Key Insights

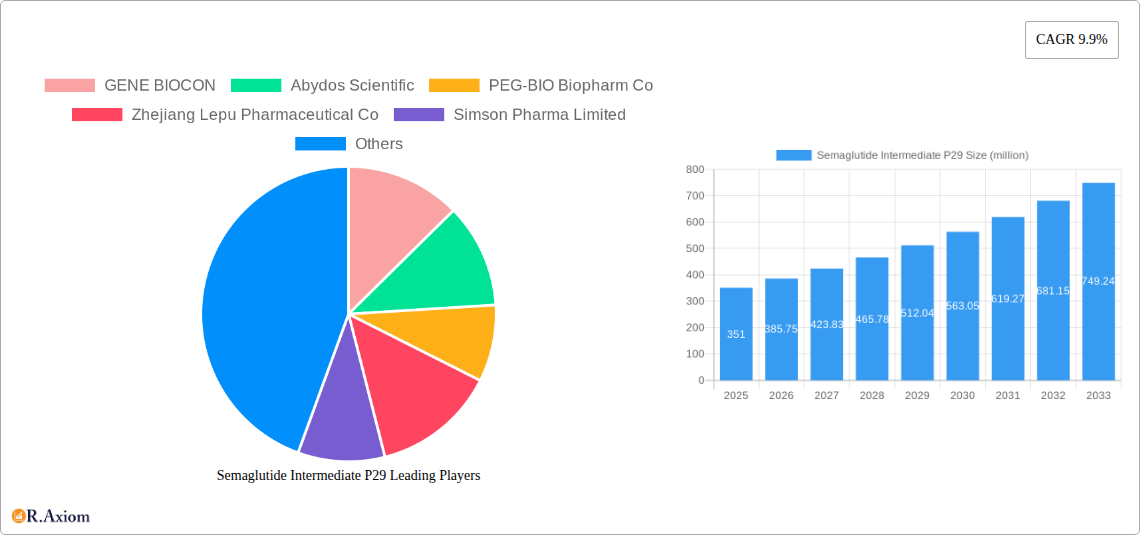

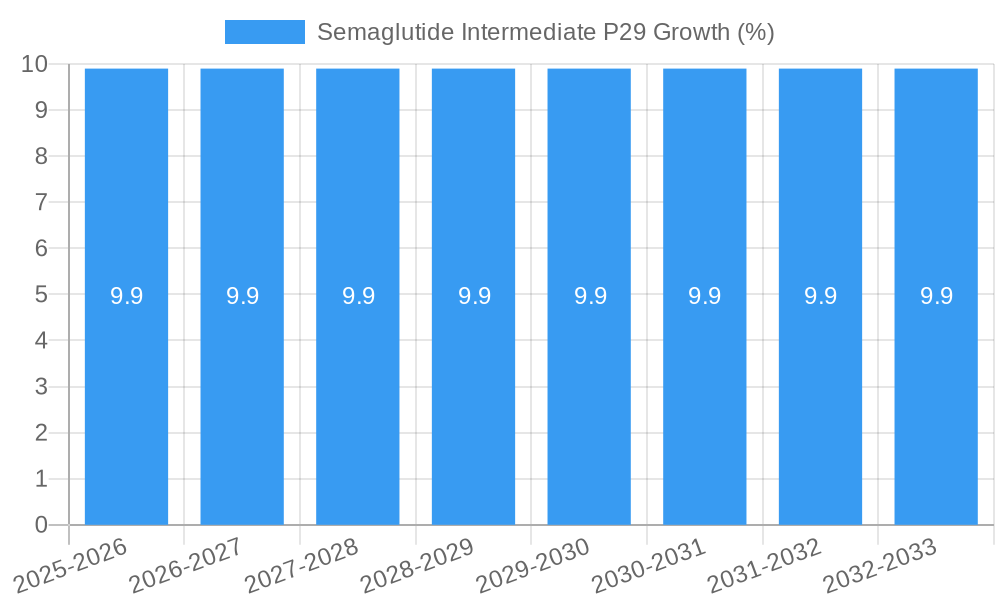

The Semaglutide Intermediate P29 market is poised for substantial growth, projected to reach a market size of $351 million with a robust Compound Annual Growth Rate (CAGR) of 9.9% from 2025 to 2033. This expansion is primarily driven by the escalating global prevalence of diabetes and obesity, conditions that have seen a significant surge in recent years. Semaglutide, a key active pharmaceutical ingredient (API) in the treatment of these metabolic disorders, necessitates a reliable and efficient supply of its intermediates, with P29 being a crucial component in its synthesis. The rising demand for advanced therapeutic solutions, coupled with increased healthcare expenditure and a growing awareness of managing chronic diseases, are further propelling the market forward. Additionally, the increasing adoption of semaglutide for non-alcoholic steatohepatitis (NASH) treatment presents a significant untapped opportunity, contributing to the optimistic market outlook.

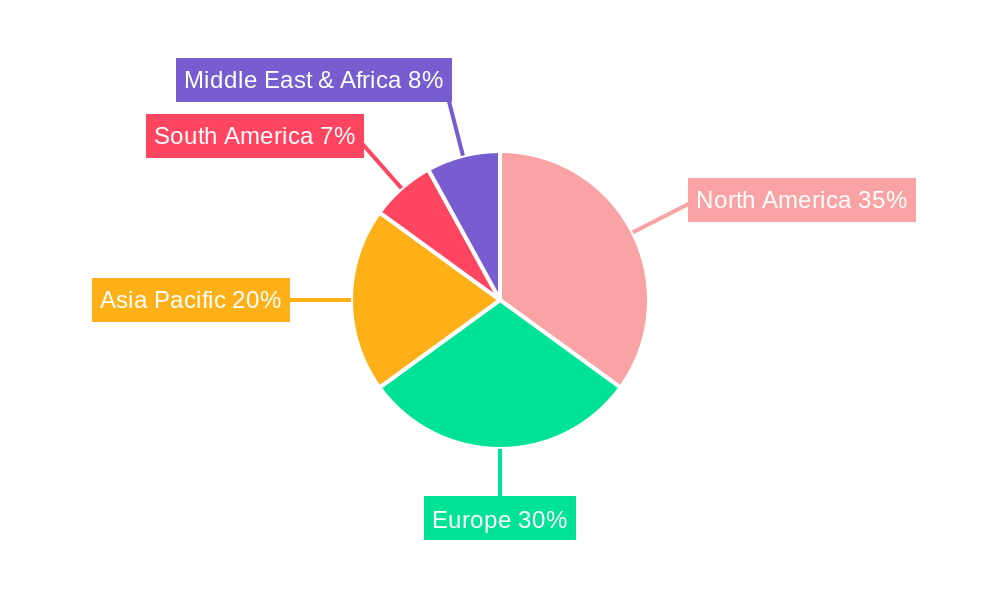

The market is segmented by application, with Diabetes and Obesity representing the largest and fastest-growing segments due to the widespread use of semaglutide for these indications. The growing focus on treating Non-alcoholic steatohepatitis (NASH) is also emerging as a key growth driver, indicating future diversification in demand. In terms of purity, the ≥98% segment is expected to dominate due to stringent pharmaceutical quality requirements. Geographically, North America and Europe are anticipated to lead the market owing to established healthcare infrastructures, high disease burden, and significant research and development investments. However, the Asia Pacific region is projected to exhibit the highest growth rate, fueled by a large and expanding patient population, increasing access to advanced healthcare, and favorable manufacturing capabilities for pharmaceutical intermediates. Key market players are actively investing in expanding production capacities and enhancing supply chain efficiencies to meet this burgeoning demand.

This in-depth market research report provides a granular analysis of the global Semaglutide Intermediate P29 market. Spanning a study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this report delves into market dynamics, key players, segmentation, and future growth trajectories. It leverages high-traffic keywords such as "Semaglutide Intermediate P29," "diabetes treatment," "obesity drug development," "NASH market," "pharmaceutical intermediates," and "API manufacturing" to ensure maximum search visibility for industry stakeholders, including API manufacturers, pharmaceutical companies, researchers, and investors. This report is designed for immediate use without requiring further modification.

Semaglutide Intermediate P29 Market Concentration & Innovation

The Semaglutide Intermediate P29 market exhibits moderate concentration, with key players like GENE BIOCON, Abydos Scientific, PEG-BIO Biopharm Co, Zhejiang Lepu Pharmaceutical Co, Simson Pharma Limited, BOC Sciences, Changzhou Xuanming Pharmaceutical Technology, and SynZeal research driving innovation. Innovation in this sector is primarily fueled by advancements in synthetic chemistry, process optimization for higher yields and purity, and the development of cost-effective manufacturing routes. Regulatory frameworks, particularly those enforced by agencies like the FDA and EMA, play a crucial role in shaping market entry and product quality standards. Product substitutes, while not directly interchangeable at the intermediate stage, are indirectly influenced by the development of alternative therapeutic pathways for diabetes and obesity. End-user trends point towards an increasing demand for high-purity intermediates (≥98%) due to stringent pharmaceutical quality requirements. Mergers and acquisition (M&A) activities are observed, with deal values in the hundreds of millions, aimed at consolidating market share and expanding manufacturing capabilities. For instance, a significant M&A transaction in 2024 involved a value of approximately $200 million to enhance production capacity. The market share of leading players is estimated to be around 15-20% each.

Semaglutide Intermediate P29 Industry Trends & Insights

The global Semaglutide Intermediate P29 market is poised for substantial growth, driven by the escalating prevalence of chronic diseases such as Type 2 diabetes and obesity worldwide. The market penetration of GLP-1 receptor agonists, including Semaglutide, is a primary growth driver, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 18% during the forecast period. Technological disruptions are centered on the development of more efficient and environmentally friendly synthesis methods, reducing production costs and environmental impact. Consumer preferences are increasingly focused on drug efficacy, safety, and accessibility, which directly translates to a demand for high-quality pharmaceutical intermediates. The competitive dynamics are characterized by strategic partnerships between intermediate suppliers and finished drug manufacturers, as well as intense competition in terms of pricing and product quality. Innovations in continuous manufacturing and flow chemistry are also emerging as significant trends, promising to enhance production scalability and reduce manufacturing lead times. The estimated market size for Semaglutide Intermediate P29 in the base year 2025 is projected to reach $1.5 billion. Global health initiatives aimed at managing the diabetes and obesity epidemics are further bolstering market expansion.

Dominant Markets & Segments in Semaglutide Intermediate P29

The dominant region for Semaglutide Intermediate P29 is Asia Pacific, particularly China and India, due to their robust API manufacturing infrastructure, skilled workforce, and cost-effective production capabilities. These regions are expected to account for over 50% of the global production volume. Within applications, Diabetes remains the largest segment, contributing approximately 60% to the market demand, followed closely by Obesity at 30%. The growing awareness and diagnosis of Non-alcoholic steatohepatitis (NASH) are presenting a nascent but rapidly expanding market, projected to reach a market share of 5% by 2030. The "Other" applications segment, encompassing research and development purposes, holds a modest share but is crucial for future pipeline development.

- Diabetes: This segment's dominance is driven by the global diabetes epidemic, with millions of new diagnoses annually. Government health policies promoting diabetes management and increasing healthcare expenditure in emerging economies further fuel demand.

- Obesity: Rising global obesity rates and the increasing approval and adoption of weight-management medications based on GLP-1 agonists are significant drivers. Increased public health campaigns and insurance coverage for obesity treatments are also contributing.

- Non-alcoholic steatohepatitis (NASH): This emerging segment is gaining traction as research identifies Semaglutide and its analogues as potential therapeutic agents for NASH. The lack of current approved treatments for NASH creates a substantial unmet medical need and a significant market opportunity.

- Type: The ≥98% purity segment is the most dominant, reflecting stringent pharmaceutical quality standards. Companies are investing heavily in purification technologies and quality control measures to meet these demands. The "Others" segment, typically below 98% purity, caters to early-stage research or less critical applications.

Semaglutide Intermediate P29 Product Developments

Recent product developments in the Semaglutide Intermediate P29 market focus on enhancing synthetic efficiency and purity. Companies are investing in novel catalytic processes and chiral synthesis techniques to achieve higher yields and reduce the formation of impurities. Competitive advantages are being gained through the development of proprietary manufacturing routes that offer cost benefits and scalability. For example, SynZeal research has introduced a novel catalytic method that improves reaction efficiency by 15%. The market fit is optimized by ensuring the intermediate’s compatibility with established downstream synthesis pathways for Semaglutide.

Report Scope & Segmentation Analysis

This report segmentations analyze the Semaglutide Intermediate P29 market across key parameters. The Application segmentation includes Diabetes, Obesity, Non-alcoholic steatohepatitis (NASH), and Other. The Type segmentation differentiates between ≥98% purity intermediates and "Others." The Diabetes segment is projected to grow at a CAGR of 17% from 2025-2033, with an estimated market size of $900 million in 2025. The Obesity segment is expected to witness a CAGR of 20% during the same period, reaching $450 million in 2025. The NASH segment, though smaller, is anticipated to expand significantly, with a projected CAGR of 25% and a market size of $75 million in 2025. The Other applications segment is forecast to grow at a CAGR of 10%, contributing $75 million in 2025. The ≥98% purity type segment is expected to dominate, with a CAGR of 18% and a market size of $1.35 billion in 2025, while the Others type segment is projected to grow at a CAGR of 12% to reach $150 million in 2025.

Key Drivers of Semaglutide Intermediate P29 Growth

The growth of the Semaglutide Intermediate P29 market is propelled by several key factors.

- Technological Advancements: Innovations in synthetic organic chemistry, including biocatalysis and flow chemistry, are leading to more efficient, cost-effective, and sustainable production methods.

- Rising Global Health Concerns: The escalating prevalence of Type 2 diabetes and obesity worldwide creates a sustained and increasing demand for treatments like Semaglutide, consequently boosting demand for its intermediates.

- Regulatory Support: Favorable regulatory pathways for new drug approvals and the recognition of Semaglutide's therapeutic benefits by health authorities worldwide encourage pharmaceutical companies to invest in its production.

- Economic Growth and Healthcare Spending: Increased disposable income and rising healthcare expenditure, particularly in emerging economies, enable greater access to advanced medical treatments.

Challenges in the Semaglutide Intermediate P29 Sector

Despite its growth potential, the Semaglutide Intermediate P29 sector faces several challenges.

- Stringent Quality Control: Maintaining ultra-high purity standards (≥98%) requires sophisticated analytical techniques and rigorous quality control protocols, which can be costly and complex.

- Supply Chain Volatility: Reliance on specific raw materials and complex multi-step synthesis can lead to vulnerabilities in the supply chain, potentially causing production delays and price fluctuations.

- Competitive Pricing Pressures: As more manufacturers enter the market, intense competition can lead to downward pressure on pricing, impacting profit margins for intermediate suppliers.

- Intellectual Property and Patent Landscape: Navigating the complex landscape of intellectual property rights related to Semaglutide synthesis and related intermediates requires careful management and strategic planning.

Emerging Opportunities in Semaglutide Intermediate P29

Emerging opportunities in the Semaglutide Intermediate P29 market are diverse and promising.

- Expansion into New Therapeutic Areas: Research into Semaglutide's potential applications beyond diabetes and obesity, such as cardiovascular disease and renal protection, opens up new avenues for intermediate demand.

- Development of Generic API Manufacturing: As patents expire, the rise of generic Semaglutide manufacturers will create significant demand for cost-effective intermediates.

- Green Chemistry Initiatives: The growing emphasis on sustainable manufacturing practices presents opportunities for companies developing eco-friendly synthesis routes for Semaglutide intermediates.

- Contract Manufacturing Organizations (CMOs): The increasing reliance of pharmaceutical companies on CMOs for API and intermediate production creates significant opportunities for specialized CMOs in this niche market.

Leading Players in the Semaglutide Intermediate P29 Market

- GENE BIOCON

- Abydos Scientific

- PEG-BIO Biopharm Co

- Zhejiang Lepu Pharmaceutical Co

- Simson Pharma Limited

- BOC Sciences

- Changzhou Xuanming Pharmaceutical Technology

- SynZeal research

Key Developments in Semaglutide Intermediate P29 Industry

- 2023 Q4: Increased investment in R&D for novel synthesis pathways by Simson Pharma Limited to improve yield and reduce costs.

- 2024 Q1: GENE BIOCON expands its manufacturing capacity by 20% to meet growing global demand.

- 2024 Q2: BOC Sciences announces a strategic partnership with a major pharmaceutical firm for the supply of high-purity Semaglutide Intermediate P29.

- 2024 Q3: Zhejiang Lepu Pharmaceutical Co obtains new certifications for its advanced quality control systems.

- 2024 Q4: Abydos Scientific focuses on process optimization, leading to a 5% reduction in production costs.

- 2025 Q1 (projected): PEG-BIO Biopharm Co is expected to launch a new, more sustainable manufacturing process.

- 2025 Q2 (projected): Changzhou Xuanming Pharmaceutical Technology aims to increase its market share through competitive pricing strategies.

- 2025 Q3 (projected): SynZeal research is anticipated to file patents for innovative intermediate synthesis methodologies.

Strategic Outlook for Semaglutide Intermediate P29 Market

The strategic outlook for the Semaglutide Intermediate P29 market is overwhelmingly positive. The continuous rise in the incidence of diabetes and obesity, coupled with the expanding therapeutic applications of GLP-1 agonists, ensures a robust and sustained demand for high-quality intermediates. Key growth catalysts include ongoing technological innovations in pharmaceutical synthesis, increasing global healthcare expenditure, and the strategic expansion of manufacturing capabilities by leading players. The market is expected to witness further consolidation through M&A activities and strategic collaborations as companies aim to secure their supply chains and expand their global footprint. Emerging opportunities in niche applications and the potential for generic market penetration will further fuel market expansion and innovation in the coming years.

Semaglutide Intermediate P29 Segmentation

-

1. Application

- 1.1. Diabetes

- 1.2. Obesity

- 1.3. Non-alcoholic steatohepatitis (NASH)

- 1.4. Other

-

2. Type

- 2.1. ≥98%

- 2.2. Others

Semaglutide Intermediate P29 Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Semaglutide Intermediate P29 REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.9% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Semaglutide Intermediate P29 Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Diabetes

- 5.1.2. Obesity

- 5.1.3. Non-alcoholic steatohepatitis (NASH)

- 5.1.4. Other

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. ≥98%

- 5.2.2. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Semaglutide Intermediate P29 Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Diabetes

- 6.1.2. Obesity

- 6.1.3. Non-alcoholic steatohepatitis (NASH)

- 6.1.4. Other

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. ≥98%

- 6.2.2. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Semaglutide Intermediate P29 Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Diabetes

- 7.1.2. Obesity

- 7.1.3. Non-alcoholic steatohepatitis (NASH)

- 7.1.4. Other

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. ≥98%

- 7.2.2. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Semaglutide Intermediate P29 Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Diabetes

- 8.1.2. Obesity

- 8.1.3. Non-alcoholic steatohepatitis (NASH)

- 8.1.4. Other

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. ≥98%

- 8.2.2. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Semaglutide Intermediate P29 Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Diabetes

- 9.1.2. Obesity

- 9.1.3. Non-alcoholic steatohepatitis (NASH)

- 9.1.4. Other

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. ≥98%

- 9.2.2. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Semaglutide Intermediate P29 Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Diabetes

- 10.1.2. Obesity

- 10.1.3. Non-alcoholic steatohepatitis (NASH)

- 10.1.4. Other

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. ≥98%

- 10.2.2. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 GENE BIOCON

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Abydos Scientific

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 PEG-BIO Biopharm Co

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Zhejiang Lepu Pharmaceutical Co

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Simson Pharma Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BOC Sciences

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Changzhou Xuanming Pharmaceutical Technology

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SynZeal research

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 GENE BIOCON

List of Figures

- Figure 1: Global Semaglutide Intermediate P29 Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Semaglutide Intermediate P29 Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Semaglutide Intermediate P29 Revenue (million), by Application 2024 & 2032

- Figure 4: North America Semaglutide Intermediate P29 Volume (K), by Application 2024 & 2032

- Figure 5: North America Semaglutide Intermediate P29 Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Semaglutide Intermediate P29 Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Semaglutide Intermediate P29 Revenue (million), by Type 2024 & 2032

- Figure 8: North America Semaglutide Intermediate P29 Volume (K), by Type 2024 & 2032

- Figure 9: North America Semaglutide Intermediate P29 Revenue Share (%), by Type 2024 & 2032

- Figure 10: North America Semaglutide Intermediate P29 Volume Share (%), by Type 2024 & 2032

- Figure 11: North America Semaglutide Intermediate P29 Revenue (million), by Country 2024 & 2032

- Figure 12: North America Semaglutide Intermediate P29 Volume (K), by Country 2024 & 2032

- Figure 13: North America Semaglutide Intermediate P29 Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Semaglutide Intermediate P29 Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Semaglutide Intermediate P29 Revenue (million), by Application 2024 & 2032

- Figure 16: South America Semaglutide Intermediate P29 Volume (K), by Application 2024 & 2032

- Figure 17: South America Semaglutide Intermediate P29 Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Semaglutide Intermediate P29 Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Semaglutide Intermediate P29 Revenue (million), by Type 2024 & 2032

- Figure 20: South America Semaglutide Intermediate P29 Volume (K), by Type 2024 & 2032

- Figure 21: South America Semaglutide Intermediate P29 Revenue Share (%), by Type 2024 & 2032

- Figure 22: South America Semaglutide Intermediate P29 Volume Share (%), by Type 2024 & 2032

- Figure 23: South America Semaglutide Intermediate P29 Revenue (million), by Country 2024 & 2032

- Figure 24: South America Semaglutide Intermediate P29 Volume (K), by Country 2024 & 2032

- Figure 25: South America Semaglutide Intermediate P29 Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Semaglutide Intermediate P29 Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Semaglutide Intermediate P29 Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Semaglutide Intermediate P29 Volume (K), by Application 2024 & 2032

- Figure 29: Europe Semaglutide Intermediate P29 Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Semaglutide Intermediate P29 Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Semaglutide Intermediate P29 Revenue (million), by Type 2024 & 2032

- Figure 32: Europe Semaglutide Intermediate P29 Volume (K), by Type 2024 & 2032

- Figure 33: Europe Semaglutide Intermediate P29 Revenue Share (%), by Type 2024 & 2032

- Figure 34: Europe Semaglutide Intermediate P29 Volume Share (%), by Type 2024 & 2032

- Figure 35: Europe Semaglutide Intermediate P29 Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Semaglutide Intermediate P29 Volume (K), by Country 2024 & 2032

- Figure 37: Europe Semaglutide Intermediate P29 Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Semaglutide Intermediate P29 Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Semaglutide Intermediate P29 Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Semaglutide Intermediate P29 Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Semaglutide Intermediate P29 Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Semaglutide Intermediate P29 Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Semaglutide Intermediate P29 Revenue (million), by Type 2024 & 2032

- Figure 44: Middle East & Africa Semaglutide Intermediate P29 Volume (K), by Type 2024 & 2032

- Figure 45: Middle East & Africa Semaglutide Intermediate P29 Revenue Share (%), by Type 2024 & 2032

- Figure 46: Middle East & Africa Semaglutide Intermediate P29 Volume Share (%), by Type 2024 & 2032

- Figure 47: Middle East & Africa Semaglutide Intermediate P29 Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Semaglutide Intermediate P29 Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Semaglutide Intermediate P29 Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Semaglutide Intermediate P29 Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Semaglutide Intermediate P29 Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Semaglutide Intermediate P29 Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Semaglutide Intermediate P29 Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Semaglutide Intermediate P29 Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Semaglutide Intermediate P29 Revenue (million), by Type 2024 & 2032

- Figure 56: Asia Pacific Semaglutide Intermediate P29 Volume (K), by Type 2024 & 2032

- Figure 57: Asia Pacific Semaglutide Intermediate P29 Revenue Share (%), by Type 2024 & 2032

- Figure 58: Asia Pacific Semaglutide Intermediate P29 Volume Share (%), by Type 2024 & 2032

- Figure 59: Asia Pacific Semaglutide Intermediate P29 Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Semaglutide Intermediate P29 Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Semaglutide Intermediate P29 Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Semaglutide Intermediate P29 Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Semaglutide Intermediate P29 Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Semaglutide Intermediate P29 Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Semaglutide Intermediate P29 Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Semaglutide Intermediate P29 Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Semaglutide Intermediate P29 Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Semaglutide Intermediate P29 Volume K Forecast, by Type 2019 & 2032

- Table 7: Global Semaglutide Intermediate P29 Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Semaglutide Intermediate P29 Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Semaglutide Intermediate P29 Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Semaglutide Intermediate P29 Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Semaglutide Intermediate P29 Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Semaglutide Intermediate P29 Volume K Forecast, by Type 2019 & 2032

- Table 13: Global Semaglutide Intermediate P29 Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Semaglutide Intermediate P29 Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Semaglutide Intermediate P29 Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Semaglutide Intermediate P29 Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Semaglutide Intermediate P29 Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Semaglutide Intermediate P29 Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Semaglutide Intermediate P29 Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Semaglutide Intermediate P29 Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Semaglutide Intermediate P29 Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Semaglutide Intermediate P29 Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Semaglutide Intermediate P29 Revenue million Forecast, by Type 2019 & 2032

- Table 24: Global Semaglutide Intermediate P29 Volume K Forecast, by Type 2019 & 2032

- Table 25: Global Semaglutide Intermediate P29 Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Semaglutide Intermediate P29 Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Semaglutide Intermediate P29 Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Semaglutide Intermediate P29 Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Semaglutide Intermediate P29 Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Semaglutide Intermediate P29 Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Semaglutide Intermediate P29 Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Semaglutide Intermediate P29 Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Semaglutide Intermediate P29 Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Semaglutide Intermediate P29 Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Semaglutide Intermediate P29 Revenue million Forecast, by Type 2019 & 2032

- Table 36: Global Semaglutide Intermediate P29 Volume K Forecast, by Type 2019 & 2032

- Table 37: Global Semaglutide Intermediate P29 Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Semaglutide Intermediate P29 Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Semaglutide Intermediate P29 Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Semaglutide Intermediate P29 Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Semaglutide Intermediate P29 Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Semaglutide Intermediate P29 Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Semaglutide Intermediate P29 Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Semaglutide Intermediate P29 Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Semaglutide Intermediate P29 Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Semaglutide Intermediate P29 Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Semaglutide Intermediate P29 Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Semaglutide Intermediate P29 Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Semaglutide Intermediate P29 Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Semaglutide Intermediate P29 Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Semaglutide Intermediate P29 Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Semaglutide Intermediate P29 Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Semaglutide Intermediate P29 Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Semaglutide Intermediate P29 Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Semaglutide Intermediate P29 Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Semaglutide Intermediate P29 Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Semaglutide Intermediate P29 Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Semaglutide Intermediate P29 Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Semaglutide Intermediate P29 Revenue million Forecast, by Type 2019 & 2032

- Table 60: Global Semaglutide Intermediate P29 Volume K Forecast, by Type 2019 & 2032

- Table 61: Global Semaglutide Intermediate P29 Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Semaglutide Intermediate P29 Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Semaglutide Intermediate P29 Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Semaglutide Intermediate P29 Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Semaglutide Intermediate P29 Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Semaglutide Intermediate P29 Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Semaglutide Intermediate P29 Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Semaglutide Intermediate P29 Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Semaglutide Intermediate P29 Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Semaglutide Intermediate P29 Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Semaglutide Intermediate P29 Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Semaglutide Intermediate P29 Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Semaglutide Intermediate P29 Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Semaglutide Intermediate P29 Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Semaglutide Intermediate P29 Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Semaglutide Intermediate P29 Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Semaglutide Intermediate P29 Revenue million Forecast, by Type 2019 & 2032

- Table 78: Global Semaglutide Intermediate P29 Volume K Forecast, by Type 2019 & 2032

- Table 79: Global Semaglutide Intermediate P29 Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Semaglutide Intermediate P29 Volume K Forecast, by Country 2019 & 2032

- Table 81: China Semaglutide Intermediate P29 Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Semaglutide Intermediate P29 Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Semaglutide Intermediate P29 Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Semaglutide Intermediate P29 Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Semaglutide Intermediate P29 Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Semaglutide Intermediate P29 Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Semaglutide Intermediate P29 Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Semaglutide Intermediate P29 Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Semaglutide Intermediate P29 Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Semaglutide Intermediate P29 Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Semaglutide Intermediate P29 Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Semaglutide Intermediate P29 Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Semaglutide Intermediate P29 Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Semaglutide Intermediate P29 Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Semaglutide Intermediate P29?

The projected CAGR is approximately 9.9%.

2. Which companies are prominent players in the Semaglutide Intermediate P29?

Key companies in the market include GENE BIOCON, Abydos Scientific, PEG-BIO Biopharm Co, Zhejiang Lepu Pharmaceutical Co, Simson Pharma Limited, BOC Sciences, Changzhou Xuanming Pharmaceutical Technology, SynZeal research.

3. What are the main segments of the Semaglutide Intermediate P29?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 351 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Semaglutide Intermediate P29," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Semaglutide Intermediate P29 report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Semaglutide Intermediate P29?

To stay informed about further developments, trends, and reports in the Semaglutide Intermediate P29, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence