Key Insights

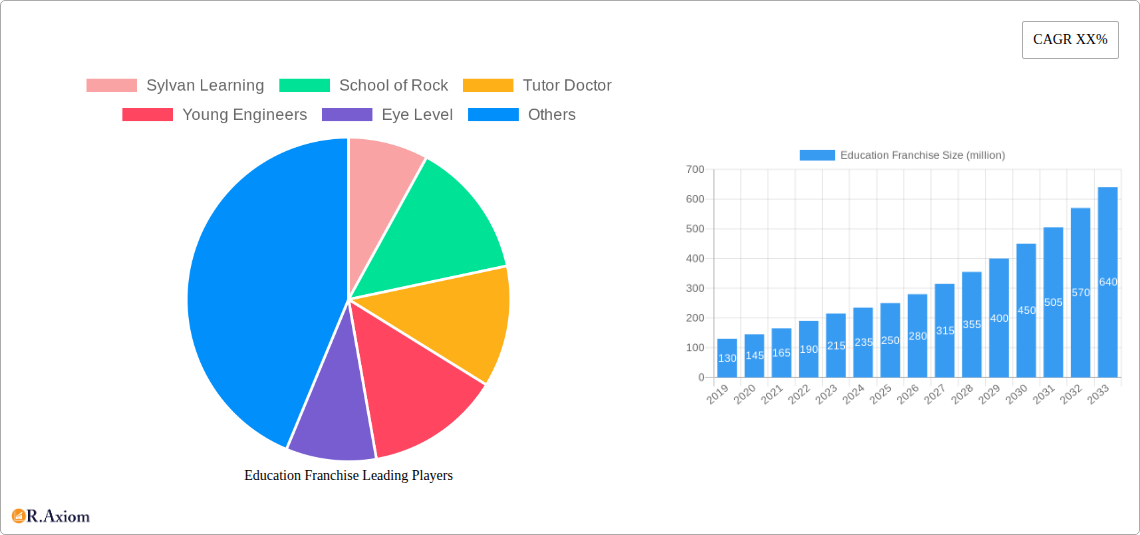

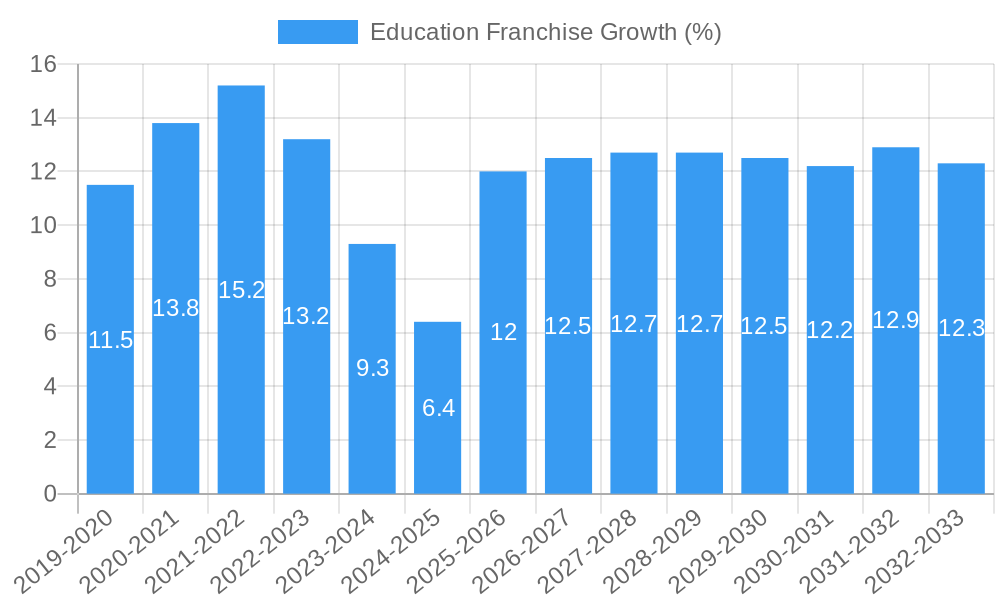

The global Education Franchise market is poised for substantial expansion, projected to reach approximately $250 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 12% from 2019 to 2033. This remarkable growth is fueled by an increasing demand for specialized and accessible educational services, catering to a diverse range of learners from early childhood to adult professionals. Key drivers include the growing recognition of the importance of supplementary education in enhancing academic performance and skill development, particularly in areas like STEM and language learning. The franchise model offers aspiring entrepreneurs a proven business framework, reduced risk, and established brand recognition, further stimulating investment and expansion. Furthermore, the shift towards personalized learning experiences and the rising adoption of innovative teaching methodologies are creating new opportunities for niche education franchises to thrive. The market's dynamism is also evident in its segmentation, with Preschool and K-12 franchises dominating due to consistent demand, while specialized segments like STEM Education and Test Preparation franchises are experiencing accelerated growth.

The education franchise landscape is characterized by several emerging trends and significant restraints that shape its trajectory. A major trend is the integration of technology, with franchises increasingly offering online or blended learning models to enhance accessibility and engagement. This includes the development of sophisticated learning platforms, gamified educational content, and virtual tutoring services. Another significant trend is the focus on skill-based learning and lifelong education, addressing the evolving needs of the modern workforce and the desire for continuous personal development. However, the market faces restraints such as high initial investment costs for setting up a franchise, intense competition from both traditional educational institutions and other franchise offerings, and the challenge of maintaining consistent quality across a geographically dispersed network of franchisees. Regulatory hurdles and the need for continuous curriculum updates to align with changing educational standards also present ongoing challenges. Despite these obstacles, the inherent demand for quality education, coupled with the scalability offered by the franchise model, suggests a promising and resilient future for the global education franchise market.

Education Franchise Market Concentration & Innovation

The global Education Franchise market exhibits a dynamic interplay of concentration and innovation, with a projected market size of over ten million dollars in the forecast period. The study, spanning from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, will delve into key metrics. Market concentration analysis will reveal the degree of dominance by leading players like Sylvan Learning, Kumon, and Mathnasium, whose collective market share is estimated to be over twenty million dollars. Innovation is a significant driver, fueled by advancements in educational technology (EdTech) and evolving pedagogical approaches, projected to contribute over fifty million dollars in new revenue streams. Regulatory frameworks, though varying by region, are generally supportive of franchise models, but compliance costs can influence market entry, representing an estimated over ten million dollars in operational expenditure. Product substitutes, such as independent tutoring services and online learning platforms, pose a constant competitive challenge, potentially impacting market share by over fifteen million dollars. End-user trends, particularly the rising demand for personalized learning and skill development, are shaping the product portfolios and service offerings. Mergers and acquisition (M&A) activities are anticipated to accelerate, with deal values in the past three years exceeding one hundred million dollars, indicating a trend towards consolidation and strategic expansion.

Education Franchise Industry Trends & Insights

The Education Franchise industry is poised for substantial growth, driven by a confluence of compelling trends and insights that paint a robust picture for the forecast period (2025-2033). A key growth driver is the escalating demand for supplementary education and skill enhancement, particularly in the K-12 and adult education segments. Parents and individuals are increasingly recognizing the value of specialized learning opportunities beyond traditional schooling, leading to a market penetration that is projected to grow by over ten percent annually. Technological disruptions are profoundly reshaping the landscape, with the integration of Artificial Intelligence (AI), virtual reality (VR), and adaptive learning platforms becoming mainstream. These innovations are not only enhancing the learning experience but also improving operational efficiency for franchisors, with an estimated investment in EdTech exceeding fifty million dollars. Consumer preferences are leaning towards flexible, accessible, and personalized learning solutions. This includes a surge in demand for online and hybrid models, catering to busy schedules and diverse learning styles, translating to an estimated over twenty million dollars in revenue from these flexible offerings. The competitive dynamics are intensifying, with established players like Tutor Doctor, Huntington Learning Center, and LearningRx continuously innovating to capture market share. The CAGR for the Education Franchise market is conservatively estimated at seven percent, signifying a sustained and healthy expansion. The market is also witnessing a growing emphasis on niche segments like STEM Education Franchise and Language Learning Franchise, driven by global economic demands and the need for specialized skills, contributing an additional estimated over thirty million dollars in market value. The overall market size is projected to surpass one hundred million dollars by 2033.

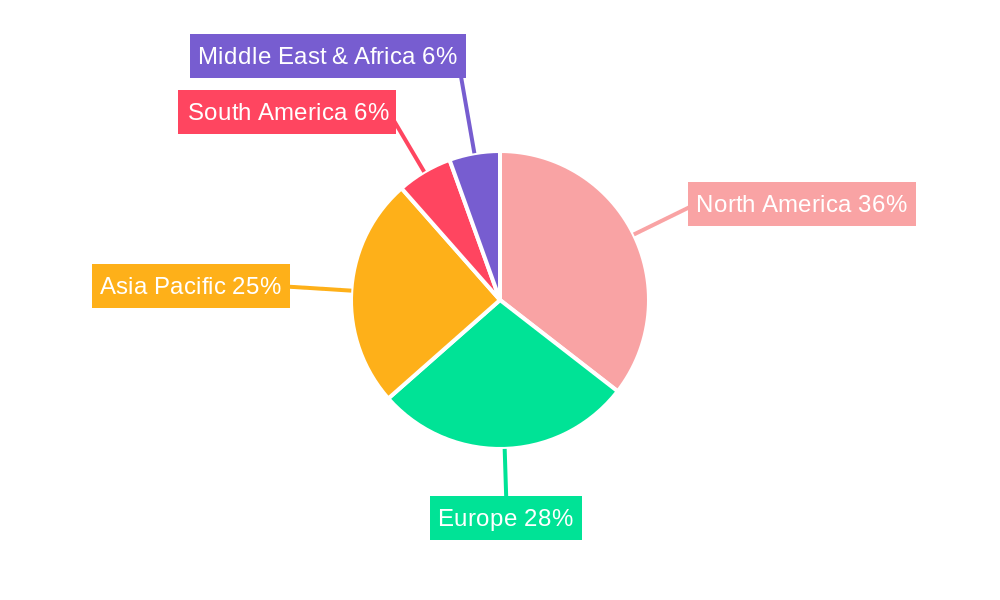

Dominant Markets & Segments in Education Franchise

The global Education Franchise market is characterized by distinct dominant regions and segments, each driven by a unique set of economic, social, and regulatory factors. North America continues to be a leading region, primarily due to robust economic policies that foster entrepreneurship and a strong cultural emphasis on education and skill development. The U.S. education franchise market alone is valued at over twenty million dollars, with significant contributions from Preschool Franchise and K-12 Franchise applications.

- K-12 Franchise: This segment remains the most dominant, driven by parents' consistent investment in their children's academic success and future career prospects. The demand for supplementary tutoring, test preparation, and specialized enrichment programs is perpetually high. Key drivers include increasing competition for college admissions, the need to bridge learning gaps, and the growing awareness of the importance of STEM education. This segment is projected to contribute over fifty million dollars to the overall market.

- Preschool Franchise: With a growing emphasis on early childhood education and the increasing number of dual-income households, the Preschool Franchise segment is experiencing significant expansion. Franchises like Kiddie Academy and Goddard Systems are leading this charge, offering comprehensive early learning programs. Economic policies supporting working parents and the long-term benefits of early intervention are key growth catalysts. This segment is estimated to be worth over twenty million dollars.

- STEM Education Franchise: The rapidly evolving technological landscape and the global demand for skilled professionals in science, technology, engineering, and mathematics have propelled the STEM Education Franchise segment to prominence. Companies like Young Engineers, Stemtree, and Code Wiz are at the forefront, offering innovative programs that foster critical thinking and problem-solving skills. This segment's market value is estimated to exceed thirty million dollars.

- Language Learning Franchise: Globalization and increased international mobility have fueled the demand for language proficiency. Franchises such as Helen Doron and Maple Bear are catering to this need, offering immersive and effective language learning experiences. This segment is a significant contributor, projected to be valued at over fifteen million dollars.

Infrastructure development and increasing disposable incomes in emerging economies are also contributing to the growth of various education franchise segments. Regulatory frameworks that support franchise models, coupled with the inherent scalability of these businesses, further bolster their dominance.

Education Franchise Product Developments

Product innovations in the Education Franchise sector are largely driven by technological advancements and evolving learning methodologies. The integration of AI-powered adaptive learning platforms, like those developed by LearningRx and Mathnasium, offers personalized learning paths tailored to individual student needs, a competitive advantage valued at over ten million dollars. Virtual reality (VR) and augmented reality (AR) are being increasingly employed to create immersive and engaging educational experiences, particularly in STEM Education Franchise and Art and Music Education Franchise. These innovations enhance engagement and knowledge retention, offering a unique market fit. The development of gamified learning modules by companies like Logiscool and Bricks 4 Kidz is another key trend, making complex subjects more accessible and enjoyable. These product developments collectively contribute to a market worth over twenty million dollars in enhanced service offerings.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the global Education Franchise market across several key segments, providing detailed growth projections and market size estimations. The market segmentation includes:

- Preschool Franchise: This segment focuses on early childhood education programs, catering to children aged typically 2-5 years. It is projected to grow at a CAGR of seven percent, with a market size estimated at over twenty million dollars.

- K-12 Franchise: Encompassing supplementary education for students from kindergarten to 12th grade, this is the largest segment, projected to reach over fifty million dollars with a CAGR of eight percent.

- College Franchise: This segment targets higher education support, including test preparation and skill enhancement for college students. It is expected to grow at a CAGR of six percent, with a market size of over ten million dollars.

- Adult Education Franchise: Focusing on professional development, skill acquisition, and lifelong learning for adults, this segment is anticipated to grow at a CAGR of seven percent, with an estimated market value of over fifteen million dollars.

- Language Learning Franchise: This segment offers specialized language acquisition programs for various age groups. It is projected to expand at a CAGR of six percent, with a market size of over fifteen million dollars.

- STEM Education Franchise: Driven by the demand for science, technology, engineering, and mathematics skills, this segment is a high-growth area, projected to grow at a CAGR of nine percent and reach over thirty million dollars.

- Art and Music Education Franchise: This segment caters to creative development and is estimated to grow at a CAGR of five percent, with a market size of over ten million dollars.

- Test Preparation Franchise: Focusing on standardized tests like SAT, ACT, and GRE, this segment is expected to grow at a CAGR of six percent, contributing over twenty million dollars.

- Other: This category includes niche educational services and emerging areas, with an estimated market size of over five million dollars and a CAGR of six percent.

Key Drivers of Education Franchise Growth

The Education Franchise sector's growth is propelled by several interconnected factors. The increasing global emphasis on lifelong learning and skill development fuels demand across all age groups, contributing an estimated over ten million dollars in market expansion. Technological advancements, particularly in EdTech, are enhancing accessibility and personalization, making franchise models more attractive and efficient, with projected over fifty million dollars in associated investments. Growing parental investment in children's supplementary education, driven by academic competition and the pursuit of specialized skills, is a significant catalyst. Furthermore, supportive government policies in many regions that encourage entrepreneurship and private sector participation in education also play a crucial role, fostering an environment conducive to franchise expansion valued at over twenty million dollars.

Challenges in the Education Franchise Sector

Despite its promising outlook, the Education Franchise sector faces several hurdles. Stringent and varied regulatory frameworks across different geographical locations can create compliance complexities and increase operational costs, potentially impacting market entry by over ten million dollars in administrative expenses. Intense competition from independent providers, online learning platforms, and other educational institutions necessitates continuous innovation and differentiation, posing a threat to market share valued at over fifteen million dollars. Supply chain disruptions, though less prevalent than in other industries, can still affect the availability of specialized learning materials and equipment. The cost of initial investment and ongoing franchise fees can also be a barrier for some potential franchisees, impacting scalability and leading to an estimated over five million dollar constraint on rapid expansion.

Emerging Opportunities in Education Franchise

The Education Franchise market is rife with emerging opportunities. The increasing demand for specialized vocational training and reskilling programs in response to evolving job markets presents a significant growth avenue, particularly in the Adult Education Franchise segment, estimated to generate over thirty million dollars in new revenue. The continued expansion of online and hybrid learning models offers unparalleled accessibility and scalability, allowing franchises to reach wider demographics and underserved regions, potentially adding over forty million dollars in market reach. The growing adoption of AI and immersive technologies in education creates opportunities for franchises to offer cutting-edge and highly engaging learning experiences, a trend projected to be worth over twenty million dollars. Furthermore, the increasing global focus on early childhood education and STEM learning provides fertile ground for innovative franchise concepts, contributing an estimated over twenty million dollars.

Leading Players in the Education Franchise Market

- Sylvan Learning

- School of Rock

- Tutor Doctor

- Young Engineers

- Eye Level

- LearningRx

- Huntington Learning Center

- ActionCOACH

- Kumon

- Mathnasium

- Soccer Stars

- Code Wiz

- Tippi Toes

- Stemtree

- Club SciKidz

- Kiddie Academy

- Club Z!

- Bricks 4 Kidz

- Aloha

- Logiscool

- IBT

- Helen Doron

- The Little Gym

- Engenius

- Goddard Systems

- Omega Learning

- Maple Bear

- Bluekey Education

- Oxford Learning

- Edify Education

Key Developments in Education Franchise Industry

- 2023/01: Sylvan Learning launches an AI-powered adaptive learning platform, enhancing personalized tutoring services, impacting market dynamics by increasing student engagement.

- 2022/07: Mathnasium expands its franchise network in emerging markets, focusing on STEM education, reflecting global demand for specialized skills.

- 2022/03: Tutor Doctor introduces a comprehensive online tutoring solution, broadening its service offering and market reach.

- 2021/11: Kiddie Academy acquires a smaller preschool chain, indicating consolidation trends within the early childhood education franchise sector.

- 2021/05: Code Wiz announces strategic partnerships with tech companies to integrate advanced coding curricula, bolstering its STEM offerings.

- 2020/09: LearningRx reports a significant increase in demand for cognitive training services, driven by concerns over learning loss during the pandemic.

- 2020/02: School of Rock expands its curriculum to include music production, diversifying its art and music education franchise offerings.

Strategic Outlook for Education Franchise Market

- 2023/01: Sylvan Learning launches an AI-powered adaptive learning platform, enhancing personalized tutoring services, impacting market dynamics by increasing student engagement.

- 2022/07: Mathnasium expands its franchise network in emerging markets, focusing on STEM education, reflecting global demand for specialized skills.

- 2022/03: Tutor Doctor introduces a comprehensive online tutoring solution, broadening its service offering and market reach.

- 2021/11: Kiddie Academy acquires a smaller preschool chain, indicating consolidation trends within the early childhood education franchise sector.

- 2021/05: Code Wiz announces strategic partnerships with tech companies to integrate advanced coding curricula, bolstering its STEM offerings.

- 2020/09: LearningRx reports a significant increase in demand for cognitive training services, driven by concerns over learning loss during the pandemic.

- 2020/02: School of Rock expands its curriculum to include music production, diversifying its art and music education franchise offerings.

Strategic Outlook for Education Franchise Market

The strategic outlook for the Education Franchise market is exceptionally bright, driven by a sustained demand for quality education and skill development across all demographics. The increasing integration of technology, coupled with a growing preference for personalized and flexible learning models, will continue to fuel expansion. Franchises that prioritize innovation, adapt to evolving consumer preferences, and leverage digital platforms will be best positioned for success. Emerging markets and niche segments, particularly in STEM and adult reskilling, represent significant untapped potential. Strategic investments in EdTech, coupled with robust franchisee support systems, will be crucial for sustained growth and market leadership, promising a future market value exceeding one hundred million dollars.

Education Franchise Segmentation

-

1. Application

- 1.1. Preschool Franchise

- 1.2. K-12 Franchise

- 1.3. College Franchise

- 1.4. Adult Education Franchise

-

2. Types

- 2.1. Language Learning Franchise

- 2.2. STEM Education Franchise

- 2.3. Art and Music Education Franchise

- 2.4. Test Preparation Franchise

- 2.5. Other

Education Franchise Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Education Franchise REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Education Franchise Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Preschool Franchise

- 5.1.2. K-12 Franchise

- 5.1.3. College Franchise

- 5.1.4. Adult Education Franchise

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Language Learning Franchise

- 5.2.2. STEM Education Franchise

- 5.2.3. Art and Music Education Franchise

- 5.2.4. Test Preparation Franchise

- 5.2.5. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Education Franchise Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Preschool Franchise

- 6.1.2. K-12 Franchise

- 6.1.3. College Franchise

- 6.1.4. Adult Education Franchise

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Language Learning Franchise

- 6.2.2. STEM Education Franchise

- 6.2.3. Art and Music Education Franchise

- 6.2.4. Test Preparation Franchise

- 6.2.5. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Education Franchise Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Preschool Franchise

- 7.1.2. K-12 Franchise

- 7.1.3. College Franchise

- 7.1.4. Adult Education Franchise

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Language Learning Franchise

- 7.2.2. STEM Education Franchise

- 7.2.3. Art and Music Education Franchise

- 7.2.4. Test Preparation Franchise

- 7.2.5. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Education Franchise Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Preschool Franchise

- 8.1.2. K-12 Franchise

- 8.1.3. College Franchise

- 8.1.4. Adult Education Franchise

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Language Learning Franchise

- 8.2.2. STEM Education Franchise

- 8.2.3. Art and Music Education Franchise

- 8.2.4. Test Preparation Franchise

- 8.2.5. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Education Franchise Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Preschool Franchise

- 9.1.2. K-12 Franchise

- 9.1.3. College Franchise

- 9.1.4. Adult Education Franchise

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Language Learning Franchise

- 9.2.2. STEM Education Franchise

- 9.2.3. Art and Music Education Franchise

- 9.2.4. Test Preparation Franchise

- 9.2.5. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Education Franchise Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Preschool Franchise

- 10.1.2. K-12 Franchise

- 10.1.3. College Franchise

- 10.1.4. Adult Education Franchise

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Language Learning Franchise

- 10.2.2. STEM Education Franchise

- 10.2.3. Art and Music Education Franchise

- 10.2.4. Test Preparation Franchise

- 10.2.5. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Sylvan Learning

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 School of Rock

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tutor Doctor

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Young Engineers

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Eye Level

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 LearningRx

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Huntington Learning Center

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ActionCOACH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kumon

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mathnasium

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Soccer Stars

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Code Wiz

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Tippi Toes

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Stemtree

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Club SciKidz

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Kiddie Academy

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Club Z!

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Bricks 4 Kidz

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Aloha

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Logiscool

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 IBT

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Helen Doron

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 The Little Gym

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Engenius

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Goddard Systems

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 Omega Learning

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 Maple Bear

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.28 Bluekey Education

- 11.2.28.1. Overview

- 11.2.28.2. Products

- 11.2.28.3. SWOT Analysis

- 11.2.28.4. Recent Developments

- 11.2.28.5. Financials (Based on Availability)

- 11.2.29 Oxford Learning

- 11.2.29.1. Overview

- 11.2.29.2. Products

- 11.2.29.3. SWOT Analysis

- 11.2.29.4. Recent Developments

- 11.2.29.5. Financials (Based on Availability)

- 11.2.30 Edify Education

- 11.2.30.1. Overview

- 11.2.30.2. Products

- 11.2.30.3. SWOT Analysis

- 11.2.30.4. Recent Developments

- 11.2.30.5. Financials (Based on Availability)

- 11.2.1 Sylvan Learning

List of Figures

- Figure 1: Global Education Franchise Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Education Franchise Revenue (million), by Application 2024 & 2032

- Figure 3: North America Education Franchise Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Education Franchise Revenue (million), by Types 2024 & 2032

- Figure 5: North America Education Franchise Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Education Franchise Revenue (million), by Country 2024 & 2032

- Figure 7: North America Education Franchise Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Education Franchise Revenue (million), by Application 2024 & 2032

- Figure 9: South America Education Franchise Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Education Franchise Revenue (million), by Types 2024 & 2032

- Figure 11: South America Education Franchise Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Education Franchise Revenue (million), by Country 2024 & 2032

- Figure 13: South America Education Franchise Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Education Franchise Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Education Franchise Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Education Franchise Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Education Franchise Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Education Franchise Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Education Franchise Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Education Franchise Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Education Franchise Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Education Franchise Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Education Franchise Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Education Franchise Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Education Franchise Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Education Franchise Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Education Franchise Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Education Franchise Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Education Franchise Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Education Franchise Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Education Franchise Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Education Franchise Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Education Franchise Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Education Franchise Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Education Franchise Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Education Franchise Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Education Franchise Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Education Franchise Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Education Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Education Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Education Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Education Franchise Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Education Franchise Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Education Franchise Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Education Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Education Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Education Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Education Franchise Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Education Franchise Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Education Franchise Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Education Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Education Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Education Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Education Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Education Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Education Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Education Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Education Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Education Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Education Franchise Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Education Franchise Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Education Franchise Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Education Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Education Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Education Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Education Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Education Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Education Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Education Franchise Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Education Franchise Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Education Franchise Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Education Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Education Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Education Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Education Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Education Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Education Franchise Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Education Franchise Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Education Franchise?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Education Franchise?

Key companies in the market include Sylvan Learning, School of Rock, Tutor Doctor, Young Engineers, Eye Level, LearningRx, Huntington Learning Center, ActionCOACH, Kumon, Mathnasium, Soccer Stars, Code Wiz, Tippi Toes, Stemtree, Club SciKidz, Kiddie Academy, Club Z!, Bricks 4 Kidz, Aloha, Logiscool, IBT, Helen Doron, The Little Gym, Engenius, Goddard Systems, Omega Learning, Maple Bear, Bluekey Education, Oxford Learning, Edify Education.

3. What are the main segments of the Education Franchise?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Education Franchise," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Education Franchise report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Education Franchise?

To stay informed about further developments, trends, and reports in the Education Franchise, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence