Key Insights

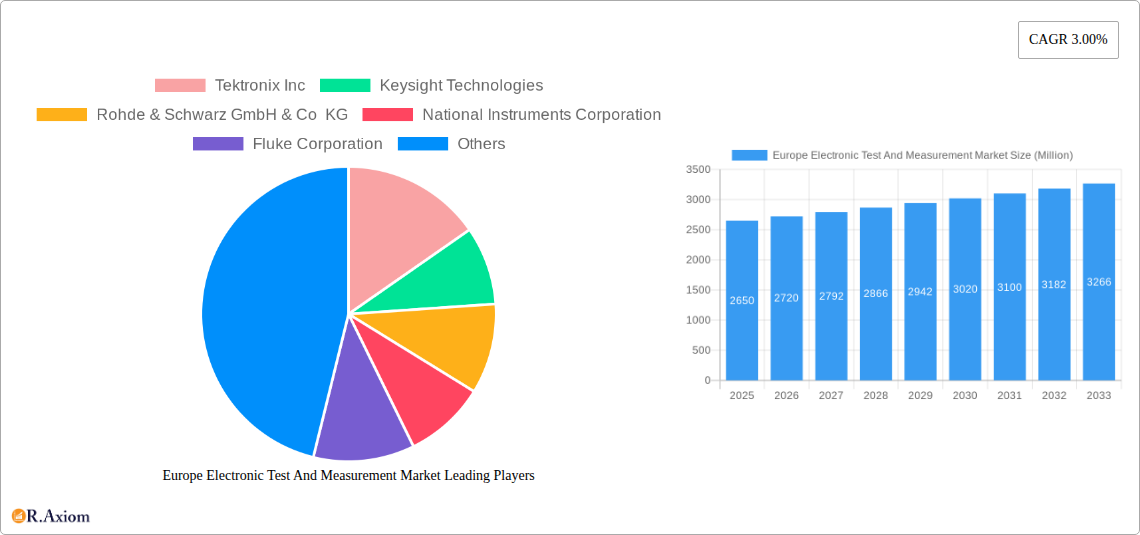

The European Electronic Test and Measurement (ET&M) market is a robust sector, exhibiting steady growth. With a 2025 market size of €2.65 billion and a Compound Annual Growth Rate (CAGR) of 3.00% projected from 2025 to 2033, the market demonstrates consistent expansion. This growth is fueled by several key drivers. The increasing adoption of advanced technologies like 5G, Internet of Things (IoT), and autonomous vehicles necessitates rigorous testing and validation, significantly boosting demand for ET&M equipment. Furthermore, stringent regulatory compliance requirements across various industries, particularly automotive and aerospace, are driving investment in sophisticated testing solutions. Growing R&D expenditure within the electronics sector further fuels market expansion. However, the market faces challenges like the cyclical nature of the electronics industry, where demand fluctuates with economic cycles, and potential supply chain disruptions affecting the availability of components. Segmentation within the market is largely driven by the type of equipment (oscilloscope, spectrum analyzer, etc.), application (automotive, aerospace, telecommunications), and end-user industry. Key players like Tektronix, Keysight, Rohde & Schwarz, and National Instruments dominate the market, leveraging their established brand reputation and technological expertise to secure market share. Competition is fierce, prompting continuous innovation in product features, performance, and affordability. The market's future growth trajectory is influenced by the overall health of the European economy and the pace of technological advancement in the electronics sector.

Europe Electronic Test And Measurement Market Market Size (In Billion)

The forecast for the European ET&M market between 2025 and 2033 suggests continued, albeit moderate, expansion. The 3.00% CAGR points to a steady increase in market value, reaching approximately €3.4 billion by 2030 and nearing €4 billion by 2033. This projection anticipates consistent demand driven by technological advancements and regulatory compliance. However, potential economic downturns or unforeseen geopolitical events could slightly moderate this growth. The competitive landscape will remain dynamic, with established players and emerging companies vying for market share through product innovation and strategic partnerships. The focus will likely remain on developing more efficient, accurate, and cost-effective testing solutions catering to the evolving needs of various industries. Further research into specific regional variations within Europe will reveal nuanced growth trends, highlighting market opportunities and challenges specific to individual countries.

Europe Electronic Test And Measurement Market Company Market Share

This detailed report provides a comprehensive analysis of the Europe Electronic Test and Measurement market, covering market size, growth drivers, competitive landscape, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report incorporates insights from key industry developments, offering actionable intelligence for stakeholders.

Europe Electronic Test and Measurement Market Concentration & Innovation

The European Electronic Test and Measurement market exhibits a moderately concentrated landscape, dominated by established players such as Tektronix Inc, Keysight Technologies, Rohde & Schwarz GmbH & Co KG, and National Instruments Corporation. These companies hold a significant market share, estimated at xx% collectively in 2025, due to their extensive product portfolios, strong brand recognition, and established distribution networks. However, the market also features several smaller, specialized players that cater to niche segments.

Innovation in the sector is driven by the rising demand for higher accuracy, faster testing speeds, and increased automation. Stringent regulatory frameworks, particularly those related to product safety and environmental compliance (like the new EU EEI labeling), are pushing companies to develop more advanced testing solutions. Product substitution is evident with the emergence of software-defined testing solutions that offer greater flexibility and cost-effectiveness compared to traditional hardware-based systems. End-user trends favor integrated, modular systems and cloud-based solutions for enhanced data management and collaborative testing. M&A activity has been moderate, with deal values averaging xx Million in the period 2019-2024, primarily focused on acquiring specialized technologies or expanding market reach.

Europe Electronic Test and Measurement Market Industry Trends & Insights

The European Electronic Test and Measurement market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several factors, including: increasing demand for electronic devices across various industries (automotive, telecommunications, aerospace), the growing adoption of advanced technologies like 5G and IoT, and the increasing need for stringent quality control and compliance testing. Technological disruptions, such as the shift toward software-defined instrumentation and artificial intelligence-powered test automation, are reshaping the market landscape. Consumer preferences are shifting toward more user-friendly interfaces, integrated solutions, and cloud-based data management. Competitive dynamics are characterized by intense rivalry amongst major players focused on product innovation, strategic partnerships, and market expansion. Market penetration of software-defined testing solutions is estimated to reach xx% by 2033, driven by their flexibility and cost-effectiveness.

Dominant Markets & Segments in Europe Electronic Test and Measurement Market

Germany and the UK currently represent the largest markets within Europe, owing to their robust industrial sectors and high concentration of technology companies. Other key markets include France, Italy, and the Nordic countries. The dominance of these regions is driven by factors such as:

- Strong industrial base: Presence of large automotive, aerospace, and telecommunications industries driving demand for testing equipment.

- Favorable regulatory environment: Supportive policies promoting technological advancement and innovation.

- Skilled workforce: Availability of engineers and technicians skilled in electronic testing and measurement.

Within the market segments, the highest growth is expected in automated test equipment (ATE) and wireless communication test solutions, fueled by the rise of 5G and IoT technologies. The industrial automation segment is experiencing robust growth due to increased demand for efficient and reliable testing in manufacturing processes.

Europe Electronic Test and Measurement Market Product Developments

Recent product developments highlight a focus on increased automation, higher test speeds, and improved integration with software platforms. The introduction of software-defined test equipment allows for greater flexibility and customization, while the use of artificial intelligence (AI) enhances test efficiency and accuracy. This trend aligns with the market’s increasing demand for faster turnaround times and cost-effective testing solutions. New product launches demonstrate a strategic focus on improving compatibility across diverse platforms and enhancing ease-of-use.

Report Scope & Segmentation Analysis

This comprehensive report meticulously dissects the European Electronic Test and Measurement (T&M) market, offering an in-depth analysis segmented across critical dimensions to provide actionable insights. Our segmentation strategy ensures a granular understanding of market dynamics, growth drivers, and emerging trends.

By Product Type: The market is segmented into key product categories including Oscilloscopes, Spectrum Analyzers, Power Meters, Signal Generators, Data Acquisition Systems, and a diverse "Other" category encompassing specialized instruments. For each segment, we provide detailed growth projections, current market size estimations, and a thorough analysis of the competitive landscape, identifying key players and their market shares.

By Application: We explore the T&M market's penetration and growth trajectory across a wide spectrum of industries. Key application areas analyzed include Automotive, Telecommunications, Aerospace & Defense, Industrial Automation, Consumer Electronics, Healthcare, and a comprehensive "Other" category for niche applications. The report details growth projections for each application area and offers a nuanced analysis of the competitive environment within each sector.

By End-User: The report further segments the market based on the primary consumers of T&M equipment and services. This includes Original Equipment Manufacturers (OEMs), Research Institutions, Contract Manufacturers, and Testing and Calibration Services providers. We present detailed competitive dynamics and market size figures for each end-user category, highlighting their unique demands and contributions to the overall market.

Key Drivers of Europe Electronic Test and Measurement Market Growth

The European Electronic Test and Measurement market is propelled by several key factors:

- Technological advancements: The development of faster, more accurate, and automated testing equipment.

- Stringent regulations: Compliance requirements related to product safety and environmental standards are driving adoption.

- Growth in end-use industries: Expansion in automotive, telecommunications, and industrial automation are fueling demand for testing solutions.

Challenges in the Europe Electronic Test and Measurement Market Sector

The European Electronic Test and Measurement market faces challenges such as:

- High initial investment costs: Advanced testing equipment requires significant capital investment.

- Supply chain disruptions: Global supply chain issues can impact availability and pricing of components.

- Intense competition: The presence of numerous established and emerging players creates a competitive environment. This leads to price pressures and the need for constant innovation.

Emerging Opportunities in Europe Electronic Test and Measurement Market

The market presents significant growth opportunities:

- Adoption of AI and machine learning: AI-powered testing solutions offer increased efficiency and improved accuracy.

- Expansion into emerging technologies: 5G, IoT, and autonomous vehicle testing present significant market potential.

- Growth in the cloud-based testing solutions: Cloud-based platforms provide greater accessibility and collaborative capabilities.

Leading Players in the Europe Electronic Test and Measurement Market Market

- Tektronix Inc

- Keysight Technologies

- Rohde & Schwarz GmbH & Co KG

- National Instruments Corporation

- Fluke Corporation

- Teledyne LeCroy Inc

- Yokogawa Test & Measurement Corporation

- Teradyne Inc

- Chauvin Arnoux Group

- Advantest Corporation

- *List Not Exhaustive

Key Developments in Europe Electronic Test and Measurement Industry

- September 2023: NI announced its third generation PXI Vector Signal Transceiver (VST), the PXIe-5842, expanding capabilities in aerospace and defense testing.

- January 2024: SmartViser and Anritsu partnered to streamline mobile device testing for energy labeling compliance.

- February 2024: Rohde & Schwarz and SmartViser collaborated on a solution for EU energy efficiency index (EEI) labeling compliance for smartphones and tablets, utilizing the R&S CMX500 radio communication tester.

Strategic Outlook for Europe Electronic Test and Measurement Market Market

The European Electronic Test and Measurement market is poised for continued growth, driven by ongoing technological advancements, increasing demand from diverse industries, and the stringent regulatory landscape. The market's future potential lies in the adoption of AI and machine learning, the expansion into new technologies (like 6G), and the growth of cloud-based testing solutions. Companies that can adapt to these trends and offer innovative, user-friendly solutions will be best positioned for success.

Europe Electronic Test And Measurement Market Segmentation

-

1. Type

- 1.1. Semiconductor Automatic Test Equipment (ATE)

- 1.2. Radio Frequency (RF) Test Equipment

- 1.3. Digital Test Equipment

- 1.4. Electrical and Environmental Test

- 1.5. Data Acquisition (DAQ)

-

2. Application

- 2.1. Communications

- 2.2. Semiconductors and Computing

- 2.3. Aerospace and Defense

- 2.4. Consumer Electronics

- 2.5. Electric Vehicles

Europe Electronic Test And Measurement Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

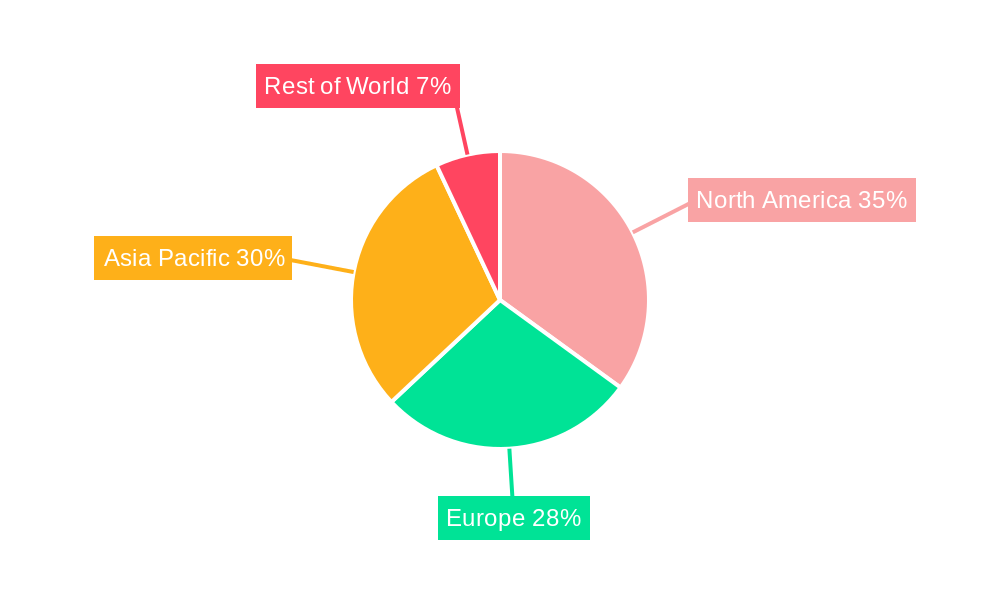

Europe Electronic Test And Measurement Market Regional Market Share

Geographic Coverage of Europe Electronic Test And Measurement Market

Europe Electronic Test And Measurement Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Advancements Leading to the Need for Test and Measurement Equipment; Emerging Trend of Electric and Hybrid Vehicle

- 3.3. Market Restrains

- 3.3.1. Technological Advancements Leading to the Need for Test and Measurement Equipment; Emerging Trend of Electric and Hybrid Vehicle

- 3.4. Market Trends

- 3.4.1. The Electric Vehicles Segment is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Electronic Test And Measurement Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Semiconductor Automatic Test Equipment (ATE)

- 5.1.2. Radio Frequency (RF) Test Equipment

- 5.1.3. Digital Test Equipment

- 5.1.4. Electrical and Environmental Test

- 5.1.5. Data Acquisition (DAQ)

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Communications

- 5.2.2. Semiconductors and Computing

- 5.2.3. Aerospace and Defense

- 5.2.4. Consumer Electronics

- 5.2.5. Electric Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tektronix Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Keysight Technologies

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Rohde & Schwarz GmbH & Co KG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 National Instruments Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fluke Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Teledyne LeCroy Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Yokogawa Test & Measurement Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Teradyne Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Chauvin Arnoux Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Advantest Corporation*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Tektronix Inc

List of Figures

- Figure 1: Europe Electronic Test And Measurement Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Electronic Test And Measurement Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Electronic Test And Measurement Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe Electronic Test And Measurement Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Europe Electronic Test And Measurement Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Europe Electronic Test And Measurement Market Volume Billion Forecast, by Application 2020 & 2033

- Table 5: Europe Electronic Test And Measurement Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Electronic Test And Measurement Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Europe Electronic Test And Measurement Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Europe Electronic Test And Measurement Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Europe Electronic Test And Measurement Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Europe Electronic Test And Measurement Market Volume Billion Forecast, by Application 2020 & 2033

- Table 11: Europe Electronic Test And Measurement Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Europe Electronic Test And Measurement Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Electronic Test And Measurement Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Europe Electronic Test And Measurement Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Germany Europe Electronic Test And Measurement Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe Electronic Test And Measurement Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: France Europe Electronic Test And Measurement Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Europe Electronic Test And Measurement Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Europe Electronic Test And Measurement Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Italy Europe Electronic Test And Measurement Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Spain Europe Electronic Test And Measurement Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Spain Europe Electronic Test And Measurement Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Netherlands Europe Electronic Test And Measurement Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Netherlands Europe Electronic Test And Measurement Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Belgium Europe Electronic Test And Measurement Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Belgium Europe Electronic Test And Measurement Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Sweden Europe Electronic Test And Measurement Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Sweden Europe Electronic Test And Measurement Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Norway Europe Electronic Test And Measurement Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Norway Europe Electronic Test And Measurement Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Poland Europe Electronic Test And Measurement Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Poland Europe Electronic Test And Measurement Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Denmark Europe Electronic Test And Measurement Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Denmark Europe Electronic Test And Measurement Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Electronic Test And Measurement Market?

The projected CAGR is approximately 3.00%.

2. Which companies are prominent players in the Europe Electronic Test And Measurement Market?

Key companies in the market include Tektronix Inc, Keysight Technologies, Rohde & Schwarz GmbH & Co KG, National Instruments Corporation, Fluke Corporation, Teledyne LeCroy Inc, Yokogawa Test & Measurement Corporation, Teradyne Inc, Chauvin Arnoux Group, Advantest Corporation*List Not Exhaustive.

3. What are the main segments of the Europe Electronic Test And Measurement Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.65 Million as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancements Leading to the Need for Test and Measurement Equipment; Emerging Trend of Electric and Hybrid Vehicle.

6. What are the notable trends driving market growth?

The Electric Vehicles Segment is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Technological Advancements Leading to the Need for Test and Measurement Equipment; Emerging Trend of Electric and Hybrid Vehicle.

8. Can you provide examples of recent developments in the market?

February 2024: Rohde & Schwarz have teamed up with SmartViser to create a solution ensuring compliance with a new EU regulation mandating Energy Efficiency Index (EEI) labeling on smartphones and tablets. Central to this solution is the R&S CMX500, a radio communication tester adept at end-to-end testing across all signaling use cases. This is seamlessly integrated with SmartViser's viSer test automation application, which is compatible with Android and iOS platforms.January 2024: SmartViser and Anritsu have teamed up to revolutionize mobile device testing in line with energy labeling regulations. Combining SmartViser's test automation prowess with Anritsu's advanced testing solutions, the duo aims to provide thorough, efficient, and forward-thinking testing services tailored to the dynamic mobile landscape.September 2023: NI announced its third generation PXI Vector Signal Transceiver (VST), the PXIe-5842. The PXIe-5842 is combined with NI’s software ecosystem, which can be used to test and validate products in aerospace and defense applications while supporting traditional RF capabilities such as signal generation, signal analysis, and spectrum analysis.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Electronic Test And Measurement Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Electronic Test And Measurement Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Electronic Test And Measurement Market?

To stay informed about further developments, trends, and reports in the Europe Electronic Test And Measurement Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence