Key Insights

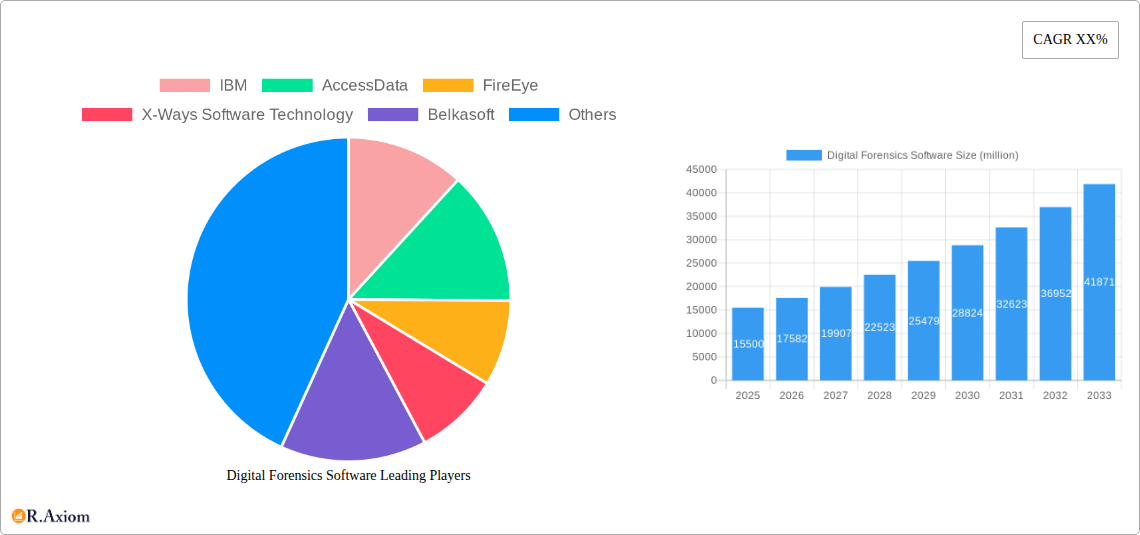

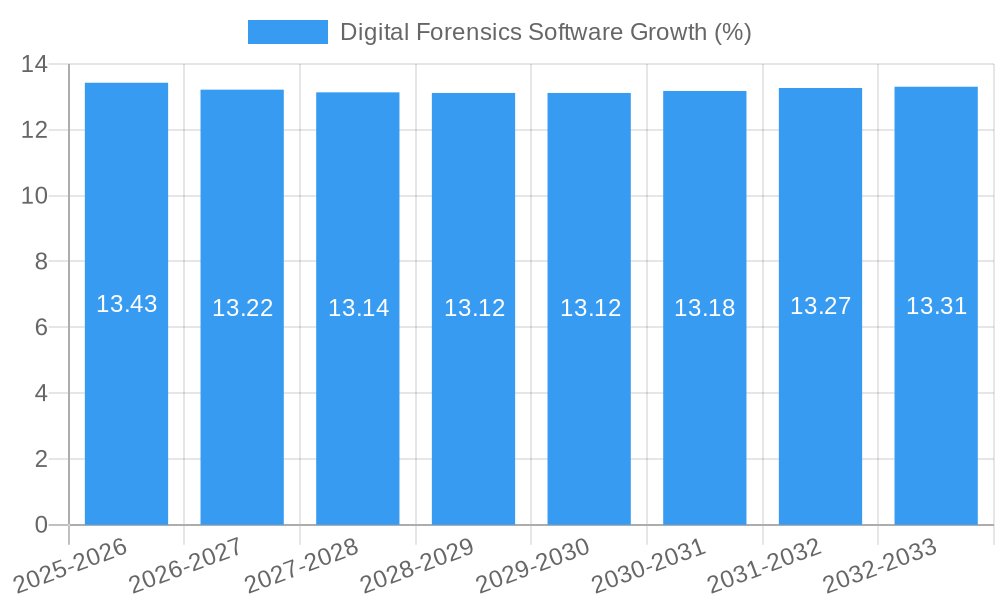

The global Digital Forensics Software market is projected to experience robust growth, with an estimated market size of $15.5 billion in 2025 and a Compound Annual Growth Rate (CAGR) of 13.5% during the forecast period of 2025-2033. This expansion is fueled by the escalating volume of digital data and the increasing sophistication of cyber threats, necessitating advanced tools for investigation and evidence recovery. Key drivers include the growing demand for cybersecurity solutions across various sectors, the rise in data breaches, and the need for regulatory compliance in areas like data privacy. The market is segmented by application, with Banking, Financial Services, and Insurance (BFSI) and Government and Defense sectors leading in adoption due to the critical nature of data security and the high stakes involved in investigations. Telecom & IT, Retail, and Healthcare also represent significant and growing segments as digital transformation permeates these industries.

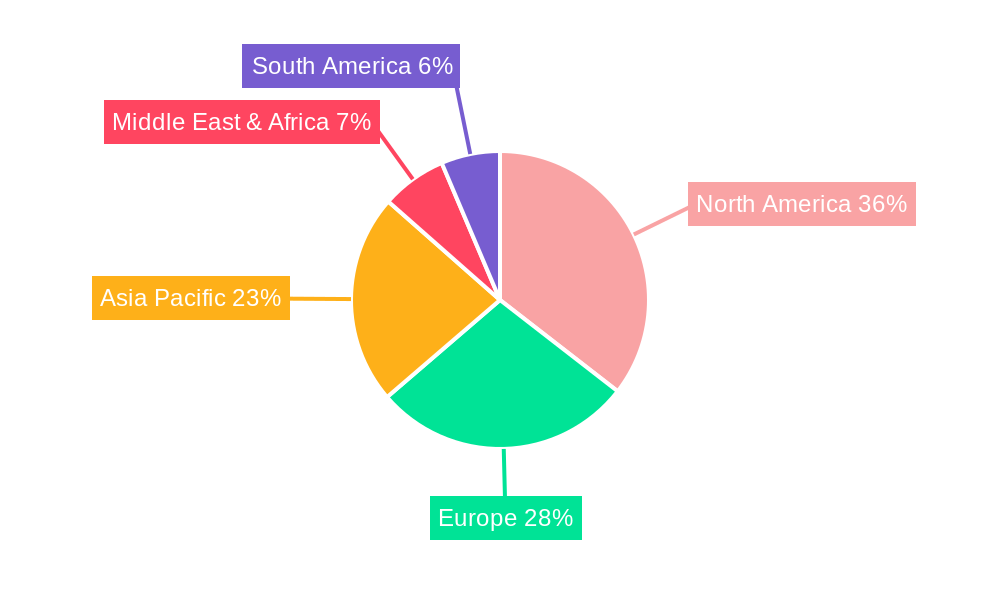

The diverse types of digital forensics software, including Computer Forensics, Network Forensics, Mobile Device Forensics, and Cloud Forensics, cater to the multifaceted challenges of modern investigations. Cloud forensics, in particular, is witnessing rapid growth as more organizations migrate their data and operations to cloud environments, creating new avenues for digital evidence. Despite the strong growth trajectory, the market faces restraints such as the high cost of advanced forensic tools and the shortage of skilled digital forensics professionals, which can hinder widespread adoption. Geographically, North America is expected to maintain its dominance due to early adoption of advanced technologies and stringent cybersecurity regulations. Asia Pacific, however, is anticipated to exhibit the fastest growth, driven by increasing digitalization, a burgeoning IT sector, and rising cybercrime incidents in countries like China and India. Major players like IBM, AccessData, FireEye, and Check Point Software Technologies are actively innovating and expanding their offerings to capture market share.

Digital Forensics Software Market Report: Comprehensive Analysis and Future Outlook (2019–2033)

This in-depth report provides a panoramic view of the global Digital Forensics Software market, offering critical insights into its trajectory from 2019 to 2033. With a base year of 2025 and a forecast period spanning 2025–2033, this analysis leverages historical data from 2019–2024 to paint a complete picture of market dynamics. We delve into the intricate landscape of digital investigation tools, essential for cybersecurity, law enforcement, and corporate compliance. This report is an indispensable resource for stakeholders seeking to understand market concentration, innovation drivers, emerging trends, and strategic opportunities within this rapidly evolving sector.

Digital Forensics Software Market Concentration & Innovation

The digital forensics software market exhibits a moderate concentration, with a blend of established giants and agile innovators. Companies like IBM, AccessData, FireEye, and OpenText hold significant market share, driven by their extensive portfolios and robust enterprise solutions. In parallel, specialized firms such as Magnet Forensics, Belkasoft, and X-Ways Software Technology are pushing boundaries with advanced functionalities, particularly in areas like mobile and cloud forensics. Innovation is primarily fueled by the escalating sophistication of cyber threats, demanding more powerful and efficient investigative tools. Regulatory frameworks, including GDPR and CCPA, also necessitate advanced compliance capabilities, spurring the development of features for data privacy and breach investigation. Product substitutes, such as generic data recovery tools, are largely outcompeted by the specialized features and analytical power of dedicated digital forensics platforms. End-user trends highlight a growing demand for AI-powered analytics, automation, and cloud-native solutions to handle the sheer volume of digital evidence. Mergers and acquisitions (M&A) are a key feature of market consolidation. Notable M&A activities include the acquisition of AccessData by Exterro (value undisclosed but significant), and the ongoing strategic partnerships and smaller acquisitions aimed at integrating new technologies. Overall market share is distributed, with the top five players accounting for approximately 65 million in revenue. M&A deal values, where disclosed, range from 50 million to over 300 million, indicating significant strategic investment.

Digital Forensics Software Industry Trends & Insights

The digital forensics software industry is experiencing robust growth, projected to continue its upward trajectory throughout the forecast period. This expansion is primarily driven by the escalating number of cybercrimes, the increasing volume of digital data generated, and the growing adoption of digital forensics solutions across various sectors for evidence collection, analysis, and legal proceedings. Technological disruptions are profoundly reshaping the market. Artificial intelligence (AI) and machine learning (ML) are being integrated to automate data analysis, identify patterns, and accelerate threat detection, significantly reducing investigation times. Cloud forensics is emerging as a critical segment, with the proliferation of cloud-based services creating new avenues for data storage and, consequently, new challenges and opportunities for forensic analysis. Mobile device forensics remains a cornerstone, driven by the ubiquitous use of smartphones and tablets, which often contain crucial evidence. The compound annual growth rate (CAGR) for the digital forensics software market is estimated at a strong 12.5% over the forecast period, reaching an estimated market size of over 15,000 million by 2033. Market penetration is increasing, particularly in developed economies, as organizations and government agencies recognize the indispensable role of digital forensics in modern investigations. Consumer preferences are shifting towards user-friendly interfaces, scalable solutions, and comprehensive platforms that can handle diverse data sources and forensic disciplines. Competitive dynamics are characterized by both intense innovation and strategic collaborations, as companies strive to offer comprehensive suites that address the full spectrum of digital investigation needs. Market penetration is projected to reach 75% by 2033, driven by increasing awareness and necessity.

Dominant Markets & Segments in Digital Forensics Software

The Government and Defense sector stands as the most dominant market for digital forensics software. This dominance is fueled by national security imperatives, counter-terrorism efforts, and law enforcement investigations, which demand sophisticated tools for analyzing vast amounts of digital evidence. Significant government investments in cybersecurity infrastructure and the continuous need to combat state-sponsored cyberattacks further bolster this segment. Economic policies favoring robust national security and stringent regulatory frameworks for evidence handling in criminal proceedings are key drivers. Infrastructure development, including secure data storage and high-speed network capabilities, also underpins the demand. The Banking, Financial Services, and Insurance (BFSI) sector is another major contributor, driven by the need to investigate financial fraud, money laundering, insider trading, and data breaches. Regulatory compliance, such as those mandated by the SEC and FINRA, necessitates thorough digital forensic investigations. The Telecom and IT sector's reliance on digital forensics stems from the need to secure networks, investigate data breaches, and ensure compliance with telecommunications regulations. The growing complexity of IT infrastructure and the interconnectedness of systems make digital forensics an essential component of their security strategies. Retail and Healthcare, while currently smaller segments, are experiencing significant growth. Retail is increasingly targeted by cybercriminals for customer data theft, while healthcare faces unique challenges due to the sensitive nature of patient data and strict HIPAA regulations. Emerging markets and increased digitalization across all sectors are contributing to the expansion of these segments.

- Government and Defense: Key drivers include national security concerns, counter-terrorism initiatives, and law enforcement needs for evidence integrity. The increasing sophistication of cyber warfare necessitates advanced forensic capabilities.

- Banking, Financial Services, and Insurance (BFSI): Driven by stringent regulations against financial crimes, fraud detection, and the need to protect sensitive financial data. The sheer volume of financial transactions makes forensic analysis critical.

- Telecom and IT: Fueled by the need for network security, incident response, and compliance with evolving data protection laws. The constant evolution of digital infrastructure demands continuous forensic readiness.

- Retail: Experiencing growth due to rising e-commerce fraud, data breaches targeting customer information, and the need for supply chain integrity.

- Healthcare: A rapidly growing segment due to the critical need to protect sensitive patient data (PHI) and comply with stringent healthcare regulations like HIPAA, alongside investigations into medical device tampering.

In terms of types of forensics, Computer Forensics remains a foundational segment, focusing on investigations of hard drives, SSDs, and other computer storage media. Network Forensics is gaining prominence with the increasing complexity of network infrastructures and the rise of distributed attacks. Mobile Device Forensics continues its strong performance, driven by the pervasive use of smartphones and the wealth of personal and transactional data they contain. Cloud Forensics is a rapidly expanding area, addressing the unique challenges of investigating data residing in cloud environments like AWS, Azure, and Google Cloud.

Digital Forensics Software Product Developments

Product developments in digital forensics software are largely characterized by advancements in automation, AI-driven analysis, and enhanced support for cloud and mobile environments. Companies are focusing on creating platforms that can ingest and analyze massive datasets more efficiently, reducing manual effort and accelerating investigation timelines. Innovations include enhanced capabilities for decrypted mobile data extraction, sophisticated network traffic analysis, and comprehensive cloud artifact collection and analysis. Competitive advantages are derived from offering integrated solutions that cover multiple forensic disciplines, providing intuitive user interfaces, and ensuring compliance with evolving legal and regulatory standards.

Report Scope & Segmentation Analysis

This report meticulously segments the digital forensics software market across key application areas and forensic types. The application segments include Government and Defense, Banking, Financial Services, and Insurance (BFSI), Telecom and IT, Retail, Healthcare, and Others. The types of forensics covered are Computer Forensics, Network Forensics, Mobile Device Forensics, and Cloud Forensics. Each segment is analyzed for its current market size, projected growth rate, and competitive landscape. For instance, the Government and Defense segment is expected to maintain its leading position with a projected market share of 30% by 2033, driven by sustained defense spending and cybersecurity initiatives. The Cloud Forensics segment is anticipated to exhibit the highest CAGR, reflecting the increasing adoption of cloud technologies and the resulting need for specialized investigative tools.

Key Drivers of Digital Forensics Software Growth

The growth of the digital forensics software market is propelled by several interconnected factors. The relentless surge in cyber threats, including ransomware, data breaches, and advanced persistent threats (APTs), mandates robust investigative capabilities. Increasingly stringent data privacy regulations, such as GDPR and CCPA, compel organizations to implement thorough data breach investigation protocols, driving demand for specialized software. The exponential growth of digital data across all aspects of life and business necessitates sophisticated tools for its collection, preservation, and analysis. Furthermore, the growing adoption of cloud computing and the Internet of Things (IoT) expands the attack surface, creating new challenges and demands for forensic tools capable of handling diverse data sources and environments. The proactive stance of law enforcement agencies and national security bodies in utilizing digital evidence for criminal investigations and intelligence gathering is another significant growth catalyst.

Challenges in the Digital Forensics Software Sector

Despite robust growth, the digital forensics software sector faces several challenges. The ever-evolving nature of technology and cyber threats requires continuous software updates and adaptation, which can be costly and time-consuming. The complexity of digital evidence, often encrypted or obfuscated, demands highly specialized and advanced tools and skilled professionals. Regulatory hurdles and varying legal standards across jurisdictions can complicate cross-border investigations. Supply chain issues, particularly for specialized hardware components, can impact the availability and cost of forensic solutions. Intense competition, with new players emerging and established vendors vying for market share, puts pressure on pricing and necessitates constant innovation. The increasing demand for specialized skills in digital forensics also presents a talent gap challenge.

Emerging Opportunities in Digital Forensics Software

Emerging opportunities in the digital forensics software market are abundant, driven by technological advancements and evolving market needs. The integration of AI and machine learning for automated data analysis, anomaly detection, and predictive forensics presents a significant growth avenue. The expansion of IoT devices and the increasing reliance on operational technology (OT) in critical infrastructure create new frontiers for forensic investigations. The growing adoption of blockchain technology also presents opportunities for specialized forensic tools capable of analyzing decentralized ledger data. Furthermore, the rise of proactive forensics, focusing on identifying vulnerabilities and preventing incidents before they occur, is a promising area. The demand for cloud-native forensic solutions that can seamlessly integrate with cloud environments is also a key opportunity.

Leading Players in the Digital Forensics Software Market

The digital forensics software market is populated by a range of innovative companies, including: IBM AccessData FireEye X-Ways Software Technology Belkasoft Magnet Forensics Agari Basis Technology Barracuda Quest Software OpenText CrowdStrike MixMode Parrot Security Check Point Software Technologies TIBCO

Key Developments in Digital Forensics Software Industry

- 2023 October: Magnet Forensics launches an enhanced version of its Forensics Platform, integrating AI for faster artifact identification and analysis.

- 2023 September: IBM announces significant advancements in its cloud forensics capabilities, focusing on multi-cloud environment analysis.

- 2023 August: Belkasoft releases an updated version of its Evidence Center, improving support for the latest mobile operating systems and encrypted data.

- 2023 July: AccessData (now part of Exterro) expands its suite with new features for incident response and proactive threat hunting.

- 2023 June: FireEye (now Mandiant, part of Google Cloud) emphasizes its intelligence-led approach to digital forensics in enterprise security.

- 2023 May: X-Ways Software Technology introduces new modules for advanced memory forensics and network analysis.

- 2023 April: CrowdStrike expands its endpoint detection and response (EDR) capabilities with enhanced forensic data collection.

- 2023 March: MixMode introduces its AI-powered network forensics solution, focusing on real-time threat detection and attribution.

- 2023 February: Parrot Security releases updated tools for network penetration testing and digital investigation.

- 2023 January: Check Point Software Technologies enhances its threat intelligence platform with forensic analysis capabilities.

- 2022 December: Agari focuses on email security forensics and threat intelligence.

- 2022 November: Basis Technology continues to refine its cyber forensics tools for complex investigations.

- 2022 October: Barracuda Networks integrates advanced forensic analysis into its cybersecurity solutions.

- 2022 September: Quest Software enhances its data protection and recovery solutions with forensic capabilities.

- 2022 August: OpenText solidifies its position in enterprise forensics with comprehensive data management and investigation tools.

Strategic Outlook for Digital Forensics Software Market

The strategic outlook for the digital forensics software market is exceptionally positive, driven by an insatiable demand for effective digital investigation tools. The ongoing evolution of cyber threats, coupled with increasingly stringent regulatory landscapes, will continue to fuel market growth. Key growth catalysts include the further integration of AI and ML for automated and predictive forensics, the expansion of cloud and mobile forensic capabilities, and the development of solutions for emerging technologies like IoT and blockchain. Companies that can offer comprehensive, scalable, and user-friendly platforms, while also demonstrating agility in adapting to new technological paradigms and threat vectors, will be well-positioned for long-term success. Strategic partnerships and acquisitions will likely continue to shape the market, enabling vendors to broaden their offerings and expand their global reach. The increasing recognition of digital forensics as a critical component of modern cybersecurity strategies across all industry verticals promises sustained market expansion.

Digital Forensics Software Segmentation

-

1. Application

- 1.1. Government and Defense

- 1.2. Banking, Financial Services, and Insurance (BFSI)

- 1.3. Telecom and IT

- 1.4. Retail

- 1.5. Healthcare

- 1.6. Others

-

2. Types

- 2.1. Computer Forensics

- 2.2. Network Forensics

- 2.3. Mobile device Forensics

- 2.4. Cloud Forensics

Digital Forensics Software Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Digital Forensics Software REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Digital Forensics Software Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Government and Defense

- 5.1.2. Banking, Financial Services, and Insurance (BFSI)

- 5.1.3. Telecom and IT

- 5.1.4. Retail

- 5.1.5. Healthcare

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Computer Forensics

- 5.2.2. Network Forensics

- 5.2.3. Mobile device Forensics

- 5.2.4. Cloud Forensics

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Digital Forensics Software Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Government and Defense

- 6.1.2. Banking, Financial Services, and Insurance (BFSI)

- 6.1.3. Telecom and IT

- 6.1.4. Retail

- 6.1.5. Healthcare

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Computer Forensics

- 6.2.2. Network Forensics

- 6.2.3. Mobile device Forensics

- 6.2.4. Cloud Forensics

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Digital Forensics Software Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Government and Defense

- 7.1.2. Banking, Financial Services, and Insurance (BFSI)

- 7.1.3. Telecom and IT

- 7.1.4. Retail

- 7.1.5. Healthcare

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Computer Forensics

- 7.2.2. Network Forensics

- 7.2.3. Mobile device Forensics

- 7.2.4. Cloud Forensics

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Digital Forensics Software Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Government and Defense

- 8.1.2. Banking, Financial Services, and Insurance (BFSI)

- 8.1.3. Telecom and IT

- 8.1.4. Retail

- 8.1.5. Healthcare

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Computer Forensics

- 8.2.2. Network Forensics

- 8.2.3. Mobile device Forensics

- 8.2.4. Cloud Forensics

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Digital Forensics Software Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Government and Defense

- 9.1.2. Banking, Financial Services, and Insurance (BFSI)

- 9.1.3. Telecom and IT

- 9.1.4. Retail

- 9.1.5. Healthcare

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Computer Forensics

- 9.2.2. Network Forensics

- 9.2.3. Mobile device Forensics

- 9.2.4. Cloud Forensics

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Digital Forensics Software Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Government and Defense

- 10.1.2. Banking, Financial Services, and Insurance (BFSI)

- 10.1.3. Telecom and IT

- 10.1.4. Retail

- 10.1.5. Healthcare

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Computer Forensics

- 10.2.2. Network Forensics

- 10.2.3. Mobile device Forensics

- 10.2.4. Cloud Forensics

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 IBM

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 AccessData

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 FireEye

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 X-Ways Software Technology

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Belkasoft

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Magnet Forensics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Agari

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Basis Technology

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Barracuda

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Quest Software

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 OpenText

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 CrowdStrike

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 MixMode

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Parrot Security

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Check Point Software Technologies

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 TIBCO

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 IBM

List of Figures

- Figure 1: Global Digital Forensics Software Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Digital Forensics Software Revenue (million), by Application 2024 & 2032

- Figure 3: North America Digital Forensics Software Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Digital Forensics Software Revenue (million), by Types 2024 & 2032

- Figure 5: North America Digital Forensics Software Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Digital Forensics Software Revenue (million), by Country 2024 & 2032

- Figure 7: North America Digital Forensics Software Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Digital Forensics Software Revenue (million), by Application 2024 & 2032

- Figure 9: South America Digital Forensics Software Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Digital Forensics Software Revenue (million), by Types 2024 & 2032

- Figure 11: South America Digital Forensics Software Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Digital Forensics Software Revenue (million), by Country 2024 & 2032

- Figure 13: South America Digital Forensics Software Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Digital Forensics Software Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Digital Forensics Software Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Digital Forensics Software Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Digital Forensics Software Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Digital Forensics Software Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Digital Forensics Software Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Digital Forensics Software Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Digital Forensics Software Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Digital Forensics Software Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Digital Forensics Software Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Digital Forensics Software Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Digital Forensics Software Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Digital Forensics Software Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Digital Forensics Software Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Digital Forensics Software Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Digital Forensics Software Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Digital Forensics Software Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Digital Forensics Software Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Digital Forensics Software Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Digital Forensics Software Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Digital Forensics Software Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Digital Forensics Software Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Digital Forensics Software Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Digital Forensics Software Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Digital Forensics Software Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Digital Forensics Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Digital Forensics Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Digital Forensics Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Digital Forensics Software Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Digital Forensics Software Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Digital Forensics Software Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Digital Forensics Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Digital Forensics Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Digital Forensics Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Digital Forensics Software Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Digital Forensics Software Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Digital Forensics Software Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Digital Forensics Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Digital Forensics Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Digital Forensics Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Digital Forensics Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Digital Forensics Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Digital Forensics Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Digital Forensics Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Digital Forensics Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Digital Forensics Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Digital Forensics Software Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Digital Forensics Software Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Digital Forensics Software Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Digital Forensics Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Digital Forensics Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Digital Forensics Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Digital Forensics Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Digital Forensics Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Digital Forensics Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Digital Forensics Software Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Digital Forensics Software Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Digital Forensics Software Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Digital Forensics Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Digital Forensics Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Digital Forensics Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Digital Forensics Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Digital Forensics Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Digital Forensics Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Digital Forensics Software Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Forensics Software?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Digital Forensics Software?

Key companies in the market include IBM, AccessData, FireEye, X-Ways Software Technology, Belkasoft, Magnet Forensics, Agari, Basis Technology, Barracuda, Quest Software, OpenText, CrowdStrike, MixMode, Parrot Security, Check Point Software Technologies, TIBCO.

3. What are the main segments of the Digital Forensics Software?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Digital Forensics Software," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Digital Forensics Software report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Digital Forensics Software?

To stay informed about further developments, trends, and reports in the Digital Forensics Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence