Key Insights

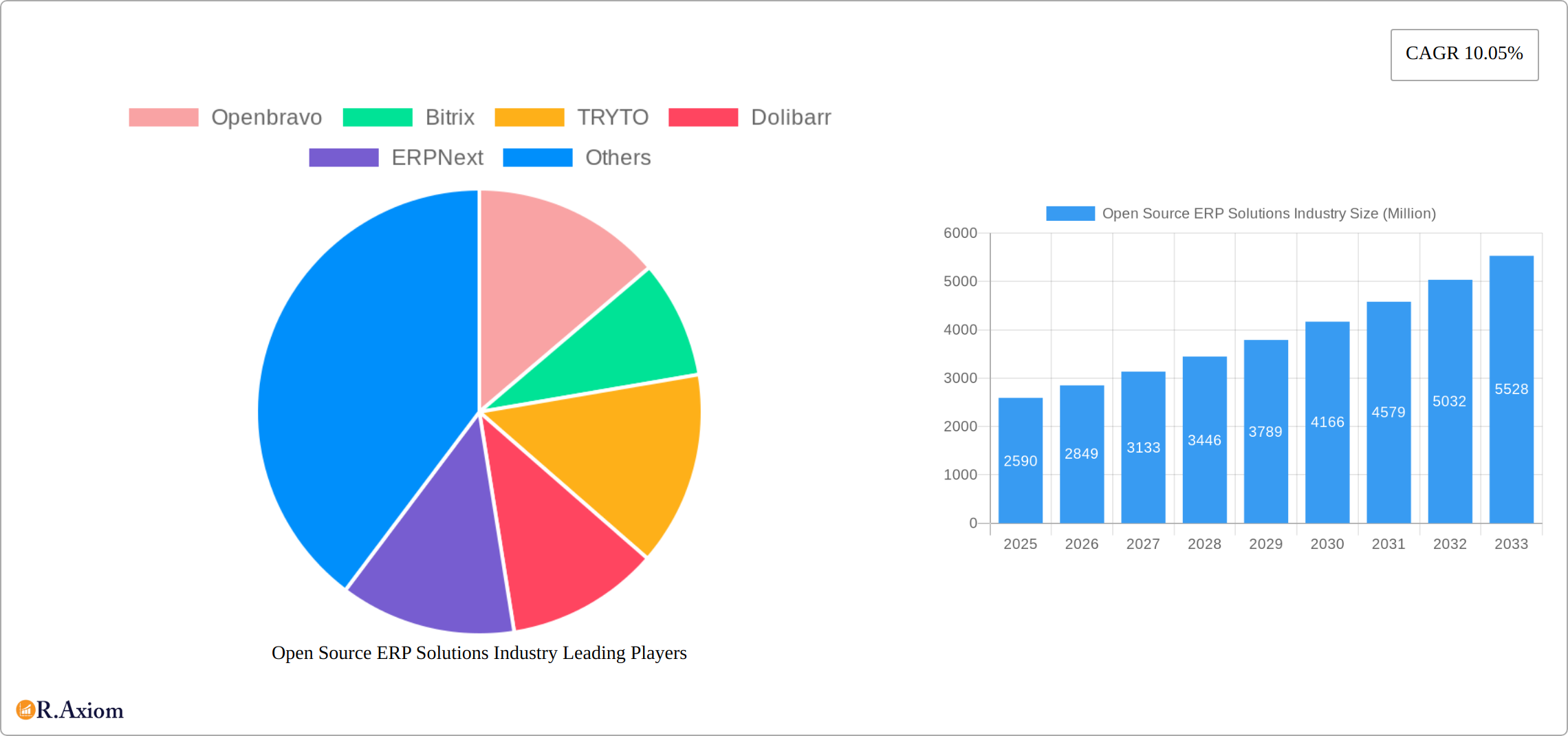

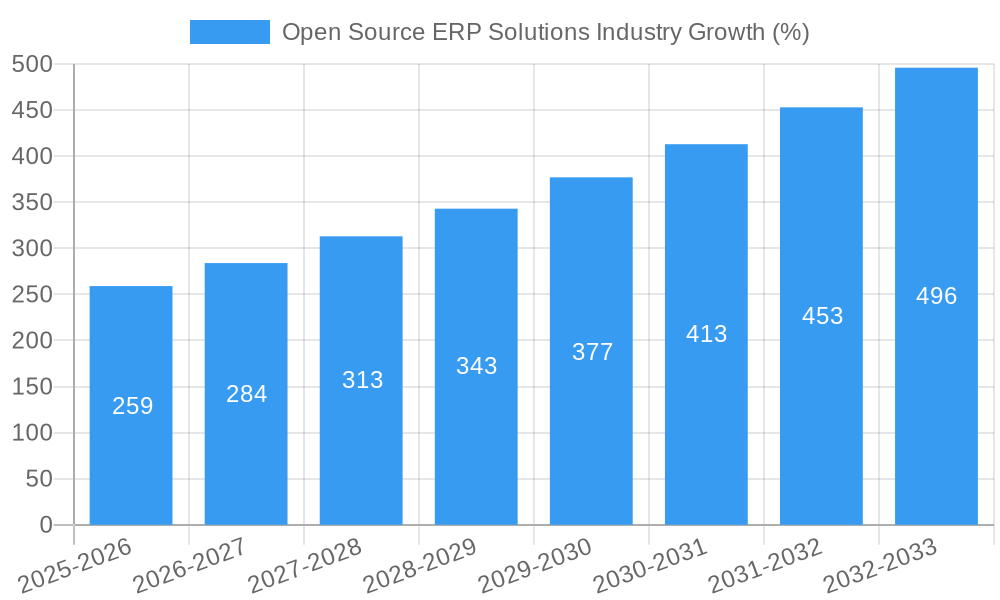

The Open Source ERP Solutions market is experiencing robust growth, projected to reach $2.59 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 10.05% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, the inherent cost-effectiveness of open-source solutions significantly reduces upfront investment and ongoing maintenance expenses, making them attractive to small and medium-sized enterprises (SMEs) and large corporations alike. Secondly, the flexibility and customization options offered by open-source platforms allow businesses to tailor ERP systems to their specific operational needs, unlike proprietary solutions which often require extensive and costly modifications. The increasing adoption of cloud-based deployment models further contributes to this growth, offering scalability, accessibility, and reduced infrastructure management burdens. Furthermore, the rising demand for integrated business solutions across diverse end-user verticals, including Information Technology, BFSI (Banking, Financial Services, and Insurance), Telecommunications, Healthcare, and Retail, is driving wider market penetration. The open-source nature also fosters a vibrant community of developers, ensuring continuous improvement and innovation within the ecosystem.

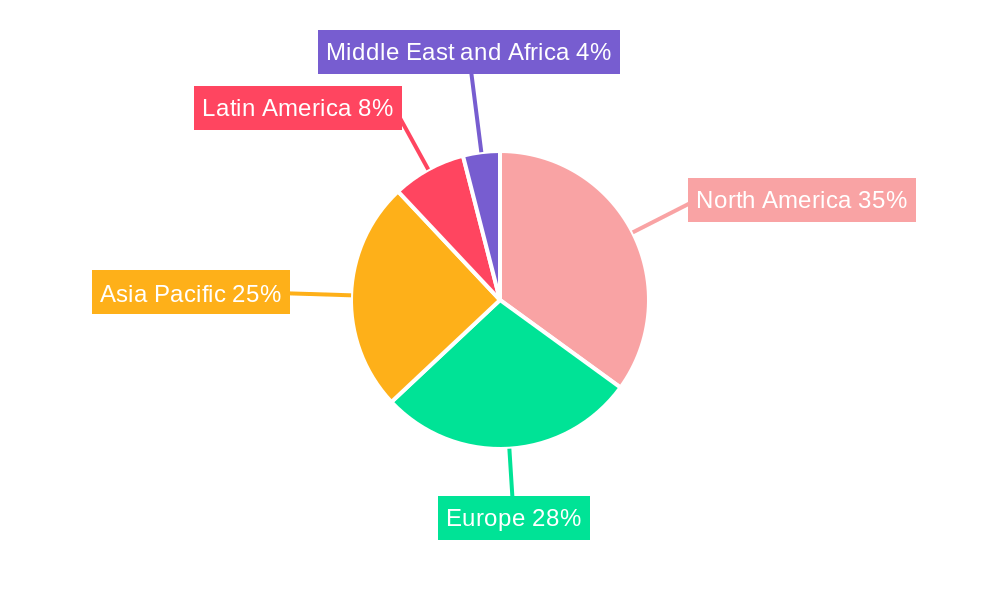

Despite these positive factors, the market faces certain restraints. The perceived lack of vendor support compared to proprietary solutions can be a deterrent for some businesses. Furthermore, the complexity of implementation and customization can require specialized technical expertise, potentially leading to higher implementation costs than initially anticipated for less technically savvy organizations. However, the growing availability of support services and pre-configured open-source solutions is gradually mitigating these challenges. The market segmentation reflects this diverse adoption, with cloud deployment gaining significant traction, while large companies often exhibit a higher adoption rate compared to SMEs. Geographical growth is expected to be substantial across all regions, with North America and Europe likely leading the charge initially, followed by rapid expansion in the Asia-Pacific region driven by increasing digitalization and technological advancements. The continued development of user-friendly interfaces and enhanced functionalities will further fuel the market's ascent in the coming years.

This comprehensive report provides a detailed analysis of the Open Source ERP Solutions industry, encompassing market size, growth projections, competitive landscape, and key trends from 2019 to 2033. The study period covers the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033), offering valuable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic market. The report segments the market by deployment mode (cloud, on-premises), organization size (small and medium-sized companies, large companies), and end-user verticals (Information Technology, BFSI, Telecommunication, Healthcare, Retail, Education, and Other End-user Verticals). The estimated market size in 2025 is projected to be xx Million USD.

Open Source ERP Solutions Industry Market Concentration & Innovation

The open-source ERP market exhibits a moderately fragmented structure, with several key players competing for market share. While no single vendor dominates, companies like Odoo have demonstrated significant growth and influence, as evidenced by its USD 215 Million funding round in July 2021. Market share data for 2024 suggests that the top five players collectively hold approximately xx% of the market. Innovation is driven by the inherent flexibility and community-driven development of open-source software, enabling rapid adaptation to evolving business needs and technological advancements.

- Market Concentration: Moderate fragmentation; top 5 players hold approximately xx% market share (2024).

- Innovation Drivers: Community development, customization flexibility, open APIs, and technological advancements (e.g., AI, cloud computing).

- Regulatory Frameworks: Vary by region, impacting data privacy and security compliance.

- Product Substitutes: Proprietary ERP systems, specialized SaaS applications.

- End-User Trends: Growing demand for cloud-based solutions, integration with other business applications, and enhanced data analytics capabilities.

- M&A Activities: While less frequent than in proprietary ERP markets, strategic acquisitions of smaller players to expand functionalities or market reach are observed. The Odoo funding round showcases significant investment in the open-source ERP sector. Total M&A deal value in 2024 estimated at xx Million USD.

Open Source ERP Solutions Industry Industry Trends & Insights

The open-source ERP market is experiencing robust growth, driven by several key factors. The increasing adoption of cloud-based solutions reduces upfront infrastructure costs and enhances scalability. Furthermore, the cost-effectiveness of open-source solutions compared to their proprietary counterparts makes them attractive to small and medium-sized businesses. Technological disruptions, such as the rise of AI and machine learning, are enhancing ERP functionalities and creating new opportunities for customization and data-driven decision-making. The competitive landscape is characterized by both established players and emerging startups, fostering innovation and ensuring a diverse range of solutions. The Compound Annual Growth Rate (CAGR) from 2025 to 2033 is projected to be xx%. Market penetration is estimated to reach xx% by 2033, with cloud-based deployment witnessing the highest growth. Consumer preferences increasingly favor user-friendly interfaces, seamless integration, and robust mobile accessibility.

Dominant Markets & Segments in Open Source ERP Solutions Industry

The North American and European regions currently dominate the open-source ERP market, driven by robust IT infrastructure, high technological adoption rates, and a large concentration of SMEs and large enterprises. However, emerging economies in Asia-Pacific and Latin America are witnessing significant growth, fueled by increasing digitalization and rising demand for affordable business solutions.

- By Deployment Mode: Cloud deployment is experiencing rapid growth due to its scalability, accessibility, and reduced infrastructure costs.

- By Organization Size: SMEs represent the largest segment due to cost-effectiveness and customization options. Large companies are increasingly adopting open-source solutions for specific functionalities or integrations.

- By End-user Verticals: The IT, BFSI, and Retail sectors are leading adopters, while other verticals, such as Healthcare and Education, are showing increasing interest. Key drivers vary by sector: Economic policies encouraging digitalization in BFSI, robust IT infrastructure in IT sector, and high demand for efficient inventory management in Retail.

Dominance Analysis: North America and Europe lead due to mature IT infrastructure and high adoption rates. Asia-Pacific is experiencing rapid growth with expanding digitalization.

Open Source ERP Solutions Industry Product Developments

Recent product developments focus on enhanced user experience, improved integration capabilities with third-party applications, and the incorporation of advanced analytics features using AI and machine learning. Cloud-native solutions and mobile-first approaches are gaining prominence. The competitive advantage lies in offering flexible, customizable, and cost-effective solutions tailored to specific industry needs.

Report Scope & Segmentation Analysis

This report analyzes the open-source ERP market across several key segments:

- By Deployment Mode: Cloud and On-premises, with growth projections and competitive dynamics analyzed for each.

- By Organization Size: Small and Medium-Sized Companies (SMEs) and Large Companies, highlighting market size and growth for each.

- By End-user Verticals: IT, BFSI, Telecommunication, Healthcare, Retail, Education, and Other End-user Verticals, examining market size, growth drivers, and competitive dynamics within each.

Key Drivers of Open Source ERP Solutions Industry Growth

The open-source Enterprise Resource Planning (ERP) solutions market is experiencing robust expansion, propelled by a confluence of compelling advantages that resonate with businesses of all sizes:

- Exceptional Cost-Effectiveness: Significantly lower initial licensing fees and reduced ongoing maintenance expenditures compared to traditional proprietary ERP systems make open-source solutions an attractive choice for budget-conscious organizations. This accessibility democratizes powerful business management tools.

- Unparalleled Flexibility and Customization: The inherent modularity and open nature of open-source ERP allow businesses to tailor the software precisely to their unique operational workflows and specific industry requirements. This adaptability ensures a perfect fit, maximizing efficiency and minimizing workarounds.

- Robust Scalability for Future Growth: Open-source ERP solutions are designed to grow with your business. They can seamlessly scale from small startups to large enterprises, accommodating increasing user numbers, transaction volumes, and evolving business needs without prohibitive reinvestment.

- Vibrant Community Support and Innovation: A hallmark of open-source is its large, active, and dedicated global community. This collaborative ecosystem provides extensive documentation, forums, plugins, and a constant stream of innovation, ensuring continuous improvement and readily available troubleshooting.

- Integration of Cutting-Edge Technological Advancements: Open-source ERP systems are at the forefront of technology adoption. They readily integrate with and leverage the power of Artificial Intelligence (AI) for intelligent automation and insights, Machine Learning (ML) for predictive analytics, and cloud computing for enhanced accessibility and collaboration.

Challenges in the Open Source ERP Solutions Industry Sector

While the benefits are substantial, organizations venturing into the open-source ERP landscape should be aware of potential hurdles:

- Implementation Complexity and Technical Expertise: Deploying and configuring open-source ERP can sometimes be more intricate than off-the-shelf proprietary solutions, often requiring specialized technical skills and a deeper understanding of the underlying architecture.

- Varied Levels of Dedicated Support and Maintenance: While community support is often excellent, securing guaranteed, enterprise-level, 24/7 support with service level agreements (SLAs) might require engaging third-party service providers, adding to the overall cost.

- Proactive Security Management is Crucial: The open nature of the code necessitates a vigilant approach to security. Organizations must implement robust security protocols, regular updates, and patches to safeguard their sensitive data from potential vulnerabilities.

- Potential Integration Hurdles with Legacy Systems: Integrating open-source ERP with existing, often disparate, legacy systems can present technical challenges. Careful planning and potentially custom middleware development may be required to ensure seamless data flow.

Emerging Opportunities in Open Source ERP Solutions Industry

The open-source ERP sector is ripe with exciting new avenues for growth and innovation:

- Development of Niche, Industry-Specific Solutions: A significant opportunity lies in creating highly specialized open-source ERP modules and configurations tailored to the unique demands of specific industries like healthcare, manufacturing, retail, or agriculture, offering unparalleled precision.

- Accelerated Adoption in Emerging Economies: As developing nations continue to digitalize their economies, the cost-effectiveness and flexibility of open-source ERP present an ideal entry point for businesses seeking to modernize their operations without significant capital outlay.

- Seamless Integration with the Internet of Things (IoT) Devices: The future of ERP is connected. Open-source platforms are well-positioned to integrate with a growing array of IoT devices, enabling real-time data capture from sensors, machinery, and supply chains for enhanced visibility and control.

- Leveraging AI-Powered Analytics for Deeper Insights: The integration of AI and ML into open-source ERP will unlock sophisticated analytical capabilities, empowering businesses with advanced forecasting, predictive maintenance, customer behavior analysis, and data-driven strategic decision-making.

Leading Players in the Open Source ERP Solutions Industry Market

Key Developments in Open Source ERP Solutions Industry Industry

- July 2021: Odoo, a prominent open-source ERP provider, secured a substantial USD 215 million in funding. This significant investment underscores strong investor confidence in the growth trajectory and commercial viability of the open-source ERP sector.

- April 2021: Samsung Electronics unveiled its internally developed N-ERP system. This adoption by a global technology giant signifies a growing trend of large enterprises recognizing and embracing the strategic advantages and flexibility offered by open-source principles in their core business systems.

Strategic Outlook for Open Source ERP Solutions Industry Market

The open-source ERP solutions market is on an upward trajectory, poised for sustained and significant expansion. This growth will be propelled by an ever-increasing demand for solutions that offer a compelling blend of cost-efficiency, unparalleled flexibility, and robust scalability. The relentless pace of technological innovation, particularly in cloud computing, AI, and IoT, will further democratize access to sophisticated business management tools, accelerating market penetration. Significant opportunities are emerging for niche, industry-specific solutions and for deeper integration into the burgeoning economies of developing nations. The competitive landscape is anticipated to evolve through continued innovation, strategic collaborations, and potential market consolidation, shaping a dynamic and promising future for open-source ERP.

Open Source ERP Solutions Industry Segmentation

-

1. Deployment Mode

- 1.1. Cloud

- 1.2. On-premises

-

2. Organization Size

- 2.1. Small and Medium Sized Companies

- 2.2. Large Companies

-

3. End-user Verticals

- 3.1. Information Technology

- 3.2. BFSI

- 3.3. Telecommunication

- 3.4. Healthcare

- 3.5. Retail

- 3.6. Education

- 3.7. Other End-user Verticals

Open Source ERP Solutions Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Open Source ERP Solutions Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.05% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Demand for Seamless Customer Experience; Integration of Advanced Technologies such as AI

- 3.2.2 IoT

- 3.2.3 and Analytics

- 3.3. Market Restrains

- 3.3.1. Rising Complexities to Implement Transition from Manual to Software Testing Process

- 3.4. Market Trends

- 3.4.1. Cloud Deployments to Witness Highest Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Open Source ERP Solutions Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 5.1.1. Cloud

- 5.1.2. On-premises

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. Small and Medium Sized Companies

- 5.2.2. Large Companies

- 5.3. Market Analysis, Insights and Forecast - by End-user Verticals

- 5.3.1. Information Technology

- 5.3.2. BFSI

- 5.3.3. Telecommunication

- 5.3.4. Healthcare

- 5.3.5. Retail

- 5.3.6. Education

- 5.3.7. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 6. North America Open Source ERP Solutions Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 6.1.1. Cloud

- 6.1.2. On-premises

- 6.2. Market Analysis, Insights and Forecast - by Organization Size

- 6.2.1. Small and Medium Sized Companies

- 6.2.2. Large Companies

- 6.3. Market Analysis, Insights and Forecast - by End-user Verticals

- 6.3.1. Information Technology

- 6.3.2. BFSI

- 6.3.3. Telecommunication

- 6.3.4. Healthcare

- 6.3.5. Retail

- 6.3.6. Education

- 6.3.7. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 7. Europe Open Source ERP Solutions Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 7.1.1. Cloud

- 7.1.2. On-premises

- 7.2. Market Analysis, Insights and Forecast - by Organization Size

- 7.2.1. Small and Medium Sized Companies

- 7.2.2. Large Companies

- 7.3. Market Analysis, Insights and Forecast - by End-user Verticals

- 7.3.1. Information Technology

- 7.3.2. BFSI

- 7.3.3. Telecommunication

- 7.3.4. Healthcare

- 7.3.5. Retail

- 7.3.6. Education

- 7.3.7. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 8. Asia Pacific Open Source ERP Solutions Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 8.1.1. Cloud

- 8.1.2. On-premises

- 8.2. Market Analysis, Insights and Forecast - by Organization Size

- 8.2.1. Small and Medium Sized Companies

- 8.2.2. Large Companies

- 8.3. Market Analysis, Insights and Forecast - by End-user Verticals

- 8.3.1. Information Technology

- 8.3.2. BFSI

- 8.3.3. Telecommunication

- 8.3.4. Healthcare

- 8.3.5. Retail

- 8.3.6. Education

- 8.3.7. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 9. Latin America Open Source ERP Solutions Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 9.1.1. Cloud

- 9.1.2. On-premises

- 9.2. Market Analysis, Insights and Forecast - by Organization Size

- 9.2.1. Small and Medium Sized Companies

- 9.2.2. Large Companies

- 9.3. Market Analysis, Insights and Forecast - by End-user Verticals

- 9.3.1. Information Technology

- 9.3.2. BFSI

- 9.3.3. Telecommunication

- 9.3.4. Healthcare

- 9.3.5. Retail

- 9.3.6. Education

- 9.3.7. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 10. Middle East and Africa Open Source ERP Solutions Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 10.1.1. Cloud

- 10.1.2. On-premises

- 10.2. Market Analysis, Insights and Forecast - by Organization Size

- 10.2.1. Small and Medium Sized Companies

- 10.2.2. Large Companies

- 10.3. Market Analysis, Insights and Forecast - by End-user Verticals

- 10.3.1. Information Technology

- 10.3.2. BFSI

- 10.3.3. Telecommunication

- 10.3.4. Healthcare

- 10.3.5. Retail

- 10.3.6. Education

- 10.3.7. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 11. North America Open Source ERP Solutions Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Open Source ERP Solutions Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Open Source ERP Solutions Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Open Source ERP Solutions Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Open Source ERP Solutions Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Openbravo

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Bitrix

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 TRYTO

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Dolibarr

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 ERPNext

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Metasfresh

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 iDempiere

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Compiere

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 xTuple

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 MixERP

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 OpenPro

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 ERP

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 Openbravo

List of Figures

- Figure 1: Global Open Source ERP Solutions Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Open Source ERP Solutions Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Open Source ERP Solutions Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Open Source ERP Solutions Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Open Source ERP Solutions Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Open Source ERP Solutions Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Open Source ERP Solutions Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Open Source ERP Solutions Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Open Source ERP Solutions Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Open Source ERP Solutions Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Open Source ERP Solutions Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Open Source ERP Solutions Industry Revenue (Million), by Deployment Mode 2024 & 2032

- Figure 13: North America Open Source ERP Solutions Industry Revenue Share (%), by Deployment Mode 2024 & 2032

- Figure 14: North America Open Source ERP Solutions Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 15: North America Open Source ERP Solutions Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 16: North America Open Source ERP Solutions Industry Revenue (Million), by End-user Verticals 2024 & 2032

- Figure 17: North America Open Source ERP Solutions Industry Revenue Share (%), by End-user Verticals 2024 & 2032

- Figure 18: North America Open Source ERP Solutions Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Open Source ERP Solutions Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Open Source ERP Solutions Industry Revenue (Million), by Deployment Mode 2024 & 2032

- Figure 21: Europe Open Source ERP Solutions Industry Revenue Share (%), by Deployment Mode 2024 & 2032

- Figure 22: Europe Open Source ERP Solutions Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 23: Europe Open Source ERP Solutions Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 24: Europe Open Source ERP Solutions Industry Revenue (Million), by End-user Verticals 2024 & 2032

- Figure 25: Europe Open Source ERP Solutions Industry Revenue Share (%), by End-user Verticals 2024 & 2032

- Figure 26: Europe Open Source ERP Solutions Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Open Source ERP Solutions Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Open Source ERP Solutions Industry Revenue (Million), by Deployment Mode 2024 & 2032

- Figure 29: Asia Pacific Open Source ERP Solutions Industry Revenue Share (%), by Deployment Mode 2024 & 2032

- Figure 30: Asia Pacific Open Source ERP Solutions Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 31: Asia Pacific Open Source ERP Solutions Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 32: Asia Pacific Open Source ERP Solutions Industry Revenue (Million), by End-user Verticals 2024 & 2032

- Figure 33: Asia Pacific Open Source ERP Solutions Industry Revenue Share (%), by End-user Verticals 2024 & 2032

- Figure 34: Asia Pacific Open Source ERP Solutions Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific Open Source ERP Solutions Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Latin America Open Source ERP Solutions Industry Revenue (Million), by Deployment Mode 2024 & 2032

- Figure 37: Latin America Open Source ERP Solutions Industry Revenue Share (%), by Deployment Mode 2024 & 2032

- Figure 38: Latin America Open Source ERP Solutions Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 39: Latin America Open Source ERP Solutions Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 40: Latin America Open Source ERP Solutions Industry Revenue (Million), by End-user Verticals 2024 & 2032

- Figure 41: Latin America Open Source ERP Solutions Industry Revenue Share (%), by End-user Verticals 2024 & 2032

- Figure 42: Latin America Open Source ERP Solutions Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America Open Source ERP Solutions Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa Open Source ERP Solutions Industry Revenue (Million), by Deployment Mode 2024 & 2032

- Figure 45: Middle East and Africa Open Source ERP Solutions Industry Revenue Share (%), by Deployment Mode 2024 & 2032

- Figure 46: Middle East and Africa Open Source ERP Solutions Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 47: Middle East and Africa Open Source ERP Solutions Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 48: Middle East and Africa Open Source ERP Solutions Industry Revenue (Million), by End-user Verticals 2024 & 2032

- Figure 49: Middle East and Africa Open Source ERP Solutions Industry Revenue Share (%), by End-user Verticals 2024 & 2032

- Figure 50: Middle East and Africa Open Source ERP Solutions Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East and Africa Open Source ERP Solutions Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 3: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 4: Global Open Source ERP Solutions Industry Revenue Million Forecast, by End-user Verticals 2019 & 2032

- Table 5: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Open Source ERP Solutions Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Open Source ERP Solutions Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Open Source ERP Solutions Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Open Source ERP Solutions Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Open Source ERP Solutions Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 17: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 18: Global Open Source ERP Solutions Industry Revenue Million Forecast, by End-user Verticals 2019 & 2032

- Table 19: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 21: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 22: Global Open Source ERP Solutions Industry Revenue Million Forecast, by End-user Verticals 2019 & 2032

- Table 23: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 25: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 26: Global Open Source ERP Solutions Industry Revenue Million Forecast, by End-user Verticals 2019 & 2032

- Table 27: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 29: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 30: Global Open Source ERP Solutions Industry Revenue Million Forecast, by End-user Verticals 2019 & 2032

- Table 31: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 33: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 34: Global Open Source ERP Solutions Industry Revenue Million Forecast, by End-user Verticals 2019 & 2032

- Table 35: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Open Source ERP Solutions Industry?

The projected CAGR is approximately 10.05%.

2. Which companies are prominent players in the Open Source ERP Solutions Industry?

Key companies in the market include Openbravo, Bitrix, TRYTO, Dolibarr, ERPNext, Metasfresh, iDempiere, Compiere, xTuple, MixERP, OpenPro, ERP.

3. What are the main segments of the Open Source ERP Solutions Industry?

The market segments include Deployment Mode, Organization Size, End-user Verticals.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.59 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Seamless Customer Experience; Integration of Advanced Technologies such as AI. IoT. and Analytics.

6. What are the notable trends driving market growth?

Cloud Deployments to Witness Highest Market Growth.

7. Are there any restraints impacting market growth?

Rising Complexities to Implement Transition from Manual to Software Testing Process.

8. Can you provide examples of recent developments in the market?

July 2021 - Odoo, a Belgium-based provider of open-source ERP software, received USD 215 million from Summit Partners. This investment values the startup at over EUR 2 billion, making Odoo the first unicorn out of Wallonia, the region in Belgium where it is based.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Open Source ERP Solutions Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Open Source ERP Solutions Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Open Source ERP Solutions Industry?

To stay informed about further developments, trends, and reports in the Open Source ERP Solutions Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence