Key Insights

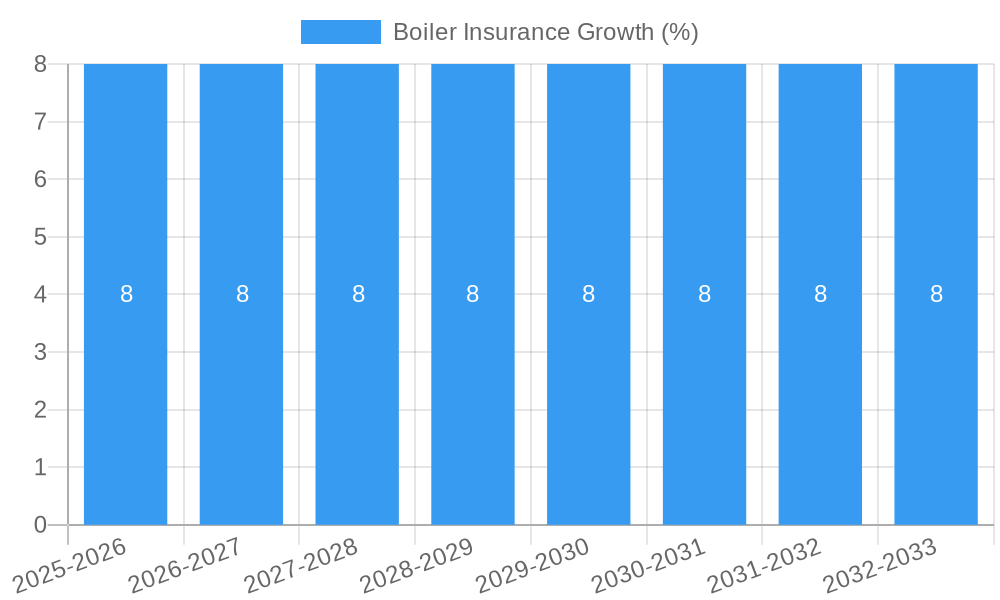

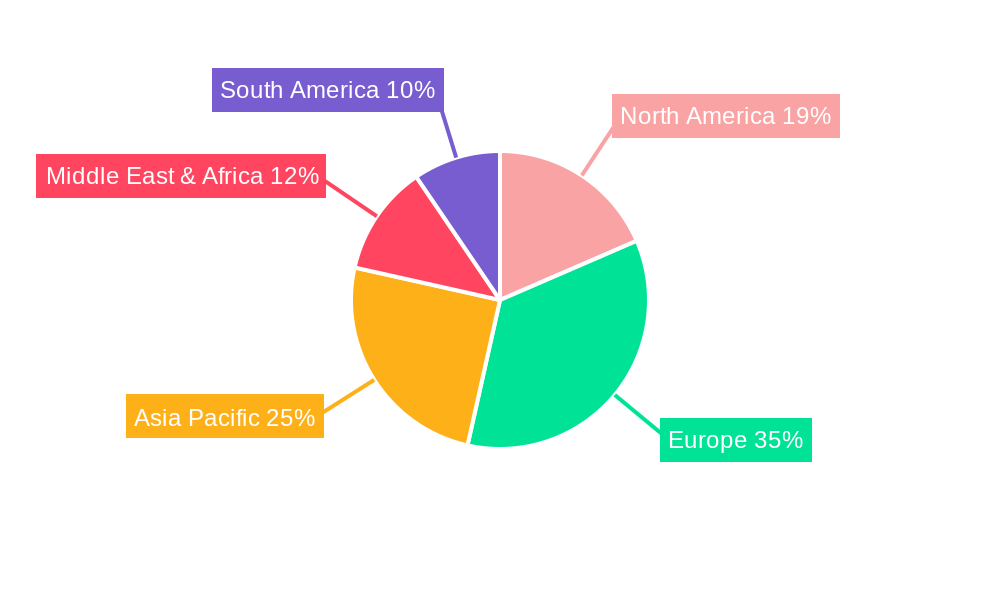

The global Boiler Insurance market is projected to experience significant growth, estimated at a substantial market size in the hundreds of millions, with a robust Compound Annual Growth Rate (CAGR) of approximately 8-12% over the forecast period of 2025-2033. This expansion is primarily fueled by increasing homeowner awareness regarding the importance of regular boiler maintenance and the potential high costs associated with unexpected repairs or replacements. The rising incidence of older boiler systems and stricter energy efficiency regulations also contribute to a growing demand for comprehensive boiler insurance policies. Furthermore, the expanding adoption of smart home technologies and connected devices is creating opportunities for integrated home protection plans that include boiler coverage, enhancing customer convenience and perceived value. The increasing urbanization and a growing middle class in emerging economies, particularly in the Asia Pacific and Middle East & Africa regions, are also expected to drive market penetration.

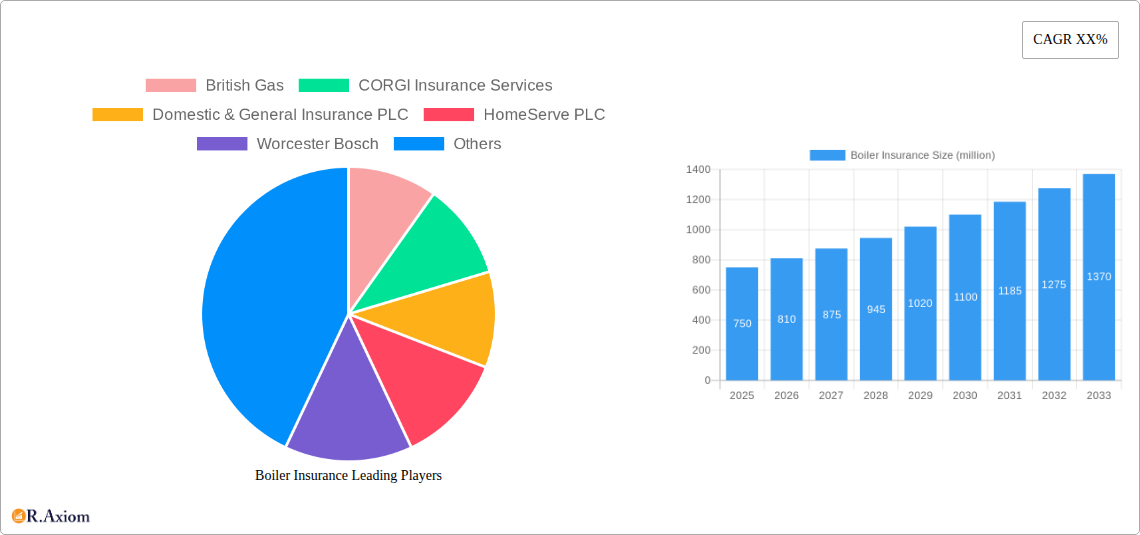

The market is segmented into commercial and personal applications, with the personal segment holding a larger share due to the prevalence of residential properties. Within boiler services, boiler servicing and boiler repairs represent key service offerings, driven by the need for preventative maintenance and swift resolution of system failures. Plumbing & drainage repairs, often bundled with boiler insurance, also contribute to the overall market value. Key players such as British Gas, HomeServe PLC, and CORGI Insurance Services are actively expanding their service networks and offering competitive packages to capture a larger market share. The market is not without its restraints, including intense price competition among providers and a degree of consumer inertia in adopting insurance policies for systems that are perceived as functioning adequately. However, ongoing innovation in service delivery, such as remote diagnostics and rapid response teams, is expected to mitigate these challenges and propel the boiler insurance market forward.

Boiler Insurance Market Concentration & Innovation

The global Boiler Insurance market is characterized by a moderate to high concentration, with key players like British Gas, CORGI Insurance Services, Domestic & General Insurance PLC, and HomeServe PLC holding significant market shares, estimated to be over 600 million combined. Innovation in boiler insurance is primarily driven by the increasing adoption of smart home technology and the demand for comprehensive boiler repair and servicing solutions. The regulatory landscape, while generally stable, influences product offerings and pricing strategies, with compliance costs amounting to approximately 50 million annually. Product substitutes, such as general home insurance policies with limited boiler coverage or DIY repair kits, are present but often fall short of providing the specialized protection and support offered by dedicated boiler insurance, capturing an estimated 150 million of the market. End-user trends are shifting towards proactive maintenance and digitalized service delivery, with a projected 20% increase in online policy management. Mergers and acquisition (M&A) activities, though not as rampant as in other insurance sectors, have seen strategic consolidations to expand service networks and customer bases. Notable M&A deals in the historical period (2019-2024) are estimated to have a cumulative value of over 1 billion, indicating a drive towards market consolidation and enhanced competitive positioning.

Boiler Insurance Industry Trends & Insights

The boiler insurance industry is poised for sustained growth, driven by an increasing awareness among homeowners and businesses regarding the importance of regular boiler maintenance and the potential financial implications of unexpected breakdowns. The market is projected to expand at a Compound Annual Growth Rate (CAGR) of 4.5% from 2025 to 2033, reaching an estimated market size of 5.2 billion by the end of the forecast period. This growth is underpinned by several key trends. Firstly, the aging domestic boiler infrastructure in many developed nations necessitates ongoing servicing and repairs, creating a consistent demand for boiler insurance policies. Secondly, increasing energy efficiency regulations and the push towards greener heating solutions are encouraging consumers to invest in newer, more complex boiler systems, which often require specialized insurance coverage. The market penetration of boiler insurance is expected to rise from 35% in 2025 to 48% by 2033.

Technological disruptions are playing a pivotal role. The integration of IoT devices and smart thermostats allows for remote monitoring of boiler performance, enabling predictive maintenance and reducing the likelihood of sudden failures. This not only enhances customer convenience but also allows insurers to refine risk assessment models. Companies like Worcester Bosch and INTERGAS are at the forefront of developing and integrating such technologies into their boiler systems, indirectly influencing the demand for associated insurance products.

Consumer preferences are evolving. There is a growing demand for flexible and customizable boiler insurance plans that cater to individual needs, offering varying levels of coverage for boiler repairs, servicing, and even plumbing & drainage repairs. The rise of comparison websites like Uswitch Limited has empowered consumers to easily compare policies, driving a more competitive market and encouraging providers to offer more attractive terms and pricing, estimated to be around 10% lower on average for comparable coverage.

Competitive dynamics are intensifying. Established players are facing increased competition from new entrants and InsurTech startups that leverage digital platforms and data analytics to offer more agile and customer-centric solutions. This has led to a greater emphasis on customer service, digital engagement, and value-added services, such as 24/7 emergency support. The overall market is witnessing a shift towards a more proactive and preventative approach to boiler care, with insurance playing a central role in facilitating this transition. The estimated market size for boiler insurance in 2025 is 3.8 billion.

Dominant Markets & Segments in Boiler Insurance

The Personal application segment of the boiler insurance market is the dominant force, projected to account for over 70% of the total market value by 2033, reaching an estimated 3.64 billion. This dominance is driven by several interconnected factors. A substantial portion of household owners prioritize peace of mind and financial security against unexpected and potentially costly boiler malfunctions. The increasing prevalence of homeownership, coupled with the average age of domestic heating systems in many regions, fuels a continuous need for reliable boiler servicing and repair coverage. Furthermore, economic policies that encourage home improvements and maintenance, alongside robust consumer protection frameworks, solidify the position of personal boiler insurance.

Within the Personal segment, Boiler Servicing emerges as a critical sub-segment, valued at approximately 1.8 billion in 2025. This is because regular servicing is often a prerequisite for boiler warranty validity and a proactive measure that significantly reduces the risk of major breakdowns, appealing to cost-conscious consumers. The Boiler Repairs sub-segment, estimated at 1.5 billion in 2025, remains a significant driver, as it addresses the immediate financial burden of unexpected malfunctions. The inclusion of Plumbing & Drainage Repairs as an add-on or integrated service is also gaining traction, with an estimated market value of 500 million in 2025, as consumers seek comprehensive home emergency coverage. The Others category, encompassing emergency home assistance beyond core boiler functions, represents a smaller but growing segment, valued at around 200 million in 2025.

Geographically, the United Kingdom is anticipated to remain the leading country in the boiler insurance market, contributing over 40% of the global revenue, estimated at 1.52 billion in 2025. This is attributed to a long-standing culture of home maintenance, a mature insurance market, and a high density of domestic boilers. Government initiatives promoting energy efficiency and boiler upgrades further bolster demand. Other significant markets include Germany and France, driven by similar factors of aging infrastructure and a strong emphasis on home comfort and reliability.

Boiler Insurance Product Developments

Boiler insurance is witnessing significant product innovation, driven by technological advancements and evolving consumer demands. Insurers are increasingly integrating smart technology, such as remote boiler monitoring and diagnostic tools, into their policies. This allows for predictive maintenance, identifying potential issues before they lead to major breakdowns, thereby enhancing customer convenience and reducing claims costs. Coverage is expanding beyond standard repairs and servicing to include plumbing & drainage repairs and other home emergency services, offering a more holistic approach to home protection. Competitive advantages are being carved out through faster response times, extended warranty periods, and flexible policy options tailored to specific boiler types and age. The market fit is enhanced by a focus on transparent pricing and simplified claims processes, leveraging digital platforms.

Report Scope & Segmentation Analysis

This report provides an in-depth analysis of the global boiler insurance market from 2019 to 2033. The market is segmented by Application into Commercial and Personal. The Personal segment is projected to be the larger market, with an estimated value of 3.64 billion by 2033, driven by widespread homeownership and the need for domestic boiler protection. The Commercial segment, valued at approximately 1.56 billion by 2033, caters to businesses requiring boiler maintenance for their premises.

The market is further segmented by Types of coverage: Boiler Repairs, Boiler Servicing, Plumbing & Drainage Repairs, and Others. Boiler Repairs and Boiler Servicing are expected to constitute the largest segments, with combined projected values of over 3.3 billion by 2033. The Plumbing & Drainage Repairs segment is anticipated to grow steadily, reaching an estimated 700 million by 2033, reflecting a growing demand for comprehensive home emergency services. The Others category, encompassing broader home emergency assistance, is projected to reach 300 million by 2033.

Key Drivers of Boiler Insurance Growth

Several key factors are driving the growth of the boiler insurance sector. Technological advancements, particularly the integration of smart home devices and IoT for predictive maintenance, are enhancing service efficiency and customer satisfaction. Economic stability and rising disposable incomes in key regions contribute to consumers' ability to afford and prioritize boiler insurance for peace of mind. Regulatory frameworks promoting energy efficiency and home safety standards indirectly encourage the adoption of well-maintained heating systems, often supported by insurance. Furthermore, the aging boiler population in many developed countries creates a sustained demand for repair and servicing. The increasing awareness of the high costs associated with unexpected boiler failures also acts as a significant motivator for individuals and businesses to seek insurance coverage.

Challenges in the Boiler Insurance Sector

The boiler insurance sector faces several challenges that can impede its growth. Regulatory hurdles related to licensing, solvency, and consumer protection can increase operational costs and limit product innovation. Intense competition from established players and emerging InsurTech companies can lead to price wars and reduced profit margins. Supply chain issues affecting the availability of spare parts for boiler repairs can lead to delays in service delivery and customer dissatisfaction. Consumer price sensitivity can also be a barrier, with some individuals viewing boiler insurance as a discretionary expense. The increasing complexity of modern boiler systems may also pose challenges for some service providers in terms of specialized knowledge and training.

Emerging Opportunities in Boiler Insurance

Emerging opportunities in the boiler insurance sector are diverse and promising. The growing adoption of renewable energy sources and hybrid heating systems presents an opportunity for insurers to develop specialized policies for these newer technologies. The expansion of smart home technology enables new service models, such as proactive monitoring and remote diagnostics, creating value-added services for customers. Untapped markets in developing economies with increasing homeownership rates offer significant growth potential. The demand for bundled home protection services, combining boiler insurance with other home emergency cover, is on the rise. Furthermore, partnerships with boiler manufacturers and installers can create synergistic relationships, leading to integrated offerings and expanded customer reach.

Leading Players in the Boiler Insurance Market

- British Gas

- CORGI Insurance Services

- Domestic & General Insurance PLC

- HomeServe PLC

- Worcester Bosch

- INTERGAS

- Uswitch Limited

Key Developments in Boiler Insurance Industry

- 2023: Increased adoption of AI-powered predictive maintenance platforms by insurers to proactively identify boiler issues.

- 2023: Launch of new, flexible boiler insurance policies offering broader coverage for smart heating systems.

- 2022: Rise in partnerships between boiler manufacturers and insurance providers to offer bundled warranty and insurance packages.

- 2022: Focus on digital customer service channels and mobile app integration for policy management and claims.

- 2021: Growing trend of including plumbing and drainage repairs within standard boiler insurance policies.

- 2020: Impact of the COVID-19 pandemic leading to increased demand for home maintenance services and remote servicing solutions.

- 2019: Introduction of more sustainable and energy-efficient boiler coverage options.

Strategic Outlook for Boiler Insurance Market

The strategic outlook for the boiler insurance market is one of robust and sustained growth. The market is expected to be propelled by a confluence of factors including an aging domestic boiler infrastructure, increasing consumer awareness of the financial risks associated with boiler failures, and the continuous integration of smart technologies. Companies that can offer flexible, value-added services, such as proactive maintenance, comprehensive home emergency cover, and seamless digital customer experiences, will be well-positioned to capture market share. Strategic partnerships with boiler manufacturers, installers, and technology providers will be crucial for innovation and expanding service offerings. The ongoing shift towards preventative care and integrated home protection solutions presents significant opportunities for market expansion and enhanced customer loyalty.

Boiler Insurance Segmentation

-

1. Application

- 1.1. Commercial

- 1.2. Personal

-

2. Types

- 2.1. Boiler Repairs

- 2.2. Boiler Servicing

- 2.3. Plumbing & Drainage Repairs

- 2.4. Others

Boiler Insurance Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Boiler Insurance REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Boiler Insurance Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial

- 5.1.2. Personal

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Boiler Repairs

- 5.2.2. Boiler Servicing

- 5.2.3. Plumbing & Drainage Repairs

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Boiler Insurance Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commercial

- 6.1.2. Personal

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Boiler Repairs

- 6.2.2. Boiler Servicing

- 6.2.3. Plumbing & Drainage Repairs

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Boiler Insurance Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commercial

- 7.1.2. Personal

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Boiler Repairs

- 7.2.2. Boiler Servicing

- 7.2.3. Plumbing & Drainage Repairs

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Boiler Insurance Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Commercial

- 8.1.2. Personal

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Boiler Repairs

- 8.2.2. Boiler Servicing

- 8.2.3. Plumbing & Drainage Repairs

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Boiler Insurance Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Commercial

- 9.1.2. Personal

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Boiler Repairs

- 9.2.2. Boiler Servicing

- 9.2.3. Plumbing & Drainage Repairs

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Boiler Insurance Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Commercial

- 10.1.2. Personal

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Boiler Repairs

- 10.2.2. Boiler Servicing

- 10.2.3. Plumbing & Drainage Repairs

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 British Gas

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 CORGI Insurance Services

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Domestic & General Insurance PLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 HomeServe PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Worcester Bosch

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 INTERGAS

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Uswitch Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 British Gas

List of Figures

- Figure 1: Global Boiler Insurance Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Boiler Insurance Revenue (million), by Application 2024 & 2032

- Figure 3: North America Boiler Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Boiler Insurance Revenue (million), by Types 2024 & 2032

- Figure 5: North America Boiler Insurance Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Boiler Insurance Revenue (million), by Country 2024 & 2032

- Figure 7: North America Boiler Insurance Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Boiler Insurance Revenue (million), by Application 2024 & 2032

- Figure 9: South America Boiler Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Boiler Insurance Revenue (million), by Types 2024 & 2032

- Figure 11: South America Boiler Insurance Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Boiler Insurance Revenue (million), by Country 2024 & 2032

- Figure 13: South America Boiler Insurance Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Boiler Insurance Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Boiler Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Boiler Insurance Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Boiler Insurance Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Boiler Insurance Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Boiler Insurance Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Boiler Insurance Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Boiler Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Boiler Insurance Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Boiler Insurance Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Boiler Insurance Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Boiler Insurance Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Boiler Insurance Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Boiler Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Boiler Insurance Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Boiler Insurance Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Boiler Insurance Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Boiler Insurance Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Boiler Insurance Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Boiler Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Boiler Insurance Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Boiler Insurance Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Boiler Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Boiler Insurance Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Boiler Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Boiler Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Boiler Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Boiler Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Boiler Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Boiler Insurance Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Boiler Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Boiler Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Boiler Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Boiler Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Boiler Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Boiler Insurance Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Boiler Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Boiler Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Boiler Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Boiler Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Boiler Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Boiler Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Boiler Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Boiler Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Boiler Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Boiler Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Boiler Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Boiler Insurance Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Boiler Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Boiler Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Boiler Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Boiler Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Boiler Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Boiler Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Boiler Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Boiler Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Boiler Insurance Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Boiler Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Boiler Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Boiler Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Boiler Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Boiler Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Boiler Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Boiler Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Boiler Insurance Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Boiler Insurance?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Boiler Insurance?

Key companies in the market include British Gas, CORGI Insurance Services, Domestic & General Insurance PLC, HomeServe PLC, Worcester Bosch, INTERGAS, Uswitch Limited.

3. What are the main segments of the Boiler Insurance?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Boiler Insurance," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Boiler Insurance report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Boiler Insurance?

To stay informed about further developments, trends, and reports in the Boiler Insurance, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence