Key Insights

The North American mutual fund industry, characterized by a robust market size and consistent growth, presents a compelling investment landscape. With a Compound Annual Growth Rate (CAGR) exceeding 5% from 2019-2033, the industry's value is projected to surpass several trillion dollars by 2033 (a precise figure requires the missing market size "XX" value, however, based on a 5%+ CAGR and common industry benchmarks, a reasonable estimate would place this in the trillions). Key drivers include increasing retail investor participation, fueled by financial literacy initiatives and the accessibility of digital investment platforms. Furthermore, the industry's evolution toward low-cost index funds and actively managed strategies catering to specific ESG (Environmental, Social, and Governance) criteria reflects growing investor demand for transparency and sustainable investment options. These trends are shaping the competitive landscape, with established players like Vanguard, Fidelity, BlackRock, and others vying for market share through innovation in product offerings and technological advancements. However, regulatory changes and potential economic downturns pose potential restraints, necessitating adaptive strategies from industry participants.

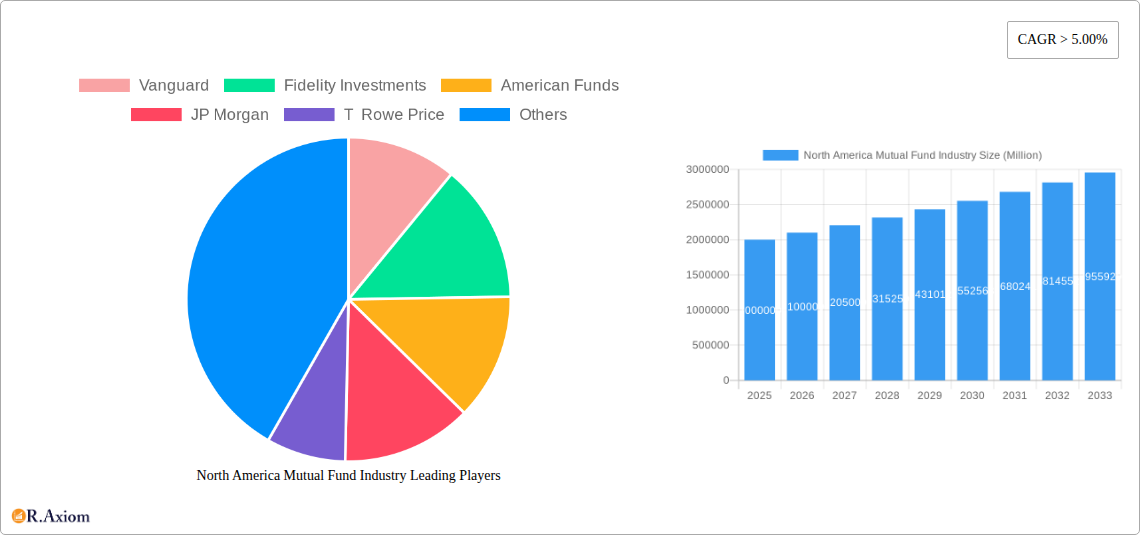

North America Mutual Fund Industry Market Size (In Million)

Despite the positive outlook, the North American mutual fund market faces challenges. The increasing prevalence of robo-advisors and other fintech solutions is disrupting traditional business models, forcing incumbents to embrace digital transformation and enhance their client experiences. Moreover, fluctuations in the broader financial markets and evolving investor preferences—including a heightened focus on ethical and sustainable investments—require continuous adaptation. Nevertheless, the sheer scale of the market, along with its resilience to economic cycles and the ongoing demand for diversified investment solutions, points towards a promising future. Segmentation within the market will remain a key driver for future growth, with specialized funds, such as those focused on specific asset classes or geographic regions, likely outperforming others. The continued consolidation within the industry through mergers and acquisitions is also expected to impact the market structure in the years to come.

North America Mutual Fund Industry Company Market Share

North America Mutual Fund Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America mutual fund industry, covering market trends, competitive landscape, and future growth projections from 2019 to 2033. The study period spans 2019-2024 (Historical Period), with 2025 serving as both the Base Year and Estimated Year. The forecast period extends from 2025-2033. This report is essential for industry stakeholders, investors, and anyone seeking a detailed understanding of this dynamic market.

North America Mutual Fund Industry Market Concentration & Innovation

This section analyzes the concentration of the North America mutual fund market, identifying key players and their market share. It also explores the drivers of innovation, regulatory frameworks impacting the industry, the presence of product substitutes, evolving end-user trends, and the significant M&A activity shaping the sector. The top players, including Vanguard, Fidelity Investments, American Funds, BlackRock, and others, constantly vie for market share, influencing product development and distribution strategies.

Market Concentration: The industry exhibits a high degree of concentration, with the top 10 players commanding approximately xx% of the market share in 2024. This concentration is influenced by factors such as economies of scale, brand recognition, and extensive distribution networks.

Innovation Drivers: Technological advancements, such as robo-advisors and AI-driven portfolio management, are key innovation drivers. Regulatory changes, including increased transparency requirements, also push innovation in risk management and reporting.

M&A Activity: The historical period (2019-2024) witnessed significant M&A activity, with deal values totaling approximately USD xx Million. These mergers and acquisitions aim to expand market reach, diversify product offerings, and enhance technological capabilities. For example, T. Rowe Price's acquisition of Oak Hill Advisors in December 2021 highlights this trend.

Regulatory Framework: Stringent regulatory oversight, including compliance with KYC/AML norms and reporting requirements, shapes industry practices and necessitates continuous adaptation.

Product Substitutes: Exchange-Traded Funds (ETFs) and other investment vehicles pose competitive pressure as substitutes.

End-User Trends: Increasing demand for low-cost, diversified, and ethically responsible investment options is significantly impacting product development and marketing strategies.

North America Mutual Fund Industry Industry Trends & Insights

This section delves into the key trends shaping the North America mutual fund industry, examining market growth drivers, technological disruptions, evolving consumer preferences, and competitive dynamics. The analysis covers various factors influencing market expansion, including changing demographics, economic growth, and investor sentiment.

The North American mutual fund market is expected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several factors, including:

- Rising Disposable Incomes: Increased disposable income among the population fuels greater participation in investment markets.

- Technological Disruption: Fintech innovations are streamlining investment processes and making them more accessible. Robo-advisors and digital platforms are driving market penetration.

- Shifting Investor Preferences: Growing demand for ESG (Environmental, Social, and Governance) investments and personalized portfolios is reshaping the market landscape.

- Competitive Dynamics: Intense competition among established players and the emergence of new entrants lead to continuous innovation and improved offerings. Market penetration strategies vary based on cost leadership, differentiation, and niche market focus. This intensifies the need for superior customer service and technological advantage.

- Market Size and Growth: The market size is projected to reach USD xx Million by 2033, indicating substantial growth potential.

Dominant Markets & Segments in North America Mutual Fund Industry

This section identifies the leading regions, countries, and segments within the North America mutual fund industry, examining the factors that contribute to their dominance. The analysis explores the unique characteristics and growth drivers for each segment.

Dominant Market: The United States represents the dominant market due to a robust economy, developed financial infrastructure, and high investor participation.

Key Drivers for U.S. Dominance:

- Strong Economic Growth: A sustained period of economic growth boosts investor confidence and capital availability.

- Well-Developed Financial Infrastructure: Sophisticated regulatory frameworks and efficient market mechanisms facilitate smooth operations.

- High Investor Sophistication: A high level of financial literacy among investors increases participation in the mutual fund market.

- Regulatory Environment: The regulatory framework, while stringent, provides a stable and transparent environment for investment.

Canada and Mexico also play significant roles, although the US dominates overall. The growth in these markets is driven by factors such as increasing awareness of mutual funds and rising disposable income. Further segment analysis reveals differences in investment strategies across demographics and risk tolerance levels.

North America Mutual Fund Industry Product Developments

The mutual fund industry constantly evolves its product offerings to meet evolving investor demands. Recent innovations include the integration of AI and machine learning for portfolio management, the rise of ESG-focused funds, and the development of more accessible and user-friendly investment platforms. These advancements enhance portfolio diversification, risk mitigation, and overall investment experience. This continuous improvement in product design and features is crucial for maintaining a competitive edge in a rapidly changing market environment.

Report Scope & Segmentation Analysis

This report segments the North America mutual fund market based on several key parameters including asset type (equity, debt, balanced, etc.), investor type (retail, institutional), and distribution channel (online, offline). Each segment's growth projections, market size, and competitive dynamics are analyzed independently. The analysis includes detailed descriptions of each segment, highlighting its unique characteristics, growth drivers, and challenges.

Key Drivers of North America Mutual Fund Industry Growth

Several factors fuel the growth of the North America mutual fund industry. These include favorable macroeconomic conditions, rising disposable incomes, increased financial literacy, and technological advancements that improve investment accessibility. Government policies promoting financial inclusion and initiatives encouraging savings and investments further support market expansion.

Challenges in the North America Mutual Fund Industry Sector

The industry faces challenges such as intense competition, regulatory scrutiny, and the need to adapt to evolving investor preferences. Maintaining profitability in a low-interest rate environment and managing risks associated with market volatility also pose significant hurdles.

Emerging Opportunities in North America Mutual Fund Industry

Emerging opportunities lie in the growing adoption of digital technologies, the rise of impact investing, and the expansion into underserved markets. The increasing demand for personalized financial advice and the development of innovative financial products present exciting prospects for future growth.

Leading Players in the North America Mutual Fund Industry Market

- Vanguard

- Fidelity Investments

- American Funds

- JP Morgan

- T Rowe Price

- BlackRock

- Goldman Sachs

- TIAA Investments

- Dimensional Fund Advisors

- Invesco

- PIMCO

- Franklin Templeton

- Charles Schwab

- MFS

- Morgan Stanley

List Not Exhaustive

Key Developments in North America Mutual Fund Industry Industry

- Dec 2021: T. Rowe Price Group, Inc. acquired Oak Hill Advisors, L.P., expanding its presence in alternative credit markets.

- 2021: Fidelity Investments, along with Visa, backed Jumo, a fintech startup focusing on financial services in emerging markets, with USD 120 Million in funding.

Strategic Outlook for North America Mutual Fund Industry Market

The North America mutual fund market is poised for continued growth, driven by technological advancements, evolving investor preferences, and favorable macroeconomic conditions. The increasing focus on sustainable and responsible investments will further shape the industry's trajectory. Companies that successfully adapt to these changes and innovate their product offerings will be best positioned to capitalize on future opportunities.

North America Mutual Fund Industry Segmentation

-

1. Fund Type

- 1.1. Equity

- 1.2. Bond

- 1.3. Hybrid

- 1.4. Money Market

-

2. Investor Type

- 2.1. Households

- 2.2. Insitutional Investors

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Mutual Fund Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Mutual Fund Industry Regional Market Share

Geographic Coverage of North America Mutual Fund Industry

North America Mutual Fund Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Market Securities Held By Mutual Funds in United States

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global North America Mutual Fund Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fund Type

- 5.1.1. Equity

- 5.1.2. Bond

- 5.1.3. Hybrid

- 5.1.4. Money Market

- 5.2. Market Analysis, Insights and Forecast - by Investor Type

- 5.2.1. Households

- 5.2.2. Insitutional Investors

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Fund Type

- 6. United States North America Mutual Fund Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Fund Type

- 6.1.1. Equity

- 6.1.2. Bond

- 6.1.3. Hybrid

- 6.1.4. Money Market

- 6.2. Market Analysis, Insights and Forecast - by Investor Type

- 6.2.1. Households

- 6.2.2. Insitutional Investors

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Fund Type

- 7. Canada North America Mutual Fund Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Fund Type

- 7.1.1. Equity

- 7.1.2. Bond

- 7.1.3. Hybrid

- 7.1.4. Money Market

- 7.2. Market Analysis, Insights and Forecast - by Investor Type

- 7.2.1. Households

- 7.2.2. Insitutional Investors

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Fund Type

- 8. Mexico North America Mutual Fund Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Fund Type

- 8.1.1. Equity

- 8.1.2. Bond

- 8.1.3. Hybrid

- 8.1.4. Money Market

- 8.2. Market Analysis, Insights and Forecast - by Investor Type

- 8.2.1. Households

- 8.2.2. Insitutional Investors

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Fund Type

- 9. Rest of North America North America Mutual Fund Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Fund Type

- 9.1.1. Equity

- 9.1.2. Bond

- 9.1.3. Hybrid

- 9.1.4. Money Market

- 9.2. Market Analysis, Insights and Forecast - by Investor Type

- 9.2.1. Households

- 9.2.2. Insitutional Investors

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Fund Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Vanguard

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Fidelity Investments

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 American Funds

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 JP Morgan

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 T Rowe Price

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 BlackRock

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Goldman Sachs

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 TIAA Investments

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Dimensional Fund Advisors

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Invesco

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 PIMCO

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Franklin Templeton

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Charles Schwab

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 MFS

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Morgan Stanley**List Not Exhaustive

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.1 Vanguard

List of Figures

- Figure 1: Global North America Mutual Fund Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: United States North America Mutual Fund Industry Revenue (undefined), by Fund Type 2025 & 2033

- Figure 3: United States North America Mutual Fund Industry Revenue Share (%), by Fund Type 2025 & 2033

- Figure 4: United States North America Mutual Fund Industry Revenue (undefined), by Investor Type 2025 & 2033

- Figure 5: United States North America Mutual Fund Industry Revenue Share (%), by Investor Type 2025 & 2033

- Figure 6: United States North America Mutual Fund Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 7: United States North America Mutual Fund Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 8: United States North America Mutual Fund Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: United States North America Mutual Fund Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Canada North America Mutual Fund Industry Revenue (undefined), by Fund Type 2025 & 2033

- Figure 11: Canada North America Mutual Fund Industry Revenue Share (%), by Fund Type 2025 & 2033

- Figure 12: Canada North America Mutual Fund Industry Revenue (undefined), by Investor Type 2025 & 2033

- Figure 13: Canada North America Mutual Fund Industry Revenue Share (%), by Investor Type 2025 & 2033

- Figure 14: Canada North America Mutual Fund Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 15: Canada North America Mutual Fund Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Canada North America Mutual Fund Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: Canada North America Mutual Fund Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Mexico North America Mutual Fund Industry Revenue (undefined), by Fund Type 2025 & 2033

- Figure 19: Mexico North America Mutual Fund Industry Revenue Share (%), by Fund Type 2025 & 2033

- Figure 20: Mexico North America Mutual Fund Industry Revenue (undefined), by Investor Type 2025 & 2033

- Figure 21: Mexico North America Mutual Fund Industry Revenue Share (%), by Investor Type 2025 & 2033

- Figure 22: Mexico North America Mutual Fund Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 23: Mexico North America Mutual Fund Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Mexico North America Mutual Fund Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Mexico North America Mutual Fund Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of North America North America Mutual Fund Industry Revenue (undefined), by Fund Type 2025 & 2033

- Figure 27: Rest of North America North America Mutual Fund Industry Revenue Share (%), by Fund Type 2025 & 2033

- Figure 28: Rest of North America North America Mutual Fund Industry Revenue (undefined), by Investor Type 2025 & 2033

- Figure 29: Rest of North America North America Mutual Fund Industry Revenue Share (%), by Investor Type 2025 & 2033

- Figure 30: Rest of North America North America Mutual Fund Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 31: Rest of North America North America Mutual Fund Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 32: Rest of North America North America Mutual Fund Industry Revenue (undefined), by Country 2025 & 2033

- Figure 33: Rest of North America North America Mutual Fund Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global North America Mutual Fund Industry Revenue undefined Forecast, by Fund Type 2020 & 2033

- Table 2: Global North America Mutual Fund Industry Revenue undefined Forecast, by Investor Type 2020 & 2033

- Table 3: Global North America Mutual Fund Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Global North America Mutual Fund Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global North America Mutual Fund Industry Revenue undefined Forecast, by Fund Type 2020 & 2033

- Table 6: Global North America Mutual Fund Industry Revenue undefined Forecast, by Investor Type 2020 & 2033

- Table 7: Global North America Mutual Fund Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Global North America Mutual Fund Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global North America Mutual Fund Industry Revenue undefined Forecast, by Fund Type 2020 & 2033

- Table 10: Global North America Mutual Fund Industry Revenue undefined Forecast, by Investor Type 2020 & 2033

- Table 11: Global North America Mutual Fund Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Global North America Mutual Fund Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global North America Mutual Fund Industry Revenue undefined Forecast, by Fund Type 2020 & 2033

- Table 14: Global North America Mutual Fund Industry Revenue undefined Forecast, by Investor Type 2020 & 2033

- Table 15: Global North America Mutual Fund Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Global North America Mutual Fund Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Global North America Mutual Fund Industry Revenue undefined Forecast, by Fund Type 2020 & 2033

- Table 18: Global North America Mutual Fund Industry Revenue undefined Forecast, by Investor Type 2020 & 2033

- Table 19: Global North America Mutual Fund Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Global North America Mutual Fund Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Mutual Fund Industry?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the North America Mutual Fund Industry?

Key companies in the market include Vanguard, Fidelity Investments, American Funds, JP Morgan, T Rowe Price, BlackRock, Goldman Sachs, TIAA Investments, Dimensional Fund Advisors, Invesco, PIMCO, Franklin Templeton, Charles Schwab, MFS, Morgan Stanley**List Not Exhaustive.

3. What are the main segments of the North America Mutual Fund Industry?

The market segments include Fund Type, Investor Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Market Securities Held By Mutual Funds in United States.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In 2021, Fidelity Investements along with Visa backed Jumo, an emerging fintech startup which offers savings and credit products to entrepreneurs in emerging markets, as well as financial services infrastructure to partners such as eMoney operators, mobile fintech platforms and banks. it raised atotal of USD 120 million.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Mutual Fund Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Mutual Fund Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Mutual Fund Industry?

To stay informed about further developments, trends, and reports in the North America Mutual Fund Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence