Key Insights

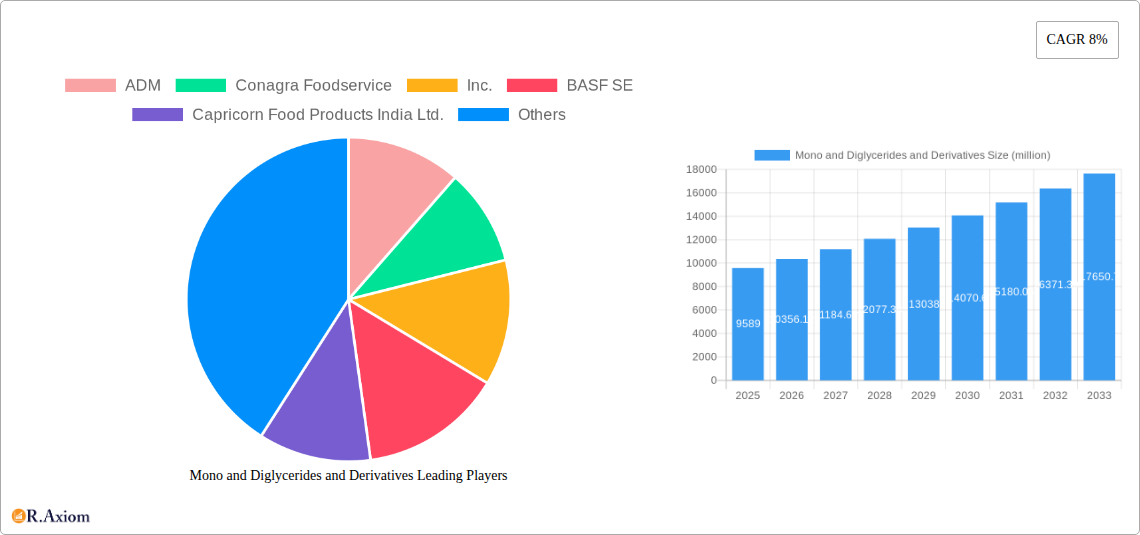

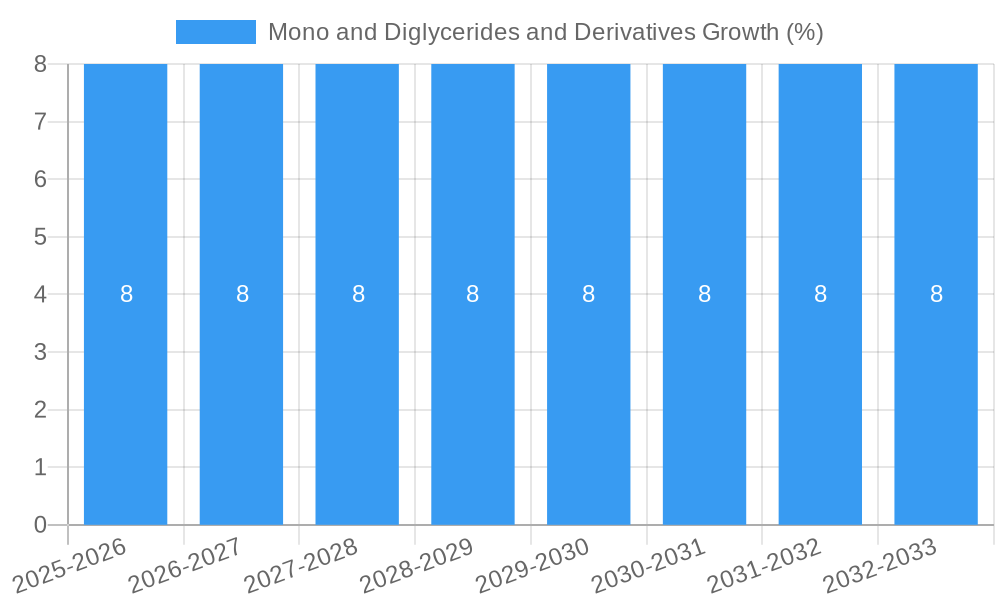

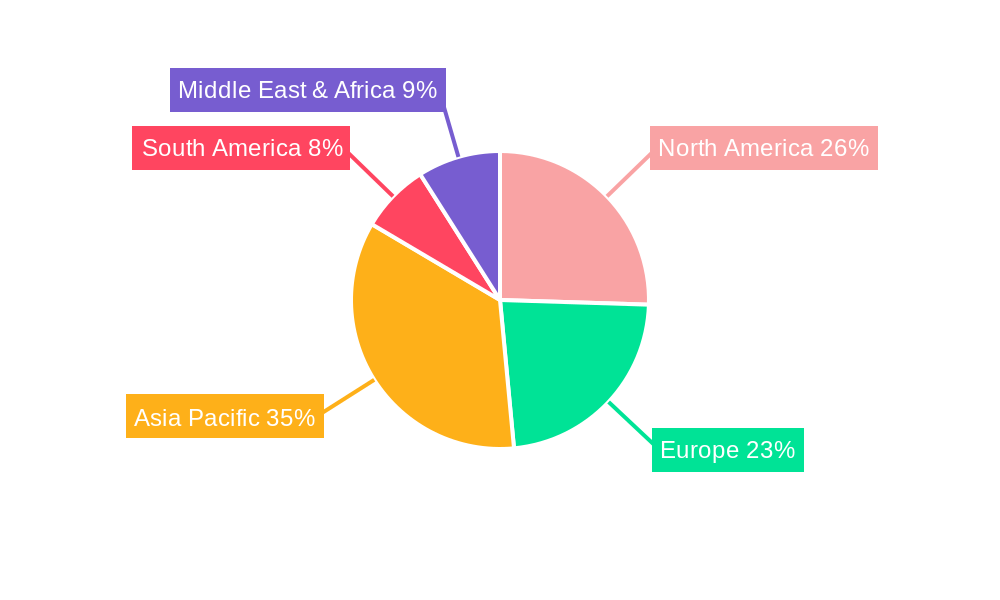

The global market for Mono and Diglycerides and Derivatives is poised for significant expansion, projected to reach approximately $9.59 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 8% anticipated between 2025 and 2033. This growth is primarily fueled by the escalating demand for processed foods and beverages, where these compounds serve as essential emulsifiers, stabilizers, and texturizers. The bakery and confectionary sector, a dominant application segment, will continue to drive market expansion due to the increasing consumer preference for convenience foods and elaborate baked goods. Furthermore, the dairy product industry's reliance on mono and diglycerides for improving texture and shelf-life in products like ice cream and yogurt presents another substantial growth avenue. Emerging economies, particularly in Asia Pacific, are expected to be key growth regions, driven by rising disposable incomes and a burgeoning middle class that is increasingly adopting Western dietary habits and processed food consumption.

The market is characterized by a dynamic interplay of drivers and restraints. Key growth drivers include the rising global population, increasing urbanization leading to higher demand for convenience foods, and advancements in food processing technologies. The versatility of mono and diglycerides and their derivatives in enhancing the quality, texture, and shelf-life of a wide array of food products further underpins their market prominence. However, potential restraints include fluctuating raw material prices, particularly for edible oils and fats, and growing consumer concerns regarding the use of food additives, which may lead to a preference for clean-label products. Nevertheless, the inherent functional benefits and cost-effectiveness of these ingredients are expected to outweigh these concerns, ensuring sustained market growth. The competitive landscape is shaped by major players such as ADM, BASF SE, and Conagra Foodservice, Inc., who are actively engaged in product innovation and strategic collaborations to capture market share.

This in-depth report offers a detailed analysis of the global Mono and Diglycerides and Derivatives market, encompassing historical trends, current dynamics, and robust future projections from 2019 to 2033. With a base year of 2025 and an estimated year also of 2025, the forecast period of 2025–2033 provides actionable insights for stakeholders. The report delves into market concentration, innovation, industry trends, dominant markets and segments, product developments, growth drivers, challenges, emerging opportunities, and a comprehensive overview of leading players and key industry developments. Our analysis is meticulously structured to provide clarity and strategic direction for businesses operating within or looking to enter this evolving sector.

Mono and Diglycerides and Derivatives Market Concentration & Innovation

The global Mono and Diglycerides and Derivatives market exhibits a moderate level of concentration, with several key players holding significant market share. Leading companies such as ADM and Conagra Foodservice, Inc. are at the forefront, leveraging extensive distribution networks and established brand recognition. Innovation is a critical driver, fueled by increasing demand for functional ingredients that enhance product texture, shelf-life, and nutritional profiles. Regulatory frameworks, particularly concerning food safety and labeling, play a pivotal role in shaping product development and market entry strategies. The presence of viable product substitutes, including other emulsifiers and stabilizers, necessitates continuous innovation and cost-effectiveness. End-user trends lean towards clean-label ingredients and plant-based alternatives, pushing manufacturers to develop novel derivatives. Mergers and Acquisitions (M&A) activity, with deal values reaching hundreds of millions, are strategically employed by major players to expand their product portfolios, geographical reach, and technological capabilities. For instance, recent M&A activities have focused on acquiring companies with expertise in specialized fatty acid derivatives and sustainable sourcing.

Mono and Diglycerides and Derivatives Industry Trends & Insights

The Mono and Diglycerides and Derivatives industry is poised for significant growth, driven by a confluence of factors that are reshaping consumer choices and industrial applications. The estimated Compound Annual Growth Rate (CAGR) for the forecast period (2025–2033) is projected to be around xx%, indicating a robust expansion trajectory. This growth is largely propelled by the escalating demand for processed foods, where mono and diglycerides and their derivatives serve as essential emulsifiers, stabilizers, and texturizers. The bakery and confectionery segment, in particular, is a major consumer, benefiting from the ability of these ingredients to improve dough handling, crumb structure, and overall product appeal. Dairy products also represent a substantial application, with their use in ice cream, whipped toppings, and cheese analogues contributing to improved texture and stability. Technological disruptions, such as advancements in enzymatic synthesis and fractionation techniques, are enabling the production of more specialized and high-purity derivatives with enhanced functionalities, contributing to market penetration in niche applications. Consumer preferences are increasingly shifting towards healthier, natural, and "clean label" products, which presents both a challenge and an opportunity. Manufacturers are responding by developing ingredients derived from sustainable and renewable sources, such as palm-free mono and diglycerides and lecithin-based alternatives. Competitive dynamics are intensifying, with companies focusing on product differentiation through performance, sustainability credentials, and cost leadership. The market penetration of specialized derivatives, such as monoglyceride derivatives for specific emulsification needs, is expected to rise. The "Others" application segment, encompassing pharmaceuticals, cosmetics, and industrial uses, is also exhibiting steady growth, driven by the versatility of these compounds. The overarching trend is towards greater functionality, sustainability, and customization in ingredient solutions.

Dominant Markets & Segments in Mono and Diglycerides and Derivatives

The global Mono and Diglycerides and Derivatives market is characterized by the strong dominance of specific regions and product segments, driven by a complex interplay of economic, regulatory, and consumer-driven factors.

Dominant Region and Country: North America currently holds a leading position in the Mono and Diglycerides and Derivatives market, driven by a large and sophisticated food processing industry. The United States, in particular, benefits from high disposable incomes, a strong demand for convenience foods, and a well-established regulatory framework that supports innovation and product development. Economic policies that favor domestic manufacturing and agricultural production also contribute to its dominance. Robust infrastructure for production, distribution, and research and development further bolsters its market leadership.

Dominant Application Segment: The Bakery and Confectionery segment is the most dominant application for mono and diglycerides and derivatives. This dominance is attributed to the inherent properties of these ingredients that are crucial for a wide array of baked goods and sweets.

- Improved Dough Rheology: Mono and diglycerides enhance dough plasticity, leading to better machinability and reduced processing time in large-scale bakeries.

- Enhanced Shelf-Life: They act as anti-staling agents, extending the freshness and appeal of bread, cakes, and pastries by preventing moisture migration.

- Volume and Texture Enhancement: In cakes and pastries, they contribute to increased volume, finer crumb structure, and a softer, more appealing texture.

- Confectionery Stability: In confectionery, they improve the texture and prevent fat bloom in chocolate and other sugar-based products.

- Versatility: Their effectiveness across a broad spectrum of bakery and confectionery items, from simple biscuits to complex chocolates, solidifies their indispensable role.

Dominant Product Type: Mono and diglycerides themselves represent the most dominant product type within the market.

- Ubiquitous Emulsification: As primary emulsifiers, they are fundamental to creating stable oil-in-water and water-in-oil emulsions across numerous food applications.

- Cost-Effectiveness: Their widespread availability and production efficiency make them a cost-effective solution for manufacturers seeking to achieve desired product attributes.

- Established Functionality: Decades of research and application have solidified their well-understood and reliable performance in various food matrices.

- Regulatory Approval: They have widespread regulatory approval for use in food products across major global markets.

- Foundation for Derivatives: They serve as the foundational components for many specialized derivatives, indicating their intrinsic importance.

The market penetration of other segments like Monoglyceride Derivatives and Fatty Acid Derivatives is growing, particularly for specialized functionalities, but currently lags behind the broad applicability of mono and diglycerides. The "Others" application segment, encompassing industrial uses and emerging markets, also shows promise but remains secondary to the food industry's demand.

Mono and Diglycerides and Derivatives Product Developments

Product development in the Mono and Diglycerides and Derivatives market is increasingly focused on natural sourcing, sustainability, and enhanced functionalities. Innovations include the development of palm-free mono and diglycerides to meet consumer demand for ethically sourced ingredients. Novel derivatives are being engineered for specific applications, such as improved emulsification in low-fat dairy products and enhanced stability in plant-based alternatives. These developments offer significant competitive advantages by addressing emerging market trends and catering to niche requirements, ultimately expanding the scope of their application in food, pharmaceutical, and cosmetic industries.

Report Scope & Segmentation Analysis

This report offers a comprehensive segmentation analysis of the Mono and Diglycerides and Derivatives market. The market is dissected by application, including Bakery and Confectionery, Dairy Products, and Others, each with its unique growth projections and market sizes. The Bakery and Confectionery segment is expected to maintain its leading position, driven by continuous innovation in food products. The Dairy Products segment is experiencing steady growth due to the demand for improved textures and shelf-life in products like ice cream and yogurts. The Others segment, encompassing pharmaceuticals, cosmetics, and industrial applications, is projected to witness significant expansion as new uses for these derivatives are discovered. Furthermore, the market is analyzed by type, encompassing Mono and diglycerides, Monoglyceride Derivatives, Fatty Acid Derivatives, Lecithin, and Others. Mono and diglycerides will continue to dominate, while Monoglyceride Derivatives and Fatty Acid Derivatives are projected to exhibit higher growth rates due to their specialized functionalities and increasing adoption in advanced formulations.

Key Drivers of Mono and Diglycerides and Derivatives Growth

The growth of the Mono and Diglycerides and Derivatives market is propelled by several interconnected factors.

- Rising Demand for Processed Foods: Increasing global urbanization and evolving consumer lifestyles drive the demand for convenient, processed food products, where these ingredients are crucial for texture, stability, and shelf-life.

- Technological Advancements: Innovations in production processes, such as enzymatic synthesis, allow for the creation of specialized derivatives with tailored functionalities, opening up new application areas.

- Consumer Preferences for Clean Labels and Natural Ingredients: The trend towards natural and recognizable ingredients is pushing manufacturers to develop plant-based and sustainably sourced mono and diglycerides and their derivatives.

- Growth in Emerging Economies: Developing nations are witnessing a rise in disposable incomes, leading to increased consumption of processed foods, thereby boosting demand for emulsifiers and stabilizers.

- Expanding Applications in Non-Food Sectors: The use of these derivatives in pharmaceuticals, cosmetics, and industrial applications is growing, diversifying market opportunities.

Challenges in the Mono and Diglycerides and Derivatives Sector

Despite robust growth, the Mono and Diglycerides and Derivatives sector faces several challenges that can impede its expansion.

- Volatility in Raw Material Prices: Fluctuations in the prices of key raw materials, such as vegetable oils and animal fats, can significantly impact production costs and profitability.

- Stringent Regulatory Landscape: Evolving food safety regulations and labeling requirements in different regions can pose compliance challenges and necessitate costly product reformulation.

- Intense Competition: The market is characterized by a high degree of competition from both established players and new entrants, leading to price pressures and the need for continuous innovation.

- Consumer Perception of Processed Ingredients: Negative consumer perceptions surrounding "artificial" or "chemically derived" ingredients can influence purchasing decisions, favoring natural alternatives.

- Supply Chain Disruptions: Global events and geopolitical factors can disrupt the supply chain, affecting the availability and timely delivery of raw materials and finished products.

Emerging Opportunities in Mono and Diglycerides and Derivatives

The Mono and Diglycerides and Derivatives market is ripe with emerging opportunities driven by evolving consumer demands and technological advancements.

- Plant-Based and Sustainable Ingredients: The surging demand for vegan and environmentally friendly products presents a significant opportunity for manufacturers to develop and market palm-free, non-GMO, and sustainably sourced mono and diglycerides and their derivatives.

- Functional Food Ingredients: There is a growing interest in ingredients that offer added health benefits, creating opportunities for derivatives with improved nutritional profiles or specific physiological functions.

- Expansion in Pharmaceutical and Cosmetic Applications: The inherent properties of these compounds, such as emulsification and stabilization, make them suitable for a wider range of pharmaceutical formulations and cosmetic products, offering new revenue streams.

- Personalized Nutrition and Customization: The trend towards personalized nutrition and customized food products will drive demand for highly specialized derivatives that can cater to specific dietary needs and preferences.

- Leveraging Blockchain for Transparency: Implementing blockchain technology in the supply chain can enhance transparency and traceability, appealing to consumers seeking assurance about the origin and processing of their food ingredients.

Leading Players in the Mono and Diglycerides and Derivatives Market

- ADM

- Conagra Foodservice, Inc.

- BASF SE

- Capricorn Food Products India Ltd.

- ALFA LAVAL

- Tricom Fruit Products Limited

- Saraf Foods Ltd.

- Del Monte Foods, Inc.

- AOHATA CORPORATION

- Reid Produce Co.

- Speyfruit Ltd.

Key Developments in Mono and Diglycerides and Derivatives Industry

- 2023/10: Launch of a new range of palm-free mono and diglycerides by a leading manufacturer, addressing growing consumer demand for sustainable ingredients.

- 2023/07: Acquisition of a specialized fatty acid derivative producer by a major player, expanding its product portfolio and market reach in niche applications.

- 2022/11: Introduction of a novel enzymatic process for the production of high-purity monoglyceride derivatives, offering enhanced emulsification capabilities.

- 2022/05: Expansion of production capacity for lecithin-based emulsifiers to meet the rising demand from the plant-based food sector.

- 2021/09: Strategic partnership formed between two key industry players to develop innovative solutions for the bakery and confectionery market.

Strategic Outlook for Mono and Diglycerides and Derivatives Market

The strategic outlook for the Mono and Diglycerides and Derivatives market is overwhelmingly positive, driven by persistent demand from core applications and the exploration of new avenues. The increasing consumer preference for natural, sustainable, and functional ingredients will continue to shape product development and market strategies. Companies that can effectively navigate regulatory landscapes, invest in innovative production technologies, and establish transparent and sustainable supply chains will be well-positioned for success. The growing footprint in emerging economies and the diversification into non-food sectors offer substantial growth catalysts. Strategic alliances, mergers, and acquisitions will likely remain prevalent as companies seek to consolidate market positions, acquire cutting-edge technologies, and expand their global reach, ensuring a dynamic and evolving market landscape for years to come.

Mono and Diglycerides and Derivatives Segmentation

-

1. Application

- 1.1. Bakery and Confectionary

- 1.2. Dairy Products

- 1.3. Others

-

2. Types

- 2.1. Mono and diglycerides

- 2.2. Monoglyceride Derivatives

- 2.3. Fatty Acid Derivatives

- 2.4. Lecithin

- 2.5. Others

Mono and Diglycerides and Derivatives Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Mono and Diglycerides and Derivatives REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mono and Diglycerides and Derivatives Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Bakery and Confectionary

- 5.1.2. Dairy Products

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Mono and diglycerides

- 5.2.2. Monoglyceride Derivatives

- 5.2.3. Fatty Acid Derivatives

- 5.2.4. Lecithin

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Mono and Diglycerides and Derivatives Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Bakery and Confectionary

- 6.1.2. Dairy Products

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Mono and diglycerides

- 6.2.2. Monoglyceride Derivatives

- 6.2.3. Fatty Acid Derivatives

- 6.2.4. Lecithin

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Mono and Diglycerides and Derivatives Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Bakery and Confectionary

- 7.1.2. Dairy Products

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Mono and diglycerides

- 7.2.2. Monoglyceride Derivatives

- 7.2.3. Fatty Acid Derivatives

- 7.2.4. Lecithin

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Mono and Diglycerides and Derivatives Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Bakery and Confectionary

- 8.1.2. Dairy Products

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Mono and diglycerides

- 8.2.2. Monoglyceride Derivatives

- 8.2.3. Fatty Acid Derivatives

- 8.2.4. Lecithin

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Mono and Diglycerides and Derivatives Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Bakery and Confectionary

- 9.1.2. Dairy Products

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Mono and diglycerides

- 9.2.2. Monoglyceride Derivatives

- 9.2.3. Fatty Acid Derivatives

- 9.2.4. Lecithin

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Mono and Diglycerides and Derivatives Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Bakery and Confectionary

- 10.1.2. Dairy Products

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Mono and diglycerides

- 10.2.2. Monoglyceride Derivatives

- 10.2.3. Fatty Acid Derivatives

- 10.2.4. Lecithin

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 ADM

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Conagra Foodservice

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Inc.

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BASF SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Capricorn Food Products India Ltd.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ALFA LAVAL

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Tricom Fruit Products Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Saraf Foods Ltd.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Del Monte Foods

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Inc.

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 AOHATA CORPORATION

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Reid Produce Co.

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Speyfruit Ltd.

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 ADM

List of Figures

- Figure 1: Global Mono and Diglycerides and Derivatives Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Mono and Diglycerides and Derivatives Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Mono and Diglycerides and Derivatives Revenue (million), by Application 2024 & 2032

- Figure 4: North America Mono and Diglycerides and Derivatives Volume (K), by Application 2024 & 2032

- Figure 5: North America Mono and Diglycerides and Derivatives Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Mono and Diglycerides and Derivatives Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Mono and Diglycerides and Derivatives Revenue (million), by Types 2024 & 2032

- Figure 8: North America Mono and Diglycerides and Derivatives Volume (K), by Types 2024 & 2032

- Figure 9: North America Mono and Diglycerides and Derivatives Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Mono and Diglycerides and Derivatives Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Mono and Diglycerides and Derivatives Revenue (million), by Country 2024 & 2032

- Figure 12: North America Mono and Diglycerides and Derivatives Volume (K), by Country 2024 & 2032

- Figure 13: North America Mono and Diglycerides and Derivatives Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Mono and Diglycerides and Derivatives Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Mono and Diglycerides and Derivatives Revenue (million), by Application 2024 & 2032

- Figure 16: South America Mono and Diglycerides and Derivatives Volume (K), by Application 2024 & 2032

- Figure 17: South America Mono and Diglycerides and Derivatives Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Mono and Diglycerides and Derivatives Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Mono and Diglycerides and Derivatives Revenue (million), by Types 2024 & 2032

- Figure 20: South America Mono and Diglycerides and Derivatives Volume (K), by Types 2024 & 2032

- Figure 21: South America Mono and Diglycerides and Derivatives Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Mono and Diglycerides and Derivatives Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Mono and Diglycerides and Derivatives Revenue (million), by Country 2024 & 2032

- Figure 24: South America Mono and Diglycerides and Derivatives Volume (K), by Country 2024 & 2032

- Figure 25: South America Mono and Diglycerides and Derivatives Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Mono and Diglycerides and Derivatives Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Mono and Diglycerides and Derivatives Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Mono and Diglycerides and Derivatives Volume (K), by Application 2024 & 2032

- Figure 29: Europe Mono and Diglycerides and Derivatives Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Mono and Diglycerides and Derivatives Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Mono and Diglycerides and Derivatives Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Mono and Diglycerides and Derivatives Volume (K), by Types 2024 & 2032

- Figure 33: Europe Mono and Diglycerides and Derivatives Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Mono and Diglycerides and Derivatives Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Mono and Diglycerides and Derivatives Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Mono and Diglycerides and Derivatives Volume (K), by Country 2024 & 2032

- Figure 37: Europe Mono and Diglycerides and Derivatives Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Mono and Diglycerides and Derivatives Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Mono and Diglycerides and Derivatives Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Mono and Diglycerides and Derivatives Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Mono and Diglycerides and Derivatives Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Mono and Diglycerides and Derivatives Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Mono and Diglycerides and Derivatives Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Mono and Diglycerides and Derivatives Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Mono and Diglycerides and Derivatives Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Mono and Diglycerides and Derivatives Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Mono and Diglycerides and Derivatives Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Mono and Diglycerides and Derivatives Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Mono and Diglycerides and Derivatives Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Mono and Diglycerides and Derivatives Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Mono and Diglycerides and Derivatives Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Mono and Diglycerides and Derivatives Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Mono and Diglycerides and Derivatives Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Mono and Diglycerides and Derivatives Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Mono and Diglycerides and Derivatives Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Mono and Diglycerides and Derivatives Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Mono and Diglycerides and Derivatives Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Mono and Diglycerides and Derivatives Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Mono and Diglycerides and Derivatives Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Mono and Diglycerides and Derivatives Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Mono and Diglycerides and Derivatives Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Mono and Diglycerides and Derivatives Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Mono and Diglycerides and Derivatives Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Mono and Diglycerides and Derivatives Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Mono and Diglycerides and Derivatives Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Mono and Diglycerides and Derivatives Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Mono and Diglycerides and Derivatives Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Mono and Diglycerides and Derivatives Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Mono and Diglycerides and Derivatives Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Mono and Diglycerides and Derivatives Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Mono and Diglycerides and Derivatives Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Mono and Diglycerides and Derivatives Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Mono and Diglycerides and Derivatives Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Mono and Diglycerides and Derivatives Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Mono and Diglycerides and Derivatives Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Mono and Diglycerides and Derivatives Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Mono and Diglycerides and Derivatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Mono and Diglycerides and Derivatives Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Mono and Diglycerides and Derivatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Mono and Diglycerides and Derivatives Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Mono and Diglycerides and Derivatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Mono and Diglycerides and Derivatives Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Mono and Diglycerides and Derivatives Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Mono and Diglycerides and Derivatives Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Mono and Diglycerides and Derivatives Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Mono and Diglycerides and Derivatives Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Mono and Diglycerides and Derivatives Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Mono and Diglycerides and Derivatives Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Mono and Diglycerides and Derivatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Mono and Diglycerides and Derivatives Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Mono and Diglycerides and Derivatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Mono and Diglycerides and Derivatives Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Mono and Diglycerides and Derivatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Mono and Diglycerides and Derivatives Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Mono and Diglycerides and Derivatives Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Mono and Diglycerides and Derivatives Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Mono and Diglycerides and Derivatives Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Mono and Diglycerides and Derivatives Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Mono and Diglycerides and Derivatives Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Mono and Diglycerides and Derivatives Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Mono and Diglycerides and Derivatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Mono and Diglycerides and Derivatives Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Mono and Diglycerides and Derivatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Mono and Diglycerides and Derivatives Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Mono and Diglycerides and Derivatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Mono and Diglycerides and Derivatives Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Mono and Diglycerides and Derivatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Mono and Diglycerides and Derivatives Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Mono and Diglycerides and Derivatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Mono and Diglycerides and Derivatives Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Mono and Diglycerides and Derivatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Mono and Diglycerides and Derivatives Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Mono and Diglycerides and Derivatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Mono and Diglycerides and Derivatives Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Mono and Diglycerides and Derivatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Mono and Diglycerides and Derivatives Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Mono and Diglycerides and Derivatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Mono and Diglycerides and Derivatives Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Mono and Diglycerides and Derivatives Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Mono and Diglycerides and Derivatives Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Mono and Diglycerides and Derivatives Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Mono and Diglycerides and Derivatives Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Mono and Diglycerides and Derivatives Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Mono and Diglycerides and Derivatives Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Mono and Diglycerides and Derivatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Mono and Diglycerides and Derivatives Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Mono and Diglycerides and Derivatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Mono and Diglycerides and Derivatives Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Mono and Diglycerides and Derivatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Mono and Diglycerides and Derivatives Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Mono and Diglycerides and Derivatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Mono and Diglycerides and Derivatives Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Mono and Diglycerides and Derivatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Mono and Diglycerides and Derivatives Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Mono and Diglycerides and Derivatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Mono and Diglycerides and Derivatives Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Mono and Diglycerides and Derivatives Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Mono and Diglycerides and Derivatives Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Mono and Diglycerides and Derivatives Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Mono and Diglycerides and Derivatives Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Mono and Diglycerides and Derivatives Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Mono and Diglycerides and Derivatives Volume K Forecast, by Country 2019 & 2032

- Table 81: China Mono and Diglycerides and Derivatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Mono and Diglycerides and Derivatives Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Mono and Diglycerides and Derivatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Mono and Diglycerides and Derivatives Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Mono and Diglycerides and Derivatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Mono and Diglycerides and Derivatives Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Mono and Diglycerides and Derivatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Mono and Diglycerides and Derivatives Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Mono and Diglycerides and Derivatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Mono and Diglycerides and Derivatives Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Mono and Diglycerides and Derivatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Mono and Diglycerides and Derivatives Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Mono and Diglycerides and Derivatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Mono and Diglycerides and Derivatives Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mono and Diglycerides and Derivatives?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the Mono and Diglycerides and Derivatives?

Key companies in the market include ADM, Conagra Foodservice, Inc., BASF SE, Capricorn Food Products India Ltd., ALFA LAVAL, Tricom Fruit Products Limited, Saraf Foods Ltd., Del Monte Foods, Inc., AOHATA CORPORATION, Reid Produce Co., Speyfruit Ltd..

3. What are the main segments of the Mono and Diglycerides and Derivatives?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 9589 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mono and Diglycerides and Derivatives," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mono and Diglycerides and Derivatives report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mono and Diglycerides and Derivatives?

To stay informed about further developments, trends, and reports in the Mono and Diglycerides and Derivatives, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence