Key Insights

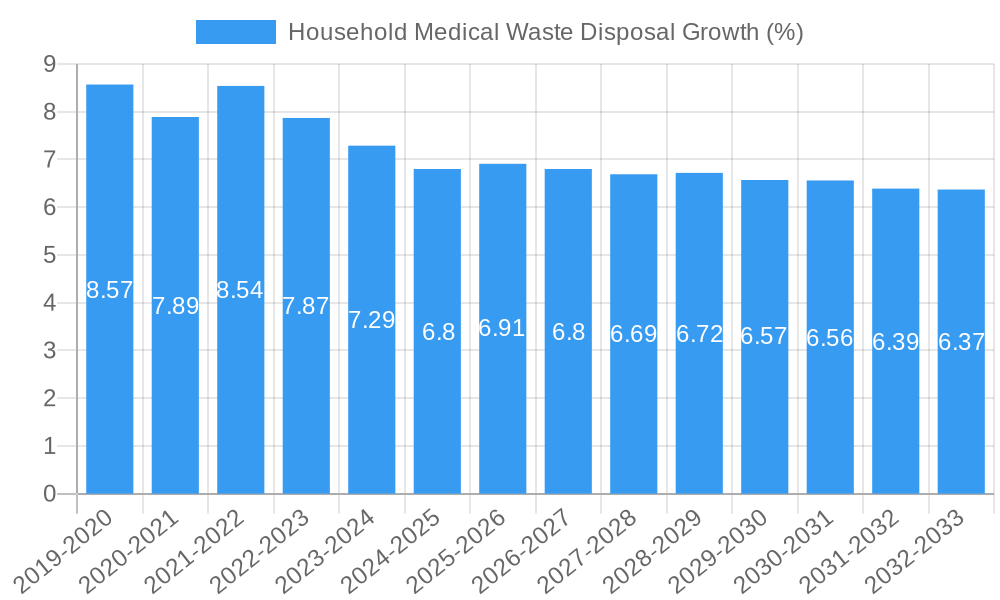

The global Household Medical Waste Disposal market is projected to experience robust growth, estimated to reach approximately $5,500 million by 2025, with a Compound Annual Growth Rate (CAGR) of around 7.5% through 2033. This expansion is significantly fueled by an increasing awareness among households regarding the safe and responsible disposal of medical waste generated at home, particularly with the aging global population and the rising prevalence of chronic diseases. Governments worldwide are also implementing stricter regulations and promoting public health initiatives, further driving the demand for specialized disposal services. The market is segmented by application into High-end Community and Ordinary Community, with the former likely to command a larger share due to higher disposable incomes and a greater emphasis on specialized services. By type, the market is divided into Hazardous Medical Waste and Non-Hazardous Medical Waste, with hazardous waste disposal services expected to see a higher growth rate owing to greater environmental and health risks associated with improper handling.

Key drivers for this market include the growing volume of home healthcare services, increasing patient self-management of medical conditions, and the widespread use of sharps and other medical consumables at home. Trends such as the adoption of advanced disposal technologies, the rise of subscription-based disposal services for convenience, and a growing preference for eco-friendly disposal methods are shaping the market landscape. However, restraints such as the high cost of specialized disposal services, lack of widespread consumer awareness in certain regions, and the complexities of regulatory compliance may pose challenges to market expansion. Key players like Stericycle, Waste Management, and Clean Harbors are actively investing in expanding their service portfolios and geographical reach to capture this burgeoning market.

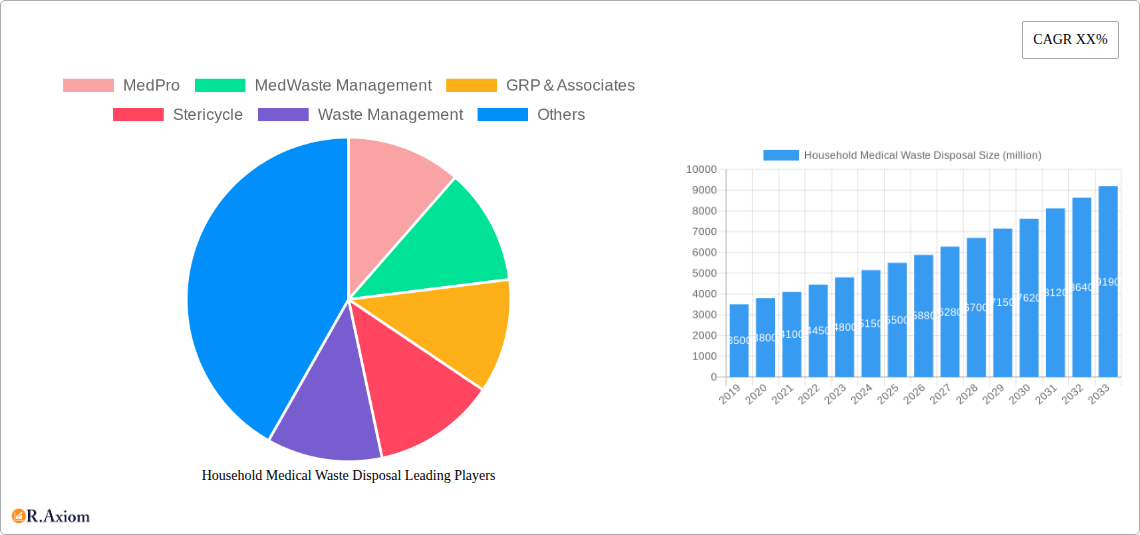

Household Medical Waste Disposal Market Concentration & Innovation

The global household medical waste disposal market is characterized by moderate concentration, with key players like Stericycle, Waste Management, and Clean Harbors holding significant market shares. The estimated market share for these leading entities is projected to reach over 70% by 2025, underscoring their dominance. Innovation is a critical driver, fueled by the increasing volume of medical waste generated at home due to chronic disease management and aging populations. Companies are investing heavily in R&D for safer, more convenient, and environmentally friendly disposal methods. Regulatory frameworks, such as strict guidelines on hazardous medical waste handling, are also shaping innovation by mandating advanced treatment technologies. Product substitutes are limited but include less specialized disposal services or improper disposal, which pose significant health and environmental risks. End-user trends show a growing demand for convenient at-home collection services, particularly in high-end communities where residents are willing to pay a premium for specialized disposal. Mergers and acquisitions (M&A) are a notable activity, with recent deal values estimated in the range of 100 million to 500 million dollars. For instance, MedPro's acquisition of a regional competitor in 2023, valued at approximately 150 million dollars, aimed to expand its service reach in key urban centers. These M&A activities consolidate market power and drive technological advancements through the integration of innovative solutions.

Household Medical Waste Disposal Industry Trends & Insights

The household medical waste disposal industry is experiencing robust growth, propelled by a confluence of factors that are reshaping how individuals and communities manage waste generated from home healthcare practices. The compound annual growth rate (CAGR) for this sector is estimated to be around 6.5% during the forecast period of 2025–2033, reflecting a sustained upward trajectory. This expansion is primarily driven by an increasing prevalence of chronic diseases, a growing aging population, and a greater emphasis on home-based healthcare solutions, all contributing to a significant rise in the volume of sharps, contaminated materials, and other hazardous medical waste generated within households. Market penetration is steadily increasing as awareness about the health and environmental risks associated with improper disposal of medical waste grows. Consumers are becoming more informed and proactive in seeking compliant and safe disposal methods. Technological disruptions are playing a pivotal role, with the introduction of advanced containment systems, automated collection technologies, and more efficient treatment processes. For example, smart bins that monitor fill levels and schedule pickups are gaining traction, especially in urban areas. Consumer preferences are shifting towards convenient, accessible, and eco-conscious disposal solutions. The demand for subscription-based services offering regular pickups and educational resources on proper waste segregation is on the rise. This is particularly evident in high-end communities where residents have a higher disposable income and a stronger inclination towards services that simplify complex tasks while adhering to environmental standards. Competitive dynamics are intensifying, with established waste management giants like Waste Management and Stericycle actively expanding their specialized medical waste divisions, alongside niche players like Sharps Compliance and Bioserv focusing on specific product categories and consumer segments. The industry is also witnessing strategic partnerships and collaborations aimed at enhancing service delivery and expanding geographical reach. For instance, collaborations between healthcare providers and disposal service companies are becoming more common to offer comprehensive home healthcare solutions, including waste management. The regulatory landscape continues to evolve, with governments worldwide implementing stricter guidelines for medical waste disposal, thereby creating a more favorable environment for compliant service providers and encouraging investment in advanced disposal technologies.

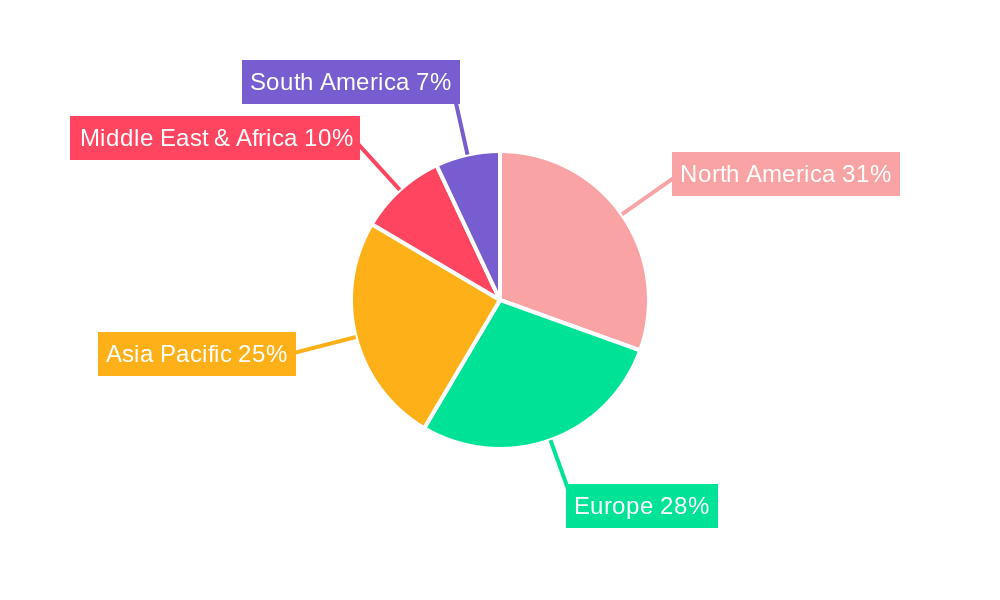

Dominant Markets & Segments in Household Medical Waste Disposal

The global household medical waste disposal market exhibits distinct dominance across various regions and segments, driven by a complex interplay of economic policies, infrastructure development, and evolving consumer behaviors. The North American region, particularly the United States and Canada, currently holds a dominant position, projected to account for over 35% of the global market share by 2025. This dominance is attributed to several key drivers: robust healthcare infrastructure, a high prevalence of chronic diseases requiring home-based care, stringent regulatory frameworks mandating safe disposal, and a high level of consumer awareness regarding health and environmental safety. Within North America, ordinary communities represent the largest segment in terms of volume, due to the sheer number of households and the increasing adoption of home healthcare for a wide range of medical needs. However, high-end communities are demonstrating a faster growth rate, driven by a willingness to adopt premium, convenient, and specialized disposal services.

The Hazardous Medical Waste segment is by far the most dominant and critical within the market. This segment accounts for an estimated 75% of the total market value in 2025, due to the inherent risks associated with sharps, contaminated bandages, and certain medications, necessitating specialized handling and disposal protocols. Stringent regulations enforced by bodies like the Environmental Protection Agency (EPA) in the US and similar organizations globally are the primary drivers for this dominance. These regulations mandate specific collection methods, treatment processes (such as incineration or autoclaving), and secure transportation, making it a high-value segment for service providers. For example, state-specific regulations in California and New York are particularly stringent, driving significant demand for compliant disposal solutions.

Conversely, the Non-Hazardous Medical Waste segment, though smaller in market value (estimated at 25% in 2025), is experiencing steady growth. This includes items like unused over-the-counter medications, packaging materials, and certain types of personal protective equipment. The growth is fueled by increasing awareness of the environmental impact of improper disposal, even of non-hazardous materials, and the availability of more accessible disposal options like mail-back programs and community collection events.

Key drivers underpinning the dominance of these segments and regions include:

- Economic Policies: Government incentives for proper medical waste disposal, tax benefits for companies investing in advanced disposal technologies, and reimbursement policies for home healthcare services that incorporate waste management.

- Infrastructure Development: The presence of specialized medical waste treatment facilities, a well-established logistics network for collection and transportation, and the availability of user-friendly disposal kits and containers.

- Regulatory Frameworks: The strict enforcement of regulations governing the handling, treatment, and disposal of hazardous medical waste is a primary catalyst. This includes guidelines from agencies like the EPA, OSHA, and state-level environmental protection departments.

- Consumer Awareness and Demand: Growing public understanding of the health risks associated with improper disposal of medical waste and a rising demand for safe, convenient, and environmentally responsible solutions.

- Technological Advancements: The development and adoption of innovative disposal technologies, such as advanced sterilization methods and secure containment systems, enhance efficiency and safety, further driving market demand.

Household Medical Waste Disposal Product Developments

Innovations in household medical waste disposal are primarily focused on enhancing safety, convenience, and environmental sustainability. Key developments include the introduction of advanced puncture-resistant and leak-proof sharps containers with integrated safety features, such as automatic locking mechanisms and tamper-evident seals. Companies are also developing smart disposal bins that can monitor fill levels and schedule pickups, integrated with mobile applications for user convenience. Furthermore, there's a growing emphasis on biodegradable or recyclable disposal materials and more efficient, less energy-intensive treatment technologies like steam sterilization and chemical disinfection for hazardous waste. These product developments offer significant competitive advantages by addressing specific end-user pain points and aligning with increasing regulatory scrutiny and environmental consciousness.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global household medical waste disposal market. The market is segmented by Application into High-end Community and Ordinary Community. The High-end Community segment is characterized by a higher disposable income, greater demand for premium services, and a strong emphasis on convenience and specialized disposal solutions. Its market size is projected to reach an estimated 2,500 million by 2025, with a projected CAGR of 7.2% during the forecast period. The Ordinary Community segment, comprising the majority of households, is driven by increasing awareness and the availability of cost-effective disposal options, with an estimated market size of 7,000 million by 2025 and a CAGR of 6.1%.

The market is also segmented by Type into Hazardous Medical Waste and Non-Hazardous Medical Waste. The Hazardous Medical Waste segment, including sharps, contaminated bandages, and soiled medical devices, is the dominant segment due to stringent regulations and inherent risks. Its market size is estimated at 7,000 million by 2025, with a CAGR of 6.5%. The Non-Hazardous Medical Waste segment, encompassing items like unused medications and certain packaging, is growing due to environmental concerns and is projected to reach 2,500 million by 2025, with a CAGR of 5.8%. Competitive dynamics within each segment are shaped by service offerings, pricing strategies, and regulatory compliance.

Key Drivers of Household Medical Waste Disposal Growth

Several key drivers are propelling the growth of the household medical waste disposal market. The increasing prevalence of chronic diseases and the subsequent rise in home-based healthcare are leading to a significant increase in the volume of medical waste generated at home. An aging global population further amplifies this trend, as elderly individuals often require more medical attention and supplies. Stringent government regulations and mandates for the safe and compliant disposal of medical waste are crucial drivers, compelling households and healthcare providers to adopt specialized disposal services. Technological advancements in waste treatment and containment solutions are making disposal more efficient, safer, and environmentally friendly, thereby encouraging wider adoption. Furthermore, growing consumer awareness regarding the health and environmental risks associated with improper disposal is fostering demand for professional disposal services.

Challenges in the Household Medical Waste Disposal Sector

Despite robust growth prospects, the household medical waste disposal sector faces several significant challenges. Navigating the complex and often varied regulatory landscape across different regions and countries can be a substantial hurdle for service providers, leading to increased compliance costs. The improper disposal of medical waste by a segment of the population, often due to lack of awareness or convenience, continues to pose a public health and environmental risk, undermining the efforts of compliant individuals and services. Supply chain disruptions, particularly concerning the availability and cost of specialized containment kits and transportation, can impact service delivery and profitability. Intense competitive pressure from both established waste management companies and emerging specialized players can lead to price wars and margin erosion. Furthermore, the initial investment required for advanced treatment technologies and specialized infrastructure can be a barrier to entry for smaller companies.

Emerging Opportunities in Household Medical Waste Disposal

The household medical waste disposal market is ripe with emerging opportunities. The increasing adoption of telemedicine and remote patient monitoring is expected to further boost the generation of household medical waste, creating sustained demand for disposal services. The development and widespread availability of user-friendly, mail-back disposal programs offer a significant opportunity to reach underserved populations and improve market penetration. Technological innovations, such as the integration of AI for route optimization in collection services and the development of more sustainable disposal methods like chemical recycling of plastics, present exciting avenues for differentiation and cost reduction. Expanding into developing economies, where regulatory frameworks are evolving and awareness is growing, offers substantial untapped market potential. Furthermore, strategic partnerships with pharmaceutical companies, home healthcare agencies, and insurance providers can create integrated service offerings and unlock new customer bases.

Leading Players in the Household Medical Waste Disposal Market

- Stericycle

- Waste Management

- Clean Harbors

- MedPro

- MedWaste Management

- GRP&Associates

- Citiwaste

- Sanpro

- Sharps Compliance

- Bioserv

- BioMedical Waste Solutions

- PureWay

- Medasend

- BWS Inc

- Veolia

- Daniels

Key Developments in Household Medical Waste Disposal Industry

- 2024 (Q1): Stericycle announced the acquisition of a regional medical waste transporter for an undisclosed sum, expanding its service footprint in the Pacific Northwest.

- 2023 (Q4): Sharps Compliance launched a new, more eco-friendly mail-back sharps disposal system with enhanced safety features.

- 2023 (Q3): Waste Management partnered with a major healthcare provider to offer comprehensive home medical waste disposal solutions to their patients.

- 2023 (Q2): Clean Harbors invested 50 million dollars in upgrading its hazardous waste treatment facilities to accommodate increased volumes from household sources.

- 2022 (Q4): MedPro introduced a subscription-based service for chronic disease patients, including regular collection of medical waste.

- 2022 (Q3): Bioserv developed a new biodegradable container for pharmaceutical waste, addressing growing environmental concerns.

- 2021 (Q4): GRP&Associates expanded its hazardous medical waste disposal services into three new metropolitan areas.

- 2021 (Q3): Citiwaste launched an educational campaign on proper household medical waste disposal, aiming to increase compliance rates.

Strategic Outlook for Household Medical Waste Disposal Market

The strategic outlook for the household medical waste disposal market remains exceptionally positive, driven by enduring demographic shifts and increasing regulatory emphasis on public health and environmental protection. The sustained rise in home-based healthcare and the growing awareness of the risks associated with improper waste disposal will continue to fuel demand for specialized services. Companies that can effectively leverage technological advancements for greater efficiency, convenience, and sustainability, while navigating the regulatory landscape, are poised for significant growth. Strategic collaborations and M&A activities will likely continue to shape the market, leading to consolidation and enhanced service offerings. The development of innovative, user-friendly, and environmentally conscious disposal solutions will be critical for capturing market share and meeting evolving consumer expectations, ensuring a robust and expanding future for the sector.

Household Medical Waste Disposal Segmentation

-

1. Application

- 1.1. High-end Community

- 1.2. Ordinary Community

-

2. Types

- 2.1. Hazardous Medical Waste

- 2.2. Non-Hazardous Medical Waste

Household Medical Waste Disposal Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Household Medical Waste Disposal REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Household Medical Waste Disposal Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. High-end Community

- 5.1.2. Ordinary Community

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Hazardous Medical Waste

- 5.2.2. Non-Hazardous Medical Waste

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Household Medical Waste Disposal Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. High-end Community

- 6.1.2. Ordinary Community

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Hazardous Medical Waste

- 6.2.2. Non-Hazardous Medical Waste

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Household Medical Waste Disposal Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. High-end Community

- 7.1.2. Ordinary Community

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Hazardous Medical Waste

- 7.2.2. Non-Hazardous Medical Waste

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Household Medical Waste Disposal Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. High-end Community

- 8.1.2. Ordinary Community

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Hazardous Medical Waste

- 8.2.2. Non-Hazardous Medical Waste

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Household Medical Waste Disposal Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. High-end Community

- 9.1.2. Ordinary Community

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Hazardous Medical Waste

- 9.2.2. Non-Hazardous Medical Waste

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Household Medical Waste Disposal Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. High-end Community

- 10.1.2. Ordinary Community

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Hazardous Medical Waste

- 10.2.2. Non-Hazardous Medical Waste

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 MedPro

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 MedWaste Management

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 GRP&Associates

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Stericycle

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Waste Management

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Citiwaste

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sanpro

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sharps Compliance

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bioserv

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BioMedical Waste Solutions

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 PureWay

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Medasend

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 BWS Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Clean Harbors

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Veolia

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Daniels

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 MedPro

List of Figures

- Figure 1: Global Household Medical Waste Disposal Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Household Medical Waste Disposal Revenue (million), by Application 2024 & 2032

- Figure 3: North America Household Medical Waste Disposal Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Household Medical Waste Disposal Revenue (million), by Types 2024 & 2032

- Figure 5: North America Household Medical Waste Disposal Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Household Medical Waste Disposal Revenue (million), by Country 2024 & 2032

- Figure 7: North America Household Medical Waste Disposal Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Household Medical Waste Disposal Revenue (million), by Application 2024 & 2032

- Figure 9: South America Household Medical Waste Disposal Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Household Medical Waste Disposal Revenue (million), by Types 2024 & 2032

- Figure 11: South America Household Medical Waste Disposal Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Household Medical Waste Disposal Revenue (million), by Country 2024 & 2032

- Figure 13: South America Household Medical Waste Disposal Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Household Medical Waste Disposal Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Household Medical Waste Disposal Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Household Medical Waste Disposal Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Household Medical Waste Disposal Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Household Medical Waste Disposal Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Household Medical Waste Disposal Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Household Medical Waste Disposal Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Household Medical Waste Disposal Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Household Medical Waste Disposal Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Household Medical Waste Disposal Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Household Medical Waste Disposal Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Household Medical Waste Disposal Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Household Medical Waste Disposal Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Household Medical Waste Disposal Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Household Medical Waste Disposal Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Household Medical Waste Disposal Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Household Medical Waste Disposal Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Household Medical Waste Disposal Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Household Medical Waste Disposal Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Household Medical Waste Disposal Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Household Medical Waste Disposal Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Household Medical Waste Disposal Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Household Medical Waste Disposal Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Household Medical Waste Disposal Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Household Medical Waste Disposal Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Household Medical Waste Disposal Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Household Medical Waste Disposal Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Household Medical Waste Disposal Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Household Medical Waste Disposal Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Household Medical Waste Disposal Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Household Medical Waste Disposal Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Household Medical Waste Disposal Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Household Medical Waste Disposal Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Household Medical Waste Disposal Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Household Medical Waste Disposal Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Household Medical Waste Disposal Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Household Medical Waste Disposal Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Household Medical Waste Disposal Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Household Medical Waste Disposal Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Household Medical Waste Disposal Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Household Medical Waste Disposal Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Household Medical Waste Disposal Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Household Medical Waste Disposal Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Household Medical Waste Disposal Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Household Medical Waste Disposal Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Household Medical Waste Disposal Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Household Medical Waste Disposal Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Household Medical Waste Disposal Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Household Medical Waste Disposal Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Household Medical Waste Disposal Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Household Medical Waste Disposal Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Household Medical Waste Disposal Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Household Medical Waste Disposal Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Household Medical Waste Disposal Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Household Medical Waste Disposal Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Household Medical Waste Disposal Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Household Medical Waste Disposal Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Household Medical Waste Disposal Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Household Medical Waste Disposal Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Household Medical Waste Disposal Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Household Medical Waste Disposal Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Household Medical Waste Disposal Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Household Medical Waste Disposal Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Household Medical Waste Disposal Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Household Medical Waste Disposal Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Household Medical Waste Disposal?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Household Medical Waste Disposal?

Key companies in the market include MedPro, MedWaste Management, GRP&Associates, Stericycle, Waste Management, Citiwaste, Sanpro, Sharps Compliance, Bioserv, BioMedical Waste Solutions, PureWay, Medasend, BWS Inc, Clean Harbors, Veolia, Daniels.

3. What are the main segments of the Household Medical Waste Disposal?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Household Medical Waste Disposal," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Household Medical Waste Disposal report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Household Medical Waste Disposal?

To stay informed about further developments, trends, and reports in the Household Medical Waste Disposal, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence