Key Insights

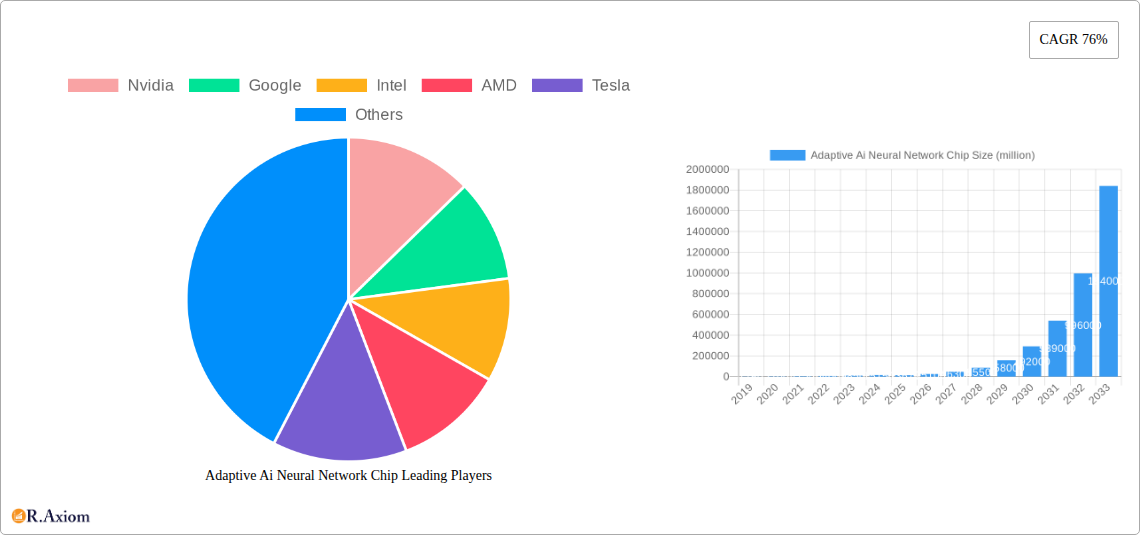

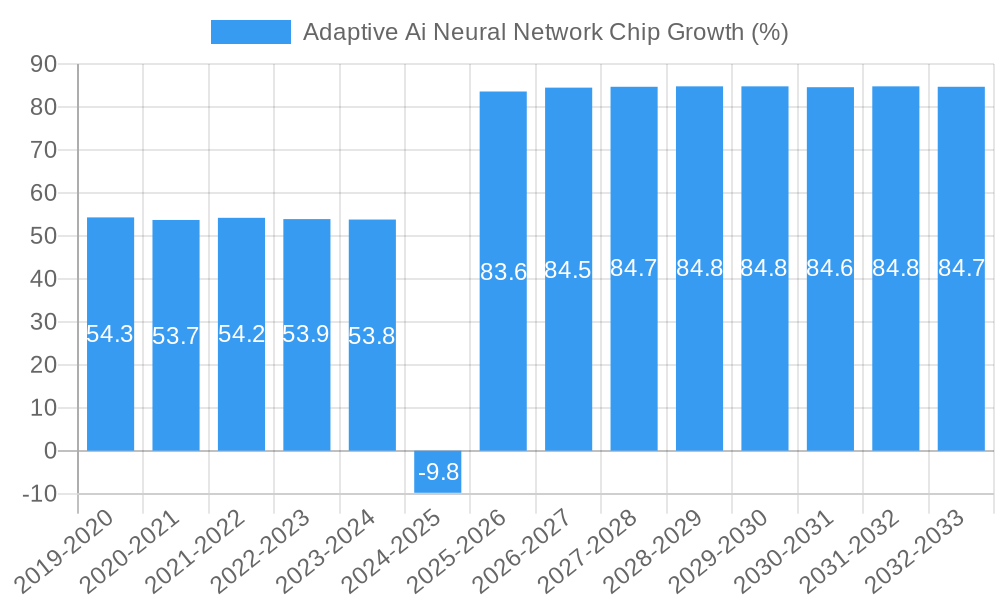

The Adaptive AI Neural Network Chip market is experiencing unprecedented growth, projected to reach a substantial USD 13,670 million by 2025. This remarkable expansion is fueled by an astonishing Compound Annual Growth Rate (CAGR) of 76%, indicating a highly dynamic and rapidly evolving sector. The primary drivers behind this surge include the escalating demand for sophisticated AI capabilities across a multitude of industries, from the intricate requirements of the automotive sector for autonomous driving and advanced driver-assistance systems (ADAS) to the critical applications in the medical field for diagnostics, drug discovery, and personalized treatment. Furthermore, the financial industry is leveraging these chips for fraud detection, algorithmic trading, and risk management, all of which necessitate faster and more efficient data processing and pattern recognition.

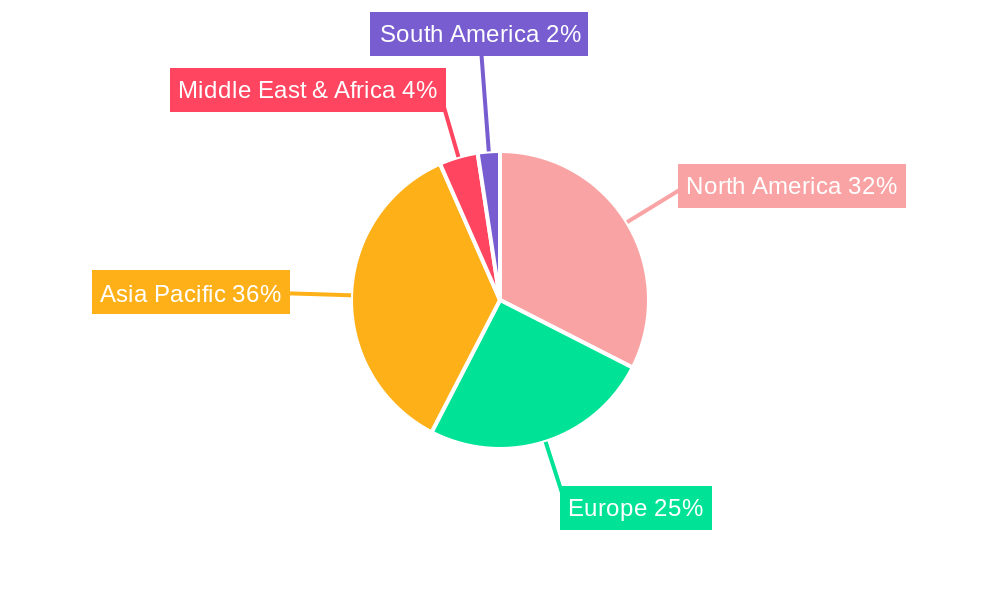

The market's segmentation reveals a clear trend towards specialized AI hardware. While Field-Programmable Gate Arrays (FPGAs) offer flexibility, the future dominance appears to lie with Application-Specific Integrated Circuits (ASICs) and Graphics Processing Units (GPUs), along with dedicated Tensor Processing Units (TPUs), which are optimized for the massive parallel computations inherent in neural networks. Key players like Nvidia, Google, Intel, AMD, and Apple are at the forefront, investing heavily in R&D to develop more powerful and energy-efficient AI chips. Emerging contenders such as Huawei, Cambricon, Graphcore, and Cerebras are also making significant inroads, pushing the boundaries of AI hardware innovation. The extensive regional presence, with significant activity anticipated in North America, Asia Pacific (driven by China and India), and Europe, highlights the global adoption of AI technologies powered by these specialized neural network chips.

Here's the SEO-optimized report description for "Adaptive AI Neural Network Chip Market," incorporating high-traffic keywords and structured as requested:

Adaptive Ai Neural Network Chip Market Concentration & Innovation

The Adaptive AI Neural Network Chip market exhibits a dynamic concentration, with key players like Nvidia, Google, Intel, AMD, Tesla, Apple, Huawei, Cambricon, Graphcore, and Cerebras vying for significant market share. Innovation is primarily driven by the relentless pursuit of increased computational efficiency, reduced power consumption, and enhanced performance for deep learning workloads across diverse applications. Regulatory frameworks are evolving to address ethical AI deployment and data privacy, impacting chip design and market access. The threat of product substitutes, such as general-purpose CPUs for simpler AI tasks, remains a consideration, though specialized AI chips offer unparalleled advantages for complex neural network operations. End-user trends are heavily influenced by the growing demand for on-device AI, edge computing, and real-time inference capabilities, pushing for miniaturization and lower power footprints. Mergers and acquisitions (M&A) are playing a pivotal role in shaping the competitive landscape, with substantial deal values indicating consolidation and strategic integration of complementary technologies. For instance, an estimated xx million in M&A deals were observed during the historical period. The market share of leading players is projected to be concentrated, with the top three companies estimated to hold over xx% by 2025.

Adaptive Ai Neural Network Chip Industry Trends & Insights

The Adaptive AI Neural Network Chip industry is poised for explosive growth, driven by a confluence of technological advancements, increasing adoption across critical sectors, and the insatiable demand for intelligent processing. The compound annual growth rate (CAGR) is projected to exceed xx% during the forecast period of 2025–2033, underscoring a robust expansion trajectory. Technological disruptions, particularly in advancements in neural network architectures and the development of novel semiconductor materials, are continuously pushing the boundaries of what's possible. Consumer preferences are increasingly shaped by the desire for personalized experiences, predictive analytics, and automated decision-making, all powered by sophisticated AI capabilities delivered through these specialized chips. The competitive dynamics are characterized by intense innovation, strategic partnerships, and a race to develop more specialized and efficient AI silicon. Market penetration is rapidly increasing, with AI chips moving beyond niche data center applications to become integral components in edge devices, automotive systems, and consumer electronics. The sheer volume of data generated globally, coupled with the growing need for its intelligent analysis, forms a fundamental market growth driver. Furthermore, the push towards autonomous systems in various industries necessitates the high-performance, low-latency processing capabilities offered by adaptive AI neural network chips. The development of more efficient training and inference algorithms is also a significant trend, directly impacting the demand for hardware that can support these advancements. The report forecasts a total market size of approximately xx million in 2025, expected to reach over xx million by 2033. This growth is underpinned by the expanding capabilities of AI, enabling new applications and enhancing existing ones across the entire economic spectrum. The increasing accessibility of AI development tools and platforms further democratizes AI adoption, fueling demand for the underlying hardware.

Dominant Markets & Segments in Adaptive Ai Neural Network Chip

The Automotive Industry stands out as a dominant application segment for Adaptive AI Neural Network Chips. The proliferation of Advanced Driver-Assistance Systems (ADAS), autonomous driving technologies, and in-car infotainment systems necessitates powerful, real-time AI processing. The ability of these chips to handle complex sensor fusion, object recognition, path planning, and decision-making is critical. Economic policies supporting the transition to electric and autonomous vehicles, alongside significant infrastructure investments in smart city initiatives and charging networks, further bolster this segment's dominance. Countries leading in automotive innovation and manufacturing, such as the United States, China, Germany, and Japan, are key markets.

Within the Type segmentation, ASIC AI Chips are emerging as a dominant force due to their unparalleled performance and power efficiency for specific AI tasks. Their tailored architecture allows for optimized execution of neural network operations, making them ideal for high-volume, specialized applications. Graphics Processing Units (GPUs) continue to hold a strong position, particularly for training large-scale neural networks and for broader AI research and development. Tensor Processing Units (TPUs), developed by Google, represent a significant advancement in hardware acceleration for machine learning workloads. Field-Programmable Gate Arrays (FPGAs) offer flexibility and reconfigurability, making them suitable for applications with evolving AI algorithms or for rapid prototyping.

The Medical Industry is another rapidly growing segment, driven by AI-powered diagnostics, personalized medicine, robotic surgery, and drug discovery. The need for precise and reliable AI processing in healthcare is paramount, leading to significant investment in AI chips for medical imaging analysis, genomic sequencing, and patient monitoring.

The Financial Industry is increasingly leveraging adaptive AI neural network chips for fraud detection, algorithmic trading, risk management, and customer analytics. The demand for high-speed, accurate processing of vast financial datasets makes these chips indispensable.

Key drivers for dominance in these segments include:

- Technological Superiority: Chips offering higher TOPS (Tera Operations Per Second) and lower power consumption for equivalent performance.

- Ecosystem Support: Robust software stacks, development tools, and compatibility with popular AI frameworks like TensorFlow and PyTorch.

- Cost-Effectiveness: Achieving optimal performance per dollar, especially for large-scale deployments.

- Regulatory Tailwinds: Government initiatives promoting AI adoption and innovation in strategic sectors.

- Data Explosion: The ever-increasing volume of data generated across all industries necessitates advanced processing capabilities.

The market share within these segments is expected to see shifts as newer, more specialized AI chips enter the market, particularly in ASICs designed for specific workloads.

Adaptive Ai Neural Network Chip Product Developments

Product developments in the Adaptive AI Neural Network Chip market are characterized by a relentless focus on enhancing performance, reducing power consumption, and increasing efficiency for AI workloads. Innovations include novel architectures like neuromorphic chips that mimic the human brain, and specialized ASICs designed for specific neural network layers or tasks. Companies are also improving integration with existing computing platforms, enabling seamless deployment across data centers, edge devices, and embedded systems. The competitive advantage stems from achieving higher FLOPS (Floating-point Operations Per Second) and TOPS per watt, as well as offering broader AI framework compatibility.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Adaptive AI Neural Network Chip market, segmented by Application and Type. The Application segments analyzed include the Automotive Industry, with projected market growth driven by autonomous driving and ADAS technologies; the Medical Industry, fueled by AI in diagnostics and personalized medicine; and the Financial Industry, impacted by AI in fraud detection and algorithmic trading.

The Type segments include Field Programmable Gate Array (FPGA) AI Chips, offering flexibility; ASIC AI Chips, providing specialized performance; Graphics Processing Unit (GPU) AI Chips, crucial for training; and Tensor Processing Unit (TPU) AI Chips, designed for machine learning acceleration. Each segment is analyzed for its growth projections, market size contribution, and competitive dynamics, with ASIC AI Chips expected to see significant growth in specialized applications.

Key Drivers of Adaptive Ai Neural Network Chip Growth

The Adaptive AI Neural Network Chip market's growth is propelled by several key drivers. Technological advancements in deep learning algorithms and neural network architectures necessitate more powerful and efficient hardware. The proliferation of big data globally, coupled with the need for real-time data processing and intelligent insights, is a major catalyst. Increasing adoption of AI across diverse industries, including automotive, healthcare, and finance, for applications like autonomous driving, medical diagnostics, and fraud detection, directly fuels demand. Furthermore, government initiatives and investments in artificial intelligence research and development, aiming to foster innovation and economic competitiveness, provide a supportive regulatory environment. The development of edge AI and the demand for on-device intelligence in IoT devices also contribute significantly.

Challenges in the Adaptive Ai Neural Network Chip Sector

Despite robust growth, the Adaptive AI Neural Network Chip sector faces several challenges. High research and development costs associated with designing cutting-edge AI silicon, coupled with long development cycles, pose significant financial hurdles for new entrants. Supply chain disruptions, particularly concerning the availability of advanced semiconductor manufacturing capabilities and critical raw materials, can impact production and lead times. Intense competition from established players and emerging startups necessitates continuous innovation and price competitiveness. Evolving technical standards and interoperability issues can also create fragmentation and hinder widespread adoption. Finally, regulatory complexities and ethical considerations surrounding AI deployment, including data privacy and bias, may influence market growth and product design.

Emerging Opportunities in Adaptive Ai Neural Network Chip

Emerging opportunities in the Adaptive AI Neural Network Chip market are abundant. The growing demand for AI at the edge in IoT devices, smart cities, and industrial automation presents a vast untapped market. Advancements in neuromorphic computing and spiking neural networks offer potential for ultra-low-power AI solutions. The expansion of AI in scientific research, including drug discovery and climate modeling, will drive the need for specialized high-performance chips. Furthermore, the increasing demand for personalized experiences in consumer electronics and entertainment opens avenues for embedded AI capabilities. Opportunities also lie in developing energy-efficient AI chips for sustainable computing initiatives.

Leading Players in the Adaptive Ai Neural Network Chip Market

- Nvidia

- Intel

- AMD

- Tesla

- Apple

- Huawei

- Cambricon

- Graphcore

- Cerebras

Key Developments in Adaptive Ai Neural Network Chip Industry

- 2023/08: Nvidia announces new generation of AI GPUs with enhanced performance for large language models.

- 2023/05: Intel launches its next-generation AI accelerators, focusing on data center and edge deployments.

- 2023/02: Google expands its TPU offerings with advanced capabilities for training and inference.

- 2022/11: AMD unveils its latest suite of AI-focused processors, targeting high-performance computing and data analytics.

- 2022/07: Tesla showcases advancements in its in-house AI chip development for autonomous driving.

- 2022/04: Apple continues to integrate its Neural Engine for on-device AI processing in its product line.

- 2022/01: Huawei introduces new AI chips designed for cloud computing and smart devices.

- 2021/10: Cambricon releases its latest AI processors with improved efficiency and performance.

- 2021/06: Graphcore announces significant upgrades to its IPU architecture.

- 2021/03: Cerebras unveils its Wafer-Scale Engine with enhanced capabilities for massive AI models.

Strategic Outlook for Adaptive Ai Neural Network Chip Market

The strategic outlook for the Adaptive AI Neural Network Chip market is exceptionally promising, driven by continued innovation and expanding applications. The increasing integration of AI across industries will lead to sustained demand for specialized hardware. Key growth catalysts include the ongoing development of more efficient and powerful AI architectures, the expansion of edge AI deployments, and the growing importance of AI in tackling complex global challenges. Strategic partnerships between chip manufacturers, software developers, and end-users will be crucial for unlocking new market opportunities and accelerating adoption. The focus on sustainability and energy efficiency in AI computing will also shape future product development and market strategies.

Adaptive Ai Neural Network Chip Segmentation

-

1. Application

- 1.1. Automotive Industry

- 1.2. Medical Industry

- 1.3. Financial Industry

-

2. Type

- 2.1. Field Programmable Gate Array AI Chip

- 2.2. ASIC AI Chip

- 2.3. Graphics Processing Unit AI Chip

- 2.4. Tensor Processing Unit AI Chip

Adaptive Ai Neural Network Chip Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Adaptive Ai Neural Network Chip REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 76% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Adaptive Ai Neural Network Chip Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Automotive Industry

- 5.1.2. Medical Industry

- 5.1.3. Financial Industry

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Field Programmable Gate Array AI Chip

- 5.2.2. ASIC AI Chip

- 5.2.3. Graphics Processing Unit AI Chip

- 5.2.4. Tensor Processing Unit AI Chip

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Adaptive Ai Neural Network Chip Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Automotive Industry

- 6.1.2. Medical Industry

- 6.1.3. Financial Industry

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Field Programmable Gate Array AI Chip

- 6.2.2. ASIC AI Chip

- 6.2.3. Graphics Processing Unit AI Chip

- 6.2.4. Tensor Processing Unit AI Chip

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Adaptive Ai Neural Network Chip Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Automotive Industry

- 7.1.2. Medical Industry

- 7.1.3. Financial Industry

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Field Programmable Gate Array AI Chip

- 7.2.2. ASIC AI Chip

- 7.2.3. Graphics Processing Unit AI Chip

- 7.2.4. Tensor Processing Unit AI Chip

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Adaptive Ai Neural Network Chip Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Automotive Industry

- 8.1.2. Medical Industry

- 8.1.3. Financial Industry

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Field Programmable Gate Array AI Chip

- 8.2.2. ASIC AI Chip

- 8.2.3. Graphics Processing Unit AI Chip

- 8.2.4. Tensor Processing Unit AI Chip

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Adaptive Ai Neural Network Chip Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Automotive Industry

- 9.1.2. Medical Industry

- 9.1.3. Financial Industry

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Field Programmable Gate Array AI Chip

- 9.2.2. ASIC AI Chip

- 9.2.3. Graphics Processing Unit AI Chip

- 9.2.4. Tensor Processing Unit AI Chip

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Adaptive Ai Neural Network Chip Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Automotive Industry

- 10.1.2. Medical Industry

- 10.1.3. Financial Industry

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Field Programmable Gate Array AI Chip

- 10.2.2. ASIC AI Chip

- 10.2.3. Graphics Processing Unit AI Chip

- 10.2.4. Tensor Processing Unit AI Chip

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Nvidia

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Google

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Intel

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 AMD

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Tesla

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Apple

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Huawei

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cambricon

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Graphcore

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Cerebras

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Nvidia

List of Figures

- Figure 1: Global Adaptive Ai Neural Network Chip Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Adaptive Ai Neural Network Chip Revenue (million), by Application 2024 & 2032

- Figure 3: North America Adaptive Ai Neural Network Chip Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Adaptive Ai Neural Network Chip Revenue (million), by Type 2024 & 2032

- Figure 5: North America Adaptive Ai Neural Network Chip Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Adaptive Ai Neural Network Chip Revenue (million), by Country 2024 & 2032

- Figure 7: North America Adaptive Ai Neural Network Chip Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Adaptive Ai Neural Network Chip Revenue (million), by Application 2024 & 2032

- Figure 9: South America Adaptive Ai Neural Network Chip Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Adaptive Ai Neural Network Chip Revenue (million), by Type 2024 & 2032

- Figure 11: South America Adaptive Ai Neural Network Chip Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Adaptive Ai Neural Network Chip Revenue (million), by Country 2024 & 2032

- Figure 13: South America Adaptive Ai Neural Network Chip Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Adaptive Ai Neural Network Chip Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Adaptive Ai Neural Network Chip Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Adaptive Ai Neural Network Chip Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Adaptive Ai Neural Network Chip Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Adaptive Ai Neural Network Chip Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Adaptive Ai Neural Network Chip Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Adaptive Ai Neural Network Chip Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Adaptive Ai Neural Network Chip Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Adaptive Ai Neural Network Chip Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Adaptive Ai Neural Network Chip Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Adaptive Ai Neural Network Chip Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Adaptive Ai Neural Network Chip Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Adaptive Ai Neural Network Chip Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Adaptive Ai Neural Network Chip Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Adaptive Ai Neural Network Chip Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Adaptive Ai Neural Network Chip Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Adaptive Ai Neural Network Chip Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Adaptive Ai Neural Network Chip Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Adaptive Ai Neural Network Chip Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Adaptive Ai Neural Network Chip Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Adaptive Ai Neural Network Chip Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Adaptive Ai Neural Network Chip Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Adaptive Ai Neural Network Chip Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Adaptive Ai Neural Network Chip Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Adaptive Ai Neural Network Chip Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Adaptive Ai Neural Network Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Adaptive Ai Neural Network Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Adaptive Ai Neural Network Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Adaptive Ai Neural Network Chip Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Adaptive Ai Neural Network Chip Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Adaptive Ai Neural Network Chip Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Adaptive Ai Neural Network Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Adaptive Ai Neural Network Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Adaptive Ai Neural Network Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Adaptive Ai Neural Network Chip Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Adaptive Ai Neural Network Chip Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Adaptive Ai Neural Network Chip Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Adaptive Ai Neural Network Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Adaptive Ai Neural Network Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Adaptive Ai Neural Network Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Adaptive Ai Neural Network Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Adaptive Ai Neural Network Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Adaptive Ai Neural Network Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Adaptive Ai Neural Network Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Adaptive Ai Neural Network Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Adaptive Ai Neural Network Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Adaptive Ai Neural Network Chip Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Adaptive Ai Neural Network Chip Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Adaptive Ai Neural Network Chip Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Adaptive Ai Neural Network Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Adaptive Ai Neural Network Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Adaptive Ai Neural Network Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Adaptive Ai Neural Network Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Adaptive Ai Neural Network Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Adaptive Ai Neural Network Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Adaptive Ai Neural Network Chip Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Adaptive Ai Neural Network Chip Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Adaptive Ai Neural Network Chip Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Adaptive Ai Neural Network Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Adaptive Ai Neural Network Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Adaptive Ai Neural Network Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Adaptive Ai Neural Network Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Adaptive Ai Neural Network Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Adaptive Ai Neural Network Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Adaptive Ai Neural Network Chip Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Adaptive Ai Neural Network Chip?

The projected CAGR is approximately 76%.

2. Which companies are prominent players in the Adaptive Ai Neural Network Chip?

Key companies in the market include Nvidia, Google, Intel, AMD, Tesla, Apple, Huawei, Cambricon, Graphcore, Cerebras.

3. What are the main segments of the Adaptive Ai Neural Network Chip?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 13670 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Adaptive Ai Neural Network Chip," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Adaptive Ai Neural Network Chip report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Adaptive Ai Neural Network Chip?

To stay informed about further developments, trends, and reports in the Adaptive Ai Neural Network Chip, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence