Key Insights

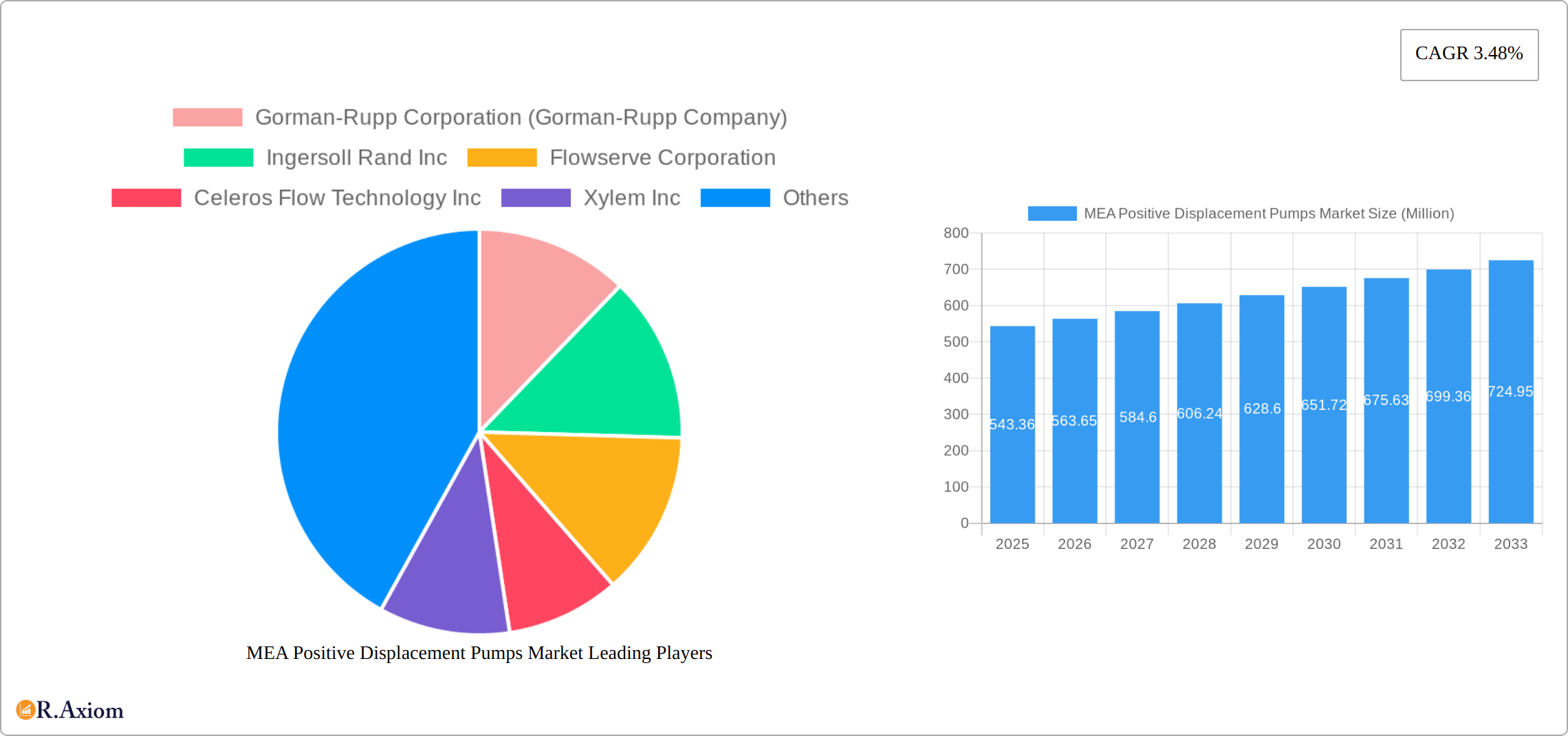

The Middle East and Africa (MEA) Positive Displacement Pumps market, valued at $543.36 million in 2025, is projected to experience steady growth, driven by robust expansion in key sectors like oil and gas, chemicals, and water and wastewater treatment. A Compound Annual Growth Rate (CAGR) of 3.48% from 2025 to 2033 indicates a continuous, albeit moderate, increase in market demand. This growth is fueled by rising industrialization across the MEA region, particularly in Saudi Arabia, the UAE, and Kuwait, coupled with increasing investments in infrastructure development and the ongoing need for efficient fluid handling solutions in various applications. The preference for energy-efficient and technologically advanced pumps, along with stringent environmental regulations promoting sustainable practices, are shaping the market landscape. Different pump types, such as diaphragm, piston, and gear pumps, cater to diverse industry needs, with the selection influenced by factors like fluid viscosity, pressure requirements, and flow rates. Competitive dynamics are marked by established players like Gorman-Rupp, Ingersoll Rand, and Flowserve, alongside regional and specialized pump manufacturers. Further market segmentation by end-user industry and country allows for a granular understanding of regional demand patterns and future growth potential.

The forecast period (2025-2033) anticipates a continued expansion of the MEA Positive Displacement Pumps market, though the CAGR might see slight fluctuations based on global economic conditions and regional project timelines. The diversification of the industrial base and expansion of water infrastructure projects across the MEA region are key factors expected to propel the market forward. However, factors such as volatile oil prices (impacting the oil and gas sector), and potential economic slowdowns in certain countries, could present challenges to sustained high growth. Nevertheless, the long-term outlook remains positive, given the fundamental need for reliable and efficient pumping solutions across various industries in the MEA region.

MEA Positive Displacement Pumps Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Middle East and Africa (MEA) Positive Displacement Pumps market, offering valuable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. The report covers the period from 2019 to 2033, with a focus on the forecast period of 2025-2033 and a base year of 2025. The study meticulously analyzes market trends, competitive dynamics, growth drivers, and emerging opportunities across various segments. It includes detailed information on key players, including market share analysis, and examines recent industry developments to provide a holistic perspective on the MEA positive displacement pumps market landscape. The total market size in 2025 is estimated at xx Million.

MEA Positive Displacement Pumps Market Market Concentration & Innovation

The MEA positive displacement pumps market exhibits a moderately concentrated landscape, with several major players holding significant market share. However, the presence of numerous smaller, specialized companies fosters innovation and competition. Market concentration is influenced by factors like technological advancements, regulatory changes, and M&A activity.

Market Concentration Metrics:

- Top 5 players' market share: Approximately xx% (2025)

- Average market share of top 10 players: Approximately xx% (2025)

Innovation Drivers:

- Growing demand for energy-efficient pumps across various industries.

- Increasing adoption of smart pumps with advanced features for process optimization.

- Development of specialized pumps for handling high-viscosity fluids and corrosive chemicals.

Regulatory Frameworks & Product Substitutes:

- Stringent environmental regulations drive the adoption of eco-friendly pumps.

- The availability of alternative technologies, such as centrifugal pumps, presents a competitive challenge. However, positive displacement pumps maintain their edge in specific applications requiring precise flow rates and handling of viscous fluids.

End-User Trends & M&A Activities:

- The Oil & Gas sector remains a major driver of market growth due to its reliance on positive displacement pumps for various operations.

- The Chemical industry's demand for specialized pumps fuels innovation in material selection and pump design.

- Recent M&A activities, such as the Atlas Copco Group's acquisition of Kracht GmbH in December 2023, underscore the strategic importance of consolidating market share and expanding technological capabilities within the MEA region. The deal value was reported to be xx Million.

MEA Positive Displacement Pumps Market Industry Trends & Insights

The MEA Positive Displacement Pumps market is experiencing robust growth, fueled by the expanding industrial sector, particularly in oil and gas, chemicals, and water treatment. This expansion is further driven by technological advancements leading to energy-efficient and smart pump solutions, a rising demand for reliable, precise, and easily maintainable equipment, and intense competition fostering innovation and market expansion. Established players are focusing on innovation and geographical expansion, while new entrants are actively seeking to establish themselves in niche markets.

- CAGR (2025-2033): [Insert CAGR percentage here]

- Market Penetration (2025): [Insert Market Penetration percentage here] in key sectors like Oil & Gas.

Significant technological disruptions are transforming the market landscape. The integration of IoT (Internet of Things) capabilities enables remote monitoring and predictive maintenance, optimizing operational efficiency and reducing downtime. The adoption of advanced materials enhances pump durability and expands applications into harsh operational environments. Market preferences increasingly favor pumps with lower operational costs, improved precision, and user-friendly interfaces. This competitive pressure stimulates innovation and pushes manufacturers to differentiate their offerings through superior performance and customized solutions to meet diverse industry demands.

Dominant Markets & Segments in MEA Positive Displacement Pumps Market

The MEA positive displacement pumps market is significantly driven by the Oil and Gas sector, leveraging the region's substantial hydrocarbon reserves and extensive exploration and production activities. Saudi Arabia and the United Arab Emirates are the leading national markets due to their substantial investments in infrastructure development and industrial projects. Within pump types, the Diaphragm Pump segment commands a substantial market share due to its versatility in handling diverse fluids, including abrasive and corrosive substances.

Key Regional and Segment Drivers:

Saudi Arabia:

- Large-scale infrastructure projects, including significant investments in renewable energy and industrial diversification.

- Government-led initiatives fostering industrial growth and technological advancements.

- Continued expansion of oil and gas production and refining capabilities.

United Arab Emirates:

- Expansion of the petrochemical and chemical industries, driven by sustained economic growth and diversification efforts.

- Significant investments in water desalination plants to meet increasing water demands.

- A strong focus on energy efficiency and sustainability initiatives, promoting the adoption of environmentally friendly technologies.

Kuwait:

- Expansion of oil refining and petrochemical capacities, aiming to increase production and export capabilities.

- Government investments in fostering industrial growth and technological development.

Africa:

- Rising demand for water treatment and wastewater management solutions due to population growth and industrialization.

- Growth of mining and industrial activities across various sectors, driving demand for robust and efficient pumping solutions.

Dominant Pump Types:

- Diaphragm pumps: Highly versatile and ideal for handling abrasive, corrosive, and viscous fluids.

- Piston pumps: Offer precise flow control and are suitable for high-pressure applications demanding accuracy.

- Gear pumps: Cost-effective and well-suited for low-viscosity fluids in various industrial processes.

Detailed Dominance Analysis: The Oil and Gas sector's dominance stems from the region's vast hydrocarbon reserves and associated industries. Saudi Arabia and the UAE, with their strong economies and proactive government policies, lead the national markets. The widespread adoption of diaphragm pumps is a direct result of their adaptability and ability to handle the challenging fluid properties commonly encountered across various MEA industries.

MEA Positive Displacement Pumps Market Product Developments

Recent innovations focus on enhancing pump efficiency, durability, and precision. CIRCOR's launch of the Zenith PEP-II Series precision gear pump for lithium battery separator production highlights the growing demand for specialized pumps in emerging industries. Technological trends indicate an increasing integration of smart technologies, advanced materials, and improved designs to cater to specific industry needs and enhance operational efficiency. The market fit for these innovations is strong, given the increasing emphasis on precision, automation, and reduced operational costs across various industrial sectors.

Report Scope & Segmentation Analysis

This report segments the MEA positive displacement pumps market by pump type (Diaphragm, Piston, Gear, Lobe, Progressive Cavity, Screw, Vane, Peristaltic, Plunger), end-user industry (Oil and Gas, Chemicals, Food and Beverage, Water and Wastewater, Pharmaceutical, Power Generation, Other), and country (Saudi Arabia, UAE, Kuwait, Africa). Growth projections vary across segments, with the Oil and Gas sector and diaphragm pumps exhibiting the highest growth rates. Competitive dynamics are influenced by technological advancements, pricing strategies, and brand recognition. Market sizes are projected to increase significantly over the forecast period, driven by growing industrialization and infrastructure development in the MEA region.

Key Drivers of MEA Positive Displacement Pumps Market Growth

The MEA positive displacement pumps market growth is propelled by several factors:

- Expanding industrialization: The region's burgeoning industrial sectors, particularly Oil & Gas, create significant demand for pumps.

- Infrastructure development: Large-scale infrastructure projects necessitate robust pumping solutions for water management and other applications.

- Technological advancements: Innovations in pump design and materials lead to improved efficiency and performance.

- Government initiatives: Government support for industrial growth and infrastructure development fuels market expansion.

Challenges in the MEA Positive Displacement Pumps Market Sector

Several challenges hinder market growth:

- Volatility in oil prices: Fluctuations in oil prices impact investment in the Oil & Gas sector, a key driver of pump demand.

- Supply chain disruptions: Global supply chain issues can affect the availability of pump components and increase costs.

- Economic downturns: Regional economic slowdowns can reduce industrial activity and dampen demand for pumps.

- Competition from substitute technologies: Centrifugal pumps provide competition in certain applications.

Emerging Opportunities in MEA Positive Displacement Pumps Market

Significant growth opportunities exist within the MEA positive displacement pumps market:

- Growing demand for water treatment and wastewater management solutions: Driven by increasing populations, industrialization, and the need for sustainable water resource management.

- Adoption of renewable energy technologies: The transition to renewable energy sources creates opportunities for pumps in related industries, such as solar and wind power.

- Development and adoption of smart pumps: Integration of IoT and advanced analytics offers improved pump monitoring, predictive maintenance, and optimized operational efficiency.

- Expansion into new markets: Untapped potential exists in less developed regions of Africa with growing infrastructure demands.

- Increased focus on process automation: Integration of positive displacement pumps into automated systems for improved efficiency and reduced manual intervention.

Leading Players in the MEA Positive Displacement Pumps Market Market

- Gorman-Rupp Corporation (Gorman-Rupp Company)

- Ingersoll Rand Inc

- Flowserve Corporation

- Celeros Flow Technology Inc

- Xylem Inc

- Atlas Copco AB

- Dover Corporation

- Busch Vacuum Solutions Inc (Busch Group)

- Alfa Laval AB

- Watson-Marlow Fluid Technology Solutions (Spirax Group PLC)

Key Developments in MEA Positive Displacement Pumps Market Industry

- April 2024: CIRCOR launched the Zenith PEP-II Series precision gear pump, designed for lithium battery separator production, highlighting advancements in precision metering and dosing for specialized applications.

- December 2023: Atlas Copco Group's acquisition of Kracht GmbH significantly expanded its positive displacement pump portfolio, strengthening its market position and technological capabilities.

Strategic Outlook for MEA Positive Displacement Pumps Market Market

The MEA positive displacement pumps market is poised for continued growth, driven by industrial expansion, infrastructure development, and technological innovation. Opportunities lie in specializing in niche applications, adopting smart technologies, and expanding into emerging markets. Companies focusing on energy efficiency, precision, and reliability will be best positioned to capitalize on the market's future potential.

MEA Positive Displacement Pumps Market Segmentation

-

1. Type of Pump

- 1.1. Diaphragm Pump

- 1.2. Piston Pump

- 1.3. Gear Pump

- 1.4. LobePump

- 1.5. Progressive Cavity Pump

- 1.6. Screw Pump

- 1.7. Vane Pump

- 1.8. Peristaltic Pump

- 1.9. Plunger Pump

-

2. End-user Industry

- 2.1. Oil and Gas

- 2.2. Chemicals

- 2.3. Food and Beverage

- 2.4. Water and Wastewater

- 2.5. Pharmaceutical

- 2.6. Power Generation

- 2.7. Other End-user Industries

MEA Positive Displacement Pumps Market Segmentation By Geography

-

1. Middle East & Africa

- 1.1. Turkey

- 1.2. Israel

- 1.3. GCC

- 1.4. North Africa

- 1.5. South Africa

- 1.6. Rest of Middle East & Africa

MEA Positive Displacement Pumps Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.48% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for PD Pumps Due to Huge Scarcity in the Disposable Water Level and Groundwater Adulteration; Increasing Demand From the Oil and Gas Industry

- 3.3. Market Restrains

- 3.3.1. Increasing Vulnerability Related To Cyber-attacks and Frauds

- 3.4. Market Trends

- 3.4.1. Growth in the Construction Sector Boosting the Demand for Furniture Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. MEA Positive Displacement Pumps Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Pump

- 5.1.1. Diaphragm Pump

- 5.1.2. Piston Pump

- 5.1.3. Gear Pump

- 5.1.4. LobePump

- 5.1.5. Progressive Cavity Pump

- 5.1.6. Screw Pump

- 5.1.7. Vane Pump

- 5.1.8. Peristaltic Pump

- 5.1.9. Plunger Pump

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil and Gas

- 5.2.2. Chemicals

- 5.2.3. Food and Beverage

- 5.2.4. Water and Wastewater

- 5.2.5. Pharmaceutical

- 5.2.6. Power Generation

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East & Africa

- 5.1. Market Analysis, Insights and Forecast - by Type of Pump

- 6. Americas MEA Positive Displacement Pumps Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe MEA Positive Displacement Pumps Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Pacific MEA Positive Displacement Pumps Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Gorman-Rupp Corporation (Gorman-Rupp Company)

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Ingersoll Rand Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Flowserve Corporation

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Celeros Flow Technology Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Xylem Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Atlas Copco AB

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Dover Corporation

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Busch Vacuum Solutions Inc (Busch Group)

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Alfa Laval AB

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Watson-Marlow Fluid Technology Solutions (Spirax Group PLC)

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Gorman-Rupp Corporation (Gorman-Rupp Company)

List of Figures

- Figure 1: MEA Positive Displacement Pumps Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: MEA Positive Displacement Pumps Market Share (%) by Company 2024

List of Tables

- Table 1: MEA Positive Displacement Pumps Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: MEA Positive Displacement Pumps Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: MEA Positive Displacement Pumps Market Revenue Million Forecast, by Type of Pump 2019 & 2032

- Table 4: MEA Positive Displacement Pumps Market Volume K Unit Forecast, by Type of Pump 2019 & 2032

- Table 5: MEA Positive Displacement Pumps Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 6: MEA Positive Displacement Pumps Market Volume K Unit Forecast, by End-user Industry 2019 & 2032

- Table 7: MEA Positive Displacement Pumps Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: MEA Positive Displacement Pumps Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: MEA Positive Displacement Pumps Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: MEA Positive Displacement Pumps Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: MEA Positive Displacement Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: MEA Positive Displacement Pumps Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: MEA Positive Displacement Pumps Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: MEA Positive Displacement Pumps Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: MEA Positive Displacement Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: MEA Positive Displacement Pumps Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: MEA Positive Displacement Pumps Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: MEA Positive Displacement Pumps Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: MEA Positive Displacement Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: MEA Positive Displacement Pumps Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: MEA Positive Displacement Pumps Market Revenue Million Forecast, by Type of Pump 2019 & 2032

- Table 22: MEA Positive Displacement Pumps Market Volume K Unit Forecast, by Type of Pump 2019 & 2032

- Table 23: MEA Positive Displacement Pumps Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 24: MEA Positive Displacement Pumps Market Volume K Unit Forecast, by End-user Industry 2019 & 2032

- Table 25: MEA Positive Displacement Pumps Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: MEA Positive Displacement Pumps Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 27: Turkey MEA Positive Displacement Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Turkey MEA Positive Displacement Pumps Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Israel MEA Positive Displacement Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Israel MEA Positive Displacement Pumps Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: GCC MEA Positive Displacement Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: GCC MEA Positive Displacement Pumps Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 33: North Africa MEA Positive Displacement Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: North Africa MEA Positive Displacement Pumps Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: South Africa MEA Positive Displacement Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: South Africa MEA Positive Displacement Pumps Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa MEA Positive Displacement Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Middle East & Africa MEA Positive Displacement Pumps Market Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Positive Displacement Pumps Market?

The projected CAGR is approximately 3.48%.

2. Which companies are prominent players in the MEA Positive Displacement Pumps Market?

Key companies in the market include Gorman-Rupp Corporation (Gorman-Rupp Company), Ingersoll Rand Inc, Flowserve Corporation, Celeros Flow Technology Inc, Xylem Inc, Atlas Copco AB, Dover Corporation, Busch Vacuum Solutions Inc (Busch Group), Alfa Laval AB, Watson-Marlow Fluid Technology Solutions (Spirax Group PLC).

3. What are the main segments of the MEA Positive Displacement Pumps Market?

The market segments include Type of Pump, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 543.36 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for PD Pumps Due to Huge Scarcity in the Disposable Water Level and Groundwater Adulteration; Increasing Demand From the Oil and Gas Industry.

6. What are the notable trends driving market growth?

Growth in the Construction Sector Boosting the Demand for Furniture Products.

7. Are there any restraints impacting market growth?

Increasing Vulnerability Related To Cyber-attacks and Frauds.

8. Can you provide examples of recent developments in the market?

April 2024 - CIRCOR unveiled its Zenith PEP-II Series precision gear pump, specifically tailored for blown film extrusion processes, a key step in producing lithium battery separators. In addition, the company introduced a range of other pump models designed for various lithium battery applications, including additives, coatings, sealants, and adhesives. The standout feature of the Zenith PEP-II pumps is their low-pulse polymer metering and dosing, ensuring exceptional precision and repeatability in metering. These pumps maintain a near-constant flow, eliminating the necessity for costly flow meters and control systems. Particularly noteworthy, when employed as a high-pressure extruder pump, the Zenith significantly diminishes the extruder pulse at the die.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Positive Displacement Pumps Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Positive Displacement Pumps Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Positive Displacement Pumps Market?

To stay informed about further developments, trends, and reports in the MEA Positive Displacement Pumps Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence