Key Insights

The UK Anti-Money Laundering (AML) market is poised for substantial expansion, driven by heightened regulatory enforcement, evolving financial crime tactics, and digital transformation. Projections indicate a market size of $4.13 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 17.8% through 2033. This robust growth is underpinned by several critical factors. Foremost, the UK's intensified efforts to combat financial crime, including stricter AML regulations and increased enforcement, are creating significant demand for advanced AML solutions. Secondly, the proliferation of digital financial technologies and an increase in cross-border transactions have expanded opportunities for money laundering, necessitating sophisticated AML technologies. Finally, the imperative for financial institutions to adhere to international AML standards and avoid substantial penalties is a key driver of market growth.

UK Anti Money Laundering Market Market Size (In Billion)

The UK AML market is segmented by solution type, including transaction monitoring, customer due diligence, and sanctions screening. Deployment models encompass on-premise and cloud solutions, serving end-users such as banks, financial institutions, and government agencies. Leading industry players are actively engaged in research and development to enhance their offerings and secure market share. While the increasing complexity of AML regulations presents a challenge, the market's growth trajectory remains positive, highlighting opportunities for innovation, particularly in AI-powered AML solutions and advanced data analytics. The future of this market will also be shaped by evolving regulatory frameworks and the ongoing need for financial institutions to maintain comprehensive AML compliance programs to mitigate risks and safeguard their reputation. The UK's unwavering commitment to combating financial crime ensures sustained growth in this vital market.

UK Anti Money Laundering Market Company Market Share

UK Anti-Money Laundering (AML) Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the UK Anti-Money Laundering market, offering invaluable insights for stakeholders, investors, and industry professionals. The study covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. The report includes market sizing, segmentation, competitive landscape analysis, and future growth projections, offering actionable intelligence to navigate the complexities of this crucial sector. The market is expected to reach £XX Million by 2033, growing at a CAGR of XX%.

UK Anti-Money Laundering Market Concentration & Innovation

The UK AML market demonstrates a moderately concentrated landscape, with several key players holding significant market share. However, a wave of innovation is disrupting the traditional approach to AML compliance. Several factors contribute to this dynamic environment.

Market Concentration: While precise market share figures for individual companies are commercially sensitive, key players like NICE Actimize, LexisNexis Risk Solutions, and Quantexa hold substantial positions. The market is not dominated by a single entity, indicating opportunities for both established players and new entrants. The total market value is estimated to be £XX Million in 2025. M&A activity has been moderate, with deal values averaging around £XX Million in recent years, reflecting the strategic importance of acquiring specialized technologies and expanding market reach.

Innovation Drivers: The increasing sophistication of financial crime necessitates constant innovation. Artificial Intelligence (AI), Machine Learning (ML), and advanced analytics are driving the development of more effective AML solutions. Regulatory pressures are also a key driver, pushing companies to adopt more robust and efficient technologies. Regulators are pushing for more real time monitoring.

Regulatory Frameworks: The UK maintains a robust regulatory framework for AML compliance, shaped by directives from bodies like the Financial Conduct Authority (FCA) and the National Crime Agency (NCA). These regulations necessitate continuous updates and improvements to AML systems, fostering innovation.

Product Substitutes: While dedicated AML solutions dominate the market, alternative technologies, such as enhanced data analytics platforms and identity verification services, offer some degree of substitution. However, the specialized nature of AML compliance largely limits the extent of this substitution.

End-User Trends: Increased demand for streamlined, automated, and cost-effective AML solutions is shaping market trends. This is driven by the increasing volume of transactions and the need for efficient compliance processes.

M&A Activities: Strategic acquisitions are playing a significant role in market consolidation. Companies are seeking to expand their product portfolios, enhance their technological capabilities, and gain access to new customer bases through strategic mergers.

UK Anti-Money Laundering Market Industry Trends & Insights

The UK AML market is experiencing robust growth, driven by several key factors. Technological advancements, particularly in AI and ML, are revolutionizing AML practices, enabling more effective detection of suspicious activities. This is reflected in a significant rise in the adoption of RegTech solutions.

The market demonstrates a growing preference for cloud-based solutions and API-driven integrations, offering increased scalability and flexibility for businesses of all sizes. The rising volume and complexity of financial transactions, coupled with evolving criminal methodologies, necessitate more sophisticated AML solutions. Furthermore, increasing regulatory scrutiny and stricter penalties for non-compliance are driving market expansion. The market is estimated to grow at a Compound Annual Growth Rate (CAGR) of XX% during the forecast period. Market penetration is currently at approximately XX%, indicating significant potential for future growth, especially amongst smaller and medium sized enterprises. The increasing interconnectedness of global financial systems also contributes significantly to market growth as compliance becomes increasingly complex.

Dominant Markets & Segments in UK Anti-Money Laundering Market

The UK represents a dominant market within the European AML landscape, driven by its significant financial sector and strong regulatory environment.

Key Drivers for UK Dominance:

- Robust Regulatory Framework: Stringent AML regulations and significant penalties for non-compliance make the UK a priority market for AML solutions.

- Large Financial Sector: The UK's thriving financial sector generates a high volume of transactions, requiring sophisticated AML measures.

- Technological Advancement: The UK is a hub for FinTech innovation, driving the development and adoption of advanced AML technologies.

- Skilled Workforce: A strong talent pool contributes to the development and implementation of effective AML solutions.

Dominance Analysis: The UK AML market holds the largest share of the European AML market, primarily due to the factors outlined above. Its advanced regulatory framework and robust financial sector create a high demand for sophisticated AML solutions, resulting in substantial market revenue. This dominance is expected to continue in the forecast period.

UK Anti-Money Laundering Market Product Developments

Recent product developments in the UK AML market emphasize advancements in AI, machine learning, and data analytics. These technologies allow for more accurate risk assessment, automated transaction monitoring, and real-time alerts. New solutions are increasingly integrated with existing systems, providing seamless compliance workflows. The focus is on improving efficiency and reducing false positives while enhancing the overall accuracy of AML detection systems. The user experience is also becoming increasingly important, with intuitive dashboards and reporting tools becoming standard features.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation of the UK Anti-Money Laundering (AML) market, analyzing key trends and growth opportunities across various dimensions. The market is segmented by deployment mode (cloud, on-premises, hybrid), solution type (transaction monitoring, KYC/KYB, sanctions screening, customer due diligence (CDD), risk assessment), organization size (small, medium, large enterprises, and public sector), and end-user industry (banking, finance, insurance, fintech, gaming, legal, real estate, etc.). Each segment's unique characteristics, growth drivers, and competitive landscape are meticulously examined. For instance, the cloud-based deployment model is experiencing significant traction due to its scalability, cost-effectiveness, and enhanced accessibility. Transaction monitoring remains a dominant segment, reflecting the increasing volume and complexity of financial transactions necessitating continuous oversight. Furthermore, the report analyzes the competitive dynamics within each segment, highlighting the presence of both established market leaders and innovative niche players.

Key Drivers of UK Anti Money Laundering Market Growth

Several key factors are propelling the growth of the UK AML market:

- Stringent Regulatory Compliance and Increased Penalties: The UK's robust and evolving regulatory framework, including the Money Laundering Regulations 2017 and the Financial Conduct Authority (FCA) guidelines, necessitates robust AML compliance. The substantial penalties for non-compliance incentivize businesses to invest in sophisticated AML solutions.

- Technological Advancements: The integration of Artificial Intelligence (AI), Machine Learning (ML), and advanced analytics is revolutionizing AML technology, enabling more accurate, efficient, and proactive detection of suspicious activities. This includes improved anomaly detection, real-time monitoring, and automated reporting functionalities.

- Rise in Sophisticated Financial Crime: The increasing sophistication and volume of money laundering, terrorist financing, and other financial crimes necessitate a continuous evolution of AML strategies and technologies to combat these threats effectively.

- Cross-border Transactions and Global Collaboration: The global nature of financial transactions necessitates cross-border collaboration and information sharing to prevent criminals from exploiting jurisdictional gaps. This drives demand for AML solutions that facilitate seamless data exchange and regulatory compliance across borders.

- Growing Awareness of AML Risks: Increased awareness among businesses and consumers of the risks associated with money laundering and financial crime is driving proactive investment in robust AML measures.

Challenges in the UK Anti-Money Laundering Market Sector

The UK AML market faces several challenges:

- Data Privacy Concerns: Balancing the need for effective AML monitoring with strict data privacy regulations poses a significant challenge. Compliance with GDPR and other data protection laws necessitates careful handling of sensitive customer information.

- Integration Complexity: Integrating AML solutions with existing IT infrastructure can be complex and costly, especially for smaller organizations.

- Keeping Pace with Evolving Threats: The constant evolution of financial crime techniques requires continuous updates and improvements to AML systems, presenting an ongoing challenge for businesses and vendors alike. This leads to ongoing expenditure.

- Talent Shortages: Finding and retaining skilled professionals with expertise in AML and related technologies poses a significant challenge for many organizations.

Emerging Opportunities in UK Anti Money Laundering Market

Several emerging opportunities are shaping the UK AML market:

- RegTech Innovation: The continuous development of innovative RegTech solutions offers enhanced efficiency, accuracy, and cost-effectiveness in AML compliance.

- AI-Powered Solutions: AI-driven solutions provide advanced fraud detection capabilities and improve the accuracy of risk assessments.

- Blockchain Technology: Blockchain's immutability and transparency could enhance the traceability of transactions, improving AML efforts.

- Increased focus on KYC/KYB: Digital identity verification technologies are gaining traction, streamlining the KYC/KYB process and reducing manual intervention.

Leading Players in the UK Anti-Money Laundering Market Market

- NICE Actimize

- Trulioo

- Quantexa

- Encompass

- BAE Systems

- LexisNexis Risk Solutions

- Passfort

- Refinitive

- Sanctionscanner

- FullCircl

List Not Exhaustive

Key Developments in UK Anti Money Laundering Market Industry

- April 2022: NICE Actimize partnered with Deutsche Telekom Global Business to deliver CXone solutions across Europe, enhancing AML capabilities within customer experience management.

- January 2022: PassFort partnered with Trulioo to offer streamlined digital KYC/KYB processes for regulated enterprises, improving the efficiency of AML compliance.

Strategic Outlook for UK Anti Money Laundering Market Market

The UK AML market is projected to experience sustained growth, fueled by the interplay of technological innovation, heightened regulatory scrutiny, and the evolving tactics of financial criminals. The strategic adoption of AI and ML will further refine AML systems, enhancing accuracy, reducing false positives, and improving overall efficiency. The market is expected to witness strategic consolidation through mergers and acquisitions, as organizations strive to expand their service offerings and market reach. A key focus will be on developing innovative solutions that prioritize data privacy while streamlining compliance workflows. The ongoing demand for secure, user-friendly, and cost-effective AML solutions will underpin the long-term expansion of this vital sector. Furthermore, the increasing emphasis on RegTech and SupTech solutions will play a crucial role in shaping the future of the UK AML market.

UK Anti Money Laundering Market Segmentation

-

1. Solutions

- 1.1. Know Your Customer (KYC) Systems

- 1.2. Compliance Reporting

- 1.3. Transactions Monitoring

- 1.4. Auditing

-

2. Type

- 2.1. Softwares

- 2.2. Solutions

-

3. Deployment Model

- 3.1. On-Cloud

- 3.2. On-Premise

-

4. End-User

- 4.1. BFSI's

- 4.2. Government

- 4.3. IT & Telecom

- 4.4. Others

UK Anti Money Laundering Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

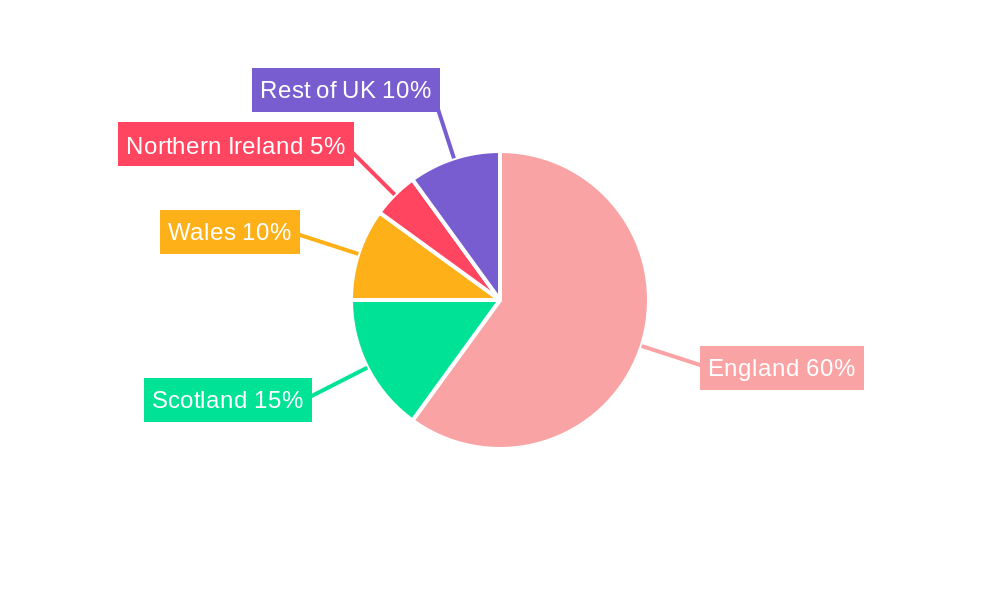

UK Anti Money Laundering Market Regional Market Share

Geographic Coverage of UK Anti Money Laundering Market

UK Anti Money Laundering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. UK Ranks in Top for Global Money Laundering

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Anti Money Laundering Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Solutions

- 5.1.1. Know Your Customer (KYC) Systems

- 5.1.2. Compliance Reporting

- 5.1.3. Transactions Monitoring

- 5.1.4. Auditing

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Softwares

- 5.2.2. Solutions

- 5.3. Market Analysis, Insights and Forecast - by Deployment Model

- 5.3.1. On-Cloud

- 5.3.2. On-Premise

- 5.4. Market Analysis, Insights and Forecast - by End-User

- 5.4.1. BFSI's

- 5.4.2. Government

- 5.4.3. IT & Telecom

- 5.4.4. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Solutions

- 6. North America UK Anti Money Laundering Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Solutions

- 6.1.1. Know Your Customer (KYC) Systems

- 6.1.2. Compliance Reporting

- 6.1.3. Transactions Monitoring

- 6.1.4. Auditing

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Softwares

- 6.2.2. Solutions

- 6.3. Market Analysis, Insights and Forecast - by Deployment Model

- 6.3.1. On-Cloud

- 6.3.2. On-Premise

- 6.4. Market Analysis, Insights and Forecast - by End-User

- 6.4.1. BFSI's

- 6.4.2. Government

- 6.4.3. IT & Telecom

- 6.4.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Solutions

- 7. South America UK Anti Money Laundering Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Solutions

- 7.1.1. Know Your Customer (KYC) Systems

- 7.1.2. Compliance Reporting

- 7.1.3. Transactions Monitoring

- 7.1.4. Auditing

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Softwares

- 7.2.2. Solutions

- 7.3. Market Analysis, Insights and Forecast - by Deployment Model

- 7.3.1. On-Cloud

- 7.3.2. On-Premise

- 7.4. Market Analysis, Insights and Forecast - by End-User

- 7.4.1. BFSI's

- 7.4.2. Government

- 7.4.3. IT & Telecom

- 7.4.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Solutions

- 8. Europe UK Anti Money Laundering Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Solutions

- 8.1.1. Know Your Customer (KYC) Systems

- 8.1.2. Compliance Reporting

- 8.1.3. Transactions Monitoring

- 8.1.4. Auditing

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Softwares

- 8.2.2. Solutions

- 8.3. Market Analysis, Insights and Forecast - by Deployment Model

- 8.3.1. On-Cloud

- 8.3.2. On-Premise

- 8.4. Market Analysis, Insights and Forecast - by End-User

- 8.4.1. BFSI's

- 8.4.2. Government

- 8.4.3. IT & Telecom

- 8.4.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Solutions

- 9. Middle East & Africa UK Anti Money Laundering Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Solutions

- 9.1.1. Know Your Customer (KYC) Systems

- 9.1.2. Compliance Reporting

- 9.1.3. Transactions Monitoring

- 9.1.4. Auditing

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Softwares

- 9.2.2. Solutions

- 9.3. Market Analysis, Insights and Forecast - by Deployment Model

- 9.3.1. On-Cloud

- 9.3.2. On-Premise

- 9.4. Market Analysis, Insights and Forecast - by End-User

- 9.4.1. BFSI's

- 9.4.2. Government

- 9.4.3. IT & Telecom

- 9.4.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Solutions

- 10. Asia Pacific UK Anti Money Laundering Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Solutions

- 10.1.1. Know Your Customer (KYC) Systems

- 10.1.2. Compliance Reporting

- 10.1.3. Transactions Monitoring

- 10.1.4. Auditing

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Softwares

- 10.2.2. Solutions

- 10.3. Market Analysis, Insights and Forecast - by Deployment Model

- 10.3.1. On-Cloud

- 10.3.2. On-Premise

- 10.4. Market Analysis, Insights and Forecast - by End-User

- 10.4.1. BFSI's

- 10.4.2. Government

- 10.4.3. IT & Telecom

- 10.4.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Solutions

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 NICE Actimize

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Trulioo

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Quantexa

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Encompass

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BAE System

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 LexisNexis Risk Solutions

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Passfort

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Refinitive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sanctionscanner

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 FullCircl**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 NICE Actimize

List of Figures

- Figure 1: Global UK Anti Money Laundering Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America UK Anti Money Laundering Market Revenue (billion), by Solutions 2025 & 2033

- Figure 3: North America UK Anti Money Laundering Market Revenue Share (%), by Solutions 2025 & 2033

- Figure 4: North America UK Anti Money Laundering Market Revenue (billion), by Type 2025 & 2033

- Figure 5: North America UK Anti Money Laundering Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America UK Anti Money Laundering Market Revenue (billion), by Deployment Model 2025 & 2033

- Figure 7: North America UK Anti Money Laundering Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 8: North America UK Anti Money Laundering Market Revenue (billion), by End-User 2025 & 2033

- Figure 9: North America UK Anti Money Laundering Market Revenue Share (%), by End-User 2025 & 2033

- Figure 10: North America UK Anti Money Laundering Market Revenue (billion), by Country 2025 & 2033

- Figure 11: North America UK Anti Money Laundering Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America UK Anti Money Laundering Market Revenue (billion), by Solutions 2025 & 2033

- Figure 13: South America UK Anti Money Laundering Market Revenue Share (%), by Solutions 2025 & 2033

- Figure 14: South America UK Anti Money Laundering Market Revenue (billion), by Type 2025 & 2033

- Figure 15: South America UK Anti Money Laundering Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: South America UK Anti Money Laundering Market Revenue (billion), by Deployment Model 2025 & 2033

- Figure 17: South America UK Anti Money Laundering Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 18: South America UK Anti Money Laundering Market Revenue (billion), by End-User 2025 & 2033

- Figure 19: South America UK Anti Money Laundering Market Revenue Share (%), by End-User 2025 & 2033

- Figure 20: South America UK Anti Money Laundering Market Revenue (billion), by Country 2025 & 2033

- Figure 21: South America UK Anti Money Laundering Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe UK Anti Money Laundering Market Revenue (billion), by Solutions 2025 & 2033

- Figure 23: Europe UK Anti Money Laundering Market Revenue Share (%), by Solutions 2025 & 2033

- Figure 24: Europe UK Anti Money Laundering Market Revenue (billion), by Type 2025 & 2033

- Figure 25: Europe UK Anti Money Laundering Market Revenue Share (%), by Type 2025 & 2033

- Figure 26: Europe UK Anti Money Laundering Market Revenue (billion), by Deployment Model 2025 & 2033

- Figure 27: Europe UK Anti Money Laundering Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 28: Europe UK Anti Money Laundering Market Revenue (billion), by End-User 2025 & 2033

- Figure 29: Europe UK Anti Money Laundering Market Revenue Share (%), by End-User 2025 & 2033

- Figure 30: Europe UK Anti Money Laundering Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Europe UK Anti Money Laundering Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa UK Anti Money Laundering Market Revenue (billion), by Solutions 2025 & 2033

- Figure 33: Middle East & Africa UK Anti Money Laundering Market Revenue Share (%), by Solutions 2025 & 2033

- Figure 34: Middle East & Africa UK Anti Money Laundering Market Revenue (billion), by Type 2025 & 2033

- Figure 35: Middle East & Africa UK Anti Money Laundering Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East & Africa UK Anti Money Laundering Market Revenue (billion), by Deployment Model 2025 & 2033

- Figure 37: Middle East & Africa UK Anti Money Laundering Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 38: Middle East & Africa UK Anti Money Laundering Market Revenue (billion), by End-User 2025 & 2033

- Figure 39: Middle East & Africa UK Anti Money Laundering Market Revenue Share (%), by End-User 2025 & 2033

- Figure 40: Middle East & Africa UK Anti Money Laundering Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East & Africa UK Anti Money Laundering Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific UK Anti Money Laundering Market Revenue (billion), by Solutions 2025 & 2033

- Figure 43: Asia Pacific UK Anti Money Laundering Market Revenue Share (%), by Solutions 2025 & 2033

- Figure 44: Asia Pacific UK Anti Money Laundering Market Revenue (billion), by Type 2025 & 2033

- Figure 45: Asia Pacific UK Anti Money Laundering Market Revenue Share (%), by Type 2025 & 2033

- Figure 46: Asia Pacific UK Anti Money Laundering Market Revenue (billion), by Deployment Model 2025 & 2033

- Figure 47: Asia Pacific UK Anti Money Laundering Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 48: Asia Pacific UK Anti Money Laundering Market Revenue (billion), by End-User 2025 & 2033

- Figure 49: Asia Pacific UK Anti Money Laundering Market Revenue Share (%), by End-User 2025 & 2033

- Figure 50: Asia Pacific UK Anti Money Laundering Market Revenue (billion), by Country 2025 & 2033

- Figure 51: Asia Pacific UK Anti Money Laundering Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Anti Money Laundering Market Revenue billion Forecast, by Solutions 2020 & 2033

- Table 2: Global UK Anti Money Laundering Market Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Global UK Anti Money Laundering Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 4: Global UK Anti Money Laundering Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 5: Global UK Anti Money Laundering Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global UK Anti Money Laundering Market Revenue billion Forecast, by Solutions 2020 & 2033

- Table 7: Global UK Anti Money Laundering Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global UK Anti Money Laundering Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 9: Global UK Anti Money Laundering Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 10: Global UK Anti Money Laundering Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global UK Anti Money Laundering Market Revenue billion Forecast, by Solutions 2020 & 2033

- Table 15: Global UK Anti Money Laundering Market Revenue billion Forecast, by Type 2020 & 2033

- Table 16: Global UK Anti Money Laundering Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 17: Global UK Anti Money Laundering Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 18: Global UK Anti Money Laundering Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Brazil UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Argentina UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global UK Anti Money Laundering Market Revenue billion Forecast, by Solutions 2020 & 2033

- Table 23: Global UK Anti Money Laundering Market Revenue billion Forecast, by Type 2020 & 2033

- Table 24: Global UK Anti Money Laundering Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 25: Global UK Anti Money Laundering Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 26: Global UK Anti Money Laundering Market Revenue billion Forecast, by Country 2020 & 2033

- Table 27: United Kingdom UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Germany UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: France UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Italy UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Spain UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Russia UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Benelux UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Nordics UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Global UK Anti Money Laundering Market Revenue billion Forecast, by Solutions 2020 & 2033

- Table 37: Global UK Anti Money Laundering Market Revenue billion Forecast, by Type 2020 & 2033

- Table 38: Global UK Anti Money Laundering Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 39: Global UK Anti Money Laundering Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 40: Global UK Anti Money Laundering Market Revenue billion Forecast, by Country 2020 & 2033

- Table 41: Turkey UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Israel UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: GCC UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: North Africa UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: South Africa UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: Global UK Anti Money Laundering Market Revenue billion Forecast, by Solutions 2020 & 2033

- Table 48: Global UK Anti Money Laundering Market Revenue billion Forecast, by Type 2020 & 2033

- Table 49: Global UK Anti Money Laundering Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 50: Global UK Anti Money Laundering Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 51: Global UK Anti Money Laundering Market Revenue billion Forecast, by Country 2020 & 2033

- Table 52: China UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 53: India UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Japan UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 55: South Korea UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: ASEAN UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 57: Oceania UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Anti Money Laundering Market?

The projected CAGR is approximately 17.8%.

2. Which companies are prominent players in the UK Anti Money Laundering Market?

Key companies in the market include NICE Actimize, Trulioo, Quantexa, Encompass, BAE System, LexisNexis Risk Solutions, Passfort, Refinitive, Sanctionscanner, FullCircl**List Not Exhaustive.

3. What are the main segments of the UK Anti Money Laundering Market?

The market segments include Solutions, Type, Deployment Model, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.13 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

UK Ranks in Top for Global Money Laundering.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In April 2022, NICE established cooperation with Deutsche Telekom Global Business, a subsidiary of Deutsche Telekom that provides telecommunications and connectivity services to businesses of all kinds, including the government. Deutsche Telekom Global Business is now delivering the CXone portfolio of industry-leading digital and agent-assisted CX solutions across Europe as part of the partnership.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Anti Money Laundering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Anti Money Laundering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Anti Money Laundering Market?

To stay informed about further developments, trends, and reports in the UK Anti Money Laundering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence