic Microspheres Particles Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Magnetic Microspheres Particles Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Magnetic Microspheres Particles Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Magnetic Microspheres Particles Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Magnetic Microspheres Particles Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Magnetic Microspheres Particles Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Magnetic Microspheres Particles Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Magnetic Microspheres Particles Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Magnetic Microspheres Particles Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Magnetic Microspheres Particles Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Magnetic Microspheres Particles Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Magnetic Microspheres Particles Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Magnetic Microspheres Particles Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Magnetic Microspheres Particles Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Magnetic Microspheres Particles Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Magnetic Microspheres Particles Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Magnetic Microspheres Particles Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Magnetic Microspheres Particles Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Magnetic Microspheres Particles Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Magnetic Microspheres Particles Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Magnetic Microspheres Particles Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Magnetic Microspheres Particles Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Magnetic Microspheres Particles Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Magnetic Microspheres Particles Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Magnetic Microspheres Particles Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Magnetic Microspheres Particles Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Magnetic Microspheres Particles Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Magnetic Microspheres Particles Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Magnetic Microspheres Particles Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Magnetic Microspheres Particles Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Magnetic Microspheres Particles Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Magnetic Microspheres Particles Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Magnetic Microspheres Particles Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Magnetic Microspheres Particles Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Magnetic Microspheres Particles Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Magnetic Microspheres Particles Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Magnetic Microspheres Particles Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Magnetic Microspheres Particles Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Magnetic Microspheres Particles Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Magnetic Microspheres Particles Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Magnetic Microspheres Particles Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Magnetic Microspheres Particles Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Magnetic Microspheres Particles Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Magnetic Microspheres Particles Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Magnetic Microspheres Particles Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Magnetic Microspheres Particles Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Magnetic Microspheres Particles Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Magnetic Microspheres Particles Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Magnetic Microspheres Particles Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Magnetic Microspheres Particles Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Magnetic Microspheres Particles Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Magnetic Microspheres Particles Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Magnetic Microspheres Particles Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Magnetic Microspheres Particles Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Magnetic Microspheres Particles Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Magnetic Microspheres Particles Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Magnetic Microspheres Particles?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Magnetic Microspheres Particles?

Key companies in the market include 3M, AkzoNobel, Chase, Momentive Performance Materials, Potters Industries, PolyMicrospheres, Generon, Matsumoto Yushi-Seiyaku, Sekisui Chemical, Chase Corporation, Momentive, Polysciences, Bangs Laboratories.

3. What are the main segments of the Magnetic Microspheres Particles?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Magnetic Microspheres Particles," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Magnetic Microspheres Particles report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Magnetic Microspheres Particles?

To stay informed about further developments, trends, and reports in the Magnetic Microspheres Particles, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence