Key Insights

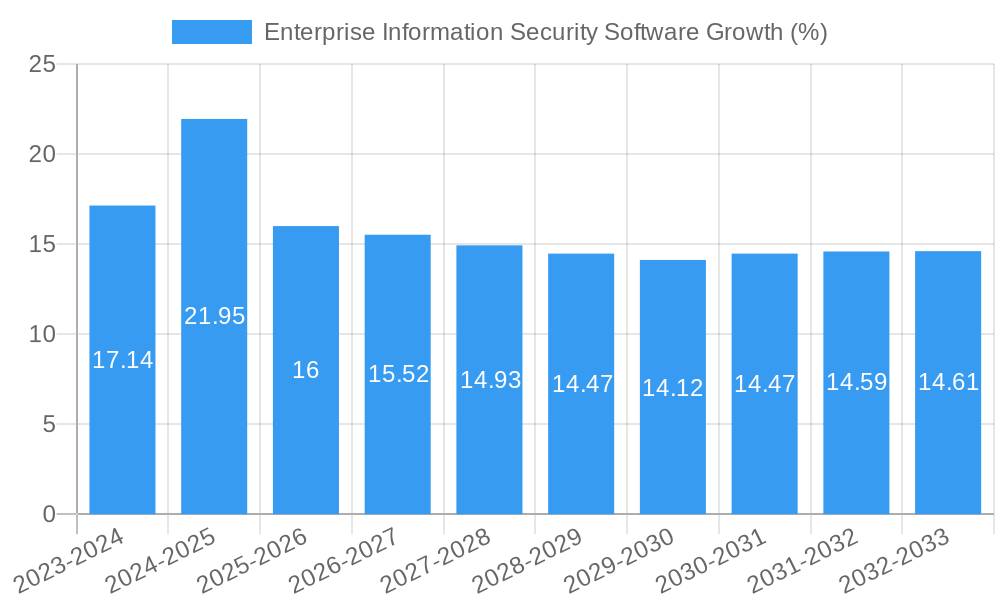

The global Enterprise Information Security Software market is poised for significant expansion, projected to reach a substantial market size of approximately USD 50 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 15%. This impressive growth is propelled by an escalating landscape of cyber threats that are becoming increasingly sophisticated and pervasive, forcing organizations of all sizes to prioritize robust security solutions. The rising adoption of cloud-based infrastructure, coupled with the growing complexity of IT environments, further fuels the demand for advanced information security software. Key drivers include the need to protect sensitive data, maintain regulatory compliance (such as GDPR and CCPA), and safeguard against financial losses and reputational damage stemming from data breaches. The market is witnessing a strong trend towards integrated security platforms that offer comprehensive protection across endpoints, networks, and cloud environments, moving away from siloed solutions. Automation and artificial intelligence (AI) are also becoming integral, enabling faster threat detection and response.

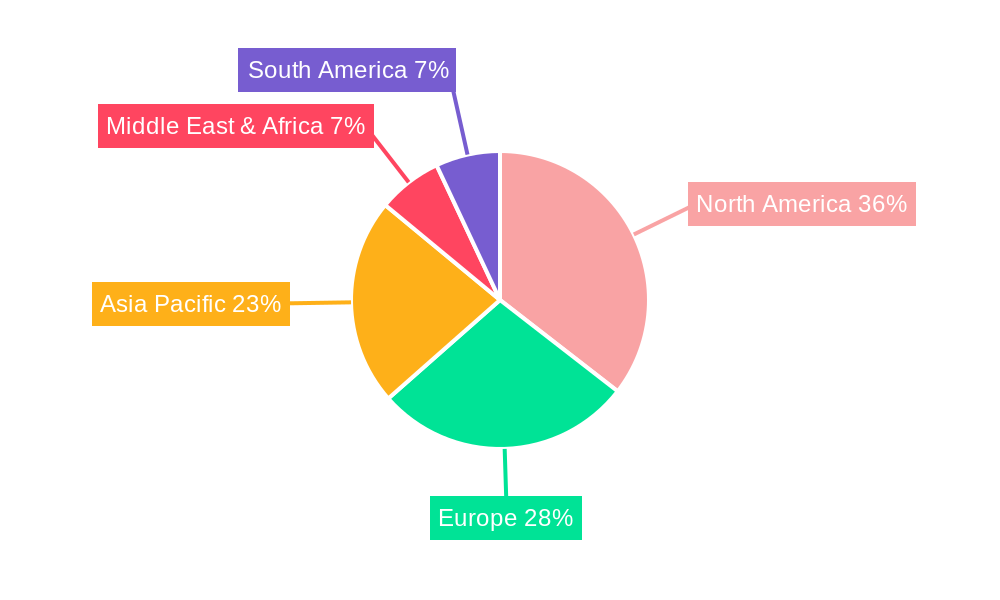

Despite the optimistic outlook, certain restraints could temper this growth. The high cost of implementing and maintaining advanced security solutions can be a significant barrier, especially for Small and Medium-Sized Enterprises (SMEs). Furthermore, the shortage of skilled cybersecurity professionals poses a challenge in effectively deploying and managing these sophisticated tools. The ever-evolving nature of cyber threats also necessitates continuous updates and adaptation of security software, adding to ongoing operational expenses. The market segments, by enterprise size, are dominated by Large Enterprises due to their extensive data assets and higher vulnerability, followed by Medium-Sized Enterprises actively investing in strengthening their defenses. Small Companies, while increasingly aware, often face budget constraints. The shift towards Cloud-Based solutions is a dominant trend, offering scalability and flexibility, though On-Premises solutions remain relevant for organizations with specific data sovereignty or legacy system requirements. Geographically, North America and Europe are leading markets due to mature cybersecurity awareness and stringent regulations, with Asia Pacific exhibiting the fastest growth potential owing to rapid digital transformation and increasing cyber-attack incidents.

Enterprise Information Security Software Market Concentration & Innovation

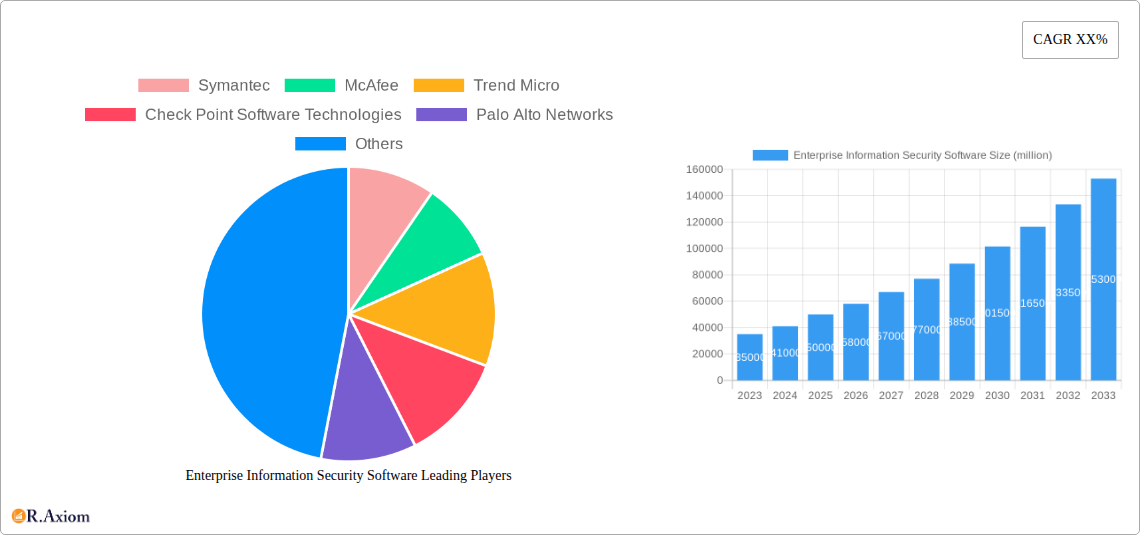

This comprehensive report delves into the intricate landscape of the Enterprise Information Security Software market, meticulously examining its concentration, key innovation drivers, and the prevailing regulatory frameworks. The study, spanning from 2019 to 2033 with a base and estimated year of 2025, provides an in-depth analysis of market dynamics. Current market concentration reveals a moderate to high level, with a few key players holding significant market share. For instance, Symantec and McAfee have historically commanded substantial portions, with market shares estimated at over 15 million and 12 million respectively in 2025. However, the influx of innovative solutions from companies like Palo Alto Networks and Fortinet, with projected market shares exceeding 10 million each by 2025, is intensifying competition and driving a shift towards specialized security solutions.

Innovation in this sector is primarily driven by the escalating sophistication of cyber threats and the rapid adoption of cloud technologies. Key innovation drivers include:

- Artificial Intelligence (AI) and Machine Learning (ML): Integration of AI/ML for advanced threat detection, anomaly analysis, and automated response mechanisms. This is crucial for combating zero-day exploits and sophisticated malware.

- Cloud Security Posture Management (CSPM): Development of robust solutions to manage and secure complex cloud environments, addressing misconfigurations and compliance issues.

- Zero Trust Architecture: Implementation of stringent access controls and continuous verification to protect sensitive data, regardless of user location or device.

- Data Loss Prevention (DLP): Enhanced capabilities to prevent unauthorized exfiltration of sensitive corporate data across various channels.

Regulatory frameworks, such as GDPR, CCPA, and industry-specific mandates, are acting as significant catalysts for innovation, compelling organizations to invest in advanced security software to ensure compliance and avoid hefty penalties. The market also witnesses constant evolution due to product substitutes, including managed security services and in-house security teams, influencing the demand for specific software functionalities. End-user trends highlight a growing preference for integrated security platforms and endpoint detection and response (EDR) solutions. Mergers and acquisitions (M&A) are a prominent feature, with an estimated total M&A deal value of over 500 million in 2024, indicating a consolidation trend and strategic acquisitions to enhance product portfolios and expand market reach. Notable M&A activities include potential acquisitions by larger players seeking to integrate niche technologies or gain market share in specific segments.

Enterprise Information Security Software Industry Trends & Insights

The Enterprise Information Security Software industry is experiencing robust growth, propelled by an escalating number of sophisticated cyber threats and the continuous digital transformation across all business sectors. The study period of 2019–2033, with a base year of 2025, projects a significant Compound Annual Growth Rate (CAGR) of approximately 12.5% for the forecast period of 2025–2033. This upward trajectory is underpinned by several critical market growth drivers. The increasing frequency and complexity of cyberattacks, including ransomware, phishing, and advanced persistent threats (APTs), are forcing businesses of all sizes to bolster their defenses. Organizations are allocating substantial budgets, estimated to exceed 150 billion globally by 2025, towards comprehensive security solutions.

Technological disruptions are profoundly reshaping the industry. The pervasive adoption of cloud computing, IoT devices, and remote workforces has expanded the attack surface, creating a demand for dynamic and scalable security solutions. Cloud-based security software, offering flexibility and cost-effectiveness, is gaining significant traction, with an estimated market penetration of over 70% by 2025. Conversely, on-premises solutions continue to be relevant for organizations with stringent data sovereignty requirements or legacy infrastructure, although their market share is gradually declining. The rise of AI and machine learning is revolutionizing threat detection and response, enabling proactive identification of malicious activities and reducing the time to mitigate breaches. Solutions incorporating behavioral analytics and predictive capabilities are becoming essential tools for cybersecurity professionals.

Consumer preferences are shifting towards integrated security platforms that offer a unified approach to managing diverse security needs, from endpoint protection to network security and data governance. This trend is driving consolidation among vendors and fostering the development of comprehensive suites that simplify security management and enhance overall effectiveness. The demand for user-friendly interfaces and automated security workflows is also increasing, as organizations strive to optimize their security operations with limited skilled personnel. Competitive dynamics are characterized by intense rivalry between established giants and agile startups. Major players like Symantec, McAfee, Trend Micro, Check Point Software Technologies, Palo Alto Networks, and Fortinet are continuously innovating and expanding their product portfolios to maintain their market leadership. Meanwhile, emerging companies are carving out niches by focusing on specialized areas such as AI-driven threat intelligence or niche cloud security solutions. The market penetration for advanced security solutions is projected to reach over 85% for large enterprises and around 60% for medium-sized enterprises by 2025, reflecting varying levels of investment capacity and security maturity. The overall market size for enterprise information security software is estimated to reach approximately 200 billion by 2025, with significant contributions from both North America and Europe.

Dominant Markets & Segments in Enterprise Information Security Software

The Enterprise Information Security Software market exhibits distinct dominance across various geographical regions and business segments, driven by a confluence of economic policies, infrastructure development, and evolving threat landscapes. North America, particularly the United States, consistently leads in terms of market size and adoption rates, with an estimated market share exceeding 35% of the global market by 2025. This dominance is fueled by its highly developed digital infrastructure, proactive regulatory environment, and the presence of a large concentration of Fortune 500 companies that are early adopters of advanced cybersecurity technologies. Economic policies in the region emphasize innovation and investment in critical infrastructure protection, further bolstering the demand for robust security solutions.

Within the application segments, Large Enterprise dominates the market, accounting for an estimated 60% of the total market revenue by 2025. This segment's prevalence is attributed to their vast and complex IT infrastructures, significant volumes of sensitive data, and higher susceptibility to high-impact cyberattacks. Their substantial budgets allow for comprehensive security investments, including advanced threat prevention, data loss prevention, and identity and access management solutions. Key drivers for large enterprise dominance include:

- High Volume of Sensitive Data: Large enterprises manage vast amounts of critical customer, financial, and intellectual property data, making them prime targets for cybercriminals.

- Complex IT Environments: The intricate networks, cloud deployments, and numerous endpoints within large organizations necessitate sophisticated, multi-layered security strategies.

- Stringent Regulatory Compliance: Compliance with global regulations like GDPR, HIPAA, and PCI DSS necessitates significant investment in security software.

- Increased Sophistication of Threats: Large enterprises are often targeted by state-sponsored attacks and sophisticated organized crime groups, requiring advanced threat intelligence and response capabilities.

Regarding the types of solutions, Cloud Based security software is rapidly emerging as the dominant force, projected to capture over 70% of the market by 2025. This shift is driven by the scalability, flexibility, and cost-effectiveness that cloud solutions offer. The ability to deploy and update security measures rapidly in dynamic cloud environments is crucial for modern businesses. Key drivers for the dominance of cloud-based solutions include:

- Scalability and Flexibility: Cloud solutions can easily scale up or down to meet fluctuating business needs and security demands.

- Cost-Effectiveness: Reduced upfront investment in hardware and infrastructure, coupled with subscription-based models, makes cloud security more accessible.

- Rapid Deployment and Updates: Cloud-based security software can be deployed quickly and receives automatic updates, ensuring organizations are protected against the latest threats.

- Accessibility and Remote Work Support: Cloud solutions facilitate secure access for remote employees and distributed workforces, aligning with modern work trends.

While Large Enterprises and Cloud-Based solutions lead, Medium-Sized Enterprises represent a significant and growing segment, projected to account for around 25% of the market by 2025. Their growth is driven by increasing awareness of cybersecurity risks and the availability of more accessible and tailored security solutions. Small Companies, while representing a smaller market share (around 15%), are also showing increased adoption, often leveraging more affordable and user-friendly cloud-based solutions. On-Premises solutions, though still crucial for specific industries like government and finance, are expected to see a gradual decrease in market share as cloud adoption accelerates.

Enterprise Information Security Software Product Developments

Enterprise Information Security Software is witnessing continuous innovation focused on enhanced threat detection, automated response, and seamless integration. Product developments are heavily influenced by the escalating sophistication of cyber threats and the evolving digital landscape. Key advancements include the widespread integration of Artificial Intelligence (AI) and Machine Learning (ML) into security platforms, enabling proactive identification of anomalies and zero-day exploits with greater accuracy. Cloud security posture management (CSPM) tools are evolving to provide comprehensive visibility and control over multi-cloud environments. Furthermore, the development of integrated Endpoint Detection and Response (EDR) and Extended Detection and Response (XDR) solutions offers a consolidated approach to threat hunting and incident response across various security layers. Competitive advantages are being gained by vendors offering unified security management dashboards, intelligent automation capabilities, and robust data encryption and privacy features, ensuring better market fit for organizations prioritizing comprehensive and agile cybersecurity strategies.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Enterprise Information Security Software market, providing detailed segmentation across key application and type categories.

- Large Enterprise: This segment is projected to be the largest contributor to the market, driven by extensive IT footprints, complex data requirements, and significant exposure to sophisticated cyber threats. Growth in this segment is estimated at over 13% CAGR during the forecast period, with an estimated market size of over 120 billion by 2025.

- Medium-Sized Enterprise: A rapidly expanding segment, medium-sized enterprises are increasingly investing in advanced security solutions due to growing threat awareness and budget availability. This segment is expected to grow at a CAGR of approximately 11% and hold an estimated market share of over 50 billion by 2025.

- Small Companies: While representing a smaller market share, small companies are demonstrating a growing appetite for user-friendly and cost-effective security solutions, particularly cloud-based offerings. Their growth is projected at around 10% CAGR, with an estimated market size of over 30 billion by 2025.

- Cloud Based: This segment is poised for significant dominance, driven by scalability, flexibility, and cost-efficiency. Its growth is estimated at over 15% CAGR, with an anticipated market size exceeding 140 billion by 2025.

- On-Premises: While still relevant for organizations with specific regulatory or data sovereignty needs, this segment is expected to experience slower growth compared to cloud-based solutions, with an estimated CAGR of around 6% and a market size of over 60 billion by 2025.

Key Drivers of Enterprise Information Security Software Growth

The Enterprise Information Security Software market is propelled by a dynamic interplay of technological advancements, economic imperatives, and regulatory mandates. The escalating sophistication and frequency of cyber threats, ranging from ransomware attacks to advanced persistent threats (APTs), are compelling organizations to invest proactively in robust security solutions. This creates a foundational growth driver as businesses seek to protect their critical assets and maintain operational continuity. Economically, the increasing reliance on digital infrastructure and the growing value of data as a corporate asset necessitate stringent security measures. Furthermore, government regulations and compliance standards, such as GDPR, CCPA, and industry-specific mandates, act as significant catalysts, forcing companies to adopt advanced security software to avoid penalties and maintain customer trust. The widespread adoption of cloud computing and the remote workforce trend have also expanded the attack surface, fueling demand for adaptable and comprehensive cloud security solutions.

Challenges in the Enterprise Information Security Software Sector

Despite robust growth, the Enterprise Information Security Software sector faces significant challenges that can hinder its advancement. The ever-evolving nature of cyber threats requires continuous innovation and adaptation, placing immense pressure on vendors to stay ahead of malicious actors. The shortage of skilled cybersecurity professionals poses a substantial barrier, making it difficult for organizations to effectively implement, manage, and monitor complex security solutions. Regulatory hurdles, while driving adoption, can also create fragmentation and complexity for global organizations that must comply with diverse and sometimes conflicting regulations. Supply chain vulnerabilities within the software development lifecycle itself present a risk, as compromised third-party components can introduce security weaknesses. Moreover, competitive pressures among a crowded market can lead to price wars and affect profitability, potentially limiting investment in R&D for smaller players. The estimated impact of major data breaches on companies in 2024 alone exceeded 5 million on average, underscoring the critical need for effective solutions despite these challenges.

Emerging Opportunities in Enterprise Information Security Software

The Enterprise Information Security Software market is ripe with emerging opportunities driven by technological innovation and shifting business priorities. The pervasive adoption of Artificial Intelligence (AI) and Machine Learning (ML) presents a significant opportunity for developing more proactive, predictive, and automated threat detection and response systems. The expansion of cloud computing, particularly multi-cloud and hybrid cloud environments, is creating a substantial demand for specialized Cloud Security Posture Management (CSPM) and cloud-native security solutions. The increasing focus on data privacy and compliance with evolving global regulations offers opportunities for vendors offering robust Data Loss Prevention (DLP) and compliance management tools. Furthermore, the growing trend of remote and hybrid work models necessitates enhanced endpoint security and secure access solutions, including Zero Trust Architecture implementations. The burgeoning Internet of Things (IoT) ecosystem also presents a new frontier for security, with opportunities in developing specialized solutions for securing connected devices and their data.

Leading Players in the Enterprise Information Security Software Market

- Symantec

- McAfee

- Trend Micro

- Check Point Software Technologies

- Palo Alto Networks

- Fortinet

- Kaspersky Lab

- Sophos

- Bitdefender

- FireEye

- Willand

- Anban Technology

- Zhengzhou Yunzhixinan Security Technology

- QIAN Technologies

Key Developments in Enterprise Information Security Software Industry

- 2024/01: Palo Alto Networks launches its new XDR platform with enhanced AI capabilities, aiming to unify threat detection and response across networks, endpoints, and cloud environments.

- 2024/03: Fortinet acquires a leading cloud security company, expanding its cloud security portfolio and strengthening its position in the multi-cloud security market.

- 2024/05: Trend Micro announces significant advancements in its AI-driven threat intelligence, offering more proactive protection against emerging cyber threats.

- 2024/07: Check Point Software Technologies releases a comprehensive suite of Zero Trust solutions, empowering organizations to adopt a more granular and adaptive security posture.

- 2024/09: Symantec introduces enhanced data loss prevention (DLP) features, focusing on protecting sensitive information in cloud-based applications and remote work scenarios.

- 2024/11: McAfee unveils its new cloud-native endpoint security solution designed for scalable protection of distributed workforces.

- 2025/01: A major consolidation in the market is rumored, with industry experts speculating on potential mergers between mid-tier players to gain competitive advantage.

- 2025/03: Anban Technology announces strategic partnerships to expand its reach in the Asia-Pacific region, focusing on cloud security solutions for enterprises.

- 2025/05: Zhengzhou Yunzhixinan Security Technology showcases advancements in IoT security at a major cybersecurity conference, highlighting its commitment to securing connected devices.

Strategic Outlook for Enterprise Information Security Software Market

The strategic outlook for the Enterprise Information Security Software market remains exceptionally positive, driven by an unwavering demand for advanced cybersecurity solutions. The continued evolution of cyber threats necessitates ongoing investment in innovative technologies such as AI, machine learning, and zero trust architecture. The ongoing digital transformation, coupled with the rise of remote workforces and the increasing complexity of cloud environments, will further fuel the demand for scalable, flexible, and integrated security platforms. Organizations will increasingly prioritize solutions that offer proactive threat detection, automated incident response, and comprehensive data protection. Strategic focus will also be on vendors that can provide seamless integration across diverse IT infrastructures and deliver demonstrable ROI through enhanced security posture and reduced risk of breaches. Emerging markets and specialized niche solutions, particularly in IoT security and cloud-native security, represent significant growth catalysts for the future.

Enterprise Information Security Software Segmentation

-

1. Application

- 1.1. Large Enterprise

- 1.2. Medium-Sized Enterprise

- 1.3. Small Companies

-

2. Types

- 2.1. Cloud Based

- 2.2. On-Premises

Enterprise Information Security Software Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Enterprise Information Security Software REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Enterprise Information Security Software Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Large Enterprise

- 5.1.2. Medium-Sized Enterprise

- 5.1.3. Small Companies

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Cloud Based

- 5.2.2. On-Premises

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Enterprise Information Security Software Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Large Enterprise

- 6.1.2. Medium-Sized Enterprise

- 6.1.3. Small Companies

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Cloud Based

- 6.2.2. On-Premises

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Enterprise Information Security Software Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Large Enterprise

- 7.1.2. Medium-Sized Enterprise

- 7.1.3. Small Companies

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Cloud Based

- 7.2.2. On-Premises

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Enterprise Information Security Software Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Large Enterprise

- 8.1.2. Medium-Sized Enterprise

- 8.1.3. Small Companies

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Cloud Based

- 8.2.2. On-Premises

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Enterprise Information Security Software Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Large Enterprise

- 9.1.2. Medium-Sized Enterprise

- 9.1.3. Small Companies

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Cloud Based

- 9.2.2. On-Premises

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Enterprise Information Security Software Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Large Enterprise

- 10.1.2. Medium-Sized Enterprise

- 10.1.3. Small Companies

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Cloud Based

- 10.2.2. On-Premises

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Symantec

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 McAfee

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Trend Micro

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Check Point Software Technologies

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Palo Alto Networks

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Fortinet

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kaspersky Lab

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sophos

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bitdefender

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 FireEye

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Willand

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Anban Technology

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Zhengzhou Yunzhixinan Security Technology

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 QIAN Technologies

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Symantec

List of Figures

- Figure 1: Global Enterprise Information Security Software Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Enterprise Information Security Software Revenue (million), by Application 2024 & 2032

- Figure 3: North America Enterprise Information Security Software Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Enterprise Information Security Software Revenue (million), by Types 2024 & 2032

- Figure 5: North America Enterprise Information Security Software Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Enterprise Information Security Software Revenue (million), by Country 2024 & 2032

- Figure 7: North America Enterprise Information Security Software Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Enterprise Information Security Software Revenue (million), by Application 2024 & 2032

- Figure 9: South America Enterprise Information Security Software Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Enterprise Information Security Software Revenue (million), by Types 2024 & 2032

- Figure 11: South America Enterprise Information Security Software Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Enterprise Information Security Software Revenue (million), by Country 2024 & 2032

- Figure 13: South America Enterprise Information Security Software Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Enterprise Information Security Software Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Enterprise Information Security Software Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Enterprise Information Security Software Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Enterprise Information Security Software Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Enterprise Information Security Software Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Enterprise Information Security Software Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Enterprise Information Security Software Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Enterprise Information Security Software Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Enterprise Information Security Software Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Enterprise Information Security Software Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Enterprise Information Security Software Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Enterprise Information Security Software Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Enterprise Information Security Software Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Enterprise Information Security Software Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Enterprise Information Security Software Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Enterprise Information Security Software Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Enterprise Information Security Software Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Enterprise Information Security Software Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Enterprise Information Security Software Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Enterprise Information Security Software Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Enterprise Information Security Software Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Enterprise Information Security Software Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Enterprise Information Security Software Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Enterprise Information Security Software Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Enterprise Information Security Software Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Enterprise Information Security Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Enterprise Information Security Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Enterprise Information Security Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Enterprise Information Security Software Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Enterprise Information Security Software Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Enterprise Information Security Software Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Enterprise Information Security Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Enterprise Information Security Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Enterprise Information Security Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Enterprise Information Security Software Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Enterprise Information Security Software Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Enterprise Information Security Software Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Enterprise Information Security Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Enterprise Information Security Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Enterprise Information Security Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Enterprise Information Security Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Enterprise Information Security Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Enterprise Information Security Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Enterprise Information Security Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Enterprise Information Security Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Enterprise Information Security Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Enterprise Information Security Software Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Enterprise Information Security Software Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Enterprise Information Security Software Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Enterprise Information Security Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Enterprise Information Security Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Enterprise Information Security Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Enterprise Information Security Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Enterprise Information Security Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Enterprise Information Security Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Enterprise Information Security Software Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Enterprise Information Security Software Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Enterprise Information Security Software Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Enterprise Information Security Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Enterprise Information Security Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Enterprise Information Security Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Enterprise Information Security Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Enterprise Information Security Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Enterprise Information Security Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Enterprise Information Security Software Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Enterprise Information Security Software?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Enterprise Information Security Software?

Key companies in the market include Symantec, McAfee, Trend Micro, Check Point Software Technologies, Palo Alto Networks, Fortinet, Kaspersky Lab, Sophos, Bitdefender, FireEye, Willand, Anban Technology, Zhengzhou Yunzhixinan Security Technology, QIAN Technologies.

3. What are the main segments of the Enterprise Information Security Software?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Enterprise Information Security Software," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Enterprise Information Security Software report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Enterprise Information Security Software?

To stay informed about further developments, trends, and reports in the Enterprise Information Security Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence