Key Insights

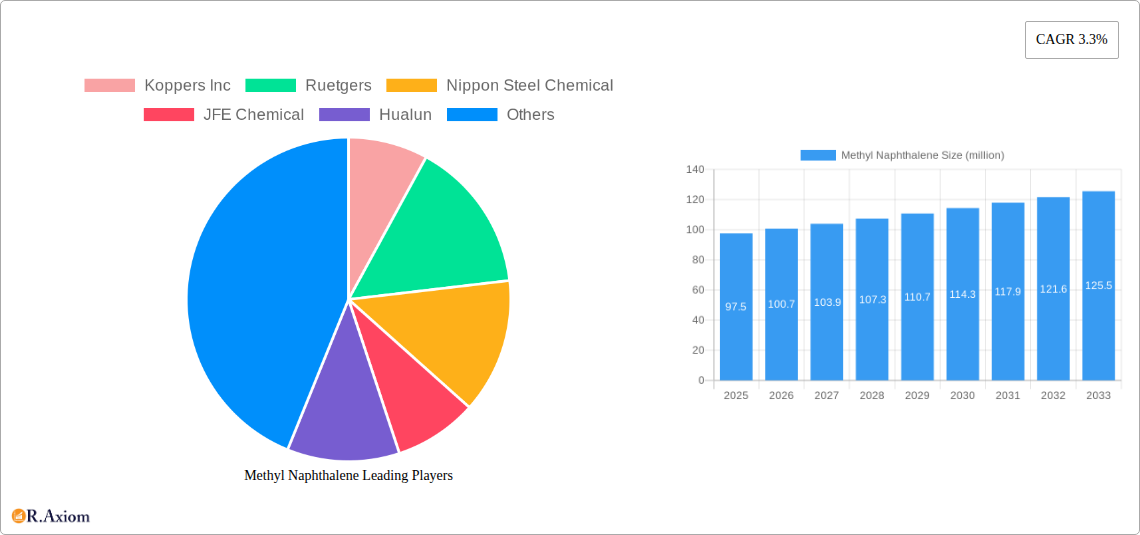

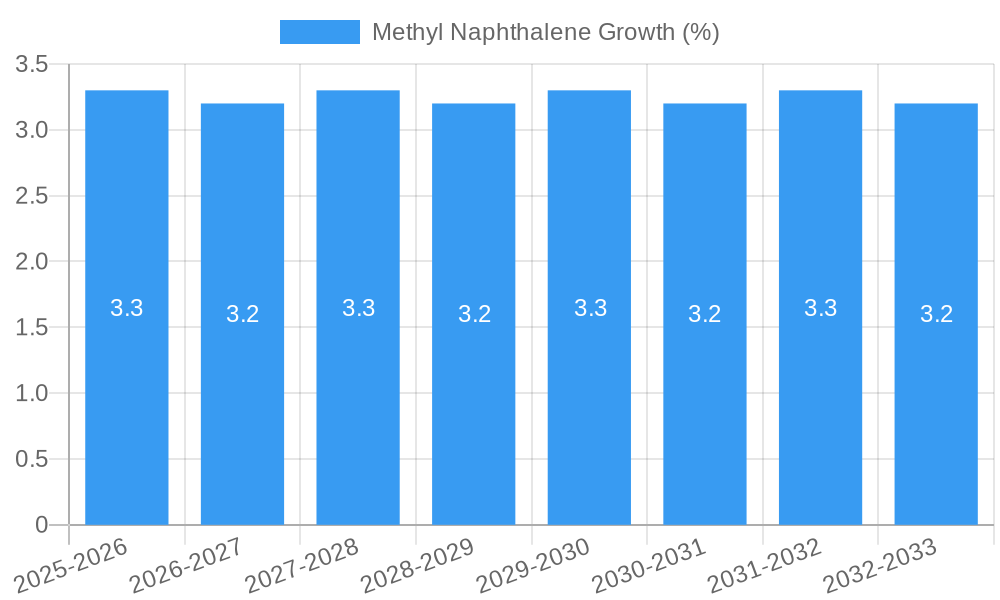

The global Methyl Naphthalene market is poised for steady expansion, projected to reach a significant valuation by 2033. With a Compound Annual Growth Rate (CAGR) of 3.3%, the market is expected to witness robust growth from its current size of 97.5 million value units. This growth is underpinned by the increasing demand for Methyl Naphthalene as a crucial intermediate in various chemical syntheses, particularly in the production of dyes, pigments, and agrochemicals. The compound's utility in organic synthesis for creating specialized chemicals further fuels its adoption across diverse industries. Key applications such as serving as an important intermediate and in organic synthesis are anticipated to drive demand, with 1-Methylnaphthalene and 2-Methylnaphthalene being the primary types. The dynamic industrial landscape, characterized by evolving manufacturing processes and a continuous need for specialized chemical building blocks, creates a fertile ground for market expansion.

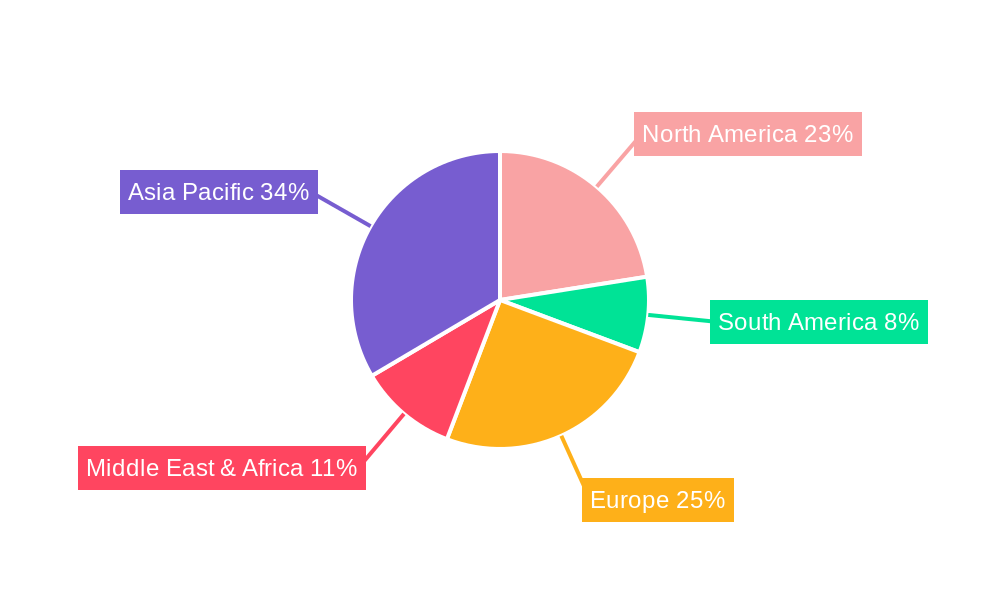

The Methyl Naphthalene market's trajectory is influenced by several dynamic factors. On the positive side, advancements in chemical manufacturing technologies and the growing sophistication of end-use industries, including pharmaceuticals and specialty chemicals, are significant drivers. The increasing global focus on sustainable chemical production and the development of novel applications for Methyl Naphthalene derivatives are also expected to contribute to market growth. However, the market also faces certain restraints, such as the price volatility of raw materials derived from coal tar and petroleum, which are the primary sources for Methyl Naphthalene. Stringent environmental regulations pertaining to the production and handling of these chemicals can also pose challenges. Geographically, the Asia Pacific region, led by China and India, is expected to dominate the market due to its strong industrial base and burgeoning chemical manufacturing sector. North America and Europe will also represent significant markets, driven by established chemical industries and a focus on research and development.

Comprehensive Methyl Naphthalene Market Analysis: 2019-2033

This detailed report provides an in-depth analysis of the global Methyl Naphthalene market, encompassing historical trends, current dynamics, and future projections. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this report offers actionable insights for stakeholders seeking to understand market concentration, innovation, industry trends, dominant segments, product developments, growth drivers, challenges, and emerging opportunities. The analysis includes key players, significant industry developments, and a strategic outlook for the Methyl Naphthalene sector.

Methyl Naphthalene Market Concentration & Innovation

The Methyl Naphthalene market exhibits a moderate level of concentration, with a few major players holding significant market share. Koppers Inc., Ruetgers, and Nippon Steel Chemical are recognized as key contributors, collectively accounting for an estimated market share exceeding 40% by 2025. Innovation in this sector is primarily driven by advancements in synthesis processes, leading to higher purity grades and novel applications. Regulatory frameworks, particularly those concerning environmental impact and chemical safety, are increasingly influencing product development and manufacturing practices. The emergence of bio-based alternatives and improved recycling technologies presents potential product substitutes, though their market penetration remains nascent. End-user trends indicate a growing demand for Methyl Naphthalene as an important intermediate in organic synthesis, particularly in the production of dyes, pesticides, and pharmaceuticals. Mergers and acquisitions (M&A) activities, while not overwhelmingly frequent, have played a role in consolidating market positions. For instance, recent M&A deals have seen valuations in the range of several hundred million to over a billion dollars, aimed at expanding production capacity and market reach. Continuous research into more efficient catalytic processes and sustainable production methods is a critical driver of innovation.

Methyl Naphthalene Industry Trends & Insights

The Methyl Naphthalene industry is poised for sustained growth, driven by robust demand from its primary applications. The global market size is projected to reach approximately $5,000 million by 2025 and is expected to expand at a Compound Annual Growth Rate (CAGR) of around 5.5% during the forecast period of 2025–2033. This growth is underpinned by the increasing utilization of Methyl Naphthalene as a crucial intermediate in organic synthesis. Technological disruptions, such as the development of more selective and energy-efficient catalytic processes, are enhancing production efficiency and product quality. Consumer preferences are indirectly influencing the market, with a growing emphasis on end-products that rely on Methyl Naphthalene in their manufacturing chains, such as advanced agrochemicals and specialty polymers. Competitive dynamics are characterized by a blend of established global players and emerging regional manufacturers, particularly in Asia. Market penetration for specific Methyl Naphthalene derivatives is expanding, fueled by their unique properties and performance advantages in diverse industrial applications. The continuous need for high-performance materials in sectors like construction and automotive further bolsters demand. The availability of abundant feedstock derived from coal tar distillation ensures a stable supply, though fluctuations in raw material prices can impact profitability. The global market penetration of Methyl Naphthalene is estimated to be around 15% within its addressable chemical intermediate market.

Dominant Markets & Segments in Methyl Naphthalene

The Methyl Naphthalene market's dominance is clearly established within specific regions and application segments. Asia-Pacific, particularly China, is the leading region, accounting for an estimated 50% of the global market share by 2025. This dominance is propelled by a robust manufacturing base, significant investments in petrochemical infrastructure, and favorable economic policies that support chemical production and export.

Application: Important Intermediate

- Key Drivers: The surge in demand for downstream products such as dyes, pigments, pesticides, and pharmaceuticals directly fuels the growth of Methyl Naphthalene as an important intermediate. Government initiatives promoting agricultural productivity and advancements in healthcare are significant economic catalysts.

- Dominance Analysis: This segment represents the largest share of the Methyl Naphthalene market, projected to exceed 60% of the total market value by 2025. The continuous development of new synthetic routes and the essential role of Methyl Naphthalene in complex chemical reactions solidify its indispensable nature in various manufacturing processes. China's extensive chemical manufacturing capabilities and its position as a global supplier of intermediates are paramount to this segment's dominance.

Application: Organic Synthesis

- Key Drivers: Methyl Naphthalene's versatility in organic synthesis allows for the creation of a wide array of complex molecules. Its reactivity and structural properties make it a preferred building block for specialty chemicals, performance materials, and advanced polymers.

- Dominance Analysis: While closely intertwined with its role as an intermediate, the specific focus on intricate organic synthesis applications represents a substantial and growing segment. The increasing R&D investments in novel chemical entities and advanced materials contribute to the expansion of this segment. The global market for organic synthesis applications of Methyl Naphthalene is estimated to be around $1,500 million by 2025.

Types: 1-Methylnaphthalene & 2-Methylnaphthalene

- Key Drivers: Both 1-Methylnaphthalene and 2-Methylnaphthalene possess distinct chemical properties, leading to specialized applications. 1-Methylnaphthalene is often preferred for certain dye and pesticide syntheses, while 2-Methylnaphthalene finds applications in the production of plasticizers and specific polymer additives.

- Dominance Analysis: While specific market share figures vary, 2-Methylnaphthalene is generally considered to hold a slightly larger market share due to its broader applications in bulk chemical production. The production efficiency and purity achieved for each isomer significantly influence their respective market dominance. The combined market share for these two isomers is expected to account for over 95% of the total Methyl Naphthalene market.

Types: Others

- Key Drivers: This category encompasses mixtures of methylnaphthalenes and isomers with higher alkylation, often used in specific niche applications or as by-products in certain industrial processes.

- Dominance Analysis: The "Others" segment represents a smaller portion of the market, typically below 5% by 2025. Its significance lies in specialized applications where specific isomeric ratios or complex mixtures are required.

Methyl Naphthalene Product Developments

Recent product developments in the Methyl Naphthalene sector focus on enhancing purity levels and exploring novel synthesis routes. Innovations are geared towards creating methylnaphthalene grades suitable for more demanding applications in pharmaceuticals and advanced materials. For instance, research into enantioselective synthesis is opening avenues for chiral methylnaphthalene derivatives. Companies are also investing in sustainable production technologies, aiming to reduce the environmental footprint of methylnaphthalene manufacturing. The competitive advantage lies in offering highly purified isomers with consistent quality, catering to stringent industry standards and specific end-user requirements, such as in high-performance polymers and specialty solvents.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Methyl Naphthalene market across various segments. The Application segmentation includes "Important Intermediate" and "Organic Synthesis." The "Important Intermediate" segment is projected to witness robust growth, reaching an estimated market size of $3,000 million by 2025, driven by consistent demand from established industries. The "Organic Synthesis" segment, estimated at $1,500 million by 2025, is anticipated to grow at a CAGR of approximately 6%, fueled by R&D in specialty chemicals. The Types segmentation encompasses "1-Methylnaphthalene," "2-Methylnaphthalene," and "Others." The "2-Methylnaphthalene" segment, estimated at $2,500 million by 2025, is expected to lead in market share due to its widespread use. "1-Methylnaphthalene" is projected to reach $2,000 million by 2025, with a CAGR of 5%. The "Others" segment, though smaller, caters to niche markets and is expected to grow modestly.

Key Drivers of Methyl Naphthalene Growth

The growth of the Methyl Naphthalene market is propelled by several key factors. Technological advancements in synthesis processes, leading to higher purity and efficiency, are crucial. The increasing demand for downstream products such as dyes, agrochemicals, and pharmaceuticals acts as a significant economic driver. Furthermore, supportive government policies in key regions, particularly in Asia, aimed at bolstering chemical manufacturing and industrial development, contribute to market expansion. The growing emphasis on specialty chemicals and high-performance materials in various industries also plays a pivotal role in driving demand for Methyl Naphthalene as a versatile intermediate.

Challenges in the Methyl Naphthalene Sector

Despite its growth potential, the Methyl Naphthalene sector faces certain challenges. Stringent environmental regulations concerning chemical production and emissions can increase operational costs and necessitate investments in cleaner technologies. Fluctuations in raw material prices, primarily coal tar, can impact profitability and supply chain stability. Intense competition from both established and emerging players, as well as the potential for the development of viable substitutes, exert pricing pressure. Supply chain disruptions, exacerbated by geopolitical events or logistical issues, can also pose a significant challenge, potentially leading to delays and increased costs.

Emerging Opportunities in Methyl Naphthalene

Several emerging opportunities are poised to shape the future of the Methyl Naphthalene market. The development of novel applications in advanced polymers, specialty coatings, and electronic materials presents significant growth avenues. The increasing focus on green chemistry and sustainable production methods creates opportunities for companies investing in eco-friendly synthesis routes and bio-based alternatives. The expansion of end-user industries in emerging economies offers untapped market potential. Furthermore, advancements in catalytic technologies for more efficient and selective production can unlock new market niches and enhance competitive positioning.

Leading Players in the Methyl Naphthalene Market

- Koppers Inc.

- Ruetgers

- Nippon Steel Chemical

- JFE Chemical

- Hualun

- SxtyChem

- SinoChem Hebei

- BaoChem

- WanshidaChem

- SinocoalChem

- Baoshun

- Flint Hills Resources

- Crowley Chemical Company

Key Developments in Methyl Naphthalene Industry

- 2023: Significant investment in R&D for high-purity 2-Methylnaphthalene for pharmaceutical applications.

- 2022: Launch of a new catalytic process offering increased yield and reduced energy consumption.

- 2021: Major merger creating a larger entity with enhanced production capacity and market reach.

- 2020: Increased focus on sustainable production methods and waste reduction initiatives.

- 2019: Expansion of production facilities in emerging Asian markets to meet growing regional demand.

Strategic Outlook for Methyl Naphthalene Market

The strategic outlook for the Methyl Naphthalene market is promising, characterized by sustained demand and evolving technological landscapes. Growth catalysts include the ongoing development of high-performance materials, the expansion of the pharmaceutical and agrochemical sectors, and increasing investments in advanced chemical synthesis. Companies that focus on technological innovation, particularly in sustainable production and the development of specialized methylnaphthalene derivatives, are well-positioned for future success. The market's trajectory will also be influenced by global economic trends and regulatory shifts, necessitating adaptability and strategic foresight from all industry participants.

Methyl Naphthalene Segmentation

-

1. Application

- 1.1. Important Intermediate

- 1.2. Organic Synthesis

-

2. Types

- 2.1. 1-Methylnaphthalene

- 2.2. 2-Methylnaphthalene

- 2.3. Others

Methyl Naphthalene Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Methyl Naphthalene REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.3% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Methyl Naphthalene Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Important Intermediate

- 5.1.2. Organic Synthesis

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. 1-Methylnaphthalene

- 5.2.2. 2-Methylnaphthalene

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Methyl Naphthalene Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Important Intermediate

- 6.1.2. Organic Synthesis

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. 1-Methylnaphthalene

- 6.2.2. 2-Methylnaphthalene

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Methyl Naphthalene Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Important Intermediate

- 7.1.2. Organic Synthesis

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. 1-Methylnaphthalene

- 7.2.2. 2-Methylnaphthalene

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Methyl Naphthalene Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Important Intermediate

- 8.1.2. Organic Synthesis

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. 1-Methylnaphthalene

- 8.2.2. 2-Methylnaphthalene

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Methyl Naphthalene Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Important Intermediate

- 9.1.2. Organic Synthesis

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. 1-Methylnaphthalene

- 9.2.2. 2-Methylnaphthalene

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Methyl Naphthalene Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Important Intermediate

- 10.1.2. Organic Synthesis

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. 1-Methylnaphthalene

- 10.2.2. 2-Methylnaphthalene

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Koppers Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ruetgers

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nippon Steel Chemical

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 JFE Chemical

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hualun

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SxtyChem

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 SinoChem Hebei

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BaoChem

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 WanshidaChem

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 SinocoalChem

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Baoshun

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Flint Hills Resources

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Crowley Chemical Company

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Koppers Inc

List of Figures

- Figure 1: Global Methyl Naphthalene Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Methyl Naphthalene Revenue (million), by Application 2024 & 2032

- Figure 3: North America Methyl Naphthalene Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Methyl Naphthalene Revenue (million), by Types 2024 & 2032

- Figure 5: North America Methyl Naphthalene Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Methyl Naphthalene Revenue (million), by Country 2024 & 2032

- Figure 7: North America Methyl Naphthalene Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Methyl Naphthalene Revenue (million), by Application 2024 & 2032

- Figure 9: South America Methyl Naphthalene Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Methyl Naphthalene Revenue (million), by Types 2024 & 2032

- Figure 11: South America Methyl Naphthalene Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Methyl Naphthalene Revenue (million), by Country 2024 & 2032

- Figure 13: South America Methyl Naphthalene Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Methyl Naphthalene Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Methyl Naphthalene Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Methyl Naphthalene Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Methyl Naphthalene Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Methyl Naphthalene Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Methyl Naphthalene Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Methyl Naphthalene Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Methyl Naphthalene Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Methyl Naphthalene Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Methyl Naphthalene Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Methyl Naphthalene Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Methyl Naphthalene Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Methyl Naphthalene Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Methyl Naphthalene Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Methyl Naphthalene Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Methyl Naphthalene Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Methyl Naphthalene Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Methyl Naphthalene Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Methyl Naphthalene Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Methyl Naphthalene Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Methyl Naphthalene Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Methyl Naphthalene Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Methyl Naphthalene Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Methyl Naphthalene Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Methyl Naphthalene Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Methyl Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Methyl Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Methyl Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Methyl Naphthalene Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Methyl Naphthalene Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Methyl Naphthalene Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Methyl Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Methyl Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Methyl Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Methyl Naphthalene Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Methyl Naphthalene Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Methyl Naphthalene Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Methyl Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Methyl Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Methyl Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Methyl Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Methyl Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Methyl Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Methyl Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Methyl Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Methyl Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Methyl Naphthalene Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Methyl Naphthalene Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Methyl Naphthalene Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Methyl Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Methyl Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Methyl Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Methyl Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Methyl Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Methyl Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Methyl Naphthalene Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Methyl Naphthalene Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Methyl Naphthalene Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Methyl Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Methyl Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Methyl Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Methyl Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Methyl Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Methyl Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Methyl Naphthalene Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Methyl Naphthalene?

The projected CAGR is approximately 3.3%.

2. Which companies are prominent players in the Methyl Naphthalene?

Key companies in the market include Koppers Inc, Ruetgers, Nippon Steel Chemical, JFE Chemical, Hualun, SxtyChem, SinoChem Hebei, BaoChem, WanshidaChem, SinocoalChem, Baoshun, Flint Hills Resources, Crowley Chemical Company.

3. What are the main segments of the Methyl Naphthalene?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 97.5 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 5900.00, USD 8850.00, and USD 11800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Methyl Naphthalene," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Methyl Naphthalene report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Methyl Naphthalene?

To stay informed about further developments, trends, and reports in the Methyl Naphthalene, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence