Key Insights

The North American Testing, Inspection, and Certification (TIC) market, valued at approximately $1125.21 million in 2025, is projected to expand at a compound annual growth rate (CAGR) of 4.88% from 2025 to 2033. Key growth drivers include stringent government regulations in environmental protection and food safety, a growing emphasis on quality control and risk mitigation across manufacturing sectors (consumer goods, food & agriculture, oil & gas), and the increasing outsourcing of TIC functions for cost optimization and specialized expertise. The United States and Canada lead the market due to their advanced economies and robust industrial bases. Outsourced TIC services are a significant segment, indicating a preference for external specialization. Market restraints include potential impacts of economic fluctuations on discretionary testing expenditure and competitive pressures requiring continuous innovation.

North America TIC Industry Market Size (In Billion)

Segmentation within the North American TIC market reveals substantial opportunities. The Environmental sector, focusing on effluent, water, and soil testing, is expected to grow significantly due to increased environmental awareness and stricter legislation. The Food and Agriculture sector will experience robust expansion, driven by safety regulations and consumer demand for transparency. The Manufacturing and Industrial Goods sector remains a key revenue generator, with persistent demand for quality control and compliance testing. In-house TIC services are anticipated to grow slower than outsourced services, underscoring the cost-effectiveness and specialized capabilities of external providers. Major players like Intertek, ALS, SGS, and Bureau Veritas compete intensely, though opportunities exist for niche firms offering specialized services.

North America TIC Industry Company Market Share

North America TIC Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America Testing, Inspection, and Certification (TIC) industry, covering the period from 2019 to 2033. It offers crucial insights into market dynamics, segment performance, competitive landscape, and future growth prospects, empowering stakeholders to make informed strategic decisions. The report utilizes data from 2019-2024 as the historical period, 2025 as the base and estimated year, and 2025-2033 as the forecast period. Market values are expressed in Millions.

North America TIC Industry Market Concentration & Innovation

This section analyzes the level of market concentration within the North American TIC industry, identifying key players and their respective market shares. We explore the drivers of innovation, including technological advancements and regulatory pressures. The report also examines the regulatory landscape, the presence of product substitutes, evolving end-user trends, and the impact of mergers and acquisitions (M&A) activity.

Market Concentration: The North American TIC market exhibits a moderately concentrated structure, with a handful of large multinational corporations holding significant market share. The top 10 players account for approximately xx% of the total market revenue (2024 Estimate). Smaller specialized firms cater to niche segments.

Innovation Drivers: Technological advancements, particularly in automation and data analytics, are driving innovation within the TIC sector. Stringent regulatory requirements, especially concerning environmental compliance and product safety, are also fostering innovation in testing and certification methodologies.

Regulatory Frameworks: The regulatory environment plays a crucial role, shaping the demand for TIC services across various industries. Changes in regulations, especially those relating to environmental protection and product safety, significantly impact market growth.

M&A Activity: The TIC industry has witnessed considerable M&A activity in recent years. Deals have primarily focused on expanding service offerings, geographic reach, and technological capabilities. For example, the estimated total value of M&A deals in 2024 was approximately $xx Million. Key transactions include SGS SA's acquisition of Penumbra Security Inc. (detailed further in the Key Developments section).

North America TIC Industry Industry Trends & Insights

This section delves into the key trends shaping the North American TIC industry. We analyze the factors driving market growth, including increasing regulatory scrutiny, rising demand for quality assurance, and the adoption of advanced technologies. Technological disruptions are examined, along with their impact on market dynamics and the competitive landscape. The report also explores the evolution of consumer preferences, which increasingly emphasize sustainability and product safety.

The market is expected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration of advanced technologies like AI and machine learning in TIC services is projected to reach xx% by 2033. Growing awareness of environmental issues and the resultant stricter regulations are significantly boosting the demand for environmental testing and certification services.

Dominant Markets & Segments in North America TIC Industry

This section identifies the leading segments and geographic regions within the dynamic North American TIC market. Dominance is assessed based on revenue generation, growth trajectories, and key market drivers. The analysis provides a comprehensive overview of the market landscape, highlighting areas of significant activity and future potential.

By End-User Vertical:

- Manufacturing and Industrial Goods: This segment remains the largest, driven by unwavering demand for stringent quality control, compliance certifications (e.g., ISO 9001, IATF 16949), and the increasing complexity of manufacturing processes. Growth is fueled by the need to ensure product safety and reliability across diverse industrial applications.

- Oil and Gas: Stringent safety regulations, environmental concerns (e.g., methane emissions), and the need for robust environmental impact assessments continue to fuel high demand for TIC services within this sector. This includes comprehensive testing and certification of equipment, materials, and processes.

- Consumer Goods and Retail: The growing consumer awareness of product safety, ethical sourcing, and sustainability is a key driver of growth in this segment. TIC services are crucial for ensuring product quality, compliance with regulations, and maintaining brand reputation.

- Environmental: Increasing environmental regulations and growing societal focus on sustainability are creating substantial opportunities for environmental testing and certification services. This includes soil and water analysis, air quality monitoring, and lifecycle assessments.

- Food and Agriculture: Stringent food safety regulations and the demand for traceability and transparency throughout the supply chain are driving demand for TIC services in this sector. This includes testing for contaminants, pathogens, and nutritional content.

By Geography:

- United States: The United States continues to dominate the North American TIC market, leveraging its robust infrastructure, diverse economy, and large manufacturing base. Stringent regulatory norms and a strong focus on quality and compliance further solidify its leading position.

- Canada: The Canadian TIC market showcases robust growth, driven by significant investments in infrastructure projects, a commitment to environmental stewardship, and the rising demand for environmental testing and certification services. This is further amplified by the country’s commitment to sustainable development.

- Mexico: While smaller compared to the US and Canada, Mexico's manufacturing sector is experiencing significant growth, presenting opportunities for TIC providers catering to the expanding nearshoring and reshoring trends.

By Service Type:

- Outsourced TIC Services: This segment maintains a larger market share than in-house testing due to cost-effectiveness, access to specialized expertise and advanced technologies, and the ability to scale operations to meet fluctuating demands.

- In-house TIC Services: Companies with highly specialized testing requirements or significant internal testing volumes often maintain in-house capabilities to ensure control over testing processes and data security.

North America TIC Industry Product Developments

Recent product innovations in the TIC industry include advanced analytical techniques, AI-powered data analysis tools, and automated testing systems. These innovations enhance efficiency, accuracy, and the speed of testing and certification processes. The market sees a growing adoption of cloud-based platforms for data management and reporting, improving collaboration and accessibility. Such innovations enhance the competitive advantage by offering faster turnaround times, more accurate results, and cost savings for clients.

Report Scope & Segmentation Analysis

This report segments the North American TIC market by end-user vertical (Consumer Goods and Retail, Environmental, Food and Agriculture, Manufacturing and Industrial Goods, Oil and Gas, Construction and Engineering, Other), by country (United States, Canada), and by type (Outsourced, In-house). Each segment's growth projections, market size, and competitive dynamics are extensively analyzed. For example, the Environmental segment is projected to exhibit a strong CAGR of xx% during the forecast period, driven by increasing environmental regulations and growing consumer awareness. The Manufacturing and Industrial Goods segment is expected to maintain a significant market share due to stringent quality control requirements.

Key Drivers of North America TIC Industry Growth

Several factors are driving the growth of the North American TIC industry. These include:

- Stringent Regulatory Compliance: Governments across North America are implementing stricter regulations related to product safety, environmental protection, and workplace safety, driving increased demand for TIC services.

- Growing Focus on Quality Assurance: Businesses are increasingly prioritizing quality control and risk management, leading to greater reliance on TIC services to ensure product safety and compliance.

- Technological Advancements: Technological innovations, such as advanced analytical techniques and automated testing systems, are enhancing the efficiency and accuracy of TIC services.

Challenges in the North America TIC Industry Sector

The North American TIC industry faces several challenges:

- Intense Competition: The market is characterized by intense competition among both large multinational corporations and smaller specialized firms. This puts downward pressure on pricing and profit margins.

- Supply Chain Disruptions: Global supply chain disruptions can impact the availability of testing equipment and materials, leading to delays and increased costs.

- Regulatory Changes: Frequent changes in regulatory requirements can create uncertainty for TIC providers and necessitate ongoing investment in compliance and adaptation.

Emerging Opportunities in North America TIC Industry

Emerging opportunities for the North American TIC industry include:

- Expansion into New Markets: Growth in sectors like renewable energy, electric vehicles, and advanced manufacturing presents significant opportunities for expansion.

- Adoption of New Technologies: Integrating technologies like AI and blockchain can enhance the efficiency, transparency, and security of TIC services.

- Focus on Sustainability: The growing focus on sustainable practices presents opportunities for TIC providers offering services related to environmental compliance and green technologies.

Leading Players in the North America TIC Industry Market

- Envigo Corporation

- Intertek Group Plc

- ALS Limited

- Avomeen LLC

- DNV GL

- Applus Services SA

- AB Sciex LLC

- SGS SA

- Mistras Group

- DEKRA SE

- Bureau Veritas

- UL LLC

- TUV SUD

Key Developments in North America TIC Industry Industry

- September 2022: SGS SA acquired Penumbra Security Inc., strengthening its cybersecurity testing and compliance services. This acquisition enhances SGS's market position in the growing information security sector.

- March 2022: DEKRA's selection to develop the Vehicle-Grid Innovation Laboratory (ViGIL) signifies the growing importance of TIC services in the electric vehicle industry. This initiative expands DEKRA's testing capabilities and strengthens its position in the rapidly evolving electric vehicle market.

Strategic Outlook for North America TIC Industry Market

The North American TIC industry is poised for continued growth, driven by increasing regulatory scrutiny, the growing demand for quality assurance, and technological advancements. The industry's future potential hinges on the ability of TIC providers to adapt to evolving market dynamics, invest in cutting-edge technologies, and provide innovative and efficient solutions to their clients. The expanding focus on sustainability and the rising importance of cybersecurity will present significant opportunities for growth.

North America TIC Industry Segmentation

-

1. Type

- 1.1. Outsourced

- 1.2. In-house

-

2. End-User Vertical

- 2.1. Consumer Goods and Retail

- 2.2. Environmental (Effluent, Water, Soil, Air)

- 2.3. Food and Agriculture

- 2.4. Manufacturing and Industrial Goods

- 2.5. Oil and Gas

- 2.6. Construction and Engineering

- 2.7. Other End-user Verticals

North America TIC Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

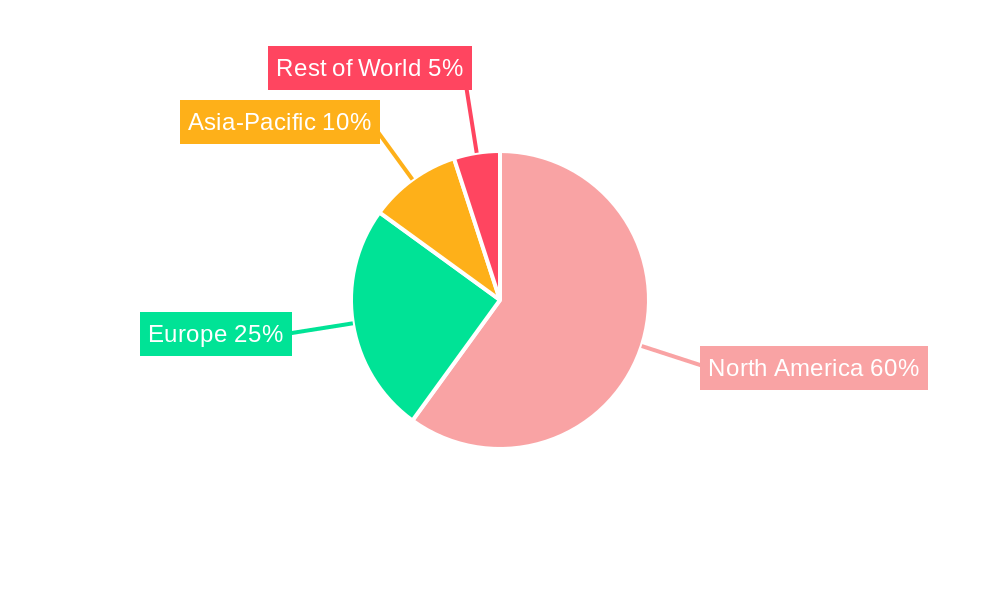

North America TIC Industry Regional Market Share

Geographic Coverage of North America TIC Industry

North America TIC Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.88% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Highly Developed Regulatory Framework; Growing Demand For Outsourced Servic

- 3.3. Market Restrains

- 3.3.1. Entry Barriers for New Players and Standardization Concerns Especially in the Case of Inter-border Transactions

- 3.4. Market Trends

- 3.4.1. Automotive Industry Holds Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America TIC Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Outsourced

- 5.1.2. In-house

- 5.2. Market Analysis, Insights and Forecast - by End-User Vertical

- 5.2.1. Consumer Goods and Retail

- 5.2.2. Environmental (Effluent, Water, Soil, Air)

- 5.2.3. Food and Agriculture

- 5.2.4. Manufacturing and Industrial Goods

- 5.2.5. Oil and Gas

- 5.2.6. Construction and Engineering

- 5.2.7. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Envigo Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Intertek Group Plc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ALS Limited*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Avomeen LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DNV GL

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Applus Services SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AB Sciex LLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SGS SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mistras Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DEKRA SE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Bureau Veritas

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 UL LLC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 TUV SUD

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Envigo Corporation

List of Figures

- Figure 1: North America TIC Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North America TIC Industry Share (%) by Company 2025

List of Tables

- Table 1: North America TIC Industry Revenue million Forecast, by Type 2020 & 2033

- Table 2: North America TIC Industry Revenue million Forecast, by End-User Vertical 2020 & 2033

- Table 3: North America TIC Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: North America TIC Industry Revenue million Forecast, by Type 2020 & 2033

- Table 5: North America TIC Industry Revenue million Forecast, by End-User Vertical 2020 & 2033

- Table 6: North America TIC Industry Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States North America TIC Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada North America TIC Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America TIC Industry Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America TIC Industry?

The projected CAGR is approximately 4.88%.

2. Which companies are prominent players in the North America TIC Industry?

Key companies in the market include Envigo Corporation, Intertek Group Plc, ALS Limited*List Not Exhaustive, Avomeen LLC, DNV GL, Applus Services SA, AB Sciex LLC, SGS SA, Mistras Group, DEKRA SE, Bureau Veritas, UL LLC, TUV SUD.

3. What are the main segments of the North America TIC Industry?

The market segments include Type, End-User Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 1125.21 million as of 2022.

5. What are some drivers contributing to market growth?

Highly Developed Regulatory Framework; Growing Demand For Outsourced Servic.

6. What are the notable trends driving market growth?

Automotive Industry Holds Significant Market Share.

7. Are there any restraints impacting market growth?

Entry Barriers for New Players and Standardization Concerns Especially in the Case of Inter-border Transactions.

8. Can you provide examples of recent developments in the market?

September 2022: SGS SA acquired Penumbra Security Inc., a recognized leader in different types of information security conformance testing to government standards and regulatory compliance for multinational companies. In addition, the company is accredited by the National Voluntary Laboratory Programs for Federal Information Processing Standard test methods (FIPS 140-2/3). This helps in the further development of TIC services for the company.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America TIC Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America TIC Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America TIC Industry?

To stay informed about further developments, trends, and reports in the North America TIC Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence