Key Insights

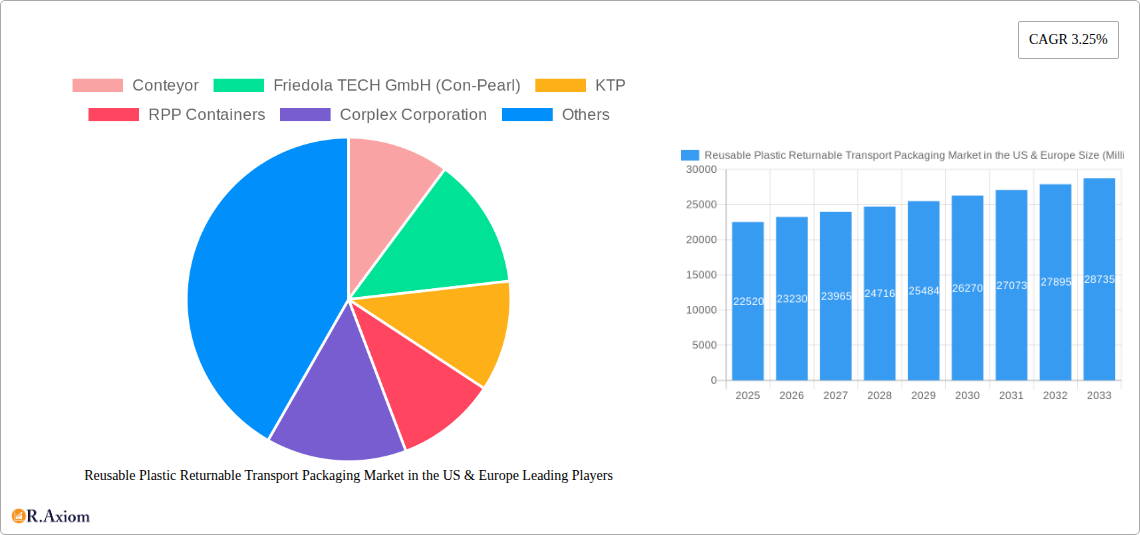

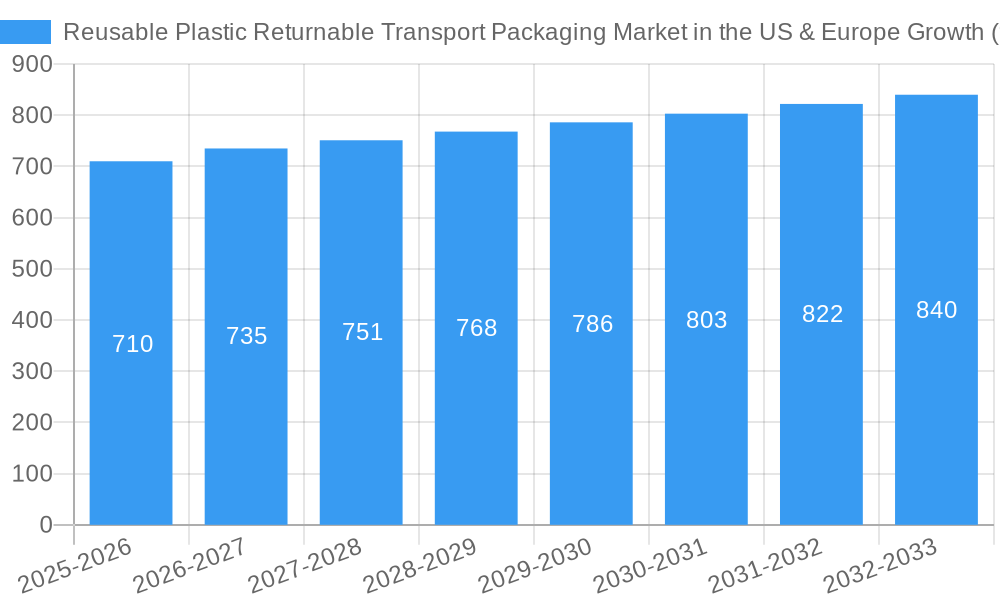

The Reusable Plastic Returnable Transport Packaging (RPTP) market in the US and Europe presents a significant growth opportunity, driven by the increasing demand for sustainable and efficient logistics solutions. The market, valued at approximately $22.52 billion in 2025 (based on provided global data, a reasonable estimation for US and Europe combined considering their significant market share in global logistics), is projected to experience steady growth fueled by several key factors. The rising adoption of e-commerce and the consequent surge in package delivery necessitate efficient and eco-friendly alternatives to single-use packaging. Furthermore, stringent environmental regulations promoting circular economy principles are compelling businesses to adopt reusable packaging solutions. Key market segments include reusable plastic containers, pallets, and IBCs, with significant demand from the food and beverage, automotive, and consumer durables sectors. The expansion of the e-commerce sector in both regions is a major driver, necessitating robust and sustainable transport packaging solutions. Moreover, companies are increasingly focusing on supply chain optimization, which further fuels the demand for reusable packaging to reduce transportation costs and environmental impact. While the initial investment in reusable systems can be higher, long-term cost savings and enhanced brand image contribute to the growing adoption of RPTP.

Competition in the US and European RPTP markets is intense, with established players like Orbis Corporation, IFCO Systems, and others competing on the basis of product innovation, service offerings, and geographical reach. However, smaller, specialized companies are also emerging, focusing on niche applications and offering customized solutions. The market is expected to witness ongoing consolidation, driven by mergers and acquisitions as larger players seek to expand their market share and product portfolios. The future growth trajectory will largely depend on factors like the evolution of e-commerce, advancements in reusable packaging technology, and the continued emphasis on environmental sustainability within the logistics sector. Government initiatives promoting sustainable packaging, coupled with evolving consumer preferences for eco-friendly products, will contribute to the market's positive outlook. Technological advancements in materials science and manufacturing processes will further enhance the durability, efficiency, and recyclability of RPTP solutions, further driving market expansion.

Reusable Plastic Returnable Transport Packaging Market in the US & Europe: A Comprehensive Market Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the Reusable Plastic Returnable Transport Packaging market in the US and Europe, offering invaluable insights for stakeholders across the supply chain. The study covers the period 2019-2033, with a focus on the 2025-2033 forecast period. This report is crucial for understanding market dynamics, identifying growth opportunities, and making strategic business decisions.

Reusable Plastic Returnable Transport Packaging Market in the US & Europe Market Concentration & Innovation

The Reusable Plastic Returnable Transport Packaging market in the US and Europe exhibits a moderately concentrated landscape, with several major players holding significant market share. However, the market also witnesses consistent innovation, driven by the increasing demand for sustainable and efficient packaging solutions. Market concentration is further analyzed by examining the market share of leading players like Orbis Corporation, IFCO Systems, and others. While precise market share figures are proprietary to this report, analysis reveals a concentration ratio indicating a moderate level of competition, with opportunities for both established players and new entrants.

Several factors fuel innovation within this market. Stringent environmental regulations are pushing companies to adopt reusable packaging, prompting the development of more durable, hygienic, and easily recyclable materials and designs. Furthermore, advancements in material science and manufacturing processes contribute to improvements in product performance and cost-effectiveness. The growing focus on supply chain optimization and automation further stimulates innovation.

Regulatory frameworks, particularly those promoting sustainability and circular economy initiatives, significantly influence market growth and innovation. These regulations often incentivize the use of reusable packaging over single-use alternatives. The ongoing evolution of these regulations necessitates continuous adaptation and innovation by market players. Product substitutes, such as biodegradable alternatives, pose a competitive threat, prompting ongoing research into enhanced reusable packaging solutions with extended lifecycles and superior performance. Trends in end-user preferences towards eco-friendly and efficient logistics solutions continuously influence product design and market offerings.

Mergers and acquisitions (M&A) activities have played a role in shaping the market landscape. While precise M&A deal values are detailed within the full report, analysis reveals a pattern of strategic acquisitions aimed at expanding product portfolios, enhancing geographical reach, and gaining access to innovative technologies. This consolidation trend is expected to continue, further influencing market concentration.

Reusable Plastic Returnable Transport Packaging Market in the US & Europe Industry Trends & Insights

The Reusable Plastic Returnable Transport Packaging market in the US and Europe is experiencing robust growth, driven by several key factors. The increasing emphasis on sustainability, coupled with stringent environmental regulations, is a primary catalyst. Companies are actively seeking ways to reduce their carbon footprint and improve their environmental credentials, leading to greater adoption of reusable packaging solutions. The push towards a circular economy further strengthens this trend.

Technological advancements are playing a crucial role in shaping market dynamics. Innovations in material science are leading to the development of lighter, stronger, and more durable reusable containers. Automation and digitalization in logistics are improving supply chain efficiency and further enhancing the appeal of reusable packaging. These technological advancements also play a crucial role in cost-effectiveness and overall market appeal.

Consumer preferences are also shifting toward sustainable products. Consumers are increasingly aware of the environmental impact of their choices, and this growing awareness is driving demand for products packaged in eco-friendly materials. This trend further boosts the market for reusable packaging, which reduces waste and environmental impact.

Competitive dynamics remain a significant aspect of the market. Existing players are constantly innovating and expanding their product lines to maintain their market positions. New entrants are also emerging, adding further intensity to competition. This intense competition leads to price pressures but also fosters innovation to create differentiated value propositions. The report's market size projections are based on these dynamics, with the Compound Annual Growth Rate (CAGR) projected at xx% for the forecast period. Market penetration is expected to increase significantly as more companies adopt reusable packaging solutions, driven by the factors mentioned above.

Dominant Markets & Segments in Reusable Plastic Returnable Transport Packaging Market in the US & Europe

Within the US and Europe, the Reusable Plastic Returnable Transport Packaging market demonstrates varied segment dominance. The Food and Beverage sector emerges as a leading end-user vertical, significantly driving demand for reusable plastic containers, crates, and pallets due to stringent hygiene requirements and the need for efficient product handling. The Automotive industry also exhibits substantial growth, primarily driven by the adoption of reusable packaging for the efficient transportation of automotive components.

By Product: Reusable Plastic Containers consistently hold the largest market share owing to their versatility and adaptability across various industries. Pallets also represent a significant segment, driven by their essential role in logistics and material handling.

By End-user Vertical: The Food and Beverage segment maintains the leading position, followed by Automotive and Industrial sectors. This dominance is driven by the increased demand for efficient, hygienic, and sustainable packaging solutions within these industries.

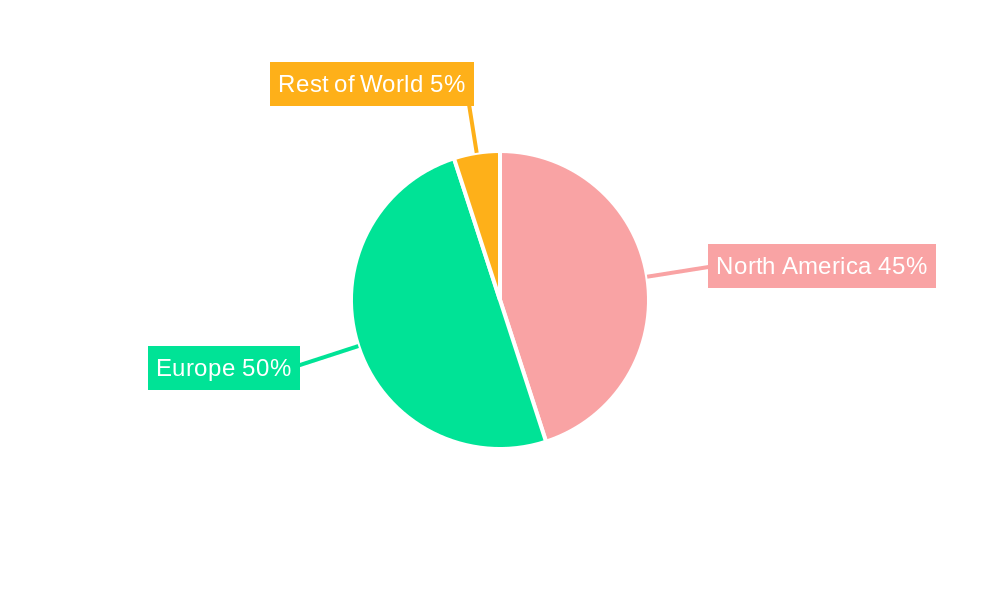

Geographic Dominance: While both the US and Europe represent significant markets, a detailed analysis within the report reveals a slight edge for one region depending on specific factors such as regulatory landscapes, consumer behavior, and industrial distribution of leading end-users. The full report offers more detailed insights into regional trends.

Key drivers fueling segment dominance include economic policies favoring sustainable practices, robust logistics infrastructure, and the escalating awareness of environmental issues among consumers and businesses.

Reusable Plastic Returnable Transport Packaging Market in the US & Europe Product Developments

Recent product innovations focus on enhanced durability, hygiene, and ease of handling. Lighter-weight materials, improved stacking capabilities, and integrated tracking systems are key features of new product offerings. These innovations directly address market demands for improved efficiency and sustainability. The integration of smart technologies, such as RFID tracking, further enhances supply chain visibility and management. These advancements strengthen the competitive advantages of these products by meeting the needs of end-users and exceeding expectations for both efficiency and environmental performance.

Report Scope & Segmentation Analysis

This report meticulously segments the Reusable Plastic Returnable Transport Packaging market in the US and Europe across various parameters.

By Product: The report analyzes the market size and growth projections for Reusable Plastic Containers, Pallets, Corrugated Boxes and Panels, IBCs, Crates and Totes, and Other Product Types. Each segment's competitive dynamics are assessed, providing insights into market share and competitive pressures.

By End-user Vertical: Market segmentation by end-user vertical covers Food and Beverage, Automotive, Consumer Durables, Industrial (including Chemicals), and Other End-user Verticals. The report includes a detailed analysis of each segment's market size, growth drivers, and competitive landscapes.

Key Drivers of Reusable Plastic Returnable Transport Packaging Market in the US & Europe Growth

The market's growth is primarily propelled by several key drivers: increasing demand for sustainable and eco-friendly packaging solutions, stringent environmental regulations, rising consumer awareness of environmental issues, and the need for efficient and cost-effective logistics. Technological advancements, such as the development of durable and lightweight materials, also contribute significantly to market growth. Government initiatives promoting sustainable practices and circular economy models further bolster market expansion.

Challenges in the Reusable Plastic Returnable Transport Packaging Market in the US & Europe Sector

Despite considerable growth potential, several challenges hinder market expansion. High initial investment costs associated with reusable packaging systems can be a deterrent for some businesses. Supply chain complexities and the need for robust return systems pose logistical hurdles. Furthermore, competition from alternative packaging materials, such as single-use plastics and biodegradable options, presents a significant challenge. Fluctuations in raw material prices also impact profitability and market stability.

Emerging Opportunities in Reusable Plastic Returnable Transport Packaging Market in the US & Europe

Emerging opportunities abound for market players. The growing adoption of e-commerce and the resulting increase in package deliveries present significant opportunities for reusable packaging solutions. Furthermore, advancements in materials science offer potential for further cost reductions and improved product performance. Expansion into developing regions with increasing industrial activity also presents considerable growth potential. Finally, collaborations and partnerships with logistics providers can unlock improved efficiency and broader market reach.

Leading Players in the Reusable Plastic Returnable Transport Packaging Market in the US & Europe Market

- Conteyor

- Friedola TECH GmbH (Con-Pearl)

- KTP

- RPP Containers

- Corplex Corporation

- Schaefer Systems International Inc

- Kiga

- Tosca Ltd

- CABKA

- Sohner Plastics LLC

- IFCO Systems

- Wellplast

- Soehner

- Sustainable Transport Packaging (Reusable Transport Packaging)

- WI Sales

- Wisechemann

- Orbis Corporation (Menasha Corporation)

- Duro-Therm

- Auer

Key Developments in Reusable Plastic Returnable Transport Packaging Market in the US & Europe Industry

- June 2022: Orbis Corporation launched its new p3 Pallet, a durable, lightweight, stackable, and hygienic reusable plastic pallet designed for seamless integration with automated and manual material handling equipment. This launch caters to the growing demand for sustainable packaging solutions in the food and beverage and CPG sectors.

Strategic Outlook for Reusable Plastic Returnable Transport Packaging Market in the US & Europe Market

The Reusable Plastic Returnable Transport Packaging market in the US and Europe is poised for continued growth, driven by the increasing focus on sustainability, technological advancements, and the evolving needs of diverse end-user industries. Strategic investments in innovation, coupled with the development of efficient and scalable return systems, will be crucial for players to capitalize on the market's significant potential. The expansion into new markets and the development of tailored solutions for specific industry applications will further drive market expansion in the coming years. The forecast indicates strong growth momentum, making this a lucrative sector for strategic investment and expansion.

Reusable Plastic Returnable Transport Packaging Market in the US & Europe Segmentation

-

1. Product

- 1.1. Reusable Plastic Containers

- 1.2. Pallets

- 1.3. Corrugated Boxes and Panels

- 1.4. IBCs

- 1.5. Crates and Totes

- 1.6. Other Product Types

-

2. End-user Vertical

- 2.1. Food and Beverage

- 2.2. Automotive

- 2.3. Consumer Durables

- 2.4. Industrial (including Chemicals)

- 2.5. Other End-user verticals

Reusable Plastic Returnable Transport Packaging Market in the US & Europe Segmentation By Geography

- 1. United States

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

Reusable Plastic Returnable Transport Packaging Market in the US & Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.25% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Favorable Governmental Regulations; Automation to Increase the Demand for Reusable Plastic RTP

- 3.3. Market Restrains

- 3.3.1. Resistance to Process Change by Various Stakeholders; Availability of Alternative Materials

- 3.4. Market Trends

- 3.4.1. Pallets to Account for Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Reusable Plastic Returnable Transport Packaging Market in the US & Europe Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Reusable Plastic Containers

- 5.1.2. Pallets

- 5.1.3. Corrugated Boxes and Panels

- 5.1.4. IBCs

- 5.1.5. Crates and Totes

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Food and Beverage

- 5.2.2. Automotive

- 5.2.3. Consumer Durables

- 5.2.4. Industrial (including Chemicals)

- 5.2.5. Other End-user verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. United States Reusable Plastic Returnable Transport Packaging Market in the US & Europe Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Reusable Plastic Containers

- 6.1.2. Pallets

- 6.1.3. Corrugated Boxes and Panels

- 6.1.4. IBCs

- 6.1.5. Crates and Totes

- 6.1.6. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. Food and Beverage

- 6.2.2. Automotive

- 6.2.3. Consumer Durables

- 6.2.4. Industrial (including Chemicals)

- 6.2.5. Other End-user verticals

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Reusable Plastic Returnable Transport Packaging Market in the US & Europe Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Reusable Plastic Containers

- 7.1.2. Pallets

- 7.1.3. Corrugated Boxes and Panels

- 7.1.4. IBCs

- 7.1.5. Crates and Totes

- 7.1.6. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. Food and Beverage

- 7.2.2. Automotive

- 7.2.3. Consumer Durables

- 7.2.4. Industrial (including Chemicals)

- 7.2.5. Other End-user verticals

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Germany Reusable Plastic Returnable Transport Packaging Market in the US & Europe Analysis, Insights and Forecast, 2019-2031

- 9. France Reusable Plastic Returnable Transport Packaging Market in the US & Europe Analysis, Insights and Forecast, 2019-2031

- 10. Italy Reusable Plastic Returnable Transport Packaging Market in the US & Europe Analysis, Insights and Forecast, 2019-2031

- 11. United Kingdom Reusable Plastic Returnable Transport Packaging Market in the US & Europe Analysis, Insights and Forecast, 2019-2031

- 12. Netherlands Reusable Plastic Returnable Transport Packaging Market in the US & Europe Analysis, Insights and Forecast, 2019-2031

- 13. Sweden Reusable Plastic Returnable Transport Packaging Market in the US & Europe Analysis, Insights and Forecast, 2019-2031

- 14. Rest of Europe Reusable Plastic Returnable Transport Packaging Market in the US & Europe Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Conteyor

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Friedola TECH GmbH (Con-Pearl)

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 KTP

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 RPP Containers

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Corplex Corporation

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Schaefer Systems International Inc

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Kiga

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 Tosca Ltd

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 CABKA

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Sohner Plastics LLC

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.11 IFCO Systems

- 15.2.11.1. Overview

- 15.2.11.2. Products

- 15.2.11.3. SWOT Analysis

- 15.2.11.4. Recent Developments

- 15.2.11.5. Financials (Based on Availability)

- 15.2.12 Wellplast

- 15.2.12.1. Overview

- 15.2.12.2. Products

- 15.2.12.3. SWOT Analysis

- 15.2.12.4. Recent Developments

- 15.2.12.5. Financials (Based on Availability)

- 15.2.13 Soehner

- 15.2.13.1. Overview

- 15.2.13.2. Products

- 15.2.13.3. SWOT Analysis

- 15.2.13.4. Recent Developments

- 15.2.13.5. Financials (Based on Availability)

- 15.2.14 Sustainable Transport Packaging (Reusable Transport Packaging)

- 15.2.14.1. Overview

- 15.2.14.2. Products

- 15.2.14.3. SWOT Analysis

- 15.2.14.4. Recent Developments

- 15.2.14.5. Financials (Based on Availability)

- 15.2.15 WI Sales*List Not Exhaustive

- 15.2.15.1. Overview

- 15.2.15.2. Products

- 15.2.15.3. SWOT Analysis

- 15.2.15.4. Recent Developments

- 15.2.15.5. Financials (Based on Availability)

- 15.2.16 Wisechemann

- 15.2.16.1. Overview

- 15.2.16.2. Products

- 15.2.16.3. SWOT Analysis

- 15.2.16.4. Recent Developments

- 15.2.16.5. Financials (Based on Availability)

- 15.2.17 Orbis Corporation (Menasha Corporation)

- 15.2.17.1. Overview

- 15.2.17.2. Products

- 15.2.17.3. SWOT Analysis

- 15.2.17.4. Recent Developments

- 15.2.17.5. Financials (Based on Availability)

- 15.2.18 Duro-Therm

- 15.2.18.1. Overview

- 15.2.18.2. Products

- 15.2.18.3. SWOT Analysis

- 15.2.18.4. Recent Developments

- 15.2.18.5. Financials (Based on Availability)

- 15.2.19 Auer

- 15.2.19.1. Overview

- 15.2.19.2. Products

- 15.2.19.3. SWOT Analysis

- 15.2.19.4. Recent Developments

- 15.2.19.5. Financials (Based on Availability)

- 15.2.1 Conteyor

List of Figures

- Figure 1: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Share (%) by Company 2024

List of Tables

- Table 1: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 4: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by Product 2019 & 2032

- Table 14: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 15: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by Product 2019 & 2032

- Table 17: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 18: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 19: United Kingdom Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Germany Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: France Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Spain Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Europe Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Reusable Plastic Returnable Transport Packaging Market in the US & Europe?

The projected CAGR is approximately 3.25%.

2. Which companies are prominent players in the Reusable Plastic Returnable Transport Packaging Market in the US & Europe?

Key companies in the market include Conteyor, Friedola TECH GmbH (Con-Pearl), KTP, RPP Containers, Corplex Corporation, Schaefer Systems International Inc, Kiga, Tosca Ltd, CABKA, Sohner Plastics LLC, IFCO Systems, Wellplast, Soehner, Sustainable Transport Packaging (Reusable Transport Packaging), WI Sales*List Not Exhaustive, Wisechemann, Orbis Corporation (Menasha Corporation), Duro-Therm, Auer.

3. What are the main segments of the Reusable Plastic Returnable Transport Packaging Market in the US & Europe?

The market segments include Product, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.52 Million as of 2022.

5. What are some drivers contributing to market growth?

Favorable Governmental Regulations; Automation to Increase the Demand for Reusable Plastic RTP.

6. What are the notable trends driving market growth?

Pallets to Account for Major Market Share.

7. Are there any restraints impacting market growth?

Resistance to Process Change by Various Stakeholders; Availability of Alternative Materials.

8. Can you provide examples of recent developments in the market?

June 2022 - Orbis corporation has introduced the new p3 Pallet to its suite of reusable plastic pallet offerings to improve sustainable handling in primary packaging, food and beverage, and CPG applications. The size of the Pallet is 40,48 inches, a durable, lightweight, stackable, hygienic packaging solution that integrates seamlessly with both automatic and manual material handling equipment

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Reusable Plastic Returnable Transport Packaging Market in the US & Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Reusable Plastic Returnable Transport Packaging Market in the US & Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Reusable Plastic Returnable Transport Packaging Market in the US & Europe?

To stay informed about further developments, trends, and reports in the Reusable Plastic Returnable Transport Packaging Market in the US & Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence