Key Insights

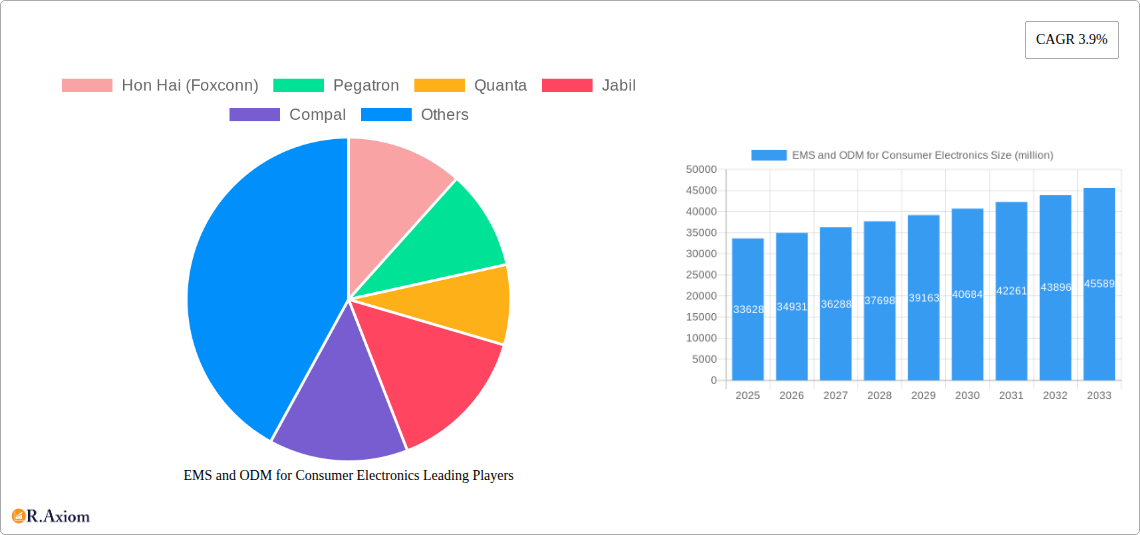

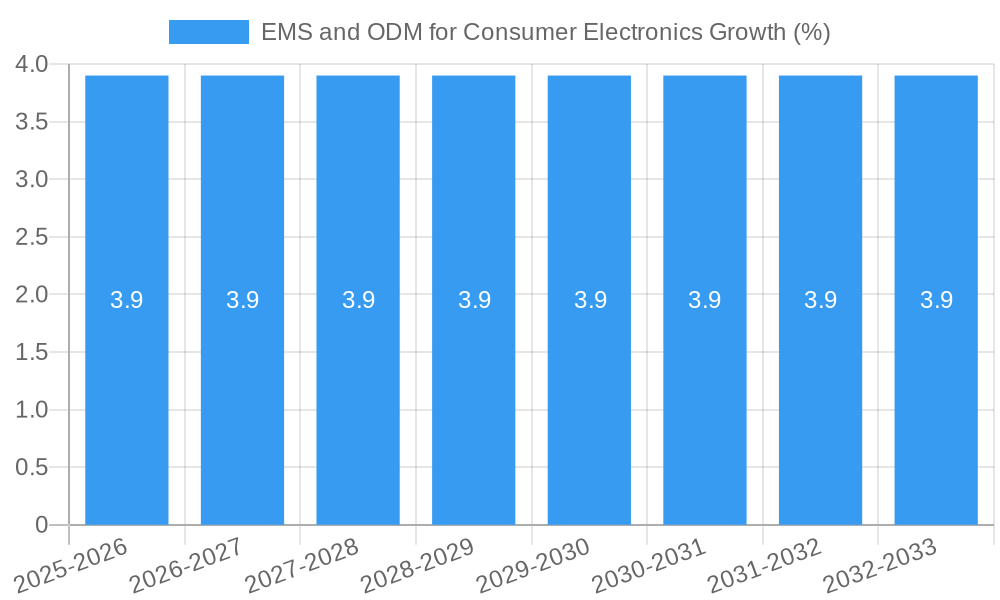

The global market for Electronic Manufacturing Services (EMS) and Original Design Manufacturers (ODM) serving the consumer electronics sector is projected for robust expansion, valued at an estimated USD 33,628 million in 2025. This growth is propelled by an anticipated Compound Annual Growth Rate (CAGR) of 3.9% from 2025 to 2033, indicating a healthy and sustained upward trajectory. The primary drivers fueling this market's ascent include the relentless innovation and rapid product life cycles characteristic of consumer electronics, the increasing demand for sophisticated features and enhanced user experiences, and the ongoing trend of brand outsourcing to specialized EMS and ODM providers to leverage their expertise, reduce costs, and accelerate time-to-market. Furthermore, the burgeoning Internet of Things (IoT) ecosystem, with its proliferation of connected devices across various categories, is creating significant new avenues for growth, as is the ongoing miniaturization and complexity of electronic components, necessitating advanced manufacturing capabilities.

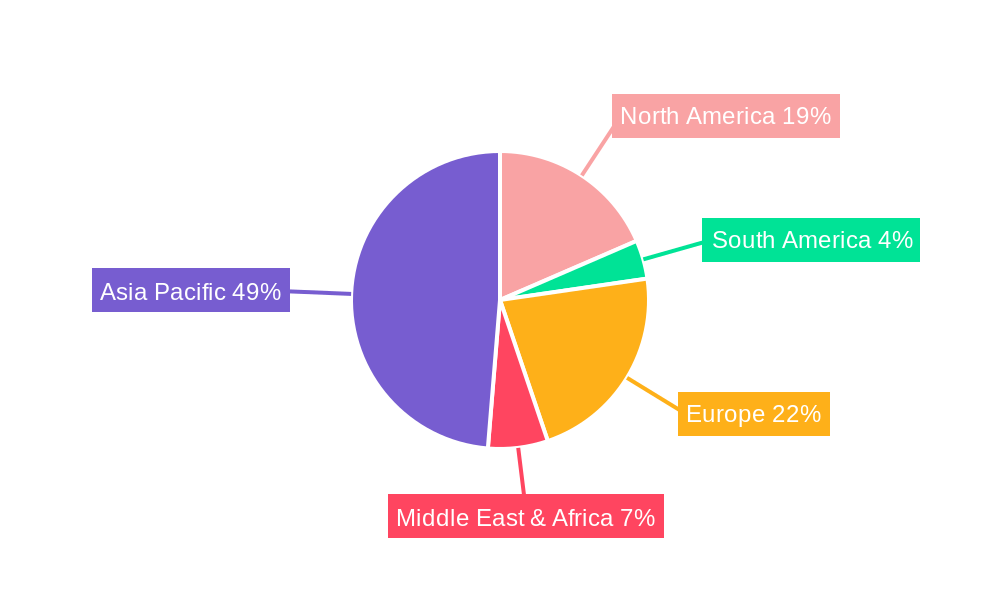

Key trends shaping the EMS and ODM landscape for consumer electronics encompass the increasing demand for integrated solutions that span design, manufacturing, and supply chain management. There's a pronounced shift towards higher-value services, including advanced product development, testing, and post-sale support. The industry is also witnessing a growing emphasis on sustainability and circular economy principles within manufacturing processes, driven by both regulatory pressures and consumer preference. Geographically, Asia Pacific, particularly China, remains the dominant manufacturing hub due to its established ecosystem and cost advantages, though diversification in manufacturing locations is a subtle but growing trend. Restraints to growth may stem from intensifying price competition among manufacturers, potential supply chain disruptions, and the increasing complexity of product compliance and regulatory requirements across different global markets. The competitive landscape is characterized by the presence of large, established players like Hon Hai (Foxconn) and Pegatron, alongside a multitude of specialized EMS and ODM providers catering to niche segments.

EMS and ODM for Consumer Electronics Market Concentration & Innovation

The global EMS (Electronics Manufacturing Services) and ODM (Original Design Manufacturer) market for consumer electronics is characterized by a moderate to high level of concentration, with a few dominant players like Hon Hai (Foxconn), Pegatron, Quanta, and Jabil commanding significant market share, collectively exceeding 70% of the total market value. Innovation within this sector is a critical differentiator, driven by the relentless demand for advanced features in product categories such as smartphones, tablets & PCs, and wearables. Key innovation drivers include the integration of AI and machine learning, miniaturization of components, development of sustainable manufacturing processes, and advancements in IoT connectivity. Regulatory frameworks, particularly concerning environmental impact and data security, are increasingly shaping product design and manufacturing strategies, influencing operational costs and market entry barriers. While direct product substitutes for highly integrated consumer electronics are limited, advancements in modular design and open-source hardware offer potential disruptors. End-user trends, such as the growing demand for personalized and connected devices, are pushing EMS and ODM providers to offer more flexible and tailored manufacturing solutions. Mergers and acquisitions (M&A) activities are notable, with deal values frequently in the hundreds of millions, aimed at consolidating market share, acquiring technological expertise, and expanding geographical reach. For instance, past M&A activities have focused on acquiring specialized R&D capabilities in areas like advanced display technologies and power management solutions, contributing to market consolidation and fostering innovation among the top-tier players.

EMS and ODM for Consumer Electronics Industry Trends & Insights

The EMS and ODM for Consumer Electronics market is poised for substantial growth, driven by a confluence of technological advancements, evolving consumer preferences, and strategic shifts within the industry. The market is projected to experience a Compound Annual Growth Rate (CAGR) of approximately 8.5% from 2025 to 2033, reaching an estimated market size of over 1.5 trillion by the end of the forecast period. This robust expansion is fueled by the increasing complexity of consumer electronics devices, necessitating specialized manufacturing expertise and design capabilities that EMS and ODM providers excel at delivering. Technological disruptions are continuously reshaping the landscape, with the widespread adoption of 5G, AI, and the Internet of Things (IoT) creating a demand for more sophisticated and interconnected devices. This trend is particularly evident in segments like smart home devices and advanced wearables, where continuous innovation is paramount. Consumer preferences are increasingly leaning towards personalized, user-friendly, and eco-conscious products, compelling manufacturers to collaborate closely with their EMS and ODM partners to integrate these attributes into their offerings. The market penetration of smart home devices is expected to surpass 75% in developed economies by 2030, creating a significant demand surge for specialized EMS and ODM services. Competitive dynamics are intensifying, with EMS and ODM providers differentiating themselves through their ability to offer end-to-end solutions, from concept and design to manufacturing and after-sales support. This includes a focus on supply chain resilience, cost optimization, and rapid prototyping to meet aggressive product launch timelines. The demand for high-volume production of popular consumer electronics, such as gaming consoles and high-definition televisions, continues to underpin market growth, with global shipments projected to exceed 2 billion units annually by 2028. Furthermore, the growing emphasis on sustainability is driving the adoption of green manufacturing practices, influencing material sourcing and waste reduction strategies, and offering a competitive edge to providers who can demonstrate strong environmental credentials. The burgeoning market for augmented reality (AR) and virtual reality (VR) devices is another significant growth catalyst, requiring specialized design and manufacturing expertise in areas like optical engineering and sensor integration, presenting substantial opportunities for innovative EMS and ODM partners.

Dominant Markets & Segments in EMS and ODM for Consumer Electronics

The global EMS and ODM for Consumer Electronics market exhibits distinct regional and segmental dominance, shaped by economic policies, robust infrastructure, and established manufacturing ecosystems. Geographically, Asia-Pacific, particularly China, continues to be the undisputed leader in both EMS and ODM services for consumer electronics. This dominance is attributed to its established supply chain networks, large skilled labor pool, and significant government support for the electronics manufacturing sector. The region’s market share in global consumer electronics manufacturing is estimated to be over 80%, translating to a substantial portion of EMS and ODM activities.

Dominant Applications:

- Smartphones: This segment remains the largest revenue generator, driven by constant product refreshes and the ever-increasing demand for advanced mobile technology. The global smartphone market alone accounts for over 40% of the total EMS and ODM consumer electronics market. Key drivers include:

- Technological Advancements: Integration of AI, foldable displays, and enhanced camera systems.

- Brand Proliferation: A large number of global brands rely on EMS providers for mass production.

- Emerging Markets: Growing disposable income in developing nations fuels demand.

- Tablets & PCs: While facing some maturity, this segment continues to be a significant contributor, especially with the rise of hybrid devices and demand for portable computing solutions. Key drivers include:

- Remote Work & Education: Sustained demand for portable computing devices.

- New Form Factors: Innovations in convertible and detachable devices.

- Gaming Laptops: A growing niche within the PC segment.

- Audio Equipment: This segment is experiencing renewed growth due to the popularity of true wireless earbuds, smart speakers, and high-fidelity audio systems. Key drivers include:

- Wireless Technology: Dominance of Bluetooth and Wi-Fi enabled devices.

- Smart Home Integration: Proliferation of voice-controlled smart speakers.

- Premiumization: Demand for higher quality audio experiences.

- Wearable Devices: This rapidly expanding segment includes smartwatches, fitness trackers, and other health-monitoring devices, representing a high-growth area. Key drivers include:

- Health & Wellness Focus: Increasing consumer interest in personal health tracking.

- Connectivity: Seamless integration with smartphones and other devices.

- Fashion & Lifestyle: Growing demand for stylish and feature-rich wearables.

- Smart Home: This segment, encompassing smart thermostats, lighting, security systems, and appliances, is witnessing exponential growth. Key drivers include:

- Convenience & Automation: Desire for automated home environments.

- Energy Efficiency: Demand for smart devices that optimize energy consumption.

- Interoperability: Increasing standardization and ease of integration.

Dominant Types:

- EMS (Electronics Manufacturing Services): EMS providers offer manufacturing capabilities, from component sourcing and assembly to testing and logistics. They are dominant in high-volume production and for established brands that have their own R&D and design teams. The EMS segment is estimated to hold a market share of over 65%. Key drivers include:

- Economies of Scale: Cost-effectiveness for mass production.

- Supply Chain Management: Expertise in managing complex global supply chains.

- Capital Investment: Ability to invest in state-of-the-art manufacturing facilities.

- ODM (Original Design Manufacturer): ODMs design and manufacture products on behalf of clients, often providing proprietary designs and intellectual property. They are crucial for brands looking to enter new markets or accelerate product development. The ODM segment is growing rapidly, especially in niche and innovative product categories. Key drivers include:

- Faster Time-to-Market: Leveraging existing designs and expertise.

- Innovation & R&D: Access to cutting-edge design and technology.

- Cost Efficiency: Reduced R&D investment for client brands.

The dominance of these segments and regions underscores the critical role of EMS and ODM providers in the global consumer electronics value chain, facilitating innovation, scaling production, and meeting diverse consumer demands.

EMS and ODM for Consumer Electronics Product Developments

Product developments in the EMS and ODM for consumer electronics sector are heavily influenced by miniaturization, increased processing power, and enhanced connectivity. Innovations focus on integrating AI capabilities into everyday devices, leading to smarter smartphones with advanced camera features and more intuitive user interfaces. Wearable devices are evolving with sophisticated health monitoring sensors and longer battery life. The smart home segment is seeing the development of more interconnected ecosystems, with devices communicating seamlessly to enhance convenience and efficiency. ODM providers are instrumental in bringing these innovations to market by offering integrated design solutions that combine cutting-edge technology with user-centric design principles, providing competitive advantages through rapid prototyping and optimized manufacturing processes for market-ready products.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the EMS and ODM market for consumer electronics, encompassing a detailed segmentation across various applications and service types.

Application Segments:

- Smartphones: This segment is projected to hold the largest market share, driven by continuous technological upgrades and global demand. Expected market size to reach over 600 million by 2028 with a CAGR of 7.9%.

- Tablets & PCs: Characterized by steady growth, especially in the hybrid and convertible device categories. Projected to reach over 150 million units annually by 2028.

- Audio Equipment: Experiencing a resurgence with demand for wireless and smart audio solutions. Expected to grow at a CAGR of 9.2% from 2025 to 2033.

- TVs: Stable growth driven by advancements in display technology and smart TV features. Market size estimated at over 200 million units annually.

- Camera: Segment facing evolving demand with integration in smartphones, but dedicated camera markets show niche growth.

- Wearables Device: A high-growth segment with increasing adoption for health and fitness tracking. Projected to grow at a CAGR of 12.5%.

- Smart Home: Experiencing rapid expansion driven by the desire for convenience and automation. Market size to exceed 300 million devices by 2028.

- Game Consoles: Strong and consistent demand driven by the gaming industry's growth.

- Others: Encompassing emerging categories and specialized electronic devices.

Service Type Segments:

- EMS (Electronics Manufacturing Services): Dominant in high-volume production and cost optimization. Expected to maintain a significant market share.

- ODM (Original Design Manufacturer): Rapidly growing segment, particularly for innovative and niche products, offering end-to-end design and manufacturing solutions.

Key Drivers of EMS and ODM for Consumer Electronics Growth

The growth of the EMS and ODM for Consumer Electronics sector is primarily propelled by the relentless pace of technological innovation, including advancements in 5G connectivity, AI integration, and miniaturization of components. Economic factors such as rising disposable incomes in emerging markets and the global demand for feature-rich devices contribute significantly. Regulatory support for manufacturing and trade agreements also play a crucial role. Furthermore, the increasing trend of brands outsourcing their manufacturing and design processes to specialized EMS and ODM providers, to reduce costs and accelerate time-to-market, is a key growth catalyst. The growing popularity of connected devices and the IoT ecosystem further amplifies this demand.

Challenges in the EMS and ODM for Consumer Electronics Sector

The EMS and ODM for Consumer Electronics sector faces significant challenges, including intense price competition, which often squeezes profit margins. Supply chain disruptions, exacerbated by geopolitical events and raw material shortages, pose a constant threat to production schedules. Evolving regulatory landscapes regarding environmental sustainability, data privacy, and product safety require continuous adaptation and compliance investments. Intellectual property protection remains a concern for ODM providers, and the need for continuous investment in advanced manufacturing technologies to stay competitive is substantial. The skilled labor shortage in specialized manufacturing roles also presents a barrier to scaling operations effectively.

Emerging Opportunities in EMS and ODM for Consumer Electronics

Emerging opportunities in the EMS and ODM for Consumer Electronics market are abundant, driven by the burgeoning demand for smart devices and the expansion of the Internet of Things (IoT). The development of sustainable and eco-friendly electronics presents a significant niche. The growing popularity of personalized and customizable devices opens avenues for ODMs to offer tailored design solutions. Furthermore, the increasing adoption of technologies like AI and machine learning in consumer electronics creates demand for specialized manufacturing and design expertise. The growth of emerging markets and the increasing consumer appetite for advanced gadgets also present substantial untapped potential.

Leading Players in the EMS and ODM for Consumer Electronics Market

- Hon Hai (Foxconn)

- Pegatron

- Quanta

- Jabil

- Compal

- LUXSHARE ICT

- Flex Ltd

- Wistron

- Inventec

- BYD Electronic

- Huaqin

- New KINPO

- USI

- Sanmina

- Celestica

- Wingtech

- Plexus

- Longcheer

- Qisda Corporation

- Benchmark

- Zollner

- Kaifa Technology

- SIIX

- Fabrinet

- Venture

- UMC

- MiTAC

- Sumitronics

- Integrated Micro-Electronics

- DBG Technology

- ATA IMS Berhad

- V.S. Industry Berhad

- Kaga Electronics

- Global Brands Manufacture Ltd

- Creation

- Vtech

- Pan International

- NEO Technology

- Scanfil

- 3CEMS Group

- TT Electronics

- Shenzhen Zowee

- Lacroix

Key Developments in EMS and ODM for Consumer Electronics Industry

- 2023 July: Hon Hai (Foxconn) announced significant investment in advanced semiconductor packaging facilities to support next-generation consumer electronics.

- 2023 August: Pegatron secured a major contract for the production of new high-end smartphones, indicating continued demand for its manufacturing expertise.

- 2023 September: Quanta Computer expanded its ODM services for AI-powered edge computing devices.

- 2023 October: Jabil strategically acquired a company specializing in advanced materials for wearable device manufacturing.

- 2023 November: Compal Electronics launched new energy-efficient manufacturing initiatives to reduce its environmental footprint.

- 2023 December: LUXSHARE ICT expanded its R&D capabilities in flexible display technology for consumer electronics.

- 2024 January: Flex Ltd announced a partnership to develop sustainable supply chain solutions for consumer electronics.

- 2024 February: Wistron invested in automation technologies to enhance production efficiency for tablets and PCs.

- 2024 March: Inventec expanded its ODM offerings for smart home security systems.

- 2024 April: BYD Electronic increased its production capacity for advanced camera modules.

Strategic Outlook for EMS and ODM for Consumer Electronics Market

The strategic outlook for the EMS and ODM for Consumer Electronics market is exceptionally positive, driven by sustained innovation and expanding global demand for smart, connected devices. The continued outsourcing trend by major brands, coupled with the increasing complexity of consumer electronics, will fuel the growth of both EMS and ODM providers. Key growth catalysts include the burgeoning markets for wearables, smart home devices, and the next generation of AR/VR technologies. Companies that can offer end-to-end solutions, demonstrate agility in adapting to technological shifts, and prioritize sustainability will be best positioned for long-term success, capitalizing on an estimated market expansion of over 70% within the next decade.

EMS and ODM for Consumer Electronics Segmentation

-

1. Application

- 1.1. Smartphones

- 1.2. Tablets & PCs

- 1.3. Audio Equipment

- 1.4. TVs

- 1.5. Camera

- 1.6. Wearables Device

- 1.7. Smart Home

- 1.8. Game Consoles

- 1.9. Others

-

2. Types

- 2.1. EMS

- 2.2. ODM

EMS and ODM for Consumer Electronics Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

EMS and ODM for Consumer Electronics REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.9% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global EMS and ODM for Consumer Electronics Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Smartphones

- 5.1.2. Tablets & PCs

- 5.1.3. Audio Equipment

- 5.1.4. TVs

- 5.1.5. Camera

- 5.1.6. Wearables Device

- 5.1.7. Smart Home

- 5.1.8. Game Consoles

- 5.1.9. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. EMS

- 5.2.2. ODM

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America EMS and ODM for Consumer Electronics Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Smartphones

- 6.1.2. Tablets & PCs

- 6.1.3. Audio Equipment

- 6.1.4. TVs

- 6.1.5. Camera

- 6.1.6. Wearables Device

- 6.1.7. Smart Home

- 6.1.8. Game Consoles

- 6.1.9. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. EMS

- 6.2.2. ODM

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America EMS and ODM for Consumer Electronics Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Smartphones

- 7.1.2. Tablets & PCs

- 7.1.3. Audio Equipment

- 7.1.4. TVs

- 7.1.5. Camera

- 7.1.6. Wearables Device

- 7.1.7. Smart Home

- 7.1.8. Game Consoles

- 7.1.9. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. EMS

- 7.2.2. ODM

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe EMS and ODM for Consumer Electronics Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Smartphones

- 8.1.2. Tablets & PCs

- 8.1.3. Audio Equipment

- 8.1.4. TVs

- 8.1.5. Camera

- 8.1.6. Wearables Device

- 8.1.7. Smart Home

- 8.1.8. Game Consoles

- 8.1.9. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. EMS

- 8.2.2. ODM

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa EMS and ODM for Consumer Electronics Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Smartphones

- 9.1.2. Tablets & PCs

- 9.1.3. Audio Equipment

- 9.1.4. TVs

- 9.1.5. Camera

- 9.1.6. Wearables Device

- 9.1.7. Smart Home

- 9.1.8. Game Consoles

- 9.1.9. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. EMS

- 9.2.2. ODM

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific EMS and ODM for Consumer Electronics Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Smartphones

- 10.1.2. Tablets & PCs

- 10.1.3. Audio Equipment

- 10.1.4. TVs

- 10.1.5. Camera

- 10.1.6. Wearables Device

- 10.1.7. Smart Home

- 10.1.8. Game Consoles

- 10.1.9. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. EMS

- 10.2.2. ODM

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Hon Hai (Foxconn)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Pegatron

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Quanta

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Jabil

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Compal

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 LUXSHAREICT

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Flex Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Wistron

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Inventec

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BYD Electronic

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Huaqin

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 New KINPO

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 USI

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Sanmina

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Celestica

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Wingtech

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Plexus

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Longcheer

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Qisda Corporation

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Benchmark

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Zollner

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Kaifa Technology

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 SIIX

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Fabrinet

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Venture

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 UMC

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 MiTAC

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.28 Sumitronics

- 11.2.28.1. Overview

- 11.2.28.2. Products

- 11.2.28.3. SWOT Analysis

- 11.2.28.4. Recent Developments

- 11.2.28.5. Financials (Based on Availability)

- 11.2.29 Integrated Micro-Electronics

- 11.2.29.1. Overview

- 11.2.29.2. Products

- 11.2.29.3. SWOT Analysis

- 11.2.29.4. Recent Developments

- 11.2.29.5. Financials (Based on Availability)

- 11.2.30 DBG Technology

- 11.2.30.1. Overview

- 11.2.30.2. Products

- 11.2.30.3. SWOT Analysis

- 11.2.30.4. Recent Developments

- 11.2.30.5. Financials (Based on Availability)

- 11.2.31 ATA IMS Berhad

- 11.2.31.1. Overview

- 11.2.31.2. Products

- 11.2.31.3. SWOT Analysis

- 11.2.31.4. Recent Developments

- 11.2.31.5. Financials (Based on Availability)

- 11.2.32 V.S. Industry Berhad

- 11.2.32.1. Overview

- 11.2.32.2. Products

- 11.2.32.3. SWOT Analysis

- 11.2.32.4. Recent Developments

- 11.2.32.5. Financials (Based on Availability)

- 11.2.33 Kaga Electronics

- 11.2.33.1. Overview

- 11.2.33.2. Products

- 11.2.33.3. SWOT Analysis

- 11.2.33.4. Recent Developments

- 11.2.33.5. Financials (Based on Availability)

- 11.2.34 Global Brands Manufacture Ltd

- 11.2.34.1. Overview

- 11.2.34.2. Products

- 11.2.34.3. SWOT Analysis

- 11.2.34.4. Recent Developments

- 11.2.34.5. Financials (Based on Availability)

- 11.2.35 Creation

- 11.2.35.1. Overview

- 11.2.35.2. Products

- 11.2.35.3. SWOT Analysis

- 11.2.35.4. Recent Developments

- 11.2.35.5. Financials (Based on Availability)

- 11.2.36 Vtech

- 11.2.36.1. Overview

- 11.2.36.2. Products

- 11.2.36.3. SWOT Analysis

- 11.2.36.4. Recent Developments

- 11.2.36.5. Financials (Based on Availability)

- 11.2.37 Pan International

- 11.2.37.1. Overview

- 11.2.37.2. Products

- 11.2.37.3. SWOT Analysis

- 11.2.37.4. Recent Developments

- 11.2.37.5. Financials (Based on Availability)

- 11.2.38 NEO Technology

- 11.2.38.1. Overview

- 11.2.38.2. Products

- 11.2.38.3. SWOT Analysis

- 11.2.38.4. Recent Developments

- 11.2.38.5. Financials (Based on Availability)

- 11.2.39 Scanfil

- 11.2.39.1. Overview

- 11.2.39.2. Products

- 11.2.39.3. SWOT Analysis

- 11.2.39.4. Recent Developments

- 11.2.39.5. Financials (Based on Availability)

- 11.2.40 3CEMS Group

- 11.2.40.1. Overview

- 11.2.40.2. Products

- 11.2.40.3. SWOT Analysis

- 11.2.40.4. Recent Developments

- 11.2.40.5. Financials (Based on Availability)

- 11.2.41 TT Electronics

- 11.2.41.1. Overview

- 11.2.41.2. Products

- 11.2.41.3. SWOT Analysis

- 11.2.41.4. Recent Developments

- 11.2.41.5. Financials (Based on Availability)

- 11.2.42 Shenzhen Zowee

- 11.2.42.1. Overview

- 11.2.42.2. Products

- 11.2.42.3. SWOT Analysis

- 11.2.42.4. Recent Developments

- 11.2.42.5. Financials (Based on Availability)

- 11.2.43 Lacroix

- 11.2.43.1. Overview

- 11.2.43.2. Products

- 11.2.43.3. SWOT Analysis

- 11.2.43.4. Recent Developments

- 11.2.43.5. Financials (Based on Availability)

- 11.2.1 Hon Hai (Foxconn)

List of Figures

- Figure 1: Global EMS and ODM for Consumer Electronics Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America EMS and ODM for Consumer Electronics Revenue (million), by Application 2024 & 2032

- Figure 3: North America EMS and ODM for Consumer Electronics Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America EMS and ODM for Consumer Electronics Revenue (million), by Types 2024 & 2032

- Figure 5: North America EMS and ODM for Consumer Electronics Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America EMS and ODM for Consumer Electronics Revenue (million), by Country 2024 & 2032

- Figure 7: North America EMS and ODM for Consumer Electronics Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America EMS and ODM for Consumer Electronics Revenue (million), by Application 2024 & 2032

- Figure 9: South America EMS and ODM for Consumer Electronics Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America EMS and ODM for Consumer Electronics Revenue (million), by Types 2024 & 2032

- Figure 11: South America EMS and ODM for Consumer Electronics Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America EMS and ODM for Consumer Electronics Revenue (million), by Country 2024 & 2032

- Figure 13: South America EMS and ODM for Consumer Electronics Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe EMS and ODM for Consumer Electronics Revenue (million), by Application 2024 & 2032

- Figure 15: Europe EMS and ODM for Consumer Electronics Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe EMS and ODM for Consumer Electronics Revenue (million), by Types 2024 & 2032

- Figure 17: Europe EMS and ODM for Consumer Electronics Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe EMS and ODM for Consumer Electronics Revenue (million), by Country 2024 & 2032

- Figure 19: Europe EMS and ODM for Consumer Electronics Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa EMS and ODM for Consumer Electronics Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa EMS and ODM for Consumer Electronics Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa EMS and ODM for Consumer Electronics Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa EMS and ODM for Consumer Electronics Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa EMS and ODM for Consumer Electronics Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa EMS and ODM for Consumer Electronics Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific EMS and ODM for Consumer Electronics Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific EMS and ODM for Consumer Electronics Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific EMS and ODM for Consumer Electronics Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific EMS and ODM for Consumer Electronics Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific EMS and ODM for Consumer Electronics Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific EMS and ODM for Consumer Electronics Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global EMS and ODM for Consumer Electronics Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global EMS and ODM for Consumer Electronics Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global EMS and ODM for Consumer Electronics Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global EMS and ODM for Consumer Electronics Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global EMS and ODM for Consumer Electronics Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global EMS and ODM for Consumer Electronics Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global EMS and ODM for Consumer Electronics Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States EMS and ODM for Consumer Electronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada EMS and ODM for Consumer Electronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico EMS and ODM for Consumer Electronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global EMS and ODM for Consumer Electronics Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global EMS and ODM for Consumer Electronics Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global EMS and ODM for Consumer Electronics Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil EMS and ODM for Consumer Electronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina EMS and ODM for Consumer Electronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America EMS and ODM for Consumer Electronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global EMS and ODM for Consumer Electronics Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global EMS and ODM for Consumer Electronics Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global EMS and ODM for Consumer Electronics Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom EMS and ODM for Consumer Electronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany EMS and ODM for Consumer Electronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France EMS and ODM for Consumer Electronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy EMS and ODM for Consumer Electronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain EMS and ODM for Consumer Electronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia EMS and ODM for Consumer Electronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux EMS and ODM for Consumer Electronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics EMS and ODM for Consumer Electronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe EMS and ODM for Consumer Electronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global EMS and ODM for Consumer Electronics Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global EMS and ODM for Consumer Electronics Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global EMS and ODM for Consumer Electronics Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey EMS and ODM for Consumer Electronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel EMS and ODM for Consumer Electronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC EMS and ODM for Consumer Electronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa EMS and ODM for Consumer Electronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa EMS and ODM for Consumer Electronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa EMS and ODM for Consumer Electronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global EMS and ODM for Consumer Electronics Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global EMS and ODM for Consumer Electronics Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global EMS and ODM for Consumer Electronics Revenue million Forecast, by Country 2019 & 2032

- Table 41: China EMS and ODM for Consumer Electronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India EMS and ODM for Consumer Electronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan EMS and ODM for Consumer Electronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea EMS and ODM for Consumer Electronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN EMS and ODM for Consumer Electronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania EMS and ODM for Consumer Electronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific EMS and ODM for Consumer Electronics Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the EMS and ODM for Consumer Electronics?

The projected CAGR is approximately 3.9%.

2. Which companies are prominent players in the EMS and ODM for Consumer Electronics?

Key companies in the market include Hon Hai (Foxconn), Pegatron, Quanta, Jabil, Compal, LUXSHAREICT, Flex Ltd, Wistron, Inventec, BYD Electronic, Huaqin, New KINPO, USI, Sanmina, Celestica, Wingtech, Plexus, Longcheer, Qisda Corporation, Benchmark, Zollner, Kaifa Technology, SIIX, Fabrinet, Venture, UMC, MiTAC, Sumitronics, Integrated Micro-Electronics, DBG Technology, ATA IMS Berhad, V.S. Industry Berhad, Kaga Electronics, Global Brands Manufacture Ltd, Creation, Vtech, Pan International, NEO Technology, Scanfil, 3CEMS Group, TT Electronics, Shenzhen Zowee, Lacroix.

3. What are the main segments of the EMS and ODM for Consumer Electronics?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 336280 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "EMS and ODM for Consumer Electronics," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the EMS and ODM for Consumer Electronics report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the EMS and ODM for Consumer Electronics?

To stay informed about further developments, trends, and reports in the EMS and ODM for Consumer Electronics, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence