Key Insights

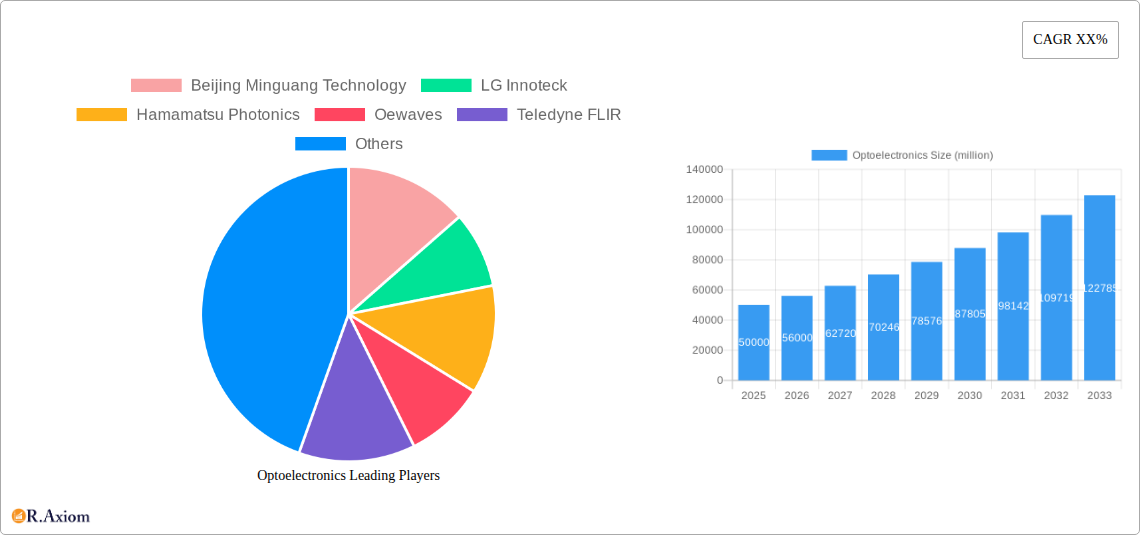

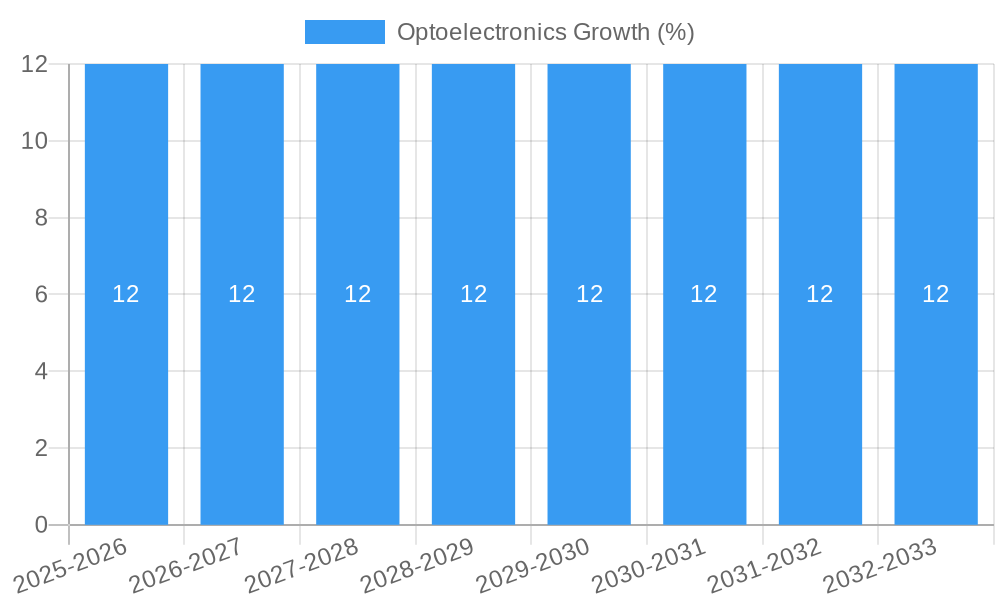

The global optoelectronics market is experiencing robust expansion, projected to reach an estimated market size of $50,000 million by 2025, with a projected Compound Annual Growth Rate (CAGR) of 12% from 2019 to 2033. This significant growth is underpinned by a confluence of powerful drivers, most notably the escalating demand from the Aerospace and Defense sector, fueled by advancements in surveillance, targeting, and communication systems. The Medical and Biotechnology industry also presents a substantial growth avenue, with optoelectronic components playing a crucial role in diagnostic imaging, therapeutic devices, and personalized medicine. Furthermore, the increasing adoption of optoelectronic devices in consumer electronics, driven by miniaturization and enhanced functionality in smartphones, wearables, and augmented/virtual reality systems, is a key contributor. The automotive sector's embrace of advanced driver-assistance systems (ADAS) and autonomous driving technologies, which rely heavily on optoelectronic sensors, further bolsters market momentum.

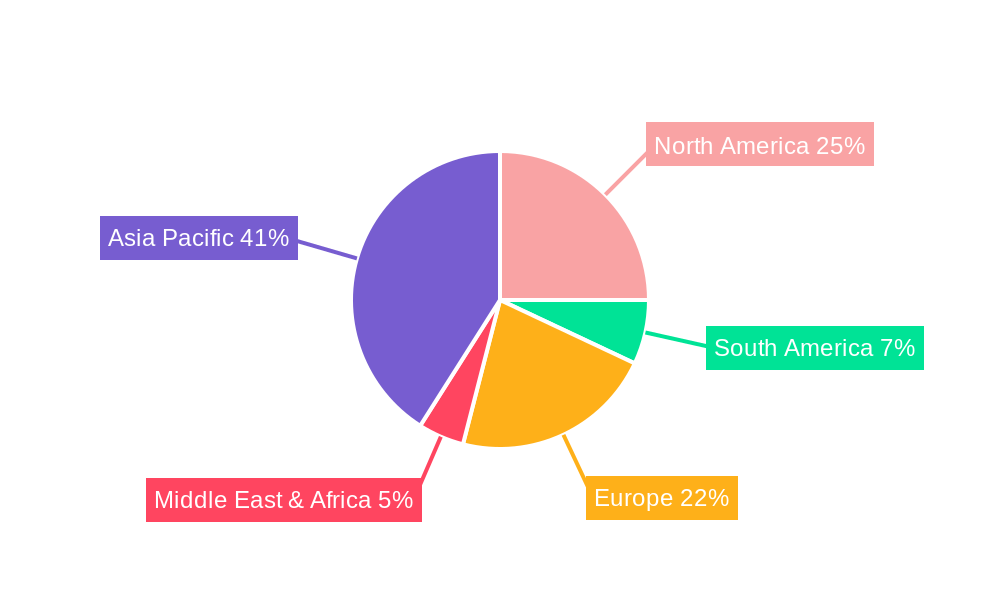

Despite the optimistic outlook, the market faces certain restraints, including the high cost of research and development for cutting-edge optoelectronic technologies and the intense price competition among manufacturers, particularly in high-volume consumer applications. Supply chain disruptions and geopolitical factors can also pose challenges to sustained growth. Nevertheless, the pervasive integration of optoelectronics across diverse industries, coupled with ongoing innovation in areas such as high-speed optical communication, advanced photodetectors, and novel optocoupler designs, is expected to propel the market forward. Key segments like Photodiodes and Optoelectronic Oscillators are anticipated to witness substantial growth due to their critical role in enabling high-performance applications, while the Optocouplers segment is also poised for expansion driven by industrial automation and safety requirements. The Asia Pacific region is expected to dominate the market, owing to its robust manufacturing base and burgeoning demand from electronics and automotive sectors, followed by North America and Europe.

Optoelectronics Market Concentration & Innovation

The optoelectronics market, a sector driven by cutting-edge technology and critical applications, exhibits a dynamic concentration of innovation. Key players like Broadcom, ON Semiconductor, and Seoul Semiconductor are at the forefront, significantly influencing market dynamics through substantial investments in research and development. Innovation in this sector is primarily fueled by the relentless demand for faster data transfer, higher energy efficiency, and miniaturization across various end-user industries. The development of advanced materials, such as novel semiconductor compounds and highly efficient light-emitting diodes (LEDs) and lasers, continues to push the boundaries of what is possible. Regulatory frameworks, while sometimes posing compliance challenges, also act as a catalyst for innovation, particularly in areas like medical devices and automotive safety. Product substitutes, while present in some commoditized segments, are often outpaced by the superior performance and unique functionalities offered by optoelectronic components. End-user trends, including the proliferation of smart devices, the expansion of 5G infrastructure, and the growing adoption of electric vehicles, are creating unprecedented demand. Mergers and acquisitions (M&A) activity is a significant indicator of market consolidation and strategic positioning. For instance, the ON Semiconductor acquisition of Coupang's semiconductor division (hypothetical value in billions) and Broadcom's ongoing strategic acquisitions are indicative of this trend. The M&A deal values are estimated to be in the range of millions to billions, reflecting the strategic importance of acquiring new technologies and expanding market reach. The market share of leading players fluctuates, but companies like Broadcom and ON Semiconductor consistently hold multi-million dollar market shares, demonstrating their dominance.

Optoelectronics Industry Trends & Insights

The global optoelectronics market is experiencing robust growth, driven by an impressive compound annual growth rate (CAGR) of approximately xx% over the forecast period of 2025–2033. This expansion is underpinned by several interconnected trends and technological disruptions that are reshaping industries and consumer behavior. The increasing demand for high-speed data transmission, propelled by the rollout of 5G networks and the burgeoning cloud computing sector, is a primary growth driver. Optoelectronic components, such as fiber optic transceivers and advanced photodiodes, are indispensable for enabling these high-bandwidth applications.

Furthermore, the burgeoning Internet of Things (IoT) ecosystem is creating substantial opportunities. The proliferation of smart devices, from wearable technology to smart home appliances and industrial sensors, relies heavily on optoelectronic sensors and communication modules for data acquisition and connectivity. The miniaturization and improved energy efficiency of these components are critical for the widespread adoption of IoT.

In the automotive sector, optoelectronics are playing an increasingly vital role in the advancement of autonomous driving and advanced driver-assistance systems (ADAS). High-resolution imaging sensors, LiDAR systems, and optical communication networks are essential for vehicle perception, decision-making, and inter-component communication. The transition towards electric vehicles (EVs) also boosts demand for optoelectronic components in battery management systems and charging infrastructure.

The medical and biotechnology industries are another significant growth engine. Advanced diagnostic equipment, minimally invasive surgical tools, and optical imaging technologies (e.g., optical coherence tomography) are increasingly incorporating sophisticated optoelectronic solutions. The demand for improved patient outcomes, faster diagnoses, and personalized medicine is driving innovation in this segment.

Consumer electronics continue to be a major market for optoelectronics. The demand for high-definition displays, advanced camera modules in smartphones, augmented reality (AR) and virtual reality (VR) devices, and energy-efficient lighting solutions fuels constant innovation and market penetration. Companies are focusing on developing smaller, more powerful, and cost-effective optoelectronic components to meet the evolving expectations of consumers.

Competitive dynamics within the optoelectronics market are characterized by intense innovation and strategic collaborations. Established players are investing heavily in next-generation technologies, while emerging companies are carving out niches by specializing in advanced materials or specific application areas. The market penetration of advanced optoelectronic solutions is expected to rise as costs decrease and performance improves, further solidifying its critical role across diverse industries.

Dominant Markets & Segments in Optoelectronics

The optoelectronics market's dominance is multifaceted, with distinct regions, countries, and application segments exhibiting significant leadership and growth potential.

Dominant Regions and Countries:

- Asia-Pacific: This region stands as a powerhouse in optoelectronics manufacturing and consumption, driven by a robust electronics industry and significant investments in infrastructure.

- China: A leading manufacturing hub for consumer electronics and components, China's demand for optoelectronic devices in smartphones, displays, and industrial automation is unparalleled. Government initiatives promoting technological self-sufficiency further bolster this dominance.

- South Korea and Japan: These nations are at the forefront of innovation in display technologies, semiconductors, and advanced optoelectronic sensors, catering to both domestic and global markets.

- North America: The region is a significant consumer and innovator, particularly in high-value segments like aerospace and defense, medical devices, and advanced research.

- United States: Its leadership in R&D, military applications, and the burgeoning medical technology sector drives substantial demand for sophisticated optoelectronic solutions.

- Europe: While having a strong industrial base, Europe's dominance is more focused on specialized applications, particularly in industrial automation and automotive sectors.

- Germany: With its strong automotive and industrial manufacturing sectors, Germany is a key market for optoelectronic components used in advanced sensing and control systems.

Dominant Application Segments:

- Consumer Electronics: This segment consistently holds a substantial market share due to the sheer volume of devices produced globally.

- Key Drivers: Insatiable consumer demand for smartphones, tablets, wearable devices, smart home gadgets, and high-definition televisions. Miniaturization and energy efficiency are paramount. The increasing adoption of AR/VR headsets is also a significant contributor.

- Aerospace and Defense: This segment, while smaller in volume, commands high value due to the stringent requirements for reliability, performance, and advanced capabilities.

- Key Drivers: Need for advanced sensing and imaging systems for surveillance, reconnaissance, targeting, and navigation. Optical communication systems for secure and high-speed data transfer. The development of advanced missile guidance systems and satellite technology.

- Industrial: This sector is experiencing rapid growth driven by the adoption of Industry 4.0 technologies and automation.

- Key Drivers: Proliferation of industrial automation, robotics, machine vision systems for quality control and inspection, sensors for process monitoring and control, and optoelectronic components in manufacturing processes.

- Medical and Biotechnology: This segment is characterized by high growth and innovation, driven by advancements in healthcare.

- Key Drivers: Demand for advanced medical imaging (e.g., CT scanners, MRI components, endoscopy), diagnostic tools, laser surgery equipment, biosensors, and drug discovery platforms. Increasing healthcare expenditure globally fuels this growth.

- Automotive: This segment is witnessing a transformative shift with the advent of autonomous driving and electric vehicles.

- Key Drivers: Adoption of ADAS features like adaptive cruise control, lane keeping assist, and automatic emergency braking. The development of LiDAR, radar, and camera systems for autonomous driving. Optoelectronics are also crucial in vehicle lighting, infotainment systems, and battery management for EVs.

Dominant Types of Optoelectronic Components:

- Photodiodes and Photodetectors: These are ubiquitous across all application segments due to their fundamental role in light sensing and signal detection. Their versatility, low cost, and improving performance make them indispensable.

- Key Drivers: Wide range of applications from simple light detection to complex imaging and spectroscopy. Continuous improvements in sensitivity, speed, and spectral response.

- Optocouplers: Essential for electrical isolation and signal transmission in power electronics and industrial control systems.

- Key Drivers: Critical for safety and reliability in high-voltage applications and noise reduction in electronic circuits.

- LEDs: While a broad category, advanced LEDs for lighting, displays, and specialized applications are driving significant market value.

- Key Drivers: Energy efficiency, long lifespan, and versatility in illumination and display technologies. MicroLED and MiniLED technologies are pushing display performance boundaries.

Optoelectronics Product Developments

The optoelectronics landscape is constantly evolving with groundbreaking product developments. Innovations are centered around enhancing performance metrics like speed, sensitivity, and efficiency while simultaneously reducing size and power consumption. For instance, advancements in photodetector technology are yielding faster response times and wider spectral ranges, crucial for high-frequency communication and advanced imaging. The development of novel laser diodes with improved beam quality and power efficiency is supporting applications in material processing and medical diagnostics. Furthermore, the integration of optoelectronic components into System-on-Chip (SoC) architectures is enabling more compact and powerful devices for consumer electronics and IoT applications. Competitive advantages are being secured through superior material science, sophisticated fabrication processes, and the ability to tailor optoelectronic solutions to specific end-user needs, driving market adoption and value.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global optoelectronics market, meticulously segmenting it by application and type. The segmentation ensures a granular understanding of market dynamics, growth trajectories, and competitive landscapes.

Application Segments:

- Aerospace and Defense: This segment is projected to witness robust growth, with an estimated market size of xx billion in 2025 and a projected expansion to xx billion by 2033. Competitive dynamics are driven by technological superiority and stringent performance requirements, with key players like Lockheed Martin and Northrop Grumman leading.

- Medical and Biotechnology: Experiencing significant expansion, this segment is expected to reach xx billion in 2025 and grow to xx billion by 2033. Innovation in diagnostics and therapeutics, alongside increasing healthcare spending, fuels its growth. Hamamatsu Photonics and Teledyne FLIR are prominent in this domain.

- Industrial: This segment is poised for substantial growth, projected at xx billion in 2025, escalating to xx billion by 2033. The drive for automation and Industry 4.0 is a major catalyst. Companies like Keyence and Rockwell Automation are key players.

- Consumer Electronics: While mature, this segment remains a significant contributor, estimated at xx billion in 2025 and reaching xx billion by 2033. Continuous innovation in displays and smart devices keeps it dynamic. Samsung and LG Innoteck are dominant here.

- Automotive: This segment is set for explosive growth due to the proliferation of ADAS and EVs. Projected to be xx billion in 2025, it's expected to reach xx billion by 2033.

- Others: This segment encompasses niche applications and emerging areas, contributing an estimated xx billion in 2025 and growing to xx billion by 2033.

Type Segments:

- Optoelectronic Oscillator: This niche segment is anticipated to reach xx million in 2025 and grow to xx million by 2033, driven by demand in specialized communication and measurement systems.

- Photodiodes: As a foundational component, photodiodes are projected to command xx billion in 2025 and expand to xx billion by 2033, with widespread applications.

- Photomultiplier Tube: This segment is expected to reach xx million in 2025 and grow to xx million by 2033, primarily serving scientific research and high-sensitivity detection needs.

- Photodetector: A broad category, photodetectors are projected to be xx billion in 2025 and reach xx billion by 2033, encompassing various sensing technologies.

- Optocouplers: This segment is estimated at xx million in 2025 and projected to grow to xx million by 2033, crucial for electrical isolation.

- Others: This category for specialized optoelectronic devices is expected to reach xx million in 2025 and grow to xx million by 2033.

Key Drivers of Optoelectronics Growth

The optoelectronics market's expansion is propelled by a confluence of technological advancements, economic imperatives, and favorable regulatory landscapes. Technologically, the relentless pursuit of higher data speeds, increased energy efficiency, and miniaturization in sectors like telecommunications (5G, fiber optics) and consumer electronics (smart devices, displays) is a primary driver. The burgeoning adoption of advanced driver-assistance systems (ADAS) and the transition to electric vehicles in the automotive sector are creating substantial demand for sophisticated sensors and communication modules. Economically, increased global spending on healthcare, driving innovation in medical imaging and diagnostics, and the ongoing industrial automation revolution (Industry 4.0) significantly contribute to growth. Regulatory pushes towards energy efficiency standards and safety regulations, particularly in automotive and industrial applications, further incentivize the adoption of advanced optoelectronic solutions.

Challenges in the Optoelectronics Sector

Despite its robust growth, the optoelectronics sector faces several significant challenges that could impede its progress. Intense price competition, particularly in commoditized segments like basic LEDs and standard photodiodes, can put pressure on profit margins for manufacturers. Supply chain disruptions, exacerbated by geopolitical tensions and the reliance on specific raw materials and manufacturing hubs, can lead to production delays and increased costs. Stringent regulatory hurdles and compliance requirements, especially in the medical and aerospace industries, necessitate significant investment in testing and certification, potentially slowing down product development cycles. Furthermore, the rapid pace of technological evolution demands continuous and substantial R&D investment to remain competitive, posing a challenge for smaller players. The development of advanced semiconductor manufacturing processes also requires considerable capital expenditure.

Emerging Opportunities in Optoelectronics

The optoelectronics sector is ripe with emerging opportunities, fueled by disruptive technologies and evolving consumer preferences. The metaverse and augmented reality (AR)/virtual reality (VR) markets present significant growth potential for advanced display technologies, high-resolution sensors, and specialized optical components. The ongoing development of quantum computing and advanced sensing technologies opens avenues for novel optoelectronic devices with unprecedented capabilities. Furthermore, the increasing global focus on sustainable energy solutions is driving demand for highly efficient solar cells and advanced LED lighting technologies. The expansion of smart cities and the proliferation of IoT devices in various applications, from agriculture to environmental monitoring, will continue to create new demand for customized optoelectronic sensors and communication modules. The growing trend towards personalized medicine and advanced biotechnological research also offers substantial opportunities for specialized optoelectronic instrumentation.

Leading Players in the Optoelectronics Market

- Beijing Minguang Technology

- LG Innoteck

- Hamamatsu Photonics

- Oewaves

- Teledyne FLIR

- Hensoldt

- Lockheed Martin

- Thales

- Rafael Advanced Defense Systems Ltd.

- Northrop Grumman

- Elbit Systems

- BAE Systems

- Leonardo

- Safran

- Israel Aerospace Industries

- Aselsan

- Elcarim Optronic

- Resonon Inc.

- Headwall Photonics

- Hamamatsu

- ON Semiconductor

- Broadcom

- KETEK GmbH

- Mirion Technologies

- PNDetector

- AdvanSiD

- Excelitas Technologies

- OSI Optoelectronics

- Opto Diode

- Edmund Optics

- OMRON

- Schneider Electric

- Panasonic

- Tri-Tronics

- Keyence

- Rockwell Automation

- Leuze Electronic

- Seoul Semiconductor

Key Developments in Optoelectronics Industry

- 2023 (Ongoing): Increased investment in MicroLED and MiniLED display technologies by major consumer electronics manufacturers, aiming for higher brightness, contrast, and efficiency.

- 2023 (Q3/Q4): Significant advancements in LiDAR technology for automotive applications, leading to more compact, cost-effective, and higher-resolution sensors being integrated into new vehicle models.

- 2024 (Early): Announcements of new photonic integrated circuits (PICs) that combine multiple optoelectronic functions onto a single chip, promising further miniaturization and performance gains in telecommunications and computing.

- 2024 (Mid-Year): Growth in the development of novel photodetectors with extended spectral response, catering to emerging applications in scientific research, medical diagnostics, and industrial inspection.

- 2024 (Late Year): Increased focus on optoelectronic components for advanced medical imaging and spectroscopy, driven by breakthroughs in AI-powered diagnostics and personalized treatment approaches.

- 2025 (Projected): Anticipated widespread adoption of advanced optical communication modules supporting higher data rates for enterprise and data center applications.

- 2025 (Projected): Continued integration of optoelectronic sensors into industrial automation and robotics for enhanced precision and real-time monitoring.

- 2026-2028 (Forecast): Expected breakthroughs in quantum dot-based optoelectronics, leading to more efficient and versatile displays and lighting solutions.

- 2029-2033 (Forecast): Maturation and broader adoption of optoelectronic solutions in emerging fields like neuromorphic computing and advanced human-machine interfaces.

Strategic Outlook for Optoelectronics Market

The strategic outlook for the optoelectronics market is overwhelmingly positive, characterized by sustained innovation and expanding application footprints. Growth catalysts include the relentless digital transformation across industries, the ongoing evolution of 5G and future wireless communication technologies, and the accelerating adoption of automation and AI. The demand for high-performance, energy-efficient, and miniaturized optoelectronic components will continue to be a driving force. Strategic investments in advanced materials, integrated photonics, and novel sensing technologies will be crucial for market players to maintain a competitive edge. The increasing convergence of optoelectronics with other advanced technologies like artificial intelligence and the Internet of Things presents significant opportunities for new product development and market penetration. The market is poised for continued expansion driven by its indispensable role in enabling future technological advancements.

Optoelectronics Segmentation

-

1. Application

- 1.1. Aerospace and Defense

- 1.2. Medical and Biotechnology

- 1.3. Industrial

- 1.4. Consumer Electronics

- 1.5. Automotive

- 1.6. Others

-

2. Types

- 2.1. Optoelectronic Oscillator

- 2.2. Photodiodes

- 2.3. Photomultiplier Tube

- 2.4. Photodetector

- 2.5. Optocouplers

- 2.6. Others

Optoelectronics Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Optoelectronics REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Optoelectronics Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Aerospace and Defense

- 5.1.2. Medical and Biotechnology

- 5.1.3. Industrial

- 5.1.4. Consumer Electronics

- 5.1.5. Automotive

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Optoelectronic Oscillator

- 5.2.2. Photodiodes

- 5.2.3. Photomultiplier Tube

- 5.2.4. Photodetector

- 5.2.5. Optocouplers

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Optoelectronics Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Aerospace and Defense

- 6.1.2. Medical and Biotechnology

- 6.1.3. Industrial

- 6.1.4. Consumer Electronics

- 6.1.5. Automotive

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Optoelectronic Oscillator

- 6.2.2. Photodiodes

- 6.2.3. Photomultiplier Tube

- 6.2.4. Photodetector

- 6.2.5. Optocouplers

- 6.2.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Optoelectronics Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Aerospace and Defense

- 7.1.2. Medical and Biotechnology

- 7.1.3. Industrial

- 7.1.4. Consumer Electronics

- 7.1.5. Automotive

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Optoelectronic Oscillator

- 7.2.2. Photodiodes

- 7.2.3. Photomultiplier Tube

- 7.2.4. Photodetector

- 7.2.5. Optocouplers

- 7.2.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Optoelectronics Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Aerospace and Defense

- 8.1.2. Medical and Biotechnology

- 8.1.3. Industrial

- 8.1.4. Consumer Electronics

- 8.1.5. Automotive

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Optoelectronic Oscillator

- 8.2.2. Photodiodes

- 8.2.3. Photomultiplier Tube

- 8.2.4. Photodetector

- 8.2.5. Optocouplers

- 8.2.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Optoelectronics Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Aerospace and Defense

- 9.1.2. Medical and Biotechnology

- 9.1.3. Industrial

- 9.1.4. Consumer Electronics

- 9.1.5. Automotive

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Optoelectronic Oscillator

- 9.2.2. Photodiodes

- 9.2.3. Photomultiplier Tube

- 9.2.4. Photodetector

- 9.2.5. Optocouplers

- 9.2.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Optoelectronics Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Aerospace and Defense

- 10.1.2. Medical and Biotechnology

- 10.1.3. Industrial

- 10.1.4. Consumer Electronics

- 10.1.5. Automotive

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Optoelectronic Oscillator

- 10.2.2. Photodiodes

- 10.2.3. Photomultiplier Tube

- 10.2.4. Photodetector

- 10.2.5. Optocouplers

- 10.2.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Beijing Minguang Technology

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 LG Innoteck

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hamamatsu Photonics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Oewaves

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Teledyne FLIR

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hensoldt

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Lockheed Martin

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Thales

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Rafael Advanced Defense Systems Ltd.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Northrop Grumman

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Elbit Systems

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 BAE Systems

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Leonardo

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Safran

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Israel Aerospace Industries

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Aselsan

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Elcarim Optronic

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Resonon Inc.

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Headwall Photonics

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Hamamatsu

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 ON Semiconductor

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Broadcom

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 KETEK GmbH

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Mirion Technologies

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 PNDetector

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 AdvanSiD

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 Excelitas Technologies

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.28 OSI Optoelectronics

- 11.2.28.1. Overview

- 11.2.28.2. Products

- 11.2.28.3. SWOT Analysis

- 11.2.28.4. Recent Developments

- 11.2.28.5. Financials (Based on Availability)

- 11.2.29 Opto Diode

- 11.2.29.1. Overview

- 11.2.29.2. Products

- 11.2.29.3. SWOT Analysis

- 11.2.29.4. Recent Developments

- 11.2.29.5. Financials (Based on Availability)

- 11.2.30 Edmund Optics

- 11.2.30.1. Overview

- 11.2.30.2. Products

- 11.2.30.3. SWOT Analysis

- 11.2.30.4. Recent Developments

- 11.2.30.5. Financials (Based on Availability)

- 11.2.31 OMRON

- 11.2.31.1. Overview

- 11.2.31.2. Products

- 11.2.31.3. SWOT Analysis

- 11.2.31.4. Recent Developments

- 11.2.31.5. Financials (Based on Availability)

- 11.2.32 Schneider Electric

- 11.2.32.1. Overview

- 11.2.32.2. Products

- 11.2.32.3. SWOT Analysis

- 11.2.32.4. Recent Developments

- 11.2.32.5. Financials (Based on Availability)

- 11.2.33 Panasonic

- 11.2.33.1. Overview

- 11.2.33.2. Products

- 11.2.33.3. SWOT Analysis

- 11.2.33.4. Recent Developments

- 11.2.33.5. Financials (Based on Availability)

- 11.2.34 Tri-Tronics

- 11.2.34.1. Overview

- 11.2.34.2. Products

- 11.2.34.3. SWOT Analysis

- 11.2.34.4. Recent Developments

- 11.2.34.5. Financials (Based on Availability)

- 11.2.35 Keyence

- 11.2.35.1. Overview

- 11.2.35.2. Products

- 11.2.35.3. SWOT Analysis

- 11.2.35.4. Recent Developments

- 11.2.35.5. Financials (Based on Availability)

- 11.2.36 Rockwell Automation

- 11.2.36.1. Overview

- 11.2.36.2. Products

- 11.2.36.3. SWOT Analysis

- 11.2.36.4. Recent Developments

- 11.2.36.5. Financials (Based on Availability)

- 11.2.37 Leuze Electronic

- 11.2.37.1. Overview

- 11.2.37.2. Products

- 11.2.37.3. SWOT Analysis

- 11.2.37.4. Recent Developments

- 11.2.37.5. Financials (Based on Availability)

- 11.2.38 Seoul Semiconductor

- 11.2.38.1. Overview

- 11.2.38.2. Products

- 11.2.38.3. SWOT Analysis

- 11.2.38.4. Recent Developments

- 11.2.38.5. Financials (Based on Availability)

- 11.2.1 Beijing Minguang Technology

List of Figures

- Figure 1: Global Optoelectronics Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Optoelectronics Revenue (million), by Application 2024 & 2032

- Figure 3: North America Optoelectronics Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Optoelectronics Revenue (million), by Types 2024 & 2032

- Figure 5: North America Optoelectronics Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Optoelectronics Revenue (million), by Country 2024 & 2032

- Figure 7: North America Optoelectronics Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Optoelectronics Revenue (million), by Application 2024 & 2032

- Figure 9: South America Optoelectronics Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Optoelectronics Revenue (million), by Types 2024 & 2032

- Figure 11: South America Optoelectronics Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Optoelectronics Revenue (million), by Country 2024 & 2032

- Figure 13: South America Optoelectronics Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Optoelectronics Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Optoelectronics Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Optoelectronics Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Optoelectronics Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Optoelectronics Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Optoelectronics Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Optoelectronics Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Optoelectronics Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Optoelectronics Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Optoelectronics Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Optoelectronics Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Optoelectronics Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Optoelectronics Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Optoelectronics Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Optoelectronics Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Optoelectronics Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Optoelectronics Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Optoelectronics Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Optoelectronics Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Optoelectronics Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Optoelectronics Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Optoelectronics Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Optoelectronics Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Optoelectronics Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Optoelectronics Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Optoelectronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Optoelectronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Optoelectronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Optoelectronics Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Optoelectronics Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Optoelectronics Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Optoelectronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Optoelectronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Optoelectronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Optoelectronics Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Optoelectronics Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Optoelectronics Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Optoelectronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Optoelectronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Optoelectronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Optoelectronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Optoelectronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Optoelectronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Optoelectronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Optoelectronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Optoelectronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Optoelectronics Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Optoelectronics Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Optoelectronics Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Optoelectronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Optoelectronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Optoelectronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Optoelectronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Optoelectronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Optoelectronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Optoelectronics Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Optoelectronics Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Optoelectronics Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Optoelectronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Optoelectronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Optoelectronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Optoelectronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Optoelectronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Optoelectronics Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Optoelectronics Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Optoelectronics?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Optoelectronics?

Key companies in the market include Beijing Minguang Technology, LG Innoteck, Hamamatsu Photonics, Oewaves, Teledyne FLIR, Hensoldt, Lockheed Martin, Thales, Rafael Advanced Defense Systems Ltd., Northrop Grumman, Elbit Systems, BAE Systems, Leonardo, Safran, Israel Aerospace Industries, Aselsan, Elcarim Optronic, Resonon Inc., Headwall Photonics, Hamamatsu, ON Semiconductor, Broadcom, KETEK GmbH, Mirion Technologies, PNDetector, AdvanSiD, Excelitas Technologies, OSI Optoelectronics, Opto Diode, Edmund Optics, OMRON, Schneider Electric, Panasonic, Tri-Tronics, Keyence, Rockwell Automation, Leuze Electronic, Seoul Semiconductor.

3. What are the main segments of the Optoelectronics?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Optoelectronics," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Optoelectronics report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Optoelectronics?

To stay informed about further developments, trends, and reports in the Optoelectronics, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence