Key Insights

The US venture capital (VC) market, valued at $1.30 billion in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 8.25% from 2025 to 2033. This expansion is fueled by several key factors. The increasing number of technology startups, particularly in sectors like artificial intelligence, biotechnology, and fintech, attracts significant VC investment. Furthermore, a supportive regulatory environment and the availability of abundant capital from both domestic and international investors contribute to the market's dynamism. The presence of prominent VC firms like Intel Capital, Tiger Global Management, Bessemer Venture Partners, Kleiner Perkins, New Enterprise Associates (NEA), Accel Partners, Sequoia Capital, and Khosla Ventures underscores the market's maturity and competitiveness. However, macroeconomic conditions, such as interest rate hikes and potential economic downturns, could pose challenges, potentially leading to reduced investment activity in certain sectors. Nevertheless, the long-term outlook remains positive, driven by ongoing technological advancements and the continued emergence of innovative companies seeking funding.

US Venture Capital Market Market Size (In Billion)

Despite potential macroeconomic headwinds, the US VC market is expected to demonstrate resilience due to its inherent dynamism and the long-term growth potential of the technology sector. The concentration of top-tier VC firms in the US attracts global capital, solidifying the nation's position as a leading hub for venture investment. While specific segment breakdowns are unavailable, we can anticipate growth across various sectors, reflecting the diversification of innovative businesses seeking funding. The historical period (2019-2024) likely saw considerable fluctuations, influenced by factors like the COVID-19 pandemic and its impact on market sentiment and technological adoption. Analyzing the historical data (assuming it includes details beyond the provided summary) would offer deeper insights into the market's cyclical behavior and better inform future projections. This analysis underscores the need for a comprehensive understanding of both the macro-economic environment and the micro-level trends within specific technology sectors to accurately predict future market performance.

US Venture Capital Market Company Market Share

US Venture Capital Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the US Venture Capital market, covering historical data (2019-2024), the base year (2025), and a forecast period (2025-2033). It delves into market concentration, innovation, industry trends, key players, and emerging opportunities, offering actionable insights for stakeholders. The report uses USD Million for all monetary values.

US Venture Capital Market Market Concentration & Innovation

This section analyzes the competitive landscape of the US Venture Capital market, evaluating market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities. We examine the market share of leading firms and analyze the value of significant M&A deals.

- Market Concentration: The US Venture Capital market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share. However, a vibrant ecosystem of smaller, specialized firms also exists. Data on precise market share will be included in the full report. For example, Sequoia Capital and Accel Partners consistently rank among the top performers.

- Innovation Drivers: Continuous technological advancements, particularly in areas like Artificial Intelligence (AI), cloud computing, and biotechnology, drive significant innovation within the venture capital ecosystem. These innovations create new investment opportunities and reshape existing market segments.

- Regulatory Framework: Regulatory changes, including those related to data privacy and securities regulations, impact investment strategies and operational procedures within the industry.

- M&A Activities: The US Venture Capital market witnesses significant M&A activity. The value of these deals varies considerably, ranging from several million to billions, depending on the size and stage of the acquired companies. Detailed analysis of recent M&A deals and their impacts is presented in the full report. For example, the March 2022 acquisition of Granulate Cloud Solutions by Intel Corporation exemplifies strategic acquisitions aimed at enhancing technological capabilities.

- Product Substitutes & End-User Trends: The emergence of alternative funding sources, such as crowdfunding and angel investors, presents a degree of substitution, while end-user trends toward specific technologies influence investment decisions.

US Venture Capital Market Industry Trends & Insights

This section explores key trends shaping the US Venture Capital market, including market growth drivers, technological disruptions, evolving consumer preferences, and the competitive dynamics between firms. We will present the Compound Annual Growth Rate (CAGR) and market penetration metrics for key segments. The analysis will incorporate recent events such as NEA's USD 6.2 Billion fund closure in January 2023, showcasing the ongoing growth and expansion within the industry. Detailed analysis of CAGR and market penetration will be provided in the full report; predicted values are xx% and xx%, respectively.

Dominant Markets & Segments in US Venture Capital Market

The US Venture Capital market is a dynamic landscape, with certain regions, sectors, and investment stages consistently attracting significant capital. This section analyzes the leading players and the key factors driving their dominance.

- Key Drivers of Dominance:

- Favorable Regulatory Environment and Tax Incentives: Government policies actively promoting entrepreneurship and innovation, coupled with attractive tax incentives for investors, significantly contribute to a thriving VC ecosystem. This includes initiatives supporting R&D, early-stage funding, and specific high-growth sectors.

- Robust Infrastructure and Access to Talent: Access to high-speed internet, cutting-edge research facilities, and a pool of skilled engineers, scientists, and business professionals are crucial for attracting both startups and investors. Regions with strong universities and technical schools often benefit greatly.

- Strong Network Effects and Ecosystem Support: A vibrant network of incubators, accelerators, angel investors, and experienced mentors fosters collaboration and creates a fertile ground for innovation. The concentration of such resources in established hubs like Silicon Valley, New York, and Boston continues to fuel their dominance, although other regions are rapidly developing.

- Access to Capital: The availability of both early-stage and late-stage funding is a critical factor. A strong presence of institutional investors, including pension funds and sovereign wealth funds, deepens the capital pool available to promising ventures.

A detailed breakdown of market share by region, sector, and investment stage is provided in the full report, including detailed market sizing and growth projections.

US Venture Capital Market Product Developments

This section examines product innovations, applications, and competitive advantages within the US Venture Capital market. Recent technological trends, particularly in areas such as AI and machine learning, are significantly impacting the development of new products and services. These developments are enhancing investment analysis, portfolio management, and deal sourcing processes. The adoption of these new technologies is creating a competitive advantage for firms that can effectively leverage them.

Report Scope & Segmentation Analysis

This report segments the US Venture Capital market based on various parameters including investment stage (seed, early-stage, growth, late-stage), industry sector (technology, healthcare, energy, etc.), and geographic location. Each segment will be analyzed in terms of market size, growth projections, and competitive dynamics. Growth projections for each segment vary, with technology-focused segments demonstrating higher projected growth compared to others. Precise figures are available in the complete report.

Key Drivers of US Venture Capital Market Growth

Several factors drive the growth of the US Venture Capital market, including:

- Technological advancements: Innovation in areas like AI, biotechnology, and sustainable energy creates numerous investment opportunities.

- Favorable economic conditions: A strong economy fuels entrepreneurship and attracts venture capital investment.

- Supportive regulatory environment: Government initiatives and policies that encourage entrepreneurship contribute to market expansion.

Challenges in the US Venture Capital Market Sector

The US Venture Capital market faces several challenges:

- Increased competition: A rise in the number of venture capital firms intensifies competition for promising investment opportunities.

- Economic downturns: Recessions or market volatility can reduce investor confidence and lead to decreased investment activity. This can be measured in terms of a reduced number of deals and lower investment amounts.

- Regulatory uncertainties: Changes in regulations can create uncertainty and impact investment decisions.

Emerging Opportunities in US Venture Capital Market

Several emerging opportunities exist within the US Venture Capital market:

- Investing in disruptive technologies: Areas like AI, quantum computing, and sustainable energy offer substantial growth potential.

- Expansion into new geographic markets: Venture capital firms are increasingly exploring investment opportunities beyond traditional hubs like Silicon Valley.

- Focus on social impact investing: Growing interest in investments aligned with environmental, social, and governance (ESG) factors is creating new opportunities.

Leading Players in the US Venture Capital Market Market

Key Developments in US Venture Capital Market Industry

- January 2023: NEA (New Enterprise Associates) closed on approximately USD 6.2 billion across two funds, expanding its assets under management to over USD 25 billion. This reflects a strategic move to cater to early-stage and growth-stage investment opportunities.

- March 2022: Intel Corporation acquired Granulate Cloud Solutions, enhancing its capabilities in cloud optimization software.

Strategic Outlook for US Venture Capital Market Market

The US Venture Capital market is poised for continued growth, driven by technological advancements, favorable economic conditions, and a supportive regulatory environment. Emerging technologies and expansion into new markets will present significant opportunities for venture capital firms. The strategic focus will be on identifying and investing in disruptive technologies with high growth potential, fostering innovation, and adapting to evolving market dynamics. The report projects continued strong growth throughout the forecast period (2025-2033), with substantial investment flowing into promising startups across various sectors.

US Venture Capital Market Segmentation

-

1. Industry Type

- 1.1. Banking & Financial Services

- 1.2. Healthcare

- 1.3. Telecommunications

- 1.4. Government Agencies

- 1.5. Other Industries

-

2. Startup Stage

- 2.1. Seed Stage

- 2.2. First Stage

- 2.3. Expansion Stage

- 2.4. Bridge Stage

-

3. Major States

- 3.1. California

- 3.2. New York

- 3.3. Massachusettes

- 3.4. Washington

- 3.5. Others

US Venture Capital Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

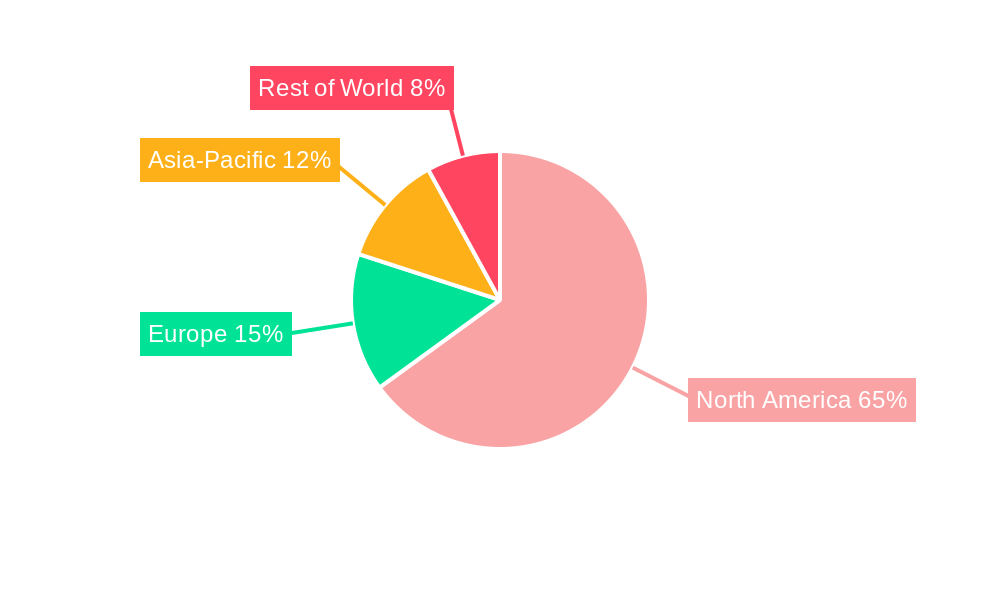

US Venture Capital Market Regional Market Share

Geographic Coverage of US Venture Capital Market

US Venture Capital Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Healthtech trends toward record-breaking year

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Venture Capital Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Industry Type

- 5.1.1. Banking & Financial Services

- 5.1.2. Healthcare

- 5.1.3. Telecommunications

- 5.1.4. Government Agencies

- 5.1.5. Other Industries

- 5.2. Market Analysis, Insights and Forecast - by Startup Stage

- 5.2.1. Seed Stage

- 5.2.2. First Stage

- 5.2.3. Expansion Stage

- 5.2.4. Bridge Stage

- 5.3. Market Analysis, Insights and Forecast - by Major States

- 5.3.1. California

- 5.3.2. New York

- 5.3.3. Massachusettes

- 5.3.4. Washington

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Industry Type

- 6. North America US Venture Capital Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Industry Type

- 6.1.1. Banking & Financial Services

- 6.1.2. Healthcare

- 6.1.3. Telecommunications

- 6.1.4. Government Agencies

- 6.1.5. Other Industries

- 6.2. Market Analysis, Insights and Forecast - by Startup Stage

- 6.2.1. Seed Stage

- 6.2.2. First Stage

- 6.2.3. Expansion Stage

- 6.2.4. Bridge Stage

- 6.3. Market Analysis, Insights and Forecast - by Major States

- 6.3.1. California

- 6.3.2. New York

- 6.3.3. Massachusettes

- 6.3.4. Washington

- 6.3.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Industry Type

- 7. South America US Venture Capital Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Industry Type

- 7.1.1. Banking & Financial Services

- 7.1.2. Healthcare

- 7.1.3. Telecommunications

- 7.1.4. Government Agencies

- 7.1.5. Other Industries

- 7.2. Market Analysis, Insights and Forecast - by Startup Stage

- 7.2.1. Seed Stage

- 7.2.2. First Stage

- 7.2.3. Expansion Stage

- 7.2.4. Bridge Stage

- 7.3. Market Analysis, Insights and Forecast - by Major States

- 7.3.1. California

- 7.3.2. New York

- 7.3.3. Massachusettes

- 7.3.4. Washington

- 7.3.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Industry Type

- 8. Europe US Venture Capital Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Industry Type

- 8.1.1. Banking & Financial Services

- 8.1.2. Healthcare

- 8.1.3. Telecommunications

- 8.1.4. Government Agencies

- 8.1.5. Other Industries

- 8.2. Market Analysis, Insights and Forecast - by Startup Stage

- 8.2.1. Seed Stage

- 8.2.2. First Stage

- 8.2.3. Expansion Stage

- 8.2.4. Bridge Stage

- 8.3. Market Analysis, Insights and Forecast - by Major States

- 8.3.1. California

- 8.3.2. New York

- 8.3.3. Massachusettes

- 8.3.4. Washington

- 8.3.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Industry Type

- 9. Middle East & Africa US Venture Capital Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Industry Type

- 9.1.1. Banking & Financial Services

- 9.1.2. Healthcare

- 9.1.3. Telecommunications

- 9.1.4. Government Agencies

- 9.1.5. Other Industries

- 9.2. Market Analysis, Insights and Forecast - by Startup Stage

- 9.2.1. Seed Stage

- 9.2.2. First Stage

- 9.2.3. Expansion Stage

- 9.2.4. Bridge Stage

- 9.3. Market Analysis, Insights and Forecast - by Major States

- 9.3.1. California

- 9.3.2. New York

- 9.3.3. Massachusettes

- 9.3.4. Washington

- 9.3.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Industry Type

- 10. Asia Pacific US Venture Capital Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Industry Type

- 10.1.1. Banking & Financial Services

- 10.1.2. Healthcare

- 10.1.3. Telecommunications

- 10.1.4. Government Agencies

- 10.1.5. Other Industries

- 10.2. Market Analysis, Insights and Forecast - by Startup Stage

- 10.2.1. Seed Stage

- 10.2.2. First Stage

- 10.2.3. Expansion Stage

- 10.2.4. Bridge Stage

- 10.3. Market Analysis, Insights and Forecast - by Major States

- 10.3.1. California

- 10.3.2. New York

- 10.3.3. Massachusettes

- 10.3.4. Washington

- 10.3.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Industry Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Intel Capital

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tiger Global Management

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bessemer Venture

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kleiner Perkins

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 New Enterprise Associates (NEA)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Accel Partners

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sequoia Capital

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Khosla Ventures**List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Intel Capital

List of Figures

- Figure 1: Global US Venture Capital Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global US Venture Capital Market Volume Breakdown (Trillion, %) by Region 2025 & 2033

- Figure 3: North America US Venture Capital Market Revenue (Million), by Industry Type 2025 & 2033

- Figure 4: North America US Venture Capital Market Volume (Trillion), by Industry Type 2025 & 2033

- Figure 5: North America US Venture Capital Market Revenue Share (%), by Industry Type 2025 & 2033

- Figure 6: North America US Venture Capital Market Volume Share (%), by Industry Type 2025 & 2033

- Figure 7: North America US Venture Capital Market Revenue (Million), by Startup Stage 2025 & 2033

- Figure 8: North America US Venture Capital Market Volume (Trillion), by Startup Stage 2025 & 2033

- Figure 9: North America US Venture Capital Market Revenue Share (%), by Startup Stage 2025 & 2033

- Figure 10: North America US Venture Capital Market Volume Share (%), by Startup Stage 2025 & 2033

- Figure 11: North America US Venture Capital Market Revenue (Million), by Major States 2025 & 2033

- Figure 12: North America US Venture Capital Market Volume (Trillion), by Major States 2025 & 2033

- Figure 13: North America US Venture Capital Market Revenue Share (%), by Major States 2025 & 2033

- Figure 14: North America US Venture Capital Market Volume Share (%), by Major States 2025 & 2033

- Figure 15: North America US Venture Capital Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America US Venture Capital Market Volume (Trillion), by Country 2025 & 2033

- Figure 17: North America US Venture Capital Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America US Venture Capital Market Volume Share (%), by Country 2025 & 2033

- Figure 19: South America US Venture Capital Market Revenue (Million), by Industry Type 2025 & 2033

- Figure 20: South America US Venture Capital Market Volume (Trillion), by Industry Type 2025 & 2033

- Figure 21: South America US Venture Capital Market Revenue Share (%), by Industry Type 2025 & 2033

- Figure 22: South America US Venture Capital Market Volume Share (%), by Industry Type 2025 & 2033

- Figure 23: South America US Venture Capital Market Revenue (Million), by Startup Stage 2025 & 2033

- Figure 24: South America US Venture Capital Market Volume (Trillion), by Startup Stage 2025 & 2033

- Figure 25: South America US Venture Capital Market Revenue Share (%), by Startup Stage 2025 & 2033

- Figure 26: South America US Venture Capital Market Volume Share (%), by Startup Stage 2025 & 2033

- Figure 27: South America US Venture Capital Market Revenue (Million), by Major States 2025 & 2033

- Figure 28: South America US Venture Capital Market Volume (Trillion), by Major States 2025 & 2033

- Figure 29: South America US Venture Capital Market Revenue Share (%), by Major States 2025 & 2033

- Figure 30: South America US Venture Capital Market Volume Share (%), by Major States 2025 & 2033

- Figure 31: South America US Venture Capital Market Revenue (Million), by Country 2025 & 2033

- Figure 32: South America US Venture Capital Market Volume (Trillion), by Country 2025 & 2033

- Figure 33: South America US Venture Capital Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America US Venture Capital Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe US Venture Capital Market Revenue (Million), by Industry Type 2025 & 2033

- Figure 36: Europe US Venture Capital Market Volume (Trillion), by Industry Type 2025 & 2033

- Figure 37: Europe US Venture Capital Market Revenue Share (%), by Industry Type 2025 & 2033

- Figure 38: Europe US Venture Capital Market Volume Share (%), by Industry Type 2025 & 2033

- Figure 39: Europe US Venture Capital Market Revenue (Million), by Startup Stage 2025 & 2033

- Figure 40: Europe US Venture Capital Market Volume (Trillion), by Startup Stage 2025 & 2033

- Figure 41: Europe US Venture Capital Market Revenue Share (%), by Startup Stage 2025 & 2033

- Figure 42: Europe US Venture Capital Market Volume Share (%), by Startup Stage 2025 & 2033

- Figure 43: Europe US Venture Capital Market Revenue (Million), by Major States 2025 & 2033

- Figure 44: Europe US Venture Capital Market Volume (Trillion), by Major States 2025 & 2033

- Figure 45: Europe US Venture Capital Market Revenue Share (%), by Major States 2025 & 2033

- Figure 46: Europe US Venture Capital Market Volume Share (%), by Major States 2025 & 2033

- Figure 47: Europe US Venture Capital Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Europe US Venture Capital Market Volume (Trillion), by Country 2025 & 2033

- Figure 49: Europe US Venture Capital Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe US Venture Capital Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East & Africa US Venture Capital Market Revenue (Million), by Industry Type 2025 & 2033

- Figure 52: Middle East & Africa US Venture Capital Market Volume (Trillion), by Industry Type 2025 & 2033

- Figure 53: Middle East & Africa US Venture Capital Market Revenue Share (%), by Industry Type 2025 & 2033

- Figure 54: Middle East & Africa US Venture Capital Market Volume Share (%), by Industry Type 2025 & 2033

- Figure 55: Middle East & Africa US Venture Capital Market Revenue (Million), by Startup Stage 2025 & 2033

- Figure 56: Middle East & Africa US Venture Capital Market Volume (Trillion), by Startup Stage 2025 & 2033

- Figure 57: Middle East & Africa US Venture Capital Market Revenue Share (%), by Startup Stage 2025 & 2033

- Figure 58: Middle East & Africa US Venture Capital Market Volume Share (%), by Startup Stage 2025 & 2033

- Figure 59: Middle East & Africa US Venture Capital Market Revenue (Million), by Major States 2025 & 2033

- Figure 60: Middle East & Africa US Venture Capital Market Volume (Trillion), by Major States 2025 & 2033

- Figure 61: Middle East & Africa US Venture Capital Market Revenue Share (%), by Major States 2025 & 2033

- Figure 62: Middle East & Africa US Venture Capital Market Volume Share (%), by Major States 2025 & 2033

- Figure 63: Middle East & Africa US Venture Capital Market Revenue (Million), by Country 2025 & 2033

- Figure 64: Middle East & Africa US Venture Capital Market Volume (Trillion), by Country 2025 & 2033

- Figure 65: Middle East & Africa US Venture Capital Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East & Africa US Venture Capital Market Volume Share (%), by Country 2025 & 2033

- Figure 67: Asia Pacific US Venture Capital Market Revenue (Million), by Industry Type 2025 & 2033

- Figure 68: Asia Pacific US Venture Capital Market Volume (Trillion), by Industry Type 2025 & 2033

- Figure 69: Asia Pacific US Venture Capital Market Revenue Share (%), by Industry Type 2025 & 2033

- Figure 70: Asia Pacific US Venture Capital Market Volume Share (%), by Industry Type 2025 & 2033

- Figure 71: Asia Pacific US Venture Capital Market Revenue (Million), by Startup Stage 2025 & 2033

- Figure 72: Asia Pacific US Venture Capital Market Volume (Trillion), by Startup Stage 2025 & 2033

- Figure 73: Asia Pacific US Venture Capital Market Revenue Share (%), by Startup Stage 2025 & 2033

- Figure 74: Asia Pacific US Venture Capital Market Volume Share (%), by Startup Stage 2025 & 2033

- Figure 75: Asia Pacific US Venture Capital Market Revenue (Million), by Major States 2025 & 2033

- Figure 76: Asia Pacific US Venture Capital Market Volume (Trillion), by Major States 2025 & 2033

- Figure 77: Asia Pacific US Venture Capital Market Revenue Share (%), by Major States 2025 & 2033

- Figure 78: Asia Pacific US Venture Capital Market Volume Share (%), by Major States 2025 & 2033

- Figure 79: Asia Pacific US Venture Capital Market Revenue (Million), by Country 2025 & 2033

- Figure 80: Asia Pacific US Venture Capital Market Volume (Trillion), by Country 2025 & 2033

- Figure 81: Asia Pacific US Venture Capital Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Asia Pacific US Venture Capital Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Venture Capital Market Revenue Million Forecast, by Industry Type 2020 & 2033

- Table 2: Global US Venture Capital Market Volume Trillion Forecast, by Industry Type 2020 & 2033

- Table 3: Global US Venture Capital Market Revenue Million Forecast, by Startup Stage 2020 & 2033

- Table 4: Global US Venture Capital Market Volume Trillion Forecast, by Startup Stage 2020 & 2033

- Table 5: Global US Venture Capital Market Revenue Million Forecast, by Major States 2020 & 2033

- Table 6: Global US Venture Capital Market Volume Trillion Forecast, by Major States 2020 & 2033

- Table 7: Global US Venture Capital Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global US Venture Capital Market Volume Trillion Forecast, by Region 2020 & 2033

- Table 9: Global US Venture Capital Market Revenue Million Forecast, by Industry Type 2020 & 2033

- Table 10: Global US Venture Capital Market Volume Trillion Forecast, by Industry Type 2020 & 2033

- Table 11: Global US Venture Capital Market Revenue Million Forecast, by Startup Stage 2020 & 2033

- Table 12: Global US Venture Capital Market Volume Trillion Forecast, by Startup Stage 2020 & 2033

- Table 13: Global US Venture Capital Market Revenue Million Forecast, by Major States 2020 & 2033

- Table 14: Global US Venture Capital Market Volume Trillion Forecast, by Major States 2020 & 2033

- Table 15: Global US Venture Capital Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global US Venture Capital Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 17: United States US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 19: Canada US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 21: Mexico US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 23: Global US Venture Capital Market Revenue Million Forecast, by Industry Type 2020 & 2033

- Table 24: Global US Venture Capital Market Volume Trillion Forecast, by Industry Type 2020 & 2033

- Table 25: Global US Venture Capital Market Revenue Million Forecast, by Startup Stage 2020 & 2033

- Table 26: Global US Venture Capital Market Volume Trillion Forecast, by Startup Stage 2020 & 2033

- Table 27: Global US Venture Capital Market Revenue Million Forecast, by Major States 2020 & 2033

- Table 28: Global US Venture Capital Market Volume Trillion Forecast, by Major States 2020 & 2033

- Table 29: Global US Venture Capital Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global US Venture Capital Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 31: Brazil US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Brazil US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 33: Argentina US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Argentina US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 35: Rest of South America US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 37: Global US Venture Capital Market Revenue Million Forecast, by Industry Type 2020 & 2033

- Table 38: Global US Venture Capital Market Volume Trillion Forecast, by Industry Type 2020 & 2033

- Table 39: Global US Venture Capital Market Revenue Million Forecast, by Startup Stage 2020 & 2033

- Table 40: Global US Venture Capital Market Volume Trillion Forecast, by Startup Stage 2020 & 2033

- Table 41: Global US Venture Capital Market Revenue Million Forecast, by Major States 2020 & 2033

- Table 42: Global US Venture Capital Market Volume Trillion Forecast, by Major States 2020 & 2033

- Table 43: Global US Venture Capital Market Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Global US Venture Capital Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 45: United Kingdom US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: United Kingdom US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 47: Germany US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Germany US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 49: France US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: France US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 51: Italy US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Italy US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 53: Spain US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Spain US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 55: Russia US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Russia US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 57: Benelux US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Benelux US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 59: Nordics US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Nordics US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 61: Rest of Europe US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Europe US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 63: Global US Venture Capital Market Revenue Million Forecast, by Industry Type 2020 & 2033

- Table 64: Global US Venture Capital Market Volume Trillion Forecast, by Industry Type 2020 & 2033

- Table 65: Global US Venture Capital Market Revenue Million Forecast, by Startup Stage 2020 & 2033

- Table 66: Global US Venture Capital Market Volume Trillion Forecast, by Startup Stage 2020 & 2033

- Table 67: Global US Venture Capital Market Revenue Million Forecast, by Major States 2020 & 2033

- Table 68: Global US Venture Capital Market Volume Trillion Forecast, by Major States 2020 & 2033

- Table 69: Global US Venture Capital Market Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Global US Venture Capital Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 71: Turkey US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Turkey US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 73: Israel US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Israel US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 75: GCC US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: GCC US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 77: North Africa US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: North Africa US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 79: South Africa US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: South Africa US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 81: Rest of Middle East & Africa US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: Rest of Middle East & Africa US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 83: Global US Venture Capital Market Revenue Million Forecast, by Industry Type 2020 & 2033

- Table 84: Global US Venture Capital Market Volume Trillion Forecast, by Industry Type 2020 & 2033

- Table 85: Global US Venture Capital Market Revenue Million Forecast, by Startup Stage 2020 & 2033

- Table 86: Global US Venture Capital Market Volume Trillion Forecast, by Startup Stage 2020 & 2033

- Table 87: Global US Venture Capital Market Revenue Million Forecast, by Major States 2020 & 2033

- Table 88: Global US Venture Capital Market Volume Trillion Forecast, by Major States 2020 & 2033

- Table 89: Global US Venture Capital Market Revenue Million Forecast, by Country 2020 & 2033

- Table 90: Global US Venture Capital Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 91: China US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: China US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 93: India US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 94: India US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 95: Japan US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 96: Japan US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 97: South Korea US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 98: South Korea US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 99: ASEAN US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 100: ASEAN US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 101: Oceania US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 102: Oceania US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 103: Rest of Asia Pacific US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 104: Rest of Asia Pacific US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Venture Capital Market?

The projected CAGR is approximately 8.25%.

2. Which companies are prominent players in the US Venture Capital Market?

Key companies in the market include Intel Capital, Tiger Global Management, Bessemer Venture, Kleiner Perkins, New Enterprise Associates (NEA), Accel Partners, Sequoia Capital, Khosla Ventures**List Not Exhaustive.

3. What are the main segments of the US Venture Capital Market?

The market segments include Industry Type , Startup Stage , Major States .

4. Can you provide details about the market size?

The market size is estimated to be USD 1.30 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Healthtech trends toward record-breaking year.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2023: NEA (New Enterprise Associates) announced it closed on approximately USD 6.2 billion across two funds, bringing the firm's assets under management to over USD 25 billion as of December 31, 2022. The new pair of funds marks a first for NEA, with one dedicated to early-stage investing and the other to venture growth-stage opportunities. It reflects the 45-year-old firm's continuous evolution of its model over decades.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Venture Capital Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Venture Capital Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Venture Capital Market?

To stay informed about further developments, trends, and reports in the US Venture Capital Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence