Key Insights

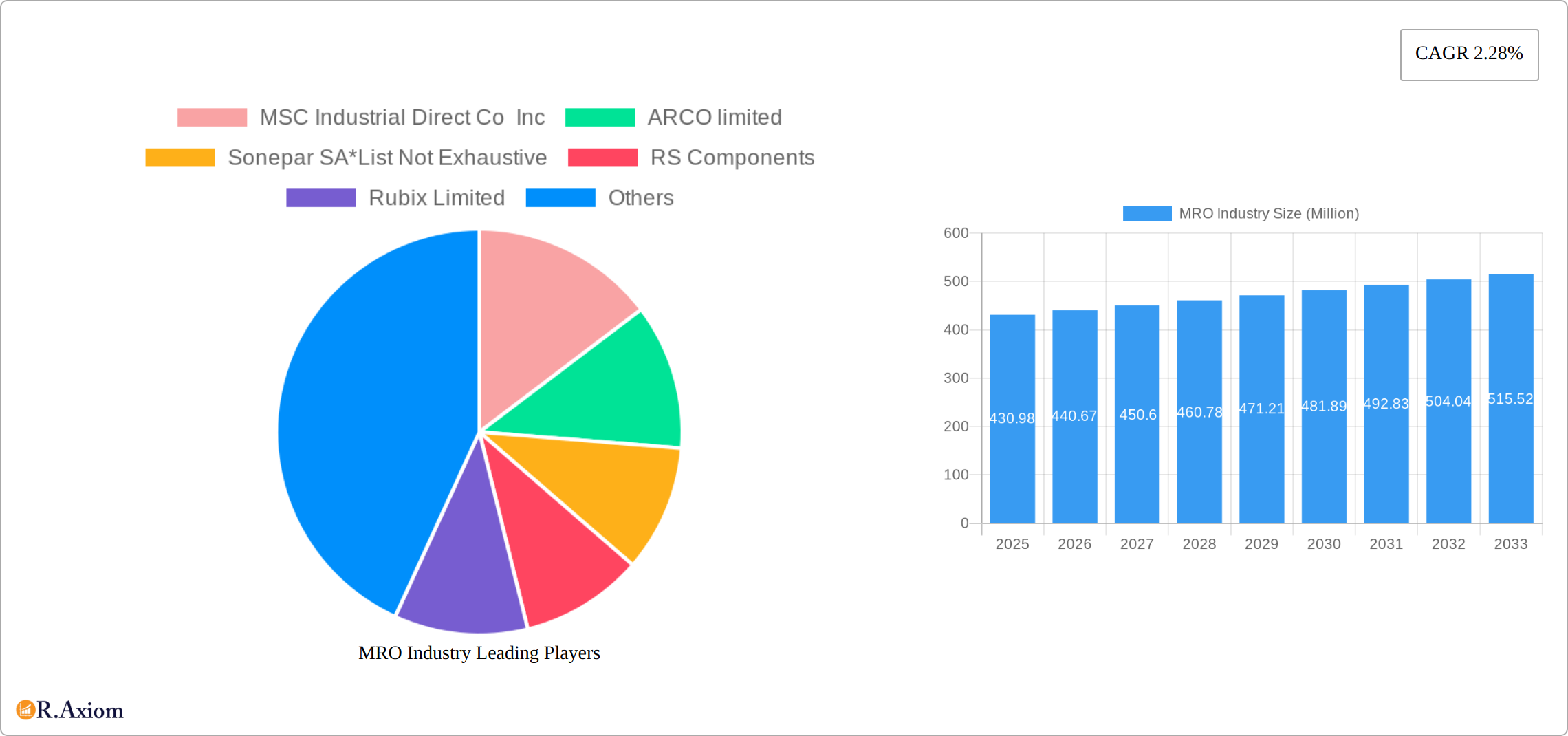

The global Maintenance, Repair, and Operations (MRO) industry, valued at $430.98 million in 2025, is projected to experience steady growth with a Compound Annual Growth Rate (CAGR) of 2.28% from 2025 to 2033. This growth is fueled by several key factors. Increased industrial automation and the expanding manufacturing sector drive demand for MRO services and supplies across various industries. The rise of predictive maintenance technologies, enabling proactive repairs and reducing downtime, is significantly impacting the market. Furthermore, a growing emphasis on operational efficiency and cost reduction within businesses necessitates reliable and readily available MRO solutions. The segment breakdown reveals a diversified market, with industrial, electrical, and facility MRO types contributing significantly to overall revenue. Leading players like Grainger, MSC Industrial Direct, and Sonepar are leveraging their established distribution networks and comprehensive product offerings to maintain market share and capture growth opportunities.

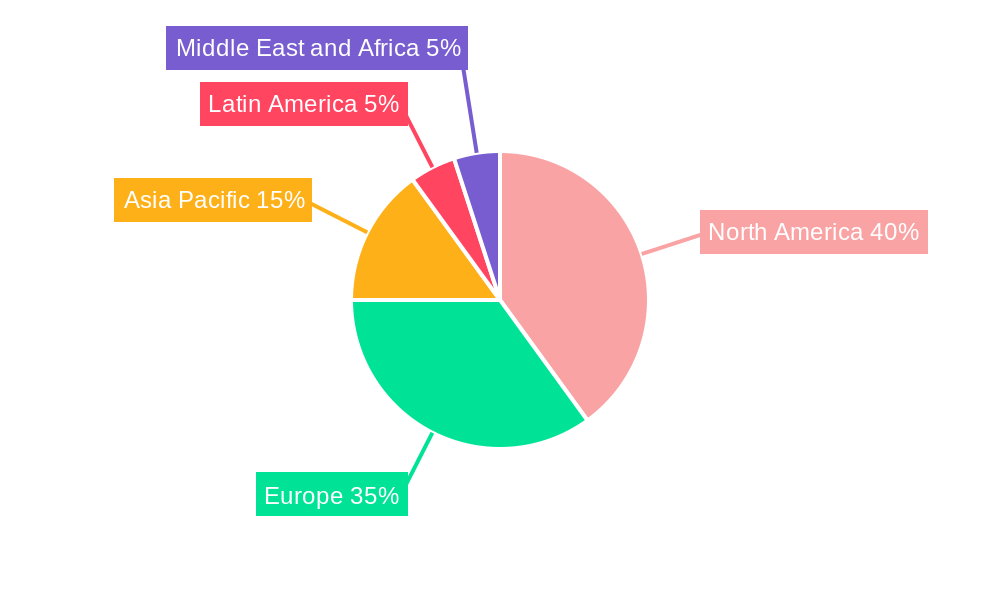

However, the MRO market also faces certain headwinds. Fluctuations in raw material prices and global supply chain disruptions can impact profitability and availability. Competition is intense, with both established players and new entrants vying for market share. Additionally, economic downturns can lead to decreased capital expenditure on maintenance and repairs, creating cyclical demand patterns. Despite these challenges, the long-term outlook for the MRO industry remains positive, driven by the fundamental need for maintenance and repair across all sectors. The continued adoption of digital technologies and the focus on sustainable practices within industries will further shape the MRO market landscape, creating opportunities for innovative solutions and service providers. The geographical distribution shows a concentration in North America and Europe initially, with growth potential particularly strong in the Asia-Pacific region due to its rapidly industrializing economies.

This comprehensive report provides a detailed analysis of the MRO (Maintenance, Repair, and Operations) industry, encompassing market size, segmentation, growth drivers, challenges, and key players. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report is invaluable for industry stakeholders, investors, and businesses seeking to understand and capitalize on opportunities within this dynamic sector. The report features in-depth analysis of key companies including MSC Industrial Direct Co Inc, ARCO limited, Sonepar SA, RS Components, Rubix Limited, WESCO International Inc, Hayley Group Limited, W W Grainger Inc, Wurth Group GmbH, Applied Industrial Technologies Inc, ERIKS N V (SHV Holdings), Airgas Inc (Air Liquide SA), and Motion Industries Inc (Genuine Parts Company).

MRO Industry Market Concentration & Innovation

The MRO industry presents a moderately concentrated market structure, dominated by several large multinational corporations commanding significant market share. However, a substantial number of smaller, regional players actively contribute to the overall market dynamics. The sector is undergoing a period of rapid innovation, fueled by the widespread adoption of digital technologies. This includes the Internet of Things (IoT), predictive maintenance leveraging AI and machine learning, and sophisticated data analytics. These advancements are enhancing operational efficiency, minimizing downtime, and optimizing complex supply chain management processes. Furthermore, increasingly stringent regulatory frameworks focused on safety and environmental compliance are fundamentally reshaping industry best practices and driving sustainable solutions. Product substitution remains a constant force, with cutting-edge materials and technologies continually offering improved performance and cost advantages. End-user preferences are clearly shifting towards integrated MRO solutions and services providing streamlined procurement and inventory management capabilities. The M&A landscape is notably active, with deal values totaling xx Million in the last five years, reflecting the strong drive for consolidation, expansion into new geographical markets, and the acquisition of innovative technologies and expertise.

- Key Metrics: Market share of top 5 players: xx%; Average M&A deal value: xx Million; Year-over-year growth in digital MRO solutions adoption: xx%.

- Innovation Drivers: IoT, AI-powered predictive maintenance, blockchain for supply chain transparency, digitalization of procurement, and advanced analytics for optimized resource allocation.

- Regulatory Frameworks: OSHA compliance, EPA regulations, GDPR/CCPA (data privacy), and evolving sustainability standards.

- M&A Activities: High levels of consolidation and strategic acquisitions driven by growth ambitions, technological advancements, and expansion into new market segments.

MRO Industry Industry Trends & Insights

The global MRO industry is experiencing robust and sustained growth, propelled by factors such as accelerating industrialization, expansive infrastructure development projects, and increasing demand across a diverse range of end-use sectors. The market demonstrates a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). The penetration rate of advanced technologies, particularly AI-powered predictive maintenance and cloud-based solutions, is steadily increasing, leading to enhanced operational efficiency and significant cost reductions. Consumer preferences are progressively shifting towards integrated, cloud-based MRO solutions offering comprehensive data analytics and real-time inventory management capabilities. This digital transformation is creating intense competitive pressure, motivating companies to invest significantly in technological advancements to maintain a competitive edge. The competitive landscape is defined by both fierce price competition and a strong focus on differentiating services and solutions based on technological sophistication and specialized expertise. This highly dynamic market demands that manufacturers exhibit agility and responsiveness to rapid shifts in customer requirements and the continuous evolution of technology.

Dominant Markets & Segments in MRO Industry

The North American region currently holds a leading position in the global MRO market, accounting for xx% of the total market share in 2025. This prominence is attributed to robust industrial activities, substantial infrastructure investments, and a highly developed and efficient supply chain network. Among the various MRO segments, Industrial MRO commands the largest market share, driven by the consistently high demand for maintenance, repair, and operations services across the manufacturing, energy, and other key industrial sectors. Growth opportunities are also emerging in other segments, such as renewable energy and sustainable infrastructure development.

- Key Drivers for North American Dominance: Strong industrial base, high infrastructure spending, early adoption of advanced technologies, skilled workforce, and favorable regulatory environment.

- Industrial MRO: Large and diverse manufacturing sector, significant maintenance needs across industries, and increasing focus on automation and efficiency.

- Electrical MRO: Growth fueled by the expansion of power grids, smart grids, and renewable energy infrastructure (solar, wind). Increased demand for specialized equipment and maintenance expertise.

- Facility MRO: Driven by increasing demand for building maintenance and repair services, along with a focus on energy efficiency and sustainability in building operations.

- Other MRO Types: Includes specialized segments like automotive, aerospace, and healthcare MRO, each with unique requirements and growth dynamics.

MRO Industry Product Developments

Recent product developments in the MRO industry reflect a strong focus on technological advancements, particularly in the areas of predictive maintenance, IoT-enabled sensors, and cloud-based software solutions. These innovations enhance efficiency, reduce downtime, and provide valuable data insights for optimizing maintenance schedules and inventory management. This trend fosters significant competitive advantages for companies that can leverage these technologies effectively to meet the evolving needs of their customers.

Report Scope & Segmentation Analysis

This comprehensive report segments the MRO market by type, encompassing Industrial MRO, Electrical MRO, Facility MRO, and Other MRO Types. Each segment undergoes detailed analysis, providing valuable insights into market size, growth projections, competitive landscapes, and key emerging trends. The Industrial MRO segment is projected to exhibit the highest CAGR, propelled by the ongoing expansion of manufacturing and industrial activities worldwide. The Electrical MRO segment is poised for substantial growth due to the rapidly expanding renewable energy sector and the modernization of existing power grids. Facility MRO is expected to experience steady and consistent growth, driven by the rising demand for building maintenance and repair services, alongside a growing emphasis on energy efficiency and sustainable building practices. The report also includes detailed regional breakdowns and analyses of key market players.

Key Drivers of MRO Industry Growth

Several factors contribute to the robust growth of the MRO industry. Technological advancements in predictive maintenance, IoT, and data analytics are driving efficiency gains and cost reductions. Economic growth and industrialization in emerging markets are fueling demand for MRO products and services. Furthermore, stringent government regulations regarding safety and environmental compliance are creating opportunities for specialized MRO solutions.

Challenges in the MRO Industry Sector

The MRO industry faces numerous challenges, including supply chain disruptions, rising material costs, and intensifying competition. Regulatory hurdles and compliance requirements can increase operational costs. These challenges are exacerbated by fluctuating global economic conditions and geopolitical uncertainties impacting material availability and pricing. The impact of these factors on the industry's profitability is estimated to be xx Million annually.

Emerging Opportunities in MRO Industry

Emerging opportunities within the MRO sector include the growth of the digital economy, expansion into emerging markets, and the increasing adoption of circular economy principles. The integration of advanced technologies, such as artificial intelligence (AI) and machine learning (ML), into MRO services provides opportunities for improved operational efficiency and predictive maintenance capabilities. The rise of e-commerce and digital marketplaces is creating new avenues for MRO procurement and distribution.

Leading Players in the MRO Industry Market

- MSC Industrial Direct Co Inc

- ARCO limited

- Sonepar SA

- RS Components

- Rubix Limited

- WESCO International Inc

- Hayley Group Limited

- W W Grainger Inc

- Wurth Group GmbH

- Applied Industrial Technologies Inc

- ERIKS N V (SHV Holdings)

- Airgas Inc (Air Liquide SA)

- Motion Industries Inc (Genuine Parts Company)

Key Developments in MRO Industry Industry

- January 2023: Applied Industrial Technologies launched the fifth edition of its Applied Maintenance Supply & Solutions Master Product Catalog, featuring over 47,000 maintenance products. This broadened product portfolio enhances its market competitiveness.

- January 2023: MSC Industrial Supply Co. acquired Buckeye Industrial Supply Co. and True-Edge Grinding Inc., strengthening its position as a multichannel supplier of MRO products and services. This acquisition expands its market reach and product offerings.

Strategic Outlook for MRO Industry Market

The MRO industry is poised for continued growth, driven by ongoing technological advancements, increasing industrialization, and expanding infrastructure development. The focus on digitalization, sustainability, and integrated solutions will shape the competitive landscape. Companies that effectively leverage technology and adapt to evolving customer needs are well-positioned to capitalize on future opportunities within this dynamic sector.

MRO Industry Segmentation

-

1. MRO Type

- 1.1. Industrial MRO

- 1.2. Electrical MRO

- 1.3. Facility MRO

- 1.4. Other MRO Types

MRO Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

MRO Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.28% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing Demand for Efficiency in Supply Chain; Increasing Focus on Industry 4.0

- 3.2.2 Leading to More Manufacturing Facilities

- 3.3. Market Restrains

- 3.3.1. Spread of COVID-19 to Affect the Supply Chain

- 3.4. Market Trends

- 3.4.1. Industrial MRO to Occupy Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. MRO Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by MRO Type

- 5.1.1. Industrial MRO

- 5.1.2. Electrical MRO

- 5.1.3. Facility MRO

- 5.1.4. Other MRO Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by MRO Type

- 6. North America MRO Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by MRO Type

- 6.1.1. Industrial MRO

- 6.1.2. Electrical MRO

- 6.1.3. Facility MRO

- 6.1.4. Other MRO Types

- 6.1. Market Analysis, Insights and Forecast - by MRO Type

- 7. Europe MRO Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by MRO Type

- 7.1.1. Industrial MRO

- 7.1.2. Electrical MRO

- 7.1.3. Facility MRO

- 7.1.4. Other MRO Types

- 7.1. Market Analysis, Insights and Forecast - by MRO Type

- 8. Asia Pacific MRO Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by MRO Type

- 8.1.1. Industrial MRO

- 8.1.2. Electrical MRO

- 8.1.3. Facility MRO

- 8.1.4. Other MRO Types

- 8.1. Market Analysis, Insights and Forecast - by MRO Type

- 9. Latin America MRO Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by MRO Type

- 9.1.1. Industrial MRO

- 9.1.2. Electrical MRO

- 9.1.3. Facility MRO

- 9.1.4. Other MRO Types

- 9.1. Market Analysis, Insights and Forecast - by MRO Type

- 10. Middle East and Africa MRO Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by MRO Type

- 10.1.1. Industrial MRO

- 10.1.2. Electrical MRO

- 10.1.3. Facility MRO

- 10.1.4. Other MRO Types

- 10.1. Market Analysis, Insights and Forecast - by MRO Type

- 11. North America MRO Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe MRO Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific MRO Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America MRO Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa MRO Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 MSC Industrial Direct Co Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 ARCO limited

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Sonepar SA*List Not Exhaustive

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 RS Components

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Rubix Limited

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 WESCO International Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Hayley Group Limited

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 W W Grainger Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Wurth Group GmbH

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Applied Industrial Technologies Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 ERIKS N V (SHV Holdings)

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Airgas Inc (Air Liquide SA)

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Motion Industries Inc (Genuine Parts Company)

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.1 MSC Industrial Direct Co Inc

List of Figures

- Figure 1: MRO Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: MRO Industry Share (%) by Company 2024

List of Tables

- Table 1: MRO Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: MRO Industry Revenue Million Forecast, by MRO Type 2019 & 2032

- Table 3: MRO Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: MRO Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: MRO Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: MRO Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: MRO Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: MRO Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: MRO Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: MRO Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: MRO Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: MRO Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: MRO Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: MRO Industry Revenue Million Forecast, by MRO Type 2019 & 2032

- Table 15: MRO Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: MRO Industry Revenue Million Forecast, by MRO Type 2019 & 2032

- Table 17: MRO Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: MRO Industry Revenue Million Forecast, by MRO Type 2019 & 2032

- Table 19: MRO Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: MRO Industry Revenue Million Forecast, by MRO Type 2019 & 2032

- Table 21: MRO Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: MRO Industry Revenue Million Forecast, by MRO Type 2019 & 2032

- Table 23: MRO Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MRO Industry?

The projected CAGR is approximately 2.28%.

2. Which companies are prominent players in the MRO Industry?

Key companies in the market include MSC Industrial Direct Co Inc, ARCO limited, Sonepar SA*List Not Exhaustive, RS Components, Rubix Limited, WESCO International Inc, Hayley Group Limited, W W Grainger Inc, Wurth Group GmbH, Applied Industrial Technologies Inc, ERIKS N V (SHV Holdings), Airgas Inc (Air Liquide SA), Motion Industries Inc (Genuine Parts Company).

3. What are the main segments of the MRO Industry?

The market segments include MRO Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 430.98 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Efficiency in Supply Chain; Increasing Focus on Industry 4.0. Leading to More Manufacturing Facilities.

6. What are the notable trends driving market growth?

Industrial MRO to Occupy Significant Market Share.

7. Are there any restraints impacting market growth?

Spread of COVID-19 to Affect the Supply Chain.

8. Can you provide examples of recent developments in the market?

January 2023: Applied Industrial Technologies launched the fifth edition of its Applied Maintenance Supply & Solutions Master Product Catalog, which features over 47,000 maintenance products specifically chosen for maintenance, repair, operations, and production (MROP) users. The catalog includes a diverse selection of products ranging from transportation, fasteners, shop supplies, electrical, welding, janitorial, fittings & hoses, paints & chemicals, cutting tools & abrasives, safety, and more.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MRO Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MRO Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MRO Industry?

To stay informed about further developments, trends, and reports in the MRO Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence